Middle East And Africa Insoluble Sulfur Market For Automotive Sector

市场规模(十亿美元)

CAGR :

%

USD

16,771.78 Thousand

USD

24,480.74 Thousand

2022

2030

USD

16,771.78 Thousand

USD

24,480.74 Thousand

2022

2030

| 2023 –2030 | |

| USD 16,771.78 Thousand | |

| USD 24,480.74 Thousand | |

|

|

|

中东和非洲汽车行业不溶性硫磺市场,按等级(常规等级、高分散等级、高稳定性等级和特殊等级)、产品(充油不溶性硫磺和非充油不溶性硫磺)、应用(轮胎和非轮胎)划分 - 行业趋势和预测到 2030 年。

中东和非洲汽车行业不溶性硫磺市场分析及规模

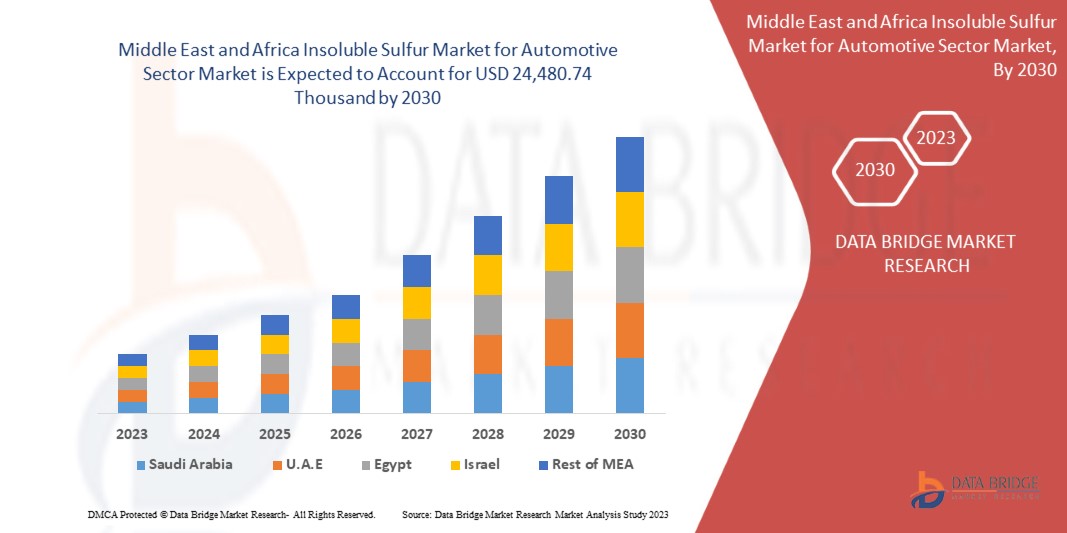

Data Bridge Market Research 分析,中东和非洲汽车领域不溶性硫磺市场规模预计将从 2022 年的 16,771.78 万美元增至 2030 年的 24,480.74 万美元,在 2023 年至 2030 年的预测期内,复合年增长率将达到 4.9%。

中东和非洲汽车行业不溶性硫磺市场报告提供了市场份额、新发展和国内和本地市场参与者影响的详细信息,分析了新兴收入来源、市场法规变化、产品审批、战略决策、产品发布、地域扩张和市场技术创新方面的机会。要了解分析和市场情况,请联系我们获取分析师简报。我们的团队将帮助您创建收入影响解决方案,以实现您的预期目标。

|

报告指标 |

细节 |

|

预测期 |

2023 至 2030 年 |

|

基准年 |

2022 |

|

历史年份 |

2021(可定制为 2015 - 2020) |

|

定量单位 |

收入(千美元) |

|

涵盖的领域 |

等级(普通等级、高分散等级、高稳定性等级和特殊等级)、产品(充油不溶性硫和非充油不溶性硫)、应用(轮胎和非轮胎) |

|

覆盖国家 |

沙特阿拉伯、南非、埃及、以色列、阿拉伯联合酋长国以及中东和非洲其他地区 |

|

涵盖的市场参与者 |

Grupa Azoty、四国化学株式会社(四国化成控股株式会社的子公司)、FLEXSYS、Lions Industries sro、中国尚舜化工控股、东方碳素化学有限公司、朗盛、Joss Elastomers & Chemicals、三新化学工业株式会社、Leader Technologies 有限公司、无锡华盛橡胶技术有限公司等 |

市场定义

不溶性硫磺(IS)是一种不溶于CS2的硫聚合物,可作为橡胶的硫化剂。它有两种类型,即充油型和非充油型。它是橡胶添加剂的重要组成部分。它提高了产品的耐磨性和抗疲劳性和老化性。除了被公认为最好的硫化剂外,它还用于生产乳胶、所有类型的汽车橡胶部件、胶管、鞋、电缆和电线绝缘材料以及带轮。因此,具有不喷霜特性的IS经常用于生产子午线橡胶和其他合成橡胶制品,以及生产普通硫磺含量较大的浅色橡胶制品。

中东和非洲汽车行业不溶性硫磺市场市场动态

本节旨在了解市场驱动因素、机遇、限制和挑战。以下内容将详细讨论所有这些内容:

驱动程序

- 全球轮胎制造和销售大量使用不溶性硫磺

随着公路车辆数量的增加和行驶距离的增加,对方便且低维护的轮胎更换的需求也随之增加。因此,全球轮胎的生产、销售和需求都在大幅增长。因此,对高效轮胎的需求日益增长。在橡胶工业中,不溶性硫主要用作促进剂和硫化剂。它使橡胶能够更牢固地粘附,防止橡胶分解,并提高耐热性和轮胎磨损性。出于这些原因,它是轮胎制造中的关键原材料。因此,轮胎生产大量使用不溶性硫。此外,轮胎的需求、制造和销售有可能成为市场扩张的主要驱动力。

- 全球道路车辆使用数量的增长

汽车行业是一个关键的经济指标,正处于重大技术进步的边缘。目前,汽车行业正受到客户对独特和昂贵功能的需求的驱动。汽车行业有可能刺激经济各个领域的活动并创造就业机会,包括汽车、轮胎、配件、物流、贸易和金融服务的生产。城市化进程加快、人口增长、可支配收入增加以及获得信贷和融资的便利是汽车行业扩张的主要驱动力。在全球范围内,客户使用乘用车、卡车、电动汽车、两轮车和三轮车等多用途车辆,这推动了市场的增长。由于汽车销量上升和全球公路汽车数量的增加,对新轮胎和方便、低维护的轮胎更换的需求激增。因此,它将大大促进轮胎的制造和消费。由于生产橡胶和轮胎的主要固化成分是不溶性硫,汽车行业有可能成为市场扩张的主要驱动力。

机会

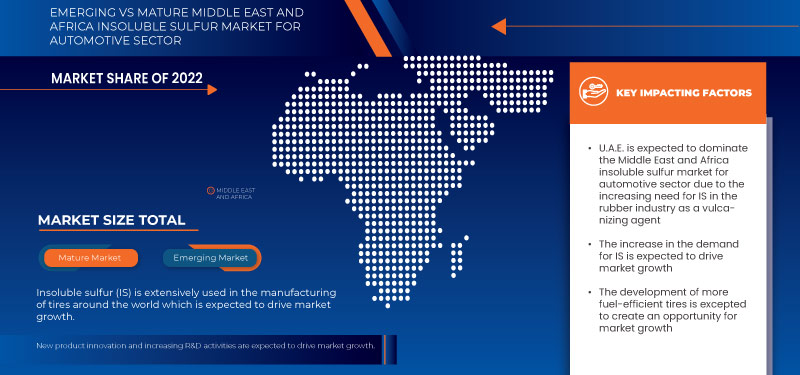

- 新产品创新和研发活动增加

不溶性硫磺阻止周围橡胶层中的橡胶移动。在顺式橡胶和丁基橡胶制成的橡胶化合物中,常规硫磺的迁移速度特别快;但是,可以通过添加不溶性硫磺来防止这种情况。固化过程加快。当达到硫化温度时,会发生称为活化或链解聚的步骤。此阶段加速硫化并降低硫含量。

不溶性硫磺虽然有很多优点,但也存在一些缺点,例如需要使用危险化学品、工艺复杂、硫和硫化碳含量高。制造商需要增加研发投入和专业知识,为现有生产线开发新产品,建设新设施,与其他参与者合作,并推出新产品以克服这些缺点。

此外,公司还可投入资金研发环保绿色技术,创新出更高效的产品,有望为市场增长创造绝佳机会。

克制/挑战

- 严格的规章制度

人们越来越担心在制造过程中使用危险化学品,这导致不溶性硫磺行业实施了严格的规则和法规。这些准则和法律涵盖了特定化学品作为原材料的使用,包括硫磺、二硫化碳和碳氢化合物油。此外,针对轮胎等橡胶产品制定的规则和法规也起着重要的制约因素作用。

尽管这些严格的规则和规定对于减少环境健康问题至关重要,但它们会干扰原材料、化学品、生产工艺和技术的使用。因此,制造商将被迫采取相应的措施,这可能会导致生产价格和所需投资增加,进而通过增加产品成本来影响难以解决的市场。

合成橡胶的生产和使用会对环境产生负面影响,因为它会消耗能源、使用化石燃料作为原材料、向空气和水中排放二氧化碳以及产生废弃物。这些物质不易生物降解,因此当废水排入水中时,会消耗海洋中的氧气含量,并增加可能危害海洋生物的毒素含量。

轮胎不会分解。轮胎可能会将化学物质泄漏到空气、地面和水中,当这些化学物质在垃圾填埋场或废品场堆积时,可能会破坏生态系统。如果轮胎着火,有毒的黑烟可能会释放到大气中。轮胎制造中使用的许多化学物质都包含在这种烟雾中。大多数轮胎材料来自化石燃料。它们极易燃烧,一旦着火就很难扑灭。一堆燃烧的轮胎可能会持续燃烧数月,直到燃料耗尽。

最新动态

- 2022 年 10 月,中国尚舜化工控股推出 MBT 项目,该项目涉及新技术,可帮助他们分阶段增加产量以满足需求。

- 2022年5月,FLEXSYS业务参加了德国汉诺威的“2022年轮胎技术博览会”。这将展示不溶性硫磺市场的新技术发展,也将提高公司在市场上的声誉。

- 2021 年 12 月,OCCL 启动了其不溶性硫磺产能扩张的第一阶段,产能为 5,500 MTPA。这些 IS 产品以“DIAMOND SULF”的名称出售,主要用作轮胎行业的硫化剂。

- 2021 年 11 月,以价值为导向、以运营为重点的私募股权公司 One Rock Capital Partners, LLC 今天宣布,其一家附属公司已成功完成之前宣布的对伊士曼化学公司轮胎添加剂业务 FLEXSYS 的收购。伊士曼化学公司是轮胎行业必不可少的特种化学品的领导者,拥有全球资产足迹和一流的技术服务。

中东和非洲汽车行业不溶性硫磺市场市场范围

中东和非洲汽车行业不溶性硫磺市场根据等级、产品和应用分为三个显著的细分市场。这些细分市场之间的增长将帮助您分析行业的主要增长细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策,确定核心市场应用。

年级

- 普通成绩

- 高分散等级

- 高稳定性等级

- 特殊等级

根据等级,市场分为常规等级、高分散等级、高稳定性等级和特殊等级。

产品

- 充油不溶性硫磺

- 非充油不溶性硫磺

根据产品,市场分为充油不溶性硫磺和非充油不溶性硫磺。

应用

- 胎

- 非轮胎

根据应用,市场分为轮胎市场和非轮胎市场。

中东和非洲汽车行业不溶性硫磺市场区域分析/见解

中东和非洲汽车不溶性硫磺市场根据等级、产品和应用分为三个显著的部分。

本市场报告涉及的国家包括沙特阿拉伯、沙特阿拉伯、南非、埃及、以色列、阿拉伯联合酋长国以及中东和非洲其他地区。

由于橡胶行业对 IS 作为硫化剂的需求不断增加,阿拉伯联合酋长国有望主导中东和非洲汽车领域的不溶性硫磺市场。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。数据点下游和上游价值链分析、技术趋势、波特五力分析和案例研究是用于预测各个国家市场情景的一些指标。此外,在提供国家数据的预测分析时,还考虑了区域品牌的存在和可用性以及它们因来自本地和国内品牌的大量或稀缺竞争而面临的挑战、国内关税的影响和贸易路线。

中东和非洲汽车不溶性硫磺市场竞争格局及份额分析

中东和非洲汽车行业不溶性硫磺市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、生产基地和设施、公司优势和劣势、产品发布、产品试验渠道、产品批准、专利、产品宽度和广度、应用优势和技术生命线曲线。以上提供的数据点仅与公司对市场的关注有关。

该市场的一些主要市场参与者包括 Grupa Azoty、四国化学株式会社(四国化成控股株式会社的子公司)、FLEXSYS、Lions Industries sro、中国尚舜化学控股、东方碳素化学有限公司、朗盛、Joss Elastomers & Chemicals、三新化学工业株式会社、Leader Technologies 有限公司、无锡华盛橡胶技术有限公司等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 GRADE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THE THREAT OF SUBSTITUTES

4.2.3 CUSTOMER BARGAINING POWER

4.2.4 SUPPLIER BARGAINING POWER

4.2.5 INTERNAL COMPETITION (RIVALRY)

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT’S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 SUPPLY CHAIN ANALYSIS

4.4.1 OVERVIEW

4.4.2 LOGISTIC COST SCENARIO

4.4.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.5 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.6 IMPORT EXPORT SCENARIO

4.7 PRICE ANALYSIS

4.8 PRODUCTION CONSUMPTION ANALYSIS

4.9 RAW MATERIAL COVERAGE

4.1 TIRE MARKET- VOLUME DEMAND

4.11 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 WORLDWIDE INCREASE IN THE NUMBER OF ON-ROAD VEHICLES UTILIZATION

6.1.2 MANUFACTURING AND SALES OF TIRES AROUND THE WORLD MAKES USE OF INSOLUBLE SULFUR EXTENSIVELY

6.1.3 INCREASING NEED FOR INSOLUBLE SULFUR FROM THE RUBBER INDUSTRY AS A VULCANIZING AGENT

6.2 RESTRAINTS

6.2.1 VOLATILITY IN RAW MATERIAL PRICES AFFECTING THE COST OF PRODUCTS

6.2.2 STRINGENT RULES AND REGULATIONS

6.3 OPPORTUNITIES

6.3.1 NEW PRODUCT INNOVATION AND INCREASING R&D ACTIVITIES

6.3.2 DEVELOPMENT OF MORE FUEL-EFFICIENT TIRES

6.4 CHALLENGE

6.4.1 ENVIRONMENTAL AND ECONOMIC ISSUES

7 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY REGION

7.1 MIDDLE EAST AND AFRICA

7.1.1 UNITED ARAB EMIRATES

7.1.2 SAUDI ARABIA

7.1.3 EGYPT

7.1.4 SOUTH AFRICA

7.1.5 ISRAEL

7.1.6 REST OF MIDDLE EAST AND AFRICA

8 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

8.2 FACILITY EXPANSION

8.3 ACQUISITION

8.4 EVENT

9 COMPANY PROFILES

9.1 ORIENTAL CARBON AND CHEMICALS LIMITED

9.1.1 COMPANY SNAPSHOT

9.1.2 REVENUE ANALYSIS

9.1.3 COMPANY SHARE ANALYSIS

9.1.4 PRODUCT PORTFOLIO

9.1.5 SWOT ANALYSIS

9.1.6 RECENT DEVELOPMENT

9.2 SHIKOKU CHEMICALS CORPORATION. (SUBSIDIARY OF SHIKOKU KASEI HOLDINGS CORPORATION.)

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 COMPANY SHARE ANALYSIS

9.2.4 SWOT ANALYSIS

9.2.5 PRODUCT PORTFOLIO

9.2.6 RECENT DEVELOPMENTS

9.3 LANXESS

9.3.1 COMPANY SNAPSHOT

9.3.2 COMPANY SHARE ANALYSIS

9.3.3 PRODUCT PORTFOLIO

9.3.4 REVENUE ANALYSIS

9.3.5 SWOT ANALYSIS

9.3.6 RECENT DEVELOPMENTS

9.4 JOSS ELASTOMERS AND CHEMICALS

9.4.1 COMPANY SNAPSHOT

9.4.2 COMPANY SHARE ANALYSIS

9.4.3 PRODUCT PORTFOLIO

9.4.4 SWOT

9.4.5 RECENT DEVELOPMENTS

9.5 LEADER TECHNOLOGIES CO., LTD

9.5.1 COMPANY SNAPSHOT

9.5.2 COMPANY SHARE ANALYSIS

9.5.3 PRODUCT PORTFOLIO

9.5.4 SWOT

9.5.5 RECENT DEVELOPMENTS

9.6 ALBEMARLE CORPORATION

9.6.1 COMPANY SNAPSHOT

9.6.2 REVENUE ANALYSIS

9.6.3 SWOT ANALYSIS

9.6.4 RECENT DEVELOPMENT

9.7 MIDDLE EAST & AFRICA SUNSINE CHEMICAL HOLDINGS.

9.7.1 COMPANY SNAPSHOT

9.7.2 REVENUE ANALYSIS

9.7.3 PRODUCT PORTFOLIO

9.7.4 SWOT ANALYSIS

9.7.5 RECENT DEVELOPMENT

9.8 FLEXSYS

9.8.1 COMPANY SNAPSHOT

9.8.2 SWOT ANALYSIS

9.8.3 PRODUCT PORTFOLIO

9.8.4 RECENT DEVELOPMENTS

9.9 GRUPA AZOTY.

9.9.1 COMPANY SNAPSHOT

9.9.2 REVENUE ANALYSIS

9.9.3 SWOT ANALYSIS

9.9.4 PRODUCT PORTFOLIO

9.9.5 RECENT DEVELOPMENTS

9.1 LIONS INDUSTRIES S.R.O.

9.10.1 COMPANY SNAPSHOT

9.10.2 SWOT ANALYSIS

9.10.3 PRODUCT PORTFOLIO

9.10.4 RECENT DEVELOPMENTS

9.11 NYNAS AB

9.11.1 COMPANY SNAPSHOT

9.11.2 REVENUE ANALYSIS

9.11.3 SWOT ANALYSIS

9.11.4 RECENT DEVELOPMENTS

9.12 SANSHIN CHEMICAL INDUSTRY CO., LTD.

9.12.1 COMPANY SNAPSHOT

9.12.2 PRODUCT PORTFOLIO

9.12.3 SWOT

9.12.4 RECENT DEVELOPMENTS

9.13 WUXI HUASHENG RUBBER TECHNICAL CO., LTD

9.13.1 COMPANY SNAPSHOT

9.13.2 PRODUCT PORTFOLIO

9.13.3 SWOT

9.13.4 RECENT DEVELOPMENTS

10 QUESTIONNAIRE

11 RELATED REPORTS

表格列表

TABLE 1 REGULATORY COVERAGE

TABLE 2 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY COUNTRY, 2021-2030 (TONS)

TABLE 4 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (TONS)

TABLE 6 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 8 UNITED ARAB EMIRATES INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 9 UNITED ARAB EMIRATES INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (TONS)

TABLE 10 UNITED ARAB EMIRATES INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 11 UNITED ARAB EMIRATES INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 12 SAUDI ARABIA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 13 SAUDI ARABIA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (TONS)

TABLE 14 SAUDI ARABIA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 15 SAUDI ARABIA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 16 EGYPT INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 17 EGYPT INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (TONS)

TABLE 18 EGYPT INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 19 EGYPT INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 20 SOUTH AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 21 SOUTH AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (TONS)

TABLE 22 SOUTH AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 23 SOUTH AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 24 ISRAEL INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 25 ISRAEL INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (TONS)

TABLE 26 ISRAEL INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 27 ISRAEL INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 28 REST OF MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 29 REST OF MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (TONS)

图片列表

FIGURE 1 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR

FIGURE 2 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: THE GRADE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: SEGMENTATION

FIGURE 14 WORLDWIDE INCREASE IN THE NUMBER OF ON-ROAD VEHICLES UTILIZATION IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR IN THE FORECAST PERIOD

FIGURE 15 THE REGULAR GRADES IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR IN 2023 AND 2030

FIGURE 16 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 17 PRICE ANALYSIS FOR THE MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR (USD/KG)

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR

FIGURE 20 NUMBER OF CAR SALES IN THE U.S. FROM 2018 TO 2022 (IN MILLION)

FIGURE 21 NUMBER OF PASSENGER CAR SALES IN EUROPE FROM 2017 TO 2021 (IN MILLION)

FIGURE 22 REVENUE OF THE MIDDLE EAST & AFRICA TOP TIRE MANUFACTURING COMPANIES (IN USD MILLION)

FIGURE 23 MIDDLE EAST & AFRICA SUNSINE CHEMICAL HOLDINGS LTD. INSOLUBLE SULFUR SALES VOLUME (IN TONS)

FIGURE 24 MIDDLE EAST AND AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: SNAPSHOT (2022)

FIGURE 25 MIDDLE EAST AND AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: BY COUNTRY (2022)

FIGURE 26 MIDDLE EAST AND AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: BY COUNTRY (2023 & 2030)

FIGURE 27 MIDDLE EAST AND AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: BY COUNTRY (2022 & 2030)

FIGURE 28 MIDDLE EAST AND AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: BYGRADE (2023-2030)

FIGURE 29 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: COMPANY SHARE 2022 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。