北美水产养殖设备市场,按类型(水净化设备、曝气设备、水循环和曝气设备、自动喂鱼器、捕鱼设备、围堵设备、围网卷轴、维护和维修设备、水温控制装置、水质检测仪器、清塘设备等)、应用(室外水产养殖、室内水产养殖)最终用途(水生动物、水生植物)、分销渠道(直接、间接)划分,行业趋势及预测至 2029 年。

北美水产养殖设备市场分析与洞察

海鲜贸易的增长和对水产养殖的需求增加预计将推动北美水产养殖设备市场的需求。然而,对水产养殖食品安全以及致命疾病和寄生虫传播的担忧可能会进一步限制市场的增长。

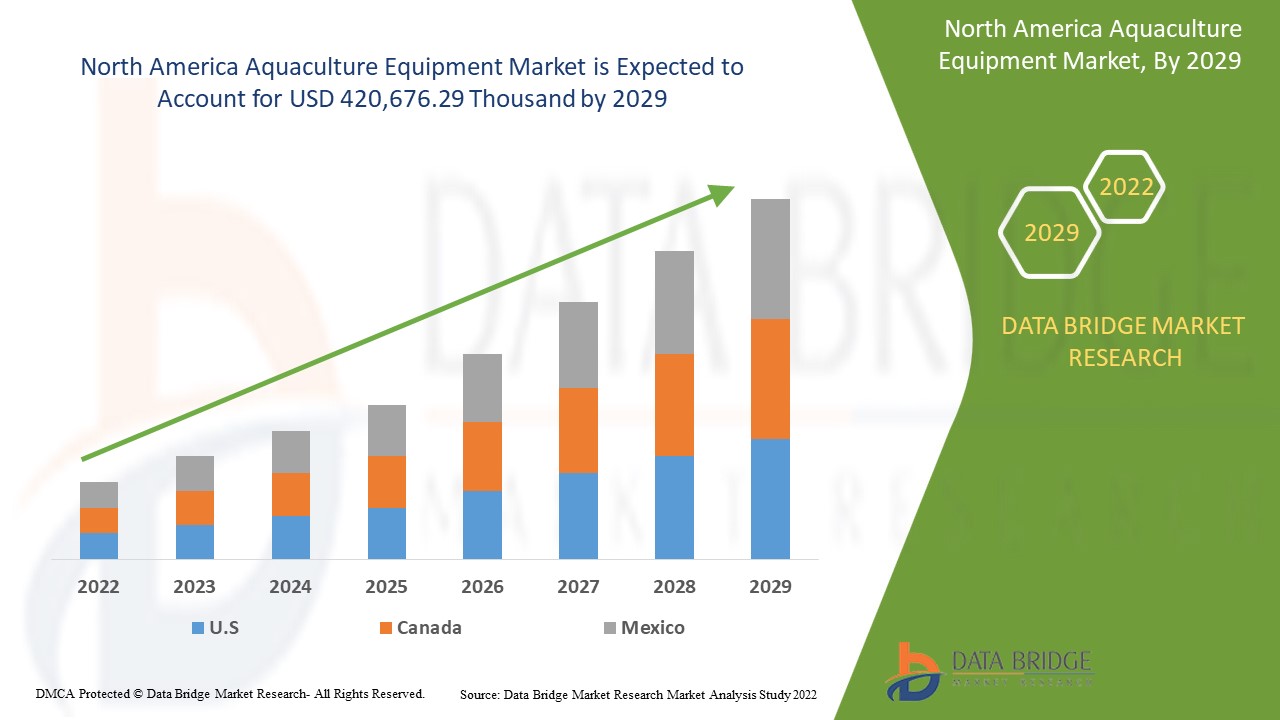

Data Bridge Market Research 分析,北美水产养殖设备市场预计到 2029 年将达到 420,676.29 万美元的价值,预测期内的复合年增长率为 3.7%。水净化设备是北美水产养殖设备市场中最大的类型细分市场。北美水产养殖设备市场报告还深入介绍了定价分析、专利分析和技术进步。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2014) |

|

定量单位 |

收入(千美元) |

|

涵盖的领域 |

按类型(水净化设备、曝气装置、水循环和曝气设备、自动喂鱼器、捕鱼设备、围堵设备、围网卷轴、维护和修理设备、水温控制装置、水质检测仪器、清塘设备等)、用途(室外水产养殖、室内水产养殖)最终用途(水生动物、水生植物)、分销渠道(直接、间接)。 |

|

覆盖国家 |

美国、加拿大和墨西哥 |

|

涵盖的市场参与者 |

AquacuLture Systems Technologies, LLC、SKAGINN 3X、Norfab Equipment Ltd.、Sino-Aqua Corporation、BAADER、FAIVRE Ets、Cflow、FREA SOLUTIONS 和 Aquamof Aquaculture Technologies Ltd. 等等。 |

市场定义

水产养殖是水生植物、水生动物和其他水生生物的养殖。它是在水环境中繁殖、饲养和收获生物。因此,水产养殖设备是指在水产养殖过程中使用的设备。在过去的一年里,水产养殖业的增长势头强劲,并显示出巨大的增长潜力。因此,越来越多的参与者进入这个领域。

北美水产养殖设备市场动态

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。下面将详细讨论所有这些内容:

驱动程序

-

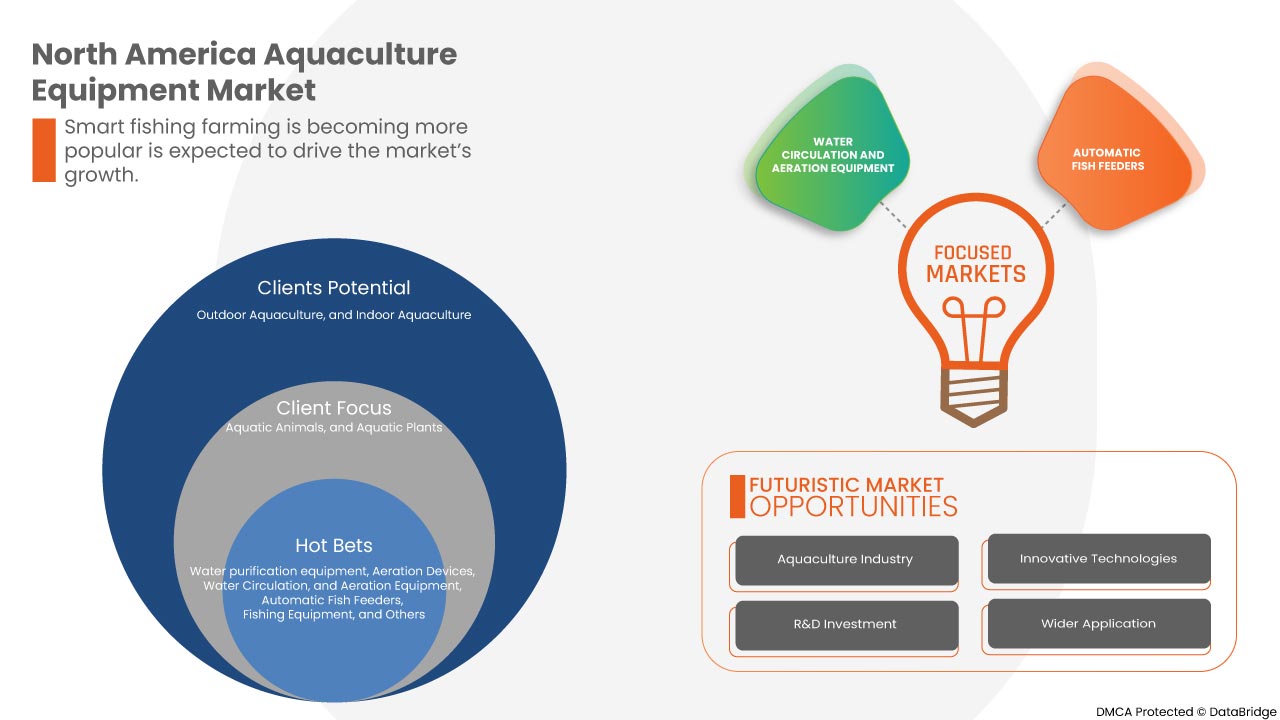

水产养殖业的兴起、扩张和增长

水产养殖,即鱼类和海鲜养殖,是食用动物行业增长最快的领域。北美贸易扩张、野生鱼类供应量下降、产品价格竞争激烈、收入增加和城市化推动了水产养殖业的增长——所有这些都导致全球人均海鲜消费量上升。此外,进行创造性技术开发、投资研发和与主要行业参与者合作将扩大水产养殖业的全球影响力。这也将促进水产养殖设备的增长,例如曝气机、泵、喂食器、过滤器和其他依赖于水产养殖业的设备。因此,随着水产养殖业的增长,对水产养殖设备的需求将上升。在可预见的未来,这预计将推动北美水产养殖设备市场的发展。

-

海产品贸易增加

由于数十年来渔业和水产养殖产量的增加以及北美需求的不断增长,海鲜已成为当今世界上交易量最大的食品类别之一。水产品贸易增长最快的表明,海鲜贸易量中更高比例的品种来自不同种类。发展中国家在海鲜出口中发挥着重要作用,因为发达国家越来越依赖发展中国家进口高价值品种。因此,海鲜贸易的增加促进了水产养殖业的增长,这将导致对水产养殖设备的需求增加。预计这将在不久的将来推动水产养殖设备市场的发展。

机会

-

政府采取措施促进水产养殖业发展

渔业和水产养殖业每天为全世界数亿人提供食物。它通过发挥多种功能,帮助粮食生产和帮助濒危动物。政府的举措,例如促进水产养殖业扩张的法规和计划,仅仅是为未来发展和技术解决方案铺平了道路。这种扩张将在可预见的未来为重要的行业参与者和农民创造更多机会,使水产养殖业成为一个值得关注的行业。因此,政府为促进水产养殖而采取的措施预计将为水产养殖设备市场提供市场增长机会

限制/挑战

- 对水产养殖食品安全的担忧

食源性感染的流行病学数据显示,如果迅速冷藏并妥善处理,从公海捕捞的鱼通常是安全健康的食物。另一方面,水产养殖产品与某些食品安全问题有关,因为淡水和沿海栖息地的化学和生物制剂污染危险高于公海。因此,缺乏基础设施和持续的政府限制可能会限制市场扩张。水产养殖生产肯定会成为生产供人类消费的水产品越来越重要的手段,但与水产养殖相关的食品安全风险将对经济造成严重打击。这种对水产养殖食品安全的担忧将阻碍水产养殖业的发展,从而限制水产养殖设备市场的增长。

- 过度捕捞的困境

由于世界上 90% 的野生“鱼类资源”已被完全捕捞、过度开发或枯竭,水产养殖业正在增长;然而,水产养殖是否是解决过度捕捞问题的办法仍有争议。由于海鲜已成为地球上交易量最大的食品商品之一,过度捕捞现象正在加剧。当鱼类种群被过度捕捞时,我们赖以生存的脆弱海洋生态系统就会受到破坏。水产养殖包括咸水和淡水物种,是一种在受控环境下养殖鱼类的技术。它是世界上增长最快的食品生产行业,约占所有鱼类消费量的 44%,但为了保持其扩张,它主要依赖于捕获野生捕捞的鱼类。因此,与过度捕捞有关的困难可能对水产养殖业构成挑战,这可能会对水产养殖设备市场的增长构成挑战。

COVID-19 对北美水产养殖设备市场的影响

2020-2021 年,COVID-19 影响了各个制造业,导致工作场所关闭、供应链中断和交通限制。由于封锁,过去几年零售店关闭和客户进出受限,市场销售额下降。

然而,后疫情时期市场的增长归因于消费者健康意识的增强以及对健康营养海鲜的需求不断增长。由于各种健康益处和高蛋白食品的日益普及,水产养殖在人们中越来越受欢迎。主要的市场参与者正在做出各种战略决策,以在 COVID-19 后反弹。参与者正在进行多项研发活动以改进他们的产品。他们通过探索不同的零售渠道和扩展到新的地区来提高市场份额。

最新动态

- 2022 年 8 月,SKAGINN 3X 与挪威 BlueWild 签署了一项合同,为该公司创新型新型拖网渔船提供一套完整的鱼类加工厂。这艘拖网渔船旨在实现各个层面的可持续性、质量和效率。这对该组织来说是一项里程碑式的协议。

- 2022 年 4 月,Cflow AS 参加了 4 月 4 日至 7 日举行的挪威海事展。挪威海事展位于海洋中心。这里是海事和海洋行业每两年聚会一次的地方——是来自世界各地的关键决策者联系、合作和达成交易以发掘新商机的天然中心。

- 2022 年 2 月,北美陆基水产养殖 RAS 技术的先驱 AquaMaof Aquaculture Technologies Ltd. 与 Atacama Yellowtail SpA (AYT) 签署了其在智利的首份合同,将在科金博地区养殖和生产 900 吨黄尾鲯鳅 (Seriola lalandi)。这将有助于该公司获得更多投资并增加其全球经济活动。

北美水产养殖设备市场范围

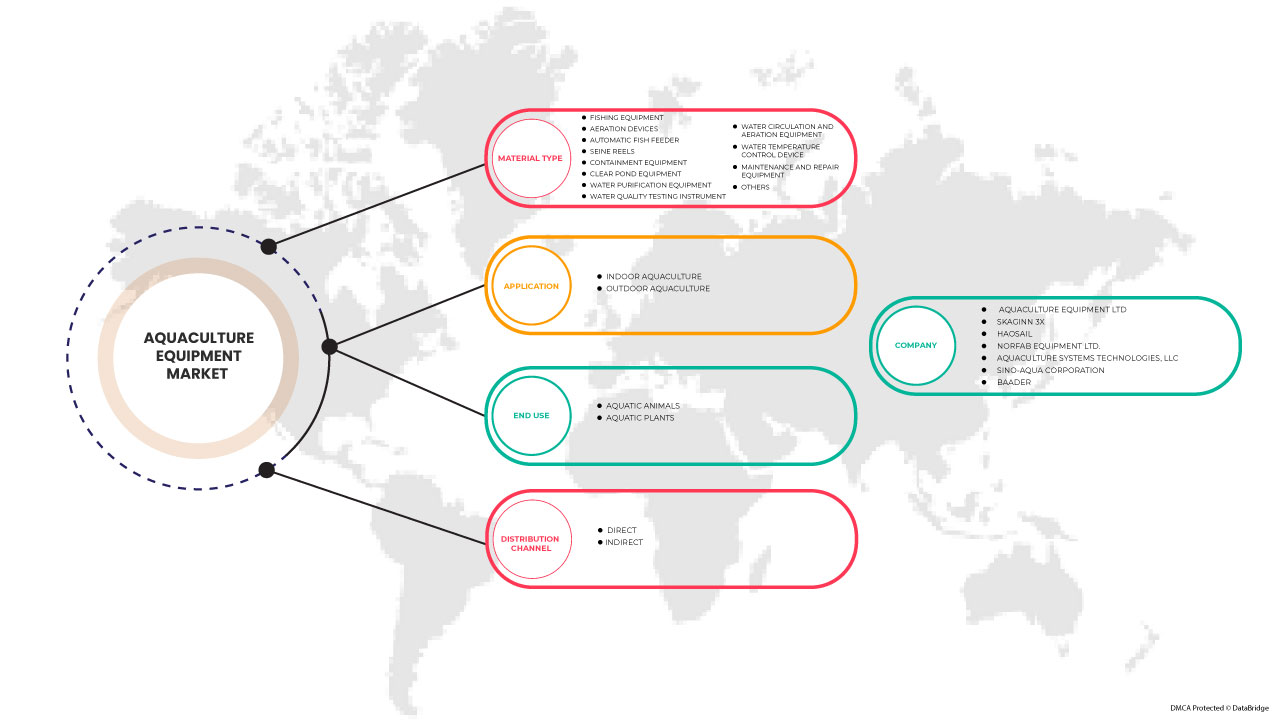

北美水产养殖设备市场根据类型、应用、最终用途和分销渠道进行细分。这些细分市场之间的增长情况将帮助您分析行业中的主要增长细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

类型

- 净水设备

- 曝气装置

- 水循环曝气设备

- 自动喂鱼器

- 钓鱼设备

- 遏制设备

- 塞纳河渔船

- 维护和修理设备

- 水温控制装置

- 水质检测仪器

- 清塘设备

- 其他的

根据类型,北美水产养殖设备市场细分为水净化设备、曝气设备、水循环和曝气设备、自动喂鱼器、捕鱼设备、围网设备、围网卷轴、维护和修理设备、水温控制装置、水质检测仪器、清塘设备等。

应用

- 户外水产养殖

- 室内水产养殖

根据应用,北美水产养殖设备市场分为室外水产养殖和室内水产养殖。

最终用途

- 水生动物

- 水生植物

根据最终用途,北美水产养殖设备市场分为水生动物和水生植物。

分销渠道

- 直接的

- 间接

根据分销渠道,北美水产养殖设备市场分为直接分销渠道和间接分销渠道。

北美水产养殖设备市场区域分析/见解

对北美水产养殖设备市场进行了分析,并按国家、类型、应用、最终用途和分销渠道提供了市场规模洞察和趋势,如上所述。

北美水产养殖设备市场覆盖美国、加拿大、墨西哥等国家。

由于美国水产养殖产量不断增长,预计美国将主导北美水产养殖设备市场。美国一直是北美地区水产养殖设备快速普及的推动力。加拿大和墨西哥是另外两个需求不断增加的国家,因为水产养殖在消费者中越来越受欢迎。

北美水产养殖设备市场报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和国内监管变化。新销售、替代销售、国家人口统计、疾病流行病学和进出口关税等数据点是用于预测各个国家市场情景的一些重要指标。此外,在提供国家数据的预测分析时,还考虑了北美品牌的存在和可用性以及由于来自本地和国内品牌的大量或稀缺竞争而面临的挑战以及销售渠道的影响。

竞争格局和北美水产养殖设备市场份额分析

北美水产养殖设备市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、北美业务、生产基地和设施、生产能力、公司优势和劣势、解决方案发布、产品宽度和广度以及应用主导地位。以上数据点仅与专注于北美水产养殖设备市场的公司有关。

北美水产养殖设备市场的一些主要参与者包括 Aquaculture Systems Technologies, LLC、SKAGINN 3X、Norfab Equipment Ltd.、Sino-Aqua Corporation、BAADER、FAIVRE Ets、Cflow、FREA SOLUTIONS 和 Aquamof Aquaculture Technologies Ltd. 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA AQUACULTURE EQUIPMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USE COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND OUTLOOK

4.1.1 COMPARATIVE BRAND ANALYSIS

4.1.2 PRODUCT VS BRAND OVERVIEW

4.2 FACTORS INFLUENCING PURCHASING DECISION OF CUSTOMER

4.2.1 ECONOMIC FACTOR

4.2.2 FUNCTIONAL FACTOR

4.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.4 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.4.1 INDUSTRY TRENDS FOR NORTHERN EUROPE

4.5 NEW PRODUCT LAUNCH STRATEGY

4.5.1 OVERVIEW

4.5.2 NUMBER OF NEW PRODUCT LAUNCHES

4.5.3 MEETING CONSUMER REQUIREMENT

4.6 IMPACT OF ECONOMIC SLOWDOWN

4.7 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.7.1 TECHNOLOGICAL ADVANCMENTS IN NORTHERN EUROPE

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 RAW MATERIAL PROCUREMENT

4.8.2 MANUFACTURING AND PACKING

4.8.3 MARKETING AND DISTRIBUTION

4.8.4 END USERS

4.9 VALUE CHAIN ANALYSIS

5 REGULATORY FRAMEWORK AND GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE RISE, EXPANSION, AND GROWTH OF THE AQUACULTURE INDUSTRY

6.1.2 INCREASE IN SEAFOOD TRADING

6.1.3 DEMAND FOR AQUAPONICS IS INCREASING

6.1.4 SMART FISH FARMING IS BECOMING MORE POPULAR

6.2 RESTRAINTS

6.2.1 CONCERNS ABOUT FOOD SAFETY IN AQUACULTURE

6.2.2 THE SPREAD OF DEADLY DISEASES AND PARASITES

6.3 OPPORTUNITIES

6.3.1 RISING GOVERNMENT MEASURES TO BOOST AQUACULTURE

6.3.2 CONCENTRATING ON THE DEVELOPMENT OF INNOVATIVE TECHNOLOGY SOLUTIONS

6.3.3 ADEQUATE AND AFFORDABLE CREDIT AVAILABILITY AND FINANCING INSTRUMENTS

6.4 CHALLENGES

6.4.1 OVERFISHING DIFFICULTIES

6.4.2 AQUACULTURE'S ENVIRONMENTAL DIFFICULTIES AND CONCERNS

7 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY TYPE

7.1 OVERVIEW

7.2 WATER PURIFICATION EQUIPMENT

7.2.1 WATER PUMPS AND FILTERS

7.2.2 AERATORS

7.2.3 FEEDERS

7.2.4 PROTEIN SKIMMER

7.3 AERATION DEVICES

7.4 WATER CIRCULATION AND AERATION EQUIPMENT

7.5 AUTOMATIC FISH FEEDER

7.6 FISHING EQUIPMENT

7.7 CONTAINMENT EQUIPMENT

7.8 SEINE REELS

7.9 MAINTENANCE AND REPAIR EQUIPMENT

7.9.1 DIGGING TOOLS

7.9.2 LEVELLING TOOLS

7.9.3 DESILTING EQUIPMENT

7.9.4 OTHERS

7.1 WATER TEMPERATURE CONTROL DEVICES

7.11 WATER QUALITY TESTING INSTRUMENT

7.12 CLEAR POND EQUIPMENT

7.13 OTHERS

8 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 OUTDOOR AQUACULTURE

8.2.1 BRACKISH WATER

8.2.2 MARINE

8.3 INDOOR AQUACULTURE

9 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY END USE

9.1 OVERVIEW

9.2 AQUATIC ANIMALS

9.2.1 FISH

9.2.2 MOLLUSKS

9.2.3 CRUSTACEAN

9.2.4 OTHERS

9.3 AQUATIC PLANTS

9.3.1 SUBMERGED (SEAWEED)

9.3.2 FLOATING (ALGAE)

9.3.3 EMERGED

10 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT

10.3 INDIRECT

11 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY GEOGRAPHY

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.1.1 NEW PRODUCTION FACILITY

12.1.2 EVENT

12.1.3 NEW PRODUCT LAUNCH

12.1.4 COLLABORATION

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 BAADER

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT UPDATES

14.2 SKAGINN 3X

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PORTFOLIO

14.2.4 RECENT UPDATES

14.3 AQUAMAOF AQUACULTURE TECHNOLOGIES LTD.

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT UPDATES

14.4 NANRONG SHANGHAI CO., LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT UPDATES

14.5 CFLOW

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT UPDATES

14.6 AQUACULTURE EQUIPMENT LTD

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATES

14.7 AQUACULTURE SYSTEMS TECHNOLOGIES, LLC

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATES

14.8 AQUANEERING INCORPORATED

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATES

14.9 DURA-TECH

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATES

14.1 FAIVRE ETS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATES

14.11 FISHFARMFEEDER

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATES

14.12 FREA SOLUTIONS

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATES

14.13 HAOSAIL

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATES

14.14 HUNG STAR ENTERPRISE CORP.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT UPDATES

14.15 NORFAB EQUIPMENT LTD.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATES

14.16 PIONEER GROUP

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT UPDATES

14.17 RASTAQUACULTURE

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT UPDATES

14.18 SAGAR AQUACULTURE PVT LTD

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT UPDATES

14.19 SINO-AQUA CORPORATION

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT UPDATES

14.2 SRR AQUA SUPPLIERS LLP

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 IMPORT DATA OF AIR PUMPS, AIR OR OTHER GAS COMPRESSORS AND VENTILATING OR RECYCLING HOODS, AND OTHER AQUACULTURE EQUIPMENT; HS CODE – 841480 (USD THOUSAND)

TABLE 2 EXPORT DATA OF AIR PUMPS, AIR OR OTHER GAS COMPRESSORS AND VENTILATING OR RECYCLING HOODS AND OTHER AQUACULTURE EQUIPMENT; HS CODE – 841480 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 6 NORTH AMERICA WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA AERATION DEVICES IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA WATER CIRCULATION AND AERATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA AUTOMATIC FISH FEEDER IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA FISHING EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 NORTH AMERICA CONTAINMENT EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA SEINE REELS IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA MAINTENANCE AND REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA MAINTENANCE AND REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA WATER TEMPERATURE CONTROL DEVICES IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA WATER QUALITY TESTING INSTRUMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA CLEAR POND EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA OTHERS IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA INDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA DIRECT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA INDIRECT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY COUNTRY, 2020-2029 (THOUSAND UNITS)

TABLE 34 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 36 NORTH AMERICA WATER PURIFICATION IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 44 U.S. AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 U.S. AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 46 U.S. WATER PURIFICATION IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 U.S. MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 U.S. AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 49 U.S. OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 50 U.S. AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 51 U.S. AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 52 U.S. AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 53 U.S. AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 54 CANADA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 CANADA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 56 CANADA WATER PURIFICATION IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 CANADA MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 CANADA AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 59 CANADA OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 60 CANADA AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 61 CANADA AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 62 CANADA AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 63 CANADA AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 64 MEXICO AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 MEXICO AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 66 MEXICO WATER PURIFICATION IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 MEXICO MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 68 MEXICO AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 69 MEXICO OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 70 MEXICO AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 71 MEXICO AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 72 MEXICO AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 73 MEXICO AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET

FIGURE 2 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: MARKET END USE COVERAGE GRID

FIGURE 11 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: SEGMENTATION

FIGURE 14 RISING, EXPANSION, AND GROWTH OF THE AQUACULTURE INDUSTRY IS EXPECTED TO DRIVE THE NORTH AMERICA AQUACULTURE EQUIPMENT MARKET GROWTH IN THE FORECAST PERIOD OF 2022 -2029

FIGURE 15 WATER PURIFICATION EQUIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA AQUACULTURE EQUIPMENT MARKET IN 2022 & 2029

FIGURE 16 SUPPLY CHAIN ANALYSIS- NORTH AMERICA AQUACULTURE EQUIPMENT MARKET

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA AQUACULTURE EQUIPMENT MARKET

FIGURE 18 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: BY TYPE, 2021

FIGURE 19 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: BY APPLICATION, 2021

FIGURE 20 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: BY END-USE, 2021

FIGURE 21 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 22 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: SNAPSHOT (2021)

FIGURE 23 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: BY COUNTRY (2021)

FIGURE 24 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: BY TYPE (2022-2029)

FIGURE 27 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。