北美奶酪零食市场,按奶酪类型(马苏里拉奶酪、切达奶酪、埃曼塔尔奶酪、高达奶酪、菲达奶酪、帕尔马干酪等)、产品类型(冷冻和普通)、包装(袋装、罐装、盒装、罐装、管装和杯装等)、来源(乳制品奶酪零食和植物性奶酪零食)、品牌(品牌和自有品牌)、类别(有机和传统)、定价(普通、高级和豪华)最终用户(家庭和食品服务业)、分销渠道(非商店和商店)、国家(美国、加拿大、墨西哥)行业趋势和预测到 2029 年

市场分析和洞察:北美奶酪零食市场

市场分析和洞察:北美奶酪零食市场

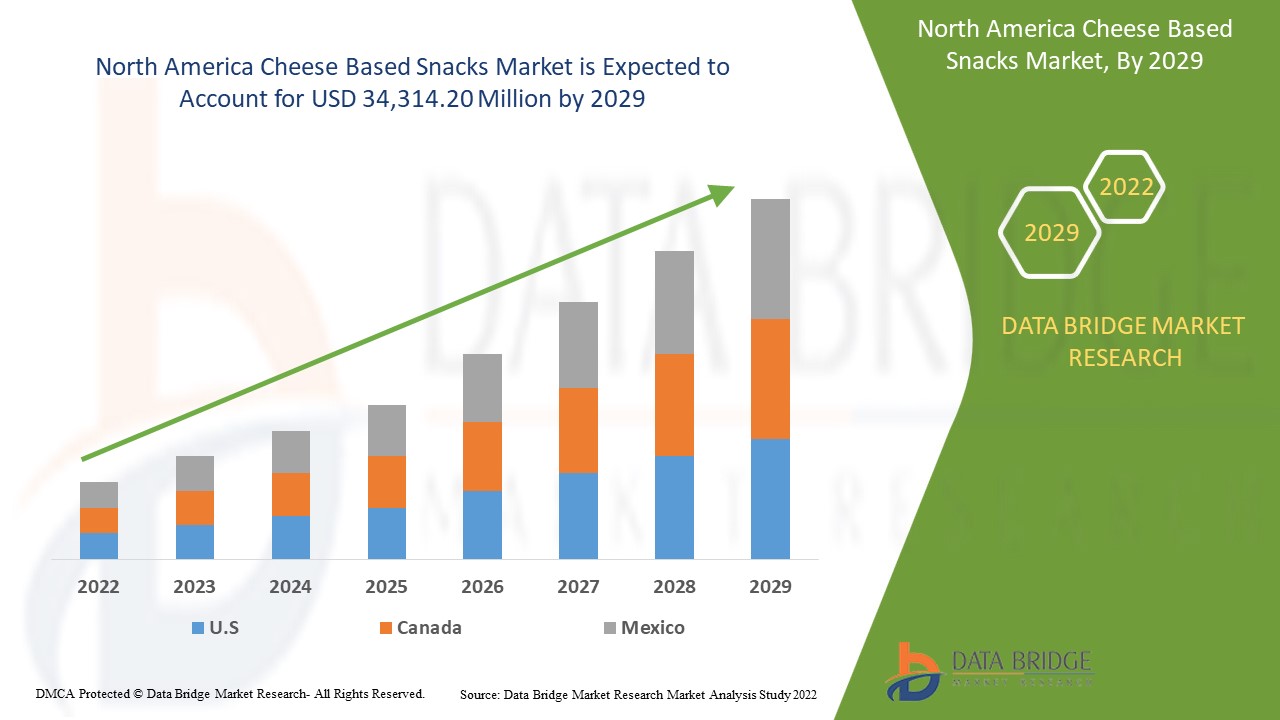

预计北美奶酪零食市场将在 2022 年至 2029 年的预测期内实现市场增长。Data Bridge Market Research 分析,在 2022 年至 2029 年的预测期内,该市场将以 6.4% 的复合年增长率增长,预计到 2029 年将达到 343.142 亿美元。由于生活方式越来越忙碌导致对即食零食的需求不断增长,以及餐饮服务行业对奶酪零食的需求不断增加,可能会推动北美奶酪零食市场的增长。

奶酪零食由不同类型的奶酪制成,包括马苏里拉奶酪、切达奶酪、帕尔马干酪等。这些奶酪零食在发展中经济体中越来越受欢迎,因为提供各种菜肴。因此,这些国家对西方食品的需求正在增加,预计这将推动市场增长。

奶酪是主要饮食,尤其是在北美,它是各种食品的主要成分。奶酪零食包括玉米奶酪球、通心粉和奶酪等。这些在超市、便利店等都有售。奶酪零食由不同类型的奶酪制成,包括马苏里拉奶酪、切达奶酪、帕尔马干酪和其他各种奶酪。

最近的趋势表明,随着公共和私人食品行业的投资不断增加,对奶酪类零食的需求不断增加。此外,方便食品消费量的增加也是推动北美地区奶酪类零食市场增长的因素之一。然而,奶酪类零食的高热量含量可能导致肥胖,这可能会阻碍市场的增长。

许多公司正在做出战略决策,例如与研究机构达成协议推出新产品以提高其市场份额,这可能会为市场创造机会。然而,供应链中断和替代品的可用性可能会对市场的增长构成挑战。

北美奶酪零食市场报告提供了市场份额、新发展和国内和本地市场参与者的影响的详细信息,分析了新兴收入来源、市场法规变化、产品审批、战略决策、产品发布、地域扩张和市场技术创新方面的机会。要了解分析和北美奶酪零食市场情况,请联系 Data Bridge Market Research 获取分析师简报;我们的团队将帮助您创建收入影响解决方案,以实现您的预期目标。

北美奶酪零食市场范围和市场规模

北美奶酪零食市场范围和市场规模

北美奶酪零食市场根据奶酪类型、产品类型、包装、来源、品牌、类别、定价、最终用户和分销渠道分为九个部分。各部分之间的增长有助于您分析利基增长领域和进入市场的策略,并确定您的核心应用领域和目标市场的差异。

- 根据奶酪类型,北美奶酪零食市场分为马苏里拉奶酪、切达奶酪、埃曼塔奶酪、高达奶酪、羊乳酪、帕尔马干酪等。2022 年,马苏里拉奶酪预计将主导北美奶酪零食市场,因为马苏里拉奶酪味道温和,质地有弹性。因此,许多制造商由于对产品的需求而推出了零食产品,预计这将在预测期内推动市场增长。

- 根据产品类型,北美奶酪零食市场分为冷冻和普通两种。2022 年,冷冻部分预计将占据市场主导地位,因为冷冻奶酪零食保质期较长,预计将在预测期内推动市场增长。

- 根据包装,北美奶酪零食市场分为袋装、罐装、盒装、罐装、管装和杯装等。2022 年,盒装部分预计将占据市场主导地位,因为它易于处理且能保证产品的安全性,预计将在预测期内推动市场的增长。

- 根据来源,北美奶酪零食市场分为乳制品奶酪零食和植物奶酪零食。由于消费者对高蛋白质含量和便携奶酪零食的需求不断增加,预计 2022 年乳制品奶酪零食将主导北美奶酪零食市场。

- 根据品牌,北美奶酪零食市场分为品牌和自有品牌。2022 年,自有品牌市场预计将占据市场主导地位,因为它价格低廉,容易买到,预计将在预测期内推动市场增长。

- 根据类别,北美奶酪零食市场分为有机和传统。2022 年,传统部分预计将占据市场主导地位,因为它易于获得且需求持续增长。此外,它提供更好的口感和更多的风味,预计将推动市场增长。

- 根据定价,北美奶酪零食市场分为普通、高级和豪华。2022 年,由于对不同口味的普通价格奶酪零食的需求不断增加,预计普通部分将主导北美奶酪零食市场。

- 根据最终用户,北美奶酪零食市场分为家庭和食品服务领域。2022 年,食品服务领域预计将占据市场主导地位,因为消费者更喜欢去餐馆和咖啡馆,这有望推动市场的增长。

- 根据分销渠道,北美奶酪零食市场分为非商店销售和商店销售。2022 年,由于附近便利店、专卖店和杂货店对现成奶酪零食的需求不断增加,商店销售预计将主导北美奶酪零食市场。

北美奶酪类零食市场国家层面分析

对北美奶酪零食市场进行了分析,并按国家、奶酪类型、产品类型、包装、来源、品牌、类别、定价、最终用户和分销渠道提供了市场规模信息。

北美奶酪零食市场报告涵盖的国家包括美国、加拿大和墨西哥。

- 在北美奶酪零食市场,美国预计将占据主导地位,因为奶酪零食供应充足,且零食行业发展迅速。墨西哥也预计将占据主导地位,因为墨西哥对玉米卷、玉米片、玉米饼等奶酪零食的需求量很大。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。新销售、替代销售、国家人口统计、监管法案和进出口关税等数据点是用于预测各个国家市场情景的一些主要指标。此外,在对国家数据进行预测分析时,还考虑了北美品牌的存在和可用性以及它们因来自本地和国内品牌的激烈或稀缺竞争而面临的挑战、销售渠道的影响。

主要市场参与者不断增加的战略活动,以提高人们对奶酪类零食的认识,正在推动市场增长

北美奶酪零食市场还为您提供每个国家在特定市场增长的详细市场分析。此外,它还提供有关市场参与者战略及其地理分布的详细信息。数据适用于 2011 年至 2020 年的历史时期。

竞争格局和北美奶酪类零食市场份额分析

北美奶酪零食市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、生产基地和设施、公司优势和劣势、产品发布、产品批准、专利、产品宽度和广度、应用优势、技术生命线曲线。以上提供的数据点仅与北美奶酪零食市场的重点相关。

北美奶酪零食市场的一些主要参与者包括百事可乐、通用磨坊公司、玛氏公司、麦凯恩食品有限公司、PARLE、艾米厨房公司、凯里、卡夫亨氏公司、WHISPS、Rich Products Corporation、Utz Brands、公司、家乐氏公司、EnWave Corporation、Arla Foods Ingredients Group P/S、SARGENTO FOODS INCORPORATED 以及其他国内参与者。DBMR 分析师了解竞争优势并为每个竞争对手分别提供竞争分析。

世界各地的公司也发起了许多开发活动,加速了北美奶酪零食市场的发展。

例如,

- 2019 年 12 月,百事可乐收购了 PopCorners 零食制造商 BFY Brands,以扩大产品组合和生产能力。此次收购帮助该公司扩大了零食领域的业务,因为 BFY 提供了具有不同口味和成分的独特产品

- 2020 年 10 月,WHISPS 推出了一种名为“The Hot & Spicy Cheese Crisps”的新型奶酪脆片。这些新型可零食化的奶酪脆片由手工奶酪制造商制作,采用专为 Whisps 制作的 100% 切达干酪以及优质香料和风味。此次推出的产品将吸引消费者,并最终帮助公司发展

合作、产品发布、业务扩展、奖励和认可、合资企业和其他市场参与者策略增强了公司在北美奶酪零食市场的影响力,有利于公司的利润增长。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA CHEESE BASED SNACKS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPETITIVE ANALYSIS

4.2 IMPORT-EXPORT ANALYSIS OF CHEESE (RAW MATERIAL)

4.3 NORTH AMERICA CHEESE BASED SNACKS MARKET: MARKETING STRATEGY

4.3.1 LAUNCHING AND MARKETING INNOVATIVE PRODUCTS CATERING TO THE LATEST TRENDS:

4.3.2 THOUGHTFUL PACKAGING AND AD CAMPAIGN

4.3.3 PARTNERSHIP WITH POPULAR BRANDS

4.3.4 OFFER AMAZING GIFTS ON CHEESE BASED SNACKS PRODUCTS

4.3.5 A VAST NETWORK OF DISTRIBUTION

4.4 NORTH AMERICA CHEESE BASED SNACKS MARKET: NEW PRODUCT LAUNCH STRATEGY

4.4.1 INNOVATIVE PRODUCT OFFERING -

4.4.2 PACKAGE DESIGNING-

4.5 PATENT ANALYSIS OF NORTH AMERICA CHEESE BASED SNACKS MARKET

4.5.1 DBMR ANALYSIS

4.5.2 COUNTRY-LEVEL ANALYSIS

4.5.3 YEAR-WISE ANALYSIS

4.5.4 COMPANY BASED ANALYSIS

4.6 CHEESE PRODUCTION AND CONSUMPTION PATTERN

4.7 PROMOTIONAL ACTIVITIES

4.8 CONTRY WISE CONSUMPTION OF CHEESE BASED SNACKS-

4.9 NORTH AMERICA CHEESE BASED SNACKS MARKET: CONSUMER SHOPPING BEHAVIOUR & DYNAMICS

4.9.1 ATTRACTION BY TEMPTATION-

4.9.2 FREE SAMPLES-

4.9.3 ATTRACTION THROUGH PROMOTION THROUGH SOCIAL MEDIA-

4.9.4 SHOPPING CHEESE BASED SNACKS THROUGH ONLINE PORTALS:

4.1 SUPPLY CHAIN OF NORTH AMERICA CHEESE BASED SNACKS MARKET

4.10.1 RAW MATERIAL PROCUREMENT

4.10.2 CHEESE BASED SNACKS PRODUCTION/PROCESSING

4.10.3 MARKETING & DISTRIBUTION

4.10.4 END USERS

4.11 VALUE CHAIN ANALYSIS

4.12 NORTH AMERICA CHEESE BASED SNACKS MARKET: REGULATIONS

4.12.1 FDA

4.12.2 FSSAI

4.12.3 USDA

4.13 NORTH AMERICA CHEESE BASED SNACKS MARKET- CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

4.14 NORTH AMERICA CHEESE BASED SNACKS MARKET- RAW MATERIAL PRICING

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN CONSUMPTION OF CONVENIENCE FOOD PRODUCTS

5.1.2 RISING DEMAND FOR NUTRITIONAL CHEESE SNACKS DUE TO HEALTH BENEFITS AND MICRONUTRIENTS CONTENT

5.1.3 INCREASING REPLACEMENT OF MEALS WITH SNACKS

5.2 RESTRAINTS

5.2.1 HIGH-CALORIE CONTENT IN CHEESE BASED SNACKS

5.2.2 INCREASE IN PREVALENCE OF LACTOSE INTOLERANT POPULATION

5.3 OPPORTUNITIES

5.3.1 CHANGING LIFESTYLE AND EATING PATTERNS OF CONSUMERS

5.3.2 RISING DEMAND FOR COMFORT FOOD

5.3.3 INTRODUCTION OF INNOVATIVE PRODUCTS SUCH AS PLANT-BASED CHEESE SNACKS

5.4 CHALLENGES

5.4.1 AVAILABILITY OF SUBSTITUTES OF CHEESE BASED SNACKS

5.4.2 SUPPLY CHAIN DISRUPTION DUE TO COVID -19

6 ANALYSIS ON IMPACT OF COVID-19 ON THE NORTH AMERICA CHEESE BASED SNACKS MARKET

6.1 COVID-19 OVERVIEW

6.2 COVID-19 IMPACT ON CHEESE BASED SNACKS MARKET

6.3 AFTERMATH OF COVID-19

6.4 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.5 IMPACT ON DEMAND AND SUPPLY CHAIN

6.6 IMPACT ON PRICE

6.7 CONCLUSION

7 NORTH AMERICA CHEESE BASED SNACKS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 FROZEN

7.3 REGULAR

7.3.1 CAKES & PASTRIES

7.3.2 CRACKERS

7.3.3 STICKS

7.3.4 NACHOS

7.3.5 COOKIES & BISCUITS

7.3.6 ROLLS, PUFFS & PIES

7.3.7 SPREADS & DIPS

7.3.8 CHEESE BALLS

7.3.9 WAFFLES

7.3.10 WRAPS

7.3.11 DONUTS

7.3.12 TORTILLAS

7.3.13 PRETZELS

7.3.14 CRISPS

7.3.15 CROISSANTS & BROWNIES

7.3.16 POPCORN

7.3.17 NUTRITIONAL BARS

7.3.18 BITES & CHIPS

7.3.19 NUTS & TRAIL MIXES

7.3.20 OTHERS

8 NORTH AMERICA CHEESE BASED SNACKS MARKET, BY CHEESE TYPE

8.1 OVERVIEW

8.2 MOZZARELLA

8.3 CHEDDAR

8.4 EMMENTAL

8.5 GOUDA

8.6 FETA

8.7 PARMESAN

8.8 OTHERS

9 NORTH AMERICA CHEESE BASED SNACKS MARKET, BY PACKAGING

9.1 OVERVIEW

9.2 POUCHES

9.3 CANS

9.4 BOXES

9.5 JARS

9.6 TUBS & CUPS

9.7 OTHERS

10 NORTH AMERICA CHEESE BASED SNACKS MARKET, BY SOURCE

10.1 OVERVIEW

10.2 DAIRY-BASED CHEESE SNACKS

10.3 PLANT-BASED CHEESE SNACKS

11 NORTH AMERICA CHEESE BASED SNACKS MARKET, BY BRAND

11.1 OVERVIEW

11.2 BRANDED

11.3 PRIVATE LABEL

6 NORTH AMERICA CHEESE BASED SNACKS MARKET, BY PRICING

6.1 OVERVIEW

6.2 COMMERCIAL

6.3 PREMIUM

6.4 LUXURY

7 NORTH AMERICA CHEESE BASED SNACKS MARKET, BY CATEGORY

7.1 OVERVIEW

7.2 ORGANIC

7.3 CONVENTIONAL

8 NORTH AMERICA CHEESE BASED SNACKS MARKET, BY END USER

8.1 OVERVIEW

8.2 HOUSEHOLD

8.3 FOOD SERVICES SECTOR

9 NORTH AMERICA CHEESE BASED SNACKS MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 NON-STORE BASED

9.3 STORE BASED

10 NORTH AMERICA CHEESE BASED SNACKS MARKET, BY REGION

10.1 NORTH AMERICA

11 COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 PEPSICO

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENT

13.2 KELLOGG CO.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 MCCAIN FOODS LIMITED

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY SHARE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT

13.4 GENERAL MILLS INC.

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

SOURCE: COMPANY WEBSITE, ANNUAL REPORTS, AND SEC FILING 126

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENT

13.5 GCMMF

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENT

13.6 AMY'S KITCHEN, INC.

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 ARLA FOODS INGREDIENTS GROUP P/S 2021

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 CHITTCHORE NAMKEENZ

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 ENWAVE CORPORATION

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENTS

13.1 EUROPE SNACKS 2021

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 GODREJ AGROVET LIMITED

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENT

13.12 GONUTZ

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENTS

13.13 KERRY

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 MARS, INCORPORATED

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 NATORI CO., LTD

13.15.1 COMPANY SNAPSHOT

1.15.2 PRODUCT PORTFOLIO

1.15.3 RECENT DEVELOPMENTS 145

13.16 PARLE

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENT

13.17 PRTAAP SNACKS LTD.

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENT

13.18 RICH PRODUCTS CORPORATION

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 SARGENTO FOODS INCORPORATED

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENTS

13.2 SERIOUS PIG

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENTS

13.21 SURYA FOOD & AGRO LTD.

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCT PORTFOLIO

13.21.3 RECENT DEVELOPMENT

13.22 THE KRAFT HEINZ COMPANY

13.22.1 COMPANY SNAPSHOT

13.22.2 REVENUE ANALYSIS

13.22.3 PRODUCT PORTFOLIO

13.22.4 RECENT DEVELOPMENTS

13.23 UNISMACK SA

13.23.1 COMPANY SNAPSHOT

13.23.2 PRODUCT PORTFOLIO

13.23.3 RECENT DEVELOPMENT

13.24 UTZ BRANDS, INC.

13.24.1 COMPANY SNAPSHOT

13.24.2 REVENUE ANALYSIS

13.24.3 PRODUCT PORTFOLIO

13.24.4 RECENT DEVELOPMENTS

13.25 WHISPS

13.25.1 COMPANY SNAPSHOT

13.25.2 PRODUCT PORTFOLIO

13.25.3 RECENT DEVELOPMENTS

14 QUETIONARY

15 RELATED REPORTS

表格列表

TABLE 1 TOP IMPORTERS OF CHEESE AND CURD (HS CODE: 0406) UNIT: USD THOUSAND

TABLE 2 TOP EXPORTERS OF CHEESE AND CURD (HS CODE: 0406) UNIT: USD THOUSAND

TABLE 3 PRODUCTION DATA OF CHEESE, 2020

TABLE 4 PRODUCTION DATA OF CHEESE, 2020

TABLE 5 PRODUCTION DATA OF CHEESE FROM COWS’ MILK (TONS)-

TABLE 6 CONSUMPTION DATA OF CHEESE, 2020

TABLE 7 CONSUMPTION DATA OF CHEESE, 2017

TABLE 8 CONSUMPTION DATA OF CHEESE (KG PER CAPITA)-

TABLE 9 PERCENTAGE OF POPULATION CONSUMING CHEESE BASED SNACKS

TABLE 10 HOUSEHOLD DISPOSABLE INCOME- GROSS ADJUSTED, U.S. DOLLARS/CAPITA-

TABLE 11 SPEND DYNAMICS ON SNACKS PER HOUSEHOLD IN CANADA-

TABLE 12 EXPENDITURE ON CHEESE AND CURD IN U.K., 2020-

TABLE 13 PRICES OF CHEDDAR CHEESE IN U.S. (USD/TON)

TABLE 14 PRICES OF CHEDDAR CHEESE EU-27(WITHOUT U.K.)- (EURO/TON)-

TABLE 15 PRICES OF GOUDA CHEESE IN GERMANY- (EURO/KG)-

TABLE 16 PRICES OF EDAMER CHEESE IN GERMANY- (EURO/TON)-

TABLE 17 PRICE OF LOCAL CHEESE IN AFRICA- 1KG- 2021

TABLE 18 PRICE OF LOCAL CHEESE IN AMERICA- 1KG- 2021

TABLE 19 PRICE OF LOCAL CHEESE IN EUROPE- 1KG- 2021

TABLE 20 PRICE OF LOCAL CHEESE IN ASIA- 1KG- 2021

图片列表

FIGURE 1 NORTH AMERICA CHEESE BASED SNACKS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA CHEESE BASED SNACKS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CHEESE BASED SNACKS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CHEESE BASED SNACKS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CHEESE BASED SNACKS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CHEESE BASED SNACKS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA CHEESE BASED SNACKS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA CHEESE BASED SNACKS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA CHEESE BASED SNACKS MARKET: SEGMENTATION

FIGURE 10 EUROPE IS EXPECTED TO DOMINATE THE NORTH AMERICA CHEESE BASED SNACKS MARKET AND GROWING WITH THE HIGHEST SHARE IN THE FORECAST PERIOD OF 2022 TO 2029.

FIGURE 11 INCREASING DEMAND FOR PROCESSED FOOD IS EXPECTED TO BE THE KEY DRIVER FOR THE NORTH AMERICA CHEESE BASED SNACKS MARKET IS DRIVING THE NORTH AMERICA CHEESE BASED SNACKS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029.

FIGURE 12 PRODUCT TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA CHEESE BASED SNACKS MARKET IN 2022 & 2029.

FIGURE 13 PATENT REGISTERED FOR CHEESE BASED SNACKS, BY COUNTRY

FIGURE 14 PATENT REGISTERED YEAR (2020 - 2021)

FIGURE 15 SUPPLY CHAIN OF NORTH AMERICA CHEESE BASED SNACKS MARKET

FIGURE 16 VALUE CHAIN OF CHEESE BASED SNACKS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA CHEESE BASED SNACKS MARKET

FIGURE 18 NORTH AMERICA CHEESE BASED SNACKS MARKET: BY PRODUCT TYPE, 2021

FIGURE 19 NORTH AMERICA REGULAR CHEESE BASED SNACKS MARKET: BY PRODUCT TYPE, 2021

FIGURE 20 NORTH AMERICA CHEESE BASED SNACKS MARKET: BY CHEESE TYPE, 2021

FIGURE 21 NORTH AMERICA CHEESE BASED SNACKS MARKET: BY PACKAGING, 2021

FIGURE 22 NORTH AMERICA CHEESE BASED SNACKS MARKET: BY SOURCE, 2021

FIGURE 23 NORTH AMERICA CHEESE BASED SNACKS MARKET: BY BRAND, 2021

FIGURE 24 NORTH AMERICA CHEESE BASED SNACKS MARKET: BY PRICING, 2021

FIGURE 25 NORTH AMERICA CHEESE BASED SNACKS MARKET: BY CATEGORY, 2021

FIGURE 26 NORTH AMERICA CHEESE BASED SNACKS MARKET: BY END USER, 2021

FIGURE 27 NORTH AMERICA CHEESE BASED SNACKS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 28 NORTH AMERICA CHEESE BASED SNACKS MARKET: SNAPSHOT (2021)

FIGURE 29 NORTH AMERICA CHEESE BASED SNACKS MARKET: BY REGION (2021)

FIGURE 30 NORTH AMERICA CHEESE BASED SNACKS MARKET: BY REGION (2022 & 2029)

FIGURE 31 NORTH AMERICA CHEESE BASED SNACKS MARKET: BY REGION (2022 & 2029)

FIGURE 32 NORTH AMERICA CHEESE BASED SNACKS MARKET: BY PRODUCT TYPE (2022 & 2029)

FIGURE 33 NORTH AMERICA CHEESE BASED SNACKS MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。