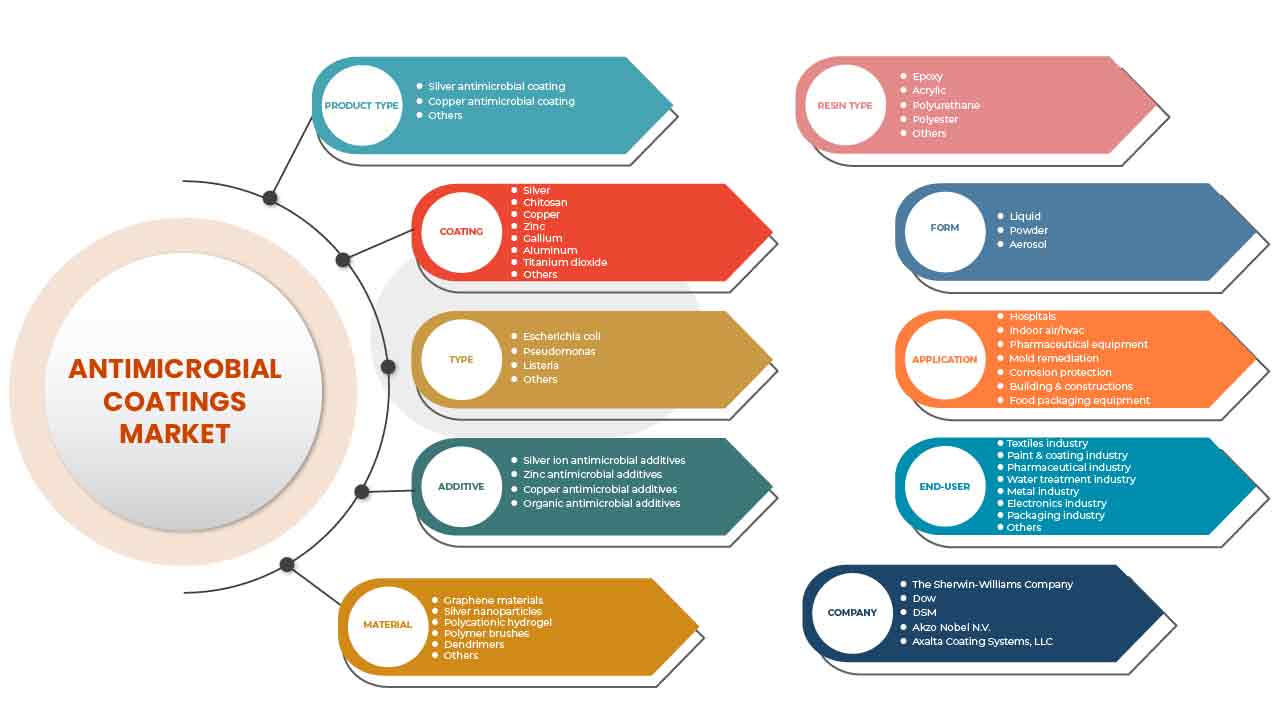

North America Antimicrobial Coatings Market, By Product Type (Silver Antimicrobial Coating, Copper Antimicrobial Coating, Others), Coating (Silver, Chitosan, Titanium Dioxide, Aluminum, Copper, Zinc, Gallium, Others), Type (Escherichia Coli, Pseudomonas, Listeria, Others), Additives (Silver Ion Antimicrobial Additives, Organic Antimicrobial Additives, Copper Antimicrobial Additives, Zinc Antimicrobial Additives), Material (Graphene Materials, Silver Nanoparticles, Polycationic Hydrogel, Polymer Brushes, Dendrimers, Others), Resin Type (Epoxy, Acrylic, Polyurethane, Polyester, Others), Form (Liquid, Powder, Aerosol), Application (Hospitals, Indoor Air/HVAC, Pharmaceutical Equipment, Mold Remediation, Corrosion Protection, Building & Construction and Food Packaging Equipment), End-Users (Pharmaceutical Industry, Paint and Coating Industry, Packaging Industry, Textiles Industry, Electronics Industry, Metal Industry, Water Treatment Industry, and Others) - Industry Trends and Forecast to 2029.

Market Analysis and Insights

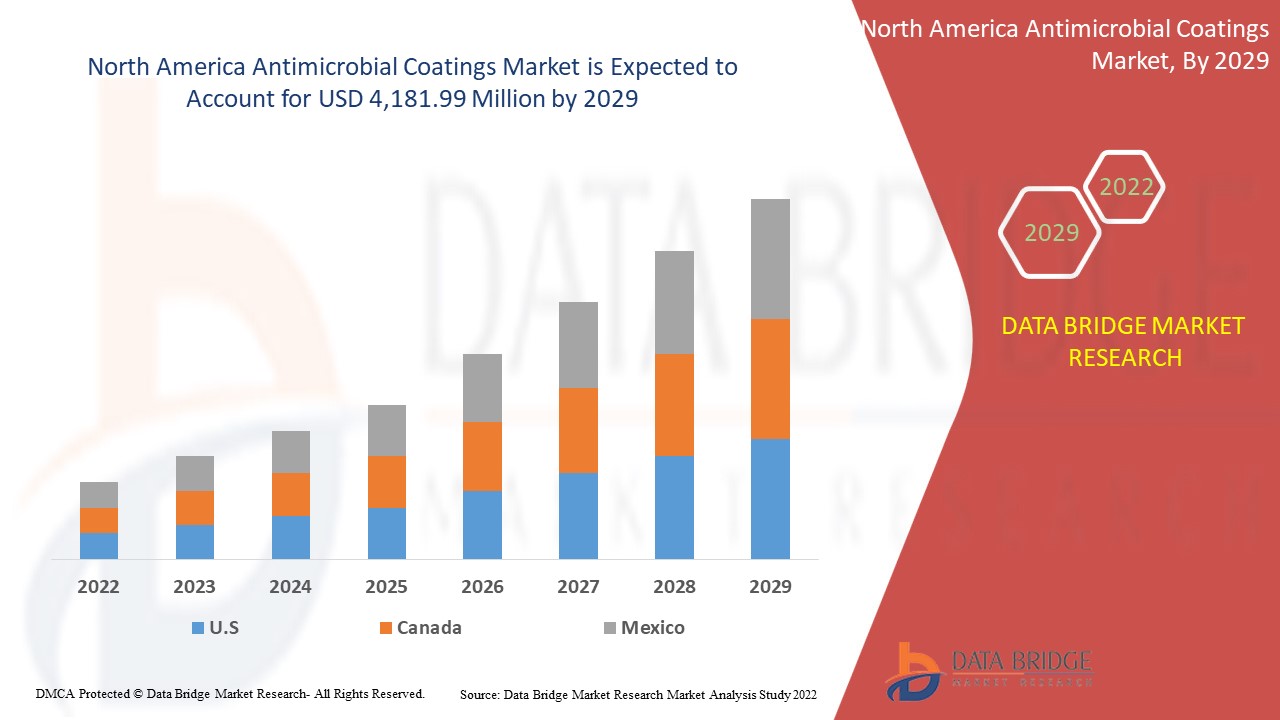

The North America antimicrobial coatings market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 11.5% in the forecast period of 2022 to 2029 and is expected to reach USD 4,181.99 million by 2029. The major factor driving the growth of the North America antimicrobial coatings market is the growing demand for heating, ventilation, and air conditioning to improve indoor air quality

Antimicrobial coatings assist in maintaining the quality of applied surfaces by preventing the growth of microorganisms such as fungi, parasites, and bacteria. The usage of these antimicrobial coatings provides improved cleanliness and hygiene as they end the requirement of frequent cleaning. As a result, antimicrobial coatings are more cost-effective and offer lasting protection against pathogens. These coatings are generally applied on walls, vents, counters, and door handles. Moreover, as these coatings help sterilize medical tools, surgical masks, gloves, and clothing, they find vast applications in clinics, hospitals, and healthcare centers.

The application of antimicrobial coatings improves the durability and appearance of the applied surface and aids in shielding the surface from the attack of microbes. As a result, these coatings are widely used to eliminate the germination of pathogens that can cause infectious diseases such as Ebola, influenza, mumps, measles, chickenpox, and rubella.

为改善室内空气质量,供暖、通风和空调的需求不断增长,以及人们对医源性感染 (HCAI) 的认识不断提高,预计将推动市场对抗菌涂料的需求。随着全球抗菌涂料消费量的增加,各大公司正在扩大其在不同国家的生产能力,以加强这些产品在市场上的存在。

可能影响市场的主要限制因素是与抗菌涂料相关的严格规定。此外,活性成分向环境中的排放也是北美抗菌涂料市场的一个制约因素。

北美抗菌涂料市场报告提供了市场份额、新发展、国内和本地市场参与者的影响的详细信息,分析了新兴收入来源、市场法规变化、产品审批、战略决策、产品发布、地域扩张和市场技术创新方面的机会。要了解分析和市场情况,请联系我们获取分析师简报;我们的团队将帮助您创建收入影响解决方案,以实现您的预期目标。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2014) |

|

定量单位 |

收入(百万美元),定价(美元) |

|

涵盖的领域 |

按产品类型(银抗菌涂层、铜抗菌涂层、其他)、按涂层(银、壳聚糖、二氧化钛、铝、铜、锌、镓、其他)、按类型(大肠杆菌、假单胞菌、李斯特菌、其他)、按添加剂(银离子抗菌添加剂、有机抗菌添加剂、铜抗菌添加剂、锌抗菌添加剂)、按材料(石墨烯材料、银纳米颗粒、聚阳离子水凝胶、聚合物刷、树枝状聚合物、其他)、按树脂类型(环氧树脂、丙烯酸树脂、聚氨酯、聚酯树脂、其他)、按形式(液体、粉末、气溶胶)、按应用(医院、室内空气/暖通空调、制药设备、霉菌修复、防腐、建筑和食品包装设备)、按最终用户(制药行业、油漆和涂料行业、包装行业、纺织行业、电子行业、金属工业、水处理工业及其他) |

|

覆盖国家 |

美国、加拿大和墨西哥 |

|

涵盖的市场参与者 |

Axalta Coating Systems, LLC、Akzo Nobel NV、SANITIZED AG、PPG Industries Inc.、The Sherwin-Williams Company、Microban International、Fiberlock、Burke Industrial Coatings、Aereus Technologies、Linetec、Katilac Coatings、Dow、Kastus Technologies Company Limited、Specialty Coating Systems Inc.、DuPont、Flowcrete、Nano Care Deutschland AG 等 |

市场定义

抗菌涂层是一种抗微生物涂层,其中含有可防止微生物杂质的抗菌剂。它们在建筑、食品和医疗保健行业有着广泛的应用。它们被应用于门、玻璃板、墙壁、门、暖通空调帐篷、柜台等。抗菌涂层是在表面应用化学剂,可以阻止致病微生物的生长。除此之外,抗菌涂层还有助于提高表面耐久性、外观、耐腐蚀性等。这些涂层用于医疗设备,以破坏或抑制微生物的生长,保护人类免受传染病的感染。众所周知,抗菌涂层是对抗医疗相关感染的有力武器。抗菌涂层具有高效的可行抗菌涂层和精确剂量的改性,可直接从医疗设备的表面输送。抗菌涂层专注于通过改变界面特征来减少生物医学设备上的积累。

北美抗菌涂料市场动态

驱动程序

- 供暖、通风和空调需求不断增长,室内空气质量不断改善

北美地区拥有许多大型建筑,包括大型办公室和住宅。随着该地区基础设施建设的不断推进,由于疾病传播的增加,人们越来越意识到良好的室内空气质量。因此,对有效的供暖、通风和空调的需求不断增加,以改善室内空气质量,这有望推动北美抗菌涂料市场的发展。

- 医疗器械行业需求巨大

抗菌涂层能够防止和控制任何表面病原体生长,尤其是在医疗保健领域,这种能力和潜力正在推动医疗器械行业对其的需求激增。因此,医疗保健行业以及诊所和医院等机构对医疗器械行业的巨大需求预计将成为北美抗菌涂层市场的驱动力。

机会

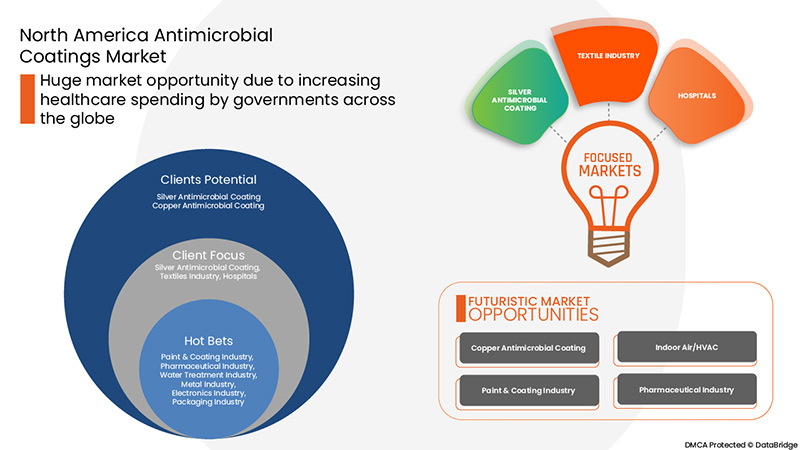

- 关键新型应用领域的使用率不断上升

随着美国和加拿大等发达国家对安全和卫生的关注和意识不断增强,各公司都致力于开发抗菌和抗菌产品,以确保客户的安全。此外,这有助于满足不断变化的消费者偏好,并有助于增加抗菌涂层产品的市场需求,从而为北美抗菌涂层市场的增长提供有利可图的机会。

- 抗菌涂层的技术进步

抗菌涂层技术的快速发展,加上不同行业对先进抗菌涂层产品的需求不断增长,预计将在预测期内为抗菌涂层市场创造机会

限制/挑战

- 向环境中排放有效成分

抗菌涂层可涂在任何产品或表面上,以防止感染传播给人类和其他生物。然而,长期使用抗菌涂层也会导致健康危害。大多数抗菌涂层由锌、银和铜等成分组成,并主动将这些成分释放回环境中。这些活性成分缓慢进入周围的空气和其他水体,对生态系统造成危害。

因此,抗菌涂料对环境的不利影响加上缺乏关于尽量减少其对环境不利影响的认识和信息可能会抑制北美抗菌涂料市场的发展。

- 与抗菌涂料相关的严格规定

美国环境保护署 (EPA)、FDA 和 REACH 等各组织对抗菌涂料的使用制定了严格的规定,可能会阻碍北美抗菌涂料市场的增长。

- 人们对纳米颗粒毒性的担忧日益增加

长期接触抗菌涂料释放的纳米颗粒毒性可能会导致严重的健康问题,这引起了人们的担忧,并可能对北美抗菌涂料市场的增长构成挑战。

- 新冠肺炎疫情导致产品成本高企和供应链中断

由于全国范围内的封锁,COVID-19 的爆发预计将对预测期内北美抗菌涂料市场的增长构成挑战,这对抗菌涂料的需求和销售产生了负面影响。然而,随着封锁的放松,工作流程开始增加,这有助于制造商重返市场。此外,政府对经济增长的支持性法规和初创企业的兴起可能会在预测期内激增对抗菌涂料市场的需求。

最新动态

- 2021 年 3 月,聚对二甲苯保形涂层服务和技术的全球领导者 Specialty Coating Systems, Inc. 宣布收购聚对二甲苯和液体保形涂层服务提供商 Diamond-MT, Inc.。这一发展将为公司带来新的增长机会。

- 2021 年 11 月,杜邦公司签署最终协议,以 52 亿美元收购罗杰斯公司(“罗杰斯”)。杜邦公司宣布了一系列举措,推进其作为一家领先的多工业公司战略,专注于市场领先的高增长、高利润业务,具有互补的技术和财务特征。这一发展将有助于杜邦公司在罗杰斯公司的帮助下扩大业务。

北美抗菌涂料市场范围

北美抗菌涂料市场根据产品类型、涂料、类型、材料、添加剂、树脂类型、形式、应用和最终用户进行分类。

产品类型

- 银抗菌涂层

- 铜抗菌涂层

- 其他的

根据产品类型,北美抗菌涂料市场分为银抗菌涂料、铜抗菌涂料和其他涂料。

涂层

- 银

- 壳聚糖

- 铜

- 锌

- 镓

- 铝

- 二氧化钛

- 其他的

根据涂层,北美抗菌涂层市场分为银、壳聚糖、铜、锌、镓、铝、二氧化钛等。

类型

- 大肠杆菌

- 假单胞菌

- 李斯特菌

- 其他的

根据类型,北美抗菌涂料市场分为大肠杆菌、假单胞菌、李斯特菌等。

添加剂

- 银离子抗菌添加剂

- 锌抗菌添加剂

- 铜抗菌添加剂

- 有机抗菌添加剂

根据添加剂,北美抗菌涂料市场分为银离子抗菌添加剂、锌抗菌添加剂、铜抗菌添加剂和有机抗菌添加剂。

材料

- 石墨烯材料

- 聚阳离子水凝胶

- 银纳米粒子

- 聚合物刷

- 树枝状聚合物

- 其他的

根据材料,北美抗菌涂料市场分为石墨烯材料、银纳米粒子、聚阳离子水凝胶、聚合物刷、树枝状聚合物等。

树脂类型

- 丙烯酸纤维

- 聚酯纤维

- 聚氨酯

- 环氧树脂

- 其他的

根据树脂类型,北美抗菌涂料市场分为环氧树脂、丙烯酸、聚氨酯、聚酯和其他。

形式

- 液体

- 气雾剂

- 粉末

根据形式,北美抗菌涂料市场分为液体、气溶胶和粉末。

应用

- 医院

- 室内空气/暖通空调

- 制药设备

- 霉菌修复

- 防腐蚀

- 建筑和施工

- 食品包装设备

- 其他的

根据应用,北美抗菌涂料市场分为医院、室内空气/暖通空调、制药设备、霉菌修复、防腐、建筑和施工、食品包装设备等。

最终用户

- 制药行业

- 油漆涂料行业

- 包装行业

- 纺织工业

- 电子行业

- 金属工业

- 水处理行业

- 其他的

On the basis of end-users, North America antimicrobial coatings market is segmented into the pharmaceutical industry, paint and coating industry, packaging industry, textiles industry, electronics industry, metal industry, water treatment industry, and others.

North America Antimicrobial Coatings Regional Analysis/Insights

The North America antimicrobial coatings market is categorized based on country, product type, coating, type, material, additive, resin type, form, application, and end-users.

North America antimicrobial coatings market is further segmented into the U.S., Canada, and Mexico.

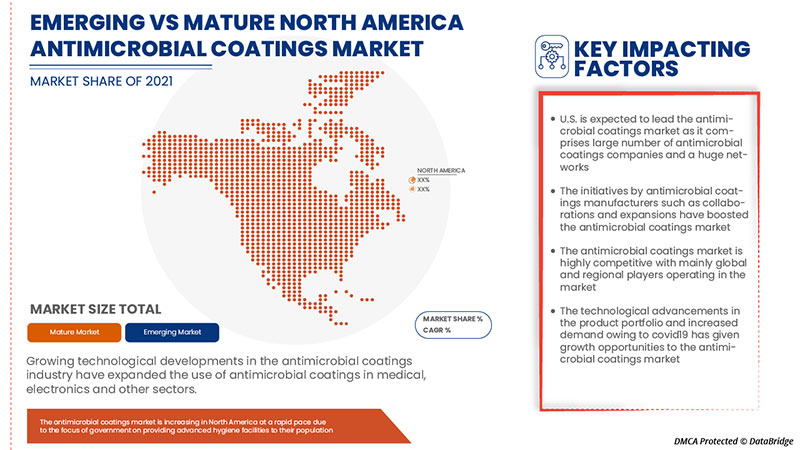

U.S. is expected to dominate the North America antimicrobial coatings market in terms of market share and revenue and will continue to flourish its dominance during the forecast period. This is due to the increasing need for safe environments in the country.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of North American brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Antimicrobial Coatings Market Share Analysis

North America antimicrobial coatings market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies' focus related to the North America antimicrobial coatings market.

Some of the prominent participants operating in the North America antimicrobial coatings market are Axalta Coating Systems, LLC, Akzo Nobel N.V., SANITIZED AG, PPG Industries Inc., The Sherwin-Williams Company, Microban International, Fiberlock, Burke Industrial Coatings, Aereus Technologies, Linetec, Katilac Coatings, Dow, Kastus Technologies Company Limited, Specialty Coating Systems Inc., DuPont, Flowcrete, Nano Care Deutschland AG, among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, North America Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA ANTIMICROBIAL COATINGS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR HEATING, VENTILATION, AND AIR CONDITIONING TO IMPROVE INDOOR AIR QUALITY

5.1.2 RISING AWARENESS REGARDING HEALTHCARE ASSOCIATED INFECTIONS (HCAI)

5.1.3 SIGNIFICANT DEMAND FROM THE MEDICAL DEVICE INDUSTRY

5.1.4 INCREASING ADOPTION ACROSS VARIOUS INDUSTRIAL APPLICATIONS

5.2 RESTRAINTS

5.2.1 EMISSION OF ACTIVE INGREDIENTS INTO THE ENVIRONMENT

5.2.2 STRINGENT REGULATIONS ASSOCIATED WITH ANTIMICROBIAL COATINGS

5.3 OPPORTUNITIES

5.3.1 RISING USAGE ACROSS KEY NOVEL APPLICATIONS

5.3.2 TECHNOLOGICAL ADVANCEMENTS IN ANTIMICROBIAL COATINGS

5.3.3 INCREASING HEALTHCARE SPENDING BY GOVERNMENTS ACROSS THE GLOBE

5.4 CHALLENGES

5.4.1 INCREASING CONCERNS REGARDING THE TOXICITY OF NANOPARTICLES

5.4.2 HIGH COST OF PRODUCTS AND SUPPLY CHAIN DISRUPTIONS DUE TO COVID-19 PANDEMIC

6 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 SILVER ANTIMICROBIAL COATINGS

6.3 COPPER ANTIMICROBIAL COATINGS

6.4 OTHERS

7 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY COATINGS

7.1 OVERVIEW

7.2 SILVER

7.3 CHITOSAN

7.4 TITANIUM DIOXIDE

7.5 ALUMINUM

7.6 COPPER

7.7 ZINC

7.8 GALLIUM

7.9 OTHERS

8 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY TYPE

8.1 OVERVIEW

8.2 ESCHERICHIA COLI

8.3 PSEUDOMONAS

8.4 LISTERIA

8.5 OTHERS

9 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE

9.1 OVERVIEW

9.2 SILVER ION ANTIMICROBIAL ADDITIVES

9.3 ORGANIC ANTIMICROBIAL ADDITIVES

9.4 COPPER ANTIMICROBIAL ADDITIVES

9.5 ZINC ANTIMICROBIAL ADDITIVES

10 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 GRAPHENE MATERIALS

10.3 SILVER NANOPARTICLES

10.4 POLYCATIONIC HYDROGEL

10.5 POLYMER BRUSHES

10.5.1 FUNCTIONALIZED POLYMER BRUSHES

10.5.2 NON-FOULING POLYMER BRUSHES

10.5.3 BRUSHES COMPRISING BACTERIAL POLYMERS

10.6 DENDRIMERS

10.7 OTHERS

11 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE

11.1 OVERVIEW

11.2 EPOXY

11.3 ACRYLIC

11.4 POLYURETHANE

11.5 POLYESTER

11.6 OTHERS

12 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY FORM

12.1 OVERVIEW

12.2 LIQUID

12.3 POWDER

12.4 AEROSOL

13 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 HOSPITALS

13.3 INDOOR AIR/HVAC

13.4 PHARMACEUTICAL EQUIPMENT

13.5 MOLD REMEDIATION

13.6 CORROSION PROTECTION

13.7 BUILDING & CONSTRUCTIONS

13.8 FOOD PACKAGING EQUIPMENT

13.9 OTHERS

14 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY END USER

14.1 OVERVIEW

14.2 TEXTILES INDUSTRY

14.2.1 SILVER ANTIMICROBIAL COATING

14.2.2 COPPER ANTIMICROBIAL COATING

14.2.3 OTHERS

14.3 PAINT & COATING INDUSTRY

14.3.1 SILVER ANTIMICROBIAL COATING

14.3.2 COPPER ANTIMICROBIAL COATING

14.3.3 OTHERS

14.4 PHARMACEUTICAL INDUSTRY

14.4.1 SILVER ANTIMICROBIAL COATING

14.4.2 COPPER ANTIMICROBIAL COATING

14.4.3 OTHERS

14.5 WATER TREATMENT INDUSTRY

14.5.1 SILVER ANTIMICROBIAL COATING

14.5.2 COPPER ANTIMICROBIAL COATING

14.5.3 OTHERS

14.6 METAL INDUSTRY

14.6.1 SILVER ANTIMICROBIAL COATING

14.6.2 COPPER ANTIMICROBIAL COATING

14.6.3 OTHERS

14.7 ELECTRONICS INDUSTRY

14.7.1 SILVER ANTIMICROBIAL COATING

14.7.2 COPPER ANTIMICROBIAL COATING

14.7.3 OTHERS

14.8 PACKAGING INDUSTRY

14.8.1 SILVER ANTIMICROBIAL COATING

14.8.2 COPPER ANTIMICROBIAL COATING

14.8.3 OTHERS

14.9 OTHERS

14.9.1 SILVER ANTIMICROBIAL COATING

14.9.2 COPPER ANTIMICROBIAL COATING

14.9.3 OTHERS

15 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.2 MERGERS & ACQUISITIONS

16.3 EXPANSIONS

16.4 NEW PRODUCT DEVELOPMENTS

17 SWOT ANALYSIS

18 COMPANY PROFILES

18.1 THE SHERWIN-WILLIAMS COMPANY

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT UPDATES

18.2 DOW

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT UPDATES

18.3 DSM

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT UPDATE

18.4 AKZO NOBEL N.V.

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT UPDATES

18.5 AXALTA COATING SYSTEMS, LLC

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT UPDATES

18.6 AEREUS TECHNOLOGIES

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT UPDATES

18.7 ARXADA AG

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT UPDATES

18.8 BURKE INDUSTRIAL COATINGS

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT UPDATE

18.9 DUPONT

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT UPDATE

18.1 FIBERLOCK

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT UPDATES

18.11 FLOWCRETE

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT UPDATE

18.12 GBNEUHAUS GMBH

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT UPDATE

18.13 LINETEC

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT UPDATE

18.14 KASTUS TECHNOLOGIES COMPANY LIMITED

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT UPDATE

18.15 KATILAC COATINGS

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT UPDATE

18.16 MICROBAN INTERNATIONAL

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT UPDATE

18.17 NANO CARE DEUTSCHLAND AG

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT UPDATE

18.18 SANITIZED AG

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT UPDATES

18.19 SPECIALTY COATING SYSTEMS INC.

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT UPDATES

18.2 PPG INDUSTRIES, INC.

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT UPDATES

19 QUESTIONNAIRE

20 RELATED REPORTS

表格列表

TABLE 1 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONNES)

TABLE 3 NORTH AMERICA SILVER ANTIMICROBIAL COATINGS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA SILVER ANTIMICROBIAL COATINGS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (KILO TONNES)

TABLE 5 NORTH AMERICA COPPER ANTIMICROBIAL COATINGS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA COPPER ANTIMICROBIAL COATINGS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (KILO TONNES)

TABLE 7 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (KILO TONNES)

TABLE 9 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY COATINGS, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA SILVER IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA CHITOSAN IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA TITANIUM DIOXIDE IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA ALUMINUM IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA COPPER IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA ZINC IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA GALLIUM IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA ESCHERICHIA COLI IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA PSEUDOMONAS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA LISTERIA IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA SILVER ION ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA ORGANIC ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA COPPER ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA ZINC ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA GRAPHENE MATERIALS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA SILVER NANOPARTICLES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA POLYCATIONIC HYDROGEL IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA DENDRIMERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA EPOXY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA ACRYLIC IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA POLYURETHANE IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA POLYESTER IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA LIQUID IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA POWDER IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA AEROSOL IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA HOSPITALS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA INDOOR AIR/HVAC IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA PHARMACEUTICAL EQUIPMENT IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA MOLD REMEDIATION IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA CORROSION PROTECTION IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA BUILDING & CONSTRUCTIONS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA FOOD PACKAGING EQUIPMENT IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA PAINT & COATING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA PAINT & COATING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY COUNTRY, 2020-2029 (KILO TONNES)

TABLE 74 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONNES)

TABLE 76 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY COATINGS, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 81 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 83 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 85 NORTH AMERICA TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 86 NORTH AMERICA PAINT & COATINGS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 87 NORTH AMERICA PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 88 NORTH AMERICA WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 89 NORTH AMERICA METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 NORTH AMERICA ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 91 NORTH AMERICA PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 92 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 U.S. ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 94 U.S. ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONNES)

TABLE 95 U.S. ANTIMICROBIAL COATINGS MARKET, BY COATINGS, 2020-2029 (USD MILLION)

TABLE 96 U.S. ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 U.S. ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 98 U.S. ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 99 U.S. POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 100 U.S. ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 101 U.S. ANTIMICROBIAL COATINGS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 102 U.S. ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 103 U.S. ANTIMICROBIAL COATINGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 U.S. TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 105 U.S. PAINT & COATINGS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 106 U.S. PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 U.S. WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 U.S. METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 109 U.S. ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 110 U.S. PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 111 U.S. OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 112 CANADA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 113 CANADA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONNES)

TABLE 114 CANADA ANTIMICROBIAL COATINGS MARKET, BY COATINGS, 2020-2029 (USD MILLION)

TABLE 115 CANADA ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 CANADA ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 117 CANADA ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 118 CANADA POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 119 CANADA ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 120 CANADA ANTIMICROBIAL COATINGS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 121 CANADA ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 CANADA ANTIMICROBIAL COATINGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 123 CANADA TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 124 CANADA PAINT & COATINGS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 125 CANADA PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 CANADA WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 127 CANADA METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 128 CANADA ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 129 CANADA PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 130 CANADA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 131 MEXICO ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 MEXICO ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONNES)

TABLE 133 MEXICO ANTIMICROBIAL COATINGS MARKET, BY COATINGS, 2020-2029 (USD MILLION)

TABLE 134 MEXICO ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 MEXICO ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 136 MEXICO ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 137 MEXICO POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 138 MEXICO ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 139 MEXICO ANTIMICROBIAL COATINGS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 140 MEXICO ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 141 MEXICO ANTIMICROBIAL COATINGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 142 MEXICO TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 143 MEXICO PAINT & COATINGS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 144 MEXICO PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 145 MEXICO WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 146 MEXICO METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 147 MEXICO ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 148 MEXICO PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 149 MEXICO OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: PRODUCT TYPE LIFELINE CURVE

FIGURE 7 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: SEGMENTATION

FIGURE 14 NORTH AMERICA IS EXPECTED TO DOMINATE THE NORTH AMERICA ANTIMICROBIAL COATINGS MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 GROWING DEMAND FOR HEATING, VENTILATION, AND AIR CONDITIONING TO IMPROVE INDOOR AIR QUALITY IS EXPECTED TO DRIVE THE NORTH AMERICA ANTIMICROBIAL COATINGS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 SILVER ANTIMICROBIAL COATINGS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ANTIMICROBIAL COATINGS MARKET IN 2022 & 2029

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA ANTIMICROBIAL COATINGS MARKET

FIGURE 18 RELATIVE CONTRIBUTIONS TO U.S. HEALTH EXPENDITURES, 2020

FIGURE 19 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY PRODUCT TYPE, 2021

FIGURE 20 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY COATINGS, 2021

FIGURE 21 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY TYPE, 2021

FIGURE 22 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY ADDITIVE, 2021

FIGURE 23 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY MATERIAL, 2021

FIGURE 24 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY RESIN TYPE, 2021

FIGURE 25 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY FORM, 2021

FIGURE 26 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY APPLICATION, 2021

FIGURE 27 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY END USER, 2021

FIGURE 28 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: SNAPSHOT (2021)

FIGURE 29 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY COUNTRY (2021)

FIGURE 30 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 31 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 32 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 33 NORTH AMERICA ANTIMICROBIAL COATINGS MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。