中东和非洲仪表盘市场,按用途(速度表、里程表、转速表、冷却液温度计、油压表等)、车辆类型(内燃机车、电池电动车 (BEV)、插电式混合动力电动车 (PHEV)、混合动力电动车 (HEV) 和燃料电池电动车 (FCEV))、技术(混合动力、模拟和数字)、企业规模(小型组织、半城市中型组织和大型组织)、最终用户(乘用车、商用车、两轮车、非公路用车、农业车辆等)、国家(沙特阿拉伯、南非、阿联酋、埃及、以色列和中东和非洲其他地区)行业趋势和预测到 2029 年。

市场分析和洞察:中东和非洲仪表盘市场

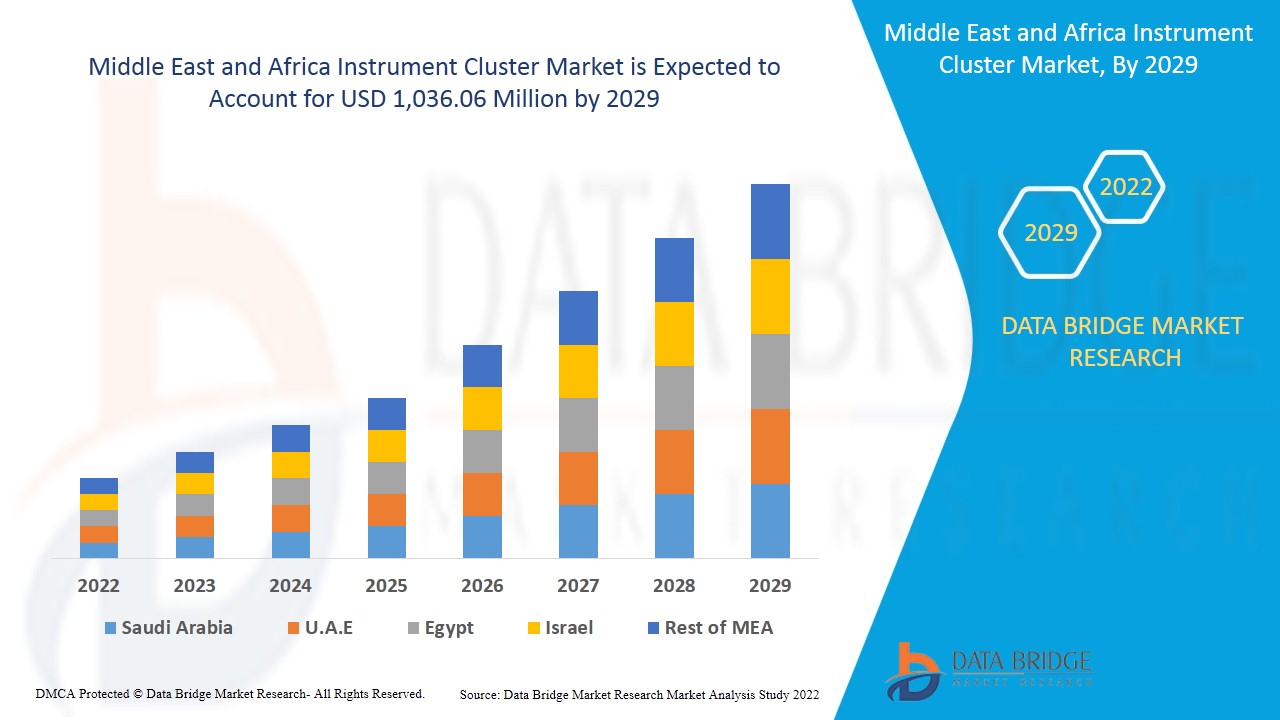

预计中东和非洲仪表盘市场将在 2022 年至 2029 年的预测期内实现市场增长。Data Bridge Market Research 分析称,在 2022 年至 2029 年的预测期内,该市场将以 4.2% 的复合年增长率增长,预计到 2029 年将达到 10.3606 亿美元。发展中国家汽车行业的增长以及对高端乘用车的需求上升推动了汽车仪表盘市场的发展。此外,汽车产销增长和信息娱乐系统的增加也推动了市场增长。然而,芯片、IC 和显示器等原材料成本的波动以及与数字仪表盘相关的成本上涨预计将阻碍市场需求。

在大多数现代汽车和卡车中,仪表组直接位于方向盘前方,使所有仪表均处于驾驶员的自然视线范围内。有些车辆的转向信号指示器安装在每个挡泥板的前端顶端,许多早期汽车的冷却液温度计内置在散热器盖中,有些车辆的转速表也安装在引擎盖上。毫无疑问,第一批汽车从制造它们的谷仓和棚子中推出时(甚至第一批量产汽车上市时)并没有仪表组。事实上,它们根本没有任何仪表。这些早期汽车更像当时的马车,而不是现代汽车,而且它们没有我们今天所熟悉的乘客舱或“驾驶舱”。

预计对完整数字驾驶舱解决方案开发的需求不断增长将推动市场增长,但政府对车辆安全的严格规定预计将阻碍市场增长。豪华车的日益普及预计将为市场增长创造机会,但数字仪表盘的复杂设计结构预计将对市场增长构成挑战

仪表盘市场报告提供了市场份额、新发展和产品线分析、国内和本地市场参与者的影响的详细信息,分析了新兴收入领域、市场法规变化、产品审批、战略决策、产品发布、地域扩张和市场技术创新方面的机会。要了解分析和仪表盘市场情景,请联系 Data Bridge Market Research 获取分析师简报,我们的团队将帮助您创建收入影响解决方案以实现您的预期目标。

仪表板市场范围和市场规模

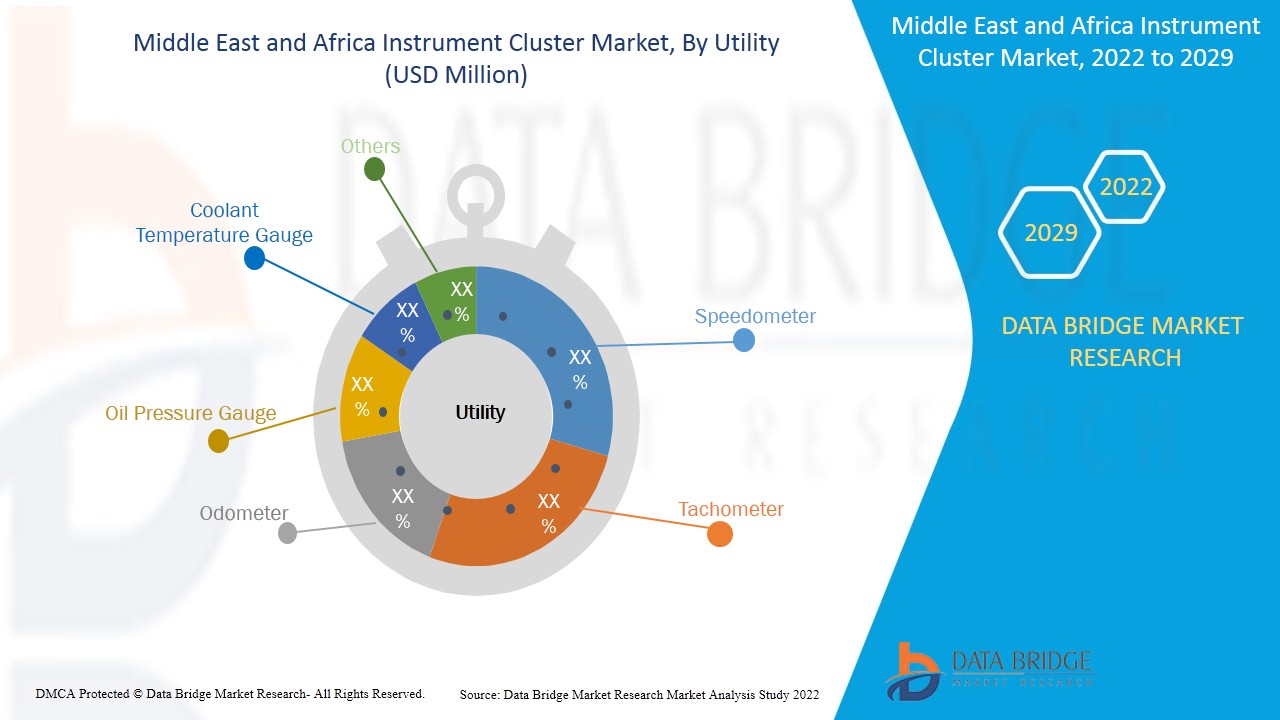

中东和非洲仪表盘市场根据实用性、车辆类型、技术、企业规模和最终用途分为五个显著的细分市场。细分市场之间的增长有助于您分析细分市场的增长空间和进入市场的策略,并确定您的核心应用领域和目标市场的差异。

- 根据实用性,中东和非洲仪表盘市场细分为速度表、转速表、里程表、油压表、冷却液温度表等。随着汽车产量的快速增长和道路安全参数的提高,汽车速度表的需求也将增加,预计到 2022 年,速度表将占据市场主导地位。

- 根据车辆类型,中东和非洲仪表盘市场分为 ICE 车辆、电池电动汽车 (BEV)、插电式混合动力电动汽车 (PHEV)、混合动力电动汽车 (HEV) 和燃料电池电动汽车 (FCEV)。2022 年,由于消费者对宝马、奥迪和梅赛德斯等高端豪华车辆的需求不断增长,预计 ICE 车辆将占据市场主导地位,而更好的经济条件和高购买力将促进阿联酋和沙特阿拉伯的 ICE 车辆使用仪表盘产品。

- 根据技术,中东和非洲仪表盘市场分为混合、模拟、数字和其他。2022 年,随着人们对便利性、安全性和舒适性的关注度不断提高,转向控制和手势控制系统等技术的使用增加,混合仪表盘市场有望占据主导地位。

- 根据企业规模,中东和非洲仪表盘市场分为大型企业、半城市中型企业和小型企业。2022 年,大型企业预计将占据市场主导地位,因为它们拥有更高的生产能力,并能处理市场上广泛的产品组合。

- 根据最终用户,中东和非洲仪表盘市场分为乘用车、商用车、两轮车、农用车、非公路用车等。2022 年,乘用车预计将占据市场主导地位,因为对轻型汽车的需求不断增长、政府对燃油排放的有利标准以及对乘用车的需求不断增长将推动 MEA 仪表盘市场满足汽车行业的需求。

仪表板市场国家层面分析

对仪表盘市场进行了分析,并按上述国家、公用事业、车辆类型、技术、企业规模和最终用户提供了市场规模信息。

仪表盘市场报告涵盖的国家包括阿拉伯联合酋长国、沙特阿拉伯、以色列、埃及、南非以及中东和非洲其他地区。沙特阿拉伯在中东和非洲地区占据主导地位,因为可支配收入的增加以及经济状况的改善为休闲活动提供了潜在的机会,进一步扩大了市场规模。由于休闲支出的增加和经济增长,沙特阿拉伯将呈现显著增长。通过有效的分销商和经销商链轻松获得车辆和车辆零件将显著扩大市场规模。

报告的国家部分还提供了影响单个市场因素和国内市场监管变化,这些因素和变化会影响市场的当前和未来趋势。新销售、替代销售、国家人口统计、监管法案和进出口关税等数据点是用于预测单个国家市场情景的一些主要指标。此外,在提供国家数据的预测分析时,还考虑了中东和非洲品牌的存在和可用性以及它们因来自本地和国内品牌的激烈或稀少竞争而面临的挑战、销售渠道的影响。

对完整数字驾驶舱解决方案开发的需求不断增长,预计将推动市场的增长

仪表盘市场还为您提供每个国家特定市场增长的详细市场分析。此外,它还提供有关市场参与者战略及其地理分布的详细信息。数据涵盖 2011 年至 2020 年的历史时期。

竞争格局和仪表盘市场份额分析

仪表盘市场竞争格局按竞争对手提供详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、生产基地和设施、公司优势和劣势、产品发布、产品试验渠道、产品批准、专利、产品宽度和广度、应用主导地位、技术生命线曲线。以上提供的数据点仅与公司对仪表盘市场的关注有关。

仪表盘市场的一些主要参与者包括伟世通公司、大陆汽车集团、派克汉尼芬公司、罗伯特·博世有限公司、Infenion Technologies AG、德尔福科技、哈曼国际、安波福、矢崎公司、日本精机株式会社、电装株式会社、瑞萨电子株式会社、IAC 集团、LUXOFT、DXC TECHNOLOGY COMPANY、Spark Minda、ALPS ALPINE CO., LTD、松下公司、Simco Ltd、德州仪器公司、Mini Meters Manufacturing Co. Pvt. Ltd. 和 Embitel 等。

许多合同和协议也由公司发起,这也加速了仪表盘市场的发展。

例如,

- 2019 年 3 月,伟世通公司在标致独特的 3D i-Cockpit 的所有部分推出了全新标致 208 的首个 3D 仪表盘,其中仪表盘主要代表了汽车生产中第一个真正的 3D 仪表盘。它有助于显示高级反射,以创造 3D 图形的印象

- 2021 年 9 月,HARMAN International 宣布与雷诺 Mégane E-TECH 电动车合作。两家公司之间的合作旨在重新设计车辆内饰。该公司的产品发布旨在为驾驶员和客户提供全新的车内体验。市场预计将推出具有最佳功能和新设计的新产品

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMPONENT TYPE TIMELINE CURVE

2.1 MARKET APPLICATION GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRICING ANALYSIS

4.2 CASE STUDY

4.3 TECHNOLOGICAL TRENDS

4.3.1 PREDICTIVE MAINTENANCE

4.3.2 DRIVER MONITORING SYSTEM

4.3.3 DIGITAL COCKPIT SOLUTIONS

4.4 REGULATORY FRAMEWORK

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR DEVELOPMENT OF COMPLETE DIGITAL COCKPIT SOLUTION

5.1.2 TRANSITION OF MECHANICAL SYSTEM TO ELECTRONIC SYSTEM IN AUTOMOBILE SECTOR

5.1.3 INCREASING NUMBER OF ELECTRIC VEHICLE SALES

5.2 RESTRAINTS

5.2.1 STRINGENT GOVERNMENT REGULATIONS FOR VEHICLE SAFETY

5.2.2 MOST OF SPEEDOMETERS ACCURACY LOWERS AS TIRES WEAR OFF

5.3 OPPORTUNITIES

5.3.1 ADOPTION OF LUXURY VEHICLES IS IMPOSING A POSITIVE OUTLOOK ON MARKET

5.3.2 INTEGRATION OF HMI SOLUTION IN INSTRUMENT CLUSTER

5.3.3 INCREASE IN ACQUISITION AND MERGER AMONG VARIOUS MARKET PLAYERS

5.4 CHALLENGES

5.4.1 COMPLICATED DESIGN STRUCTURE OF DIGITAL INSTRUMENT CLUSTER

5.4.2 ERRORS ASSOCIATED WITH ANY VEHICLE SENSORS IMPACTS WORKING OF INSTRUMENT CLUSTER

6 IMPACT OF COVID-19 ON MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST MARKET GROWTH

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE AND DEMAND

6.4 IMPACT ON SUPPLY CHAIN

6.5 CONCLUSION

7 MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET, BY UTILITY

7.1 OVERVIEW

7.2 SPEEDOMETER

7.2.1 ANALOG

7.2.2 DIGITAL

7.3 TACHOMETER

7.4 ODOMETER

7.4.1 MECHANICAL

7.4.2 ELECTRONIC

7.5 OIL PRESSURE GAUGE

7.6 COOLANT TEMPERATURE GAUGE

7.7 OTHERS

8 MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET, BY VEHICLE TYPE

8.1 OVERVIEW

8.2 ICE VEHICLE

8.3 BATTERY ELECTRIC VEHICLE (BEV)

8.4 HYBRID ELECTRIC VEHICLE (HEV)

8.5 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

8.6 FUEL CELL ELECTRIC VEHICLE (FCEV)

9 MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 HYBRID

9.3 DIGITAL

9.3.1 LIQUID CRYSTAL DISPLAY (LCD)

9.3.2 ORGANIC LIGHT EMITTING DIODE (OLED)

9.3.3 THIN FILM TRANSISTOR-LIQUID CRYSTAL DISPLAY (TFT-LCD)

9.3.4 5-8 INCH

9.3.5 9-11 INCH

9.3.6 MORE THAN 12 INCH

9.3.7 AI-BASED: DIGITAL INSTRUMENT CLUSTER

9.3.8 NON AI-BASED: DIGITAL INSTRUMENT CLUSTER

9.4 ANALOG

10 MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET, BY ENTERPRISE SIZE

10.1 OVERVIEW

10.2 LARGE SCALE ORGANIZATIONS

10.3 SEMI-URBAN MID SCALE ORGANIZATIONS

10.4 SMALL SCALE ORGANIZATIONS

11 MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET, BY END-USER

11.1 OVERVIEW

11.2 PASSENGER CARS

11.3 COMMERCIAL VEHICLES

11.4 TWO-WHEELERS

11.5 AGRICULTURE VEHICLES

11.6 OFF-HIGHWAY VEHICLES

11.7 OTHERS

12 MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

13 MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 VISTEON CORPORATION

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 INFINEON TECHNOLOGIES AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 CONTINENTAL AG

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 ROBERT BOSCH GMBH

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 RENESAS ELECTRONICS CORPORATION.

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 RECENT DEVELOPMENT

15.6 APTIV

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 ALPS ALPINE CO., LTD

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 DENSO CORPORATION

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 DELPHI TECHNOLOGIES (BORGWARNER INC)

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 DONGFENG MOTOR PARTS (GROUP) CO., LTD.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 EMBITEL

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 HARMAN INTERNATIONAL.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 IAC GROUP

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 LUXOFT, A DXC TECHNOLOGY COMPANY

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 MINI METERS MANUFACTURING CO. PVT. LTD.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 MARELLI HOLDINGS CO., LTD.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 NIPPON SEIKI CO., LTD

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 PARKER HANNIFIN CORP

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 PANASONIC CORPORATION

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 PRICOL LIMITED

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

15.21 SIMCO LTD

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 SPARK MINDA

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENTS

15.23 TEXAS INSTRUMENTS INCORPORATED

15.23.1 COMPANY SNAPSHOT

15.23.2 REVENUE ANALYSIS

15.23.3 PRODUCT PORTFOLIO

15.23.4 RECENT DEVELOPMENT

15.24 YAZAKI CORPORATION

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA SPEEDOMETER IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA SPEEDOMETER IN INSTRUMENT CLUSTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA TACHOMETER IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA ODOMETER IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA ODOMETER IN INSTRUMENT CLUSTER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA OIL PRESSURE GAUGE IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA COOLANT TEMPERATURE GAUGE IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA OTHERS IN INSTRUMENT CLUSTER MARKET, BY REGION, 2022-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA ICE VEHICLE IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA BATTERY ELECTRIC VEHICLE (BEV) IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA HYBRID ELECTRIC VEHICLE (HEV) IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA PLUG-IN ELECTRIC VEHICLE (PHEV) IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA FUEL CELL ELECTRIC VEHICLE (FCEV) IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA HYBRID IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA DIGITAL IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA DIGITAL IN INSTRUMENT CLUSTER MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA DIGITAL IN INSTRUMENT CLUSTER MARKET, BY DISPLAY SIZE, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA DIGITAL IN INSTRUMENT CLUSTER MARKET, BY EMBEDDED TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA ANALOG IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA LARGE SCALE ORGANIZATIONS IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA SEMI-URBAN MID SCALE ORGANIZATIONS IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA SMALL SCALE ORGANIZATIONS IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA PASSENGER CARS IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA COMMERCIAL VEHICLES IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA TWO-WHEELERS IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA AGRICULTURE VEHICLES IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA OFF-HIGHWAY VEHICLES IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA OTHERS IN INSTRUMENT CLUSTER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA INSTRUMENT CLUSTER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET : DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET: SEGMENTATION

FIGURE 11 RISING DEMAND FOR COMPLETE DIGITAL COCKPIT IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET IN THE FORECAST PERIOD OF 2022 -2029

FIGURE 12 SPEEDOMETER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND BE THE FASTEST-GROWING REGION IN THE MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 BELOW IS THE ESTIMATED PRICE OF THE VARIOUS COMPONENT OF THE INSTRUMENT CLUSTER (USD)

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET

FIGURE 16 CONSUMER AND GOVERNMENT SPENDING ON ELECTRIC CARS, 2016-2020 (USD BILLION)

FIGURE 17 MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET: BY UTILITY, 2021

FIGURE 18 MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET: BY VEHICLE TYPE, 2021

FIGURE 19 MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET: BY TECHNOLOGY, 2021

FIGURE 20 MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET: BY ENTERPRISE SIZE, 2021

FIGURE 21 MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET: BY END USER, 2021

FIGURE 22 MIDDLE EAST AND AFRICA INSTRUMENT CLUSTER MARKET: SNAPSHOT (2021)

FIGURE 23 MIDDLE EAST AND AFRICA INSTRUMENT CLUSTER MARKET: BY COUNTRY (2021)

FIGURE 24 MIDDLE EAST AND AFRICA INSTRUMENT CLUSTER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 MIDDLE EAST AND AFRICA INSTRUMENT CLUSTER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 MIDDLE EAST AND AFRICA INSTRUMENT CLUSTER MARKET: BY RAW MATERIAL (2022-2029)

FIGURE 27 MIDDLE EAST & AFRICA INSTRUMENT CLUSTER MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。