中东和非洲大麻二酚 (CBD) 市场,按来源(大麻和印度大麻)、等级(食品级和治疗级)、性质(有机和无机)、应用(酊剂、食品、饮料、制药、外用、膳食补充剂和其他)、产品类型(CBD 油、CBD 浓缩物、CBD 分离物和其他)划分 - 行业趋势和预测到 2029 年。

中东和非洲大麻二酚 (CBD) 市场分析与洞察

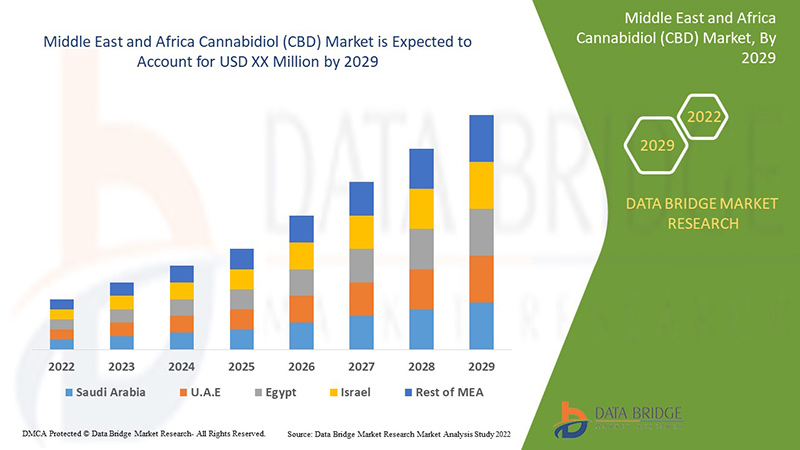

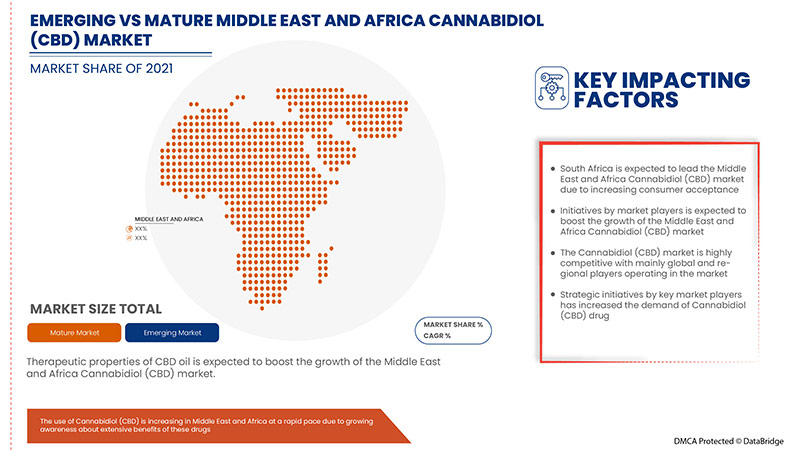

预计中东和非洲大麻二酚 (CBD) 市场将在 2022 年至 2029 年的预测期内实现市场增长。Data Bridge Market Research 分析,在 2022 年至 2029 年的预测期内,该市场的复合年增长率为 22.7%。大麻二酚 (CBD) 药物治疗的技术进步、医疗保健行业的兴起是预测期内推动中东和非洲大麻二酚 (CBD) 市场增长的另一个因素。

然而,CBD 油的副作用以及市场上的假冒和合成产品将抑制市场增长。主要市场参与者建立合作伙伴关系和收购等战略联盟为中东和非洲大麻二酚 (CBD) 市场的增长提供了机会。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020 (可定制为 2019-2014) |

|

定量单位 |

收入(百万美元),定价(美元) |

|

涵盖的领域 |

按来源(大麻和印度大麻)、等级(食品级和治疗级)、性质(有机和无机)、应用(酊剂、食品、饮料、药品、外用药、膳食补充剂等)、产品类型(CBD 油、CBD 浓缩物、CBD 分离物等) |

|

覆盖国家 |

阿联酋、以色列、南非和中东其他地区 |

|

涵盖的市场参与者 |

中东和非洲大麻二酚 (CBD) 市场的一些主要参与者包括 CV Sciences, Inc.、VIVO Cannabis Inc.、Gaia Herbs Hemp、Phoena Holdings Inc.、Medical Marijuana, Inc.、The Cronos Group、CHARLOTTE'S WEB、HEXO Corp.、Aurora Cannabis、Canopy Growth Corporation、Jazz Pharmaceuticals, Inc.、Tilray、Curaleaf、KAZMIRA、Freedom Leaf, Inc.、Koi CBD、Groff North America Hemplex、Joy Organics、Elixinol Wellness Limited、Isodiol International Inc.、Healthy Food Ingredients, LLC、NuLeaf Naturals, LLC、Diamond CBD、Medterra CBD、ENDOCA、Green Roads 等。 |

大麻二酚(CBD)市场定义

大麻二酚 (CBD) 是一种存在于大麻植物中的化学化合物,可从大麻中提取,通常从大麻中提取,因为大麻中天然含有高含量的大麻二酚 (CBD)。它在治疗焦虑和癫痫以及减轻疼痛方面具有多种益处。由于其具有治愈特性,人们对 CBD 的健康和保健需求很高,这是推动市场发展的主要因素。在所有大麻素中,大麻二酚由于缺乏精神活性作用而最广泛地用于治疗目的。大麻二酚油在许多医疗应用中都有使用,例如焦虑和抑郁治疗、缓解压力、预防糖尿病、缓解疼痛、缓解癌症症状和炎症。由于越来越多地采用基于 CBD 的产品来治疗疾病,预计中东和非洲市场在预测期内将以可观的速度增长。大麻二酚油越来越多地被用于制造治疗痤疮和皱纹的护肤品。例如,丝芙兰 (Sephora) 最近在其门店推出了大麻二酚或 CBD 护肤品系列。同样,Ulta Beauty 也打算推出基于大麻二酚的产品系列。几家新公司也正在进入含大麻二酚化妆品市场。

此外,各国政府以及大麻素市场的主要参与者都在投资研发活动。多项临床试验表明,CBD 可有效治疗包括癫痫在内的多种神经系统疾病。

市场动态

驱动程序

- 健康和健身领域对 CBD 的需求不断增加

消费者对健康和健身的意识不断增强,将有助于 CBD 市场快速增长。消费者可支配收入的增加以及医用大麻的合法化预计将对该领域对大麻二酚的需求产生积极影响。

此外,CBD 产品还用于缓解各种问题,如焦虑/压力、睡眠/失眠、慢性疼痛、偏头痛、皮肤护理、癫痫、关节痛和炎症、神经系统疾病等。由于使用 CBD 时能带来额外的好处,慢性疼痛治疗已广受欢迎。近年来,由于其广泛的医疗应用和疼痛缓解治疗,对大麻二酚 (CBD) 产品的需求不断增加。CBD 通过作用于体内的各种生物过程来帮助减轻慢性疼痛。此外,CBD 还具有抗氧化、抗炎和镇痛特性。因此,CBD 产品可以减轻慢性疼痛患者的焦虑。因此,对 CBD 在治疗慢性疼痛方面的需求不断增加,促进了市场的增长。这也有助于人们保持健康和健身习惯,同时远离健身活动中可能出现的疼痛。

- 改善 CBD 产品的政府审批和监管

政府法规非常严格,CBD 产品在本地和国际市场销售和供应之前需要经过严格的批准,这限制了市场的增长。然而,随着时间的推移,这些限制已经放宽,精制 CBD 产品的接受度越来越高,同时大麻和大麻衍生产品在各种用途上的合法化程度也越来越高。这将推动市场的增长和需求。

此外,全球各地都有主要的 CBD 产品制造商,这进一步促使政府和其他监管机构(例如美国食品药品监督管理局 (FDA)、欧洲的欧盟等)放宽对 CBD 和基于 CBD 的产品的限制。

克制

-

CBD 产品成本高

对于正在与疼痛、炎症和睡眠问题作斗争的人来说,CBD 是一种流行且全面的选择。由于 CBD 是一种新产品,研究和开发较少,并且最近才受到监管和批准,因此 CBD 的价格容易波动。大麻生产于 2018 年合法化,这影响了 CBD 产品的价格。结果,各种 CBD 产品的价格都出现了一定程度的上涨。

此外,许多农民正在转向种植和销售用于制造 CBD 产品的大麻,但尽管这种产品越来越受欢迎,但它也带来了自身的农业挑战。首先,转向新作物会带来新的开支。收获大麻最有效的方法是使用联合收割机。然而,以前种植不需要联合收割机的作物(如草莓)的农民无法立即购买联合收割机。因此,他们需要雇人帮忙收割大麻,这会推高整体产品价格,因为原材料变得昂贵。

此外,种植大麻需要更多的时间和劳动力,农民需要在作物生长过程中密切检查。此外,一旦收获,提取大麻二酚是一个困难且昂贵的过程。CBD 的加工商和提取商需要使用乙醇或超临界二氧化碳 (CO2 萃取)。提取和精炼过程需要特殊的机器,需要很长时间,这推高了 CBD 的成本。因此,所有这些因素加起来增加了 CBD 产品的成本,使其比其他产品贵得多,这可能会抑制市场的需求。

机会

-

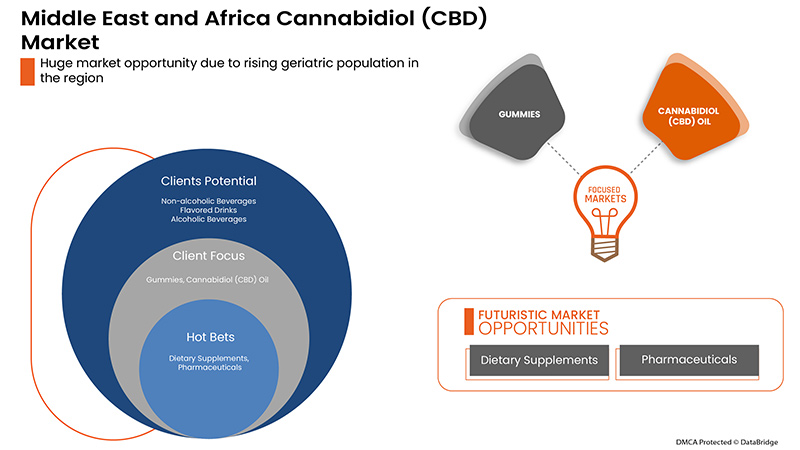

加大对基于 CBD 的新产品开发的投资

随着市场上提供创新和精炼产品的趋势日益增长,制造商正在投入大量资金进行研发,以生产新的 CBD 产品。油、酊剂、浓缩物、胶囊、外用溶液(如奴隶)、润唇膏、乳液和可食用产品(如烘焙食品、咖啡、巧克力、口香糖和糖果)是一些需求量很大的 CBD 产品。

需求的增加增加了研究 CBD 对某些健康状况影响的试验数量,预计这将开发新产品,从而为未来几年需求的增长提供机会。此外,许多公司批量采购 CBD 油并生产注入 CBD 的产品。此外,许多健康和保健零售商都在提供基于 CBD 的产品,例如 Rite Aid、CVS Health 和 Walgreens Boots Alliance。

此外,随着大麻产品监管和批准的放宽,各公司正在投入巨额资金进行产品开发和升级原材料生产,这也将有助于他们降低成本,同时满足市场不断增长的需求。新产品开发和不断增加的研发活动以及市场主要制造商做出的各种战略决策将为中东和非洲 CBD 市场的增长提供丰厚的机会。

挑战

- CBD 油相关的副作用

大麻二酚因其治疗多种疾病的能力而闻名,包括焦虑、癫痫、神经系统问题、癌症相关恶心、慢性疼痛等。然而,尽管它对多种疾病有用,但许多组织进行的各种研究和调查表明,基于 CBD 的药物也可能产生负面影响。

消费者经常遇到的一些副作用包括口干、嗜睡、低血压和头晕。CBD 还会提高体内的 Coumadin(一种血液稀释剂)水平,这可能会与其他药物相互作用并引起负面副作用。这些因素可能会阻碍未来采用 CBD 进行治疗。

此外,另一个令人担忧的原因是 CBD 油等产品中 CBD 的纯度和剂量不可靠。高浓度的 CBD 油也会对消费者的健康产生有害影响。在某些情况下,过量使用 CBD 油还可能增加肝酶,这是肝脏炎症的标志。细胞色素 P450 (CYP450) 是人体用来分解某些药物的酶。CBD 油可以阻断 CYP450。这意味着将 CBD 油与这些药物一起服用可能会使它们产生比需要的更强的效果,或者根本不起作用。

此外,含有 CBD 和草药成分混合物的膳食补充剂可能并不适合所有人,因为许多草药可能会与常用处方药发生相互作用。所有这些副作用可能因人而异,因为对某些人来说轻微的副作用对其他人来说可能很严重。这可能对中东和非洲 CBD 市场对 CBD 产品日益增长的需求构成挑战。

COVID-19 对中东和非洲大麻二酚 (CBD) 市场的影响

COVID-19 导致医护人员和普通民众对医疗用品的需求大幅增加,以采取预防措施。这些产品的制造商有机会通过确保市场上个人防护设备的稳定供应来利用医疗用品需求的增长。预计 COVID-19 将对中东和非洲大麻二酚 (CBD) 市场产生重大影响。

中东和非洲大麻二酚 (CBD) 市场范围和市场规模

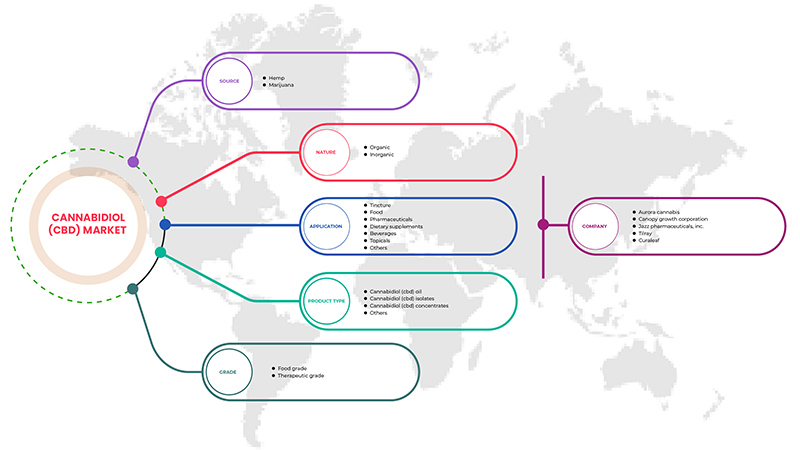

中东和非洲大麻二酚 (CBD) 市场根据来源、等级、应用、产品类型和性质进行细分。细分市场之间的增长有助于您分析利基增长领域和进入市场的策略,并确定您的核心应用领域和目标市场的差异。

来源

- 麻

- 大麻

根据来源,中东和非洲的大麻二酚 (CBD) 市场分为大麻和印度大麻。

按产品类型

- CBD 油

- CBD 分离物

- CBD 浓缩物

- 其他的

根据产品类型,中东和非洲大麻二酚 (CBD) 市场细分为 CBD 油、CBD 浓缩物、CBD 分离物和其他

天生如此

- 有机的

- 无机

根据性质,中东和非洲的大麻二酚 (CBD) 市场分为有机和无机。

按等级

- 食品级

- 治疗级

根据等级,中东和非洲的大麻二酚 (CBD) 市场分为食品级和治疗级。

按应用

- 酊剂

- 食物

- 饮料

- 制药

- 专题

- 膳食补充剂

- 其他的

根据应用,中东和非洲的大麻二酚 (CBD) 市场分为酊剂、食品、饮料、药品、外用药、膳食补充剂和其他。

中东和非洲大麻二酚 (CBD) 市场国家级分析

对大麻二酚 (CBD) 市场进行分析,并按来源、等级、应用、产品类型、性质提供市场规模信息。

大麻二酚 (CBD) 市场报告涵盖的国家包括阿联酋、以色列、南非和中东其他国家。

2022 年,南非将占据主导地位,因为该国拥有主要市场参与者,是最大的消费市场,GDP 较高。由于药物治疗技术的进步,南非预计将实现增长。

报告的国家部分还提供了影响单个市场因素和国内市场监管变化,这些因素和变化影响了市场的当前和未来趋势。新销售、替代销售、国家人口统计、监管法案和进出口关税等数据点是用于预测单个国家市场情景的一些主要指标。此外,在提供国家数据的预测分析时,还考虑了中东和非洲品牌的存在和可用性以及它们因来自本地和国内品牌的激烈或稀少的竞争而面临的挑战、销售渠道的影响。

大麻二酚 (CBD) 市场还为您提供每个国家医疗保健行业增长的详细市场分析。此外,它还提供有关医疗保健服务和治疗、监管情景影响以及大麻二酚 (CBD) 市场趋势参数的详细信息。

竞争格局和中东及非洲大麻二酚 (CBD) 市场份额分析

中东和非洲大麻二酚 (CBD) 市场竞争格局按竞争对手提供详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、生产基地和设施、公司优势和劣势、产品发布、产品试验渠道、产品批准、专利、产品宽度和广度、应用优势、技术生命线曲线。以上提供的数据点仅与公司对大麻二酚 (CBD) 产品的关注有关。

涉足大麻二酚(CBD)市场的主要公司有 CV Sciences, Inc.、VIVO Cannabis Inc.、Gaia Herbs Hemp、Phoena Holdings Inc.、Medical Marijuana, Inc.、The Cronos Group、CHARLOTTE'S WEB、HEXO Corp.、Aurora Cannabis、Canopy Growth Corporation、Jazz Pharmaceuticals, Inc.、Tilray、Curaleaf、KAZMIRA、Freedom Leaf, Inc.、Koi CBD、Groff North America Hemplex、Joy Organics、Elixinol Wellness Limited、Isodiol International Inc.、Healthy Food Ingredients, LLC、NuLeaf Naturals, LLC、Diamond CBD、Medterra CBD、ENDOCA、Green Roads 等。

预计主要市场参与者的合并、收购和协议等战略联盟将进一步加速大麻二酚 (CBD) 产品的增长。

例如,

- 2022年5月,Canopy Growth Corporation与总部位于加州的高品质大麻提取物生产商和清洁电子烟技术的先驱Lemurian, Inc.宣布,双方已达成最终协议,根据该协议,Canopy Growth将通过其全资子公司的方式,在美国联邦政府批准 THC 后或 Canopy Growth 选择的更早时间,获得收购 Jetty 高达 100% 的已发行股本的权利。此举将帮助该公司拓展市场业务。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 BENCHMARKING ANALYSIS

4.2 CBD PRODUCTS, INCLUDING CANNABINOIDS (IN %)

4.3 CBD RAW MATERIAL DEVELOPMENT TREND

4.3.1 MORE CONTROLLED CBD LEVELS:

4.3.2 CBD AND GENETICS:

4.3.3 ADVANCEMENTS MADE IN EXTRACTION:

4.3.4 NANOTECHNOLOGY

4.3.5 CONCLUSION

4.4 COMPANY POSITIONING GRID

4.4.1 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: COMPANY LANDSCAPE

4.4.1.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

4.4.1.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

4.4.1.3 COMPANY SHARE ANALYSIS: EUROPE

4.4.1.4 COMPANY SHARE ANALYSIS: SOUTH AMERICA

4.4.2 COMPANY’S CURRENT VENDORS

4.5 OVERALL VOLUME (KILO TONS) & QUANTITY OF COMPLETED TRANSACTIONS: MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET

4.6 LIST OF COUNTRIES THAT LEGALIZED CANNABIDIOL (CBD)

4.7 REGULATION COVERAGE

4.8 IMPORT & EXPORT REGULATION

4.8.1 IMPORT REGULATIONS

4.8.2 EXPORT REGULATIONS

4.9 IMPORT STANDARDS

4.1 GOVERNMENT POLICIES

4.11 QUALIFICATION/CERTIFICATION REQUIRED

4.12 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: PRICING ANALYSIS & DEAL PRICING

4.13 RAW MATERIAL EXTRACTOR POSITIONING GRID

4.13.1 KEY EXTRACTION

4.13.2 LINE CAPABILITY

4.14 TECHNOLOGICAL ADVANCEMENTS:

4.15 VENDOR/ DISTRIBUTOR SHARE ANALYSIS

4.16 VENDOR/DISTRIBUTOR KEY BUYERS

5 CLIMATE CHANGE SCENARIO: MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET

5.1 ENVIRONMENT CONCERNS-

5.2 INDUSTRY RESPONSE-

5.3 GOVERNMENT INITIATIVES

5.4 ANALYST RECOMMENDATIONS

6 SUPPLY CHAIN OF THE MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET

6.1 LOGISTIC COST SCENARIO

6.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASE IN DEMAND FOR CBD IN HEALTH & FITNESS

7.1.2 IMPROVING GOVERNMENT APPROVALS AND REGULATIONS FOR CBD PRODUCTS

7.1.3 THERAPEUTIC PROPERTIES OF CBD OIL

7.1.4 CONSUMERS' SHIFT TOWARDS LEGALLY PURCHASING CANNABIS FOR MEDICAL AS WELL AS RECREATIONAL USE

7.2 RESTRAINTS

7.2.1 HIGH COST OF CBD PRODUCTS

7.2.2 AVAILABILITY OF COUNTERFEIT AND SYNTHETIC PRODUCTS IN THE MARKET

7.3 OPPORTUNITIES

7.3.1 INCREASING INVESTMENTS IN THE DEVELOPMENT OF NEW CBD BASED PRODUCTS

7.3.2 GROWING MEDICAL APPLICATIONS OF CBD

7.4 CHALLENGES

7.4.1 SIDE EFFECTS ASSOCIATED WITH CBD OIL

7.4.2 BARRIERS IN TERMS OF MARKETING OF CBD

8 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET, BY SOURCE

8.1 OVERVIEW

8.2 HEMP

8.3 MARIJUANA

9 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 CANNABIDIOL (CBD) OIL

9.2.1 CARBON DIOXIDE EXTRACTION

9.2.2 STEAM DISTILLATION

9.2.3 SOLVENT EXTRACTION

9.2.4 OTHERS

9.3 CANNABIDIOL (CBD) ISOLATES

9.4 CANNABIDIOL (CBD) CONCENTRATES

9.5 OTHERS

10 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET, BY NATURE

10.1 OVERVIEW

10.2 ORGANIC

10.3 INORGANIC

11 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET, BY GRADE

11.1 OVERVIEW

11.2 FOOD GRADE

11.3 THERAPEUTIC GRADE

12 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 TINCTURE

12.3 FOOD

12.3.1 CHOCOLATE & CONFECTIONERY

12.3.1.1 CANDY

12.3.1.2 CHOCOLATE

12.3.1.3 CHEWS

12.3.1.4 GUMMIES

12.3.1.5 OTHERS

12.3.2 HONEY

12.3.3 DAIRY BASED EDIBLE

12.3.3.1 MILK

12.3.3.2 ICE CREAM

12.3.3.3 OTHERS

12.3.4 SAUCES AND SEASONINGS

12.3.5 BAKERY EDIBLE

12.3.5.1 COOKIES AND BISCUITS

12.3.5.2 BROWNIES

12.3.5.3 OTHERS

12.3.6 OTHERS

12.3.7 PHARMACEUTICALS

12.3.7.1 DRAVET SYNDROME

12.3.7.2 MULTIPLE SCLEROSIS DRUG APPLICATIONS

12.3.7.3 NEUROLOGICAL DRUG APPLICATIONS

12.3.7.4 CANCER DRUG APPLICATIONS

12.3.7.5 OTHERS

12.3.8 DIETARY SUPPLEMENTS

12.3.8.1 CAPSULES

12.3.8.2 GUMMIES

12.3.8.3 OTHERS

12.3.9 BEVERAGES

12.3.9.1 NON-ALCOHOLIC BEVERAGES

12.3.9.1.1 ENERGY DRINKS

12.3.9.1.2 SOFT DRINKS

12.3.9.1.3 RTD COFFEE

12.3.9.1.4 TEA

12.3.9.1.5 SPARKLING WATER

12.3.9.1.6 OTHERS

12.3.9.2 FLAVORED DRINKS

12.3.9.2.1 ORANGE

12.3.9.2.2 LEMON

12.3.9.2.3 BERRIES

12.3.9.2.4 COCONUT

12.3.9.2.5 OTHERS

12.3.9.3 ALCOHOLIC BEVERAGES

12.3.9.3.1 BEER

12.3.9.3.2 WINE

12.3.9.3.3 OTHERS

12.3.9.4 OTHERS

12.3.10 TOPICAL

12.3.10.1 LOTION

12.3.10.2 SALVE

12.3.10.3 LIP BALM

12.3.10.4 OTHERS

12.3.11 OTHERS

12.3.11.1 VAPES

12.3.11.2 CIGARETTES

12.3.11.3 SPA AND RECREATION

13 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 SOUTH AFRICA

13.1.2 U.A.E

13.1.3 ISRAEL

13.1.4 REST OF MIDDLE EAST AND AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 CURALEAF

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 TILRAY

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 JAZZ PHARMACEUTICALS, INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 CANOPY GROWTH CORPORATION

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 AURORA CANNABIS.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 CHARLOTTE’S WEB.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 CV SCIENCES, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 DIAMOND CBD.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 ELIXINOL WELLNESS LIMITED

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 ENDOCA.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 FREEDOM LEAF, INC

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 GAIA HERBS HEMP

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 GREEN ROADS.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 GROFF NORTH AMERICA HEMPLEX

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 HEXO CORP.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 HEALTHY FOOD INGREDIENTS, LLC.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 ISODIOL INTERNATIONAL INC

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 JOY ORGANICS

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 KAZMIRA

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 KOI CBD

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 MEDICAL MARIJUANA, INC.

15.21.1 COMPANY SNAPSHOT

15.21.2 EVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENTS

15.22 MEDTERRA CBD

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENTS

15.23 NULEAF NATURALS, LLC

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

15.24 PHOENA HOLDINGS INC.

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENTS

15.25 THE CRONOS GROUP

15.25.1 COMPANY SNAPSHOT

15.25.2 REVENUE ANALYSIS

15.25.3 PRODUCT PORTFOLIO

15.25.4 RECENT DEVELOPMENTS

15.26 VIVO CANNABIS INC.

15.26.1 COMPANY SNAPSHOT

15.26.2 REVENUE ANALYSIS

15.26.3 PRODUCT PORTFOLIO

15.26.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 BENCHMARK ANALYSIS

TABLE 2 AVERAGE VOLUME TREND FOR MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET (KILO TONS)

TABLE 3 THE FOLLOWING ARE THE PRICES OF PRODUCTS OFFERED BY THE COMPANIES:

TABLE 4 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA HEMP IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA MARIJUANA IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) ISOLATES IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) CONCETRATES IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA OTHERS IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA ORGANIC IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA INORGANIC IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA FOOD GRADE IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA THERAPEUTIC GRADE IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA TINCTURE IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA FOOD IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA FOOD IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA PHARMACEUTICALS IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA TOPICAL IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA TOPICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA OTHERS IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA CANNABIDIOL (CBD) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA TOPICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 57 MIDDLE EAST AND AFRICA OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 SOUTH AFRICA CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 59 SOUTH AFRICA CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 SOUTH AFRICA CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 61 SOUTH AFRICA CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 62 SOUTH AFRICA CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 63 SOUTH AFRICA CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 SOUTH AFRICA FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 SOUTH AFRICA CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 SOUTH AFRICA BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 SOUTH AFRICA DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 SOUTH AFRICA BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 SOUTH AFRICA ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 SOUTH AFRICA NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SOUTH AFRICA FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 SOUTH AFRICA PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 SOUTH AFRICA TOPICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 SOUTH AFRICA DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 SOUTH AFRICA OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 U.A.E CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 77 U.A.E CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 78 U.A.E CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 79 U.A.E CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 80 U.A.E CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 81 U.A.E CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 U.A.E FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 U.A.E CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 U.A.E BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 U.A.E DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 U.A.E BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 U.A.E ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 U.A.E NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 U.A.E FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 U.A.E PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 91 U.A.E TOPICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 U.A.E DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 U.A.E OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 ISRAEL CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 95 ISRAEL CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 96 ISRAEL CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 97 ISRAEL CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 98 ISRAEL CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 99 ISRAEL CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 ISRAEL FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 ISRAEL CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 ISRAEL BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 ISRAEL DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 ISRAEL BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 ISRAEL ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 ISRAEL NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 ISRAEL FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 ISRAEL PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 ISRAEL TOPICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 ISRAEL DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 111 ISRAEL OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 REST OF MIDDLE EAST AND AFRICA CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET AND IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 THE INCREASING DEMAND FOR CANNABIDIOL (CBD) DUE TO ITS HEALING PROPERTIES AND HEALTH AND WELLNESS PURPOSES IS HIGH, WHICH IS THE MAJOR FACTOR DRIVING THE MARKET IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 HEMP IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET IN 2022 & 2029

FIGURE 13 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: COMPANY SHARE 2021 (%)

FIGURE 14 NORTH AMERICA CANNABIDIOL (CBD) MARKET: COMPANY SHARE 2021 (%)

FIGURE 15 EUROPE CANNABIDIOL (CBD) MARKET: COMPANY SHARE 2021 (%)

FIGURE 16 SOUTH AMERICA CANNABIDIOL (CBD) MARKET: COMPANY SHARE 2021 (%)

FIGURE 17 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: VENDOR/ DISTRIBUTOR SHARE ANALYSIS (%)

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET

FIGURE 19 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY SOURCE, 2021

FIGURE 20 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY SOURCE, 2022-2029 (USD MILLION)

FIGURE 21 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY SOURCE, CAGR (2022-2029)

FIGURE 22 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY SOURCE, LIFELINE CURVE

FIGURE 23 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY PRODUCT TYPE, 2021

FIGURE 24 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 25 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 27 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY NATURE, 2021

FIGURE 28 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY NATURE, 2022-2029 (USD MILLION)

FIGURE 29 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY NATURE, CAGR (2022-2029)

FIGURE 30 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY NATURE, LIFELINE CURVE

FIGURE 31 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY GRADE, 2021

FIGURE 32 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY GRADE, 2022-2029 (USD MILLION)

FIGURE 33 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY GRADE, CAGR (2022-2029)

FIGURE 34 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY GRADE, LIFELINE CURVE

FIGURE 35 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY APPLICATION, 2021

FIGURE 36 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 37 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 38 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 39 MIDDLE EAST AND AFRICA CANNABIDIOL (CBD) MARKET: SNAPSHOT (2021)

FIGURE 40 MIDDLE EAST AND AFRICA CANNABIDIOL (CBD) MARKET: BY COUNTRY (2021)

FIGURE 41 MIDDLE EAST AND AFRICA CANNABIDIOL (CBD) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 42 MIDDLE EAST AND AFRICA CANNABIDIOL (CBD) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 43 MIDDLE EAST AND AFRICA CANNABIDIOL (CBD) MARKET: BY SOURCE (2022-2029)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。