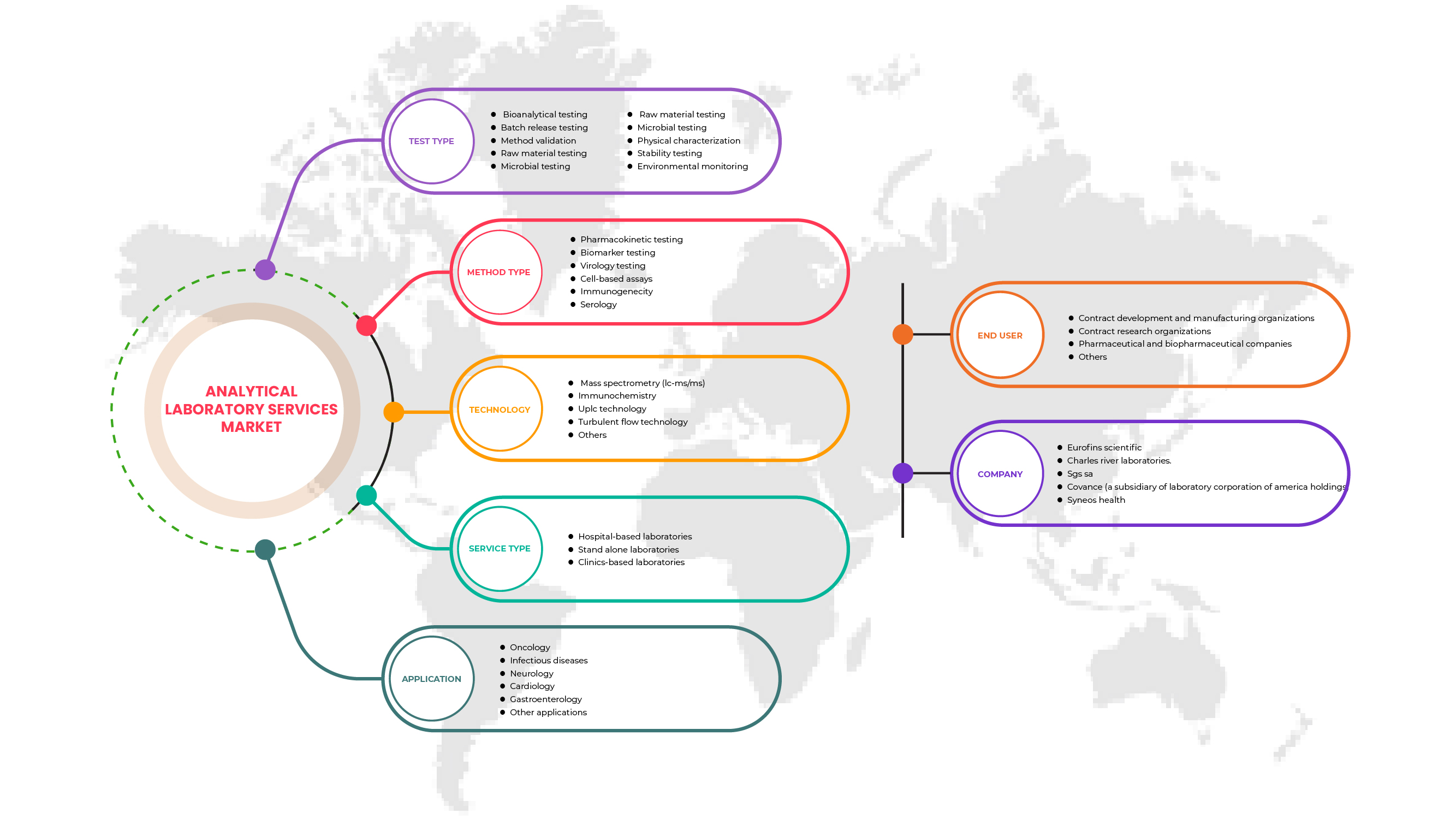

North America Analytical Laboratory Services Market, By Test Type (Bioanalytical Testing, Batch Release Testing, Stability Testing, Raw Material Testing, Physical Characterization, Method Validation, Microbial Testing, Environmental Monitoring), Service Type (Hospital-Based Laboratories, Stand-Alone Laboratories and Clinics-Based Laboratories), Method Type (Cell-Based Assays, Virology Testing, Biomarker Testing, Pharmacokinetic Testing, Immunogenicity and Serology), Application (Oncology, Neurology, Infectious disease, Gastroenterology, Cardiology and Other Applications), Technology (Mass Spectroscopy (LC-MS/MS), Immunochemistry, UPLC Technology, Turbulent Flow Technology, Others), End User Channel (Pharmaceutical and Biopharmaceutical Companies, Contract Development and Manufacturing Organizations, Contract Research Organizations and Others) -Industry Trends and Forecast to 2029.

North America Analytical Laboratory Services Market Analysis and Size

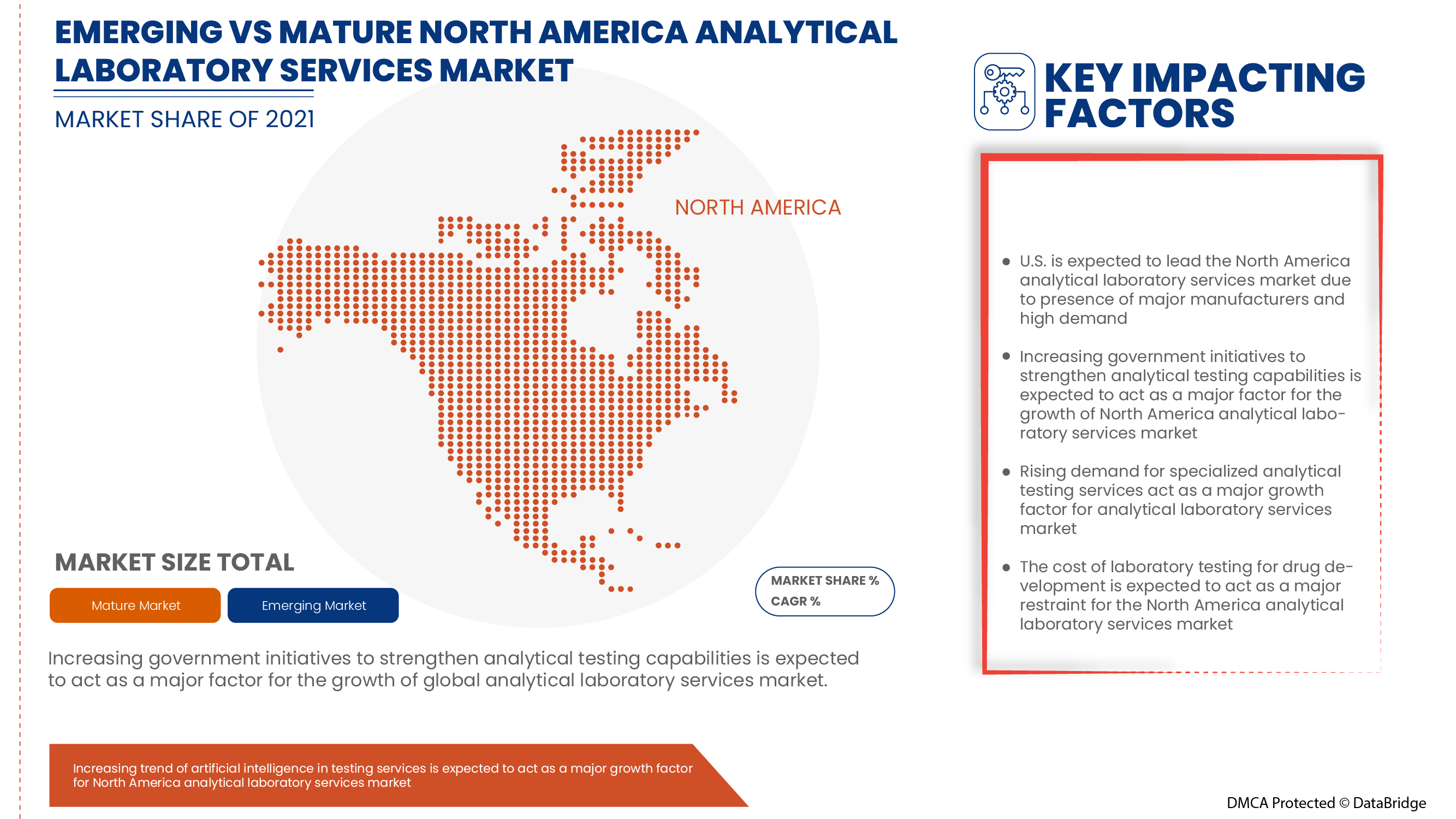

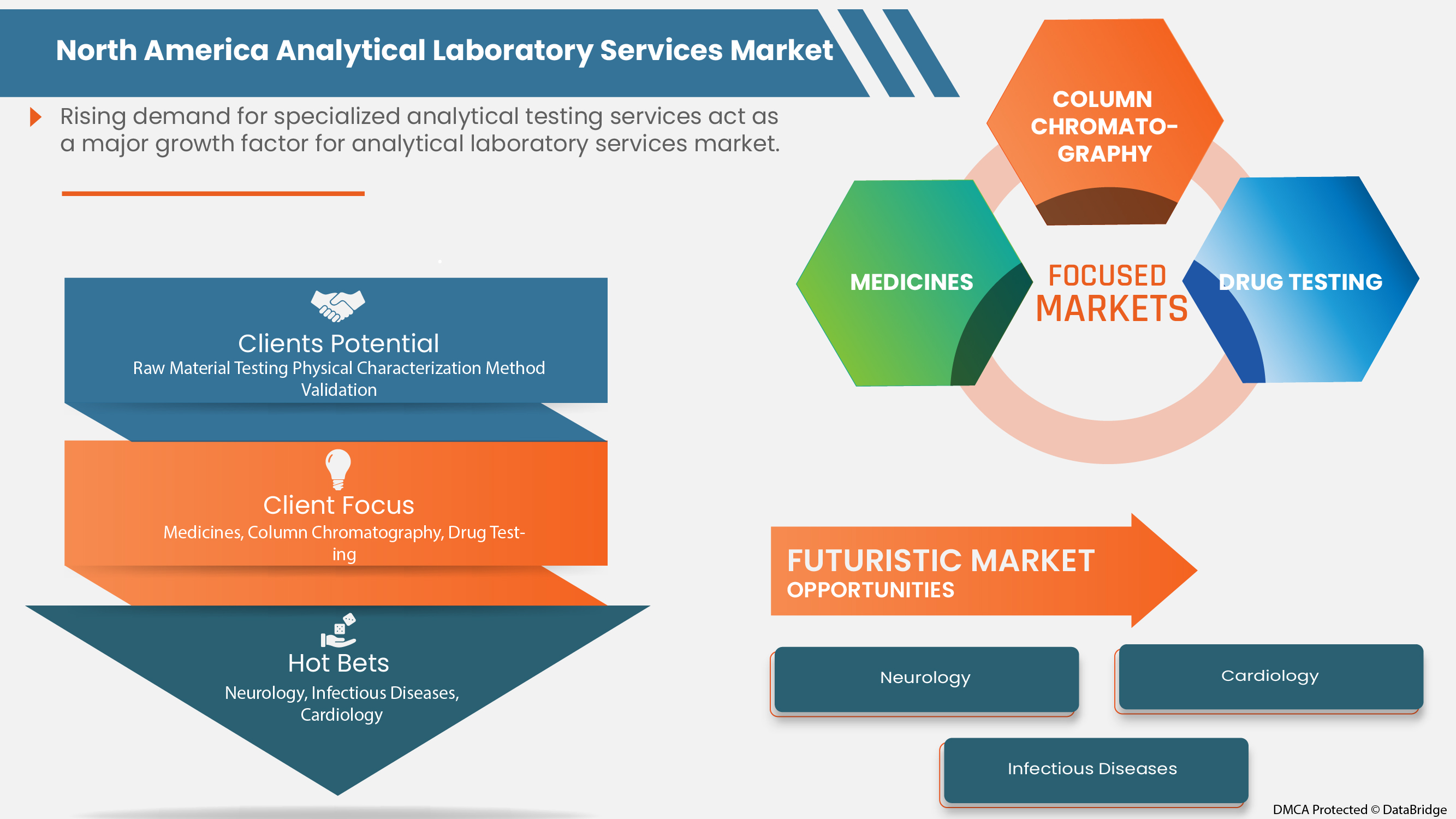

A number of analytical services are provided in the market, such as bioanalytical testing, raw material testing, batch release testing, product validation, physical characterization and others. These services are widely employed in the healthcare sector, including pharmaceutical companies, biopharmaceutical companies and medical device companies. These services provide a reliable source for accuracy, quality and efficiency. They have applications in areas such as oncology, neurology, infectious diseases, cardiology and others. The analytical laboratory services market is growing with the rise in government initiatives to strengthen analytical testing capabilities and the growing number of drug approvals and clinical trials. Moreover, rising usage and development of a large number of macromolecules and biosimilar for various therapeutic areas and increased spending by governments to set up new laboratories are other factors accelerating the laboratory services market growth.

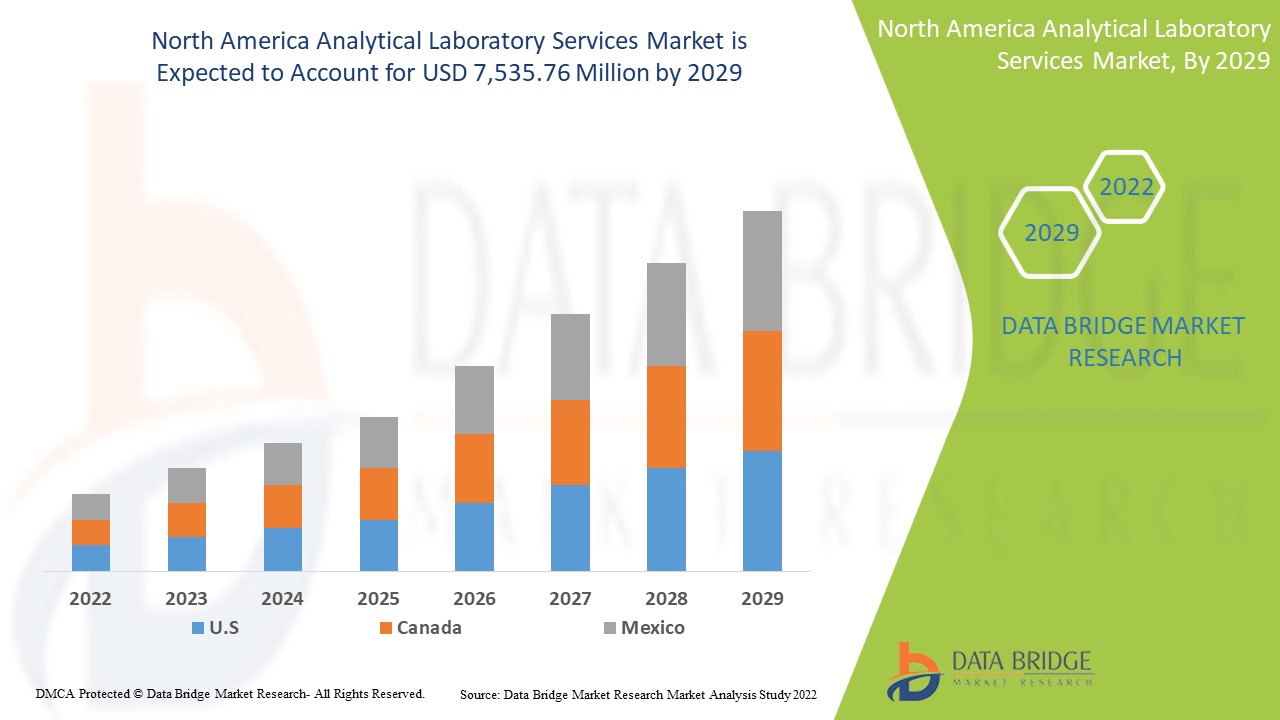

Data Bridge Market Research analyses that the analytical laboratory services market is expected to reach a value of USD 7,535.76 million by 2029, at a CAGR of 14.1% during the forecast period. The bioanalytical testing segment accounts for the largest offering segment in the analytical laboratory services market. The analytical laboratory services market report also covers pricing analysis, patent analysis, and technological advancements in detail.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customisable 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

按测试类型(生物分析测试、批次放行测试、稳定性测试、原材料测试、物理特性、方法验证、微生物测试、环境监测)、服务类型(医院实验室、独立实验室和诊所实验室)、方法类型(基于细胞的测定、病毒学测试、生物标志物测试、药代动力学测试、免疫原性和血清学)、应用(肿瘤学、神经病学、传染病、胃肠病学、心脏病学和其他应用)、技术(质谱(LC-MS/MS)、免疫化学、UPLC 技术、湍流技术、其他)、最终用户渠道(制药和生物制药公司、合同开发和制造组织、合同研究组织等) |

|

覆盖国家 |

美国、加拿大和墨西哥 |

|

涵盖的市场参与者 |

Charles River Laboratories、Medpace、WuXi AppTec、Eurofins Scientific、Q2 Solutions(IQVIA 的子公司)、SGS SA、SOLVIAS AG、Syneos Health、ICON plc、Frontage Labs、TOXIKON、BioAgilytix Labs、VxP Pharma, Inc.、Pace Analytical Services, LLC、Pharmaceutical Research Associates Inc.、ALS Limited、Evotec SE、Intertek Group plc、Covance(Laboratory Corporation of America 的子公司)和 PPD Inc.(Thermo Fisher Scientific Inc. 的子公司)等 |

市场定义

分析实验室服务涉及广泛的化学和微生物检测。分析实验室服务包括方法开发和验证、用于确认浓度的样品分析、用于 IND、NDA 和 ANDA 提交的初步配方和最终药品的纯度、均匀性和稳定性检测。分析服务也称为“材料测试”,用于描述用于识别特定样品的化学组成或特性的各种技术。制药、食品、电子和塑料等行业的制造商通常使用分析测试进行逆向工程或故障分析,并识别产品上的污染物或污渍

市场动态

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。下面将详细讨论所有这些内容:

驱动程序

-

药品和医疗器械支出不断增长

制药和生物技术行业的兴起将增加这些分析服务的市场,因为它们依赖药物市场来提供药代动力学测试和其他批量测试以及微生物测试等服务。因此,预计它将在预测期内成为北美分析实验室服务市场增长的驱动力。

-

政府采取措施加强分析测试能力

政府的资金和扩大分析服务的举措将有助于市场增长,并在预测期内增加市场参与者。预计这将增加市场规模,并成为预测期内北美分析实验室服务市场增长的动力。

-

药品批准和临床试验数量不断增加

市场参与者根据合同研究提供分析测试流程。此外,随着药物生产和新产品研究的增加,生物制药行业的发展预计将在预测期内成为北美分析实验室服务市场增长的驱动力。

机会

-

加强市场参与者之间的合作

市场合作是有望创造市场机会的主要因素。协议、伙伴关系和合作旨在克服全球影响力和供应链有限等障碍,并增加服务组合。在分析实验室服务市场,各种市场参与者都做到了这一点,从而创造了市场机会。

限制/挑战

- 高成本设立先进分析实验室

建立配备有限且高效仪器的生物分析设施需要大量投资,预计由于投资成本高昂,市场增长将受到限制。预计这将在预测期内限制北美分析实验室服务市场的增长。

COVID-19 对北美分析实验室服务市场的影响

COVID-19 对各行各业产生了重大影响,因为几乎每个国家都选择关闭除经营必需品部门的设施以外的所有设施。政府采取了一些严格的措施,例如关闭设施和销售非必需品、封锁国际贸易等等,以防止 COVID-19 的传播。唯一应对这种流行病的企业是获准开放和运行流程的基本服务。

将资源用于治疗 COVID-19 患者,对大多数临床试验招募和治疗患者的研究中心的运营产生了重大影响。这些分析服务广泛应用于不同生物分析研究的临床试验。此外,这导致试验启动减少,新业务授予放缓,而这两者都导致各公司的收入下降。

COVID-19 对分析实验室服务市场产生了负面影响。由于临床试验取消,对分析服务的需求也受到了影响。这些分析服务的主要部分来自临床试验和 CRO,它们受到了严重影响。然而,一些可以提供分析支持的市场参与者,如 Eurofins Scientific,成功地将 COVID-19 期间的损失降到最低。由于这些分析测试所必需的材料和溶剂在海关部门面临挑战,不允许跨越国界,供应链中断。

因此,COVID-19 对分析测试业务产生了负面影响,但市场参与者的战略举措在某种程度上成功地减少了净收入或分部收入的损失。

最新动态

- 2021 年 2 月,Eurofins Scientific 宣布收购了卓越的药物发现和合同研究组织 (CRO) Beacon Discovery。这将增加该公司获得合同研究的机会,并将增加公司的收入

- 2021 年 4 月,SGS SA 宣布 SYNLAB Analytics & Services 公司更名为 SGS Analytics,这是由于收购了领先的欧洲环境、食品和健康科学测试和摩擦学服务公司。此次收购将通过帮助企业遵守旨在确保食品、制药和环境安全的日益严格的法规来继续增长和创新

北美分析实验室服务市场范围

分析实验室服务市场根据测试类型、服务类型、方法类型、应用、技术和最终用户进行细分。这些细分市场之间的增长将帮助您分析行业中增长微弱的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

按测试类型

- 生物分析测试

- 批量放行测试

- 方法验证

- 原材料检测

- 微生物检测

- 物理特性

- 稳定性测试

- 环境监测

根据测试类型,分析实验室服务市场分为生物分析测试、批次放行测试、稳定性测试、原材料测试、物理特性、方法验证、微生物测试和环境监测。

按服务类型

- 医院实验室

- 独立实验室

- 诊所实验室

根据服务类型,分析实验室服务市场分为医院实验室、独立实验室和诊所实验室。

按方法类型

- 药代动力学测试

- 生物标志物检测

- 病毒学检测

- 基于细胞的检测

- 免疫原性

- 血清学

根据方法类型,分析实验室服务市场分为基于细胞的分析、病毒学测试、生物标志物测试、药代动力学测试、免疫原性和血清学。

按应用

- 肿瘤学

- 神经病学

- 传染病

- 心脏病学

- 胃肠病学

- 其他的

根据应用,分析实验室服务市场细分为肿瘤学、神经病学、传染病、胃肠病学、心脏病学和其他应用。

按技术分类

- 质谱

- 免疫化学

- UPLC 技术

- 湍流技术

- 其他的

根据技术,分析实验室服务市场细分为质谱、免疫化学、UPLC 技术、湍流技术和其他技术。

按最终用户

- 制药和生物制药公司

- 合同开发和制造组织

- 合同研究组织

- 其他的

根据最终用户,分析实验室服务市场分为制药和生物制药行业、合同开发和制造组织、合同研究组织和其他。

分析实验室服务市场区域分析/见解

对分析实验室服务市场进行了分析,并按上述国家、测试类型、服务类型、方法类型、应用、技术和最终用户提供了市场规模洞察和趋势。

分析实验室服务市场报告涵盖的国家包括美国、加拿大和墨西哥。

由于该地区实验室的不断发展,美国预计将主导北美分析实验室服务市场。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。下游和上游价值链分析、技术趋势和波特五力分析以及案例研究等数据点是用于预测各个国家市场情景的一些指标。此外,在提供国家数据的预测分析时,还考虑了北美品牌的存在和可用性以及它们因来自本地和国内品牌的大量或稀缺竞争而面临的挑战、国内关税的影响和贸易路线。

竞争格局和分析实验室服务市场份额分析

分析实验室服务市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、北美业务、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度以及应用主导地位。以上提供的数据点仅与公司对分析实验室服务市场的关注有关。

在北美分析实验室服务市场提供分析实验室服务的一些主要公司包括 Charles River Laboratories、Medpace、WuXi AppTec、Eurofins Scientific、Q2 Solutions(IQVIA 的子公司)、SGS SA、SOLVIAS AG、Syneos Health、ICON plc、Frontage Labs、TOXIKON、BioAgilytix Labs、VxP Pharma, Inc.、Pace Analytical Services, LLC、Pharmaceutical Research Associates Inc.、ALS Limited、Evotec SE、Intertek Group plc、Covance(Laboratory Corporation of America 的子公司)和 PPD Inc.(Thermo Fisher Scientific Inc. 的子公司)等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 MARKET TYPE OF MANUFACTURER COVERAGE GRID

2.1 MULTIVARIATE MODELLING

2.11 TEST TYPE LIFELINE CURVE

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 REGULATORY SCENARIO IN NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING EXPENDITURE ON DRUGS AND MEDICAL DEVICES

5.1.2 GOVERNMENT INITIATIVES TO STRENGTHEN ANALYTICAL TESTING CAPABILITIES

5.1.3 INCREASING NUMBER OF DRUG APPROVALS & CLINICAL TRIALS

5.1.4 RISING DEMAND FOR SPECIALIZED ANALYTICAL TESTING SERVICES

5.1.5 INCREASING INVESTMENT IN ANALYTICAL TESTING BY MARKET PLAYERS

5.2 RESTRAINTS

5.2.1 LIMITATION IN ANALYZING NOVEL COMPLEX PRODUCTS

5.2.2 COST OF LABORATORY TESTING FOR DRUG DEVELOPMENT

5.2.3 MAINTENANCE AND UPDATING OF EQUIPMENT

5.2.4 HIGH COST SETTING AN ADVANCED ANALYTICAL LAB

5.3 OPPORTUNITIES

5.3.1 INCREASING COLLABORATION AMONG MARKET PLAYERS

5.3.2 INCREASING OUTSOURCING FACILITIES

5.3.3 INCREASING TREND OF ARTIFICIAL INTELLIGENCE IN TESTING SERVICES

5.4 CHALLENGES

5.4.1 MAINTAINING REGULATORY STANDARD FOR TESTING

5.4.2 DEVELOPMENT AND MAINTENANCE OF EXPERTISE

6 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE

6.1 OVERVIEW

6.2 CELL-BASED ASSAYS

6.3 VIRAL CELL-BASED ASSAYS

6.4 BACTERIAL CELL-BASED ASSAYS

6.5 VIROLOGY TESTING

6.6 IN VITRO VIROLOGY TESTING

6.7 IN VIVO VIROLOGY TESTING

6.8 SPECIES-SPECIFIC VIRAL PCR ASSAYS

6.9 SEROLOGY

6.1 IMMUNOGENICITY

6.11 BIOMARKER TESTING

6.12 PHARMACOKINETIC TESTING

7 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY TEST TYPE

7.1 OVERVIEW

7.2 BIOANALYTICAL TESTING

7.2.1 PHARMACOKINETIC TEST

7.2.2 PHARMACODYNAMICS TEST

7.2.3 BIOEQUIVALENCE TEST

7.2.4 BIOAVAILABILITY TEST

7.2.5 OTHER TEST

7.3 BATCH RELEASE TESTING

7.4 STABILITY TESTING

7.5 RAW MATERIAL TESTING

7.6 PHYSICAL CHARACTERIZATION

7.7 METHOD VALIDATION

7.8 MICROBIAL TESTING

7.9 ENVIRONMENTAL MONITORING

8 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 MASS SPECTROSCOPY (LC-MS/MS)

8.3 IMMUNOCHEMISTRY

8.4 UPLC TECHNOLOGY

8.5 TURBULENT FLOW TECHNOLOGY

8.6 OTHERS

9 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY SERVICE TYPE

9.1 OVERVIEW

9.2 HOSPITAL-BASED LABORATORIES

9.3 STANDALONE LAORATORIES

9.4 CLINICS-BASED LABORATORIES

10 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 ONCOLOGY

10.3 INFECTIOUS DISEASES

10.4 NEUROLOGY

10.5 CARDIOLOGY

10.6 GASTROENTEROLOGY

10.7 OTHER APPLICATIONS

11 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY END USER

11.1 OVERVIEW

11.2 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES

11.3 CONTRACT DEVELOPMENT AND MANUFACTURING ORGANIZATIONS

11.4 CONTRACT RESEARCH ORGANIZATIONS

11.5 OTHERS

12 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 EUROFINS SCIENTIFIC

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 SERVICE PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 CHARLES RIVER LABORATORIES

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 SGS SA

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 COVANCE (A SUBSIDIARY OF LABORATORY CORPORATION OF AMERICA HOLDINGS)

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 SERVICE PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 WUXI APPTEC

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 SYNEOS HEALTH

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 SOLUTION PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 PHARMACEUTICAL RESEARCH ASSOCIATES INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 SERVICE PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 AGENZIA ITALIANA DEL FARMACO - AIFA

15.8.1 COMPANY SNAPSHOT

15.8.2 SERVICE PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 ALS LIMITED

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 BIOAGILYTIX LABS

15.10.1 COMPANY SNAPSHOT

15.10.2 SERVICE PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 CENTRAL DRUGS STANDARD CONTROL ORGANIZATION

15.11.1 COMPANY SNAPSHOT

15.11.2 SERVICE PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 EUROPEAN MEDICINES AGENCY

15.12.1 COMPANY SNAPSHOT

15.12.2 SERVICE PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 EVOTEC SE

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 FEDERAL INSTITUTE FOR DRUGS & MEDICAL DEVICES (BFARM)

15.14.1 COMPANY SNAPSHOT

15.14.2 SERVICE PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 FOOD SAFETY AND DRUG ADMINISTRATION DEPARTMENT

15.15.1 COMPANY SNAPSHOT

15.15.2 SERVICE PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 FRONTAGE LABS

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 SERVICE & SOLUTION PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

15.17 ICON PLC

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 INTERTEK GROUP PLC

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 INDUSTRY & SERVICE PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 MEDPACE

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENTS

15.2 NATIONAL MEDICAL PRODUCTS ADMINISTRATION

15.20.1 COMPANY SNAPSHOT

15.20.2 SERVICE PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 PACE ANALYTICAL SERVICES, LLC

15.21.1 COMPANY SNAPSHOT

15.21.2 SERVICE PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

15.22 PHARMACEUTICALS AND MEDICAL DEVICES AGENCY

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 PPD INC. (A SUBSIDIARY OF THERMO FISHER SCIENTIFIC INC.)

15.23.1 COMPANY SNAPSHOT

15.23.2 REVENUE ANALYSIS

15.23.3 SOLUTION PORTFOLIO

15.23.4 RECENT DEVELOPMENTS

15.24 Q2 SOLUTIONS (A SUBSIDIARY OF IQVIA)

15.24.1 COMPANY SNAPSHOT

15.24.2 SOLUTION PORTFOLIO

15.24.3 RECENT DEVELOPMENTS

15.25 SHANGHAI MEDICILON INC.

15.25.1 COMPANY SNAPSHOT

15.25.2 SERVICE PORTFOLIO

15.25.3 RECENT DEVELOPMENTS

15.26 SPANISH AGENCY FOR MEDICINES AND HEALTH PRODUCTS

15.26.1 COMPANY SNAPSHOT

15.26.2 SERVICE PORTFOLIO

15.26.3 RECENT DEVELOPMENT

15.27 SOLVIAS AG

15.27.1 COMPANY SNAPSHOT

15.27.2 SERVICE PORTFOLIO

15.27.3 RECENT DEVELOPMENTS

15.28 TOXIKON

15.28.1 COMPANY SNAPSHOT

15.28.2 SERVICE PORTFOLIO

15.28.3 RECENT DEVELOPMENTS

15.29 VXP PHARMA, INC.

15.29.1 COMPANY SNAPSHOT

15.29.2 SERVICE PORTFOLIO

15.29.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA CELL-BASED ASSAYS IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA CELL BASED ASSAYS IN ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA VIROLOGY TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA VIROLOGY TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA SEROLOGY IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA IMMUNOGENICITY IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA BIOMARKER TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA PHARMACOKINETIC TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA BIOANALYTICAL IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA BIOANALYTICAL TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA BATCH RELEASE IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA STABILITY TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA RAW MATERIAL TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA PHYSICAL CHARACTERIZATION IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA METHOD VALIDATION IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA MICROBIAL TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA ENVIRONMENTAL MONITORING IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA MASS SPECTROMETRY (LC-MS/MS) IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA IMMUNOCHEMISTRY IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA UPLC TECHNOLOGY IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA TURBULENT FLOW TECHNOLOGY IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA OTHERS IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA HOSPITAL-BASED LABORATORIES IN ANALYTICAL LABORATORIES SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA STANDALONE LABORATORIES IN ANALYTICAL LABORATORIES SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA CLINICAL-BASED LABORATORIES IN ANALYTICAL LABORATORIES SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA ONCOLOGY IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA INFECTIOUS DISEASES IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA NEUROLOGY IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA CARDIOLOGY IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA GASTROENTEROLOGY IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA OTHER APPLICATIONS IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA CONTRACT DEVELOPMENT AND MANUFACTURING ORGANIZATIONS IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA CONTRACT RESEARCH ORGANIZATIONS IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA OTHERS IN ANALYTICAL LABORATORY SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA BIOANALYTICAL TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA CELL BASED ASSAYS IN ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA VIROLOGY TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 52 U.S. ANALYTICAL LABORATORY SERVICES MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.S. BIOANALYTICAL TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 54 U.S. ANALYTICAL LABORATORY SERVICES MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 55 U.S. ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 56 U.S. CELL BASED ASSAYS IN ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.S. VIROLOGY TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 58 U.S. ANALYTICAL LABORATORY SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 59 U.S. ANALYTICAL LABORATORY SERVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 60 U.S. ANALYTICAL LABORATORY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 61 CANADA ANALYTICAL LABORATORY SERVICES MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 62 CANADA BIOANALYTICAL TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 63 CANADA ANALYTICAL LABORATORY SERVICES MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 64 CANADA ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 65 CANADA CELL BASED ASSAYS IN ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 66 CANADA VIROLOGY TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 67 CANADA ANALYTICAL LABORATORY SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 CANADA ANALYTICAL LABORATORY SERVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 69 CANADA ANALYTICAL LABORATORY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 MEXICO ANALYTICAL LABORATORY SERVICES MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO BIOANALYTICAL TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 72 MEXICO ANALYTICAL LABORATORY SERVICES MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 74 MEXICO CELL BASED ASSAYS IN ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 75 MEXICO VIROLOGY TESTING IN ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2020-2029 (USD MILLION)

TABLE 76 MEXICO ANALYTICAL LABORATORY SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 77 MEXICO ANALYTICAL LABORATORY SERVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 78 MEXICO ANALYTICAL LABORATORY SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: MARKET TYPE COVERAGE GRID

FIGURE 10 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: MULTIVARIATE MODELLING

FIGURE 11 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: SEGMENTATION

FIGURE 12 GROWING EXPENDITURE ON DRUGS IS DRIVING THE NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET GROWTH IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 ANALYTICAL LABORATORY TESTING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET IN 2022 & 2029

FIGURE 14 OVERVIEW OF DIFFERENT GUIDELINES AROUND THE GLOBE

FIGURE 15 CGMP REQUIREMENT FOR ANALYTICAL LABORATORY INCLUDES

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET

FIGURE 17 INCREASING PRESCRIPTION OF DRUGS

FIGURE 18 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY METHOD TYPE, 2021

FIGURE 19 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY METHOD TYPE, 2021-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY METHOD TYPE, CAGR (2021-2029)

FIGURE 21 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY METHOD TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY TEST TYPE, 2021

FIGURE 23 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY TEST TYPE 2021-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY TEST TYPE, CAGR (2021-2029)

FIGURE 25 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY TEST TYPE, LIFELINE CURVE

FIGURE 26 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY TECHNOLOGY, 2021

FIGURE 27 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY TECHNOLOGY, 2021-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY TECHNOLOGY, CAGR (2021-2029)

FIGURE 29 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 30 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY SERVICE TYPE, 2021 (USD MILLION)

FIGURE 31 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY SERVICE TYPE, 2021-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY SERVICE TYPE, CAGR (2021-2029)

FIGURE 33 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY SERVICE TYPE, LIFELINE CURVE

FIGURE 34 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY APPLICATION, 2021 (USD MILLION)

FIGURE 35 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY APPLICATION, 2021-2029 (USD MILLION)

FIGURE 36 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY APPLICATION, CAGR (2021-2029)

FIGURE 37 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY APPLICATION , LIFELINE CURVE

FIGURE 38 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET, BY END USER, 2021

FIGURE 39 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY END USER, 2021-2029 (USD MILLION)

FIGURE 40 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY END USER, CAGR (2021-2029)

FIGURE 41 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 42 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: SNAPSHOT (2021)

FIGURE 43 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY COUNTRY (2021)

FIGURE 44 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 45 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 46 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: BY TEST TYPE (2022-2029)

FIGURE 47 NORTH AMERICA ANALYTICAL LABORATORY SERVICES MARKET: COMPANY SHARE 2020 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。