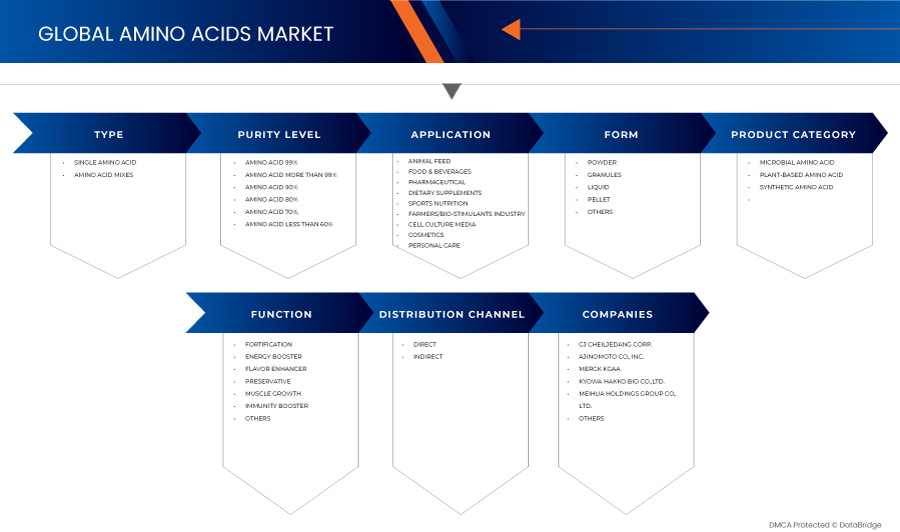

北美氨基酸市场,按氨基酸类型(谷氨酸、蛋氨酸、半胱氨酸、赖氨酸、精氨酸、酪氨酸、丙氨酸、亮氨酸、组氨酸、苯丙氨酸、缬氨酸、脯氨酸、色氨酸、甘氨酸、丝氨酸、异亮氨酸苏氨酸、谷氨酰胺、天冬氨酸、天冬酰胺等)、纯度水平(99% 氨基酸、99% 以上的氨基酸、90% 的氨基酸、80% 的氨基酸、70% 的氨基酸和 60% 以下的氨基酸)、形式(粉末、颗粒、液体、颗粒等)、产品类别(微生物氨基酸、植物氨基酸和合成氨基酸)、功能(强化、能量增强剂、增味剂、防腐剂、肌肉生长、免疫增强剂等)、应用(动物饲料、食品和饮料、制药、膳食补充剂、运动营养、细胞培养基、化妆品和个人护理)、分销渠道(直接和间接)行业趋势和预测到 2029 年

市场分析和见解

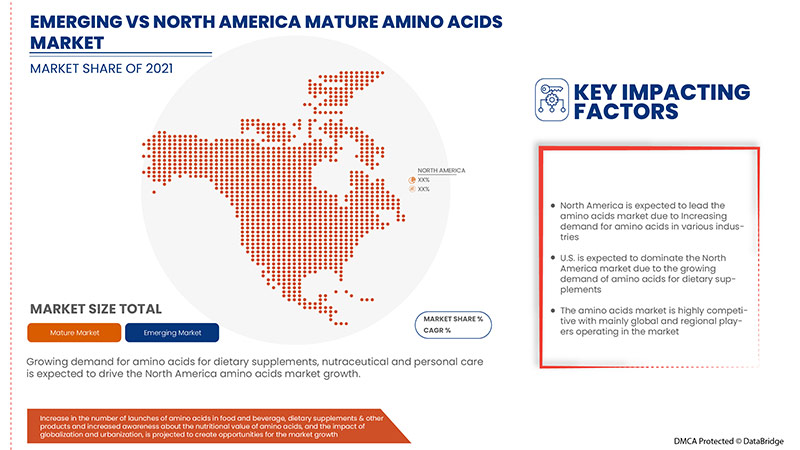

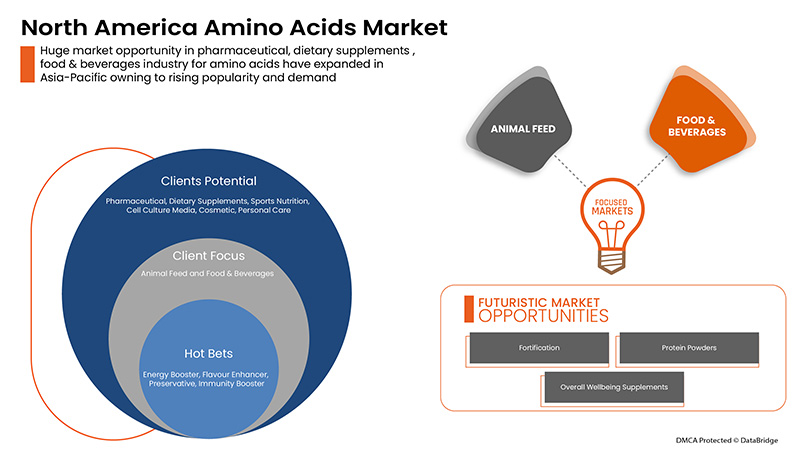

食品和饮料、膳食补充剂、化妆品和动物饲料等各行各业对氨基酸的需求不断增长,推动了全球氨基酸市场的增长。此外,用于生产氨基酸的生物技术的进步也进一步促进了市场的增长。此外,氨基酸药用特性的接受度不断提高,推动了市场参与者的销售和利润,预计这将进一步推动氨基酸市场的增长。

影响市场增长的主要制约因素是复杂的制造工艺。此外,氨基酸生产的高物流成本也将抑制市场增长。另一方面,不同类型的氨基酸的供应有望为全球氨基酸市场的增长提供机遇。然而,市场增长的挑战是实施严格的氨基酸产品商业化法规。

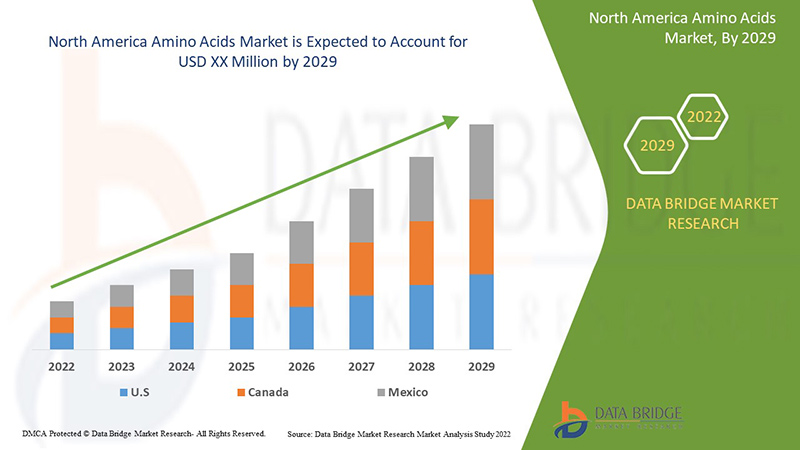

Data Bridge Market Research 分析称,2022 年至 2029 年的预测期内,北美氨基酸市场将以 5.9% 的复合年增长率增长。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史年份 |

2020 (可定制至 2019 - 2015) |

|

定量单位 |

收入(百万美元) |

|

涵盖的领域 |

按氨基酸类型(谷氨酸、蛋氨酸、半胱氨酸、赖氨酸、精氨酸、酪氨酸、丙氨酸、亮氨酸、组氨酸、苯丙氨酸、缬氨酸、脯氨酸、色氨酸、甘氨酸、丝氨酸、异亮氨酸、苏氨酸、谷氨酰胺、天冬氨酸、天冬酰胺等)、纯度等级(99% 氨基酸、99% 以上氨基酸、90% 氨基酸、80% 氨基酸、70% 氨基酸和 60% 以下氨基酸)、形式(粉末、颗粒、液体、颗粒等)、产品类别(微生物氨基酸、植物性氨基酸和合成氨基酸)、功能(强化、能量增强剂、增味剂、防腐剂、肌肉生长、免疫增强剂等)、应用(动物饲料、食品和饮料、制药、膳食补充剂、运动营养、细胞培养基、化妆品和个人护理)、分销渠道(直接和间接)、 |

|

覆盖国家 |

美国、加拿大、墨西哥 |

|

涵盖的市场参与者 |

默克集团、味之素株式会社、协和发酵生物株式会社、赢创工业股份公司、ADM、Prinova Group LLC、NOVUS INTERNATIONAL、青岛三民化工有限公司、PACIFIC RAINBOW INTERNATIONAL, INC.、大象、安迪苏、CJ CheilJedang Corp.、Global Bio-chem Technology Group Company Limited.、Sunrise Nutrachem Group Co.,LTD、Kingchem Life Science LLC、日本理化株式会社、四川同盛氨基酸有限公司、阜丰集团、Asiamerica Group, Inc.、住友化学株式会社 |

市场定义

氨基酸是结合形成蛋白质的分子。氨基酸和蛋白质是生命的基石。氨基酸是动物和人类营养的重要组成部分。在人体中,它们是生命过程所必需的,例如神经递质和激素的合成。它们有利于滋养免疫系统、对抗关节炎和癌症以及治疗直肠疾病和耳鸣。如今,对氨基酸的需求正在增加,因为它们有助于改善抑郁症、睡眠障碍、经前烦躁症(PMDD)、戒烟、磨牙症和注意力缺陷多动障碍 (ADHD) 等状况。红肉、海鲜、鸡蛋、乳制品和大豆制品中也含有丰富的氨基酸。

北美氨基酸市场动态

驱动程序

- 强大的供应链

由于优质原材料的供应对于氨基酸的生产至关重要。为了确保原材料的持续供应,知名市场参与者正在使用前向和后向整合技术,旨在确保原材料的高质量和可靠供应。这种垂直整合过程提供了更高的原材料供应可靠性,并为利用现有原材料开发新产品和创意产品提供了机会。因此,建立了强大的供应链,以实现氨基酸的可行生产。

此外,制造商建立的强大而快速的直接和间接分销渠道确保了产品的及时交付,从而增加了对氨基酸的需求。因此,强大的供应链正在推动市场对氨基酸的需求,因为它确保了氨基酸的及时供应。

- 市场上不同类型氨基酸的供应情况

氨基酸可分为三类:非必需氨基酸、必需氨基酸和条件性氨基酸。这些组根据其需求由不同类型的氨基酸组成。由于每种必需氨基酸在生物体中具有不同的功能,因此缺乏的症状也相应不同。因此,不同类型的氨基酸的可用性及其不同的需求导致了生产具有不同氨基酸的产品。

因此,对不同类型氨基酸的需求导致了具有不同成分和益处的不同产品的生产,最终导致氨基酸市场的增长。

机会

-

氨基酸制造商采取的举措增多

制造商在氨基酸方面采取的举措(如产品发布、扩张、投资等)数量增加,将为全球氨基酸市场的增长创造巨大的机会。

例如,

-

2020 年 10 月,赢创宣布将其 MetAMINO(DL-蛋氨酸)生产集中到三个国际枢纽(美洲、欧洲和亚洲)。该公司采取这一举措是为了最大限度地发挥规模经济并利用强大的工艺。该公司旨在通过改善成本状况来巩固其地位

因此,随着氨基酸上市数量的增加、制造商的扩张、增加产量的投资和其他举措,再加上不同行业对氨基酸的需求不断增长,预计将为全球氨基酸市场创造巨大的机会。

克制/挑战

- 严格的政府法规

为了保持产品的质量和纯度,对氨基酸和含氨基酸产品的生产实施了规定。为了避免其副作用,对氨基酸的日常消费也实施了规定。此外,还对食品和膳食补充剂中氨基酸的使用实施了规定,以确保氨基酸的正确消费。

因此,对氨基酸消费的日益严格的监管可能会阻碍市场的增长,因为这些规定限制了各种产品和补充剂中氨基酸的使用。

新冠肺炎疫情对北美氨基酸市场的影响

疫情过后,由于不再限制人们的出行,保健品和健康食品的需求增加,因此产品供应将变得容易。COVID-19 的持续较长时间影响了供应链,导致供应链中断,难以向消费者供应食品,最初导致产品需求下降。然而,在疫情过后,由于人们越来越意识到氨基酸在健康和营养食品中的长期益处,对健康和保健食品的需求大幅增加,从而增加了对氨基酸产品的需求。消费者正在努力过上健康的生活方式,更倾向于最健康的食品,例如植物性、纯素和营养食品和饮料,因为它们富含氨基酸。

最新动态

- 2021年12月,拜耳将首款氨基酸生物刺激素Ambition引入中国市场。该产品探索农业发展潜力,使作物生长旺盛,抗逆性强,产量高,质量好,有利于农民收获、土壤保护和消费者安全。Ambition适用于有机农业

- 2017 年 10 月,韩国食品制造公司大象宣布,已在韩国首次成功生产出高附加值氨基酸 L-组氨酸。L-组氨酸在红肉和蓝肉鱼中含量丰富。它常用于药品、营养补充剂和动物饲料

北美氨基酸市场范围

北美氨基酸市场分为七个显著的部分,即氨基酸类型、纯度水平、形式、产品类别、功能、应用和分销渠道。

这些细分市场之间的增长将帮助您分析行业中的主要增长细分市场,并为用户提供有价值的市场概览和市场洞察,以做出战略决策,确定核心市场应用。

氨基酸的种类

- 谷氨酸

- 蛋氨酸

- 半胱氨酸

- 赖氨酸

- 精氨酸

- 酪氨酸

- 丙氨酸

- 亮氨酸

- 组氨酸

- 苯丙氨酸

- 缬氨酸

- 脯氨酸

- 色氨酸

- 甘氨酸

- 丝氨酸

- 异亮氨酸

- 苏氨酸

- 谷氨酰胺

- 天冬氨酸

- 天冬酰胺

- 其他的

根据氨基酸的类型,北美氨基酸市场分为丙氨酸、精氨酸、天冬氨酸、半胱氨酸、谷氨酸、谷氨酰胺、甘氨酸、组氨酸、异亮氨酸、亮氨酸、赖氨酸、蛋氨酸、苯丙氨酸、脯氨酸、丝氨酸、天冬酰胺、苏氨酸、酪氨酸、色氨酸、缬氨酸等。

纯度等级

- 氨基酸 99%

- 氨基酸含量99%以上

- 氨基酸 90%

- 氨基酸 80%

- 氨基酸 70%

- 氨基酸含量低于60%

根据纯度水平,北美氨基酸市场分为低于 60% 的氨基酸、70% 的氨基酸、80% 的氨基酸、90% 的氨基酸、99% 的氨基酸和高于 99% 的氨基酸。

形式

- 粉末

- 颗粒

- 液体

- 颗粒

- 其他的

On the basis of form, the North America amino acids market is segmented into liquid, crystal, powder, pellet, and others.

Fat content

- No Fat

- Low Fat

- Reduced-Fat

On the basis of fat content, the North America health and wellness food market is segmented into no fat, low fat, and reduced-fat.

Product category

- Microbial Amino Acid

- Plant-Based Amino Acid

- Synthetic Amino Acid

On the basis of product category, the North America amino acids market is segmented into plant based amino acids, microbial based amino acids, and synthetic amino acids.

Function

- Fortification

- Energy Booster

- Flavor Enhancer

- Preservative

- Muscle Growth

- Immunity Booster

- Others

On the basis of function, the amino acids market is divided into immunity booster, preservative, flavor enhancer, fortification, muscle growth, energy booster, and others.

Application

- Animal Feed

- Food & Beverages

- Pharmaceutical

- Dietary Supplements

- Sports Nutrition

- Cell Culture Media

- Cosmetic

- Personal Care

On the basis of application, the North America amino acids market is segmented into the food & beverages, dietary supplements, pharmaceutical, sports nutrition, animal feed, personal care, cosmetic and cell culture media.

Distribution Channel

- Direct

- Indirect

On the basis of distribution channel, North America amino acids market is segmented into direct and indirect.

North America Amino Acids Markets Regional Analysis/Insights

The North America amino acids market is analyzed, and market size insights and trends are provided based on as referenced above.

The countries covered in the North America health and wellness food Markets report are U.S., Canada and Mexico.

The U.S. dominates the North America amino acids market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to the industrialization of the livestock industry and the economic growth of the country. The North America region's demand for meat-based food items is increasing, which is boosting the region's amino acid market.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of North America brands, their challenges faced due to high competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Amino Acids Market Share Analysis

竞争激烈的北美氨基酸市场详细介绍了竞争对手。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、北美业务、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度以及应用主导地位。以上数据点仅与公司对北美氨基酸市场的关注有关。

北美氨基酸市场的一些主要参与者包括默克公司、味之素株式会社、协和发酵生物株式会社、赢创工业股份公司、ADM、Prinova Group LLC、NOVUS INTERNATIONAL、青岛三民化工有限公司、PACIFIC RAINBOW INTERNATIONAL, INC.、大象、安迪苏、CJ CheilJedang Corp.、全球生物化学科技集团有限公司、Sunrise Nutrachem Group Co.,LTD、Kingchem Life Science LLC、日本理化株式会社、四川同盛氨基酸有限公司、阜丰集团、Asiamerica Group, Inc. 和住友化学株式会社等。

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析以及主要(行业专家)验证。除此之外,数据模型还包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、公司市场份额分析、测量标准、北美与地区以及供应商份额分析。如有进一步询问,请要求分析师致电。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA AMINO ACIDS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SUPPLY CHAIN ANALYSIS

4.1.1 RAW MATERIAL PROCUREMENT

4.1.2 MANUFACTURING PROCESS

4.1.3 MARKETING AND DISTRIBUTION

4.1.4 END USERS

4.2 SUPPLY SHORTAGE

4.3 TECHNOLOGICAL ADVANCEMENT

4.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.5.1 MANUFACTURERS ARE DOING EXPANSIONS TO CATER TO THE DEMAND

4.5.2 LAUNCH OF DIFFERENT AMINO ACIDS BY MANUFACTURERS

4.5.3 MANUFACTURERS LAUNCHING NATURAL INGREDIENT BASED/PLANT-BASED AMINO ACIDS

4.5.4 FUTURE PERSPECTIVE

4.6 FACTOR INFLUENCING PURCHASE DECISION (B2B)

4.6.1 HIGH NUTRITIONAL VALUE

4.6.2 PRICING OF THE AMINO ACIDS

4.6.3 HIGH QUALITY

5 REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR AMINO ACIDS IN VARIOUS INDUSTRIES

6.1.2 ADVANCEMENTS IN BIOTECHNOLOGY USED FOR THE PRODUCTION OF AMINO ACIDS

6.1.3 AVAILABILITY OF DIFFERENT TYPES OF AMINO ACIDS IN THE MARKET

6.1.4 STRONG SUPPLY CHAIN

6.2 RESTRAINTS

6.2.1 COMPLICATED MANUFACTURING PROCESS

6.2.2 STRICT GOVERNMENT REGULATIONS

6.3 OPPORTUNITIES

6.3.1 GROWING DEMAND FOR AMINO ACIDS FOR DIETARY SUPPLEMENTS

6.3.2 RISING DEMAND FOR NUTRITIOUS AND HEALTHY PRODUCTS

6.3.3 INCREASING NUMBER OF INITIATIVES TAKEN BY AMINO ACID MANUFACTURERS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION AMONG THE MARKET PLAYERS

6.4.2 RISING AWARENESS REGARDING THE SIDE EFFECTS OF AMINO ACIDS

7 NORTH AMERICA AMINO ACIDS MARKET, BY TYPE OF AMINO ACID

7.1 OVERVIEW

7.2 GLUTAMIC ACID

7.3 METHIONINE

7.4 CYSTEINE

7.5 LYSINE

7.6 ARGININE

7.7 TYROSINE

7.8 ALANINE

7.9 LEUCINE

7.1 HISTIDINE

7.11 PHENYLALANINE

7.12 VALINE

7.13 PROLINE

7.14 TRYPTOPHAN

7.15 GLYCINE

7.16 SERINE

7.17 ISOLEUCINE

7.18 THREONINE

7.19 GLUTAMINE

7.2 ASPARTIC ACID

7.21 ASPARAGINE

7.22 OTHERS

8 NORTH AMERICA AMINO ACIDS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 ANIMAL FEED

8.2.1 ANIMAL FEED, BY ANIMAL TYPE

8.2.1.1 POULTRY FEED

8.2.1.1.1 BROILERS

8.2.1.1.2 BREEDERS

8.2.1.1.3 LAYERS

8.2.1.2 RUMINANT FEED

8.2.1.2.1 CALVES

8.2.1.2.2 DAIRY CATTLE

8.2.1.2.3 BEEF CATTLE

8.2.1.2.4 OTHERS

8.2.1.3 SWINE FEED

8.2.1.3.1 STARTER

8.2.1.3.2 GROWER

8.2.1.3.3 SOW

8.2.1.4 PET FOOD

8.2.1.4.1 DOGS

8.2.1.4.2 CATS

8.2.1.4.3 BIRDS

8.2.1.4.4 RABBIT

8.2.1.4.5 OTHERS

8.2.1.5 AQUACULTURE

8.2.1.5.1 FISH

8.2.1.5.2 CRUSTACEANS

8.2.1.5.3 MOLLUSKS

8.2.1.5.4 OTHERS

8.2.1.6 OTHERS

8.2.2 ANIMAL FEED, BY PRODUCT CATEGORY

8.2.2.1 PLANT-BASED AMINO ACID

8.2.2.2 MICROBIAL AMINO ACID

8.2.2.3 SYNTHETIC AMINO ACID

8.3 FOOD & BEVERAGES

8.3.1 FOOD & BEVERAGES, BY TYPE

8.3.1.1 BEVERAGES

8.3.1.1.1 BEVERAGES, BY TYPE

8.3.1.1.1.1 JUICES

8.3.1.1.1.2 SPORTS DRINKS

8.3.1.1.1.3 ENERGY DRINKS

8.3.1.1.1.4 DAIRY BASED DRINKS

8.3.1.1.1.4.1 REGULAR PROCESSED MILK

8.3.1.1.1.4.2 FLAVOURED MILK

8.3.1.1.1.4.3 MILK SHAKES

8.3.1.1.1.5 PLANT-BASED BEVERAGES

8.3.1.1.1.5.1 SOY MILK

8.3.1.1.1.5.2 ALMOND MILK

8.3.1.1.1.5.3 OAT MILK

8.3.1.1.1.5.4 CASHEW MILK

8.3.1.1.1.5.5 COCONUT MILK

8.3.1.1.1.5.6 OTHERS

8.3.1.1.1.6 SMOOTHIES

8.3.1.2 PROCESSED FOOD

8.3.1.2.1 PROCESSED FOOD, BY TYPE

8.3.1.2.1.1 SAUCES, DRESSINGS AND CONDIMENTS

8.3.1.2.1.2 JAMS, PRESERVES & MARMALADES

8.3.1.2.1.3 READY MEALS

8.3.1.2.1.4 SOUPS

8.3.1.2.1.5 OTHERS

8.3.1.3 BAKERY

8.3.1.3.1 BAKERY, BY TYPE

8.3.1.3.1.1 BREAD & ROLLS

8.3.1.3.1.2 BISCUIT, COOKIES & CRACKERS

8.3.1.3.1.3 CAKES, PASTRIES & TRUFFLE

8.3.1.3.1.4 TART & PIES

8.3.1.3.1.5 BROWNIES

8.3.1.3.1.6 OTHER

8.3.1.4 DAIRY PRODUCTS

8.3.1.4.1 DAIRY PRODUCTS, BY TYPE

8.3.1.4.1.1 ICE CREAM

8.3.1.4.1.2 CHEESE

8.3.1.4.1.3 YOGURT

8.3.1.4.1.4 OTHERS

8.3.1.5 CONVENIENCE FOOD

8.3.1.5.1 CONVENIENCE FOOD, BY TYPE

8.3.1.5.1.1 SNACKS & EXTRUDED SNACKS

8.3.1.5.1.2 PIZZA & PASTA

8.3.1.5.1.3 INSTANT NOODLES

8.3.1.5.1.4 OTHERS

8.3.1.6 FUNCTIONAL FOOD

8.3.1.7 FROZEN DESSERTS

8.3.1.7.1 FROZEN DESSERTS, BY TYPE

8.3.1.7.1.1 GELATO

8.3.1.7.1.2 CUSTARD

8.3.1.7.1.3 OTHERS

8.3.1.8 CONFECTIONERY

8.3.1.8.1 CONFECTIONARY, BY TYPE

8.3.1.8.1.1 GUMS & JELLIES

8.3.1.8.1.2 HARD-BOILED SWEETS

8.3.1.8.1.3 CHOCOLATE

8.3.1.8.1.4 CHOCOLATE SYRUPS

8.3.1.8.1.5 CARAMELS & TOFFEES

8.3.1.8.1.6 MINTS

8.3.1.8.1.7 OTHERS

8.3.1.9 INFANT FORMULA

8.3.1.9.1 INFANT FORMULA, BY TYPE

8.3.1.9.1.1 FIRST INFANT FORMULA

8.3.1.9.1.2 ANTI-REFLUX (STAY DOWN) FORMULA

8.3.1.9.1.3 COMFORT FORMULA

8.3.1.9.1.4 HYPOALLERGENIC FORMULA

8.3.1.9.1.5 FOLLOW-ON FORMULA

8.3.1.9.1.6 OTHERS

8.3.2 FOOD AND BEVERAGES, BY PRODUCT CATEGORY

8.3.2.1 PLANT-BASED AMINO ACID

8.3.2.2 MICROBIAL AMINO ACID

8.3.2.3 SYNTHETIC AMINO ACID

8.4 PHARMACEUTICAL

8.4.1 PHARMACEUTICAL, BY PRODUCT CATEGORY

8.4.1.1 PLANT-BASED AMINO ACID

8.4.1.2 MICROBIAL AMINO ACID

8.4.1.3 SYNTHETIC AMINO ACID

8.4.2 PHARMACEUTICAL, BY TYPE OF AMINO ACID

8.4.2.1 GLUTAMIC ACID

8.4.2.2 METHIONINE

8.4.2.3 CYSTEINE

8.4.2.4 LYSINE

8.4.2.5 ARGININE

8.4.2.6 TYROSINE

8.4.2.7 ALANINE

8.4.2.8 LEUCINE

8.4.2.9 HISTIDINE

8.4.2.10 PHENYLALANINE

8.4.2.11 VALINE

8.4.2.12 PROLINE

8.4.2.13 TRYPTOPHAN

8.4.2.14 GLYCINE

8.4.2.15 SERINE

8.4.2.16 ISOLEUCINE

8.4.2.17 THREONINE

8.4.2.18 GLUTAMINE

8.4.2.19 ASPARTIC ACID

8.4.2.20 ASPARAGINE

8.4.2.21 OTHERS

8.5 DIETARY SUPPLEMENTS

8.5.1 DIETARY SUPPLEMENTS, BY TYPE

8.5.1.1 IMMUNITY SUPPLEMENTS

8.5.1.2 BONE AND JOINT HEALTH SUPPLEMENTS

8.5.1.3 OVERALL WELLBEING SUPPLEMENTS

8.5.1.4 BRAIN HEALTH SUPPLEMENTS

8.5.1.5 SKIN HEALTH SUPPLEMENTS

8.5.1.6 OTHERS

8.5.2 DIETARY SUPPLEMENTS, BY PRODUCT CATEGORY

8.5.2.1 PLANT-BASED AMINO ACID

8.5.2.2 MICROBIAL AMINO ACID

8.5.2.3 SYNTHETIC AMINO ACID

8.5.3 DIETARY SUPPLEMENTS, BY TYPE OF AMINO ACID

8.5.3.1 GLUTAMIC ACID

8.5.3.2 METHIONINE

8.5.3.3 CYSTEINE

8.5.3.4 LYSINE

8.5.3.5 ARGININE

8.5.3.6 TYROSINE

8.5.3.7 ALANINE

8.5.3.8 LEUCINE

8.5.3.9 HISTIDINE

8.5.3.10 PHENYLALANINE

8.5.3.11 VALINE

8.5.3.12 PROLINE

8.5.3.13 TRYPTOPHAN

8.5.3.14 GLYCINE

8.5.3.15 SERINE

8.5.3.16 ISOLEUCINE

8.5.3.17 THREONINE

8.5.3.18 GLUTAMINE

8.5.3.19 ASPARTIC ACID

8.5.3.20 ASPARAGINE

8.5.3.21 OTHERS

8.6 SPORTS NUTRITION

8.6.1 SPORTS NUTRITION, BY TYPE

8.6.1.1 SPORT DRINK MIXES

8.6.1.2 ENERGY GELS

8.6.1.3 SPORTS NUTRITION BARS

8.6.1.4 PROTEIN POWDERS

8.6.1.5 OTHERS

8.6.2 SPORTS NUTRITION, BY PRODUCT CATEGORY

8.6.2.1 PLANT-BASED AMINO ACID

8.6.2.2 MICROBIAL AMINO ACID

8.6.2.3 SYNTHETIC AMINO ACID

8.6.3 SPORTS NUTRITION, BY TYPE OF AMINO ACID

8.6.3.1 GLUTAMIC ACID

8.6.3.2 METHIONINE

8.6.3.3 CYSTEINE

8.6.3.4 LYSINE

8.6.3.5 ARGININE

8.6.3.6 TYROSINE

8.6.3.7 ALANINE

8.6.3.8 LEUCINE

8.6.3.9 HISTIDINE

8.6.3.10 PHENYLALANINE

8.6.3.11 VALINE

8.6.3.12 PROLINE

8.6.3.13 TRYPTOPHAN

8.6.3.14 GLYCINE

8.6.3.15 SERINE

8.6.3.16 ISOLEUCINE

8.6.3.17 THREONINE

8.6.3.18 GLUTAMINE

8.6.3.19 ASPARTIC ACID

8.6.3.20 ASPARAGINE

8.6.3.21 OTHERS

8.7 CELL CULTURE MEDIA

8.7.1 CELL CULTURE MEDIA, BY PRODUCT CATEGORY

8.7.1.1 PLANT-BASED AMINO ACID

8.7.1.2 MICROBIAL AMINO ACID

8.7.1.3 SYNTHETIC AMINO ACID

8.7.2 CELL CULTURE MEDIA, BY TYPE OF AMINO ACID

8.7.2.1 GLUTAMIC ACID

8.7.2.2 METHIONINE

8.7.2.3 CYSTEINE

8.7.2.4 LYSINE

8.7.2.5 ARGININE

8.7.2.6 TYROSINE

8.7.2.7 ALANINE

8.7.2.8 LEUCINE

8.7.2.9 HISTIDINE

8.7.2.10 PHENYLALANINE

8.7.2.11 VALINE

8.7.2.12 PROLINE

8.7.2.13 TRYPTOPHAN

8.7.2.14 GLYCINE

8.7.2.15 SERINE

8.7.2.16 ISOLEUCINE

8.7.2.17 THREONINE

8.7.2.18 GLUTAMINE

8.7.2.19 ASPARTIC ACID

8.7.2.20 ASPARAGINE

8.7.2.21 OTHERS

8.8 COSMETIC

8.8.1 COSMETIC, BY TYPE

8.8.1.1 FACE SERUMS

8.8.1.2 FACE CREAM

8.8.1.3 LIP CARE AND LIPSTICK PRODUCTS

8.8.1.4 OTHERS

8.8.2 COSMETIC, BY PRODUCT CATEGORY

8.8.2.1 PLANT-BASED AMINO ACID

8.8.2.2 MICROBIAL AMINO ACID

8.8.2.3 SYNTHETIC AMINO ACID

8.8.3 COSMETIC, BY TYPE OF AMINO ACID

8.8.3.1 GLUTAMIC ACID

8.8.3.2 METHIONINE

8.8.3.3 CYSTEINE

8.8.3.4 LYSINE

8.8.3.5 ARGININE

8.8.3.6 TYROSINE

8.8.3.7 ALANINE

8.8.3.8 LEUCINE

8.8.3.9 HISTIDINE

8.8.3.10 PHENYLALANINE

8.8.3.11 VALINE

8.8.3.12 PROLINE

8.8.3.13 TRYPTOPHAN

8.8.3.14 GLYCINE

8.8.3.15 SERINE

8.8.3.16 ISOLEUCINE

8.8.3.17 THREONINE

8.8.3.18 GLUTAMINE

8.8.3.19 ASPARTIC ACID

8.8.3.20 ASPARAGINE

8.8.3.21 OTHERS

8.9 PERSONAL CARE

8.9.1 PERSONAL CARE, BY TYPE

8.9.1.1 SKIN CARE

8.9.1.2 HAIR CARE

8.9.2 PERSONAL CARE, BY PRODUCT CATEGORY

8.9.2.1 PLANT-BASED AMINO ACID

8.9.2.2 MICROBIAL AMINO ACID

8.9.2.3 SYNTHETIC AMINO ACID

9 NORTH AMERICA AMINO ACIDS MARKET, BY PURITY LEVEL

9.1 OVERVIEW

9.2 AMINO ACID 99%

9.3 AMINO ACID MORE THAN 99%

9.4 AMINO ACID 90%

9.5 AMINO ACID 80%

9.6 AMINO ACID 70%

9.7 AMINO ACID LESS THAN 60%

10 NORTH AMERICA AMINO ACIDS MARKET, BY FORM

10.1 OVERVIEW

10.2 POWDER

10.2.1 POWDER, BY TYPE

10.2.1.1 FINE POWDER

10.2.1.2 CRYSTALLINE POWDER

10.2.1.3 GRANULAR POWDER

10.3 GRANULES

10.4 LIQUID

10.5 PELLET

10.6 OTHERS

11 NORTH AMERICA AMINO ACIDS MARKET, BY PRODUCT CATEGORY

11.1 OVERVIEW

11.2 MICROBIAL AMINO ACID

11.2.1 MICROBIAL AMINO ACID, BY TYPE

11.2.1.1 BACTERIA

11.2.1.2 FUNGI

11.2.1.3 YEAST

11.3 PLANT-BASED AMINO ACID

11.4 SYNTHETIC AMINO ACID

12 NORTH AMERICA AMINO ACIDS MARKET, BY FUNCTION

12.1 OVERVIEW

12.2 FORTIFICATION

12.3 ENERGY BOOSTER

12.4 FLAVOR ENHANCER

12.5 PRESERVATIVE

12.6 MUSCLE GROWTH

12.7 IMMUNITY BOOSTER

12.8 OTHERS

13 NORTH AMERICA AMINO ACIDS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT

13.3 INDIRECT

14 NORTH AMERICA AMINO ACIDS MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 AJINOMOTO CO., INC.

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 CJ CHEILJEDANG CORP.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 MERCK KGAA

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 FUFENG GROUP

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 DAESANG

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 KYOWA HAKKO BIO CO., LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 COMPANY SHARE ANALYSIS

17.6.4 PRODUCT PORTFOLIO

17.6.5 RECENT DEVELOPMENTS

17.7 ADISSEO

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 ADM

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 AMINO GMBH

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 ASIAMERICA GROUP, INC.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 EVONIK INDUSTRIES AG

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 NORTH AMERICA BIO-CHEM TECHNOLOGY GROUP COMPANY LIMITED.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 KINGCHEM LIFE SCIENCE LLC

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 NIPPON RIKA CO., LTD.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 NOVUS INTERNATIONAL

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 PANGAEA SCIENCES.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 PACIFIC RAINBOW INTERNATIONAL, INC.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 PRINOVA GROUP LLC.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 QINGDAO SAMIN CHEMICAL CO., LTD.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 SICHUAN TONGSHENG AMINO ACID CO., LTD

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

17.21 SUMITOMO CHEMICAL.

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 PRODUCT PORTFOLIO

17.21.4 RECENT DEVELOPMENTS

17.22 SUNRISE NUTRACHEM GROUP CO.,LTD

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

图片列表

FIGURE 1 NORTH AMERICA AMINO ACIDS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AMINO ACIDS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AMINO ACIDS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AMINO ACIDS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AMINO ACIDS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AMINO ACIDS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA AMINO ACIDS MARKET : DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA AMINO ACIDS MARKET : VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA AMINO ACIDS MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS EXPECTED TO DOMINATE THE NORTH AMERICA AMINO ACIDS MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 INCREASING USE OF AMINO ACIDS IN FOOD AND BEVERAGES, PERSONAL CARE, COSMETIC PRODUCTS, ANIMAL FEED AND PHARMACEUTICAL DRUGS IS LEADING THE GROWTH OF THE NORTH AMERICA AMINO ACIDS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 TYPE OF AMINO ACID SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA AMINO ACIDS MARKET IN 2022 & 2029

FIGURE 13 SUPPLY CHAIN ANALYSIS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA AMINO ACIDS MARKET

FIGURE 15 NORTH AMERICA AMINO ACIDS MARKET: BY TYPE OF AMINO ACID, 2021

FIGURE 16 NORTH AMERICA AMINO ACIDS MARKET, BY APPLICATION

FIGURE 17 NORTH AMERICA AMINO ACIDS MARKET: BY PURITY LEVEL, 2021

FIGURE 18 NORTH AMERICA AMINO ACIDS MARKET: BY FORM, 2021

FIGURE 19 NORTH AMERICA AMINO ACIDS MARKET: BY PRODUCT CATEGORY, 2021

FIGURE 20 NORTH AMERICA AMINO ACIDS MARKET: BY FUNCTION, 2021

FIGURE 21 NORTH AMERICA AMINO ACIDS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 22 NORTH AMERICA AMINO ACIDS MARKET: SNAPSHOT (2021)

FIGURE 23 NORTH AMERICA AMINO ACIDS MARKET: BY COUNTRY (2021)

FIGURE 24 NORTH AMERICA AMINO ACIDS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 NORTH AMERICA AMINO ACIDS MARKET : BY COUNTRY (2021 & 2029)

FIGURE 26 NORTH AMERICA AMINO ACIDS MARKET: BY TYPE OF AMINO ACID (2022 & 2029)

FIGURE 27 NORTH AMERICA AMINO ACIDS MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。