中东聚合物市场、按产品(聚乙烯 (PE)、聚丙烯(PP)、丙烯腈丁二烯苯乙烯、聚酰胺 (PA) 等)行业趋势和预测到 2030 年。

中东聚合物市场分析与洞察

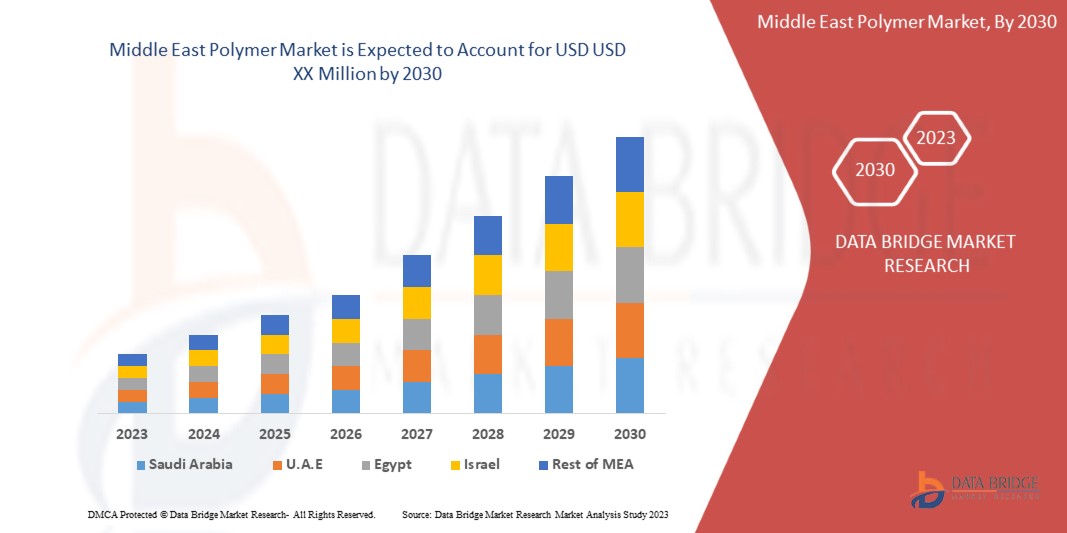

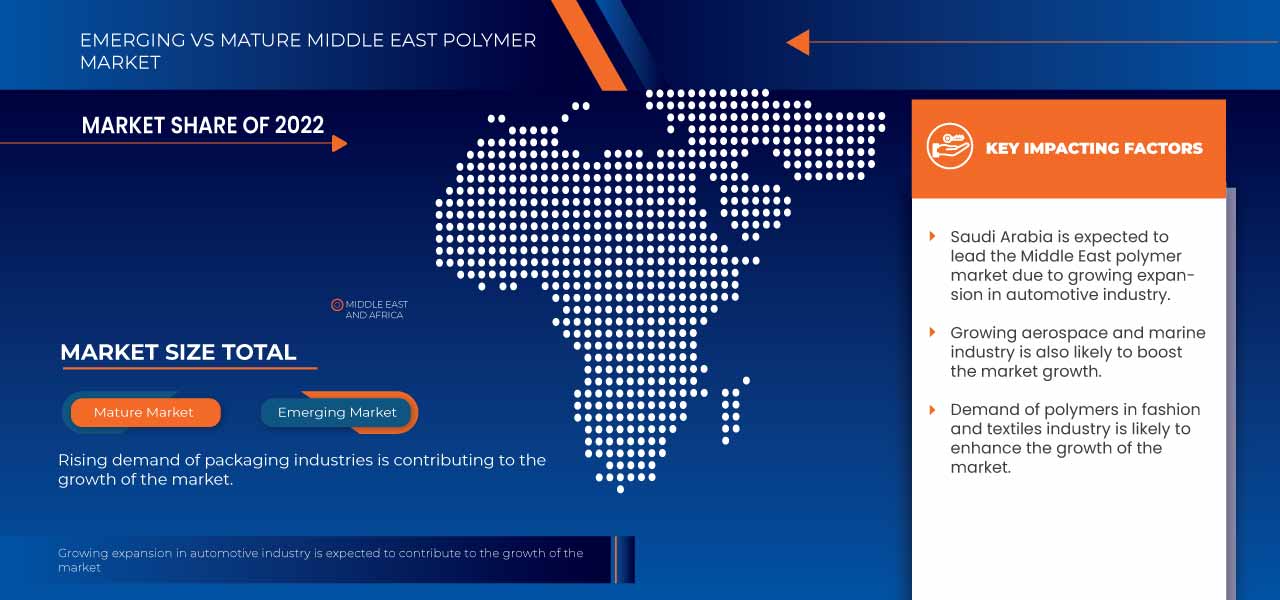

预计中东聚合物市场将在 2023 年至 2030 年的预测期内实现显着增长。Data Bridge Market Research 分析称,在 2023 年至 2030 年的预测期内,该市场的复合年增长率为 4.7%,预计到 2030 年将达到 752.9596 亿美元。推动中东聚合物市场增长的主要因素是包装材料、汽车、航空航天和船舶以及建筑等行业对聚合物基产品的需求不断增长。

聚合物由多个称为单体的小分子单元通过聚合过程制成。根据来源,聚合物分为天然聚合物和合成聚合物。天然聚合物也称为生物聚合物,如丝绸、橡胶、纤维素、羊毛等。合成聚合物是一种化学产品,主要使用石油作为原料,添加其他催化剂和酶,通过实验室化学反应制备,例如聚苯乙烯、尼龙、硅酮、氯丁橡胶、聚乙烯等。聚合物以各种可能的方式广泛应用于各个行业,包括汽车、航空航天、船舶、建筑材料、包装和纺织品、家庭、医疗和制药设备。

中东聚合物市场报告提供了市场份额、新发展以及国内和本地市场参与者的影响的详细信息,分析了新兴收入来源、市场法规变化、产品审批、战略决策、产品发布、地域扩张和市场技术创新方面的机会。要了解分析和市场情况,请联系我们获取分析师简报,我们的团队将帮助您创建收入影响解决方案,以实现您的预期目标。

|

报告指标 |

细节 |

|

预测期 |

2023 至 2030 年 |

|

基准年 |

2022 |

|

历史岁月 |

2021 (可定制为 2020-2016) |

|

定量单位 |

收入(百万美元) |

|

涵盖的领域 |

副产品(聚乙烯(PE)、聚丙烯 (PP)、丙烯腈丁二烯苯乙烯、聚酰胺 (PA) 等) |

|

覆盖国家 |

国家(阿联酋、沙特阿拉伯、以色列、阿曼、卡塔尔、科威特、巴林和中东其他地区)。 |

|

涵盖的市场参与者 |

沙特基础工业公司 (SABIC)、利安德巴塞尔工业控股有限公司、巴斯夫公司 (BASF SE)、住友化学株式会社、沙特聚合物有限责任公司、卡塔尔石油化工公司 (QAPCO)QPJSC、金星石化(孟买)私人有限公司、中东聚合物与化学品有限责任公司、Petro Rabigh、埃克森美孚公司、博禄、信实工业有限公司。 |

市场定义

该聚合物具有许多有用的特性,使其适用于各种终端工业应用。它的强度和硬度较低,但延展性很好,冲击强度也很好;它会拉伸而不是断裂。聚合物基产品具有良好的电绝缘体,具有抗电树枝化性,但可能会带静电。因此,由于这些特性,汽车、电气和电子、食品和饮料以及消费品等各个行业对聚合物的需求正在增长。在汽车行业,制造商正致力于通过减轻车辆重量来提高车辆效率。聚合物材料是首选,因为它重量轻,易于加工、密封和刚度好。在食品和饮料行业,由于对食品和饮料包装材料生产的需求不断增长,聚合物的消费量正在快速增长。制造商更喜欢有效的包装,以减少食品污染和质量损失的可能性。由于聚合物具有抵抗物理应力和耐用性、包装灵活性和易于成型产品的能力,因此在时装、运动和玩具中的使用正在增长。在农业领域,由于灌溉田对滴头、微管、喷嘴和发射管的需求不断增加,聚合物的应用正在增长。

中东聚合物市场动态

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。下面将详细讨论所有这些内容:

驱动程序

- 汽车行业不断扩张

在这个现代社会,汽车和车辆已经成为人们往返两地的主要商品。人们还利用汽车进行各种其他用途的运输,例如在不同地点之间转移货物和服务。本质上,车辆由发动机、底盘、车身部件、轮胎、传动装置和转向部件、悬架、制动器和电气设备组成,它们结合在一起发挥功能。除此之外,根据汽车的类型和类别,还会添加一些额外的豪华设备,以改善外观、功能和舒适度。随着汽车行业新发展,客户对新设计功能和舒适度的需求不断增长,加上各国政府实施的各种法规和安全措施,导致增加了额外的设备,从而增加了车辆的总重量。政府机构的环境限制和燃油效率是车辆设计的主要关键因素。为了补偿车辆的额外重量和燃油效率,开发结构轻巧的设计和产品至关重要。这可以通过使用聚合物基产品来实现,例如聚丙烯、聚氨酯、聚酰胺和 PVC、丙烯腈丁二烯苯乙烯、聚碳酸酯 (PC) 等,这些产品与金属产品相比重量较轻。由于其功能可靠、重量轻、韧性和耐磨性,高性能热塑性弹性体 (TPE) 和液体橡胶等聚合物已用于制造轮胎、外部、内部、引擎盖下、噪音、振动、声振粗糙度 (NVH) 和阻尼和照明等汽车零部件,它们有助于提供安全性和舒适性,同时减少排放。汽车行业的不断扩张预计将增加中东聚合物市场对聚合物的需求。

- 航空航天和海洋工业的增长

航空航天业是中东地区最重要的行业之一,多年来一直保持强劲增长势头。中东是国际旅客和贸易的热门枢纽,也是商务、旅游和休闲旅客的主要目的地。在制造飞机时,找到高强度和低重量之间的平衡至关重要。为了抵抗飞机在飞行过程中产生的多种力,飞机结构必须轻便、坚固且坚硬。此外,它们还必须足够坚固,以在飞机的整个使用寿命期间承受这些压力。在每架飞机的设计中,有效载荷能力、价格、航程、速度、燃油效率、耐用性、噪音水平、必要的跑道长度以及许多其他标准都经过精心平衡。聚合物是航空航天工业的重要组成部分。由于聚合物具有重量轻、耐腐蚀、耐冲击、耐化学腐蚀、耐用和成本效益高等特点,因此被广泛用于制造航空航天部件、导航功能、结构元件和内部部件,而减轻重量和提高燃油效率是主要关注点。对于军用飞机而言,轻质聚合物有助于延长飞行距离以避开雷达探测。

机会

- 生物基聚合物的开发

塑料和其他聚合物产品的处理是环境的主要问题,聚合物基塑料在日常生活中大量生产和使用,这对环境产生了不良影响。为了解决这个问题,正在开发可生物降解的聚合物来替代不可生物降解的聚合物材料。可生物降解聚合物也称为生物聚合物,是一种环保材料,使用后可降解,由各种废物或生物来源制成,如食物垃圾、动物废物、农业废物和其他来源,如淀粉和纤维素。近年来,可生物降解材料在包装、农业、医药和其他领域的应用越来越受欢迎。人们认为,使用可生物降解的聚合物产品将通过减少污染对环境和经济产生良好影响。可持续和环保聚合物的发展有望为中东聚合物市场提供机会。

- 政府对增加基础设施和制造业的投资和支持

The government in the Middle East is focusing in the investment of new infrastructure projects that involve in direct link with the economy development of the country. Considering the Middle East strategic location in the globe Middle East has emerged as the growing hub for trade and commerce, tourism, and not to forget their booming petroleum industry. With the development of materials science and technologies, polymers materials have exhibited its potential in the construction industries due to their superior qualities such as waterproof, wear resistant, anticorrosion, antiseismic, lightweight, good strength, sound insulation, heat insulation, good electric insulation and bright colors. Polymer materials, including the insulation layer of water supply and drainage pipes, wire and cable, and wall insulation material, have been widely used in construction due to their outstanding qualities. converted into bitumen or tar through a conventional modifier. Polymer-based construction materials have been widely used in building coatings, safeguard construction materials, enhance their aesthetic appeal, and provide unique functionalities, including fire-resistant, waterproof, heat-insulating, self-healing, sterilization, and anticorrosive coatings. Additionally, the use of polymer binders would effectively improve the bonding abilities of cement or mortar. The focus by the governmental body funding and investment on new infrastructure projects and development of various projects on construction of many upcoming infrastructures is expected to act as an opportunity for the polymer manufacturer and producer to grow if we take proper attention with the right approach.

Restraints/ Challenges

- Strict government regulations on polymer based product

Polymers are made up of by the corporation of many chemically small unit called monomer which, most of which are considered to possess a threat to both humans and the environment. To overcome and counter the health and environmental risk possess by the polymer product, several government and NGO’s bodies are implementing strict regulation, taxes on product sourcing and product transportation. As a result, the scenario has become increasingly difficult to comply with. Environmental, social, and governance (ESG) issues are becoming increasingly critical for the polymers industries added, with consumers are giving more importance to the products that have little to no social and environmental thread. Moreover, several complex situation impost by the government in the import-export, both at the domestic and international level addition with the restriction on the environmental impact is expected to restrain the polymer market in the Middle East region.

- Harmful impact of polymers on the environment

Despite their advantages and popularity in various industries, polymer are highly hazardous to the environment due to their high corrosive resistant and non-degradable in nature polymer especially the single used plastics once used it end mostly as waste in the landfill which gradually end up in the water bodies like rivers and ocean harming the both the aquatic and terrestrial life. For Example, water bottles and other similar materials made up of polyethylene terephthalate (PET), which is a petroleum based polymer that take upto 450 years to decompose. Polymer compound and polymer finished products due to its large quantity. Recycling of polymer waste includes many processes, which are the separation of polymer compound, grinding and separation of impurities, which comprises high cost. The difficulty of polymer to be decomposed has possess many difficulties and challenges to the manufacturer due to their adverse effect on the environment, and contribution to waste will act as a challenge to the growth of the polymer market.

Recent Developments

- In December 2014, in a magazine by Toyota (GB) PLC state that Toyota created a nano clay-polyamide known as Nylon-6, a synthetic clay exfoliated to a thickness of around five atoms between layers of nylon polymer base material. The technology has advanced to reduce tire rolling resistance and create ultra-hard protective coatings for paintwork, windscreen glass, and headlamps. This material has larger uses, such as bumpers, body panels, and fuel tanks.

- In December 2018, a report by Bicerano & Associates Consulting, LLC stated that aircraft interiors and tires both use polymer matrix composites. Many interior parts of airplanes, including interior panels, instrument panels, table tops, bar tops, countertops, doors, cabinets, trim, casings, and overhead storage bins, are made of polymers and polymer matrix composites.

Middle East Polymer Market Scope

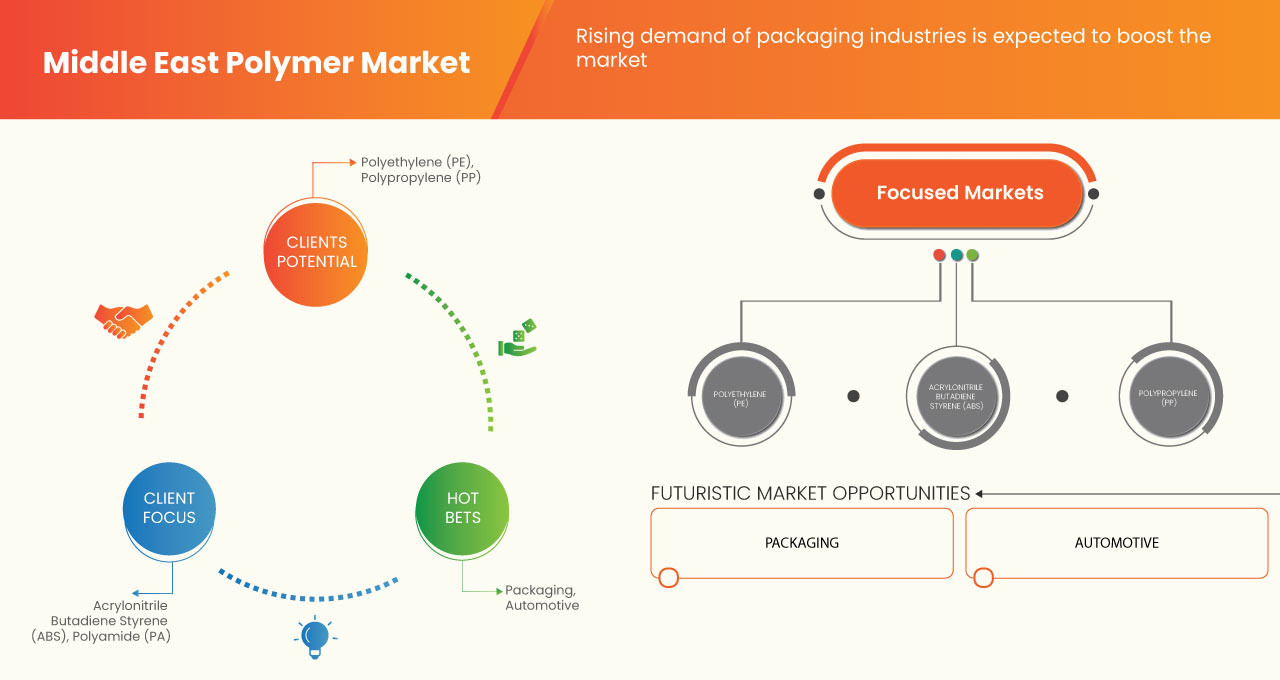

The Middle East polymer market is categorized based on product. The growth amongst the segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Products

- Polyethylene (PE)

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene

- Polyamide (PA)

Based on product, the Middle East polymer market is classified into Polyethylene (PE), Polypropylene (PP), Acrylonitrile Butadiene Styrene, and Polyamide (PA).

Middle East Polymer Market Regional Analysis/Insights

The Middle East polymer market is segmented on the basis of product and market size insights and trends are provided based on as referenced above.

The countries covered in the Middle East polymer market are UAE, Saudi Arabia, Israel, Oman, Qatar, Kuwait, Bahrain, and the Rest of the Middle East.

本区域报告提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。数据点下游和上游价值链分析、技术趋势、波特五力分析和案例研究是用于预测各个国家市场情景的一些指标。此外,在提供国家数据的预测分析时,还考虑了国际品牌的存在和可用性以及它们因来自本地和国内品牌的大量或稀缺竞争而面临的挑战、国内关税的影响和贸易路线。

竞争格局中东聚合物市场份额分析

中东聚合物市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、生产基地和设施、公司优势和劣势、产品发布、产品批准、专利、产品宽度和广度、应用优势、产品生命线曲线。以上提供的数据点仅与公司关注的中东聚合物市场有关。

中东聚合物市场的一些知名参与者包括 SABIC、Lyondellbasell Industries Holdings BV、BASF SE、住友化学株式会社、沙特聚合物有限责任公司、卡塔尔石油化工公司 (QAPCO)QPJSC、Venus Petrochemicals (Bombay) Pvt. Ltd、中东聚合物与化学品有限责任公司、Petro Rabigh、埃克森美孚公司、博禄、信实工业有限公司等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST POLYMER MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 RAW MATERIAL LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT’S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 IMPORT EXPORT SCENARIO

4.5 PRICE ANALYSIS

4.6 PRODUCTION CAPACITY OVERVIEW

4.7 PRODUCTION CONSUMPTION ANALYSIS

4.8 RAW MATERIAL COVERAGE

4.9 SUPPLY CHAIN ANALYSIS

4.1 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.11 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING EXPANSION IN THE AUTOMOTIVE INDUSTRY

6.1.2 GROWTH IN THE AEROSPACE AND MARINE INDUSTRY

6.1.3 DEMAND FOR POLYMERS IN THE FASHION AND TEXTILES INDUSTRY

6.1.4 RISING DEMAND PACKAGING INDUSTRIES

6.2 RESTRAINTS

6.2.1 STRICT GOVERNMENT REGULATIONS ON POLYMER BASED PRODUCT

6.2.2 VOLATILITY IN PRICE OF RAW MATERIAL

6.3 OPPORTUNITIES

6.3.1 DEVELOPMENT OF BIO-BASED POLYMERS

6.3.2 GOVERNMENT INVESTMENT AND SUPPORT FOR INCREASING INFRASTRUCTURE AND MANUFACTURING

6.4 CHALLENGES

6.4.1 HARMFUL IMPACT OF POLYMERS ON THE ENVIRONMENT

7 MIDDLE EAST POLYMER MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 POLYETHYLENE (PE)

7.2.1 BY TYPE

7.2.1.1 HDPE (HIGH DENSITY POLYETHYLENE)

7.2.1.2 LDPE (LOW DENSITY POLYETHYLENE)

7.2.1.3 MDPE (MEDIUM DENSITY POLYETHYLENE)

7.2.2 BY TECHNOLOGY

7.2.2.1 BLOW MOLDING

7.2.2.2 PIPE EXTRUSION

7.2.2.3 FILMS & SHEET EXTRUSION

7.2.2.4 INJECTION MOLDING

7.2.2.5 OTHERS

7.2.3 BY END-USE

7.2.3.1 PACKAGING

7.2.3.2 AUTOMOTIVE

7.2.3.3 INFRASTRUCTURE & CONSTRUCTION

7.2.3.4 CONSUMER GOODS/LIFESTYLE

7.2.3.5 HEALTHCARE & PHARMACEUTICALS

7.2.3.6 ELECTRICAL & ELECTRONICS

7.2.3.7 AGRICULTURE

7.2.3.8 OTHERS

7.3 POLYPROPYLENE (PP)

7.3.1 BY TYPE

7.3.1.1 HOMOPOLYMER

7.3.1.2 COPOLYMER

7.3.1.2.1 BLOCK COPOLYMER

7.3.1.2.2 RANDOM COPOLYMER

7.3.2 BY PROCESS

7.3.2.1 INJECTION MOLDING

7.3.2.2 BLOW MOLDING

7.3.2.3 EXTRUSION

7.3.2.4 OTHERS

7.3.3 BY APPLICATION

7.3.3.1 FIBER

7.3.3.2 FILM AND SHEET

7.3.3.3 RAFFIA

7.3.3.4 FOAM

7.3.3.5 TAPE

7.3.3.6 OTHERS

7.3.4 BY END-USE

7.3.4.1 PACKAGING

7.3.4.2 BUILDING AND CONSTRUCTION

7.3.4.3 AUTOMOTIVE

7.3.4.4 FURNITURE

7.3.4.5 ELECTRICAL AND ELECTRONICS

7.3.4.6 MEDICAL

7.3.4.7 CONSUMER PRODUCTS

7.3.4.8 OTHERS

7.4 ACRYLONITRILE BUTADIENE STYRENE

7.4.1 BY SOURCE

7.4.1.1 ACRYLONITRILE MONOMERS

7.4.1.2 BUTADIENE MONOMERS

7.4.1.3 STYRENE MONOMERS

7.4.2 BY PROCESS

7.4.2.1 INJECTION MOLDING

7.4.2.2 EXTRUSION

7.4.3 BY ADDITIVES

7.4.3.1 GLASS

7.4.3.2 POLYVINYLCHLORIDE (PVC)

7.4.3.3 OTHERS

7.4.4 BY APPEARANCE

7.4.4.1 OPAQUE

7.4.4.2 TRANSPARENT

7.4.4.3 COLOURED

7.4.5 BY APPLICATION

7.4.5.1 CONSTRUCTION

7.4.5.2 AUTOMOTIVE

7.4.5.3 MARINE

7.4.5.4 FURNITURE

7.4.5.5 PLUMBING

7.4.5.6 OTHERS

7.5 POLYAMIDE (PA)

7.5.1 BY TYPE

7.5.1.1 PA 6

7.5.1.2 PA 66

7.5.1.3 BIO POLYAMIDES

7.5.1.4 SPECIALTY POLYAMIDES

7.5.1.5 OTHERS

7.5.2 BY CLASS

7.5.2.1 ALIPHATIC POLYAMIDES

7.5.2.2 SEMI-AROMATIC

7.5.2.3 AROMATIC POLYAMIDES

7.5.3 BY APPLICATION

7.5.3.1 FIBERS

7.5.3.2 WIRE AND CABLES

7.5.3.3 3D PRINTING

7.5.3.4 SPORTS EQUIPMENT

7.5.3.5 ENGINE COMPONENTS

7.5.3.6 BRAKES AND TRANSMISSION PARTS

7.5.3.7 HOUSEHOLD GOODS AND APPLIANCES

7.5.3.8 OTHERS

7.5.4 BY END-USE

7.5.4.1 AUTOMOTIVE

7.5.4.2 ELECTRICAL AND ELECTRONICS

7.5.4.3 TEXTILE

7.5.4.4 AEROSPACE AND DEFENCE

7.5.4.5 PACKAGING

7.5.4.6 CONSUMER GOODS

7.5.4.7 OTHERS

7.6 OTHERS

8 MIDDLE EAST POLYMER MARKET, BY COUNTRY

8.1 SAUDI ARABIA

8.2 U.A.E.

8.3 ISRAEL

8.4 QATAR

8.5 OMAN

8.6 KUWAIT

8.7 BAHRAIN

8.8 REST OF MIDDLE EAST

9 MIDDLE EAST POLYMER MARKET COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: MIDDLE EAST

9.2 PRODUCT LAUNCH

9.3 COLLABORATIONS

9.4 EXPANSIONS

9.5 ACHIEVEMENT

9.6 DEVELOPMENTS

9.7 PARTNERSHIP

10 SWOT ANALYSIS

11 COMPANY PROFILES

11.1 SABIC

11.1.1 COMPANY SNAPSHOT

11.1.2 PRODUCT PORTFOLIO

11.1.3 SWOT

11.1.4 REVENUE ANALYSIS

11.1.5 RECENT DEVELOPMENTS

11.2 LYONDELLBASELLINDUSTRIES HOLDINGS B.V

11.2.1 COMPANY SNAPSHOT

11.2.2 PRODUCT PORTFOLIO

11.2.3 SWOT

11.2.4 REVENUE ANALYSIS

11.2.5 RECENT DEVELOPMENTS

11.3 BASF SE

11.3.1 COMPANY SNAPSHOT

11.3.2 PRODUCT PORTFOLIO

11.3.3 SWOT

11.3.4 REVENUE ANALYSIS

11.3.5 RECENT DEVELOPMENT

11.4 SUMITOMO CHEMICAL CO. LTD.

11.4.1 COMPANY SNAPSHOT

11.4.2 PRODUCT PORTFOLIO

11.4.3 SWOT

11.4.4 REVENUE ANALYSIS

11.4.5 RECENT DEVELOPMENTS

11.5 EXXON MOBIL CORPORATION

11.5.1 COMPANY SNAPSHOT

11.5.2 PRODUCT PORTFOLIO

11.5.3 SWOT

11.5.4 REVENUE ANALYSIS

11.5.5 RECENT DEVELOPMENTS

11.6 BOROUGE

11.6.1 COMPANY SNAPSHOT

11.6.2 PRODUCT PORTFOLIO

11.6.3 SWOT

11.6.4 RECENT DEVELOPMENTS

11.7 MIDDLE EAST POLYMERS & CHEMICALS.L.L.C

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 SWOT

11.7.4 RECENT DEVELOPMENT

11.8 PETRO RABIGH

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 SWOT

11.8.4 REVENUE ANALYSIS

11.8.5 RECENT DEVELOPMENT

11.9 QATAR PETROCHEMICAL COMPANY(QAPCO)Q.P.J.S.C

11.9.1 COMPANY SNAPSHOT

11.9.2 PRODUCT PORTFOLIO

11.9.3 SWOT

11.9.4 RECENT DEVELOPMENT

11.1 RELIANCE INDUSTRIES LIMITED

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 SWOT

11.10.4 REVENUE ANALYSIS

11.10.5 RECENT DEVELOPMENT

11.11 SAUDI POLYMER LLC

11.11.1 COMPANY SNAPSHOT

11.11.2 SWOT

11.11.3 PRODUCT PORTFOLIO

11.11.4 RECENT DEVELOPMENT

11.12 VENUS PETROCHEMICALS (BOMBAY) PVT.LTD

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 SWOT

11.12.4 RECENT DEVELOPMENT

12 QUESTIONNAIRE

13 RELATED REPORTS

表格列表

TABLE 1 IMPORT DATA OF POLYMERS OF PROPYLENE OR OTHER OLEFINS, IN PRIMARY FORMS; HS CODE – 3902 (USD THOUSAND)

TABLE 2 EXPORT DATA OF POLYMERS OF PROPYLENE OR OTHER OLEFINS IN PRIMARY FORMS; HS CODE – 3902 (USD THOUSAND)

TABLE 3 MIDDLE EAST POLYMER MARKET, AVERAGE SELLING PRICE, BY POLYMER, 2021-2030 (USD/KILO TONS)

TABLE 4 REGULATORY FRAMEWORK

TABLE 5 MIDDLE EAST POLYMER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 6 MIDDLE EAST POLYMER MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

TABLE 7 MIDDLE EAST POLYETHYLENE (PE) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 MIDDLE EAST POLYETHYLENE (PE) IN POLYMER MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 9 MIDDLE EAST POLYETHYLENE (PE) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 10 MIDDLE EAST POLYPROPYLENE (PP) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST COPOLYMER IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 MIDDLE EAST POLYPROPYLENE (PP) IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 13 MIDDLE EAST POLYPROPYLENE (PP) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 14 MIDDLE EAST POLYPROPYLENE (PP) IN POLYMER MARKET, BY END-USE, 2021-2030 (USD MILLION)

TABLE 15 MIDDLE EAST ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 16 MIDDLE EAST ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 17 MIDDLE EAST ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY ADDITIVES 2021-2030 (USD MILLION)

TABLE 18 MIDDLE EAST ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPEARANCE, 2021-2030 (USD MILLION)

TABLE 19 MIDDLE EAST ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 20 MIDDLE EAST POLYAMIDE (PA) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 MIDDLE EAST POLYAMIDE (PA) IN POLYMER MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 22 MIDDLE EAST POLYAMIDE (PA) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 23 MIDDLE EAST POLYAMIDE (PA) IN POLYMER MARKET, BY END-USE, 2021-2030 (USD MILLION)

TABLE 24 MIDDLE EAST POLYMER MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 25 MIDDLE EAST POLYMER MARKET, BY COUNTRY, 2021-2030 (KILO TONS)

TABLE 26 SAUDI ARABIA POLYMER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 27 SAUDI ARABIA POLYMER MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

TABLE 28 SAUDI ARABIA POLYETHYLENE (PE) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 SAUDI ARABIA POLYETHYLENE (PE) IN POLYMER MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 30 SAUDI ARABIA POLYETHYLENE (PE) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 31 SAUDI ARABIA POLYPROPYLENE (PP) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 SAUDI ARABIA COPOLYMER IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 SAUDI ARABIA POLYPROPYLENE (PP) IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 34 SAUDI ARABIA POLYPROPYLENE (PP) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 35 SAUDI ARABIA POLYPROPYLENE (PP) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 36 SAUDI ARABIA ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 37 SAUDI ARABIA ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 38 SAUDI ARABIA ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY ADDITIVE, 2021-2030 (USD MILLION)

TABLE 39 SAUDI ARABIA ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPEARANCE, 2021-2030 (USD MILLION)

TABLE 40 SAUDI ARABIA ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 41 SAUDI ARABIA POLYAMIDE (PA) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 SAUDI ARABIA POLYAMIDE (PA) IN POLYMER MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 43 SAUDI ARABIA POLYAMIDE (PA) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 44 SAUDI ARABIA POLYAMIDE (PA) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 45 U.A.E. POLYMER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 46 U.A.E. POLYMER MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

TABLE 47 U.A.E. POLYETHYLENE (PE) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 U.A.E. POLYETHYLENE (PE) IN POLYMER MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 49 U.A.E. POLYETHYLENE (PE) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 50 U.A.E. POLYPROPYLENE (PP) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 U.A.E. COPOLYMER IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 U.A.E. POLYPROPYLENE (PP) IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 53 U.A.E. POLYPROPYLENE (PP) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 54 U.A.E. POLYPROPYLENE (PP) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 55 U.A.E. ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 56 U.A.E. ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 57 U.A.E. ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY ADDITIVE, 2021-2030 (USD MILLION)

TABLE 58 U.A.E. ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPEARANCE, 2021-2030 (USD MILLION)

TABLE 59 U.A.E. ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 60 U.A.E. POLYAMIDE (PA) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 U.A.E. POLYAMIDE (PA) IN POLYMER MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 62 U.A.E. POLYAMIDE (PA) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 63 U.A.E. POLYAMIDE (PA) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 64 ISRAEL POLYMER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 65 ISRAEL POLYMER MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

TABLE 66 ISRAEL POLYETHYLENE (PE) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 ISRAEL POLYETHYLENE (PE) IN POLYMER MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 68 ISRAEL POLYETHYLENE (PE) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 69 ISRAEL POLYPROPYLENE (PP) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 ISRAEL COPOLYMER IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 ISRAEL POLYPROPYLENE (PP) IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 72 ISRAEL POLYPROPYLENE (PP) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 73 ISRAEL POLYPROPYLENE (PP) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 74 ISRAEL ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 75 ISRAEL ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 76 ISRAEL ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY ADDITIVE, 2021-2030 (USD MILLION)

TABLE 77 ISRAEL ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPEARANCE, 2021-2030 (USD MILLION)

TABLE 78 ISRAEL ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 79 ISRAEL POLYAMIDE (PA) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 ISRAEL POLYAMIDE (PA) IN POLYMER MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 81 ISRAEL POLYAMIDE (PA) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 82 ISRAEL POLYAMIDE (PA) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 83 QATAR POLYMER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 84 QATAR POLYMER MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

TABLE 85 QATAR POLYETHYLENE (PE) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 QATAR POLYETHYLENE (PE) IN POLYMER MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 87 QATAR POLYETHYLENE (PE) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 88 QATAR POLYPROPYLENE (PP) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 QATAR COPOLYMER IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 QATAR POLYPROPYLENE (PP) IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 91 QATAR POLYPROPYLENE (PP) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 92 QATAR POLYPROPYLENE (PP) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 93 QATAR ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 94 QATAR ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 95 QATAR ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY ADDITIVE, 2021-2030 (USD MILLION)

TABLE 96 QATAR ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPEARANCE, 2021-2030 (USD MILLION)

TABLE 97 QATAR ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 98 QATAR POLYAMIDE (PA) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 QATAR POLYAMIDE (PA) IN POLYMER MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 100 QATAR POLYAMIDE (PA) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 101 QATAR POLYAMIDE (PA) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 102 OMAN POLYMER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 103 OMAN POLYMER MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

TABLE 104 OMAN POLYETHYLENE (PE) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 OMAN POLYETHYLENE (PE) IN POLYMER MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 106 OMAN POLYETHYLENE (PE) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 107 OMAN POLYPROPYLENE (PP) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 108 OMAN COPOLYMER IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 OMAN POLYPROPYLENE (PP) IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 110 OMAN POLYPROPYLENE (PP) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 111 OMAN POLYPROPYLENE (PP) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 112 OMAN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 113 OMAN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 114 OMAN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY ADDITIVE, 2021-2030 (USD MILLION)

TABLE 115 OMAN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPEARANCE, 2021-2030 (USD MILLION)

TABLE 116 OMAN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 117 OMAN POLYAMIDE (PA) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 118 OMAN POLYAMIDE (PA) IN POLYMER MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 119 OMAN POLYAMIDE (PA) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 120 OMAN POLYAMIDE (PA) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 121 KUWAIT POLYMER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 122 KUWAIT POLYMER MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

TABLE 123 KUWAIT POLYETHYLENE (PE) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 124 KUWAIT POLYETHYLENE (PE) IN POLYMER MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 125 KUWAIT POLYETHYLENE (PE) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 126 KUWAIT POLYPROPYLENE (PP) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 127 KUWAIT COPOLYMER IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 KUWAIT POLYPROPYLENE (PP) IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 129 KUWAIT POLYPROPYLENE (PP) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 130 KUWAIT POLYPROPYLENE (PP) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 131 KUWAIT ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 132 KUWAIT ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 133 KUWAIT ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY ADDITIVE, 2021-2030 (USD MILLION)

TABLE 134 KUWAIT ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPEARANCE, 2021-2030 (USD MILLION)

TABLE 135 KUWAIT ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 136 KUWAIT POLYAMIDE (PA) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 KUWAIT POLYAMIDE (PA) IN POLYMER MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 138 KUWAIT POLYAMIDE (PA) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 139 KUWAIT POLYAMIDE (PA) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 140 BAHRAIN POLYMER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 141 BAHRAIN POLYMER MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

TABLE 142 BAHRAIN POLYETHYLENE (PE) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 143 BAHRAIN POLYETHYLENE (PE) IN POLYMER MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 144 BAHRAIN POLYETHYLENE (PE) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 145 BAHRAIN POLYPROPYLENE (PP) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 BAHRAIN COPOLYMER IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 147 BAHRAIN POLYPROPYLENE (PP) IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 148 BAHRAIN POLYPROPYLENE (PP) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 149 BAHRAIN POLYPROPYLENE (PP) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 150 BAHRAIN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 151 BAHRAIN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY PROCESS, 2021-2030 (USD MILLION)

TABLE 152 BAHRAIN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY ADDITIVE, 2021-2030 (USD MILLION)

TABLE 153 BAHRAIN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPEARANCE, 2021-2030 (USD MILLION)

TABLE 154 BAHRAIN ACRYLONITRILE BUTADIENE STYRENE IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 155 BAHRAIN POLYAMIDE (PA) IN POLYMER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 156 BAHRAIN POLYAMIDE (PA) IN POLYMER MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 157 BAHRAIN POLYAMIDE (PA) IN POLYMER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 158 BAHRAIN POLYAMIDE (PA) IN POLYMER MARKET, BY END USE, 2021-2030 (USD MILLION)

TABLE 159 REST OF MIDDLE EAST POLYMER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 160 REST OF MIDDLE EAST POLYMER MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

图片列表

FIGURE 1 MIDDLE EAST POLYMER MARKET

FIGURE 2 MIDDLE EAST POLYMER MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST POLYMER MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST POLYMER MARKET: MIDDLE EAST MARKET ANALYSIS

FIGURE 5 MIDDLE EAST POLYMER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST POLYMER MARKET: THE RAW MATERIAL LIFE LINE CURVE

FIGURE 7 MIDDLE EAST POLYMER MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST POLYMER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST POLYMER MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST POLYMER MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 MIDDLE EAST POLYMER MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 MIDDLE EAST POLYMER MARKET: SEGMENTATION

FIGURE 13 GROWING EXPANSION IN THE AUTOMOTIVE INDUSTRY IS EXPECTED TO DRIVE THE MIDDLE EAST POLYMER MARKET IN THE FORECAST PERIOD

FIGURE 14 THE POLYETHYLENE (PE) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST POLYMER MARKET IN 2022 & 2029

FIGURE 15 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE MIDDLE EAST POLYMER MARKET

FIGURE 17 MIDDLE EAST POLYMER MARKET, BY PRODUCT, 2022

FIGURE 18 MIDDLE EAST POLYMER MARKET: SNAPSHOT (2022)

FIGURE 19 MIDDLE EAST POLYMER MARKET: BY COUNTRY (2022)

FIGURE 20 MIDDLE EAST POLYMER MARKET: BY COUNTRY (2023 & 2030)

FIGURE 21 MIDDLE EAST POLYMER MARKET: BY COUNTRY (2022 & 2030)

FIGURE 22 MIDDLE EAST POLYMER MARKET: BY PRODUCT (2023-2030)

FIGURE 23 MIDDLE EAST POLYMER MARKET: COMPANY SHARE 2022 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。