North America Acute Respiratory Distress Syndrome (ARDS) Market, By Cause (Coronavirus Disease 2019 (COVID-19), Sepsis, Inhalation of Harmful Substances, Severe Pneumonia, and Others), Type (Diagnosis and Treatment), Route of Administration (Oral, Parenteral, and Others), End User (Hospitals, Specialty Clinics, Home Healthcare, and Others), Distribution Channel (Direct Tender, Hospital Pharmacy, Retail Pharmacy, Online Pharmacy, and Others), Country (U.S., Canada and Mexico) Industry Trends and Forecast to 2029.

Market Analysis and Insights: North America Acute Respiratory Distress Syndrome (ARDS) Market

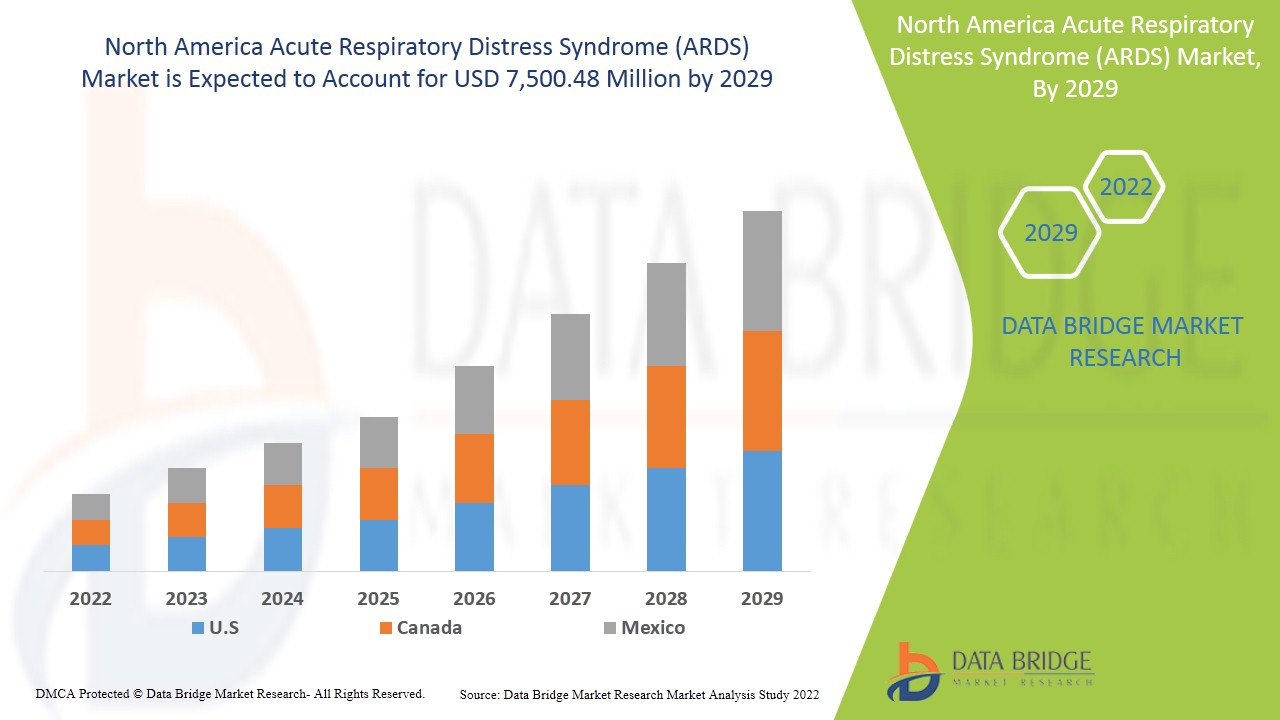

North America acute respiratory distress syndrome (ARDS) market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 10.5% in the forecast period of 2022 to 2029 and is expected to reach USD 7,500.48 million by 2029. Increasing prevalence of COVID-19 act as driver for the acute respiratory distress syndrome (ARDS) market growth.

Acute respiratory distress syndrome (ARDS) is a life-threatening lung injury that allows fluid to leak into the lungs. Most people who get ARDS are already at the hospital for trauma or illness like COVID-19. The syndrome usually occurs when fluids build up in the tiny, elastic air sacs called alveoli in lungs. This fluid build-up causes less oxygen reach the bloodstream. This deprives the organs to get enough oxygen for their normal function. People with other illness develops ARDS within few hours to days after the precipitating injury or infection. The risk of death increases with age and depending on severity of illness patients surviving the syndrome becomes hard. Severe illness or injury which causing damage to the membrane sacs of lungs leads to ARDS. The most common underlying causes for the said diseases includes sepsis, inhalation of harmful substances, severe pneumonia, head, chest or other major injury, coronavirus disease 2019 (COVID-19) and others.

Increasing prevalence and incidence of acute lung injury, wide range of risk factors for ARDS and acceleration in patient pool of covid-19 with ARDS acts as driver for the acute respiratory distress syndrome (ARDS) market. The other factors which are anticipated to propel the growth of the North America acute respiratory distress syndrome (ARDS) market include the rising rate of air pollution and life style related diseases and Increasing accident rates and trauma causing ARDS.

However, the factors such as the complications associated with treatments, high cost of devices and treatments are hampering the growth of the North America acute respiratory distress syndrome (ARDS) market. On the other hand, the growing geriatric population, rising healthcare expenditure and strategic Initiatives by market players act as an opportunity for the growth of the North America acute respiratory distress syndrome (ARDS) market. The stringent Regulations for approval and multiple challenges faced by ICU nurses is the key market challenge faced in the North America acute respiratory distress syndrome (ARDS) market.

The acute respiratory distress syndrome (ARDS) market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the acute respiratory distress syndrome (ARDS) market scenario contact Data Bridge Market Research for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

Acute Respiratory Distress Syndrome (ARDS) Market Scope and Market Size

The acute respiratory distress syndrome (ARDS) market is segmented on basis of cause, type, route of administration, end users and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of cause, the North America acute respiratory distress syndrome (ARDS) market is segmented into coronavirus disease 2019 (COVID-19), sepsis, inhalation of harmful substances, severe pneumonia and others. In 2022, coronavirus disease 2019 (COVID-19) segment is expected to dominate the market as the disease has spread all over the region with huge death rates.

- On the basis of type, the North America acute respiratory distress syndrome (ARDS) market is segmented into diagnosis and treatment. In 2022, diagnosis segment is expected to dominate the market as people were more aware of the timely diagnosis for proper treatment for deadly disorder.

- On the basis of route of administration, the North America acute respiratory distress syndrome (ARDS) market is segmented into oral, parenteral and others. The parenteral segment is further segmented into intramuscular and intravenous. In 2022, parenteral segment is expected to dominate the market due to high range of products getting approved by FDA with increasing number of products under pipeline.

- On the basis of end-users, the North America acute respiratory distress syndrome (ARDS) market is segmented into hospitals, specialty clinics, home healthcare and others. In 2022, hospitals segment is expected to dominate the market due to high technological developments in developed part of country.

- On the basis of distribution channel, the North America acute respiratory distress syndrome (ARDS) market is segmented into direct tender, hospital pharmacy, retail pharmacy, online pharmacy and others. In 2022, direct tender segment is expected to dominate the market as the players are taking strategic initiatives in expanding their distribution channel for worldwide supply.

Acute Respiratory Distress Syndrome (ARDS) Market Country Level Analysis

The acute respiratory distress syndrome (ARDS) market is analyzed and market size information is provided by the country, five notable segments such as cause, type, route of administration, end users and distribution channel as referenced above.

The countries covered in the acute respiratory distress syndrome (ARDS) market report are U.S., Canada and Mexico.

Hospitals segment in the U.S. is expected to grow with the highest growth rate in the forecast period of 2022 to 2029 because of increasing government and organizational support. The hospitals segment in Canada is second dominating the market owing to increasing cases of chronic respiratory diseases and high adoption of proper diagnosis. Mexico is third leading the growth of the market and hospitals segment is dominating in this country due to increasing number of new hospital infrastructure being opened due to emergence of COVID-19.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Growing Strategic Activities by Major Market Players to Enhance the Awareness for Acute Respiratory Distress Syndrome (ARDS) Treatment, is Boosting the Market Growth of Acute Respiratory Distress Syndrome (ARDS) Market

The acute respiratory distress syndrome (ARDS) market also provides you with detailed market analysis for every country growth in particular market. Additionally, it provides the detail information regarding the market players’ strategy and their geographical presence. The data is available for historic period 2011 to 2020.

Competitive Landscape and Acute Respiratory Distress Syndrome (ARDS) Market Share Analysis

Acute respiratory distress syndrome (ARDS) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to acute respiratory distress syndrome (ARDS) market.

The major companies which are dealing in the acute respiratory distress syndrome (ARDS) are Drägerwerk AG & Co. KGaA, Fisher & Paykel Healthcare Limited., LivaNova PLC, Gilead Sciences, Inc., Fresenius SE & Co. KGaA, Armstrong Medical, Smiths Medical (part of ICU Medical, Inc.), ResMed, ALung Technologies, Inc., Medtronic, F. Hoffmann-La Roche Ltd, Hamilton Medical, nice Neotech Medical Systems Pvt. Ltd., Pfizer Inc., WEINMANN Emergency Medical Technology GmbH + Co. KG, NIPRO, Terumo Medical Corporation, Getinge AB., EUROSETS and among other domestic players. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many contract and agreement are also initiated by the companies’ worldwide which are also accelerating the acute respiratory distress syndrome (ARDS) market.

For instance,

- In May 2021, Medtronic announced the launch of SonarMed airway monitoring system. The system utilizes acoustic technology to check for endotracheal tube obstruction. This has helped the company to increase its product portfolio.

- In July 2020, F. Hoffman-La Roche Ltd announced the launch of SARS-CoV-2 rapid antibody test. The test was launched in partnership with SD Biosenseor, Inc. This has helped the company to increase its product portfolio.

Collaboration, product launch, business expansion, award and recognition, joint ventures and other strategies by the market player is enhancing the company footprints in the acute respiratory distress syndrome market which also provides the benefit for organization’s profit growth.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 CAUSE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTERS FIVE FORCES

5 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: REGULATIONS

5.1 REGULATION IN U.S.:

5.2 REGULATION FOR VENTILATORS AND RESPIRATORY DEVICES AS PER FDA

5.3 REGULATION FOR THE USE OF VENTILATOR AND ANESTHESIA GAS MACHINE BREATHING CIRCUIT DEVICES

5.4 LABELING OF MODIFIED DEVICES

5.5 REGULATION IN EUROPE:

5.6 REGULATION IN INDIA:

5.7 REGULATION IN JAPAN:

6 REGIONAL SUMMARY

6.1 NORTH AMERICA REGION

6.2 EUROPE REGION

6.3 ASIA-PACIFIC

6.4 SOUTH AMERICA

6.5 MIDDLE EAST AND AFRICA

7 PIPELINE ANALYSIS

8 INSURANCE REIMBURSEMENT

8.1 CENTER FOR MEDICARE SERVICES (CMS)–ELSO (EXTRACORPOREAL LIFE SUPPORT ORGANIZATION)

8.2 HEALTH RESOURCES AND SERVICES ADMINISTRATION

8.3 ABBOTT CODING GUIDE FOR ECMO

8.4 CENTRAL GOVERNMENT HEALTH SCHEME (CGHS)

8.5 CERN HEALTH INSURANCE SCHEME

8.6 AMERICAN SOCIETY OF CLINICAL ONCOLOGY (ASCO) – (MEDICARE & MEDICAID)

8.7 AMERICAN HOSPITAL ASSOCIATION

8.8 CONCLUSION

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 INCREASING PREVALENCE AND INCIDENCE OF ACUTE LUNG INJURY

9.1.2 WIDE RANGE OF RISK FACTORS FOR ARDS

9.1.3 ACCELERATION IN PATIENT POOL OF COVID-19 WITH ARDS

9.1.4 RISING RATE OF AIR POLLUTION AND LIFESTYLE-RELATED DISEASES

9.1.5 INCREASING ACCIDENT RATES AND TRAUMA CAUSING ARDS

9.2 RESTRAINTS

9.2.1 COMPLICATIONS ASSOCIATED WITH TREATMENTS

9.2.2 HIGH COST OF DEVICE AND TREATMENTS

9.2.3 LACK OF SKILLED WORKFORCE

9.3 OPPORTUNITIES

9.3.1 GROWING GERIATRIC POPULATION

9.3.2 RISING HEALTHCARE EXPENDITURE

9.3.3 STRATEGIC INITIATIVES BY MARKET PLAYERS

9.3.4 IMPROVING AWARENESS REGARDING ARD SYNDROME

9.4 CHALLENGES

9.4.1 STRINGENT RULES & REGULATIONS

9.4.2 MULTIPLE CHALLENGES FACED BY ICU NURSES

10 IMPACT OF COVID-19 PANDEMIC ON THE NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET

10.1 PRICE IMPACT

10.2 IMPACT ON DEMAND

10.3 IMPACT ON SUPPLY CHAIN

10.4 STRATEGIC DECISIONS FOR MANUFACTURERS

10.5 CONCLUSION

11 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE

11.1 OVERVIEW

11.2 DIAGNOSIS

11.2.1 IMAGING TESTS

11.2.1.1 CHEST X-RAY

11.2.1.2 CT SCAN

11.2.1.3 ULTRASOUND

11.2.1.4 OTHERS

11.2.2 BLOOD TEST

11.2.3 RESPIRATORY RATE

11.2.4 SPO2 TEST

11.2.5 OTHERS

11.3 TREATMENT

11.3.1 MECHANICAL VENTILATION

11.3.1.1 HIGH-FLOW NASAL O2

11.3.1.2 BI-LEVEL POSITIVE AIRWAY PRESSURE

11.3.1.3 CONTINOUS POSITIVE AIRWAY PRESSURE

11.3.1.4 PRONE POSITIVE VENTILATION

11.3.1.5 OTHERS

11.3.2 CORTICOSTEROIDS

11.3.2.1 METHYLPREDNISOLONE

11.3.2.2 DEXAMETHASONE

11.3.2.3 OTHERS

11.3.3 ANTIVIRAL MEDICATION

11.3.3.1 REMDESIVIR

11.3.3.2 COMBINATION DRUGS

11.3.3.3 OTHERS

11.3.4 EXTRACORPOREAL MEMBRANE OXYGENATION (ECMO)

11.3.5 TOCILIZUMAB

11.3.6 OTHERS

12 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION

12.1 OVERVIEW

12.2 PARENTERAL

12.2.1 INTRAVENOUS

12.2.2 INTRAMUSCULAR

12.3 ORAL

12.4 OTHERS

13 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY CAUSE

13.1 OVERVIEW

13.2 CORONAVIRUS DISEASE 2019 (COVID-19)

13.3 SEPSIS

13.4 INHALATION OF HARMFUL SUBSTANCES

13.5 SEVERE PNEUMONIA

13.6 OTHERS

14 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY END USER

14.1 OVERVIEW

14.2 HOSPITALS

14.3 SPECIALTY CLINICS

14.4 HOME HEALTHCARE

14.5 OTHERS

15 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 DIRECT TENDER

15.3 HOSPITAL PHARMACY

15.4 RETAIL PHARMACY

15.5 ONLINE PHARMACY

16 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

17 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 GILEAD SCIENCES INC.

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUS ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENT

19.2 TERUMO CORPORATION

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUS ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENT

19.3 GETINGE AB

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUS ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENT

19.4 LIVANOVA PLC

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 MEDTRONIC

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENTS

19.6 ALUNG TECHNOLOGIES, INC

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.3 RECENT DEVELOPMENT

19.7 ARMSTRONG MEDICAL

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENT

19.8 BESMED HEALTH BUSINESS CORP.

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENTS

19.9 DRÄGERWERK AG & CO. KGAA

19.9.1 COMPANY SNAPSHOT

19.9.2 REVENUE ANALYSIS

19.9.3 PRODUCT PORTFOLIO

19.9.4 RECENT DEVELOPMENTS

19.1 EUROSETS

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 F. HOFFMANN-LA ROCHE LTD

19.11.1 COMPANY SNAPSHOT

19.11.2 RECENT ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENTS

19.12 FISHER & PAYKEL HEALTHCARE LIMITED

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 PRODUCT PORTFOLIO

19.12.4 RECENT DEVELOPMENTS

19.13 FRESENIUS SE & CO. KGAA

19.13.1 COMPANY SNAPSHOT

19.13.2 REVENUS ANALYSIS

19.13.3 PRODUCT PORTFOLIO

19.13.4 RECENT DEVELOPMENTS

19.14 HAMILTON MEDICAL

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENT

19.15 NICE NEOTECH MEDICAL SYSTEMS PVT.LTD.

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 RECENT DEVELOPMENT

19.16 NIPRO

19.16.1 COMPANY SNAPSHOT

19.16.2 REVENUS ANALYSIS

19.16.3 PRODUCT PORTFOLIO

19.16.4 RECENT DEVELOPMENT

19.17 PFIZER INC.

19.17.1 COMPANY SNAPSHOT

19.17.2 REVENUS ANALYSIS

19.17.3 PRODUCT PORTFOLIO

19.17.4 RECENT DEVELOPMENT

19.18 RESMED

19.18.1 COMPANY SNAPSHOT

19.18.2 REVENUE ANALYSIS

19.18.3 PRODUCT PORTFOLIO

19.18.4 RECENT DEVELOPMENT

19.19 SMITHS MEDICAL

19.19.1 COMPANY SNAPSHOT

19.19.2 REVENUS ANALYSIS

19.19.3 PRODUCT PORTFOLIO

19.19.4 RECENT DEVELOPMENTS

19.2 WEINMANN EMERGENCY MEDICAL TECHNOLOGY GMBH + CO. KG

19.20.1 COMPANY SNAPSHOT

19.20.2 PRODUCT PORTFOLIO

19.20.3 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

表格列表

TABLE 1 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: PIPELINE ANALYSIS

TABLE 2 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA DIAGNOSIS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA DIAGNOSIS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA IMAGING TESTS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA TREATMENT IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA TREATMENT IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA MECHANICAL VENTILATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA CORTICOSTEROIDS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA ANTIVIRAL MEDICATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PARENTERAL IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA PARENTERAL IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA ORAL IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA OTHERS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY CAUSE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA CORONAVIRUS DISEASE 2019 (COVID-19) IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA SEPSIS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA INHALATION OF HARMFUL SUBSTANCES IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA SEVERE PNEUMONIA IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA OTHERS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA HOSPITALS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA SPECIALTY CLINICS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA HOME HEALTHCARE IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA OTHERS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA DIRECT TENDER IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA HOSPITAL PHARMACY IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA RETAIL PHARMACY IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA ONLINE PHARMACY IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY CAUSE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA DIAGNOSIS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA IMAGING TESTS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA TREATMENT IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA ANTIVIRAL MEDICATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA CORTICOSTEROIDS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA MECHANICAL VENTILATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA PARENTERAL IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 U.S. ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY CAUSE, 2020-2029 (USD MILLION)

TABLE 46 U.S. ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 U.S. DIAGNOSIS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 U.S. IMAGING TESTS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 U.S. TREATMENT IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 U.S. ANTIVIRAL MEDICATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 U.S. CORTICOSTEROIDS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.S. MECHANICAL VENTILATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.S. ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 54 U.S. PARENTERAL IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 55 U.S. ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 56 U.S. ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 57 CANADA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY CAUSE, 2020-2029 (USD MILLION)

TABLE 58 CANADA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 CANADA DIAGNOSIS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 CANADA IMAGING TESTS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 CANADA TREATMENT IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 CANADA ANTIVIRAL MEDICATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 CANADA CORTICOSTEROIDS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 CANADA MECHANICAL VENTILATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 CANADA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 66 CANADA PARENTERAL IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 67 CANADA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 CANADA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 69 MEXICO ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY CAUSE, 2020-2029 (USD MILLION)

TABLE 70 MEXICO ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO DIAGNOSIS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 MEXICO IMAGING TESTS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO TREATMENT IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 MEXICO ANTIVIRAL MEDICATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 MEXICO CORTICOSTEROIDS IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 MEXICO MECHANICAL VENTILATION IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 MEXICO ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 78 MEXICO PARENTERAL IN ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 79 MEXICO ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 80 MEXICO ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: SEGMENTATION

FIGURE 11 ACCELERATION IN PATIENT POOL OF COVID-19 WITH ARDS IS EXPECTED TO DRIVE THE NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 CORONAVIRUS DISEASE 2019 (COVID-19) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET

FIGURE 15 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY TYPE, 2021

FIGURE 16 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY TYPE, 2020-2029 (USD MILLION)

FIGURE 17 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 18 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY TYPE, LIFELINE CURVE

FIGURE 19 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY ROUTE OF ADMINISTRATION, 2021

FIGURE 20 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 23 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY CAUSE, 2021

FIGURE 24 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY CAUSE, 2020-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY CAUSE, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY CAUSE, LIFELINE CURVE

FIGURE 27 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY END USER, 2021

FIGURE 28 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 29 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY END USER, CAGR (2022-2029)

FIGURE 30 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY END USER, LIFELINE CURVE

FIGURE 31 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: DISTRIBUTION CHANNEL, 2021

FIGURE 32 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

FIGURE 33 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 34 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 35 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: SNAPSHOT (2021)

FIGURE 36 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY COUNTRY (2021)

FIGURE 37 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: BY CAUSE (2022 & 2029)

FIGURE 40 NORTH AMERICA ACUTE RESPIRATORY DISTRESS SYNDROME (ARDS) MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。