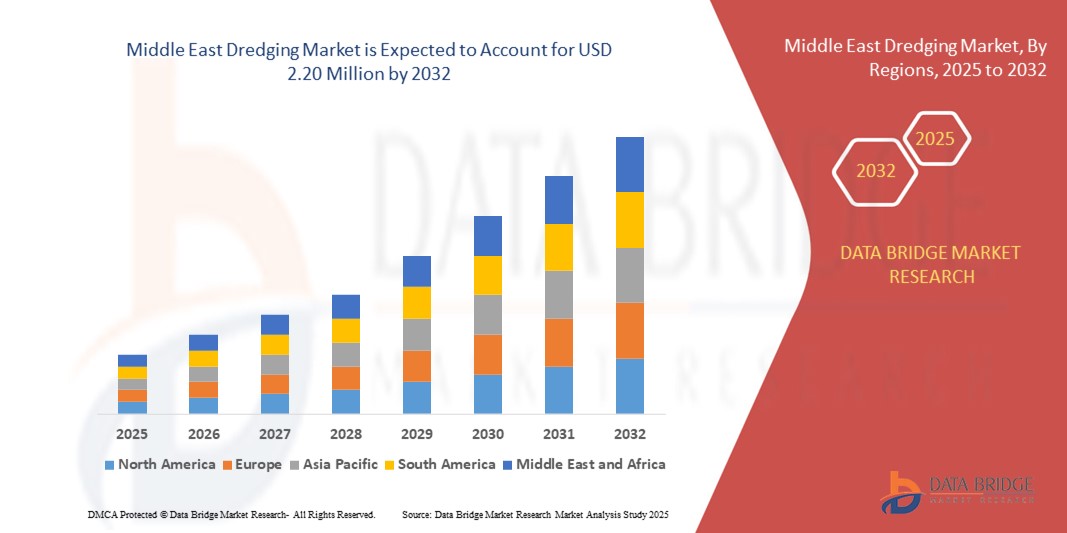

Middle East Dredging Market

市场规模(十亿美元)

CAGR :

%

USD

1.80 Million

USD

2.20 Million

2024

2032

USD

1.80 Million

USD

2.20 Million

2024

2032

| 2025 –2032 | |

| USD 1.80 Million | |

| USD 2.20 Million | |

|

|

|

|

中東疏浚市場細分,按產品(機械疏浚船、液壓疏浚船、機械/液壓疏浚船、水動力疏浚船和輔助設備)、服務類型(維護疏浚、基本疏浚和補救疏浚)、材料(砂礫石、粘土和狹縫、岩石等)、疏浚深度(淺水疏浚和深水疏浚)、浚作業區域(港口、河流、湖泊和運河等)、運輸方式(管道和駁船)、部署(海上和陸上)、應用(城市發展、貿易活動、貿易維護、海岸保護、能源基礎設施、土地復墾和休閒)、最終用戶(石油和天然氣、金屬和採礦、可再生能源、政府、食品和農業等)-產業趨勢和預測到 2032 年

中東疏浚市場規模和成長率是多少?

- 2024 年中東疏浚市場規模為180 萬美元 ,預計 到 2032 年將達到 220 萬美元,預測期內複合年增長率 為2.50%。

- 該地區採礦活動的快速成長以及對高效、經濟解決方案的需求不斷增長,是推動市場成長的主要因素。政府資金推動疏浚計畫的發展,將進一步促進市場成長。

- 此外,由於能源和石油天然氣產業的成長,基礎設施疏浚市場也呈現成長態勢,進一步推動了市場的成長。然而,政府嚴格的環境安全法規正在抑制市場的成長。

中東疏浚市場的主要亮點是什麼?

- 目前,中東疏浚市場正經歷採礦活動的顯著成長,顯示該地區的市場正在快速大幅擴張。這種強勁成長可歸因於對疏浚服務及相關活動日益增長的需求。中東地區的疏浚作業量正在顯著增加,這表明該行業正在蓬勃發展,並已超越地域界限。

- 預計到 2024 年,阿聯酋將以 41.87% 的收入份額主導中東疏浚市場,這得益於大規模港口擴建項目、人工島開發以及棕櫚島傑貝阿里和哈利法港擴建等沿海保護舉措

- 預計沙烏地阿拉伯在 2030 願景下的大型計畫(例如 NEOM、紅海計畫和吉達伊斯蘭港擴建)的支持下,從 2025 年到 2032 年的複合年增長率將達到 7.24%,為最快的國家。

- 受港口深化和土地復墾計畫大規模應用的推動,液壓疏浚船將在 2024 年佔據市場主導地位,收入佔比達 41.6%

報告範圍與中東疏浚市場細分

|

屬性 |

中東疏浚關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

中東

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深入的專家分析、定價分析、品牌份額分析、消費者調查、人口統計分析、供應鏈分析、價值鏈分析、原材料/消耗品概述、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

中東疏浚市場的主要趨勢是什麼?

可持續且技術先進的疏浚解決方案推動市場轉型

- 全球疏浚市場的關鍵趨勢是越來越多地轉向環保疏浚技術和自動化驅動的解決方案,以最大限度地減少對環境的影響,同時提高營運效率

- 製造商正在採用先進的GPS、LiDAR和物聯網監控系統,以確保精確疏浚、降低燃料消耗並遵守更嚴格的海洋環境法規

- 例如,2024年,荷蘭Van Oord公司推出了一款全電動耙吸式挖泥船,可減少20%的碳排放,為永續海洋作業樹立了標桿

- 水動力疏浚方法和沈積物回收技術正在大力支持沿海復原力計畫、土地復墾和再生能源基礎設施

- 荷蘭的 Boskalis 和比利時的 DEME 等公司正在大力投資混合動力推進系統和生物燃料,以符合全球脫碳目標

- 這一趨勢正在引導疏浚產業走向綠色海事實踐,使專案能夠平衡經濟成長與環境管理,同時滿足全球 ESG 目標

中東疏浚市場的主要驅動力是什麼?

- 全球貿易活動不斷增加和港口擴建推動了疏浚需求,以維護通航水道並容納更大的船隻

- 2024 年 1 月,Jan De Nul(比利時)部署了其下一代絞吸式挖泥船,用於印度深水港擴建,凸顯了對海上基礎設施投資的不斷增長

- 城市發展和土地復墾項目,尤其是在亞太地區和中東地區,正在推動對疏浚服務的需求,以創建新的住宅區、商業區和工業區

- 離岸風電場和石油天然氣勘探的快速增長,推動了對海床準備、管道開挖和地基加固的需求

- 政府推動海岸保護和氣候調適的措施正在增加對防洪疏浚、海灘維護和濕地修復的投資

- 這些因素共同使疏浚成為全球貿易、能源安全和氣候調適的關鍵推動因素,確保未來十年市場穩定成長

哪些因素對中東疏浚市場的成長構成挑戰?

- 疏浚市場面臨的一個主要挑戰是先進疏浚船所需的高額資本支出,以及不斷上漲的燃料和維護成本

- 例如,由於混合動力推進系統和符合 Tier III 標準的引擎成本上升,東南亞的幾家小型承包商推遲了 2023 年的船隊升級

- 環境問題以及對沉積物處理、噪音排放和海洋生物多樣性保護的嚴格規定增加了項目的複雜性和時間表

- 疏浚船零件(鋼材、液壓系統)原材料價格波動以及全球供應鏈中斷進一步加劇了營運預算壓力

- 技術人員短缺和安全合規挑戰(尤其是在深水和海上作業)阻礙了高效的專案執行

- 克服這些挑戰需要協作監管框架、對具有成本效益的綠色技術的研發投資以及能力建設,以創建一個具有彈性、面向未來的疏浚產業

中東疏浚市場如何細分?

市場根據產品類型、技術和最終用途行業進行細分。

- 透過提供

疏浚市場細分為機械疏浚機、液壓疏浚機、機械/液壓疏浚機、水動力疏浚機和輔助設備。液壓疏浚機在2024年佔據市場主導地位,營收佔41.6%,這得益於港口深化和填海造地計畫的大規模應用。機械疏浚機因其在處理粗粒物料方面的精準度,廣泛應用於狹窄水道。水動力疏浚機因其環保的沉積物管理、最大程度地減少渾濁度和環境破壞而日益受到青睞。

隨著全球監管機構推動永續疏浚實踐,水動力疏浚船預計將實現最快成長。

- 按服務類型

市場分為維護性疏浚、基本疏浚和補救性疏浚。維護性疏浚佔主導地位,2024 年收入佔 46.8%,因為港口和河流需要定期清除沉積物以維持通航能力。由於港口擴建、工業走廊和城市濱水區的開發,基本疏浚正在加速發展。補救性疏浚雖然規模較小,但對於環境修復和污染清除至關重要。

由於全球貿易成長和大型專案開發,預計 Capital Dredging 將實現最快成長。政府資金和公私合作正在增加對長期維護週期的投資。

- 按材質

市場分為砂礫石、黏土和狹縫、岩石和其他。受海灘養護和土地復墾需求的推動,砂礫石在2024年佔據主導地位,市場份額達38.5%。黏土和狹縫材料廣泛應用於河流和湖泊疏浚,以維持水流並降低洪水風險。由於海上能源計畫需要深海海底幹預,岩石疏浚正在蓬勃發展。

隨著深水採礦和能源基礎設施的擴張,岩石疏浚預計將實現最快成長。先進的切割設備正在降低岩石和混合材料環境中的作業難度。

- 按疏浚深度

市場細分為淺水疏浚和深水疏浚。淺水疏浚在2024年佔57.2%的收入,主要得益於內陸水道、港口和海岸防護計畫。深水疏浚對海上石油、天然氣和再生能源開發至關重要,通常需要先進的船舶。技術進步正在提高深海挖掘和泥沙輸送的效率。淺水作業仍然具有成本效益,並且對地方政府和私人業者來說都易於操作。

隨著全球對海底資源需求的不斷增長,深水疏浚預計將成為成長最快的領域。氣候適應措施正在增加對淺水疏浚的需求,以防止海岸侵蝕。

- 按營運區域

市場涵蓋海洋、港口、河流、湖泊、運河及其他。受離岸風電場和海底管線建設的推動,海洋領域在2024年佔據主導地位,市佔率達34.9%。港口疏浚使大型船舶能夠安全停靠,從而支援全球航運。河流和運河在內陸貿易和防洪中發揮著至關重要的作用,推動了穩定的需求。湖泊疏浚有助於水質恢復和休閒娛樂發展。

隨著全球貿易樞紐的現代化,港口業務預計將快速成長。專用船舶的設計越來越適應多種環境。

- 按交通方式

市場分為管道和駁船兩大類。管道在2024年佔據61.4%的市場份額,在大型專案中尤其適用於長距離泥沙輸送。駁船對於不宜使用管道的岩石地形和深海應用至關重要。管道和駁船相結合的混合系統因其操作靈活性而變得越來越普遍。泥沙泵送技術的創新正在提高管道效率並降低燃料成本。

管道運輸預計將因其成本優勢和可擴展性而保持主導地位。駁船系統對於基礎設施有限的偏遠地區和島嶼開發項目仍然至關重要。

- 按部署

市場細分為海上疏浚和陸上疏浚。受石油天然氣、離岸風電和海底採礦活動的推動,海上疏浚佔2024年收入的55.8%。陸上疏浚廣泛應用於城市發展、防洪和農業灌溉系統。海上作業需要先進的大容量疏浚船,這增加了資本密集度。陸上項目正在採用模組化設備以降低成本並提高機動性。政府對再生能源的措施正在增強海上疏浚的需求。

隨著智慧城市和海岸保護計畫的實施,陸上疏浚預計將穩定成長。

- 按應用

市場細分為城市發展、貿易活動、貿易維護、海岸防護、能源基礎設施、土地復墾和休閒。貿易維護佔主導地位,2024 年的份額為 29.7%,確保全球航線的通航。城市發展計畫正在利用疏浚來打造濱水區和房地產區。由於海平面上升和風暴潮,海岸防護正在蓬勃發展。能源基礎設施,尤其是離岸風電場,正在推動專業疏浚服務的發展。

為因應人口成長,亞太地區的填海造陸計畫正迅速擴張。包括碼頭和旅遊區在內的休閒應用正在推動利基市場的成長。

- 按最終用戶

市場細分為石油天然氣、金屬礦業、再生能源、政府、食品農業等領域。政府項目佔據主導地位,2024 年將佔據 36.4% 的份額,並由公共資金用於港口和洪水管理。石油天然氣作業需要深水疏浚來安裝海底設施。再生能源,尤其是離岸風電,正在成為高成長的推動因素。金屬礦業利用疏浚進行水下礦物開採和尾礦管理。食品農業依靠疏浚來灌溉渠道並擴大水產養殖規模。

隨著全球清潔能源轉型加速,再生能源預計將成長最快。

哪個國家佔據中東疏浚市場的最大份額?

- 預計到 2024 年,阿聯酋將以 41.87% 的收入份額主導中東疏浚市場,這得益於大規模港口擴建項目、人工島開發以及棕櫚島傑貝阿里和哈利法港擴建等沿海保護舉措

- 該國作為全球貿易和物流中心的戰略地位加快了對疏浚資本和維護的投資,以支持更大的船舶運輸並深化港口航道

- 此外,阿聯酋注重永續疏浚實踐和採用先進設備,吸引了國際領先的疏浚承包商,並提升了區域技術能力

哪個地區是疏浚市場成長最快的地區?

預計沙烏地阿拉伯在2025年至2032年期間的複合年增長率將達到7.24%,為全球最高,這得益於「2030願景」下的大型項目,例如NEOM、紅海項目和吉達伊斯蘭港擴建。為發展旅遊和工業區而進行的填海造地需求日益增長,加上為應對海平面上升而進行的海岸保護,這些因素正在推動疏浚活動的發展。此外,國內企業與全球疏浚企業之間的戰略合作夥伴關係正在加速技術轉讓,並提升沙烏地阿拉伯的疏浚能力,以滿足未來的基礎設施需求。

中東疏浚市場頂級公司有哪些?

疏浚產業主要由知名公司主導,其中包括:

- 博斯卡利斯(荷蘭)

- 潮水公司(美國)

- DEME(比利時)

- Jan De Nul(比利時)

- Van Oord nv(荷蘭)

- Holland Dredging Industries BV(荷蘭)

- ARCHIRODON SA(希臘)

- 國家海洋疏浚公司(阿聯酋)

- 聯合疏浚與海洋承包有限責任公司(阿聯酋)

- 海灣科布拉有限責任公司(阿聯酋)

- 賽萊默(美國)

- 拉格斯密特(荷蘭)

- 納賽爾控股有限公司(阿聯酋)

中東疏浚市場的最新發展如何?

- 2023年12月,DEME與沙烏地阿拉伯Archirodon公司合作,獲得了位於沙烏地阿拉伯西北部的NEOM港口改造計畫的第二期工程。這項策略性開發對NEOM的經濟目標至關重要,涉及建造一個可容納全球最大船舶的可持續港口港池,體現了DEME的技術實力和工程專業知識。

- 2023年12月,ARCHIRODON SA與DEME合作,獲得了NEOM港口二期改造的合同,該改造將為該港口在全球貿易中奠定戰略地位。該計畫於2023年12月啟動,旨在打造一個方便全球最大船舶進港的港池,協助NEOM實現其經濟雄心和區域影響力。

- 2023年10月,國家海洋疏浚公司(NMDC)公佈了其新品牌,強調了加強現有合作夥伴關係並建立跨部門合作以實現可持續業務增長的計劃。 NMDC集團執行長Yasser Zaghloul先生強調了透過創新和策略聯盟致力於實現永續能源未來的承諾。這家總部位於阿布達比的疏浚產業領導者旨在探索與政府和私營部門的合作,為全產業的脫碳目標做出貢獻。 NMDC將繼續致力於促進成長,同時與阿布達比的文化復興和阿聯酋的永續發展倡議保持一致。

- 2023年10月,博斯卡利斯公司與皇家IHC公司簽訂了建造一艘先進耙吸式挖泥船的合同,該船將成為博斯卡利斯船隊中最大的挖泥船之一。該船擁有31,000立方公尺的料斗容量,並將採用節能創新技術,包括全柴電系統、Azipods吊艙推進系統以及使用(綠色)甲醇作為替代燃料的能力。該船預計將於2026年中期投入使用,彰顯了博斯卡利斯公司致力於打造更永續的疏浚船隊的承諾。

- 2023年3月,Holland Dredging Industries BV成功交付並安裝了一款創新絞吸式挖泥船。這款新型絞吸式挖泥船配備可更換的噴嘴、板片和齒,並在其護目鏡上安裝了不銹鋼板,以保護橡膠。 HDD報告稱,透過這項改進,裝載時間顯著縮短了30%,彰顯了公司對效率的承諾。 HDD也強調,其能夠提供將現有船舶改造成絞吸式挖泥船所需的所有組件,並與荷蘭造船廠合作完成這項改造。護目鏡上增加的不銹鋼板增強了對橡膠的保護。事實證明,這款創新絞吸式挖泥船可將裝載時間縮短30%,彰顯了HDD對疏浚作業效率的承諾。 HDD還提供用於絞吸式挖泥船(TSHD)的全套組件,透過與荷蘭造船廠合作,將現有船舶改造成高效的絞吸式挖泥船。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。