North America Amaranth Oil Market

市场规模(十亿美元)

CAGR :

%

USD

223.83 Million

USD

550.25 Million

2025

2033

USD

223.83 Million

USD

550.25 Million

2025

2033

| 2026 –2033 | |

| USD 223.83 Million | |

| USD 550.25 Million | |

|

|

|

|

North America Amaranth Oil Market, By Extraction Type (Supercritical Fluid CO2 Extraction Process, Cold Pressing Process, Organic Solvent (Hexane) Extraction Process, Others), Packaging Type (HDPE Carboy, Aluminum Bottles, G. I. Drums, Others), Category (Conventional, Organic), Application (Cosmetic and Personal Care, Dietary Supplements, Aromatics, Pharmaceuticals, Others), Country (U.S., Canada, Mexico) Industry Trends and Forecast to 2028

Market Analysis and Insights: North America Amaranth Oil Market

Market Analysis and Insights: North America Amaranth Oil Market

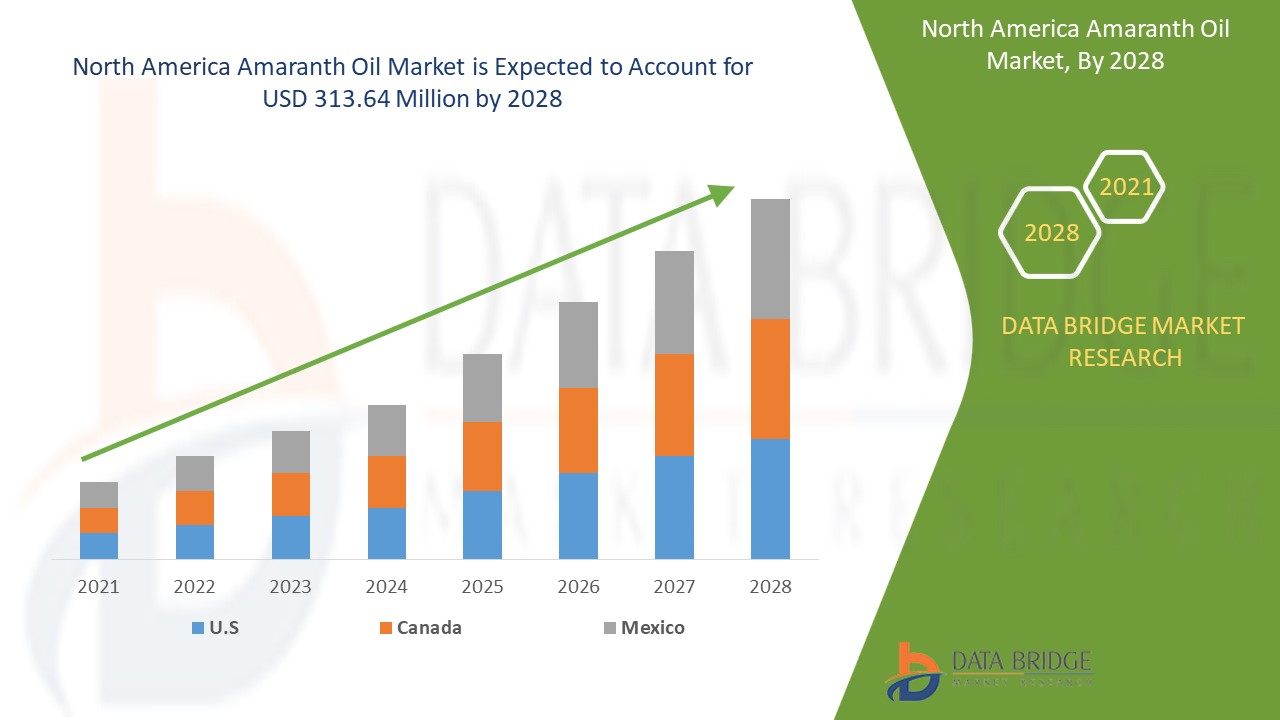

North America amaranth oil market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with a CAGR of 11.9% in the forecast period of 2021 to 2028 and is expected to reach USD 313.64 million by 2028. Rise in demand of amaranth oil from food supplementary industry. Increasing consumer acceptance of natural products for healthy living thus acts as a driver for north america amaranth oil market growth.

Amaranth oil has various health benefits, such as it is good for heart, skin, and body. In addition, it is used in several applications such as perfumery industry, aromatics, pharmaceuticals, and food supplements due to its increase in demand in the market.

Also, the rise in demand for organic and natural products among consumers and growing awareness about natural products is expected to create huge opportunities for the North America amaranth oil market.

The high production costs and fluctuating prices of raw materials is projected to huge challenge the north america amaranth oil market.

The demand for amaranth oil is increasing, for which key players or companies are now more focused and are involved in expansion, partnership, collaboration, event participation, certification, acquisition, and innovation in the market. These decisions are ultimately enhancing the growth of the market. Increase in awareness regarding the health benefits of amaranth oil acts as driver for the North America amaranth oil market. Factor such as Fluctuating prices of raw materials is restraining the North America amaranth oil market growth. Increasing demand for organic products among consumers acts as an opportunity for the market. Availability of substitute products in the market acts as challenge for the North America amaranth oil market growth.

The North America amaranth oil market report provides details of market share, new developments, and impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographical expansions, and technological innovations in the market. To understand the analysis and the amaranth oil market scenario contact Data Bridge Market Research for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

North America Amaranth Oil Market Scope and Market Size

North America Amaranth Oil Market Scope and Market Size

North America amaranth oil market is segmented into four notable segments based on extraction type, packaging type, category, and application.

The growth among segments helps you analyses niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of extraction type, the North America amaranth oil market is segmented into supercritical fluid CO2 extraction process, cold-pressing process, organic solvent (hexane) extraction process, and others. In 2021, the supercritical liquid co2 extraction process segment is expected to dominate the amaranth oil market due to emergence on new extraction techniques like Supercritical Extraction technique.

- On the basis of packaging type, the North America amaranth oil market is segmented into aluminum bottles, HDPE carboy and G.I. drums. In 2021, the HDPE carboy segment is expected to dominate the amaranth oil market due to the increase in demand for amaranth oil market to avoid nutritional risks and to increase the adoption of food safety standards.

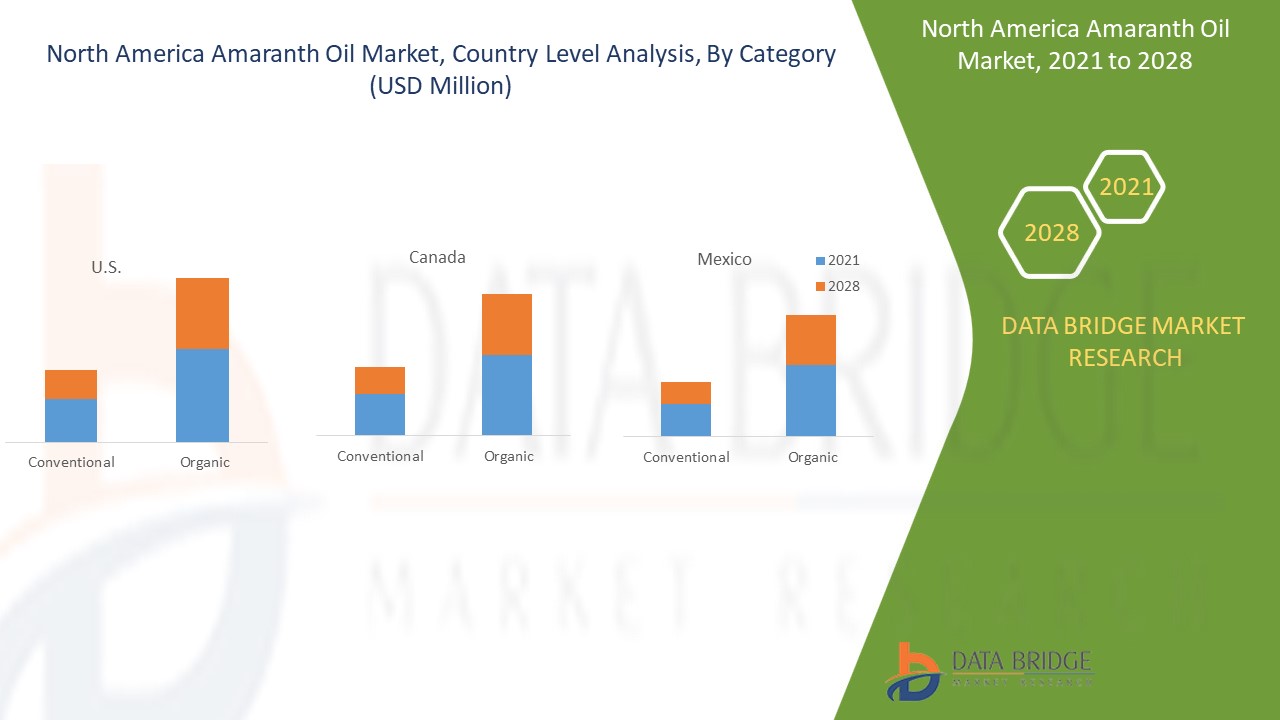

- On the basis of category, the North America amaranth oil market is segmented into conventional and organic. In 2021, the conventional segment is expected to dominate the amaranth oil market due to increase demand for natural and vegan products among consumers to lead a healthy lifestyle.

- On the basis of application, the North America amaranth oil market is segmented into cosmetics and personal care, dietary supplements, pharmaceuticals, aromatics and others. In 2021, the cosmetics and personal care segment is expected to dominate the amaranth oil market due to the increase in demand for certified sustainable food products among consumers.

North America Amaranth Oil Market Country Level Analysis

North America Amaranth Oil Market Country Level Analysis

The North America amaranth oil market is analyzed, and market size information is provided by the country, extraction type, packaging type, category, and application as referenced above.

- On the basis of country, the north america amaranth oil market is segmented into U.S., Canada, Mexico. In 2021, the U.S. is expected to dominate the market due to rise in demand for bio based products like amaranth oil. Canada is leading the growth of the market and conventional segment is expected to dominate the market due to increase in demand for conventional amaranth oil in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of north merica brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Growing strategic activities by major market players to enhance the awareness for north america amaranth oil market is boosting the market growth of amaranth oil market

The amaranth oil market also provides you with detailed market analysis for every country growth in particular market. Additionally, it provides the detail information regarding the market players’ strategy and their geographical presence. The data is available for historic period 2010 to 2019.

Competitive Landscape and North America Amaranth Oil Market Share Analysis

North America amaranth oil market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to North America amaranth oil market.

Some of the major players operating in the market are FLAVEX Naturextrakte GmbH, "M" plus Group" LTD, Ziani Organic Oils, Sunsoil Pvt. Ltd, Nature Pure Extracts Inc. and O&3 Limited among other domestic players. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many developments are also initiated by the companies worldwide, which are also accelerating the North America amaranth oil market.

For instance,

- In March 2020 Russian Oliva has launched new website for their consumers to buy the products easily. This development will increase company’s digital customer base and will help increase company’s revenue

Collaboration, product launch, business expansion, award and recognition, joint ventures and other strategies by the market player is enhancing the company footprints in the amaranth oil market market which also provides the benefit for organization’s profit growth.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。