North America Bladder Disorders Market

市场规模(十亿美元)

CAGR :

%

USD

4,332.44 Million

USD

10,554.59 Million

2021

2029

USD

4,332.44 Million

USD

10,554.59 Million

2021

2029

| 2022 –2029 | |

| USD 4,332.44 Million | |

| USD 10,554.59 Million | |

|

|

|

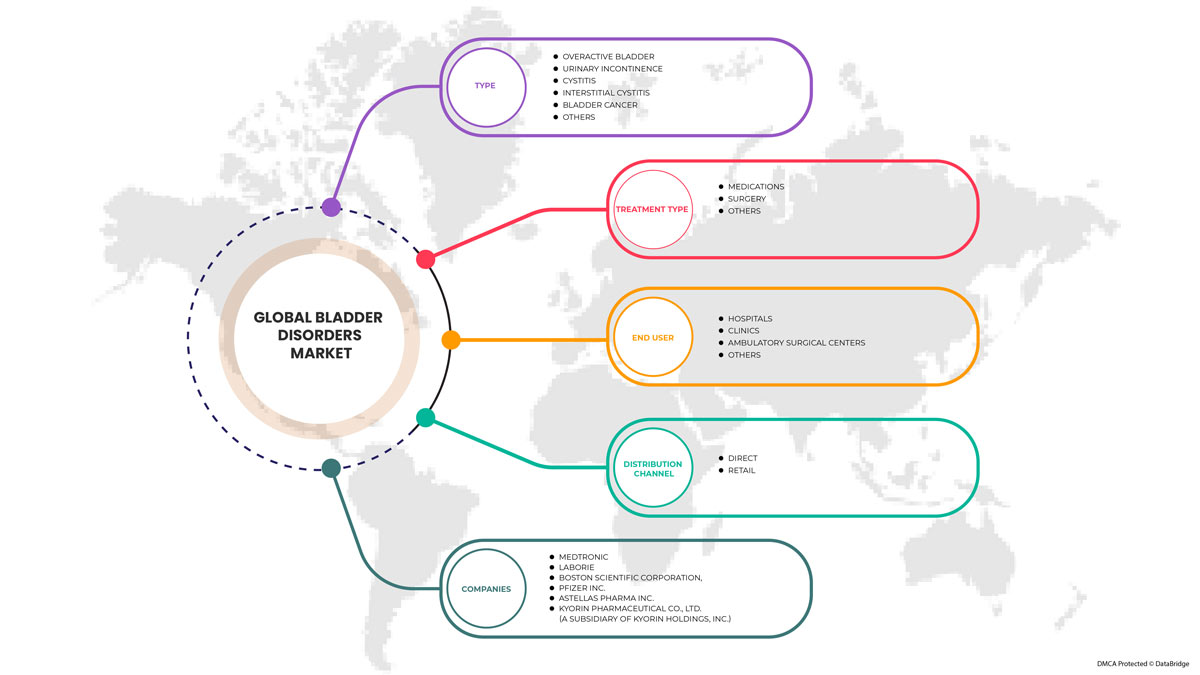

北美膀胱疾病市场,按类型(膀胱炎、尿失禁、膀胱过度活动症、间质性膀胱炎、膀胱癌)、治疗类型(手术、药物、非手术)、最终用户(医院、诊所、门诊手术中心、其他)、分销渠道(直接、零售)划分 - 行业趋势和预测到 2029 年。

北美膀胱疾病市场分析与洞察

膀胱疾病是一组会影响人类日常生活的疾病。最常见的膀胱疾病包括膀胱炎(膀胱感染并引起炎症)。尿失禁(失去膀胱控制)、间质性膀胱炎(膀胱疼痛和频繁、紧迫排尿)和膀胱过度活动症(膀胱挤压尿液的一种情况)。膀胱疾病会影响生活质量并导致其他健康问题。健康变化和问题(包括神经系统和生活方式因素)可能导致或加剧男性和女性的 UI。

最常见的膀胱疾病是膀胱过度活动症和尿路感染。这些问题与神经系统有关。神经将信息从大脑传递到膀胱,指示肌肉收缩或释放。

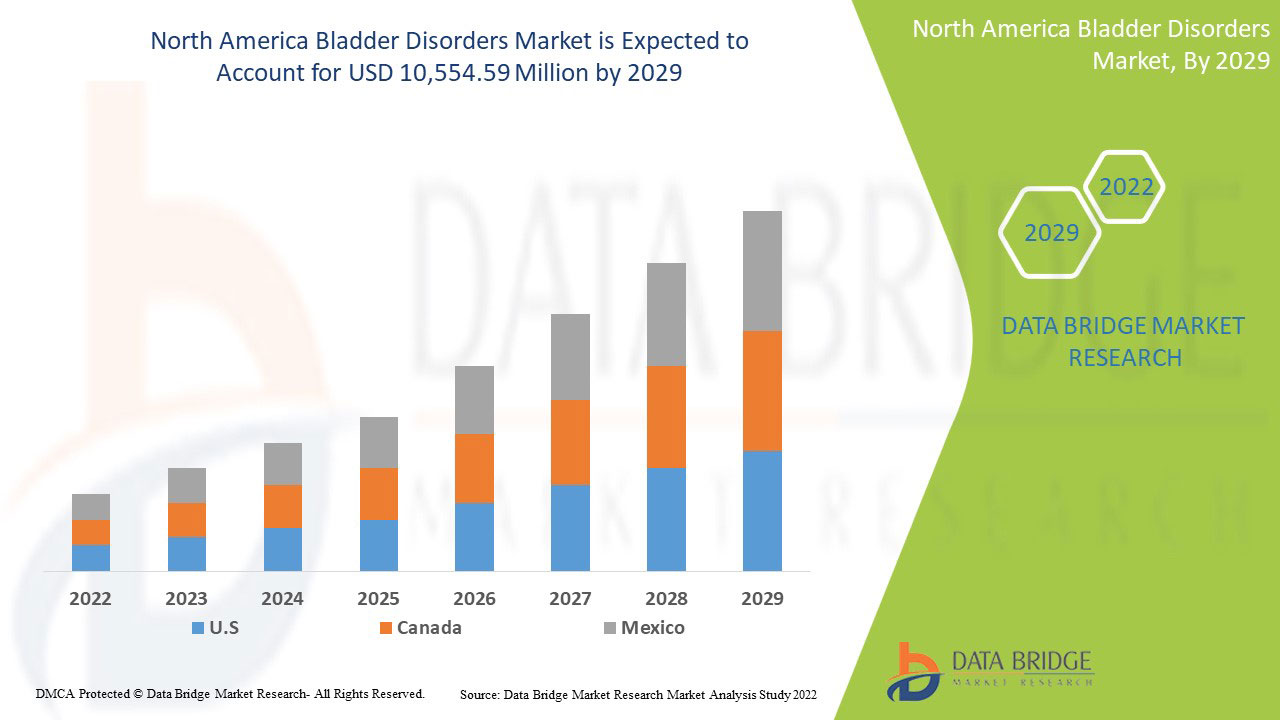

北美膀胱疾病市场预计将在 2022 年至 2029 年的预测期内增长。Data Bridge Market Research 分析称,在 2022 年至 2029 年的预测期内,该市场将以 11.8% 的复合年增长率增长,预计到 2029 年将从 2021 年的 43.3244 亿美元达到 105.5459 亿美元。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制 2019-2014) |

|

定量单位 |

收入(百万美元) |

|

涵盖的领域 |

按类型(膀胱炎、尿失禁、膀胱过度活动症、间质性膀胱炎、膀胱癌)、治疗类型(手术、药物、非手术)、最终用户(医院、诊所、门诊手术中心、其他)、分销渠道(直接、零售) |

|

覆盖国家 |

美国、加拿大、墨西哥 |

|

涵盖的市场参与者 |

在市场上运营的主要公司有美敦力、Laborie、波士顿科学公司、辉瑞公司、安斯泰来制药公司、KYORIN 制药有限公司(KYORIN Holdings, Inc. 的子公司)、百时美施贵宝公司、强生服务公司子公司、Axonics, Inc.、默克公司、Viatris Inc.、Blue Wind Medical、Valencia Technologies、Gaylord Chemical Company, LLC、Coloplast Corp、艾伯维公司、太阳制药工业有限公司、Zydus Group 和 Urovant Sciences 等。 |

北美膀胱疾病市场的市场定义

与膀胱相关的疾病包括膀胱炎(通常由于感染引起的膀胱炎症)、尿失禁(失去对膀胱的控制)、膀胱过度活动症(膀胱在错误的时间挤出尿液的一种情况)、间质性膀胱炎(导致膀胱疼痛和频繁、紧急排尿和膀胱癌的慢性问题)。

医生会进行各种检查来诊断膀胱疾病,包括 X 光检查、尿液检查和膀胱镜检查膀胱壁。疾病的治疗取决于问题的原因,治疗包括药物治疗、手术(严重情况下)和非手术治疗。

抗胆碱能药物是治疗膀胱过度活动症 (OAB) 的一线药物。OAB 是一种临床症状,其特征是尿意紧迫,难以推迟,通常每天排尿次数超过八次被认为是 OAB。抗胆碱能药物抑制逼尿肌上的毒蕈碱受体,从而降低膀胱收缩力。为了减少副作用,正在开发具有改进膀胱选择性和缓释配方的新药物。大多数较新的药物在减轻膀胱过度活动症的症状方面同样有效。

北美膀胱疾病市场动态

驱动程序

-

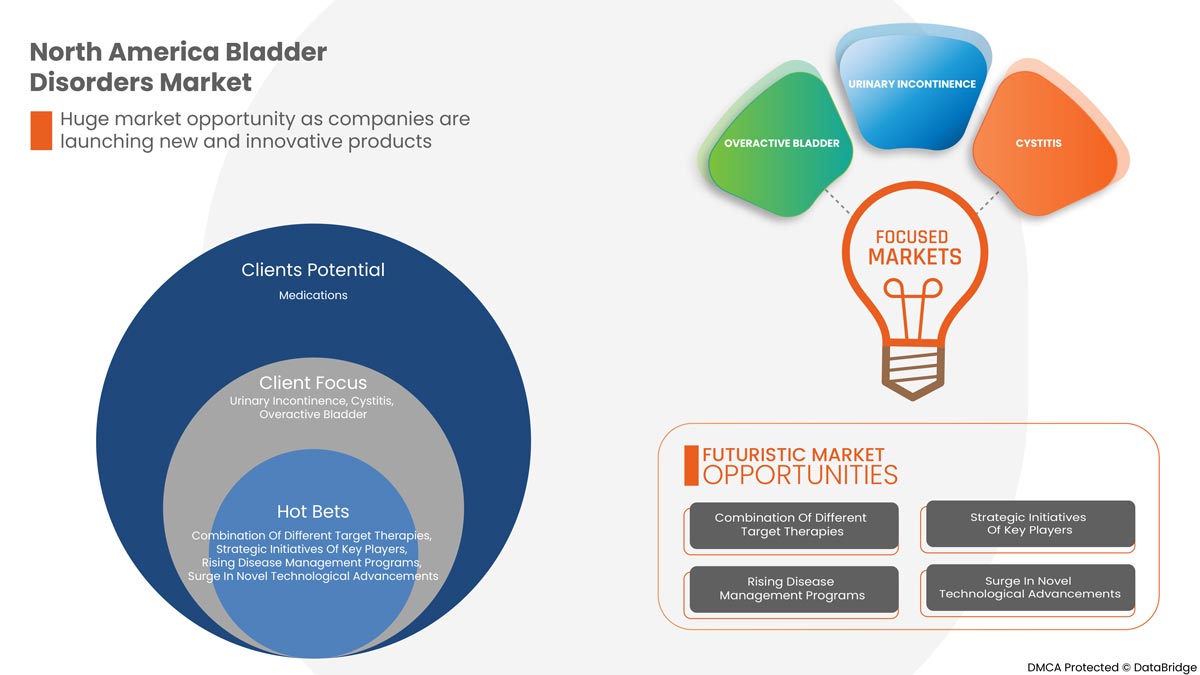

市场参与者采取的战略举措

膀胱疾病是一系列会影响日常身体活动的膀胱问题。最常见的膀胱疾病是膀胱炎、间质性膀胱炎、膀胱过度活动症、尿失禁和膀胱癌。大多数膀胱问题是由进入尿道的细菌感染引起的。

市场参与者在合作、收购、合作等方面采取的各种战略举措,使他们能够增加公司的产品组合,从而扩大市场,并进而提高客户对产品的需求,最终使市场参与者获得最大的收入。

-

老年人口不断增长

衰老是与膀胱相关疾病相关的一个主要风险因素。衰老会促使膀胱功能发生神经、解剖和生化变化,这可能导致 OAB 的发展,而膀胱过度活动症是老年人群中最常见的问题。老年人群患有各种与膀胱相关的问题和疾病,因此他们是慢性健康管理服务和解决方案的主要用户。

根据贵族研究,膀胱过度活动症的患病率在女性和男性中约为16.9%,约为16.0%,并且OAB的患病率随着年龄的增长而增长。然而,治疗指南指定了首选的一线、二线和三线OAB治疗策略。膀胱疾病与痴呆症等神经系统疾病有关,在这个年龄段,OAB对老年人来说非常具有挑战性。在过去的几十年里,全球老年人口急剧增长。

-

未来几年研发投入将不断增加,新疗法将不断推出

针对 OAB 和其他膀胱疾病,有多种治疗方案和创新疗法可供选择。许多生物制药和制药公司正在投资各种膀胱疾病的非常规疗法,预计这些疗法将在预测期内推出。

-

不同靶向疗法的组合

联合疗法比单一疗法更有效,且没有额外的副作用。联合疗法是难治性膀胱疾病患者的安全有效的替代疗法。结合不同的靶向治疗策略是缓解患者膀胱疾病的最佳方法。对于难治性患者,应考虑口服药物和行为疗法。有各种先进的靶向疗法可供选择,例如骶神经调节、逼尿肌内注射肉毒杆菌毒素 A 和经皮胫神经刺激。这些是先进的治疗方法,与口服药物相比更有效。

机会

-

新技术进步不断涌现

慢性病是全球发展中国家的主要死亡原因之一。因此,公共卫生从业者越来越重视慢性病的医疗管理。

膀胱疾病管理现在强调帮助患者进行各种自我护理,并提供一系列咨询服务,让患者了解自己的病情并继续前进。这些疗法还可以帮助患者克服情感创伤和焦虑,这可能起到反保护机制的作用。

不断涌现的技术突破使医疗保健组织能够探索管理慢性膀胱疾病的创新服务和解决方案。由于他们不需要长期住院,因此也降低了成本和患者数量。此外,减少医院就诊和住院次数也为老年人带来了便利。考虑到有利的方面,许多组织和企业正在开发和实施管理慢性疾病的最新技术,以改善患者的治疗效果。

-

疾病管理计划的兴起

患有膀胱相关疾病的人通常需要更多的医疗服务,例如住院、看医生和处方药。患有多种慢性疾病的人寿命越来越长,再加上医疗费用的增加,促使人们制定更好的医疗保健计划。

疾病管理是一种试图改善护理同时降低慢性病护理费用的策略。疾病管理计划旨在增强某些慢性疾病(如膀胱疾病)患者的健康,同时降低对医疗服务的需求以及可避免的后果(如住院和急诊)的相关费用。这些计划还包括有关慢性病管理服务和解决方案的信息。由于全球慢性病患病率不断上升,这些计划变得非常受欢迎。政府和医疗保健组织已经组织和实施了针对这些慢性病的多种疾病管理计划,如膀胱癌、间质性膀胱炎和膀胱过度活动症管理计划。由于疾病管理计划可以显著改善自我护理习惯,并在很大程度上减少住院次数和住院时间,因此它们受到人们的更多关注。

限制/挑战

然而,由于需要进行各种检查,以及执行这些程序的高科技技术和方式,因此诊断疾病的难度以及治疗和诊断的成本很高。由于治疗中使用的先进技术设备价格高昂,因此程序的成本通常会升高,预计这将抑制市场增长。

这份北美膀胱疾病市场报告详细介绍了最新发展、贸易法规、进出口分析、生产分析、价值链优化、市场份额、国内和本地市场参与者的影响,分析了新兴收入来源、市场法规变化、战略市场增长分析、市场规模、类别市场增长、应用领域和主导地位、产品批准、产品发布、地域扩展、市场技术创新等方面的机会。如需了解有关北美膀胱疾病市场的更多信息,请联系 Data Bridge Market Research 获取分析师简报。我们的团队将帮助您做出明智的市场决策,以实现市场增长。

COVID-19 对北美膀胱疾病市场的影响

COVID-19 对市场产生了积极影响。疫情期间的封锁和隔离使疾病管理和药物依从性变得复杂。因此,世界人口中各种治疗药物的使用量大幅增加。因此,疫情对这个市场产生了积极影响

近期发展

- 2022 年 6 月,Valencia Technologies Corporation 宣布了可植入神经调节技术产品 eCoin®,该产品正在重塑膀胱控制长期治疗的交付方式,是一种用于治疗急迫性尿失禁 (UUI) 的胫骨植入物。eCoin® 于 2022 年 3 月获得美国食品药品监督管理局 (FDA) 的上市前批准 (PMA),成为首个也是唯一一个获得 FDA 批准用于治疗急迫性尿失禁 (UUI) 的可植入胫骨神经刺激器。这款新产品帮助该公司扩大了其产品组合。

北美膀胱疾病市场范围

北美膀胱疾病市场分为类型、治疗类型、最终用户和分销渠道。这些细分市场之间的增长将帮助您分析行业中增长微弱的细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策,确定核心市场应用。

类型

- 膀胱炎

- 尿失禁

- 膀胱过度活动症

- 间质性膀胱炎

- 膀胱癌

根据类型,北美膀胱疾病市场分为膀胱炎、尿失禁、膀胱过度活动症、间质性膀胱炎、膀胱癌。

治疗类型

- 外科手术

- 药物

- 其他的

根据产品,北美膀胱疾病市场分为手术、药物和其他。

最终用户

- 医院

- 诊所

- 门诊手术中心

- 其他的

根据最终用户,北美膀胱疾病市场分为医院、诊所、门诊手术中心和其他。

分销渠道

- 直接的

- 零售

根据分销渠道,北美膀胱疾病市场分为直接分销和零售分销。

北美膀胱疾病市场区域分析/见解

对北美膀胱疾病市场进行了分析,并按上述国家、类型、治疗类型、最终用户和分销渠道提供了市场规模洞察和趋势。

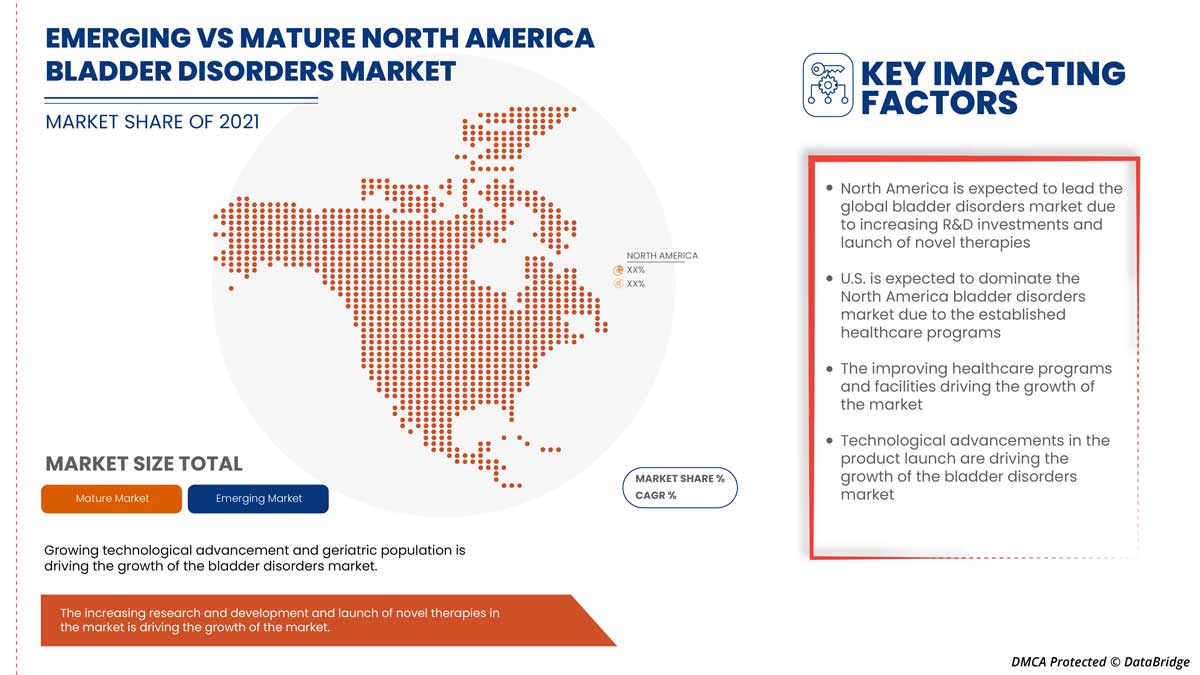

该市场涵盖的国家包括美国、加拿大和墨西哥。美国在市场份额和收入方面占据北美膀胱疾病市场的主导地位,并将在预测期内继续保持主导地位。这是由于该地区膀胱过度活动症的患病率很高,而不断增长的研发投资和新疗法的推出正在推动市场的发展

报告的国家部分还提供了影响单个市场因素和市场法规变化的信息,这些因素和变化会影响市场的当前和未来趋势。新旧销售、国家人口统计、疾病流行病学和进出口关税等数据点是预测单个国家市场情况的一些主要指标。此外,在对国家数据进行预测分析时,还考虑了北美品牌的存在和可用性以及它们因本土和国内品牌的激烈竞争而面临的挑战以及销售渠道的影响。

竞争格局和北美膀胱疾病市场份额分析

北美膀胱疾病市场竞争格局提供了有关竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、北美业务、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度以及应用主导地位。以上数据点仅与公司对北美膀胱疾病市场的关注有关。

北美膀胱疾病市场的一些主要参与者包括美敦力、Laborie、波士顿科学公司、辉瑞公司、安斯泰来制药公司、KYORIN 制药有限公司(KYORIN Holdings, Inc. 的子公司)、百时美施贵宝公司、强生服务公司、Axonics, Inc.、默克公司、Viatris Inc.、Blue Wind Medical、Valencia Technologies、Gaylord Chemical Company, LLC、Coloplast Corp、艾伯维公司、太阳制药工业有限公司、Zydus Group、Swati Spentose、Urovant Sciences 等。

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析以及主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、公司市场份额分析、测量标准、北美与地区以及供应商份额分析。如有进一步询问,请要求分析师致电。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA BLADDER DISORDERS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES

4.3 NORTH AMERICA BLADDER DISORDERS MARKET, PIPELINE ANALYSIS

5 NORTH AMERICA BLADDER DISORDER MARKET: REGULATIONS

5.1 THE U.S. REGULATORY FRAMEWORK FOR BLADDER DISOREDER MEDICATION

5.2 EUROPE REGULATORY FRAMEWORK FOR BLADDER DISORDER DRUGS

5.3 JAPAN REGULATORY GUIDANCE ON BLADDER DISORDER DRUGS

6 NORTH AMERICA BLADDER DISORDERS MARKET OVERVIEW

6.1 DRIVERS

6.1.1 STRATEGIC INITIATIVES ADOPTED BY MARKET PLAYERS

6.1.2 GROWING GERIATRIC POPULATION

6.1.3 RISING R&D INVESTMENTS AND LAUNCH OF NOVEL THERAPIES IN UPCOMING YEARS

6.1.4 COMBINATION OF DIFFERENT TARGET THERAPIES

6.2 RESTRAINTS

6.2.1 HIGH COST ASSOCIATED WITH BLADDER DISORDER DIAGNOSTIC TREATMENT

6.2.2 PRODUCTS RECALLS FROM MARKET

6.3 OPPORTUNITIES

6.3.1 SURGE IN NOVEL TECHNOLOGICAL ADVANCEMENTS

6.3.2 RISING DISEASE MANAGEMENT PROGRAMS

6.4 CHALLENGES

6.4.1 LACK OF AWARENESS ABOUT BLADDER DISORDERS RELATED PROBLEMS

6.4.2 PATENT EXPIRY OF DRUGS

7 NORTH AMERICA BLADDER DISORDERS MARKET, BY TYPE

7.1 OVERVIEW

7.2 OVERACTIVE BLADDER

7.3 URINARY INCONTINENCE

7.4 CYSTITIS

7.5 INTERSTITIAL CYSTITIS

7.6 BLADDER CANCER

7.7 OTHERS

8 NORTH AMERICA BLADDER DISORDERS MARKET, BY TREATMENT TYPE

8.1 OVERVIEW

8.2 MEDICATION

8.2.1 TOLTERODINE

8.2.2 MIRABEGRON

8.2.3 FESOTERODINE

8.2.4 OXYBUTYNIN

8.2.5 SOLIFENACIN

8.2.6 DARIFENACIN

8.2.7 TROSPIUM

8.2.8 OTHERS

8.3 SURGERY

8.3.1 SURGERY TO INCREASE BLADDER CAPACITY

8.3.2 BLADDER REMOVAL

8.3.3 OTHERS

8.4 OTHERS

9 NORTH AMERICA BLADDER DISORDERS MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 DIRECT

9.3 RETAIL

10 NORTH AMERICA BLADDER DISORDERS MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITALS

10.3 CLINICS

10.4 AMBULATORY SURGICAL CENTERS

10.5 OTHERS

11 NORTH AMERICA BLADDER DISORDERS MARKET, BY GEOGRAPHY

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA BLADDER DISORDERS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 MERCK AND CO. INC. (2021)

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 ASTELLAS PHARMA INC. (2021)

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 BRISTOL-MYERS SQUIBB COMPANY (2021)

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 BOSTON SCIENTIFIC CORPORATION (2021)

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 VIATRIS INC. (2021)

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 ABBVIE (2021)

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 AXONICS, INC. (2021)

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 BLUE WIND MEDICAL (2021)

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 COLOPLAST CORP. (2021)

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.1 GAYLORD CHEMICAL COMPANY, LLC (2021)

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 JOHNSON & JOHNSON SERVICES, INC. (2021)

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 KYORIN PHARMACEUTICAL CO., LTD. (A SUBSIDIARY OF KYORIN HOLDINGS, INC.) (2021)

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 LABORIE (2021)

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 MEDTRONIC (2021)

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 PFIZER INC. (2021)

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENTS

14.16 VALENCIA TECHNOLOGIES (2021)

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 SUN PHAMACEUTICAL INDUSTRIES LTD. (2021)

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENT

14.18 SWATI SPENTOSE (2021)

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 UROVANT SCIENCES (2021)

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 ZYDUS GROUP (2021)

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 NORTH AMERICA BLADDER DISORDERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA OVERACTIVE BLADDER IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA URINARY INCONTINENCE IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA CYSTITIS IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA INTERSTITIAL CYSTITIS IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA BLADDER CANCER IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA OTHERS IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA MEDICATION IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA MEDICATIONS IN BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA SURGERY IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA SURGERY IN BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA OTHERS IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA BLADDER DISORDERS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA DIRECT IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA RETAIL IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA BLADDER DISORDERS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA HOSPITALS IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA CLINICS IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA OTHERS IN BLADDER DISORDERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA BLADDER DISORDERS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA BLADDER DISORDERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA MEDICATIONS IN BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA SURGERY IN BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA BLADDER DISORDERS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA BLADDER DISORDERS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 U.S. BLADDER DISORDERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 U.S. BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 31 U.S. MEDICATIONS IN BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 32 U.S. SURGERY IN BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 33 U.S. BLADDER DISORDERS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 34 U.S. BLADDER DISORDERS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 35 CANADA BLADDER DISORDERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 CANADA BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 37 CANADA MEDICATIONS IN BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 38 CANADA SURGERY IN BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 39 CANADA BLADDER DISORDERS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 40 CANADA BLADDER DISORDERS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 41 MEXICO BLADDER DISORDERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 MEXICO BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 43 MEXICO MEDICATIONS IN BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 44 MEXICO SURGERY IN BLADDER DISORDERS MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 45 MEXICO BLADDER DISORDERS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 MEXICO BLADDER DISORDERS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA BLADDER DISORDERS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA BLADDER DISORDERS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA BLADDER DISORDERS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA BLADDER DISORDERS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA BLADDER DISORDERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA BLADDER DISORDERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA BLADDER DISORDERS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA BLADDER DISORDERS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA BLADDER DISORDERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA BLADDER DISORDERS MARKET: SEGMENTATION

FIGURE 11 RISING EPIDEMIC AND PANDEMIC OUTBREAK AND INCREASING PREVALENCE OF BLADDER DISORDERS EXPECTED TO DRIVE THE NORTH AMERICA BLADDER DISORDERS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 OVERACTIVE BLADDER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA BLADDER DISORDERS MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA BLADDER DISORDER MARKET

FIGURE 14 NORTH AMERICA BLADDER DISORDERS MARKET: BY TYPE, 2021

FIGURE 15 NORTH AMERICA BLADDER DISORDERS MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA BLADDER DISORDERS MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA BLADDER DISORDERS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA BLADDER DISORDERS MARKET: BY TREATMENT TYPE, 2021

FIGURE 19 NORTH AMERICA BLADDER DISORDERS MARKET: BY TREATMENT TYPE, 2022-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA BLADDER DISORDERS MARKET: BY TREATMENT TYPE, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA BLADDER DISORDERS MARKET: BY TREATMENT TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA BLADDER DISORDERS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 23 NORTH AMERICA BLADDER DISORDERS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA BLADDER DISORDERS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA BLADDER DISORDERS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 26 NORTH AMERICA BLADDER DISORDERS MARKET: BY END USER, 2021

FIGURE 27 NORTH AMERICA BLADDER DISORDERS MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA BLADDER DISORDERS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA BLADDER DISORDERS MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 NORTH AMERICA BLADDER DISORDERS MARKET: SNAPSHOT (2021)

FIGURE 31 NORTH AMERICA BLADDER DISORDERS MARKET: BY COUNTRY (2021)

FIGURE 32 NORTH AMERICA BLADDER DISORDERS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 33 NORTH AMERICA BLADDER DISORDERS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 34 NORTH AMERICA BLADDER DISORDERS MARKET: BY TYPE (2022-2029)

FIGURE 35 NORTH AMERICA BLADDER DISORDERS MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。