North America Carpets And Rugs Market

市场规模(十亿美元)

CAGR :

%

USD

17.16 Billion

USD

26.54 Billion

2024

2032

USD

17.16 Billion

USD

26.54 Billion

2024

2032

| 2025 –2032 | |

| USD 17.16 Billion | |

| USD 26.54 Billion | |

|

|

|

|

北美地毯和地墊市場、類型(地毯和地墊)、產品(簇絨、機織、針刺、平織、鉤編、打結、其他)、原材料(合成纖維和天然纖維)、應用(住宅和商業)、分銷渠道(線下和線上)——行業趨勢和預測到 2032 年。

北美地毯和地墊市場規模

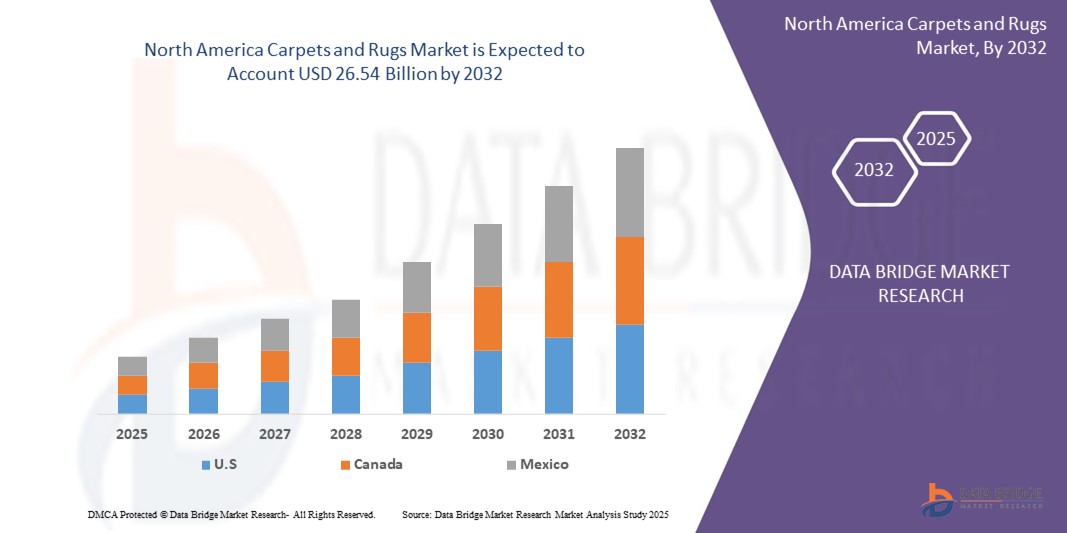

- 2024 年北美地毯和地墊市場規模為171.6 億美元 ,預計 到 2032 年將達到 265.4 億美元,預測期內 複合年增長率為 5.6%。

- 市場成長主要受到對美觀實用的家居裝飾的需求不斷增長、住宅和商業建築活動的增加以及可持續耐用的地毯製造技術的進步的推動

- 消費者對天然纖維等環保材料的偏好日益增長,以及家居用品線上零售平台的興起,進一步加速了市場擴張

北美地毯和地墊市場分析

- 地毯和地墊是室內設計的必備元素,無論是在住宅或商業環境中,都能提供美觀、舒適和實用的功能。它們的多功能性,加上設計和材料的進步,使其成為現代家居和辦公空間不可或缺的一部分。

- 城鎮化進程加快、可支配收入增加以及對可持續和可定制室內解決方案的日益關注,推動了地毯和地墊的需求

- 美國在北美地毯和地墊市場佔據主導地位,2024 年將佔據 33.9% 的最大收入份額,這得益於消費者在家居裝修方面的高支出、強勁的房地產市場以及領先製造商和零售商的存在

- 預計在預測期內,加拿大將成為北美地毯和地墊市場成長最快的地區,這得益於住宅環境中對舒適、美觀的地板的需求不斷增長

- 2024 年,地毯細分市場佔據最大的市場收入份額,達到 60%,這得益於住宅和商業空間對滿鋪地毯的需求不斷增長,尤其是其隔熱性能和美觀度

報告範圍和美國地毯和地毯市場細分

|

屬性 |

北美地毯和地墊關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深入的專家分析、定價分析、品牌份額分析、消費者調查、人口統計分析、供應鏈分析、價值鏈分析、原材料/消耗品概述、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

北美地毯和地墊市場趨勢

“智慧技術與永續材料的日益融合”

- 北美地毯和地墊市場正經歷智慧技術與永續材料融合的顯著趨勢

- 智慧技術,例如語音控製或加熱地毯,可實現自動滾動和溫度調節等創新功能,提高用戶的便利性和舒適度

- 由於消費者對環保和可生物降解產品的需求不斷增長,永續材料(包括再生纖維和羊毛、棉花和黃麻等天然纖維)正受到越來越多的關注

- 例如,Interface 和 Bentley Mills 等公司正在推出低碳足跡地毯磚以及由再生 PET 和植物纖維製成的產品,以實現永續發展目標

- 這些進步提高了地毯和地墊的功能性和環保吸引力,使其對住宅和商業消費者更具吸引力

- 智慧且永續的地毯也正在設計中,以符合現代室內設計趨勢,為人流量大的區域提供可客製化的圖案和增強的耐用性

北美地毯和地墊市場動態

司機

“家居裝修和美學室內設計的需求不斷增長”

- 消費者對家居裝修和室內美觀的日益關注是北美地毯和地毯市場的主要驅動力

- 地毯和地墊可增強居住空間的視覺吸引力和舒適度,為住宅和商業應用提供隔熱、降噪和可客製化的設計選擇

- 政府激勵措施和不斷增長的可支配收入(尤其是在美國)正在推動對時尚且實用的地板解決方案的需求

- 電子商務平台的普及以及建築和房地產行業的成長進一步推動了市場擴張,使人們更容易獲得各種地毯和地毯產品

- 製造商越來越多地提供可客製化和工廠安裝的地毯解決方案,以滿足消費者對獨特設計和高品質材料的期望

- 由於美國高度關注家居裝飾趨勢和強勁的建築活動,預計將佔據市場主導地位

克制/挑戰

“可持續材料成本高昂,且面臨來自硬地板的競爭”

- 生產和購買可持續地毯(尤其是由天然或再生纖維製成的地毯)的初始成本較高,這可能是採用的重大障礙,尤其是在成本敏感的市場

- 將智慧技術整合到地毯中,例如嵌入式加熱或自動化系統,增加了生產和安裝的複雜性和費用

- 此外,來自硬木、複合地板、乙烯基和瓷磚等其他地板材料的競爭也構成了重大挑戰。這些材料通常因其耐用性、低維護成本和現代美學設計而受到青睞。

- 產業報告數據表明,硬質地板在人流量大的商業空間和簡約的住宅設計中越來越受歡迎,這可能會限制地毯和地墊市場的成長

- 消費者對維護的擔憂,例如地毯的清潔和過敏原殘留,使得在衛生意識強、維護方便的地區採用地毯變得更加困難

- 北美各地在環境標準和回收要求方面的監管格局分散,也可能使製造商的營運變得複雜,並阻礙市場擴張。

北美地毯和地墊市場範圍

市場根據類型、產品、原材料、應用和分銷管道進行細分。

- 按類型

北美地毯和地墊市場按類型細分為地毯和地墊。地毯細分市場在2024年佔據了最大的市場收入份額,達到60%,這得益於住宅和商業空間對滿鋪地毯日益增長的需求,尤其是其隔熱性能和美觀度。地毯因其能夠提升舒適度並降低能源成本而備受青睞,尤其是在氣候較冷的地區。

預計地毯市場將在2025年至2032年期間實現6.2%的最快增長率,這得益於消費者對可自訂、可移動的地板覆蓋物日益增長的興趣,這些覆蓋物可以為特定區域增添裝飾元素。家居裝修項目的興起以及室內設計趨勢對社交媒體的影響進一步加速了地毯的普及。

- 按產品

根據產品類型,北美地毯和地墊市場可細分為簇絨地毯、機織地毯、針刺地毯、平織地毯、鉤針編織地毯、打結地毯和其他地毯。簇絨地毯佔據主導地位,2024 年的收入份額為 62.3%,這得益於其經濟高效的生產流程和多樣化的設計,使其適用於住宅和商業用途。簇絨地毯和地墊高度可定制,提供各種圖案、顏色和紋理,以滿足不同消費者的喜好。

預計2025年至2032年,結飾地毯市場將以4.9%的最快成長率成長,這得益於手工和手工裝飾需求的不斷增長。結飾地毯通常採用羊毛和絲綢等優質材料製成,吸引了追求奢華高品質地板解決方案的富裕消費者。

- 按原料

根據原料,北美地毯和地墊市場可分為合成纖維和天然纖維。 2024年,合成纖維佔據了最大的市場收入份額,達65.8%。這種優勢得益於合成纖維的耐用性、抗污性和價格實惠,使其成為住宅和商業場所人流量大區域的理想選擇。

天然纖維領域,包括羊毛、棉花、黃麻和絲綢,預計在 2025 年至 2032 年間顯著成長。消費者對環保和永續材料的偏好日益增加,再加上天然纖維卓越的舒適性和美感,推動了這一領域的成長,尤其是在奢侈品市場。

- 按應用

根據應用領域,北美地毯和地墊市場可分為住宅和商業兩大類。 2024年,住宅市場佔據了市場收入份額的72%,這得益於房屋裝修支出的增加,以及地毯和地墊在提升室內美觀度和舒適度方面的日益普及。滿鋪地毯因其在住宅環境中的隔熱優勢而尤其受到青睞。

預計2025年至2032年,商業領域將以6.5%的強勁速度成長,這得益於辦公室、飯店和零售場所對耐用、低維護且美觀的地板解決方案的需求不斷增長。耐污和環保材料的進步進一步支持了商業環境中地板的採用。

- 按分銷管道

根據分銷管道,北美地毯市場分為線下和線上。線下通路包括專賣店、百貨公司和超市/大賣場,在2024年佔據了最大的市場收入份額,達68.4%。這是因為消費者傾向於在購買前親自評估地毯的質地、品質和顏色,尤其是在當地商店和展覽會上。

預計2025年至2032年期間,線上市場將以8.3%的最快成長率成長,這得益於亞馬遜、Wayfair等電商平台以及製造商網站提供的便利性和多樣性。數位商務的擴張以及消費者對家居裝飾產品在線購買的日益增長的舒適度是關鍵的成長動力。

北美地毯和地墊市場區域分析

- 預計美國將主導北美地毯和地墊市場,到 2024 年將佔據 33.9% 的最大收入份額,這得益於消費者在家居裝修方面的高支出、強勁的房地產市場以及領先製造商和零售商的存在

- 消費者優先考慮地毯和地墊,因為它們可以提高室內舒適度、改善音響效果並增加美感,尤其是在氣候條件多樣、需要耐用且多功能地板的地區

- 製造技術的進步(例如環保合成纖維和天然纖維的選擇)以及透過線下和線上分銷管道在住宅和商業應用中的日益普及推動了成長

美國地毯和地墊市場洞察

預計到2024年,美國將以62.67%的最高收入份額佔據北美地毯和地墊市場的主導地位,這得益於住宅和商業領域強勁的需求,以及消費者對可持續和時尚地板選擇日益增長的認識。家居裝修和室內客製化趨勢進一步推動了市場擴張。簇絨、機織、針刺、平織、鉤編和打結等多種地毯和地墊產品種類的供應,補充了線下和線上銷售,從而構建了一個強大的市場生態系統。

加拿大地毯和地墊市場洞察

加拿大地毯和地墊市場預計將顯著增長,這得益於住宅環境對舒適美觀的地板日益增長的需求。消費者尋求具有隔熱性和耐用性的產品,並偏好天然纖維等永續材料。由於建築活動的興起以及便捷購買的線上分銷管道的普及,城市地區的成長尤為突出。

北美地毯和地墊市場份額

北美地毯和地墊行業主要由知名公司主導,其中包括:

- 莫霍克工業公司(美國)

- 肖氏工業集團(美國)

- Mannington Mills, Inc.(美國)

- Interface, Inc.(美國)

- 迪克西集團(美國)

- 得嘉(法國)

- 東方織工(埃及)

- Belysse(比利時)

- 國際地板覆蓋物公司(美國)

- 本特利米爾斯(美國)

- 工程地板(美國)

- InJ&J 地板介面(美國)

- 斯塔克地毯(美國)

- 美利肯公司(美國)

- Masland 地毯(美國)

北美地毯和地墊市場的最新發展如何?

- 2025年3月,Interface斥資4,500萬美元,用於擴大其喬治亞州工廠的模組化地毯磚生產。這項投資重點在於提升產能,並整合專為100%再生尼龍訂製的先進設備。該計劃與Interface的可持續發展目標相契合,強化了其對環保地板解決方案的承諾。透過提高產量,Interface旨在滿足不斷增長的市場需求,同時推廣循環經濟實踐。此次擴建預計將鞏固Interface在商用地板領域的地位。

- 2025年1月,Oriental Weavers將在德國法蘭克福國際家用地毯及地毯展覽會(Heimtextil)上展示其最新的區域地毯和地毯產品。該公司將重點展示其綠色環保系列、天然纖維產品以及屢獲殊榮的可折疊可折疊可水洗地毯,這些地毯設計易於在標準洗衣機中清洗。 Oriental Weavers的2025系列產品靈感源自埃及悠久的歷史,將經典圖案與現代設計融為一體。此次展覽將於1月14日至17日舉行,Oriental Weavers將在5.1展廳B80展位展示其創新產品,該展位隸屬於日益壯大的地毯及地毯展區。

- 2024年2月,Shaw Floors推出了六款全新的Pet Perfect+地毯,專為寵物友善家庭設計。這些地毯採用LifeGuard Spill-Proof技術,確保更耐用、更耐污且易於維護。這項創新旨在為房主提供能夠抵禦寵物帶來的髒亂的地板解決方案,提供舒適、時尚和持久的保護。該系列包含豐富的紋理和圖案,在保持高性能標準的同時,滿足不同的美學偏好。 Shaw Floors持續優先考慮寵物友善創新,並強化其對品質和永續性的承諾。

- 2023年3月,莫霍克工業公司 (Mohawk Industries, Inc.) 推出了 PetProof 地毯系列,該系列採用增強型防污防臭技術。這項創新旨在滿足日益增長的寵物友善地板解決方案需求,確保耐用性、易於維護以及持久保護,防止寵物意外。系列採用莫霍克專有的 EasyClean™ 技術,提供卓越的防污防塵性能,清潔起來毫不費力。

- 2022年11月,得嘉 (Tarkett SA) 推出了 Desso Origin 地毯磚系列,該系列採用100%再生紗線,是歐洲循環碳足跡最低的地毯磚系列。此系列包含 Recharge 和 Retrace 兩個系列,兩者的再生材料含量均高達61.1%。得嘉強調閉環回收,確保這些地毯磚可以拆卸並重新用於製造新產品。此次推出的產品符合得嘉對永續發展的承諾,在生產過程中100%使用綠色能源。

- 2025年3月,Interface斥資4,500萬美元,用於擴大其喬治亞州工廠的模組化地毯磚生產。這項投資重點在於提升產能,並整合專為100%再生尼龍訂製的先進設備。該計劃與Interface的可持續發展目標相契合,強化了其對環保地板解決方案的承諾。透過提高產量,Interface旨在滿足不斷增長的市場需求,同時推廣循環經濟實踐。此次擴建預計將鞏固Interface在商用地板領域的地位。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA CARPETS AND RUGS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELLING

2.8 TYPE TIMELINE CURVE

2.9 APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING FOCUS ON INTERIOR DESIGN AND AESTHETICS IN COMMERCIAL SPACES

5.1.2 RECYCLABILITY AND REUSABILITY OF CARPET

5.1.3 EASY AND SPEEDY INSTALLATION

5.1.4 INCREASING PREFERENCE OVER OTHER FLOORING MATERIAL IN DEVELOPING COUNTRIES

5.2 RESTRAINTS

5.2.1 INCREASING RAW MATERIAL PRICE

5.2.2 HIGH MAINTENANCE COST

5.3 OPPORTUNITIES

5.3.1 RISE IN ECO-FRIENDLY CARPETS & RUGS

5.3.2 INCREASE IN E-COMMERCE AND ONLINE SALES

5.3.3 STRATEGIC INITIATIVES BY THE MARKET PLAYERS

5.4 CHALLENGE

5.4.1 HIGHLY SUSCEPTIBLE TO ALLERGENS

5.4.2 STRINGENT REGULATIONS REGARDING LEED CERTIFICATION

6 NORTH AMERICA CARPETS AND RUGS MARKET, BY TYPE

6.1 OVERVIEW

6.2 CARPET

6.2.1 CUT PILE CARPET

6.2.2 LOOP PILE CARPET

6.2.3 CUT LOOP CARPET

6.2.4 SHAG CARPET

6.2.5 OTHERS

6.3 RUGS

6.3.1 DISTRESSED RUGS

6.3.2 COASTAL RUGS

6.3.3 CHEVRON RUGS

6.3.4 BORDER RUGS

6.3.5 FLORAL RUGS

6.3.6 IKAT RUGS

6.3.7 ANIMAL PRINT RUGS

6.3.8 OTHERS

7 NORTH AMERICA CARPETS AND RUGS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 TUFTED

7.3 WOVEN

7.4 NEEDLE-PUNCHED

7.5 FLAT-WEAVE

7.6 HOOKED

7.7 KNOTTED

7.8 OTHERS

8 NORTH AMERICA CARPETS AND RUGS MARKET, BY RAW MATERIAL

8.1 OVERVIEW

8.2 SYNTHETIC FIBER

8.2.1 NYLON

8.2.2 POLYESTER

8.2.3 POLYPROPYLENE

8.2.4 OTHERS

8.3 NATURAL FIBER

8.3.1 WOOL

8.3.2 COTTON

8.3.3 SISAL

8.3.4 SEAGRASS

8.3.5 JUTE

8.3.6 COIR

8.3.7 OTHERS

9 NORTH AMERICA CARPETS AND RUGS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 RESIDENTIAL

9.2.1 SINGLE-FAMILY HOMES

9.2.2 CONDOMINIUMS

9.2.3 TOWNHOUSE

9.2.4 MULTI-FAMILY HOME

9.2.5 OTHERS

9.3 COMMERCIAL

9.3.1 COMMERCIAL BUILDINGS

9.3.2 PUBLIC BUILDINGS

9.3.3 RETAIL

9.3.4 LEISURE & HOSPITALITY

9.3.5 HEALTHCARE

9.3.6 EDUCATION

9.3.7 OTHERS

10 NORTH AMERICA CARPETS AND RUGS MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 OFFLINE

10.2.1 SPECIALTY STORES

10.2.2 SUPERMARKET/HYPERMARKETS

10.2.3 HOME CENTERS

10.2.4 OTHERS

10.3 ONLINE

11 NORTH AMERICA CARPETS AND RUGS MARKET, BY COUNTRY

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA CARPETS AND RUGS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 MOHAWK INDUSTRIES, INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 SHAW INDUSTRIES GROUP, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT DEVELOPMENTS

14.3 MANNINGTON MILLS, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT DEVELOPMENTS

14.4 INTERFACE, INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 THE DIXIE GROUP, INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.6 AMER RUGS

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 AXMINSTER CARPETS

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 BEAULIEU INTERNATIONAL GROUP

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 BELYSSE

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 BRINTONS CARPETS LIMITED

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 FLOOR COVERINGS INTERNATIONAL

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 HAIMA GROUP

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 HOUSE OF TAI PING

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 INTER IKEA SYSTEMS B.V.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 MILLIKEN

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 ORIENTAL WEAVERS

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 STEVENS OMNI

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 TARKETT

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 VICTORIA PLC

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 RECYCLED CONTENT FOR CARPET

TABLE 2 NORTH AMERICA CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 3 NORTH AMERICA CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (MILLION SQ FT)

TABLE 4 NORTH AMERICA CARPET IN CARPETS AND RUGS MARKET, BY CARPET TYPE, 2022-2031 (USD MILLION)

TABLE 5 NORTH AMERICA RUGS IN CARPETS AND RUGS MARKET, BY RUGS TYPE, 2022-2031 (USD MILLION)

TABLE 6 NORTH AMERICA CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 7 NORTH AMERICA CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (MILLION SQ FT)

TABLE 8 NORTH AMERICA CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (USD MILLION)

TABLE 9 NORTH AMERICA CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (MILLION SQ FT)

TABLE 10 NORTH AMERICA SYNTHETIC FIBER IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 11 NORTH AMERICA NATURAL FIBER IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 12 NORTH AMERICA CARPETS AND RUGS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 13 NORTH AMERICA RESIDENTIAL FIBER IN CARPETS AND RUGS MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 14 NORTH AMERICA COMMERCIAL IN CARPETS AND RUGS MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 15 NORTH AMERICA CARPETS AND RUGS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 16 NORTH AMERICA OFFLINE IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 17 NORTH AMERICA CARPETS AND RUGS MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 18 NORTH AMERICA CARPETS AND RUGS MARKET, BY COUNTRY, 2022-2031 (MILLION SQ FT)

TABLE 19 U.S. CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 20 U.S. CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (MILLION SQ FT)

TABLE 21 U.S. CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 22 U.S. CARPET IN CARPETS AND RUGS MARKET, BY CARPET TYPE, 2022-2031 (USD MILLION)

TABLE 23 U.S. RUGS IN CARPETS AND RUGS MARKET, BY RUGS TYPE, 2022-2031 (USD MILLION)

TABLE 24 U.S. CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 25 U.S. CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (MILLION SQ FT)

TABLE 26 U.S. CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 27 U.S. CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (USD MILLION)

TABLE 28 U.S. CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (MILLION SQ FT)

TABLE 29 U.S. CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (ASP)

TABLE 30 U.S. SYNTHETIC FIBER IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 31 U.S. NATURAL FIBER IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 32 U.S. CARPETS AND RUGS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 33 U.S. RESIDENTIAL FIBER IN CARPETS AND RUGS MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 34 U.S. COMMERCIAL IN CARPETS AND RUGS MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 35 U.S. CARPETS AND RUGS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 36 U.S. OFFLINE IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 37 CANADA CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 38 CANADA CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (MILLION SQ FT)

TABLE 39 CANADA CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 40 CANADA CARPET IN CARPETS AND RUGS MARKET, BY CARPET TYPE, 2022-2031 (USD MILLION)

TABLE 41 CANADA RUGS IN CARPETS AND RUGS MARKET, BY RUGS TYPE, 2022-2031 (USD MILLION)

TABLE 42 CANADA CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 43 CANADA CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (MILLION SQ FT)

TABLE 44 CANADA CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 45 CANADA CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (USD MILLION)

TABLE 46 CANADA CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (MILLION SQ FT)

TABLE 47 CANADA CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (ASP)

TABLE 48 CANADA SYNTHETIC FIBER IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 49 CANADA NATURAL FIBER IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 50 CANADA CARPETS AND RUGS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 51 CANADA RESIDENTIAL FIBER IN CARPETS AND RUGS MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 52 CANADA COMMERCIAL IN CARPETS AND RUGS MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 53 CANADA CARPETS AND RUGS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 54 CANADA OFFLINE IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 55 MEXICO CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 56 MEXICO CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (MILLION SQ FT)

TABLE 57 MEXICO CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 58 MEXICO CARPET IN CARPETS AND RUGS MARKET, BY CARPET TYPE, 2022-2031 (USD MILLION)

TABLE 59 MEXICO RUGS IN CARPETS AND RUGS MARKET, BY RUGS TYPE, 2022-2031 (USD MILLION)

TABLE 60 MEXICO CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 61 MEXICO CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (MILLION SQ FT)

TABLE 62 MEXICO CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 63 MEXICO CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (USD MILLION)

TABLE 64 MEXICO CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (MILLION SQ FT)

TABLE 65 MEXICO CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (ASP)

TABLE 66 MEXICO SYNTHETIC FIBER IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 67 MEXICO NATURAL FIBER IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 68 MEXICO CARPETS AND RUGS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 69 MEXICO RESIDENTIAL FIBER IN CARPETS AND RUGS MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 70 MEXICO COMMERCIAL IN CARPETS AND RUGS MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 71 MEXICO CARPETS AND RUGS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 72 MEXICO OFFLINE IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA CARPETS AND RUGS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA CARPETS AND RUGS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CARPETS AND RUGS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CARPETS AND RUGS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CARPETS AND RUGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CARPETS AND RUGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA CARPETS AND RUGS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA CARPETS AND RUGS MARKET: MULTIVARIATE MODELLING

FIGURE 9 NORTH AMERICA CARPETS AND RUGS MARKET: TYPE TIMELINE CURVE

FIGURE 10 NORTH AMERICA CARPETS AND RUGS MARKET: APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA CARPETS AND RUGS MARKET: SEGMENTATION

FIGURE 12 INCREASING DEMAND FOR INTERIOR IN COMMERCIAL SPACE IS EXPECTED TO DRIVE THE GROWTH OF THE NORTH AMERICA CARPETS AND RUGS MARKET IN THE FORECAST PERIOD

FIGURE 13 CARPET IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA CARPETS AND RUGS MARKET FROM 2024 AND 2031

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA CARPETS AND RUGS MARKET

FIGURE 15 NORTH AMERICA CARPETS AND RUGS MARKET: TYPE, 2023

FIGURE 16 NORTH AMERICA CARPETS AND RUGS MARKET: PRODUCT, 2023

FIGURE 17 NORTH AMERICA CARPETS AND RUGS MARKET: RAW MATERIAL, 2023

FIGURE 18 NORTH AMERICA CARPETS AND RUGS MARKET: APPLICATION, 2023

FIGURE 19 NORTH AMERICA CARPETS AND RUGS MARKET: DISTRIBUTION CHANNEL, 2023

FIGURE 20 NORTH CARPETS AND RUGS MARKET: SNAPSHOT (2023)

FIGURE 21 NORTH AMERICA CARPETS AND RUGS MARKET: COMPANY SHARE 2023 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。