Middle East And Africa Next Generation Packaging Market

市场规模(十亿美元)

CAGR :

%

USD

271.70 Million

USD

413.76 Million

2021

2029

USD

271.70 Million

USD

413.76 Million

2021

2029

| 2022 –2029 | |

| USD 271.70 Million | |

| USD 413.76 Million | |

|

|

|

Middle East and Africa Next Generation Packaging Market, By Type (Active Packaging, Intelligent Packaging, and Modified Atmosphere Packaging), Function (Moisture Control, Temperature Indicators, Shelf Life Sensing, Product Tracking, and Others), Technology (Scavengers and Susceptors, RFID Tags, QR Codes, NFC Tags, Coding & Markings, Sensors & Output Devices, and Others), Material (Plastic, Paper, Glass, Corrugated Board, Metal, and Others), and Application (Food, Beverages, Personal Care, Healthcare, Logistics And Supply Chain, Consumer Electronics, and Others), Country (South Africa, Saudi Arabia, UAE, Egypt, Israel, and Rest of Middle East and Africa) Industry Trends and Forecast To 2029.

Market Analysis and Insights: Middle East and Africa Next Generation Packaging Market

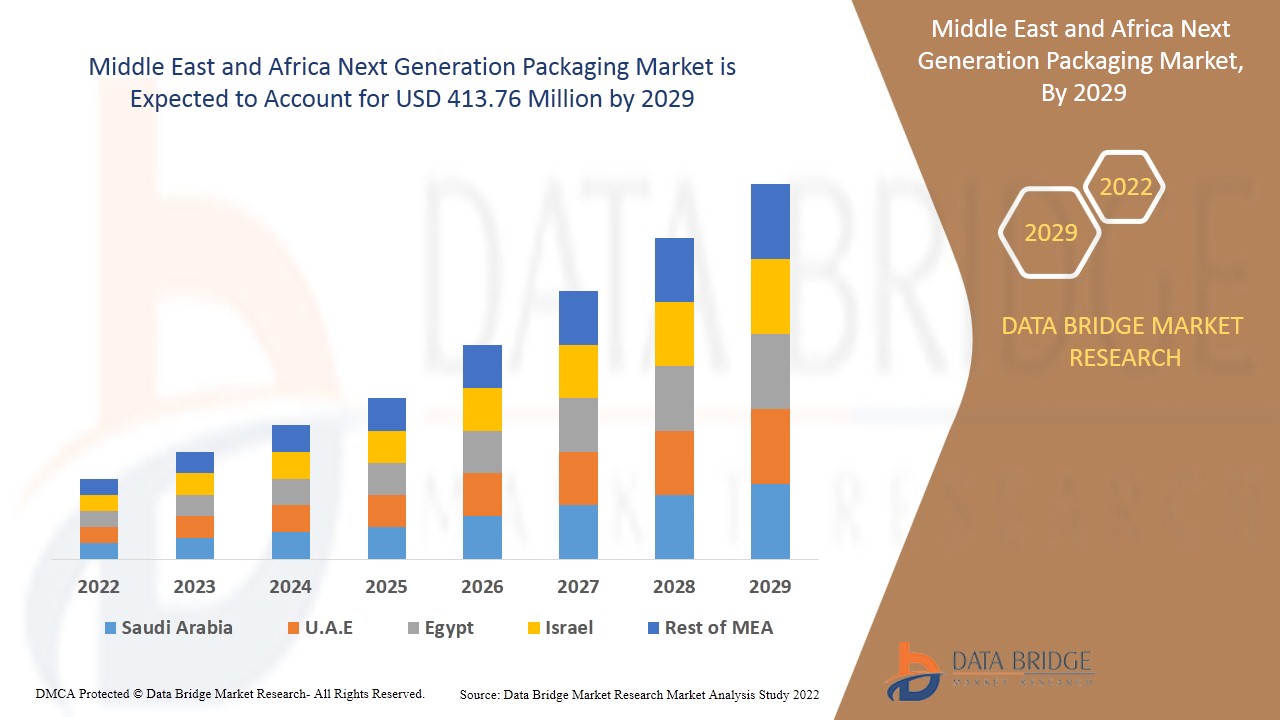

The Middle East & Africa next generation packaging market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyzes that the market is growing with a CAGR of 5.4% in the forecast period of 2022 to 2029 and is expected to reach USD 413.76 million by 2029 from USD 271.70 million in 2021.

Next generation packaging includes active, intelligent and modified atmosphere packaging. It is basically a packaging technology, which possesses different advanced features, such as traceability, offers various benefits such as product shelf life extension and provides product quality information. The term active packaging, intelligent packaging, smart packaging refer to packaging systems used for foods, pharmaceuticals, and several other types of products. They help extend shelf life, monitor freshness, display information on quality, improve safety, and improve convenience. These terms are closely related. For instance- active packaging usually means having active functions beyond the inert passive containment and protection of the product, Intelligent and active packaging usually involves the ability to sense or measure an attribute of the product, the inner atmosphere of the package, or the shipping environment. This information can be communicated to users or can trigger active packaging functions, programmable matter, and smart materials among others.

The recent trend indicates increasing demand for next generation packaging as investments in public and private healthcare industries increase. The factors driving the growth of the market are raising health awareness among the general population, and continuous technological advancements in packaging. With the rapid growth of globalization and increase in mandates for food and beverages by various countries and regions, the global next generation packaging market will witness an increased trajectory in the coming years. However, the high cost of packaging will restrict the market growth.

Various companies are making strategic decisions, such as forming agreements with research facilities to launch new products, to improve their market share. As a result, the next generation packaging market is growing at a rapid rate.

To understand the analysis and the next generation packaging market scenario, contact Data Bridge Market Research for an Analyst Brief. Our team will help you create a revenue impact solution to achieve your desired goal.

Middle East & Africa Next Generation Packaging Market Scope and Market Size

Middle East & Africa next generation packaging market is segmented into five segments based on packaging type, function, technology, material, and application. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

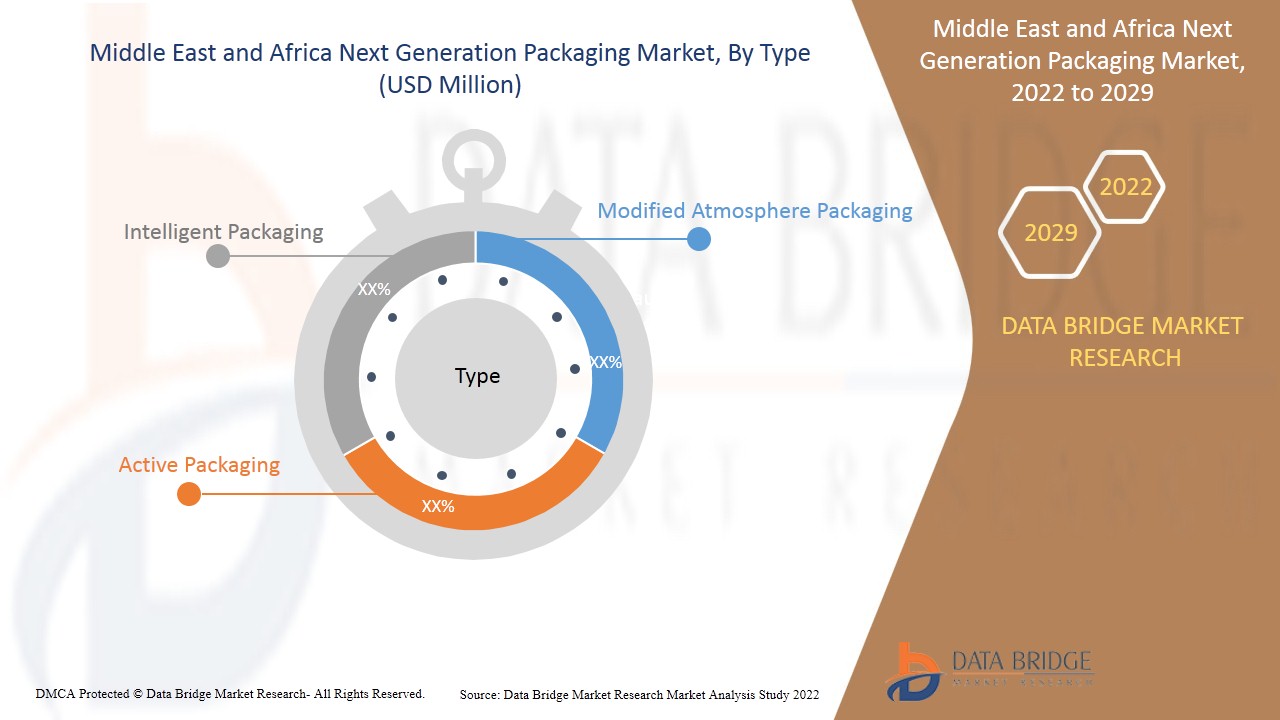

- On the basis of type, the Middle East & Africa next generation packaging market is segmented into active packaging, intelligent packaging and modified atmosphere packaging. In 2022, active packaging segment is expected to dominate the market due to the high production quantity and ease in use of active packaging.

- On the basis of function, the Middle East & Africa next generation packaging market is segmented into moisture control, temperature indicators, shelf life sensing, product tracking, and others. In 2022, the moisture control segment is expected to dominate the market as it is the most demanded packaging function to extend the shelf life of the product.

- On the basis of technology, the Middle East & Africa next generation packaging market is segmented into scavengers and susceptors, RFID tags, QR codes, NFC tags, coding & markings, sensors & output devices, and others. In 2022, the Scavengers and Susceptors segment is expected to dominate the market as it gives easy access of the product to consumers.

- On the basis of material, the Middle East & Africa next generation packaging market is segmented into plastic, paper, glass, corrugated board, metal, and others. In 2022, plastic segment is expected to dominate the market as consumers are interesting in such type of packaging due to affordability.

- On the basis of application, the Middle East & Africa next generation packaging market is segmented into food, beverages, personal care, healthcare, logistics and supply chain, consumer electronics, and others. In 2022, the food segment is expected to dominate the market as the demand for packaged food is increasing all over the world owing to the busy lifestyle.

Middle East & Africa next generation packaging market is fragmented and the major players have used various strategies, such as new product launches, expansions, agreements, joint ventures, partnerships, acquisitions, and others, to increase their footprints in the Middle East & Africa next generation packaging market.

Middle East and Africa by country is segmented into South Africa, Saudi Arabia, UAE, Egypt, Israel, and Rest of Middle East and Africa. In 2022, South Africa is expected to dominate the Middle East and Africa next generation packaging market, due to growing application of this market in the food and beverage industry.

Growing Strategic Activities by Major Market Players to Enhance the Awareness for Next Generation Packaging is Boosting the Market Growth

The next generation packaging market also provides you with a detailed market analysis for every country's growth in a particular market. Additionally, it provides detailed information regarding the market players’ strategies and their geographical presence. The data is available for the historical period 2010 to 2019.

Competitive Landscape and Middle East & Africa Next Generation Packaging Market Share Analysis

Middle East & Africa next generation packaging market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product approvals, patents, product width, and breadth, application dominance, and technology lifeline curve. The above data points provided are only related to the companies’ focus related to the Middle East & Africa next generation packaging market.

Some of the major players operating in the Middle East & Africa next generation packaging market are Amcor plc, Sealed Air, BALL CORPORATION, DuPont de Nemours, Inc., R.R. Donnelley & Sons Company, and MITSUBISHI GAS CHEMICAL among others. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many developments are also initiated by the companies worldwide, which are accelerating the Middle East & Africa next generation packaging market growth.

For instance,

- In April 2021, DuPont announced that it successfully completed the acquisition of Laird Performance Materials, a world leader in high-performance electromagnetic shielding and thermal management solutions.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 SOURCE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET: APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 INDUSTRIAL INSIGHTS: MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET

5.1 DEVELOPMENT OF ADVANCED SMART PACKAGING PRODUCT

5.2 TEMPERATURE BALANCING SMART PACKAGING:

5.3 SMART PACKAGING TO IMPROVE CONSUMER SAFETY:

5.4 CONCLUSION:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR INTELLIGENT PACKAGING TO AVOID FOOD WASTAGE

6.1.2 INCREASING DISPOSABLE INCOME OF CONSUMERS

6.1.3 INCREASING CASES OF FOOD CONTAMINATION

6.1.4 INCREASE IN THE CONSUMPTION OF PACKAGED PRODUCTS

6.1.5 INCREASING HEALTH AWARENESS AMONG CONSUMERS

6.2 RESTRAINTS

6.2.1 COSTS ASSOCIATED WITH RESEARCH AND DEVELOPMENT ACTIVITIES

6.2.2 HIGH COMPETITION AMONG MARKET PLAYERS

6.3 OPPORTUNITIES

6.3.1 RECENT INNOVATIONS AND NEW PRODUCT LAUNCHES

6.3.2 GROWING ALCOHOLIC AND NON-ALCOHOLIC INDUSTRY WITH ACTIVE AND INTELLIGENT PACKAGING

6.4 CHALLENGES

6.4.1 AVAILABILITY OF ALTERNATIVES IN THE MARKET

6.4.2 SUPPLY CHAIN DISRUPTION DUE TO COVID-19

7 IMPACT OF COVID-19 ON THE MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET

7.1 AWARENESS ABOUT FOOD SAFETY AND QUALITY INCREASED DUE TO THE COVID-19 PANDEMIC

7.2 COVID-19 IMPACT ON DEMAND & SUPPLY CHAIN OF NEXT GENERATION PACKAGING

7.3 IMPACT ON PRICE

7.4 INITIATIVES TAKEN BY MANUFACTURERS

7.5 CONCLUSION

8 MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET, BY TYPE

8.1 OVERVIEW

8.2 ACTIVE PACKAGING

8.2.1 GAS SCAVENGERS/EMITTERS

8.2.2 MICROWAVE SUSCEPTORS

8.2.3 OTHERS

8.3 INTELLIGENT PACKAGING

8.4 MODIFIED ATMOSPHERE PACKAGING

9 MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET, BY FUNCTION

9.1 OVERVIEW

9.2 MOISTURE CONTROL

9.3 TEMPERATURE INDICATORS

9.4 PRODUCT TRACKING

9.5 SHELF LIFE SENSING

9.6 OTHERS

10 MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 SCAVENGERS AND SUSCEPTORS

10.3 RFID TAGS

10.4 NFC TAGS

10.5 QR CODES

10.6 SENSORS & OUTPUT DEVICES

10.7 CODING & MARKINGS

10.8 OTHERS

11 MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET, BY MATERIAL

11.1 OVERVIEW

11.2 PLASTIC

11.3 PAPER

11.4 CORRUGATED BOARD

11.5 OTHERS

12 MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD

12.2.1 PACKAGED FOOD

12.2.2 PROCESSED FOOD

12.2.2.1 CHILLED

12.2.2.2 DRIED

12.2.3 MEAT & POULTRY

12.2.4 DAIRY

12.2.5 BAKERY & CONFECTIONERY

12.2.6 FRUITS & VEGETABLES

12.2.7 FROZEN FOOD

12.2.8 OTHERS

12.3 BEVERAGES

12.3.1 NON- ALCOHOLIC

12.3.2 ALCOHOLIC

12.4 PERSONAL CARE

12.5 HEALTH CARE

12.6 LOGISTICS & SUPPLY CHAIN

12.7 CONSUMER ELECTRONICS

12.8 OTHERS

13 MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 SOUTH AFRICA

13.1.2 SAUDI ARABIA

13.1.3 U.A.E.

13.1.4 EGYPT

13.1.5 ISRAEL

13.1.6 REST OF MIDDLE EAST & AFRICA

14 COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 AVERY DENNISON CORPORATION

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 DUPONT

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 BALL CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 GRAHAM PACKAGING COMPANY

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 R.R. DONNELLEY & SONS COMPANY

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ACTIVE PACKAGING

16.6.1 COMPANY SANPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 AMCOR PLC

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 AMERPLAST

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 AMERICAN THERMAL INSTRUMENTS

16.9.1 COMPANY SANPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 CORTEC PACKAGING

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 KLÖCKNER PENTAPLAST

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 MICROBEGUARD CORPORATION

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 MITSUBISHI GAS CHEMICAL COMPANY, INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 SAES GETTERS S.P.A.

16.14.1 COMPANY SANPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 SEALED AIR

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 TEMPTIME CORPORATION.

16.16.1 COMPANY SANPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 TOPPAN INC.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 VESTA

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

表格列表

TABLE 1 MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA INTELLIGENT PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA MODIFIED ATMOSPHERE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA MOISTURE CONTROL IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA TEMPERATURE INDICATORS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA PRODUCT TRACKING IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA SHELF LIFE SENSING IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA OTHERS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA SCAVENGERS AND SUSCEPTORS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA RFID TAGS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA NFC TAGS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA QR CODES IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA SENSORS & OUTPUT DEVICES IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA CODING & MARKINGS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA OTHERS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA PLASTIC IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA PAPER IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA CORRUGATED BOARD IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA OTHERS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA FOOD IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICTION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA PERSONAL CARE IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA HEALTHCARE IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA LOGISTICS & SUPPLY CHAIN IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA OTHERS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 SOUTH AFRICA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 SOUTH AFRICA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 SOUTH AFRICA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 49 SOUTH AFRICA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 50 SOUTH AFRICA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 51 SOUTH AFRICA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 SOUTH AFRICA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 SOUTH AFRICA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 SOUTH AFRICA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 SAUDI ARABIA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 SAUDI ARABIA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 SAUDI ARABIA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 58 SAUDI ARABIA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 59 SAUDI ARABIA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 60 SAUDI ARABIA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 SAUDI ARABIA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 SAUDI ARABIA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 SAUDI ARABIA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 U.A.E. NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 U.A.E. ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.A.E. NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 67 U.A.E. NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 68 U.A.E. NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 69 U.A.E. NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 U.A.E. FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 U.A.E. PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 72 U.A.E. BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 EGYPT NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 EGYPT ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 EGYPT NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 76 EGYPT NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 77 EGYPT NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 78 EGYPT NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 EGYPT FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 EGYPT PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 EGYPT BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 ISRAEL NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 ISRAEL ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 ISRAEL NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 85 ISRAEL NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 86 ISRAEL NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 87 ISRAEL NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 ISRAEL FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 ISRAEL PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 ISRAEL BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 91 REST OF MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET: SEGMENTATION

FIGURE 10 ASIA-PACIFIC IS EXPECTED TO DOMINATE MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET AND IS EXPECTED TO GROW WITH HIGHEST CAGR IN FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 AN INCREASE IN CONSUMPTION OF BEVERAGES AND HEALTH AWARENESS AMONG CONSUMERS IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PACKAGING TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR LARGEST SHARE OF MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRINTS, OPPORTUNITIES AND CHALLENGES OF MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET

FIGURE 14 MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2021

FIGURE 15 MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2021

FIGURE 16 MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2021

FIGURE 17 MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2021

FIGURE 18 MIDDLE EAST & AFRICA NEXT GENERATION MARKET, BY APPLICATION, 2021

FIGURE 19 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 20 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 21 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 23 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET: BY TYPE (2022 & 2029)

FIGURE 24 MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。