中东和非洲无麸质早餐谷物市场,按类型(热谷物、即食谷物)、早餐谷物产品类型(粥、薄片、环、脆片、脆饼、麦片、其他)、早餐谷物来源(玉米、大米、小麦、荞麦、格兰诺拉麦片、麸皮、小米、杂粮、其他)、口味(原味、调味)、含糖量(添加糖、不添加糖)、产品类别(原味、含坚果、含水果、坚果和水果)、有机类别(有机、传统)、性质(转基因、非转基因)、包装类型(塑料包装/袋、纸板纸盒、塑料罐、其他)、包装尺寸(小于 5 盎司、5 - 7 盎司、8 - 10 盎司、11 - 13 盎司、超过 13 盎司)、消费者类别(成人、儿童)、分销渠道(基于商店的零售、在线零售)- 行业趋势和预测到 2029 年。

市场分析和规模

无麸质早餐谷物经过高度加工,添加了许多成分以降低罹患冠心病、癌症、糖尿病和憩室病等疾病的风险。早餐谷物可能会被膨化、压片、切碎,或涂上巧克力或糖霜,然后烘干,最后制成球形、星形、环形或矩形等形状。

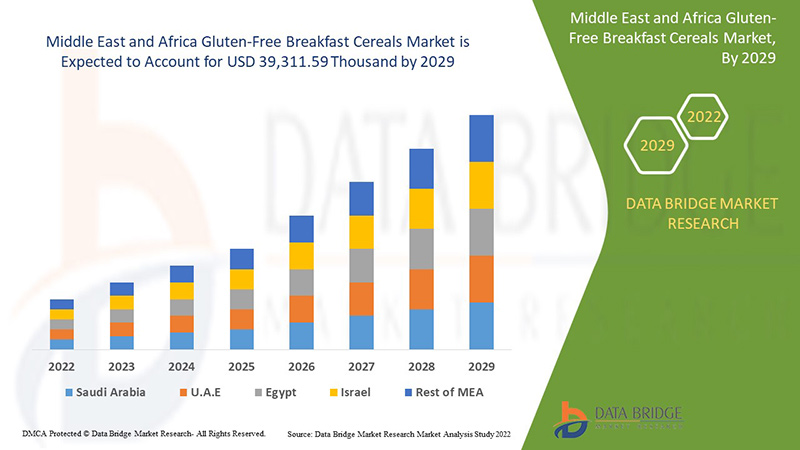

消费者对即食早餐谷物的需求不断增长,以及健康意识的增强,预计将推动中东和非洲无麸质早餐谷物市场的需求。Data Bridge Market Research 分析称,到 2029 年,无麸质早餐谷物市场预计将达到 39,311.59 万美元的价值,预测期内的复合年增长率为 6.1%。由于人们对健康生活方式的认识不断提高,对无麸质早餐谷物的需求增加,“成人”成为各自市场中最突出的消费者类别。Data Bridge Market Research 团队策划的市场报告包括深入的专家分析、进出口分析、定价分析、生产消费分析和气候链情景。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2014) |

|

定量单位 |

收入(千美元),定价(美元) |

|

涵盖的领域 |

按类型(热麦片、即食麦片)、早餐麦片产品类型(粥、薄片、圈状、松脆、脆片、麦片、其他)、早餐麦片来源(玉米、大米、小麦、荞麦、格兰诺拉麦片、麸皮、小米、杂粮、其他)、口味(原味、调味)、含糖量(添加糖、不添加糖)、产品类别(原味、含坚果、含水果、坚果和水果)、有机类别(有机、传统)、天然(转基因、非转基因)、包装类型(塑料包装/袋、纸板纸盒、塑料罐、其他)、包装尺寸(小于 5 盎司、5 - 7 盎司、8 - 10 盎司、11 - 13 盎司、超过 13 盎司)、消费者类别(成人、儿童)、分销渠道(实体店零售、在线零售) |

|

覆盖国家 |

沙特阿拉伯、阿联酋、南非、埃及、以色列、中东和非洲其他地区 (MEA)。 |

|

涵盖的市场参与者 |

通用磨坊公司(美国明尼苏达州)、家乐氏公司(美国密歇根州)、雀巢公司(瑞士沃韦)、桂格燕麦公司(百事可乐子公司)(美国伊利诺伊州)等。 |

市场定义

无麸质早餐麦片由加工过的谷物制成,通常添加维生素和矿物质,通常与牛奶、酸奶、水果或坚果一起食用。无麸质早餐麦片是供人类食用的加工谷物,通常包装成即食 (RTE) 或热麦片 (HC) 出售,食用前必须煮熟。麦片通过连续烹饪、成型和干燥操作制成,然后在包装前添加调味剂、甜味剂、维生素、矿物质强化剂和颗粒添加剂。如果麦片经过加工去除麸质,并且食用后食品中的麸质含量低于 20 ppm,则来自含麸质谷物的麦片可以贴上“无麸质”的标签。

监管框架

食品和药物管理局 (FDA):该规则规定,除其他标准外,任何标有“无麸质”、“无麸质”、“不含麸质”或“无麸质”标签的食品所含麸质必须低于千分之二十 (ppm)。这是使用科学验证的分析方法在食品中可靠检测出的最低水平。其他国家和国际机构也采用同样的标准,因为大多数患有乳糜泻的人可以耐受含有极少量麸质的食物。

无麸质早餐谷物市场的市场动态包括:

无麸质早餐谷物市场的驱动因素/机遇

- 即食早餐谷物的需求不断增加

即食食品行业服务了众多消费者,并响应了不断变化的需求。预制食品使人们的生活更加轻松。即食食品带来的便利提供了一种健康饮食方式,同时适应了一天繁忙的日程安排。此外,格兰诺拉麦片和谷物等即食食品美味又健康,与牛奶和其他健康饮料一起食用时可作为健康的膳食选择。

- 消费者偏好转向无麸质、有机和全谷物食品

有机谷物不含人工香料或防腐剂,因此食物和饮食都是纯天然的,对健康更有益。有机谷物不含传统加工食品中的合成添加剂。这些化学上瘾的添加剂会导致太多健康问题,从糖尿病到肥胖症和其他与食物有关的疾病,因此提高了人们对有机食品行业的认识。

- 方便食品前景乐观

近年来,千禧一代劳动者的忙碌生活方式、家庭总收入的增加以及核心家庭保留的概念都推动了包括谷物在内的方便食品细分市场的大幅增长。对健康食品的需求激增催生了整个包装食品细分市场,包括增强免疫力的食品、健康的全谷物和谷物。

- 消费者健康意识增强

如今,人们对谷物等健康食品更感兴趣,并会光顾那些提供营养食品且适合他们健康的地方。他们现在明白,当他们吃垃圾食品或没有营养的食物并降低饮食质量时,会对他们的健康产生严重而危险的影响。此外,消费者也意识到他们的日常食品质量,并选择营养食品,如谷物和全麦谷物。

无麸质早餐谷物市场面临的限制/挑战

- 提供其他早餐选择

最健康的早餐选择包括蛋白质、纤维、健康脂肪和适量未精制碳水化合物的组合,以提供快速能量。谷物的替代品包括迷你煎蛋饼、松饼、面包等,通常富含各种维生素和矿物质,蔬菜丰富。因此,无论是短期还是长期,替代早餐食品总体上都更健康。

- 假冒产品大规模商业化

假冒无麸质早餐谷物包装和产品可能看起来像真品,但食用后会导致多种疾病。许多消费者不知道他们的产品是假冒的,因此如果产品功能不正常或不符合总体预期,客户就会责怪正品公司。这可能会导致客户对品牌失去信心,并且将来不会再购买同一品牌。

COVID-19 对无麸质早餐谷物市场影响甚微

2020-2021 年,COVID-19 影响了各种制造业和服务业,导致工作场所关闭、供应链中断和运输限制。不过,供需失衡及其对定价的影响被认为是短期的,预计随着疫情结束,这种影响将会恢复。由于全球爆发 covid19,对无麸质早餐谷物的需求下降。因此,食品行业在 covid19 爆发期间遭受了巨大损失,随着各国限制的取消,无麸质早餐谷物行业有望增长。

最新动态

- 2022 年 5 月,通用磨坊公司同意收购 TNT Crust,后者是一家为地区和国家披萨连锁店、餐饮服务分销商和零售店生产高品质冷冻披萨饼皮的制造商。此次收购将有助于该公司扩大其在市场上的业务。

- 2020年,家乐氏公司荣获美国最值得信赖品牌(Morning Consult)。这提升了公司在中东和非洲市场的形象。

中东和非洲无麸质早餐谷物市场范围

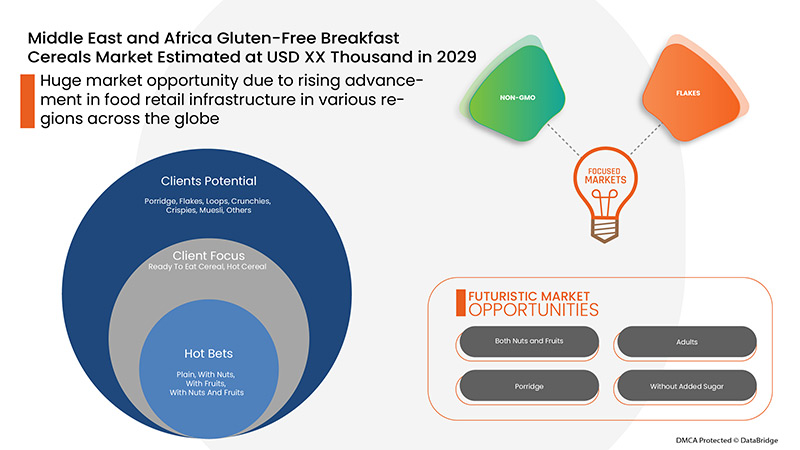

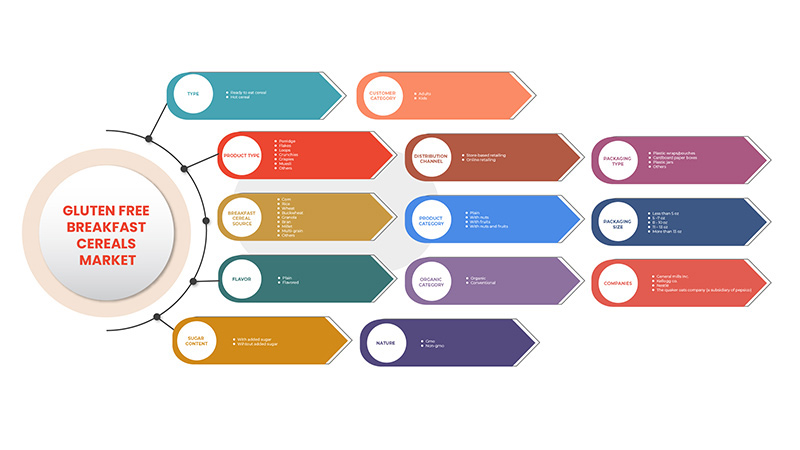

无麸质早餐谷物市场根据类型、早餐谷物产品类型、早餐谷物来源、风味、含糖量、产品类别、有机类别、性质、包装尺寸、包装类型、消费者类别、分销渠道进行细分。这些细分市场之间的增长将帮助您分析行业中增长微弱的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

类型

- 即食谷物

- 热麦片

根据类型,无麸质早餐谷物市场分为热谷物和即食谷物。

早餐谷物食品类型

- 稀饭

- 薄片

- 循环

- 脆脆的

- 脆饼

- 麦片

- 其他的

根据早餐谷物产品类型,无麸质早餐谷物市场分为粥、薄片、环状谷物、脆片、酥脆片、麦片和其他。

早餐谷物来源

- 玉米

- 小麦

- 麸

- 杂粮

- 粟

- 米

- 荞麦

- 格兰诺拉麦片

- 其他的

根据早餐谷物的来源,无麸质早餐谷物市场分为玉米、大米、小麦、荞麦、格兰诺拉麦片、麸皮、小米、杂粮等。

味道

- 清楚的

- 调味

根据口味,无麸质早餐谷物市场分为原味和调味味。

糖含量

- 添加糖

- 不添加糖

根据糖含量,无麸质早餐谷物市场分为添加糖和不添加糖。

产品类别

- 清楚的

- 配坚果

- 配水果

- 坚果和水果

根据产品类别,无麸质早餐谷物市场分为原味、含坚果、含水果、坚果和水果兼有。

有机类别

- 有机的

- 传统的

根据有机类别,无麸质早餐谷物市场分为有机和传统。

自然

- 转基因

- 非转基因

On the basis of nature, the gluten-free breakfast cereals market is segmented into GMO and non-GMO.

Packaging Type

- Plastic Wraps/Pouches

- Cardboard Paper Boxes

- Plastic Jars

- Others

On the basis of packaging type, the gluten-free breakfast cereals market is segmented into plastic wraps/pouches, cardboard paper boxes, plastic jars and others.

Packaging Size

- Less Than 5 Oz

- 5 –7 Oz

- 8 - 10 Oz

- 11 – 13 Oz

- More Than 13 Oz

On the basis of packaging size, the gluten-free breakfast cereals market is segmented into less than 5 OZ, 5-7 OZ, 8-10 OZ, 11-13 OZ and more than 13 OZ.

Consumer Category

- Adults

- Kids

On the basis of consumer category, the gluten-free breakfast cereals market is segmented into adults and kids.

Distribution Channel

- Store-Based Retailing

- Online Retailing

On the basis of distribution channel, the gluten-free breakfast cereals market is segmented into store-based retailing and online retailing.

Gluten-Free Breakfast Cereals Market Regional Analysis/Insights

The gluten-free breakfast cereals market is analyzed and market size insights and trends are provided by country, type, breakfast cereal product type, breakfast cereal sources, flavor, sugar content, product category, organic category, nature, packaging size, packaging type, consumer category, distribution channel as referenced above.

The countries covered in the gluten-free breakfast cereals market report are the Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA).

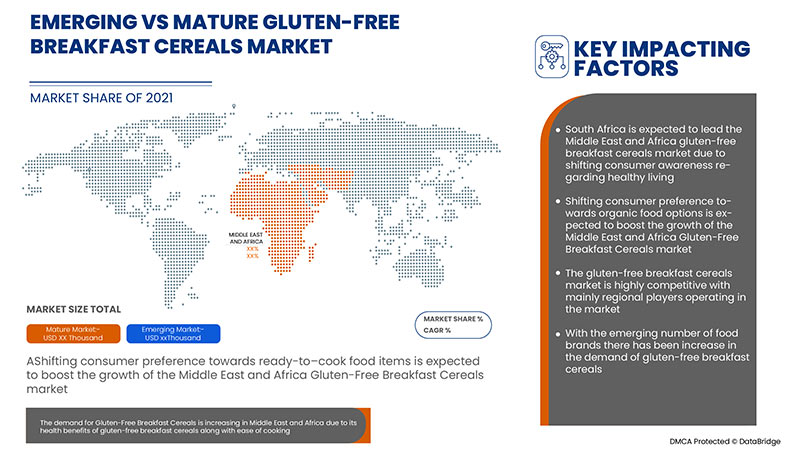

South Africa dominates the gluten-free breakfast cereals market because of the new and improved product launches in the region. South Africa is followed by Saudi Arabia and is expected to witness significant growth during the forecast period of 2022 to 2029 due to growing demand for gluten-free breakfast cereals from adult consumer in the region. Saudi Arabia is followed by United Arab Emirates and is expected to grow significantly owing to positive outlook towards convenience food products.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East & Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Gluten-Free Breakfast Cereals Market Share Analysis

无麸质早餐谷物市场竞争格局提供了按竞争对手划分的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、中东和非洲业务、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度、应用主导地位。以上提供的数据点仅与公司对无麸质早餐谷物市场的关注有关。

参与中东和非洲无麸质早餐谷物市场的一些主要市场参与者包括通用磨坊公司、家乐氏公司、雀巢、桂格燕麦公司(百事可乐的子公司)等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。