中东和非洲健康与保健食品市场,按类型(功能性食品、强化和健康烘焙产品、健康零食、BFY 食品、饮料、巧克力等)、卡路里含量(无卡路里、低卡路里和减卡路里)、性质(非转基因和转基因)、脂肪含量(无脂肪、低脂肪和减脂肪)、类别(常规和有机)、不含类别(无麸质、无乳制品、无大豆、无坚果、无乳糖、无人工香料、无人工色素等)和分销渠道(商店零售商和非商店零售商)、行业趋势和预测到 2029 年

市场分析和见解

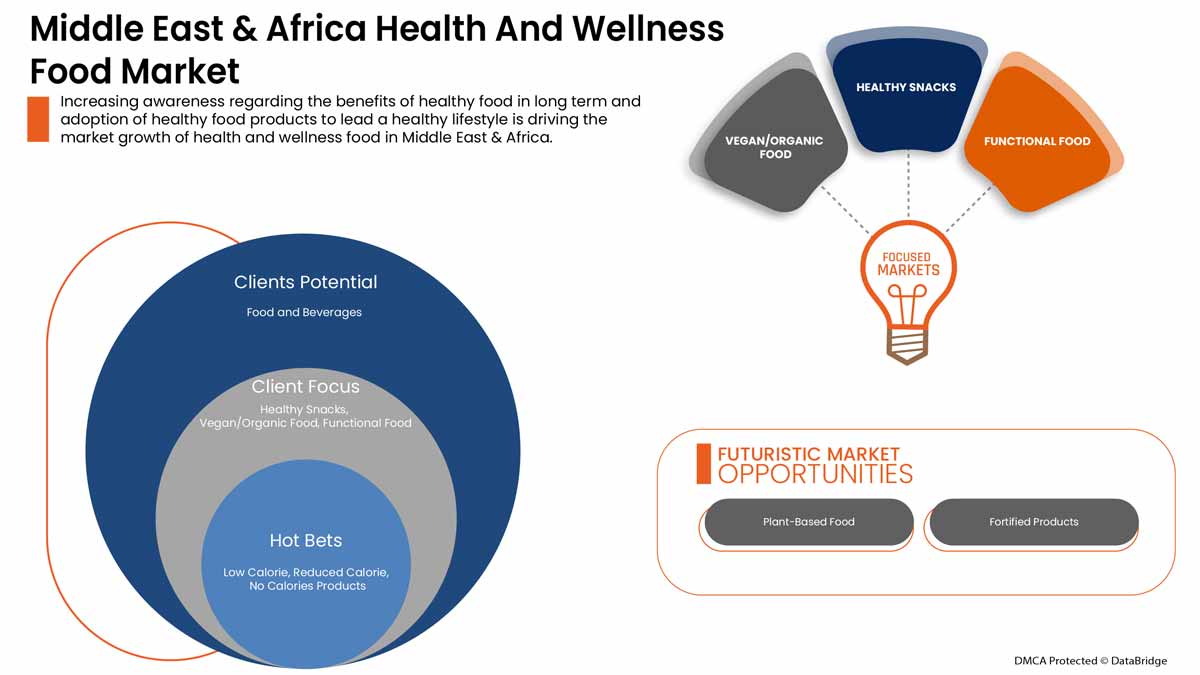

中东和非洲健康与保健食品市场的增长速度快于包装食品行业,这是由于消费者的口味转向更自然、更实用的产品,以采用更全面的均衡饮食方法。越来越多的人改变饮食习惯,接受均衡的营养饮食和积极的生活方式,这是推动健康与保健食品行业增长的主要因素。全世界的人们都意识到健康饮食、运动和定期体育锻炼的价值,这对市场的增长至关重要。然而,健康与保健食品的高价格和高维护成本可能会阻碍市场的增长。

与无机食品相比,由天然成分制成的有机食品的消费量不断增加,这将为中东和非洲健康和保健食品市场带来新的机遇,而市场参与者之间的激烈竞争可能会对市场的增长带来挑战。

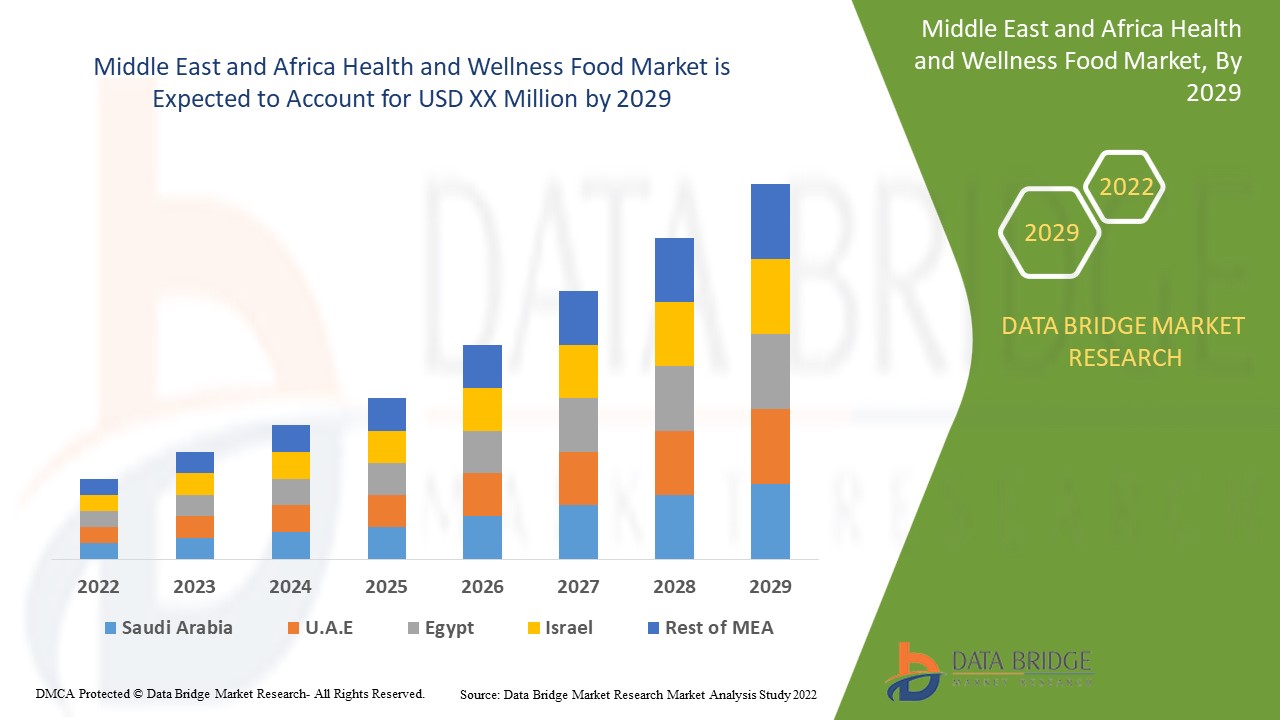

Data Bridge Market Research 分析称,2022 年至 2029 年的预测期内,中东和非洲健康和保健食品市场将以 8.3% 的复合年增长率增长。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史年份 |

2020(可定制至 2019 - 2015) |

|

定量单位 |

收入(十亿美元) |

|

涵盖的领域 |

按类型(功能性食品、强化健康烘焙产品、健康零食、BFY 食品、饮料、巧克力等)、卡路里含量(无卡路里、低卡路里和减卡路里)、性质(非转基因和转基因)、脂肪含量(无脂肪、低脂肪和减脂肪)、类别(常规和有机)、不含类别(无麸质、无乳制品、无大豆、无坚果、无乳糖、无人工香料、无人工色素等)和分销渠道(实体店零售商和非实体店零售商)、行业趋势和预测到 2029 年) |

|

覆盖国家 |

南非、沙特阿拉伯、阿联酋、科威特以及中东和非洲其他地区 |

|

涵盖的市场参与者 |

Maspex、百事可乐、通用磨坊公司、玛氏公司、雀巢、达能、雅培、Huel Inc.、葛兰素史克集团、Clif Bar & Company、Yoplait USA, Inc.、Chobani, LLC.、SO DELICIOUS DAIRY FREE、The Simply Good Foods Company、亿滋国际、家乐氏公司、桂格燕麦公司、养乐多本社株式会社、LIBERTÉ |

市场定义

食物、健康和保健都是相互关联的。我们吃的食物及其来源会影响我们的健康和体质。保健源于我们日常生活中摄入的均衡食物。健康不仅仅是吃更好的食物,还包括减轻紧张、压力和定期锻炼。食物、健康和保健食物可以通过添加功能性元素或加工改进来帮助降低疾病风险或治疗,并改善身体或精神表现。

中东和非洲健康与保健食品市场动态

驱动程序

- 对纯素或植物性食品的需求不断增加

植物基/纯素食品由杏仁、大豆、豌豆、大米和燕麦等植物提取物制成。这些产品富含蛋白质、矿物质和维生素,是人体促进健康生活方式和降低各种疾病风险所必需的。素食主义的日益普及以及人们对植物基产品健康益处的认识推动了全球纯素营养食品和饮料的发展。

此外,技术进步和对天然和清洁标签产品的要求促使制造商开发无麸质、高纤维蛋白奶昔和其他产品,这有望刺激植物性食品产品的增长。

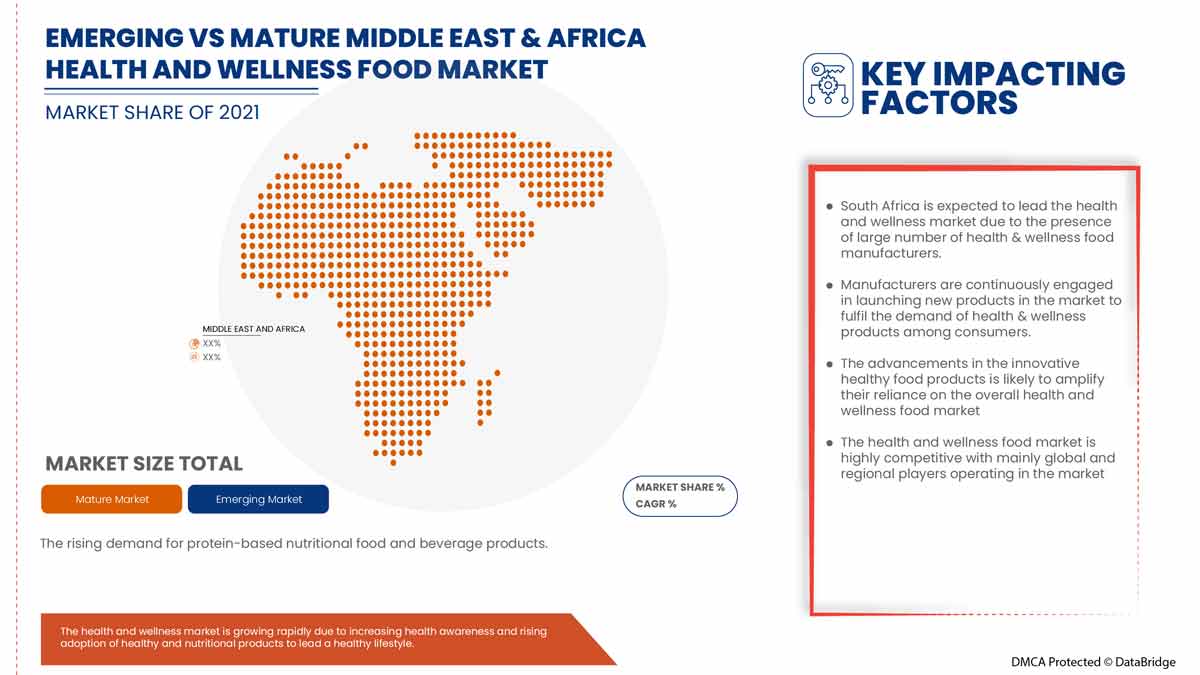

- 对蛋白质营养食品和饮料的需求不断增长

随着消费者越来越注重健康,喜欢营养价值更高、健康益处更大的食品,以帮助他们保持健康饮食,对基于蛋白质的营养、健康食品和饮料的需求迅速增长。坚果、谷物、谷类、水果和蔬菜是重要的蛋白质来源,用于生产基于蛋白质的食品。因此,制造商专注于新产品开发,推出各种坚果、水果、谷物、基于谷物的零食、能量棒、饮料和其他高蛋白产品,以吸引消费者群体。

此外,蛋白质是我们身体正常运作所需的主要常量营养素之一。蛋白质是每个身体细胞都需要的重要物质。蛋白质是指甲和头发的主要元素,在皮肤和身体中也起着重要作用,因为它可以构建和修复组织。它对骨骼、肌肉和血液也至关重要。因此,制造商正在努力将富含蛋白质的食品引入市场。

机会

-

对有益健康的非酒精饮料的需求不断增长

人们越来越意识到酒精饮料的有害影响,对果汁和能量饮料等非酒精健康替代品的需求不断增长,推动了全球健康和保健食品市场的需求。市场上推出了各种创新饮料,推动了非酒精饮料在市场上的增长。

此外,许多公司寻求提供满足消费者日益增长的健康、方便和非酒精饮料需求的产品,例如即饮 (RTD) 茶和咖啡、苏打水、低糖冰沙、奶昔和果汁。这些快速创新导致市场对健康饮料的需求增加。消费者越来越注重健康,对营养饮料和低糖非酒精饮料的需求增加,因此运动和能量饮料正在进入市场。此外,消费者正在转向不含化学成分的有机饮料,这可以为他们带来更多的营养和健康益处。

限制/挑战

- 加强对强化食品和饮料的监管

强化食品和饮料适用法规,以保持消费者透明度并避免掺假。与强化食品和饮料相关的各种标签、声明和其他法律让消费者了解食品的营养和微量营养素含量。这些严格的法规适用于强化食品和饮料,涉及标签和声明等,以便消费者了解食品的营养价值。然而,有时制造商很难遵守所有的规则和法规,这可能会对市场产生负面影响。

强化营养产品是一种方便、高效的载体,可以输送与特定身体功能相关的许多必需营养素。它们通过使身体发挥最佳功能来增强整体健康。然而,与强化食品和饮料相关的监管越来越严格,以防止污染并保持食品安全和卫生。

COVID-19 对中东和非洲保健食品市场的影响

COVID-19 疫情严重影响了中东和非洲的健康和保健食品市场。COVID-19 疫情持续较长时间,供应链中断,难以向消费者供应食品,最初导致食品需求下降。然而,疫情过后,由于人们越来越意识到长期健康营养食品的好处,对健康和保健食品的需求大幅增加,这增加了对健康和保健食品的需求。消费者正在尝试过上健康的生活方式,更倾向于最健康的食品,如植物性、纯素和营养食品和饮料。

因此,健康饮食模式的趋势对市场产生了重大影响,并将在未来几年引领市场快速增长。

最新动态

- 2021 年 5 月,百事可乐推出了一款功能性气泡水饮料 Soulboost。该产品有两种类型:支持精神耐力的 Lift 和支持放松的 Ease。新产品的推出帮助该品牌拓展了健康产品领域,最终将帮助公司获得更多收入

中东和非洲健康与保健食品市场范围

中东和非洲健康与保健食品市场根据类型、卡路里含量、性质、脂肪含量、类别、不含类别和分销渠道细分为显著的细分市场。这些细分市场之间的增长将帮助您分析行业中的主要增长细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策以确定核心市场应用。

类型

- 功能性食品

- 强化健康烘焙产品

- 健康零食

- BFY 食品

- 饮料

- 巧克力

- 其他的

根据类型,中东和非洲健康和保健食品市场分为功能性食品、强化健康烘焙产品、健康零食、BFY 食品、饮料、巧克力等。

卡路里含量

- 零卡路里

- 低卡路里

- 减少卡路里

根据卡路里含量,中东和非洲健康食品市场分为无卡路里、低卡路里和减卡路里。

自然

- 非转基因

- 转基因

从本质上讲,中东和非洲健康和保健食品市场分为非转基因和转基因。

脂肪含量

- 无脂肪

- 低脂肪

- 减少脂肪

根据脂肪含量,中东和非洲健康和保健食品市场分为无脂肪、低脂肪和减脂肪。

类别

- 传统的

- 有机的

根据类别,中东和非洲健康和保健食品市场分为传统食品和有机食品。

免費類別

- 不含麸质

- 不含乳制品

- 不含大豆

- 不含坚果

- 不含乳糖

- 不含人工香料

- 不含人工色素

- 其他的

根据不含成分的类别,中东和非洲健康和保健食品市场分为无麸质、无乳制品、无大豆、无坚果、无乳糖、无人工香料、无人工色素等。

分销渠道

- 商店零售商

- 无店铺零售商

根据分销渠道,中东和非洲健康和保健食品市场分为商店零售商和非商店零售商。

中东和非洲健康与保健食品市场区域分析/见解

对中东和非洲健康和保健食品市场进行了分析,并根据上述内容提供了市场规模洞察和趋势。

中东和非洲健康和保健食品市场报告涵盖的国家包括南非、沙特阿拉伯、阿联酋、科威特以及中东和非洲其他地区。

South Africa is expected to dominate the Middle East & Africa health and wellness food market in terms of market share and market revenue and is estimated to maintain its dominance during the forecast period due to the increasing demand for healthy and fortified food products to lead a healthy lifestyle and change in eating pattern and rising adoption of healthy products to stay fit and to boost their immunity.

The region section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Middle East & Africa brands and their challenges faced due to high competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East & Africa Health and Wellness Food Market Share Analysis

The Middle East & Africa health and wellness food market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East & Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on Middle East & Africa health and wellness food market.

Some of the major players operating in the Middle East & Africa health and wellness food market are Maspex, PepsiCo, General Mills Inc., Mars, Incorporated, Nestlé, Danone, Abbott, Huel Inc., GSK Group of Companies, Clif Bar & Company, Yoplait USA, Inc., Chobani, LLC., SO DELICIOUS DAIRY FREE, The Simply Good Foods Company, Mondelez International, Kellogg Co., The Quaker Oats Company, Yakult Honsha Co., Ltd., LIBERTÉ, among others.

Research Methodology

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析以及主要(行业专家)验证。除此之外,数据模型还包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、公司市场份额分析、测量标准、中东和非洲与地区以及供应商份额分析。如有进一步询问,请要求分析师致电。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPARATIVE ANALYSIS

4.2 CONSUMER DISPOSABLE INCOME DYNAMICS

4.3 CONSUMER LEVEL TRENDS OF MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET

4.3.1 OVERVIEW

4.3.2 HIGH NUTRITIONAL VALUE

4.3.3 PLANT-BASED AND ORGANIC PRODUCTS

4.3.4 ON-THE-GO FOOD PRODUCTS

4.3.5 HEALTHY SNACKING

4.4 FACTORS INFLUENCING PURCHASE DECISION

4.4.1 GROWING CONSUMERS' INTEREST IN PLANT-BASED DIETS

4.4.2 DEMAND FOR FREE-FROM FOODS PRODUCTS

4.4.3 HEALTHY AND SUSTAINABLE FOOD AVAILABILITY

4.4.4 PRICING OF HEALTH AND WELLNESS FOOD

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET

4.5.1 MANUFACTURERS LAUNCHING NATURAL INGREDIENT-BASED FOOD PRODUCTS

4.5.2 GROWING PRODUCTION OF A WIDE RANGE OF HEALTH AND WELLNESS FOOD BY MANUFACTURERS

4.5.3 MANUFACTURERS FOCUSING ON THE DEVELOPMENT OF NUTRACEUTICAL FOOD PRODUCTS

4.6 LIST OF KEY SOURCES OF MARKET INSIGHTS

4.7 MEETING CONSUMER REQUIREMENTS

4.8 NEW PRODUCT LAUNCH STRATEGY

4.8.1 NUMBER OF PRODUCT LAUNCHES

4.8.1.1 LINE EXTENSION

4.8.1.2 NEW PACKAGING

4.8.1.3 RELAUNCHED

4.8.1.4 NEW FORMULATION

4.9 PRIVATE LABEL VS BRAND LABEL

4.1 PROMOTIONAL ACTIVITIES

4.11 REGULATIONS, CERTIFICATION, AND LABELLING CLAIMS

4.11.1 REGULATIONS

4.11.2 LABELING AND CLAIM

4.11.3 CERTIFICATIONS

4.11.3.1 BRC FOOD SAFETY CERTIFICATION

4.11.3.2 AGMARK CERTIFICATION

4.11.3.3 PLANT AND PLANT PRODUCTS

4.12 SHOPPING BEHAVIOR AND DYNAMICS

4.12.1 RECOMMENDATIONS FROM FAMILY AND FRIENDS-

4.12.2 RESEARCH

4.12.3 IMPULSIVE

4.12.4 ADVERTISEMENT:

4.12.4.1 TELEVISION ADVERTISEMENT

4.12.4.2 ONLINE ADVERTISEMENT

4.12.4.3 IN-STORE ADVERTISEMENT

4.12.4.4 OUTDOOR ADVERTISEMENT

4.12.5 CONCLUSION

4.13 SUPPLY CHAIN ANALYSIS

4.13.1 RAW MATERIAL PROCUREMENT

4.13.2 MANUFACTURING PROCESS

4.13.3 MARKETING AND DISTRIBUTION

4.13.4 END USERS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR PROTEIN-BASED NUTRITIONAL AND HEALTHY FOOD & BEVERAGES

5.1.2 INCREASING DISPOSABLE INCOME AND GROWING EXPENDITURE ON HEALTHY FOOD PRODUCTS

5.1.3 INCREASING DEMAND FOR VEGAN/PLANT-BASED HEALTHY FOOD

5.1.4 GROWING DEMAND FOR CLEAN LABEL FOOD

5.2 RESTRAINTS

5.2.1 INCREASING REGULATION ON FORTIFIED FOOD & BEVERAGES

5.2.2 HIGHER PRICES OF HEALTHY NUTRITIONAL FOOD & BEVERAGES

5.3 OPPORTUNITIES

5.3.1 INCREASE IN NUMBER OF LAUNCHES OF HEALTH AND WELLNESS FOOD & BEVERAGE PRODUCTS

5.3.2 CHANGE IN EATING HABITS AND LIFESTYLE OF MILLENNIALS

5.3.3 GROWING DEMAND FOR NON-ALCOHOLIC DRINKS THAT PROVIDE HEALTH BENEFITS

5.4 CHALLENGES

5.4.1 DISRUPTED SUPPLY CHAIN DUE TO COVID-19

5.4.2 LACK OF AWARENESS AMONG PEOPLE AND SKEPTICISM TOWARDS HEALTHY FOOD & BEVERAGES

6 POST-COVID IMPACT ON THE MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET

6.1 AFTERMATH OF COVID-19

6.2 IMPACT ON DEMAND AND SUPPLY CHAIN

6.3 IMPACT ON PRICE

6.4 CONCLUSION

7 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET, BY TYPE

7.1 OVERVIEW

7.2 FUNCTIONAL FOOD

7.2.1 FUNCTIONAL FOOD, BY TYPE

7.2.1.1 BREAKFAST CEREAL PRODUCTS

7.2.1.1.1 BREAKFAST CEREAL FLAKES

7.2.1.1.2 BREAKFAST OATMEAL

7.2.1.1.3 BREAKFAST CEREAL PORRIDGE

7.2.1.1.4 BREAKFAST COOKIES

7.2.1.1.5 OTHERS

7.2.1.2 YOGURTS

7.2.1.2.1 YOGURT, BY TYPE

7.2.1.2.1.1 REGULAR YOGURTS

7.2.1.2.1.2 CONCENTRATED YOGURT

7.2.1.2.1.3 PROBIOTIC YOGURT

7.2.1.2.1.4 SET YOGURT

7.2.1.2.1.5 BIO LIVE YOGURT

7.2.1.2.1.6 STIRRED YOGURT

7.2.1.2.1.7 OTHERS

7.2.1.2.2 YOGURT, BY CATEGORY

7.2.1.2.2.1 FROZEN YOGURT

7.2.1.2.2.2 DRINKABLE YOGURT

7.2.1.2.2.3 SPOONABLE YOGURT

7.2.1.2.2.4 OTHERS

7.2.1.2.3 YOGURT, BY FLAVOR

7.2.1.2.3.1 PLAIN

7.2.1.2.3.2 FLAVORED

7.2.1.2.3.2.1 STRAWBERRY

7.2.1.2.3.2.2 VANILLA

7.2.1.2.3.2.3 BLUEBERRY

7.2.1.2.3.2.4 PEACH

7.2.1.2.3.2.5 BANANA

7.2.1.2.3.2.6 BLACKBERRY

7.2.1.2.3.2.7 CHERRY

7.2.1.2.3.2.8 BUTTERSCOTCH

7.2.1.2.3.2.9 CARAMEL

7.2.1.2.3.2.10 POMEGRANATE

7.2.1.2.3.2.11 CHOCOLATES

7.2.1.2.3.2.12 NUTS

7.2.1.2.3.2.13 COCONUT

7.2.1.2.3.2.14 ORCHARD CHERRY

7.2.1.2.3.2.15 COTTON CANDY

7.2.1.2.3.2.16 HONEY

7.2.1.2.3.2.17 MOCHA

7.2.1.2.3.2.18 AMARETTO

7.2.1.2.3.2.19 PUMPKIN

7.2.1.2.3.2.20 PEPPERMINT

7.2.1.2.3.2.21 OTHERS

7.2.1.3 NUTRITION BARS

7.2.1.3.1 NUTRITION BARS, BY TYPE

7.2.1.3.1.1 CEREALS BARS

7.2.1.3.1.1.1 GRANOLA BARS

7.2.1.3.1.1.2 OAT BARS

7.2.1.3.1.1.3 RICE BARS

7.2.1.3.1.1.4 MIXED CEREAL BARS

7.2.1.3.1.1.5 OTHERS

7.2.1.3.1.2 ENERGY BARS

7.2.1.3.1.2.1 PLANT-BASED PROTEIN BARS

7.2.1.3.1.2.2 ANIMAL-BASED PROTEIN BARS

7.2.1.3.1.2.2.1 WHEY PROTEIN BARS

7.2.1.3.1.2.2.2 CASEIN PROTEIN BARS

7.2.1.3.1.2.2.2.1 FIBER BARS

7.2.1.3.1.2.2.2.2 PROBIOTIC BARS

7.2.1.3.1.2.2.2.3 OMEGA-3 BARS

7.2.1.3.1.2.2.2.4 AMINO ACID BARS

7.2.1.3.1.2.2.2.5 OTHERS

7.2.1.3.1.3 FRUIT BARS

7.2.1.3.1.3.1 BANANA

7.2.1.3.1.3.2 APPLES

7.2.1.3.1.3.3 ORANGES

7.2.1.3.1.3.4 BERRIES

7.2.1.3.1.3.5 CHERRY

7.2.1.3.1.3.6 AVOCADO

7.2.1.3.1.3.7 OTHERS

7.2.1.3.1.4 NUT BARS

7.2.1.3.1.4.1 ALMOND

7.2.1.3.1.4.2 PEANUT

7.2.1.3.1.4.3 HAZELNUTS

7.2.1.3.1.4.4 CASHEW

7.2.1.3.1.4.5 DATES

7.2.1.3.1.4.6 OTHERS

7.2.1.3.1.5 OTHERS

7.2.1.3.2 NUTRITION BARS, BY CATEGORY

7.2.1.3.3 REGULAR

7.2.1.3.4 PRE WORK OUT BARS

7.2.1.3.5 MEAL REPLACEMENT BAR

7.2.1.3.6 POST WORK OUT BARS

7.2.1.3.7 YOGA BARS

7.2.1.3.8 OTHERS

7.2.2 FUNCTIONAL FOODS, BY CATEGORY

7.2.2.1 CONVENTIONAL

7.2.2.2 ORGANIC

7.2.3 FUNCTIONAL FOODS, BY CALORIE CONTENT

7.2.3.1 LOW CALORIES

7.2.3.2 REDUCED CALORIE

7.2.3.3 NO CALORIES

7.3 HEALTHY SNACKS

7.3.1 HEALTHY SNACKS, BY PRODUCT TYPE

7.3.1.1 VEGGIE SNACKS

7.3.1.2 MULTIGRAIN WAFERS, CRACKERS & CHIPS

7.3.1.3 TRAIL MIXES

7.3.1.4 DRY BERRIES SNACKS

7.3.1.5 OTHERS

7.3.2 HEALTHY SNACKS, BY CATEGORY

7.3.2.1 CONVENTIONAL

7.3.2.2 ORGANIC

7.3.3 HEALTHY SNACKS, BY CALORIE CONTENT

7.3.3.1 LOW CALORIES

7.3.3.2 REDUCED CALORIE

7.3.3.3 NO CALORIES

7.4 BEVERAGES

7.4.1 BEVERAGES, BY TYPE

7.4.1.1 FORTIFIED COFFEE

7.4.1.2 BFY BEVERAGES

7.4.1.2.1 HEALTHY SMOOTHIES

7.4.1.2.2 DIET SODA

7.4.1.2.3 PLANT-BASED MILK

7.4.1.2.3.1 PLANT-BASED MILK, BY TYPE

7.4.1.2.3.1.1 ALMOND MILK

7.4.1.2.3.1.2 SOY MILK

7.4.1.2.3.1.3 COCONUT MILK

7.4.1.2.3.1.4 OAT MILK

7.4.1.2.3.1.5 CASHEW MILK

7.4.1.2.3.1.6 OTHERS

7.4.1.2.4 PLANT-BASED MILK, BY FORMULATION

7.4.1.2.4.1.1 SWEETENED

7.4.1.2.4.1.2 UNSWEETENED

7.4.1.2.5 FLAVORED WATER

7.4.1.3 ENERGY DRINKS

7.4.1.4 KOMBUCHA DRINKS

7.4.1.5 HERBAL TEA

7.4.1.5.1 MIXED HERB

7.4.1.5.2 YERBA MATE

7.4.1.5.3 OOLONG

7.4.1.5.4 CHAMOMILE

7.4.1.5.5 MATCHA

7.4.1.5.6 MINT

7.4.1.5.7 ROSEMARY

7.4.1.5.8 PEPPERMINT

7.4.1.5.9 CONVENTIONAL TEA LEAVES

7.4.1.5.10 SINGLE HERB

7.4.1.5.11 CINNAMON

7.4.1.5.12 THYME

7.4.1.5.13 ROSE HIP

7.4.1.5.14 ECHINACEA

7.4.1.5.15 BUBBLE

7.4.1.5.16 OTHERS

7.4.1.6 FRUIT TEA

7.4.1.6.1 SINGLE FRUIT TEA

7.4.1.6.2 PEACH

7.4.1.6.3 ORANGE

7.4.1.6.4 POMEGRANATE

7.4.1.6.5 MANGO

7.4.1.6.6 STRAWBERRY

7.4.1.6.7 APPLE TEA

7.4.1.6.8 PINEAPPLE

7.4.1.6.9 KIWI

7.4.1.6.10 RASPBERRY

7.4.1.6.11 CRANBERRY

7.4.1.6.12 BLUEBERRY

7.4.1.6.13 GOJI BERRY

7.4.1.6.14 PASSION FRUIT

7.4.1.6.15 OTHERS

7.4.1.6.16 MIX FRUIT TEA

7.4.2 BEVERAGES, BY CATEGORY

7.4.2.1 CONVENTIONAL

7.4.2.2 ORGANIC

7.4.3 BEVERAGES, BY CALORIE CONTENT

7.4.3.1 LOW CALORIES

7.4.3.2 REDUCED CALORIES

7.4.3.3 NO CALORIES

7.5 FORTIFIED & HEALTHY BAKERY PRODUCTS

7.5.1 FORTIFIED & HEALTHY BAKERY PRODUCTS, BY TYPE

7.5.1.1 BREAD & ROLLS

7.5.1.2 BISCUIT & COOKIES

7.5.1.3 PANCAKES & OTHER BAKERY MIXES

7.5.1.4 CAKES & PASTRIES

7.5.1.5 TORTILLA

7.5.1.6 CUPCAKES & MUFFINS

7.5.2 FORTIFIED & HEALTHY BAKERY PRODUCTS, BY CATEGORY

7.5.2.1 CONVENTIONAL

7.5.2.2 ORGANIC

7.5.3 FORTIFIED & HEALTHY BAKERY PRODUCTS, BY CALORIE CONTENT

7.5.3.1 LOW CALORIES

7.5.3.2 REDUCED CALORIE

7.5.3.3 NO CALORIES

7.6 BFY FOODS

7.6.1 BFY FOODS, BY TYPE

7.6.1.1 HEALTHY PIZZA & PASTA

7.6.1.2 HEALTHY CRISPS

7.6.1.3 HEALTHY CRISPS, BY TYPE

7.6.1.3.1 PROTEIN CRISPS

7.6.1.3.2 VEGGIES CRISPS

7.6.1.3.3 GREEN BEANS CRISPS

7.6.1.3.4 MIX VEGGIE CRISPS

7.6.1.3.5 BEETS CRISPS

7.6.1.3.6 CAULIFLOWER CRISPS

7.6.1.3.7 OTHERS

7.6.1.3.8 HEALTHY CRISPS, BY FLAVOR

7.6.1.3.9 BARBECUE

7.6.1.3.10 CHEESE

7.6.1.3.11 SEA SALT

7.6.1.3.12 SWEET CHILLI

7.6.1.3.13 BUFFALO WING

7.6.1.3.14 SWEET & SALT

7.6.1.3.15 OTHERS

7.6.1.4 SOUPS

7.6.1.5 SPREADS

7.6.1.6 SAUCES, MAYONNAISE & DRESSINGS

7.6.1.7 OTHERS

7.6.2 BFY FOODS, BY CATEGORY

7.6.2.1 CONVENTIONAL

7.6.2.2 ORGANIC

7.6.3 BFY FOODS, BY CALORIE CONTENT

7.6.3.1 LOW CALORIES

7.6.3.2 REDUCED CALORIES

7.6.3.3 NO CALORIES

7.7 CHOCOLATE

7.7.1 CHOCOLATES, BY TYPE

7.7.1.1 DARK CHOCOLATE BARS

7.7.1.2 NUT INFUSED CHOCOLATES

7.7.1.3 FRUIT & NUT INFUSED CHOCOLATE BRITTLES

7.7.1.4 FORTIFIED CHOCOLATE BARS

7.7.1.5 OTHERS

7.7.2 CHOCOLATES, BY FORMULATION

7.7.2.1 SWEET

7.7.2.2 SEMI-SWEET

7.7.2.3 SUGAR FREE

7.7.3 CHOCOLATES, BY CATEGORY

7.7.3.1 CONVENTIONAL

7.7.3.2 ORGANIC

7.7.4 CHOCOLATES, BY CALORIE CONTENT

7.7.4.1 LOW CALORIES

7.7.4.2 REDUCED CALORIE

7.7.4.3 NO CALORIES

7.8 OTHERS

8 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET, BY CALORIE CONTENT

8.1 OVERVIEW

8.2 LOW CALORIES

8.3 REDUCED CALORIES

8.4 NO CALORIES

9 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET, BY NATURE

9.1 OVERVIEW

9.2 NON-GMO

9.3 GMO

10 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET, BY FAT CONTENT

10.1 OVERVIEW

10.2 NO FAT

10.3 LOW FAT

10.4 REDUCED FAT

11 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET, BY CATEGORY

11.1 OVERVIEW

11.2 ORGANIC

11.3 CONVENTIONAL

12 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET, BY FREE FROM CATEGORY

12.1 OVERVIEW

12.2 GLUTEN FREE

12.3 DAIRY FREE

12.4 SOY FREE

12.5 NUT FREE

12.6 LACTOSE FREE

12.7 ARTIFICIAL FLAVOR FREE

12.8 ARTIFICIAL COLOR FREE

12.9 OTHERS

13 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 STORE BASED RETAILERS

13.2.1 SUPERMARKET/HYPERMARKET

13.2.2 CONVENIENCE STORES

13.2.3 SPECIALTY STORES

13.2.4 GROCERY STORES

13.2.5 OTHERS

13.3 NON-STORE RETAILERS

13.3.1 COMPANY WEBSITES

13.3.2 ONLINE

14 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET, BY REGION

14.1 MIDDLE EAST & AFRICA

14.1.1 SOUTH AFRICA

14.1.2 SAUDI ARABIA

14.1.3 UAE

14.1.4 KUWAIT

14.1.5 REST OF MIDDLE EAST & AFRICA

15 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 PEPSICO

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 DANONE

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 NESTLÉ

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 ABBOTT

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 GENERAL MILLS INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 YAKULT HONSHA CO., LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 GSK GROUP OF COMPANIES

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 SIMPLY GOOD FOODS USA, INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 ALTER ECO

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 BARREL. SITE BY BARREL

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 CHOBANI, LLC.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 CLIF BAR & COMPANY

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 ENJOY LIFE

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 FORAGER PROJECT

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 GREEN VALLEY DAIRIE

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 HUEL INC.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 KASHI

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 KELLOGG CO.

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENT

17.19 KITE HILL

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 LAKE CHAMPLAIN CHOCOLATES

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

17.21 LAVVA

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 LIBERTE

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

17.23 MARS, INCORPORATED

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 MASPEX GROUP

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENTS

17.25 MONDELĒZ INTERNATIONAL.

17.25.1 COMPANY SNAPSHOT

17.25.2 REVENUE ANALYSIS

17.25.3 PRODUCT PORTFOLIO

17.25.4 RECENT DEVELOPMENT

17.26 SO DELICIOUS DAIRY FREE

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENTS

17.27 STONYFIELD FARM, INC.

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENTS

17.28 THE QUAKER OATS COMPANY

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENTS

17.29 THE SIMPLY GOOD FOODS COMPANY

17.29.1 COMPANY SNAPSHOT

17.29.2 REVENUE ANALYSIS

17.29.3 PRODUCT PORTFOLIO

17.29.4 RECENT DEVELOPMENTS

17.3 YOPLAIT USA, INC.

17.30.1 COMPANY SNAPSHOT

17.30.2 PRODUCT PORTFOLIO

17.30.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE:

19 RELATED REPORTS

图片列表

FIGURE 1 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET AND GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 11 RISING DEMAND FOR PROTEIN-BASED NUTRITIONAL AND HEALTHY FOOD & BEVERAGES IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET IN THE FORECAST PERIOD 2022 TO 2029

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET IN 2022 & 2029

FIGURE 13 SUPPLY CHAIN ANALYSIS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET

FIGURE 15 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET: BY TYPE, 2021

FIGURE 16 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET: BY CALORIE CONTENT, 2021

FIGURE 17 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET: BY NATURE, 2021

FIGURE 18 MIDDLE EAST & AFRICA GMO CROP REVENUE (2018)

FIGURE 19 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET: BY FAT CONTENT, 2021

FIGURE 20 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET: BY CATEGORY, 2021

FIGURE 21 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET: BY FREE FROM CATEGORY, 2021

FIGURE 22 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 23 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET: SNAPSHOT (2021)

FIGURE 24 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET: BY COUNTRY (2021)

FIGURE 25 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET: BY TYPE (2022 & 2029)

FIGURE 28 MIDDLE EAST & AFRICA HEALTH AND WELLNESS FOOD MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。