北美国防和航空航天市场的 2D 显示器,按显示技术(液晶显示器 (LCD)、发光二极管 (LED)、有机 LED (OLED)、Micro-LED 等)、类型(触摸和非触摸)、分辨率(全高清、高清、4K 等)、面板尺寸(5 英寸至 10 英寸、大于 10 英寸和小于 5 英寸)、显示类型(传统显示器和智能显示器)、销售渠道(OEMS 和零售商)、应用(航空航天和国防)划分 - 行业趋势和预测到 2030 年。

北美国防和航空航天 2D 显示器市场分析和规模

航空航天和国防 2D 显示器市场是一个专门为军事和商业航空航天应用提供显示器的市场。该市场使用的显示器必须满足严格的可靠性、性能和耐用性要求,并符合各种监管标准。航空航天和国防 2D 显示器市场预计将在未来几年实现稳步增长,这得益于对先进显示技术的需求不断增长、航空航天和国防工业的增长以及军事和商业航空对改进态势感知和通信能力的需求。高分辨率显示器、触摸屏和增强现实显示器等新技术的出现也有望推动该市场的增长。

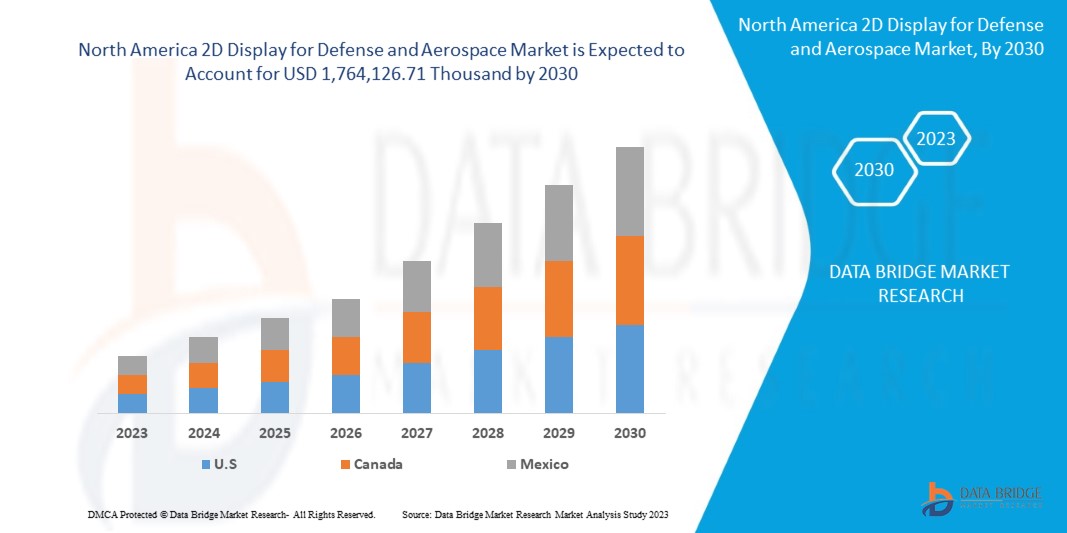

Data Bridge Market Research 分析,北美国防和航空航天 2D 显示器市场预计到 2030 年将达到 1,764,126.71 千美元,预测期内复合年增长率为 6.6%。北美国防和航空航天 2D 显示器市场报告还全面涵盖了定价分析、专利分析和技术进步。

|

报告指标 |

细节 |

|

预测期 |

2023 至 2030 年 |

|

基准年 |

2022 |

|

历史岁月 |

2021 (可定制为 2015-2020) |

|

定量单位 |

收入(千美元),定价(美元) |

|

涵盖的领域 |

按显示技术(液晶显示器 (LCD)、发光二极管 (LED)、有机 LED (OLED)、Micro-LED、其他)、类型(触摸、非触摸)、分辨率(全高清、高清、4K、其他)、面板尺寸(5 英寸至 10 英寸、大于 10 英寸、小于 5 英寸)、显示类型(传统显示器、智能显示器)、销售渠道(OEMS、零售商)、应用(航空航天、国防) |

|

覆盖国家 |

美国、加拿大和墨西哥。 |

|

涵盖的市场参与者 |

Korry、美国宇航公司、FDS Avionics Corp.、Rosen Aviation、ScioTeq、Excelitas Technologies Corp.、DIEHL STIFTUNG & CO. KG、Nighthawk Flight Systems, Inc、Aspen Avionics, Inc.、US Micro Products、AvMap srl、Meggitt PLC、霍尼韦尔国际公司、巴可公司、BAE Systems、泰雷兹公司、Garmin Ltd.、WINMATE INC、柯林斯航空航天公司、D&T Inc 和 Elbit Systems Ltd. |

市场定义

显示设备是一种以视觉或触觉形式呈现信息的输出设备。当提供的输入信息具有电信号时,显示器称为电子显示器。2D 头戴式显示器 (HMD) 是一种戴在头上或作为头盔一部分的显示设备,在一只眼睛(单眼 HMD)或每只眼睛(双眼 HMD)前面有一个小型显示光学元件。HMD 有许多用途,包括游戏、航空、工程和医学。虚拟现实耳机是与 IMU 相结合的 HMD。还有一种光学头戴式显示器 (OHMD),这是一种可穿戴显示器,可以反射投影图像并允许用户透过它观看。

北美国防和航空航天 2D 显示器市场动态

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。下面将详细讨论所有这些内容:

司机

- 全球军事现代化项目的增长

军事现代化是更新和改进一个国家的军事能力和装备,以更好地应对当前和未来的安全挑战。它涉及获取新的武器系统、技术和基础设施,以及制定新的战略和理论。军事现代化对一个国家来说很重要,因为它有助于保持对潜在对手的可靠威慑能力,提高军事准备和效力,并确保军队能够履行其指定的角色和任务。随着世界各国增加各自的国防预算,军事现代化项目的数量也在增加。

- 先进显示技术需求增长

全球政府的国防和航空航天业需要先进的显示器,以便为飞行员和士兵提供高分辨率图像、实时信息和增强的态势感知。因此,对能够满足这些要求的 2D 显示器的需求日益增长。

机会

- 模拟和训练系统需求增加

国防和航空航天工业中的模拟和训练系统是用于模拟真实场景并训练军事人员和飞行员的工具和技术。这些系统可以模拟各种场景,从常规操作到复杂的战场场景,并允许军事人员在安全、受控的环境中训练和磨练他们的技能。模拟和训练系统在国防和航空航天工业中的重要性怎么强调也不为过。这些系统有助于确保军事人员训练有素,并为可能遇到的任何情况做好准备。此外,它们还有助于降低训练演习或任务期间发生事故或灾难的风险。

限制/挑战

- 严格的政府法规

严格的政府法规预计将限制北美国防和航空航天市场的 2D 显示器,为某些 2D 显示技术的采购和使用设置障碍。制定这些法规是为了确保国防和航空航天行业使用的技术符合某些安全标准

- 国防和航空航天领域的高科技过时

技术过时是指由于技术进步而过时的状态。这意味着,随着更新、更先进的技术的开发和广泛应用,曾经流行且需求量很大的技术、产品或服务可能会变得无关紧要且无法使用。在市场环境中,当国防和航空航天中使用的 2D 显示技术过时并被更新、更先进的技术取代时,就会发生技术过时,从而导致对旧技术的需求下降。这是国防和航空航天工业面临的挑战,因为技术需要不断更新和改进,以满足军方不断变化的需求和要求。就国防和航空航天 2D 显示器而言,技术过时可能会在多个方面限制市场的增长。

新冠肺炎疫情对北美国防和航空航天市场 2D 显示器的影响

COVID-19 疫情严重影响了航空航天和国防工业,包括 2D 显示器市场。疫情导致航空旅行减少和国防开支减少,从而影响了飞机和国防应用中使用的 2D 显示器的需求。疫情的主要影响之一是北美供应链中断,导致制造 2D 显示器所用的原材料和零部件短缺。这导致显示器的生产和交付延迟,影响了航空航天和国防公司按时完成项目的能力。疫情还导致商用飞机需求下降,从而影响了驾驶舱显示器和其他应用中使用的 2D 显示器的需求。此外,国防开支的减少导致军事采购放缓,从而影响了军事应用中使用的显示器的需求。

最新动态

- 2022 年 3 月,Nighthawk Flight Systems, Inc. 宣布该公司已获得 AS9100/ISO9001 证书。该认证使该公司能够设计和制造紧凑型集成显示系统。该系统用于通用航空、商务航空、军事、航空运输和北美地区 2D 显示器下的国防和航空航天市场的支线飞机

- 2020 年 8 月,Aspen Avionics, Inc. 宣布该公司已与 AIRO 航空航天公司集团达成协议。此举扩大了公司的投资和资源,并增强了其不仅在通用航空航空电子设备方面的技术,而且还在北美国防航空航天市场 2D 展示下为商用、军用、机器人和多式联运飞机的载人和无人飞行平台提供航空电子设备产品

北美国防和航空航天 2D 显示器市场范围

北美国防和航空航天 2D 显示器市场根据显示技术、类型、分辨率、面板尺寸、显示器类型、销售渠道和应用进行细分。这些细分市场之间的增长将帮助您分析行业中微弱的增长细分市场,并为用户提供有价值的市场概览和见解,帮助他们做出战略决策,以确定核心市场应用。

按显示技术

- 液晶显示器 (LCD)

- 发光二极管 (LED)

- 有机发光二极管 (OLED)

- 微型LED

- 其他的

根据显示技术,北美国防和航空航天市场的 2D 显示器分为液晶显示器 (LCD)、发光二极管 (LED)、有机 LED (OLED)、微型 LED 等。

按类型

- 触碰

- 非触摸

根据类型,北美国防和航空航天市场的 2D 显示器分为触摸式和非触摸式。

按分辨率

- 全高清

- 高清

- 4K

- 其他的

根据分辨率,北美国防和航空航天市场的 2D 显示器分为全高清、高清、4K 和其他。

按面板尺寸

- 5 英寸至 10 英寸

- 大于 10 英寸

- 小于 5 英寸

根据面板尺寸,北美国防和航空航天市场的 2D 显示器分为 5 英寸至 10 英寸、大于 10 英寸和小于 5 英寸。

按显示类型

- 传统显示

- 智能显示

根据显示类型,北美国防和航空航天市场的 2D 显示器分为传统显示器和智能显示器。

按销售渠道

- 原始设备制造商

- 零售商

根据销售渠道,北美国防和航空航天 2D 显示器市场细分为 OEMS 和零售商。

按应用

- 航天

- 防御

根据应用,北美国防和航空航天市场的 2D 显示器分为航空航天和国防。

北美国防和航空航天 2D 显示器市场区域分析/见解

分析了北美国防和航空航天市场的 2D 显示器。如上所述,市场规模洞察和趋势由显示技术、类型、分辨率、面板尺寸、显示类型、销售渠道和应用提供。

北美国防和航空航天市场 2D 显示器报告涵盖的国家包括美国、加拿大和墨西哥。

U.S. dominates in the North America region as the U.S. has a well-developed aerospace and defense industry, with many leading companies involved in designing, developing, and manufacturing 2D displays. This continues to grow and is expected to boost the market growth

The region section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the region data.

Competitive Landscape and North America 2D display for defense and aerospace Market Share Analysis

North America 2D display for defense and aerospace Market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the companies' focus on North America 2D display for defense and aerospace market.

Some of the major players operating in the North America 2D display for defense and aerospace market are Korry, Astronautics Corporation of America, FDS Avionics Corp., Rosen Aviation, ScioTeq, Excelitas Technologies Corp., DIEHL STIFTUNG & CO. KG, Nighthawk Flight Systems, Inc, Aspen Avionics, Inc., US Micro Products, AvMap s.r.l., Meggitt PLC, Honeywell International Inc., Barco, BAE Systems, Thales, Garmin Ltd., WINMATE INC, Collins Aerospace, D&T Inc, and Elbit Systems Ltd.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 COMPONENT CURVE

2.1 MARKET CHALLENGE MATRIX

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 TECHNOLOGICAL TRENDS

4.3 COMPANY COMPARATIVE ANALYSIS

4.4 VALUE CHAIN ANALYSIS

4.5 PATENT ANALYSIS

4.6 CASE STUDY

4.7 REGULATORY STANDARDS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING MILITARY MODERNIZATION PROGRAMS ACROSS THE GLOBE

5.1.2 GROWING DEMAND FOR ADVANCED DISPLAY TECHNOLOGIES

5.1.3 EMERGING REQUIREMENTS OF ENHANCED COMMUNICATION SYSTEMS

5.1.4 INCREASE IN TECHNOLOGICAL ADVANCEMENTS IN DISPLAY TECHNOLOGY

5.2 RESTRAINTS

5.2.1 HIGH DEVELOPMENT AND MANUFACTURING COSTS ASSOCIATED WITH ADVANCED 2D DISPLAYS

5.2.2 STRINGENT GOVERNMENT REGULATIONS

5.3 OPPORTUNITIES

5.3.1 INCREASE IN DEMAND FOR SIMULATION AND TRAINING SYSTEMS

5.3.2 INCREASING PARTNERSHIP, ACQUISITION, AND COLLABORATION AMONG MARKET PLAYERS

5.3.3 RISE IN DEMAND FOR HEAD-MOUNTED DISPLAYS (HMDS)

5.3.4 EXPANSION OF THE DEFENSE AND AEROSPACE INDUSTRY ACROSS THE GLOBE

5.4 CHALLENGES

5.4.1 INTEGRATION CHALLENGES ASSOCIATED WITH ADVANCED 2D DISPLAYS

5.4.2 HIGH TECHNOLOGICAL OBSOLESCENCE IN DEFENCE AND AEROSPACE SECTOR

6 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY TYPE

6.1 OVERVIEW

6.2 LIQUID CRYSTAL DISPLAYS (LCD)

6.3 LIGHT EMITTING DIODE (LED)

6.4 ORGANIC LED (OLED)

6.4.1 RIGID

6.4.2 FLEXIBLE

6.4.3 FOLDABLE

6.5 MICRO-LED

6.6 OTHERS

7 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY TYPE

7.1 OVERVIEW

7.2 TOUCH

7.3 NON-TOUCH

8 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY RESOLUTION

8.1 OVERVIEW

8.2 FULL HD

8.3 HD

8.4 4K

8.5 OTHERS

9 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY PANEL SIZE

9.1 OVERVIEW

9.2 5 INCHES TO 10 INCHES

9.3 GREATER THAN 10 INCHES

9.4 LESS THAN 5 INCHES

10 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY DISPLAY TYPE

10.1 OVERVIEW

10.2 CONVENTIONAL DISPLAY

10.3 SMART DISPLAY

11 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY SALES CHANNEL

11.1 OVERVIEW

11.2 OEMS

11.3 RETAIL

12 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 AEROSPACE

12.2.1 BY TYPE

12.2.1.1 PRIMARY FLIGHT DISPLAY

12.2.1.2 MULTI-FUNCTIONAL DISPLAY

12.2.1.3 BACKUP DISPLAY

12.2.1.4 MISSION DISPLAY

12.2.2 BY TYPE

12.2.2.1 AIRCRAFT

12.2.2.2 HELICOPTERS

12.2.2.3 OTHERS

12.3 DEFENCE

12.3.1 BY TYPE

12.3.1.1 LAND

12.3.1.2 AIRBORNE

12.3.1.3 NAVAL

13 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 HONEYWELL INTERNATIONAL INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCTS PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 THALES

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 SOLUTION PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 COLLINS AEROSPACE

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 SOLUTION PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 EXCELITAS TECHNOLOGIES CORP.

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCTS PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 BAE SYSTEMS

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCTS PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ASPEN AVIONICS, INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 ASTRONAUTICS CORPORATION OF AMERICA

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCTS PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 AVMAP SRL

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCTS PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 BARCO

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 SOLUTION PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 DIEHL STIFTUNG & CO. KG

16.10.1 COMPANY SNAPSHOT

16.10.2 SOLUTION PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 D&T INC

16.11.1 COMPANY SNAPSHOT

16.11.2 SOLUTION PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 ELBIT SYSTEMS LTD.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 BUSINESS PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 FDS AVIONICS CORP.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCTS PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 GARMIN LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 KORRY

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCTS PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 MEGGIT PLC

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCTS PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 NIGHTHAWK FLIGHT SYSTEMS, INC.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 ROSEN AVIATION.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 SCIOTEQ

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 US MICRO PRODUCTS

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 WINMATE INC.

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

表格列表

TABLE 1 PATENT ANALYSIS

TABLE 2 REGULATORY STANDARDS

TABLE 3 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA LIQUID CRYSTAL DISPLAYS (LCD) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA LIGHT EMITTING DIODE (LED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA MICRO-LED IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA OTHERS IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA TOUCH IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA NON-TOUCH IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA FULL HD IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA HD IN 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA 4K IN 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA OTHERS IN 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA 5 INCHES TO 10 INCHES IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA GREATER THAN 10 INCHES IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA LESS THAN 5 INCHES IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA CONVENTIONAL DISPLAY IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA SMART DISPLAY IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA OEMS IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA RETAIL IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 43 NORTH AMERICA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 NORTH AMERICA DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 U.S. 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 47 U.S. ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 U.S. 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 U.S. 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 50 U.S. 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 51 U.S. 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 U.S. 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 53 U.S. 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 54 U.S. AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 U.S. AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 U.S. DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 CANADA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 58 CANADA ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 CANADA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 60 CANADA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 61 CANADA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 62 CANADA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 CANADA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 64 CANADA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 65 CANADA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 CANADA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 CANADA DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 MEXICO 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 69 MEXICO ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 MEXICO 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 MEXICO 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 72 MEXICO 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 73 MEXICO 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 MEXICO 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 75 MEXICO 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 76 MEXICO AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 MEXICO AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 78 MEXICO DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA 2D DIPLAY FOR DEFENSE AND AEROSPACE MARKET: DBMR TRIPOD DATA VALIDATION MODEL

FIGURE 3 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: MULTIVARIATE MODELLING

FIGURE 10 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: DISPLAY TECHNOLOGY CURVE

FIGURE 11 THE MARKET CHALLENGE MATRIX BY DISPLAY TECHNOLOGY

FIGURE 12 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 13 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: SEGMENTATION

FIGURE 14 EMERGING REQUIREMENTS OF ENHANCED COMMUNICATION SYSTEMS IS EXPECTED TO BE A KEY DRIVER FOR NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 LIQUID CRYSTAL DISPLAYS (LCD) IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET IN 2023 TO 2030

FIGURE 16 TECHNOLOGY TRENDS IN 2D DISPLAY FOR AEROSPACE AND DEFENSE

FIGURE 17 COMPANY COMPARISON

FIGURE 18 VALUE CHAIN FOR THE NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET

FIGURE 20 TOP 7 DEFENSE BUDGET OF NATION ACROSS THE GLOBE OF 2023 (IN USD)

FIGURE 21 MILITARY EXPENDITURE (% OF GDP) OF U.S., U.K., INDIA, CHINA, AND RUSSIA (2013-2021)

FIGURE 22 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY DISPLAY TECHNOLOGY, 2022

FIGURE 23 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY TYPE, 2022

FIGURE 24 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY RESOLUTION, 2022

FIGURE 25 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY PANEL SIZE, 2022

FIGURE 26 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY DISPLAY TYPE, 2022

FIGURE 27 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY SALES CHANNEL, 2022

FIGURE 28 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY APPLICATION, 2022

FIGURE 29 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: SNAPSHOT (2022)

FIGURE 30 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: BY COUNTRY (2022)

FIGURE 31 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 32 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 33 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: BY DISPLAY TECHNOLOGY (2023-2030)

FIGURE 34 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: COMPANY SHARE 2022 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。