Middle East And Africa Bioactive Ingredient Market

市场规模(十亿美元)

CAGR :

%

USD

3.55 Billion

USD

6.01 Billion

2025

2033

USD

3.55 Billion

USD

6.01 Billion

2025

2033

| 2026 –2033 | |

| USD 3.55 Billion | |

| USD 6.01 Billion | |

|

|

|

|

Middle East and Africa bioactive ingredient market is segmented By Ingredient Type (Prebiotics, Probiotics, Amino Acid, Peptides, Omega 3 And Structured Lipid, Phytochemicals & Plant Extracts, Minerals, Vitamins, Fibers, And Specialty Carbohydrates, Carotenoids And Antioxidants And Others), Application (Functional Food, Dietary Supplements, Gummy Supplements, Animal Nutrition, Personal Care And Others) and Source (Plant, Animal And Microbial), By Country (UAE, Saudi Arabia, Qatar, Kuwait, South Africa, Rest of Middle East and Africa ), industry Trends and Forecast to 2028

Market Analysis and Insights: Middle East and Africa Bioactive Ingredient Market

Market Analysis and Insights: Middle East and Africa Bioactive Ingredient Market

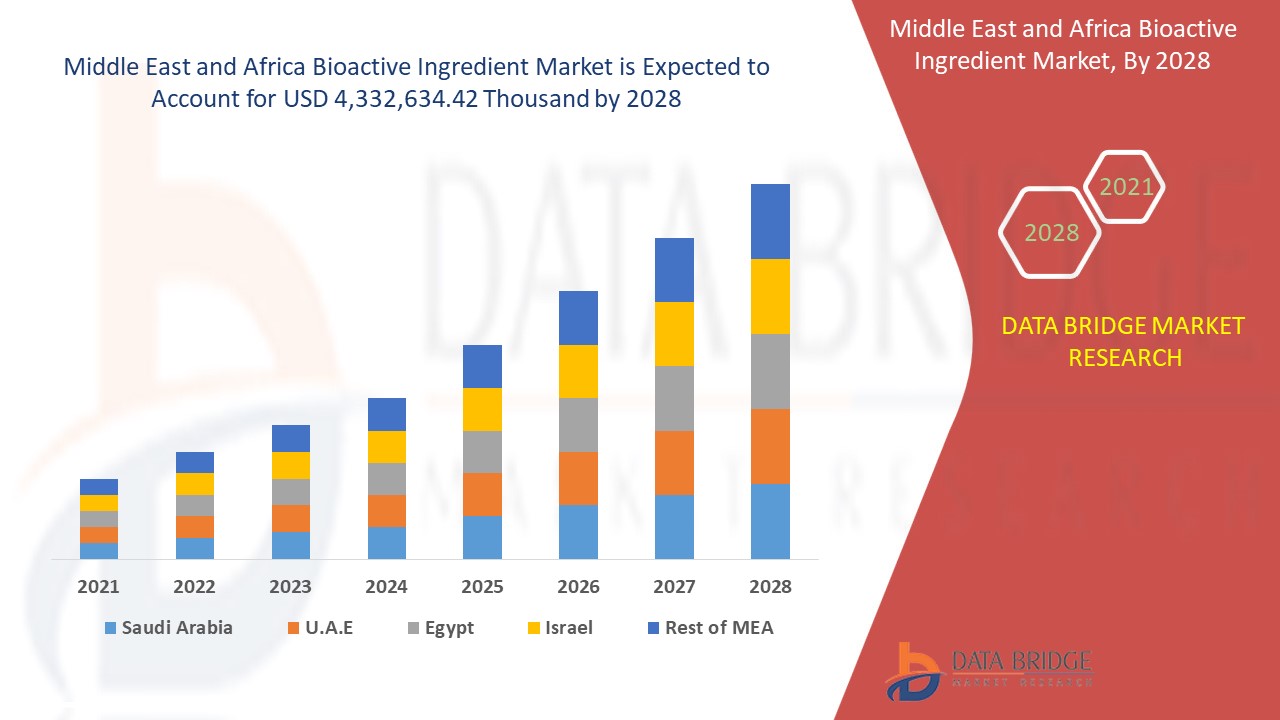

Bioactive ingredient market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing at a CAGR of 6.8% in the forecast period of 2021 to 2028 and expected to reach USD 4,332,634.42 thousand by 2028.

Bioactive ingredients are substances that have a biological effect on living organisms. The components come from various sources, including plants, food, animals, the sea, and microorganisms. Bioactive substances are added to food and feed products to improve the physical and physiologic health of customers. Functional foods and drinks, nutritional supplements, and newborn nutrition all make extensive use of bioactive substances. These chemicals can help prevent cancer, heart disease, and other illnesses.

Bioactive substances are widely utilized in a variety of sectors, including food and drinks, medicines and nutraceuticals, personal care items, and animal feed. Carotenoids, essential oils, and antioxidants are instances of bioactive substances utilized in functional meals to improve their sensory and nutritional qualities. They are a kind of biomolecules that aid in the metabolic process of healthy molecules added to food and different type of products.

This bioactive ingredient Market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

Middle East and Africa bioactive ingredient Market Scope and Market Size

Middle East and Africa bioactive ingredient Market Scope and Market Size

Middle East and Africa bioactive ingredient Market is categorized into three notable segments, which are based on the ingredient type, application and source. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of ingredient type, global bioactive ingredient market is segmented into prebiotic, probiotics, amino acid, peptides, omega 3 and structured lipid, phytochemicals & plant extracts, minerals, vitamins, fibers and specialty carbohydrates, carotenoids and antioxidants and others. Prebiotic is further segmented into fructans, galacto-oligosaccharides, starch, and glucose-derived oligosaccharides, non-carbohydrate oligosaccharides, and others. Probiotics is further segmented into lactobacilli, bifidobacteria, yeasts. Amino acid is further segmented into isoleucine, histidine, leucine, lysine, methionine, phenylalanine, threonine, tryptophan, valine, and others. Peptides are further segmented into dipeptides, tripeptides, oligopeptides, and polypeptides. Minerals are further segmented into calcium, phosphorus, magnesium, sodium, potassium, manganese, iron, copper, iodine, zinc, and others. Vitamins are further segmented into vitamin A, vitamin C, vitamin D, vitamin E, vitamin K, vitamin B1, vitamin B2, vitamin B3, vitamin B6, vitamin B12 and others.

- On the basis of application, the global bioactive ingredient market is segmented into functional food, dietary supplements, gummy supplements, animal nutrition, personal care, and others. Functional food is further segmented into dairy, dairy alternatives, bread, pasta, cereal, egg products, snack bars, bars, and beverages. Dairy is further sub-segmented into milk, yogurt, cheese, butter, and others. Dairy alternatives are further sub-segmented into plant-based milk, plant-based yogurt, bioactive ingredients and others. Bars are further sub-segmented into protein bars, sports nutrition bars, yoga bars, pre-workout bars, post-workout bars, and others. Beverages are further sub-segmented into juices and smoothies. Animal nutrition is further segmented by animal category into beef, poultry, seafood, and pork. Personal care is further segmented into hair care and skincare.

- On the basis of source, the global bioactive ingredient market is segmented into plant, animal and microbial.

Bioactive ingredient Market Country Level Analysis

Middle East and Africa market is analysed and market size information is provided by Ingredient, Applications, Source. The countries covered in Middle East and Africa bioactive ingredient Market report are UAE, Saudi Arabia, Qatar, Kuwait and South Africa.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Growth in the Bioactive ingredient Industry

Middle East and Africa bioactive ingredient Market also provides you with detailed market analysis for every country growth in installed base of different kind of products for bioactive ingredient Market, impact of technology using life line curves and changes in infant formula regulatory scenarios and their impact on the bioactive ingredient Market. The data is available for historic period 201o to 2019.

Competitive Landscape and bioactive ingredient Market Share Analysis

Middle East and Africa Bioactive ingredient Market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to Middle East and Africa bioactive Market.

The major market players engaged in the global bioactive ingredient market are DSM, BASF SE , Kerry, DuPont, ADM, Global Bio-chem Technology Group Company Limited, Evonik Industries AG, Cargill,Incorporated, Arla Food Ingredients Group P/S (a subsidiary of Arla Foods amba), FMC Corporation, Sunrise Nutrachem Group, Adisseo (a subsidiary of Bluestar Adisseo Co., Ltd.), Chr.Hansen Holding A/S, Sabinsa, Ajinomoto Co., Inc, NOVUS INTERNATIONAL (a subsidiary of Mitsui & Co. (U.S.A.), Inc.), Ingredion, Roquette Frères, Probi and Advanced Animal Nutrition Pty Ltd. among others

For instance,

- In January 2021, DuPont Nutrition & Biosciences launched a new product, HOWARD Calm, a probiotic that is targeted at assisting dietary supplement producers in breaking the cycle of customer stress. The implementation was carried out to respond to the market's rising customer demand.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。