Middle East And Africa Hydrophobic Coatings Market

市场规模(十亿美元)

CAGR :

%

USD

185.09 Million

USD

257.23 Million

2025

2033

USD

185.09 Million

USD

257.23 Million

2025

2033

| 2026 –2033 | |

| USD 185.09 Million | |

| USD 257.23 Million | |

|

|

|

|

中東和非洲疏水塗料市場細分,按產品(聚矽氧烷、氟聚合物、氟烷基矽烷、二氧化鈦及其他)、基材類型(金屬、玻璃、聚合物、陶瓷、混凝土和紡織品)、塗層層數(單層和多層)、施工方法(浸塗、刷塗、輥塗、噴塗及其他)、功能(防腐蝕浸塗)、功能性(防腐蝕性、抗菌、防污、防冰/潤濕、自清潔及其他)、等級(食品級、工業級及其他)、分銷渠道(線下和線上)、最終用戶(汽車、電子、建築、船舶、紡織、醫療保健、航空航天、石油天然氣、食品飲料及其他)劃分——行業趨勢及至2033年的預測

中東和非洲疏水塗料市場規模

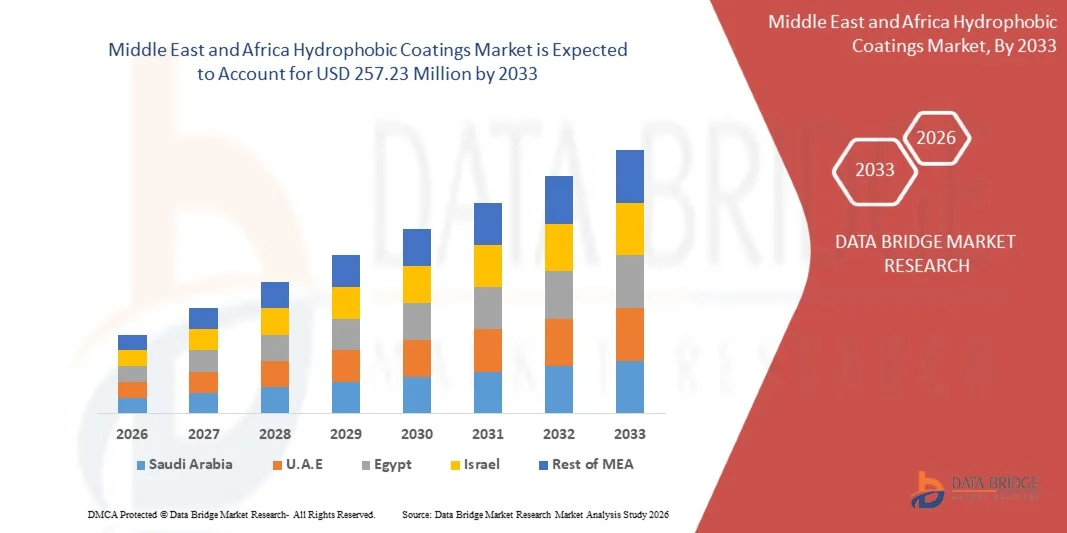

- 2025年中東和非洲疏水塗料市場規模為1.8509億美元,預計到2033年將達到2.5723億美元,預測期內 複合年增長率為4.2%。

- 市場成長主要得益於汽車、電子、建築和航空航天等行業對防護塗層的需求不斷增長,這些行業對錶面防水、耐腐蝕和耐久性的要求較高。

- 此外,消費者和工業界日益關注永續性、衛生和低維護表面,這推動了先進疏水塗層的應用,使其成為高性能和環保應用的關鍵解決方案。這些因素共同加速了疏水塗層的普及,顯著促進了市場成長。

中東和非洲疏水塗料市場分析

- 疏水塗層具有防水、自清潔、防腐蝕和抗菌等特性,在多種工業和商業應用中,對於提高表面的耐久性、安全性和功能性至關重要。

- 疏水塗層需求的不斷增長主要得益於塗層材料的技術進步、日益嚴格的監管和環境合規要求,以及對多功能、低維護、高性能表面處理的需求不斷增加。

- 由於快速的工業化、廣泛的基礎設施建設以及汽車、建築和電子行業對防水防腐塗料日益增長的需求,沙烏地阿拉伯預計將在2025年主導中東和非洲疏水塗料市場。

- 由於阿聯酋基礎設施不斷擴建、房地產和建築業蓬勃發展,以及商業和工業資產對先進防護塗料的需求日益增長,預計該國將在預測期內成為中東和非洲疏水塗料市場成長最快的國家。

- 聚矽氧烷憑藉其優異的防水性能、耐化學腐蝕性和對各種基材的適應性,在2025年佔據了市場主導地位,市佔率超過40%。這些塗料因其長期耐久性和保持表面美觀的能力而廣泛應用於汽車、電子和建築行業。聚矽氧烷還具有易於施工和相容多種塗裝方法的優點,從而提高了作業效率。它們能夠形成薄而透明的塗層,且不會改變基材的外觀,這進一步增強了其市場吸引力。該領域完善的供應鏈和廣泛的工業應用進一步鞏固了其市場主導地位。

報告範圍及中東及非洲疏水塗料市場細分

|

屬性 |

疏水塗層關鍵市場洞察 |

|

涵蓋部分 |

|

|

覆蓋國家/地區 |

中東和非洲

|

|

主要市場參與者 |

|

|

市場機遇 |

|

|

加值資料資訊集 |

除了對市場狀況(如市場價值、成長率、細分、地理覆蓋範圍和主要參與者)的洞察之外,Data Bridge Market Research 精心編制的市場報告還包括進出口分析、產能概覽、生產消費分析、價格趨勢分析、氣候變遷情境、供應鏈分析、價值鏈分析、原材料/消耗標準概覽、供應商選擇、PESTLE 分析、五力分析和監管框架。 |

中東和非洲疏水塗料市場趨勢

“自清潔和多功能塗層的應用日益廣泛”

- 中東和非洲疏水塗料市場的一個顯著趨勢是,各行業對自清潔和多功能塗料的應用日益廣泛。這主要是由於市場需要能夠防水、防塵、防污染且能提高產品耐久性的表面。這些塗料透過減少維護需求和延長資產壽命,提升了汽車、電子和建築等行業的性能。

- 例如,P2i 和 3M 等公司為消費性電子產品和醫療器材提供先進的疏水塗層,可防止水滲入和表面污垢堆積。此類解決方案可延長設備使用壽命,並提高使用者在潮濕和顆粒物環境中的使用便利性。

- 隨著應用於擋風玻璃、感測器和車身面板的疏水塗層能夠提升車輛的可見度、安全性和耐腐蝕性,汽車產業對疏水塗層的應用正在加速。這使得疏水塗層成為現代車輛性能和乘客保護的關鍵要素。

- 在電子產品和穿戴式裝置領域,疏水塗層正被用於保護敏感元件免受水和汗水的損害。這一趨勢使得製造商能夠提供可靠耐用的產品,以滿足消費者對堅固耐用設備日益增長的需求。

- 建築和建材行業越來越多地在玻璃、混凝土和金屬表面採用疏水塗層,以防止水漬和污漬。這促使人們傾向於選擇既能提供長期保護又能保持美觀的塗層。

- 專注於能源和基礎設施的產業正在將疏水塗層應用於渦輪機、管道和太陽能電池板,以提高效率並降低維護成本。此類塗層的日益普及正在鞏固市場成長,並使其成為延長設備使用壽命的關鍵因素。

中東和非洲疏水塗料市場動態

司機

“關鍵行業對耐腐蝕和防水塗料的需求不斷增長”

- The growing need for corrosion and water-resistant surfaces across automotive, electronics, and industrial equipment is driving the Middle East and Africa Hydrophobic Coatings Market. These coatings protect high-value assets from environmental degradation, extending operational life and reducing repair costs

- For instance, PPG Industries supplies specialized hydrophobic coatings for automotive and aerospace applications that enhance corrosion resistance under extreme conditions. These coatings enable manufacturers to deliver safer, longer-lasting products and meet stringent regulatory standards

- The electronics industry increasingly relies on hydrophobic coatings to prevent moisture-induced failures in sensitive devices such as smartphones, wearables, and medical equipment. This adoption is fostering innovation in nanocoatings and protective surface treatments

- Industrial machinery and heavy equipment benefit from hydrophobic coatings that reduce rust and surface wear, improving equipment uptime and productivity. This is driving adoption across sectors where operational continuity is critical

- The renewable energy sector is leveraging hydrophobic coatings for wind turbines, solar panels, and hydro equipment to improve efficiency and minimize water-related damage. The ongoing demand for resilient coatings is sustaining market expansion and positioning them as essential for asset protection

Restraint/Challenge

“High Cost and Complex Application of Advanced Coatings”

- The Middle East and Africa Hydrophobic Coatings Market faces challenges due to the high cost of advanced formulations and the intricate application processes required for optimal performance. These factors limit adoption, particularly in price-sensitive segments and small-scale industries

- For instance, companies such as P2i use precision vapor deposition techniques to apply nanocoatings on electronics, which require specialized equipment and skilled personnel. The complexity of these processes increases production expenses and restricts large-scale deployment

- Achieving uniform coating thickness and adhesion on diverse surfaces requires rigorous process control, further elevating operational costs and extending production timelines

- The reliance on high-purity chemicals and nanomaterials increases supply chain sensitivity and affects cost stability, creating challenges in maintaining competitive pricing

- Scaling hydrophobic coatings for industrial and consumer applications while ensuring consistent quality remains a key constraint. These challenges collectively compel manufacturers to invest in process optimization and cost reduction strategies to meet growing demand while maintaining performance standards

Middle East and Africa Hydrophobic Coatings Market Scope

The market is segmented on the basis of product, substrate type, coating layer, application method, function, grade, distribution channel, and end-user.

• By Product

On the basis of product, the Middle East and Africa Hydrophobic Coatings Market is segmented into polysiloxanes, fluoropolymers, fluoro-alkylsilanes, titanium dioxide, and others. The polysiloxanes segment dominated the market with the largest revenue share of over 40% in 2025, driven by their excellent water-repellent properties, chemical resistance, and adaptability across various substrates. These coatings are widely preferred in automotive, electronics, and construction applications for their long-term durability and ability to maintain surface aesthetics. Polysiloxanes also offer easy application and compatibility with multiple coating methods, enhancing operational efficiency. Their versatility in forming thin, transparent layers without altering the substrate’s appearance adds to their market preference. The segment’s established supply chains and wide industrial adoption further consolidate its dominance.

The fluoropolymers segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising demand in advanced electronics, aerospace, and marine applications. For instance, Chemours has expanded its Teflon-based hydrophobic coatings portfolio to meet industrial requirements for high-performance, corrosion-resistant surfaces. Fluoropolymers provide superior chemical inertness and thermal stability, making them ideal for harsh environments. Their low surface energy properties enable effective anti-fouling and self-cleaning capabilities. Increasing investments in R&D for next-generation fluoropolymer coatings also drive rapid adoption. The segment benefits from a growing preference for high-end, long-lasting protective coatings across multiple industries.

• By Substrate Type

On the basis of substrate type, the Middle East and Africa Hydrophobic Coatings Market is segmented into metal, glass, polymer, ceramics, concrete, and textiles. The metal substrate segment dominated the market in 2025, owing to extensive use in automotive, aerospace, and construction industries requiring corrosion-resistant and water-repellent surfaces. Metal substrates benefit from enhanced durability and performance when coated with hydrophobic layers, prolonging the lifecycle of critical components. Industrial standards and regulations further favor metal coatings for protective applications. Their compatibility with various coating methods and ability to maintain structural integrity drive continued adoption. The segment’s established industrial presence contributes to its sustained market leadership.

The glass substrate segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising adoption of smart windows, solar panels, and consumer electronics. For instance, PPG Industries has developed advanced hydrophobic coatings for architectural glass to enhance water repellency and self-cleaning properties. These coatings improve visibility and reduce maintenance costs in residential and commercial buildings. Glass substrates coated with hydrophobic layers also offer anti-fouling benefits for automotive windshields. Increased urbanization and smart building trends fuel demand for treated glass surfaces. The segment grows rapidly due to technological advancements and rising awareness of energy-efficient solutions.

• By Coating Layer

On the basis of coating layer, the Middle East and Africa Hydrophobic Coatings Market is segmented into single layer and multi-layer. The single-layer segment dominated the market in 2025, driven by cost-effectiveness, ease of application, and suitability for large-scale industrial deployment. Single-layer coatings are widely used in automotive, electronics, and building applications for surface protection without significantly altering substrate dimensions. Their simplicity ensures consistent performance and minimal production downtime. The segment benefits from established manufacturing practices and compatibility with conventional coating methods. Single-layer solutions also offer reliable hydrophobicity while reducing material waste. Their versatility across applications contributes to market dominance.

The multi-layer segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for high-performance and multifunctional coatings. For instance, AkzoNobel has introduced multi-layer hydrophobic coatings for marine applications to combine anti-corrosion, anti-fouling, and self-cleaning functions. Multi-layer systems enhance durability, thermal resistance, and surface performance in challenging environments. The segment gains traction in aerospace, electronics, and industrial machinery sectors where advanced protection is essential. Rising R&D investments for multifunctional coatings accelerate adoption. Multi-layer solutions cater to the demand for high-end, engineered surface treatments.

• By Application Method

On the basis of application method, the Middle East and Africa Hydrophobic Coatings Market is segmented into dip coating, brushing, roll coating, spraying, and others. The spraying segment dominated the market in 2025, driven by its efficiency in coating complex geometries and large surfaces uniformly. Spraying offers precise control over coating thickness and reduces material wastage, making it suitable for automotive and construction applications. Industrial-scale adoption and mechanization enhance throughput and ensure consistent quality. Spraying methods also enable compatibility with multiple substrates and coating formulations. The segment’s established presence in commercial and industrial processes contributes to its market leadership.

The dip coating segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing use in small-scale manufacturing and specialized industrial applications. For instance, DuPont has leveraged dip coating techniques to apply hydrophobic layers on electronic components to enhance moisture resistance. Dip coating ensures uniform coverage and strong adhesion on intricate or irregularly shaped surfaces. The method is gaining popularity in textiles, electronics, and healthcare applications for its precision and efficiency. Rising demand for cost-effective and scalable coating processes supports growth. Dip coating also facilitates multifunctional coatings, driving faster adoption.

• By Function

On the basis of function, the Middle East and Africa Hydrophobic Coatings Market is segmented into anti-corrosion, anti-microbial, anti-fouling, anti-icing/wetting, self-cleaning, and others. The anti-corrosion segment dominated the market in 2025, driven by widespread industrial use in automotive, marine, oil & gas, and construction sectors requiring long-term protection against rust and degradation. Anti-corrosion coatings extend component lifespan and reduce maintenance costs, making them critical in infrastructure and industrial machinery. These coatings are preferred due to proven performance, regulatory compliance, and compatibility with diverse substrates. Anti-corrosion solutions also integrate well with other functional layers, enhancing overall surface protection. The segment’s established industrial relevance reinforces market dominance.

預計2026年至2033年間,自清潔領域將迎來最快的成長,這主要得益於建築玻璃、太陽能板和消費性電子產品領域對自清潔技術的日益普及。例如,聖戈班已開發出用於建築外牆的自清潔疏水塗層,旨在減少維護成本和用水量。這些塗層利用其超疏水特性,能夠自然地排斥污垢和污染物。快速的城市化和智慧建築趨勢推動了對低維護表面的需求。此外,人們對永續發展和資源效率的日益重視也促進了該領域的成長。奈米塗層技術的進步將進一步加速市場成長。

按年級

依等級劃分,中東和非洲疏水塗料市場可分為食品級、工業級和其他等級。預計到2025年,工業級疏水塗料將佔據市場主導地位,這主要得益於其在汽車、航空航太、建築和電子等行業的廣泛應用,這些行業對高性能防護塗層的需求日益增長。工業級疏水塗料在嚴苛的工況下仍能維持耐久性、熱穩定性和耐化學腐蝕性。由於符合業界標準並能帶來長期的營運效益,這些塗料備受青睞。該細分市場在製造中心的強大影響力以及穩健的供應鏈,為其持續佔據主導地位提供了有力支撐。此外,工業級塗料還可與多功能塗層集成,從而提升其應用價值。

受食品飲料產業對衛生、防水錶面需求不斷增長的推動,食品級塗料預計將在2026年至2033年間實現最快成長。例如,PPG公司開發了食品級疏水塗層,可防止加工設備中的細菌滋生,並簡化清潔工作。這些塗層符合安全法規,確保產品品質。食品加工產業對污染控制和衛生標準的日益重視推動了此類塗層的應用。隨著製造商越來越注重效率和安全性,該細分市場持續成長。食品級塗料還能延長設備使用壽命,同時盡量減少清潔工作量。

• 透過分銷管道

根據分銷管道,中東和非洲疏水塗料市場可分為線下和線上兩大板塊。預計到2025年,線下通路將佔據市場主導地位,這主要得益於成熟的供應鏈、完善的工業採購流程以及塗料產品技術支援的普及。工業買家通常更傾向於透過線下管道進行大量訂購、諮詢和客製化解決方案。線下分銷管道能夠實現產品的實際評估,並確保符合品質標準。該板塊受益於汽車、航空航天和建築等行業的製造商、分銷商和終端用戶之間建立的牢固關係。由於信任度和便捷性,線下通路仍然是疏水性塗料的主要銷售管道。

預計在2026年至2033年期間,線上通路將實現最快成長,這主要得益於電子商務的普及、B2B市場和數位化採購平台的蓬勃發展。例如,阿里巴巴已推動了用於工業和小規模應用的特殊疏水塗料的線上銷售。線上管道為買家提供了便利、更廣泛的覆蓋率和產品比較資訊。數位化程度的提高和遠端採購的普及推動了中小企業和全球買家對線上管道的接受度。隨著製造商擴大線上曝光度和進行直銷活動,該領域也將持續成長。線上分銷能夠幫助企業更快滲透市場,並觸及細分應用領域。

• 由最終用戶

根據最終用戶,中東和非洲疏水塗料市場可細分為汽車、電子、建築、船舶、紡織、醫療保健、航空航太、石油天然氣、食品飲料及其他行業。預計到2025年,汽車產業將佔據市場主導地位,這主要得益於消費者對車輛防護塗層的需求不斷增長,以增強其耐腐蝕性、防水性和表面耐久性。疏水性塗料不僅能提升車輛美觀度,還能減少維修成本,並支持永續的生產方式。汽車製造商正日益將塗層技術應用於高價值零件的生產流程。該行業成熟的產業基礎以及在乘用車、商用車和電動車領域的廣泛應用,進一步鞏固了其市場主導地位。消費者對低維護成本車輛的強烈偏好也為該產業的發展提供了強力支撐。

預計2026年至2033年間,電子產品領域將迎來最快的成長,這主要得益於智慧型手機、穿戴式裝置和工業電子產品的日益普及,這些產品對防潮和自清潔表面提出了更高的要求。例如,三星已在行動裝置中採用疏水塗層,以增強其防水性和可靠性。小型化趨勢、物聯網的普及以及對長期耐用性要求較高的高價值電子元件,都為該領域帶來了正面影響。消費者對設備保護意識的提升也推動了相關技術的快速普及。電子塗層也有助於實現設備的節能和免維護。隨著製造商不斷強調創新和產品差異化,該領域也將持續成長。

中東和非洲疏水塗料市場區域分析

- 沙烏地阿拉伯憑藉快速的工業化、廣泛的基礎設施建設以及汽車、建築和電子產業對防水防腐塗料日益增長的需求,在2025年佔據中東和非洲疏水塗料市場的主導地位,擁有最大的收入份額。

- 該國製造業和建築業的強勁成長,以及對耐用且易於維護表面的需求不斷增加,持續推動疏水塗層在商業、工業和住宅應用中的普及。

- The presence of regional and international suppliers, including PPG Industries and AkzoNobel, combined with rising deployment of advanced coating technologies, reinforces Saudi Arabia’s dominant position in the regional market while strengthening its leadership across multifunctional and self-cleaning surface protection applications

U.A.E. Middle East and Africa Hydrophobic Coatings Market Insight

The U.A.E. is projected to record the fastest CAGR in the Middle East and Africa Hydrophobic Coatings Market from 2026 to 2033, supported by the country’s expanding infrastructure, booming real estate and construction sectors, and rising adoption of advanced protective coatings for commercial and industrial assets. For instance, collaborations between global coating suppliers and U.A.E.-based distributors to provide high-performance, water-repellent, and corrosion-resistant coatings are enhancing adoption in buildings, automotive, and electronics manufacturing. Growing preference for multifunctional and long-lasting coatings, investments in modern industrial facilities, and focus on durability and maintenance reduction are accelerating market penetration, while sustainability initiatives and urban development projects further position the U.A.E. as the fastest-growing market in the region.

South Africa Middle East and Africa Hydrophobic Coatings Market Insight

South Africa is expected to experience steady growth between 2026 and 2033, driven by increasing industrialization, growth in construction, automotive, and electronics sectors, and rising adoption of surface-protective coatings to enhance product lifespan and operational efficiency. Modernization of small and mid-sized manufacturing units, combined with growing demand for reliable, long-lasting, and low-maintenance coatings, is boosting adoption of hydrophobic solutions. Partnerships between local and global suppliers, including AkzoNobel and Sherwin-Williams, along with the availability of high-performance hydrophobic coatings for industrial and commercial applications, are improving market coverage across urban and semi-urban regions. Government support for infrastructure development and increasing focus on sustainable and durable materials contribute to consistent long-term growth in South Africa’s Middle East and Africa Hydrophobic Coatings Market.

Middle East and Africa Hydrophobic Coatings Market Share

The hydrophobic coatings industry is primarily led by well-established companies, including:

- Nanofilm (U.S.)

- BASF SE (Germany)

- AccuCoat Inc. (U.S.)

- NeverWet, LLC (U.S.)

- Arkema (France)

- COTEC GmbH (Germany)

- P2i Ltd. (U.K.)

- PPG Industries, Inc. (U.S.)

- 3M (U.S.)

- Artekya Teknoloji (Turkey)

- The Sherwin-Williams Company (U.S.)

- Advanced Nanotech Lab (U.S.)

- AkzoNobel N.V. (Netherlands)

- Aculon Inc. (U.S.)

- UltraTech International, Inc. (U.S.)

- Nukote Coating Systems International (U.S.)

- Cytonix, LLC (U.S.)

Latest Developments in Middle East and Africa Hydrophobic Coatings Market

- In June 2024, NEI Corporation introduced NANOMYTE AM-100EC, a next-generation antimicrobial coating designed to offer superior protection against harmful microorganisms. This innovative product provides both antimicrobial functionality and easy-to-clean characteristics, making it highly suitable for applications in healthcare, food processing, and public hygiene environments. The AM-100EC coating is engineered to withstand rigorous cleaning protocols while maintaining its effectiveness, addressing the rising market demand for hygiene-focused and safe surfaces. The launch strengthens NEI’s position in the Middle East and Africa Hydrophobic Coatings Market by expanding offerings for antimicrobial and multi-functional coatings, reflecting the growing emphasis on public safety and regulatory compliance

- In March 2024, Mitsui Chemicals, Inc., in collaboration with German firm CADIS Engineering GmbH, introduced a digital printer designed to enhance advanced hydrophobic-coated automotive displays through its subsidiary COTEC GmbH. This innovation facilitates precise deposition of hydrophobic coatings on automotive electronic surfaces, improving water repellency, anti-fouling, and durability. The development is expected to accelerate adoption of hydrophobic coatings in automotive electronics, a fast-growing segment, by enabling more efficient and high-performance applications. It also reinforces the market trend toward integrating advanced coatings with digital manufacturing and smart vehicle technologies

- In February 2024, the Leibniz Institute for Plasma Science and Technology (INP) in Greifswald, Germany, developed a novel method for producing ultra-hydrophobic organosilicon polymer coatings. This approach provides an environmentally friendly alternative to per- and polyfluorinated compounds (PFAS), which are widely used but face increasing regulatory scrutiny. By reducing reliance on PFAS, this innovation addresses sustainability concerns in the Middle East and Africa Hydrophobic Coatings Market, promoting safer, eco-conscious solutions. The development supports market growth in industries prioritizing green coatings and positions organosilicon polymers as a key high-performance and regulatory-compliant solution

- 2023年7月,巴斯夫汽車OEM塗料業務在中國所有生產基地實現了100%再生能源利用,這是公司邁向淨零排放轉型的重要一步。透過再生能源直接購電、國際再生能源證書及其他策略,該計畫預計到2023年底將減少約1.9萬噸碳排放。這項里程碑彰顯了巴斯夫對永續發展的承諾,並與中東和非洲疏水性塗料市場產生共鳴,凸顯了市場對環保低碳解決方案日益增長的需求。該計劃透過使產品與全球永續發展趨勢保持一致,增強了巴斯夫的競爭優勢。

- 2022年9月,巴斯夫塗料在德國明斯特-希爾特魯普(Münster-Hiltrup)啟用了一座先進的電泳浸塗研究中心,致力於提升疏水塗層技術。該中心優先考慮安全性、效率和客戶特定製程的模擬,旨在推進該公司CathoGuard 800電泳塗層技術的發展。這項創新技術以其低溶劑含量和減少廢水排放,有效保護汽車表面免受腐蝕而聞名,並兼具高性能和環保優勢。該研究中心鞏固了巴斯夫在汽車疏水塗層領域的市場領先地位,協助開發滿足不斷發展的行業標準和客戶期望的先進環保解決方案。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。