Middle East And Africa Maltitol In Chocolate Market

市场规模(十亿美元)

CAGR :

%

USD

3,503.64 Thousand

USD

4,807.32 Thousand

2021

2029

USD

3,503.64 Thousand

USD

4,807.32 Thousand

2021

2029

| 2022 –2029 | |

| USD 3,503.64 Thousand | |

| USD 4,807.32 Thousand | |

|

|

|

中东和非洲巧克力市场的麦芽糖醇,按形式(晶体粉末和糖浆)、巧克力类别(白巧克力、牛奶巧克力和黑巧克力)、应用(烘焙、零售巧克力、巧克力内含物)、国家(南非、沙特阿拉伯、阿联酋、科威特和中东和非洲其他地区)行业趋势和预测到 2029 年。

市场分析与洞察:中东和非洲巧克力市场的麦芽糖醇

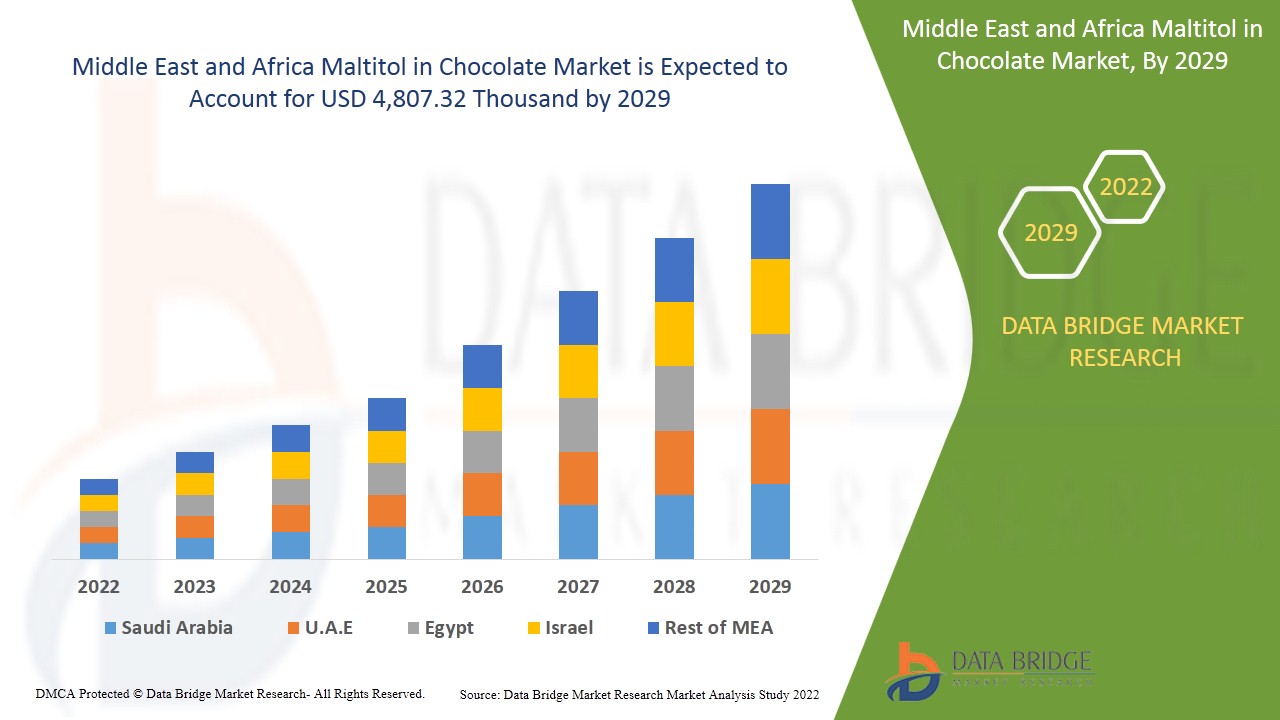

巧克力中的麦芽糖醇市场预计将在 2022 年至 2029 年的预测期内增长。Data Bridge Market Research 分析称,在 2022 年至 2029 年的预测期内,该市场以 4.1% 的复合年增长率增长,预计到 2029 年将从 2021 年的 3,503.64 万美元达到 4,807.32 万美元。

麦芽糖醇是一种碳水化合物,又称糖醇或多元醇。麦芽糖醇是一种水溶性化合物,天然存在于许多水果和蔬菜中。麦芽糖醇大规模生产自富含麦芽糖的淀粉。麦芽糖醇在食品工业中的主要应用是烘焙食品、无糖巧克力、口香糖、硬糖和巧克力涂层。麦芽糖醇对人类来说是安全的,因为它的安全性已得到世界各地卫生当局的审查和确认,例如欧盟、世界卫生组织以及澳大利亚和加拿大等国家。麦芽糖醇的味道与普通糖相同。它的甜度与糖的相似度约为 90%,每克热量几乎是糖的一半(麦芽糖醇为 2.1 卡路里,而糖为 4 卡路里)。

麦芽糖醇是从水果、蔬菜和淀粉等各种原料中提取的糖醇。淀粉中的麦芽糖是麦芽糖醇的来源,它被用作各种食品和饮料产品中的低热量甜味剂,如无糖巧克力、硬糖、烘焙食品、巧克力涂层和口香糖。随着人们越来越注重健康,对低热量甜味剂的需求也在增加,世界糖尿病患者人数也在增加。因此,全球对低热量巧克力和无糖巧克力中麦芽糖醇的需求也在增加。推动市场增长的因素包括对低热量和无糖巧克力产品的需求增加、常规糖成分引起的健康问题越来越多、麦芽糖醇作为蔗糖替代品的采用率不断提高、原材料来源丰富。制约市场增长的因素包括麦芽糖醇的副作用、与其他甜味剂相比麦芽糖醇的高成本以及市场上可用的替代品数量。许多公司正在扩大其生产设施,以满足对含麦芽糖醇巧克力的更高需求。

麦芽糖醇巧克力市场报告提供了市场份额、新发展和产品线分析、国内和本地市场参与者的影响的详细信息,分析了新兴收入领域、市场法规变化、产品审批、战略决策、产品发布、地域扩张和市场技术创新方面的机会。要了解分析和全球麦芽糖醇巧克力市场情景,请联系 Data Bridge Market Research 获取分析师简报;我们的团队将帮助您创建收入影响解决方案,以实现您的预期目标。

麦芽糖醇在巧克力中的市场范围和市场规模

巧克力麦芽糖醇市场根据形式、巧克力类别和应用分为三个显著的细分市场。细分市场之间的增长有助于您分析利基增长领域和进入市场的策略,并确定您的核心应用领域和目标市场的差异。

- 根据形态,巧克力市场中的麦芽糖醇分为晶体、粉末和糖浆。 2022 年,由于糖浆与其他形式相比成本较低等因素,预计糖浆部分将占据市场份额的主导地位。

- 根据巧克力类别,巧克力市场中的麦芽糖醇分为白巧克力、牛奶巧克力和黑巧克力。 2022 年,由于幼儿父母对白巧克力的需求量大等因素,白巧克力市场预计将占据市场份额的主导地位。

- 根据应用,巧克力麦芽糖醇市场分为烘焙、零售巧克力和巧克力内含物。2022 年,由于对低热量巧克力产品的需求量很大,预计零售巧克力市场将占据市场主导地位。

麦芽糖醇在巧克力市场的国家层面分析

对巧克力市场中的麦芽糖醇进行了分析,并按上述形式、巧克力类别和应用提供了市场规模信息。

巧克力麦芽糖醇市场报告涉及的国家包括南非、沙特阿拉伯、阿联酋、科威特以及中东和非洲其他地区。

由于生产无糖巧克力对麦芽糖醇的需求不断增长,沙特阿拉伯在中东和非洲的麦芽糖醇巧克力市场上占据主导地位。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。新销售、替代销售、国家人口统计、监管法案和进出口关税等数据点是用于预测各个国家市场情景的一些主要指标。此外,在对国家数据进行预测分析时,还考虑了全球品牌的存在和可用性以及它们因来自本地和国内品牌的激烈或稀缺竞争而面临的挑战、销售渠道的影响。

主要市场参与者不断增加的战略活动提高了人们对巧克力中麦芽糖醇的认识,推动了巧克力市场中麦芽糖醇的市场增长

巧克力麦芽糖醇市场还为您提供了每个国家在特定市场增长的详细市场分析。此外,它还提供有关市场参与者战略及其地理分布的详细信息。数据适用于 2012 年至 2020 年的历史时期。

巧克力市场的竞争格局和麦芽糖醇份额分析

巧克力麦芽糖醇市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、生产基地和设施、公司优势和劣势、产品发布、产品试验渠道、产品批准、专利、产品宽度和广度、应用优势、技术生命线曲线。以上数据点仅与公司对巧克力麦芽糖醇市场的关注有关。

巧克力麦芽糖醇市场的一些主要参与者包括浙江华康药业有限公司、罗盖特公司、宜瑞安、三菱商事生命科学有限公司、ADM、Brenntag、默克集团、山东福田食品有限公司、嘉吉公司、B 食品科学有限公司、杭州威凯科技有限公司、海航工业、Sosa、Foodchem International Corporation、PT. Ecogreen Oleochemicals、Mitushi Biopharma、MUBY CHEMICALS、Hylen Co., Ltd、Nutra Food Ingredients 等。

例如,

- 2020 年 12 月,默克集团扩建了其在美国的生命科学业务生产设施,其中包括麦芽糖醇生产。这些扩建将分别在 2021 年和 2022 年底显著提高这些设施的产能和产量,并创造近 700 个新的制造岗位。此次扩张有助于公司扩大其地理分布。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 INGREDIENT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT & EXPORT ANALYSIS OF MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET

4.1.1 IMPORT-EXPORT ANALYSIS

5 LIST OF SUBSTITUTES

6 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET: MARKETING STRATEGIES

7 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET: REGULATIONS

7.1 REGULATIONS ON THE MALTITOL BY EUROPEAN UNIONS

7.2 REGULATIONS ON THE USE OF FOOD ADDITIVES

7.3 REGULATIONS ON MALTITOL BY THE U.S. FDA

8 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET: SUPPLY CHAIN ANALYSIS

8.1 RAW MATERIAL PROCUREMENT

8.2 MANUFACTURING

8.3 MARKETING AND DISTRIBUTION

8.4 END USERS

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 INCREASING DEMAND FOR LOW CALORIE AND SUGAR-FREE CHOCOLATE PRODUCTS

9.1.2 GROWING NUMBER OF HEALTH ISSUES CAUSED BY REGULAR SUGAR INGREDIENT

9.1.3 GROWING ADOPTION OF MALTITOL AS SUCROSE ALTERNATIVE

9.1.4 ABUNDANT SOURCES OF RAW MATERIAL

9.2 RESTRAINTS

9.2.1 SIDE EFFECTS OF MALTITOL

9.2.2 HIGH COST OF MALTITOL AS COMPARED TO OTHER SWEETENERS

9.2.3 NUMBER OF SUBSTITUTES AVAILABLE IN THE MARKET

9.3 OPPORTUNITIES

9.3.1 MALTITOL IS AN IMPORTANT INGREDIENT IN CHOCOLATES TO PREVENT DENTAL CARIES IN CHILDREN AND ADULTS

9.3.2 HEALTH BENEFITS ASSOCIATED WITH CONSUMPTION OF MALTITOL

9.4 CHALLENGES

9.4.1 HIGH COST OF CHOCOLATES CONTAINING MALTITOL

9.4.2 STRINGENT GOVERNMENT REGULATIONS

10 COVID-19 IMPACT ON MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET

10.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET

10.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

10.3 IMPACT ON PRICE

10.4 IMPACT ON DEMAND

10.5 IMPACT ON SUPPLY CHAIN

10.6 CONCLUSION

11 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET, BY FORM

11.1 OVERVIEW

11.2 SYRUP

11.2.1 HIGH MALTOSE SYRUP

11.2.2 EXTRA HIGH MALTOSE SYRUP

11.3 CRYSTAL

11.4 POWDER

12 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY

12.1 OVERVIEW

12.2 MILK CHOCOLATE

12.3 DARK CHOCOLATE

12.4 WHITE CHOCOLATE

13 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 RETAIL CHOCOLATES

13.2.1 CHOCOLATE BARS

13.2.2 CANDIES

13.2.3 ASSORTMENT CHOCOLATES

13.2.4 BITES

13.2.5 CHOCOLATE WAFFERS

13.2.6 OTHERS

13.3 BAKERY

13.3.1 CAKES & PASTRIES

13.3.2 BREADS & ROLLS

13.3.3 BISCUIT

13.3.4 COOKIES & CRACKERS

13.3.5 OTHERS

13.4 CHOCOLATE INCLUSIONS

13.4.1 CHOCOLATE SHAPES

13.4.2 JIMMIES

13.4.3 DRAGEES

13.4.3.1 OVAL DRAGEES

13.4.3.2 PEARL DRAGEES

13.4.4 CHOCOLATE SYRUPS

13.4.5 CHOCOLATE FLAKES

13.4.6 QUINS

13.4.7 NONPAREILS

13.4.8 CHOCOLATE CHUNKS

13.4.9 CHOCOLATE SHELLS

13.4.10 CHOCOLATE CUPS

13.4.11 OTHERS

14 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET, BY REGION

14.1 MIDDLE EAST AND AFRICA

14.1.1 SOUTH AFRICA

14.1.2 U.A.E.

14.1.3 SAUDI ARABIA

14.1.4 KUWAIT

14.1.5 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 INGREDION

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 CARGILL, INCORPORATED

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 MERCK KGAA

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 ROQUETTE FRÈRES

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 ADM

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 SHANDONG FUTASTE CO.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 BRENNTAG

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 B FOOD SCIENCE CO., LTD.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 FOODCHEM INTERNATIONAL CORPORATION

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 HANGZHOU VERYCHEM SCIENCE AND TECHNOLOGY CO.LTD

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 HAIHANG INDUSTRY

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 HYLEN CO., LTD

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 MITSUBISHI CORPORATION LIFE SCIENCES LIMITED

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 MITUSHI BIOPHARMA

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 MUBY CHEMICALS

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 NUTRA FOOD INGREDIENTS

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 PT. ECOGREEN OLEOCHEMICALS

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 SOSA

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 ZHEJIANG HUAKANG PHARMACEUTICAL CO., LTD.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

表格列表

TABLE 1 IMPORT DATA OF PRODUCT: 1107 MALT (USD THOUSAND)

TABLE 2 EXPORT DATA OF PRODUCT: 1107 MALT (USD THOUSAND)

TABLE 3 LIST OF MALTITOL SUBSTITUTES

TABLE 4 A COMPARISON OF SOME PHYSICO-CHEMICAL PROPERTIES FOR SUCROSE AND MALTITOL

TABLE 5 FREQUENCY AND MEAN SCORE OF INTOLERANCE SYMPTOMS INTENSITY AFTER REGULAR CONSUMPTION OF INCREASING DOSES OF MALTITOL IN 12 HEALTHY VOLUNTEERS

TABLE 6 PRICES INDICATION OF DIFFERENT SWEETENERS

TABLE 7 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA SYRUP IN MALTITOL IN CHOCOLATE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA SYRUP IN MALTITOL IN CHOCOLATE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA CRYSTAL IN MALTITOL IN CHOCOLATE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA POWDER IN MALTITOL IN CHOCOLATE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA MILK CHOCOLATE IN MALTITOL IN CHOCOLATE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA DARK CHOCOLATE IN MALTITOL IN CHOCOLATE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA WHITE CHOCOLATE IN MALTITOL IN CHOCOLATE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA RETAIL CHOCOLATES IN MALTITOL IN CHOCOLATE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA RETAIL CHOCOLATES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA BAKERY IN MALTITOL IN CHOCOLATE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA BAKERY IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA DRAGEES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA MALTITOL IN CHOCOLATE MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA MALTITOL IN CHOCOLATE MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA SYRUP IN MALTITOL IN CHOCOLATE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA BAKERY IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA RETAIL CHOCOLATES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA DRAGEES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 33 SOUTH AFRICA MALTITOL IN CHOCOLATE MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 34 SOUTH AFRICA SYRUP IN MALTITOL IN CHOCOLATE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 35 SOUTH AFRICA MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 36 SOUTH AFRICA MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 37 SOUTH AFRICA BAKERY IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 38 SOUTH AFRICA RETAIL CHOCOLATES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 39 SOUTH AFRICA CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 40 SOUTH AFRICA DRAGEES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 41 U.A.E. MALTITOL IN CHOCOLATE MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 42 U.A.E. SYRUP IN MALTITOL IN CHOCOLATE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 43 U.A.E. MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 44 U.A.E. MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 45 U.A.E. BAKERY IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 46 U.A.E. RETAIL CHOCOLATES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 47 U.A.E. CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 48 U.A.E. DRAGEES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 49 SAUDI ARABIA MALTITOL IN CHOCOLATE MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 50 SAUDI ARABIA SYRUP IN MALTITOL IN CHOCOLATE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 SAUDI ARABIA MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 52 SAUDI ARABIA MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 53 SAUDI ARABIA BAKERY IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 54 SAUDI ARABIA RETAIL CHOCOLATES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 55 SAUDI ARABIA CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 56 SAUDI ARABIA DRAGEES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 57 KUWAIT MALTITOL IN CHOCOLATE MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 58 KUWAIT SYRUP IN MALTITOL IN CHOCOLATE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 KUWAIT MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 60 KUWAIT MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 61 KUWAIT BAKERY IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 62 KUWAIT RETAIL CHOCOLATES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 63 KUWAIT CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 64 KUWAIT DRAGEES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 65 REST OF MIDDLE EAST AND AFRICA MALTITOL IN CHOCOLATE MARKET, BY FORM, 2020-2029 (USD THOUSAND)

图片列表

FIGURE 1 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE: MARKET APPLICATION GRID

FIGURE 9 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INCREASING DEMAND FOR LOW CALORIE AND SUGAR-FREE CHOCOLATE PRODUCTS ARE LEADING TO THE GROWTH OF THE MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET IN THE FORECAST PERIOD

FIGURE 13 SYRUP SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET IN 2022 & 2029

FIGURE 14 SUPPLY CHAIN OF MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET

FIGURE 16 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET, BY FORM, 2021

FIGURE 17 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY, 2021

FIGURE 18 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2021

FIGURE 19 MIDDLE EAST AND AFRICA MALTITOL IN CHOCOLATE MARKET: SNAPSHOT (2021)

FIGURE 20 MIDDLE EAST AND AFRICA MALTITOL IN CHOCOLATE MARKET: BY COUNTRY (2021)

FIGURE 21 MIDDLE EAST AND AFRICA MALTITOL IN CHOCOLATE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 MIDDLE EAST AND AFRICA MALTITOL IN CHOCOLATE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 23 MIDDLE EAST AND AFRICA MALTITOL IN CHOCOLATE MARKET: BY FORM (2022 & 2029)

FIGURE 24 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。