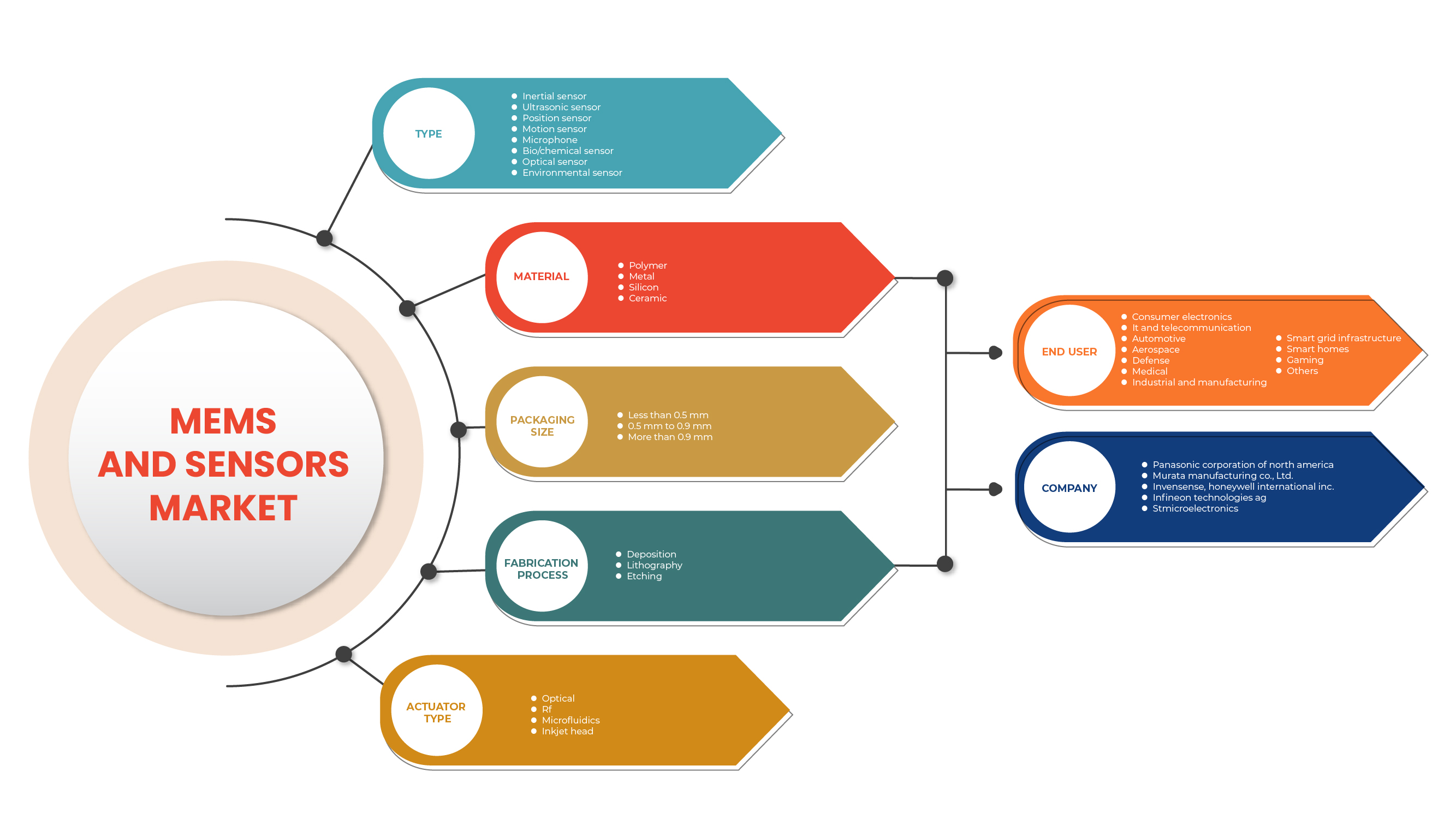

中东和非洲 MEMS 和传感器市场,按类型(惯性传感器、超声波传感器、位置传感器、运动传感器、麦克风、生物/化学传感器、光学传感器和环境传感器)、材料(聚合物、金属、硅和陶瓷)、封装尺寸(小于 0.5 毫米、0.5 毫米至 0.9 毫米、大于 0.9 毫米)、制造工艺(沉积、光刻和蚀刻)、执行器类型(光学、射频、微流体和喷墨头)、最终用户(消费电子、IT 和电信、汽车、航空航天、国防、医疗、工业和制造、智能电网基础设施、智能家居、游戏等)、行业趋势和预测到 2029 年。

市场分析和见解

传感器是用于检测附近是否存在任何物理对象并将有关该对象的信息发送到接收端的设备或机器。该设备主要与其他电子设备一起使用。任何物理量,如压力、力、应变、光等,都可以被识别并转换为所需的电信号。这些传感器分为模拟传感器和数字传感器。其他包括温度、超声波、压力和接近传感器。它们消耗的能量更少,性能更高。物联网使用传感器从环境中收集数据。

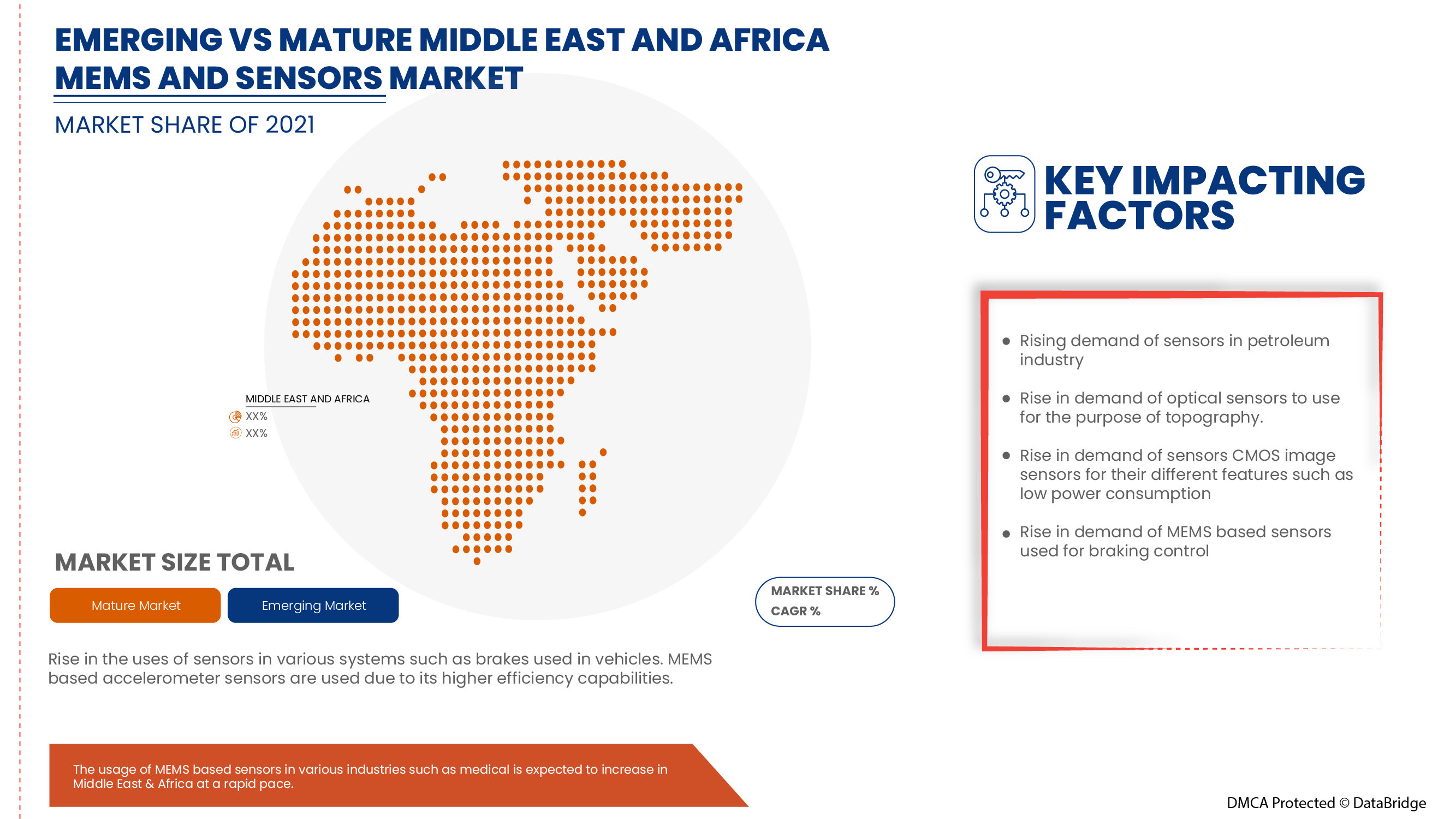

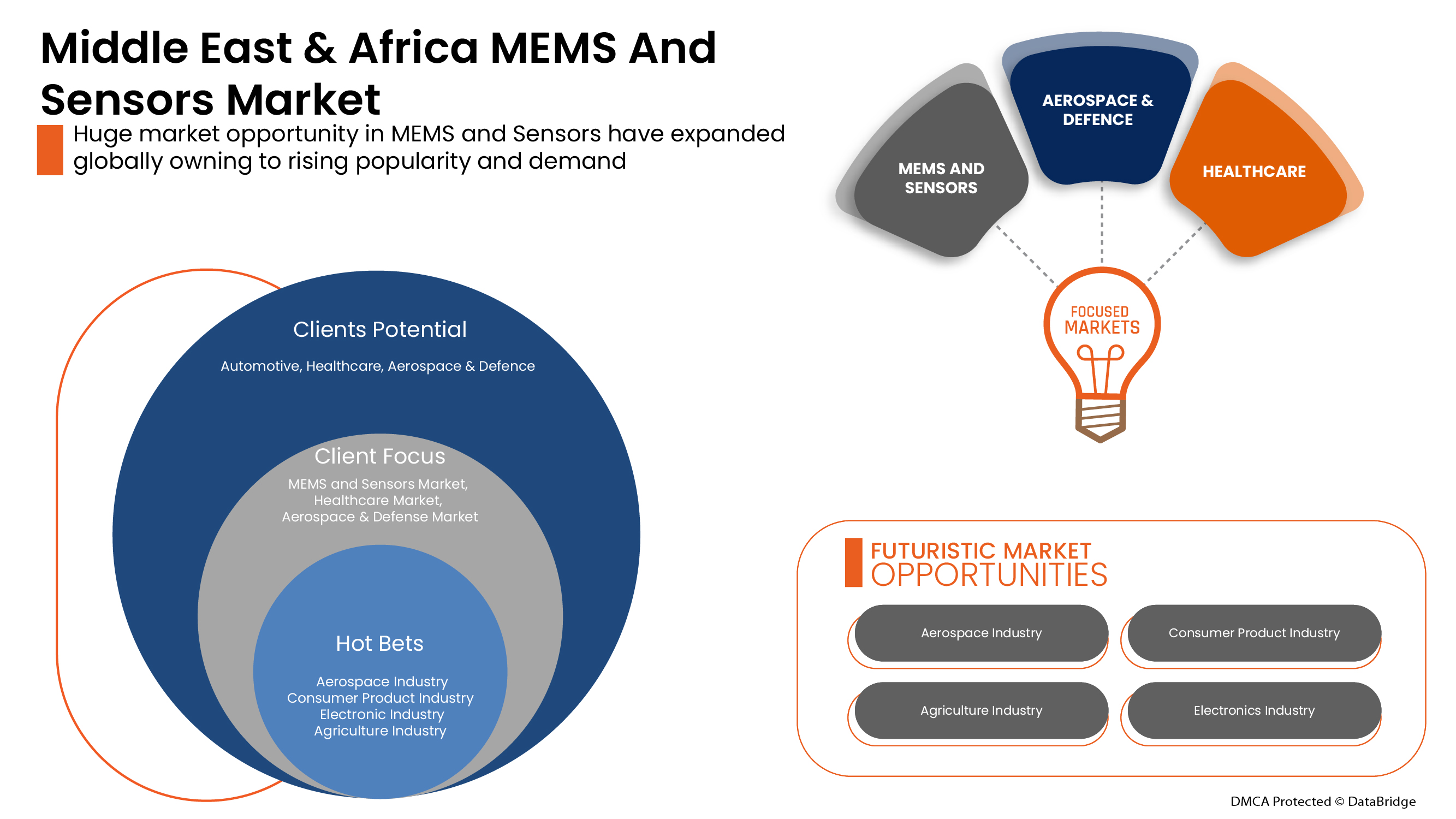

半导体行业的技术发展增加了基于应用和 MEMS 技术的传感器的制造,这些传感器用于各种因素,例如智能电网基础设施、智能家电等。随着人们越来越倾向于使用数字平台、互联网服务和在线服务来满足日常需求,这已成为可能。基于物联网的半导体设备日益普及,增加了对智能消费电子产品和可穿戴设备的需求。预计中东和非洲的 MEMS 和传感器市场未来将蓬勃发展。

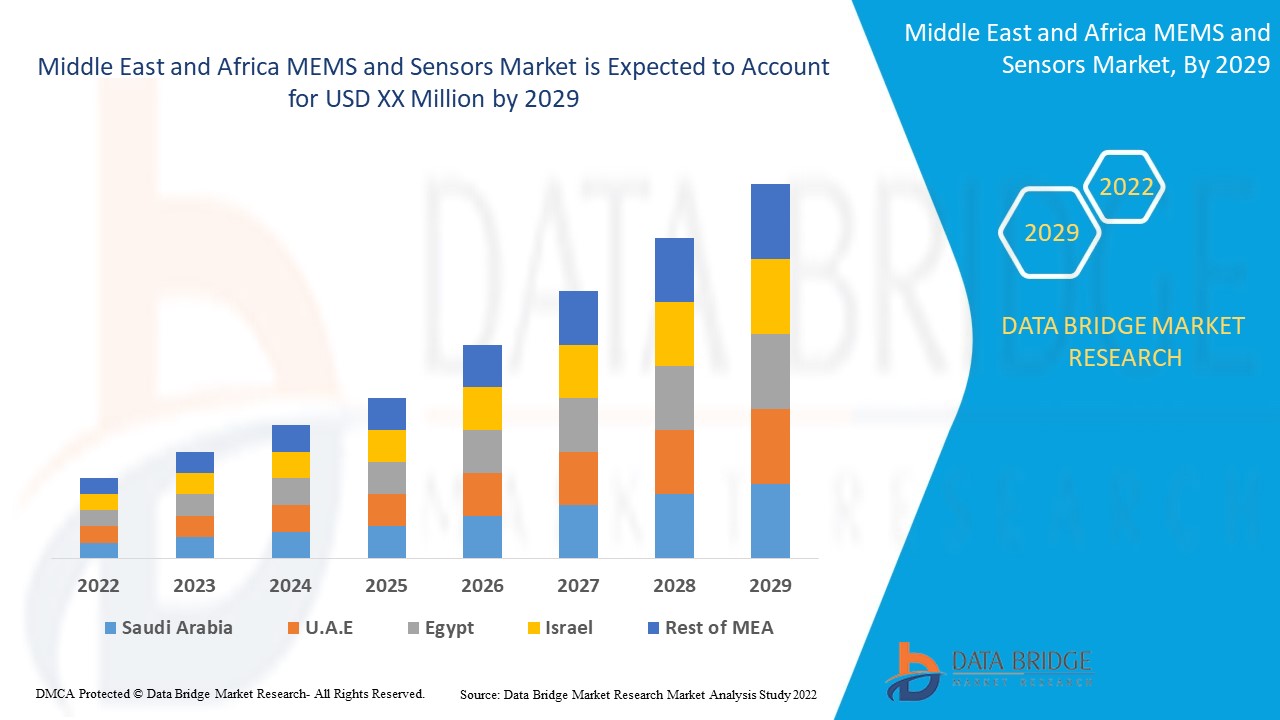

目前,MEMS 设备的重要性急剧增长,中东和非洲的惯性传感器、超声波传感器和基于封装尺寸的服务也在增长。此外,各个行业对 MEMS 和传感器的需求不断增长,推动了市场繁荣。Data Bridge Market Research 分析称,在 2022 年至 2029 年的预测期内,中东和非洲 MEMS 和传感器市场的复合年增长率将达到 7.6%。

市场定义

MEMS 是使用微制造技术制造的机械和机电设备及结构的集成系统。MEMS 设备由三维特性组成,可感知和操纵任何物理或化学特性。使用微传感器、微执行器和其他微结构的基本组件在单个硅基板上制造。MEMS 设备的基本组件包括微传感器和微执行器,它们将一种形式的能量转换为另一种形式。MEMS 设备可以具有静态或可移动组件,其物理尺寸从一微米以下到几毫米不等。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2014) |

|

定量单位 |

收入(千美元),定价(美元) |

|

涵盖的领域 |

按类型(惯性传感器、超声波传感器、位置传感器、运动传感器、麦克风、生物/化学传感器、光学传感器和环境传感器)、材料(聚合物、金属、硅和陶瓷)、封装尺寸(小于 0.5 毫米、0.5 毫米至 0.9 毫米、大于 0.9 毫米)、制造工艺(沉积、光刻和蚀刻)、执行器类型(光学、射频、微流体和喷墨头)、最终用户(消费电子、IT 和电信、汽车、航空航天、国防、医疗、工业和制造、智能电网基础设施、智能家居、游戏等) |

|

覆盖国家 |

南非、沙特阿拉伯、阿联酋、埃及、以色列、中东和非洲其他地区 |

|

涵盖的市场参与者 |

松下北美公司、村田制作所、InvenSense、霍尼韦尔国际公司、英飞凌科技股份公司、意法半导体、德州仪器公司、恩智浦半导体、ADI 公司、罗姆株式会社、Teledyne Technologies Incorporated、罗伯特·博世有限公司、森萨塔科技公司、电装株式会社、日立有限公司、高通技术公司、Allegro MicroSystems 公司、MegaChips 公司、Vishay Intertechnology 公司 |

中东和非洲 MEMS 和传感器市场动态

驱动程序

- 汽车安全传感器需求不断增长

世界已逐渐将对传统汽车的偏好转向电动汽车。在汽车中,传感器和基于 MEMS 的设备是汽车电子控制系统的重要组成部分。现代汽车,如混合动力电动汽车和插电式混合动力汽车 (PHEV),根据与车载计算机系统连接的各种传感器提供的数据做出数千个决策。传感器用于汽车的安全目的,因为它们可以在极端温度、振动和暴露于环境污染物等恶劣条件下运行。

- 消费电子产品对传感器的需求不断增长

2020 年,COVID-19 疫情对消费电子市场产生了积极影响。增长的推动力是家庭外娱乐机会的缺乏以及在家办公的员工数量不断增加。消费电子产品涉及从娱乐到休闲再到通信等许多设备。

消费者正在迅速接受可穿戴设备、语音激活智能扬声器、视频游戏机和汽车电子产品等新兴产品。传感器广泛应用于消费电子产品的监控、测量、数据记录和控制。消费电子产品中的各种应用(例如电视遥控系统)都使用红外传感器来更改与设备相关的设置。

- 微机电系统 (MEMS) 陀螺仪的使用日益增多

MEMS 陀螺仪已用于许多不同的应用,包括消费电子、汽车、工业和军事。MEMS 陀螺仪已在便携式设备中实现令人兴奋的应用,包括相机的光学图像稳定、航位推算和 GPS 辅助。MEMS 技术的出现控制了各种应用的微型、低成本、低功耗传感器的开发。

近年来,半导体、无源器件和互连器件不断改进,以实现高精度数据采集和处理。由于对可耐受 175 度以上温度的传感器的需求,MEMS 传感器被广泛接受。MEMS 陀螺仪因其耐高温、尺寸较小和维护成本低而被广泛使用。

- MEMS 传感器在国防和军事领域的应用日益广泛

国防和军事应用的传感器需要经过验证的可靠技术。传感器是技术的重要组成部分,因为它们为国防生态系统提供解决方案,包括监控和执行。

各种系统(包括无人机、航天器、导弹、军用车辆、船舶、海洋系统、卫星和火箭)都需要传感器,因为这些系统用于从太空收集数据。军事应用中使用不同类型的传感器,例如主动、智能、智能、摄像头、红外和纳米传感器。主动传感器在高性能军事控制和测量应用中提供传感解决方案。

机会

- 智能电网基础设施需求不断增长

智能电网基础设施需要传感器来监测电力线温度和天气状况。监测整个电网基础设施电气参数的传感器在保护智能电网和提高电网能源效率方面发挥着重要作用。智能电网包括用于感测电气故障的保护装置,从传统的模拟机电继电器到现代智能电子设备。保护系统在维护智能电网的电能质量和可靠性方面发挥着重要作用。

智能电网基础设施的特点是可再生能源渗透率高。它主要关注持续时间指标,例如系统平均中断持续时间指数(SAIDI)或频率指标,例如系统平均中断频率指数(SAIFI)。

- 环境传感器的发展

全球范围内正在采用用于环境状况监测的多功能环境传感器。气体、温度和烟雾传感器等环境传感器的不断发展具有基于人工智能的接口,从而促进了环境状况的保护。在工业规模上,该技术具有许多好处,例如可以持续监测化学物质的排放,并有助于减少化学物质的排放以保护环境资源。

大量基于环境的传感器(例如生物传感器)被引入市场,用于监测有害环境物质。各公司都在积极制造和开发基于环境的传感器

- MEMS 传感器研发投资增加

自 1971 年首次开发以来,MEMS 传感器已经取得了长足的进步。它是一种基于芯片的技术,传感器由一对电容板之间的悬浮质量组成。它们的尺寸大幅减小,而效率却成倍增加。然而,随着对超薄和柔性显示器的需求不断增加,它们还有很长的路要走。鉴于此,各大公司正在投入巨资研究 MEMS 传感器的未来潜力,并对其进行开发,以将其变为现实。

MEMS 传感器在极端温度下使用和操作。它们主要由于其抗冲击和振动特性而被使用。因此,为了克服精度因素等诸多限制并提高测量精度,人们正在开展大量研发工作以进一步增强这项技术,从而降低传感器的成本。

Covid-19 对中东和非洲 MEMS 和传感器市场的影响

2020 年,COVID-19 疫情对消费电子市场产生了积极影响。增长的推动力是家庭外娱乐机会的缺乏以及在家办公的员工数量不断增加。消费电子产品涉及从娱乐到休闲再到通信等许多设备。

消费者正在迅速接受可穿戴设备、语音激活智能扬声器、视频游戏机和汽车电子产品等新兴产品。传感器广泛应用于消费电子产品的监控、测量、数据记录和控制。消费电子产品中的各种应用(例如电视遥控系统)都使用红外传感器来更改与设备相关的设置。

消费电子产品和家用电器中的传感器包括压力、接近度、运动、温度、流量和液位、声学、触摸和图像传感器。此外,传感器也经历了巨大的变化,尺寸减小,效率提高了数倍。联网家庭已成为现实,只需一个手势就能控制整个房屋。

近期发展

- 2022 年 5 月,Analog Devices Inc. 与 Synopsys 合作加速电源系统设计。此次合作为 DC/DC IC 和 µModule 稳压器提供了模型选项。此次合作将有助于开发电子系统创新并满足客户的设计目标。此次合作将帮助两家公司扩大客户群

- 2022 年 5 月,霍尼韦尔国际公司宣布扩大其室内通信产品组合。此次扩张将有助于该公司开发安全频谱,并能够提供可扩展的解决方案。这将有助于该公司瞄准新客户。

中东和非洲 MEMS 和传感器市场范围

中东和非洲 MEMS 和传感器市场根据类型、材料、封装尺寸、制造工艺、执行器类型和最终用户进行细分。这些细分市场之间的增长情况将帮助您分析行业中增长缓慢的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

按类型

- 惯性传感器

- 超声波传感器

- 位置传感器

- 运动传感器

- 麦克风

- 生物/化学传感器

- 光学传感器

- 环境传感器

根据类型,MEMS 和传感器市场分为惯性传感器、超声波传感器、位置传感器、运动传感器、麦克风、生物/化学传感器、光学传感器和环境传感器。

材料

- 聚合物

- 金属

- 硅

- 陶瓷制品

根据材料,MEMS 和传感器市场分为聚合物、金属、硅和陶瓷。

包装尺寸

- 小于 0.5 毫米

- 0.5 毫米至 0.9 毫米

- 大于 0.9 毫米

根据封装尺寸,MEMS 和传感器市场细分为小于 0.5 毫米、0.5 毫米至 0.9 毫米和大于 0.9 毫米。

制造工艺

- 沉积

- 光刻

- 蚀刻

根据制造工艺,MEMS 和传感器市场分为沉积、光刻和蚀刻。

执行器类型

- 光学的

- 射频

- 微流体

- 喷墨头

根据执行器类型,MEMS 和传感器市场分为光学、RF、微流体和喷墨头。

最终用户

- 消费电子产品

- 信息技术和电信

- 汽车

- 航天

- 防御

- 医疗的

- 工业和制造业

- 智能电网基础设施

- 智能家居

- 赌博

- 其他的

根据最终用户,MEMS 和传感器市场细分为消费电子、IT 和电信、汽车、航空航天、国防、医疗、工业和制造、智能电网基础设施、智能家居、游戏等。

中东和非洲 MEMS 和传感器市场区域分析/见解

如上所述,MEMS 和传感器市场按类型、材料、封装尺寸、制造工艺、执行器类型、最终用户进行分析。

中东和非洲 MEMS 和传感器市场涵盖的国家包括南非、沙特阿拉伯、阿联酋、埃及、以色列、中东和非洲其他地区。

沙特阿拉伯因其技术的使用和现代化而成为主导国家。

报告的国家部分还提供了影响当前和未来市场趋势的各个市场影响因素和国内监管变化。新销售、替代销售、国家人口统计、疾病流行病学和进出口关税等数据点是用于预测各个国家市场情景的一些主要指标。此外,在对国家数据进行预测分析时,还考虑了全球品牌的存在和可用性以及它们因来自本地和国内品牌的激烈或稀缺竞争而面临的挑战以及销售渠道的影响。

竞争格局和中东和非洲 MEMS 和传感器市场份额分析

MEMS 和传感器市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、全球影响力、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度、应用主导地位。以上提供的数据点仅与公司对 MEMS 和传感器市场的关注有关。

MEMS 和传感器市场的一些主要参与者包括北美松下公司、村田制作所、InvenSense、霍尼韦尔国际公司、英飞凌科技股份公司、意法半导体、德州仪器公司、恩智浦半导体、ADI 公司、罗姆株式会社、Teledyne Technologies Incorporated.、罗伯特·博世有限公司、森萨塔科技公司、电装株式会社、日立有限公司、高通技术公司、Allegro MicroSystems 公司、MegaChips 公司、Vishay Intertechnology 公司等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 REGULATIONS

4.1.1 OVERVIEW

4.1.2 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO)

4.1.3 OCCUPATIONAL SAFETY & HEALTH ADMINISTRATION (OSHA)

4.1.4 AMERICAN NATIONAL STANDARDS INSTITUTE (ANSI)

4.1.5 UNDERWRITERS LABORATORIES (UL)

4.1.6 UNDERWRITERS LABORATORIES (UL)

4.1.7 EN ISO/IEC 17025

4.1.8 CCC CERTIFICATION

4.2 PORTER'S FIVE FORCE ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR AUTOMOTIVE SENSORS FOR SECURITY

5.1.2 RISING DEMAND FOR SENSORS IN CONSUMER ELECTRONICS

5.1.3 INCREASING USE OF (MICRO-ELECTRO-MECHANICAL-SYSTEM) MEMS GYROSCOPES

5.1.4 GROWING APPLICATIONS OF MEMS SENSORS IN DEFENSE AND MILITARY

5.2 RESTRAINT

5.2.1 LACK OF STANDARDIZED FABRICATION PROCESS OF MEMS (MICRO-ELECTRO-MECHANICAL-SYSTEM)

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR SMART GRID INFRASTRUCTURE

5.3.2 DEVELOPMENTS IN ENVIRONMENTAL BASED SENSORS

5.3.3 RISE IN INVESTMENTS FOR R&D OF MEMS SENSORS

5.4 CHALLENGES

5.4.1 TECHNICAL CHALLENEGS AND HIGH COST OF END PRODUCTS

5.4.2 TOUCH SENSORS LEAD TO HIGH SENSITIVITY

6 MIDDLE EAST & AFRICA MEMS & SENSORS MARKET, BY TYPE

6.1 OVERVIEW

6.2 MICROPHONE

6.3 MOTION SENSOR

6.3.1 ACTIVE

6.3.1.1 ULTRASONIC SENSOR

6.3.1.2 MICROWAVE SENSOR

6.3.1.3 TOMOGRAPHIC SENSOR

6.3.2 PASSIVE

6.3.2.1 DUAL OR HYBRID TECHNOLOGY

6.3.2.2 INFRARED MOTION SENSOR

6.3.2.3 OTHERS

6.4 OPTICAL SENSOR

6.4.1 AMBIENT LIGHT SENSOR

6.4.2 MICROBOLOMETER

6.4.3 PIR AND THERMOPHILE

6.4.4 OTHERS

6.5 INERTIAL SENSOR

6.5.1 ACCELEROMETER

6.5.1.1 SINGLE AXIS

6.5.1.2 MULTI AXIS

6.5.2 GYROSCOPE

6.5.3 COMBO SENSOR

6.5.4 MAGNETOMETER

6.6 POSITION SENSOR

6.6.1 PROXIMITY SENSORS

6.6.2 LINEAR SENSORS

6.6.3 DISPLACEMENT SENSORS

6.6.4 3D SENSORS

6.6.5 PHOTOELECTRIC SENSORS

6.6.6 ROTARY SENSOR

6.7 ULTRASONIC SENSOR

6.8 ENVIRONMENTAL SENSOR

6.8.1 HUMIDITY SENSORS

6.8.1.1 ABSOLUTE HUMIDITY SENSORS

6.8.1.2 RELATIVE HUMIDITY SENSORS

6.8.1.3 OSCILLATING HYGROMETER

6.8.1.4 OPTICAL HYGROMETER

6.8.1.5 GRAVIMETRIC HYGROMETER

6.8.2 PRESSURE SENSORS

6.8.2.1 GAUGE PRESSURE SENSORS

6.8.2.2 DIFFERENTIAL PRESSURE SENSORS

6.8.2.3 ABSOLUTE PRESSURE SENSORS

6.8.2.4 VACUUM PRESSURE SENSORS

6.8.2.5 SEALED PRESSURE SENSORS

6.8.3 TEMPERATURE SENSORS

6.8.3.1 CONTACT

6.8.3.1.1 THERMOCOUPLES

6.8.3.1.2 BIMETALLIC TEMPERATURE SENSORS

6.8.3.1.3 RESISTIVE TEMPERATURE DETECTORS

6.8.3.1.4 TEMPERATURE SENSORS ICS

6.8.3.1.5 THERMISTORS

6.8.3.2 NON-CONTACT

6.8.3.2.1 FIBER OPTIC TEMPERATURE SENSORS

6.8.3.2.2 INFRARED TEMPERATURE SENSORS

6.8.4 GAS SENSORS

6.8.4.1 OXYGEN

6.8.4.2 CARBON DIOXIDE

6.8.4.3 AMMONIA

6.8.4.4 HYDROGEN

6.8.4.5 HYDROGEN SULFIDE

6.8.4.6 CARBON MONOXIDE

6.8.4.7 METHANE

6.8.4.8 NITROGEN OXIDE

6.8.4.9 CHLORINE

6.8.4.10 HYDROCARBON

6.8.4.11 VOLATILE ORGANIC COMPOUND

6.8.5 OTHERS

6.9 BIO/CHEMICAL SENSOR

6.9.1 ELECTROCHEMICAL

6.9.2 SENSOR PATCH

7 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY ACTUATOR TYPE

7.1 OVERVIEW

7.2 OPTICAL

7.3 RF

7.3.1 SWITCH

7.3.2 FILTER

7.3.3 OSCILLATOR

7.4 MICROFLUIDICS

7.5 INKJET HEAD

8 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY PACKAGING SIZE

8.1 OVERVIEW

8.2 LESS THAN 0.5 MM

8.3 0.5 MM TO 0.9 MM

8.4 MORE THAN 0.9 MM

9 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY FABRICATION PROCESS

9.1 OVERVIEW

9.2 DEPOSITION

9.3 LITHOGRAPHY

9.4 ETCHING

10 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 POLYMER

10.3 METAL

10.4 SILICON

10.5 CERAMIC

11 MIDDLE EAST & AFRICA MEMS & SENSORS MARKET, BY END USER

11.1 OVERVIEW

11.2 CONSUMER ELECTRONICS

11.2.1 BY TYPE

11.2.1.1 SMARTPHONES

11.2.1.2 LAPTOPS

11.2.1.3 TABLETS

11.2.1.4 CAMERAS

11.2.1.5 WEARABLE DEVICES

11.2.1.6 HEADPHONES

11.2.1.7 SMART AUDIO DEVICES

11.2.1.8 TELEVISION

11.2.1.9 INKJET PRINTERS

11.2.1.10 AR/VR

11.2.1.11 OTHERS

11.2.2 BY SENSOR TYPE

11.2.2.1 MICROPHONE

11.2.2.2 MOTION SENSOR

11.2.2.3 OPTICAL SENSOR

11.2.2.4 INERTIAL SENSOR

11.2.2.5 POSITION SENSOR

11.2.2.6 ULTRASONIC SENSOR

11.2.2.7 ENVIRONMENTAL SENSOR

11.2.2.8 BIO/CHEMICAL SENSOR

11.2.2.9 OTHERS

11.3 IT AND TELECOMMUNICATION

11.4 AUTOMOTIVE

11.4.1 BY TYPE

11.4.1.1 VEHICLE COMFORT SYSTEMS

11.4.1.2 AIR CONDITIONING COMPRESSOR

11.4.1.3 BRAKE FORCE AND SUSPENSION CONTROL

11.4.1.4 FUEL AND VAPOUR LEVEL SENSOR

11.4.1.5 ENGINE MANAGEMENT SYSTEM

11.4.1.6 RESTRAINT SYSTEMS

11.4.1.7 TIRE PRESSURE

11.4.1.8 OTHERS

11.4.2 BY SENSOR TYPE

11.4.2.1 MICROPHONE

11.4.2.2 MOTION SENSOR

11.4.2.3 OPTICAL SENSOR

11.4.2.4 INERTIAL SENSOR

11.4.2.5 POSITION SENSOR

11.4.2.6 ULTRASONIC SENSOR

11.4.2.7 ENVIRONMENTAL SENSOR

11.4.2.8 BIO/CHEMICAL SENSOR

11.4.2.9 OTHERS

11.5 GAMING

11.5.1 MICROPHONE

11.5.2 MOTION SENSOR

11.5.3 OPTICAL SENSOR

11.5.4 INERTIAL SENSOR

11.5.5 POSITION SENSOR

11.5.6 ULTRASONIC SENSOR

11.5.7 ENVIRONMENTAL SENSOR

11.5.8 BIO/CHEMICAL SENSOR

11.5.9 OTHERS

11.6 AEROSPACE

11.6.1 MICROPHONE

11.6.2 MOTION SENSOR

11.6.3 OPTICAL SENSOR

11.6.4 INERTIAL SENSOR

11.6.5 POSITION SENSOR

11.6.6 ULTRASONIC SENSOR

11.6.7 ENVIRONMENTAL SENSOR

11.6.8 BIO/CHEMICAL SENSOR

11.6.9 OTHERS

11.7 DEFENSE

11.7.1 BY TYPE

11.7.1.1 AIRCRAFT CONTROL

11.7.1.2 SURVEILLANCE

11.7.1.3 ARMING SYSTEMS

11.7.1.4 EMBEDDED SENSORS

11.7.1.5 MUNITIONS GUIDANCE

11.7.1.6 DATA STORAGE

11.7.2 BY SENSOR TYPE

11.7.2.1 MICROPHONE

11.7.2.2 MOTION SENSOR

11.7.2.3 OPTICAL SENSOR

11.7.2.4 INERTIAL SENSOR

11.7.2.5 POSITION SENSOR

11.7.2.6 ULTRASONIC SENSOR

11.7.2.7 ENVIRONMENTAL SENSOR

11.7.2.8 BIO/CHEMICAL SENSOR

11.7.2.9 OTHERS

11.8 MEDICAL

11.8.1 BY TYPE

11.8.1.1 MONITORING DEVICES

11.8.1.2 SURGICAL DEVICES

11.8.1.3 DIAGNOSTIC DEVICES

11.8.1.4 THERAPEUTIC DEVICES

11.8.1.5 OTHERS

11.8.2 BY SENSOR TYPE

11.8.2.1 MICROPHONE

11.8.2.2 MOTION SENSOR

11.8.2.3 OPTICAL SENSOR

11.8.2.4 INERTIAL SENSOR

11.8.2.5 POSITION SENSOR

11.8.2.6 ULTRASONIC SENSOR

11.8.2.7 ENVIRONMENTAL SENSOR

11.8.2.8 BIO/CHEMICAL SENSOR

11.8.2.9 OTHERS

11.9 INDUSTRIAL AND MANUFACTURING

11.9.1 BY TYPE

11.9.1.1 INDUSTRIAL ROBOTS

11.9.1.2 DRONES

11.9.1.3 OTHERS

11.9.2 BY SENSOR TYPE

11.9.2.1 MICROPHONE

11.9.2.2 MOTION SENSOR

11.9.2.3 OPTICAL SENSOR

11.9.2.4 INERTIAL SENSOR

11.9.2.5 POSITION SENSOR

11.9.2.6 ULTRASONIC SENSOR

11.9.2.7 ENVIRONMENTAL SENSOR

11.9.2.8 BIO/CHEMICAL SENSOR

11.9.2.9 OTHERS

11.1 SMART GRID INFRASTRUCTURE

11.10.1 MICROPHONE

11.10.2 MOTION SENSOR

11.10.3 OPTICAL SENSOR

11.10.4 INERTIAL SENSOR

11.10.5 POSITION SENSOR

11.10.6 ULTRASONIC SENSOR

11.10.7 ENVIRONMENTAL SENSOR

11.10.8 BIO/CHEMICAL SENSOR

11.10.9 OTHERS

11.11 SMART HOMES

11.11.1 MICROPHONE

11.11.2 MOTION SENSOR

11.11.3 OPTICAL SENSOR

11.11.4 INERTIAL SENSOR

11.11.5 POSITION SENSOR

11.11.6 ULTRASONIC SENSOR

11.11.7 ENVIRONMENTAL SENSOR

11.11.8 BIO/CHEMICAL SENSOR

11.11.9 OTHERS

11.12 OTHERS

12 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET BY GEOGRAPHY

12.1 MIDDLE EAST AND AFRICA

12.1.1 SAUDI ARABIA

12.1.2 SOUTH AFRICA

12.1.3 U.A.E.

12.1.4 ISRAEL

12.1.5 EGYPT

12.1.6 REST OF MIDDLE EAST & AFRICA

13 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 SENSATA TECHNOLOGIES, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 ROBERT BOSCH GMBH

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 DENSO CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 HITACHI, LTD.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 HONEYWELL INTERNATIONAL INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ALLEGRO MICROSYSTEMS, INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 ANALOG DEVICES, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 INVENSENSE

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 INFINEON TECHNOLOGIES AG

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 MURATA MANUFACTURING CO., LTD.

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 MEGACHIPS CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 NXP SEMICONDUCTORS

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 PANASONIC CORPORATION OF NORTH AMERICA

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 QUALCOMM TECHNOLOGIES, INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 ROHM CO., LTD.

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 STMICROELECTRONICS

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 TEXAS INSTRUMENTS INCORPORATED

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 TELEDYNE TECHNOLOGIES INCORPORATED

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 VISHAY INTERTECHNOLOGY, INC.

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 MIDDLE EAST & AFRICA MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 2 MIDDLE EAST & AFRICA MICROPHONE IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA MOTION SENSORS IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 4 MIDDLE EAST & AFRICA MOTION SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA ACTIVE IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA PASSIVE IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA OPTICAL SENSOR IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA OPTICAL SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA INERTIAL SENSOR IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA INERTIAL SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA ACCELEROMETER IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA POSITION SENSOR IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA POSITION SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA ULTRASONIC SENSOR IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA ENVIRONMENTAL SENSOR IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA ENVIRONMENTAL SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA HUMIDITY SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA PRESSURE SENSORS IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA TEMPERATURE SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA CONTACT IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA NON-CONTACT IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA GAS SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA BIO/CHEMICAL SENSOR IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA BIO/CHEMICAL SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY ACTUATOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA OPTICAL IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA RF IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA RF IN MEMS AND SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA MICROFLUIDICS IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA INKJET HEAD IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY PACKAGING SIZE, 2020-2029 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA LESS THAN 0.5 MM IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA 0.5MM TO 0.9 MM IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA MORE THAN 0.9 MM IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY FABRICATION PROCESS, 2020-2029 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA DEPOSITION IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA LITHOGRAPHY IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA ETCHING IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 40 MIDDLE EAST & AFRICA POLYMER IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 41 MIDDLE EAST & AFRICA METAL IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 42 MIDDLE EAST & AFRICA SILICON IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 43 MIDDLE EAST & AFRICA CERAMIC IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 44 MIDDLE EAST & AFRICA MEMS & SENSORS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 45 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 46 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 MIDDLE EAST & AFRICA IT AND TELECOMMUNICATION IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 49 MIDDLE EAST & AFRICA AUTOMOTIVE IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 50 MIDDLE EAST & AFRICA AUTOMOTIVE IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 MIDDLE EAST & AFRICA AUTOMOTIVE IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 52 MIDDLE EAST & AFRICA GAMING IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 53 MIDDLE EAST & AFRICA GAMING IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 MIDDLE EAST & AFRICA AEROSPACE IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 55 MIDDLE EAST & AFRICA AEROSPACE IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 MIDDLE EAST & AFRICA DEFENSE IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 57 MIDDLE EAST & AFRICA DEFENSE IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 MIDDLE EAST & AFRICA DEFENSE IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 MIDDLE EAST & AFRICA MEDICAL IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 60 MIDDLE EAST & AFRICA MEDICAL IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 MIDDLE EAST & AFRICA MEDICAL IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 62 MIDDLE EAST & AFRICA INDUSTRIAL AND MANUFACTURING IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 63 MIDDLE EAST & AFRICA INDUSTRIAL AND MANUFACTURING IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 MIDDLE EAST & AFRICA INDUSTRIAL AND MANUFACTURING IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 MIDDLE EAST & AFRICA SMART GRID INFRASTRUCTURE IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 66 MIDDLE EAST & AFRICA SMART GRID INFRASTRUCTURE IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 MIDDLE EAST & AFRICA SMART HOMES IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 68 MIDDLE EAST & AFRICA SMART HOMES IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 MIDDLE EAST & AFRICA OTHERS IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

图片列表

FIGURE 1 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: SEGMENTATION

FIGURE 11 DEMAND FOR HIGH DEFINITION CONTENT BY CONSUMERS IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC EXPECTED TO DOMINATE, AND IS THE FASTEST-GROWING REGION IN THE MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET

FIGURE 15 MIDDLE EAST & AFRICA MEMS & SENSORS MARKET, BY TYPE, 2021

FIGURE 16 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY ACTUATOR TYPE, 2021

FIGURE 17 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY PACKAGING SIZE, 2021

FIGURE 18 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY FABRICATION PROCESS, 2021

FIGURE 19 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY MATERIAL, 2021

FIGURE 20 MIDDLE EAST & AFRICA MEMS & SENSORS MARKET, BY END USER, 2021

FIGURE 21 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: BY COUNTRY (2021)

FIGURE 22 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: BY COUNTRY (2021)

FIGURE 23 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: BY TYPE (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。