Middle East and Africa Application Specific Integrated Circuit (ASIC) Market, By Design Type (Full Custom, Semi-Custom, And Programmable), By Programming Technology (Static Ram, EPROM, EEPROM, Antifuse, And Others), By Application (Consumer Electronics, Data Center & Computing, IT & Telecommunication, Medical, Multimedia, Automotive, And Industrial), By Country (Saudi Arabia, U.A.E., Israel, South Africa, Egypt and Rest of Middle East and Africa), Market Trends and Forecast to 2029.

Market Analysis and Insights: Middle East and Africa Application specific integrated circuit (ASIC) Market

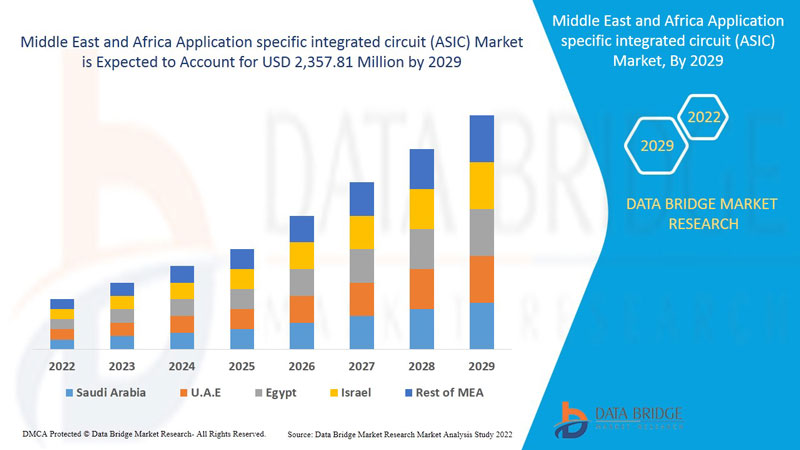

Middle East and Africa application specific integrated circuit (ASIC) market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 6.9% in the forecast period of 2022 to 2029 and expected to reach USD 2,357.81 million by 2029.

An application-specific integrated circuit (ASIC) is an IC chip that is tailored to a specific application rather than being designed for broad usage. An ASIC is, for example, a chip that runs in a digital voice recorder or a high-efficiency video encoder (such as AMD VCE). Application-specific standard product (ASSP) chips are a middle ground between ASICs and industry-standard integrated circuits such as the 7400 or 4000 series. As MOS integrated circuit chips, ASIC chips are generally produced using metal-oxide-semiconductor (MOS) technology which includes FPGA. The greatest complexity (and hence usefulness) available in an ASIC has expanded from 5,000 logic gates to over 100 million as feature sizes have dropped and design tools have improved over time. Microprocessors, memory blocks such as ROM, RAM, EEPROM, flash memory, and other significant building blocks are frequently included in modern ASICs. A SoC is a common moniker for such an ASIC (system-on-chip). A hardware description language (HDL), such as Verilog or VHDL, is frequently used by designers of digital ASICs to define the functioning of ASICs.

Some of the factors which are driving the market is emergence of ASIC driven IoT devices and upsurge in adoption of mechatronics for automotive applications. But high cost associated with manufacturing customized circuits can be a restraining factor. Moreover, the Europe application specific integrated circuit (ASIC) market is also expanding due to growing utilizing of ASIC technologies for powering AI.

This application specific integrated circuit (ASIC) market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

Middle East and Africa Application Specific Integrated Circuit (ASIC) Market Scope and Market Size

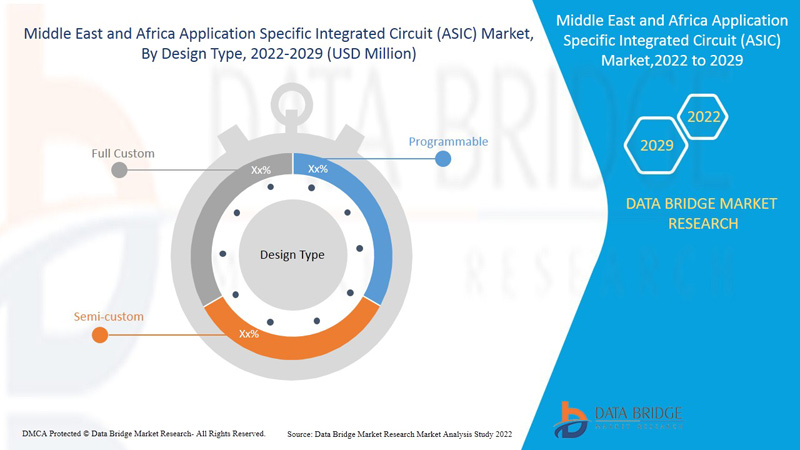

Middle East and Africa application specific integrated circuit (ASIC) market is segmented on the basis of design type, programming technology, and application. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of design type, Middle East and Africa application-specific integrated circuit (ASIC) market has been segmented into full custom, semi-custom, and programmable. In 2022, the semi-custom segment is expected to dominate the Middle East and Africa application-specific integrated circuit (ASIC) market as with growing demand for for advanced data centers in order to meet the growing demand for data, content by the consumer is boosting the requirements semi-custom ASIC technologies which can be used for various applications such as automotive, manufacturing, medical, multimedia and others.

- On the basis of programming technology segment, Middle East and Africa application-specific integrated circuit (ASIC) market has been segmented into static ram, EPROM, EEPROM, antifuse, and others. In 2022, the static ram segment is expected to dominate the Middle East and Africa application-specific integrated circuit (ASIC) market due to hoist in demand for smart wearable electronic devices and growing demand for data-driven healthcare devices has increased the demand for static ram ASIC technologies, as these technology plays a vital role in enhancing the processing capabilities of these electronics devices, this can hoist the growth in market.

- On the basis of application segment, Middle East and Africa application-specific integrated circuit (ASIC) market has been segmented into consumer electronics, data center & computing, IT & telecommunication, medical, multimedia, automotive, and industrial. In 2022, the consumer electronics is expected to dominate the Middle East and Africa application-specific integrated circuit (ASIC) market due to growing large streaming and broadcast content from consumer and with availability of high speed infrastructure to cater these demands is boosting the smart consumer electronic products. As ASIC technologies helps in providing high speed data content transmission using high performance ICs.

Middle East and Africa Application Specific Integrated Circuit (ASIC) Market Country Level Analysis

Middle East and Africa Application specific integrated circuit (ASIC) Market is analysed and market size information is provided by design type, programming technology, and application.

The countries covered in Middle East and Africa application specific integrated circuit (ASIC) Market report are South Africa, Egypt, U.A.E., Saudi Arabia, Israel, and rest of Middle East and Africa.

Israel dominates the application specific integrated circuit (ASIC) market owing to various factors such emergence of ASIC driven IoT devices among consumer and upsurge in adoption of mechatronics for automotive applications.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Rising Demand of Application Specific Integrated Circuit (ASIC).

Application specific integrated circuit (ASIC) Market also provides you with detailed market analysis for every country growth in industry with sales, components sales, impact of technological development application specific integrated circuit (ASIC) and changes in regulatory scenarios with their support for the application specific integrated circuit (ASIC) market. The data is available for historic period 2012 to 2020.

Competitive Landscape and Application Specific Integrated Circuit (ASIC) Market Share Analysis

Application specific integrated circuit (ASIC) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to Middle East and Africa application specific integrated circuit (ASIC) market.

The major players covered in the report are Intel Corporation, Infineon Technologies AG, NXP Semiconductors, Qualcomm Technologies, Microchip Technology Inc., Analog Devices and others. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately. Many product developments are also initiated by the companies worldwide which are also accelerating the growth of application specific integrated circuit (ASIC) market.

For instance,

- In November 2021, Qualcomm Technologies, Inc. launched snapdragon automotive cockpit platform for PEUGEOT 308 vehicle. The key feature of this product launch was to provide digital and automotive technology to offer premium experience for drivers and passengers. This processor is specifically designed for this vehicle. This helped the company to grow its reputation in automotive.

Partnership, contract, joint ventures and other strategies enhances the company market share with increased coverage and presence. It also provides the benefit for organisation to improve their offering for application specific integrated circuit (ASIC) market through expanded range of size.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMRMARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 DESIGN TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR SMARTPHONES AND TABLETS

5.1.2 INCREASE IN DEMAND FROM SMART CONSUMER DEVICES

5.1.3 EMERGENCE OF ASIC DRIVEN IOT DEVICES

5.1.4 RISE IN DEMAND FOR MINIATURIZED ELECTRONICS DEVICE

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH MANUFACTURING CUSTOMIZED CIRCUITS

5.2.2 ASICS VULNERABILITY TOWARDS SECURITY ATTACKS/CYBER ATTACKS

5.3 OPPORTUNITIES

5.3.1 UTILIZING ASIC TECHNOLOGIES FOR POWERING AI

5.3.2 UPSURGE IN ADOPTION OF MECHATRONICS FOR AUTOMOTIVE APPLICATIONS

5.3.3 RISE IN DEPLOYMENT OF DATA CENTERS AND HIGH-PERFORMANCE COMPUTING

5.3.4 GROW IN PARTNERSHIP, ACQUISITIONS, AND MERGERS FOR ASIC

5.4 CHALLENGES

5.4.1 FUNCTIONAL RELIABILITY ISSUES FACED IN ASIA

5.4.2 COMPLEXITY INVOLVED IN DESIGNING AND FABRICATION OF APPLICATION SPECIFIC CIRCUITS

6 IMPACT OF COVID-19 PANDEMIC ON MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE MARKET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON DEMAND

6.4 IMPACT ON PRICE

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE

7.1 OVERVIEW

7.2 SEMI-CUSTOM

7.2.1 STANDARD –CELL-BASED ASICS

7.2.2 GATE-ARRAY-BASED ASICS

7.2.2.1 CHANNEL LESS GATE ARRAYS

7.2.2.2 STRUCTURED GATE ARRAYS

7.2.2.3 CHANNELLED GATE ARRAYS

7.3 PROGRAMMABLE

7.3.1 FPGAS (FIELD PROGRAMMABLE GATE ARRAY)

7.3.1.1 BY TYPE

7.3.1.1.1 HIGH-END FPGAS

7.3.1.1.2 LOW-END FPGAS

7.3.1.1.3 MID-RANGE FPGAS

7.3.1.2 BY NODE SIZE

7.3.1.2.1 LESS THAN 28 NM

7.3.1.2.2 28-90 NM

7.3.1.2.3 MORE THAN 90 NM

7.3.1.3 BY APPLICATION

7.3.1.3.1 FILTERING AND COMMUNICATION

7.3.1.3.2 MEDICAL IMAGING

7.3.1.3.3 COMPUTER HARDWARE EMULATION

7.3.1.3.4 SOFTWARE-DEFINED RADIO

7.3.1.3.5 BIOINFORMATICS

7.3.1.3.6 DIGITAL SIGNAL PROCESSING

7.3.1.3.7 VOICE RECOGNITION

7.3.1.3.8 CRYPTOGRAPHY

7.3.1.3.9 INTEGRATING MULTIPLE SPLDS

7.3.1.3.10 ASIC PROTOTYPING

7.3.1.3.11 DEVICE CONTROLLERS

7.3.2 PLDS (PROGRAMMABLE LOGIC DEVICES)

7.3.2.1 BY TYPE

7.3.2.1.1 SIMPLE PROGRAMMABLE LOGIC DEVICE (SPLDS)

7.3.2.1.2 HIGH CAPACITY PROGRAMMABLE LOGIC DEVICE (HCPLDS)

7.4 FULL CUSTOM

8 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY

8.1 OVERVIEW

8.2 STATIC RAM

8.3 ANTIFUSE

8.4 EEPROM

8.5 EPROM

8.6 OTHERS

9 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 CONSUMER ELECTRONICS

9.2.1 SMARTPHONES AND TABLETS

9.2.2 WIRELESS VIRTUAL REALITY DEVICES

9.2.3 OTHERS

9.3 IT & TELECOMMUNICATION

9.3.1 WIRELESS COMMUNICATION

9.3.2 WIRED COMMUNICATION

9.4 DATA CENTER & COMPUTING

9.5 MEDICAL

9.5.1 IMAGING DIAGNOSTICS

9.5.2 WEARABLE DEVICES

9.5.3 OTHERS

9.6 INDUSTRIAL

9.6.1 BY SECTOR

9.6.1.1 MILITARY, AEROSPACE & DEFENSE

9.6.1.2 SATELLITE & SPACE

9.6.1.3 AVIATION

9.6.1.4 POWER GENERATION

9.6.1.5 OIL & GAS

9.6.2 BY APPLICATION

9.6.2.1 MACHINE VISION

9.6.2.2 ROBOTICS

9.6.2.3 INDUSTRIAL SENSOR

9.6.2.4 INDUSTRIAL NETWORKING

9.6.2.5 INDUSTRIAL MOTOR CONTROL

9.6.2.6 VIDEO SURVEILLANCE

9.7 AUTOMOTIVE

9.7.1 ADAS

9.7.2 AUTOMOTIVE INFOTAINMENT & DRIVER INFORMATION SYSTEM

9.8 MULTIMEDIA

9.8.1 COMMUNICATIONS

9.8.2 VIDEO PROCESSING

9.8.3 AUDIO

10 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION

10.1 MIDDLE EAST & AFRICA

10.1.1 ISRAEL

10.1.2 U.A.E.

10.1.3 SAUDI ARABIA

10.1.4 SOUTH AFRICA

10.1.5 EGYPT

10.1.6 REST OF MIDDLE EAST AND AFRICA

11 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 INTEL CORPORATION

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCTS PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 INFINEON TECHNOLOGIES AG

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCTS PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 ANALOG DEVICES, INC.

13.3.1 COMPANY SNAPHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 NXP SEMICONDUCTORS

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCTS PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 MICROCHIP TECHNOLOGY INC.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 TEXAS INSTRUMENTS INCORPORATED

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENTS

13.7 ACHRONIX SEMICONDUCTOR CORPORATION

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCTS PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 AVNET ASIC ISRAEL LTD.

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 COBHAM LIMITED

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 ENSILICA

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCTS PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 GOWIN SEMICONDUCTOR

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCTS PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 HONEYWELL INTERNATIONAL INC.

13.12.1 COMPANY SNAPHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENTS

13.13 LATTICE SEMICONDUCTOR

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 MAXIM INTEGRATED

13.14.1 COMPANY SNAPHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 MEGACHIPS CORPORATION

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCTS PORTFOLIO

13.15.4 RECENT DEVELOPMENTS

13.16 QUALCOMM TECHNOLOGIES, INC.

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCTS PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 QUICKLOGIC CORPORATION

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENTS

13.18 RENESAS ELECTRONICS CORPORATION

13.18.1 COMPANY SNAPHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENTS

13.19 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCTS PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 SOCIONEXT INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENTS

13.21 XILINX

13.21.1 COMPANY SNAPSHOT

13.21.2 REVENUE ANALYSIS

13.21.3 PRODUCTS PORTFOLIO

13.21.4 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

表格列表

TABLE 1 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA FULL CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA STATIC RAM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA ANTIFUSE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA EEPROM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA EPROM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA OTHERS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA DATA CENTER & COMPUTING IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 202O-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 ISRAEL APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 52 ISRAEL SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 ISRAEL GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 ISRAEL PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 ISRAEL FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 ISRAEL FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 57 ISRAEL FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 ISRAEL PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 ISRAEL APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 60 ISRAEL APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 ISRAEL CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 ISRAEL IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 ISRAEL MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 ISRAEL INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 65 ISRAEL INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 ISRAEL AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYP APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 ISRAEL MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 U.A.E. APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 69 U.A.E. SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 U.A.E. GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 U.A.E. PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 U.A.E. FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 U.A.E. FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 74 U.A.E. FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 U.A.E. PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 U.A.E. APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 77 U.A.E. APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 78 U.A.E. CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 U.A.E. IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 U.A.E. MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 U.A.E. INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 82 U.A.E. INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 U.A.E. AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 U.A.E. MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 SAUDI ARABIA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 86 SAUDI ARABIA SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 SAUDI ARABIA GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 SAUDI ARABIA PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 SAUDI ARABIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 SAUDI ARABIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 91 SAUDI ARABIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 SAUDI ARABIA PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 SAUDI ARABIA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 94 SAUDI ARABIA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 SAUDI ARABIA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 SAUDI ARABIA IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 SAUDI ARABIA MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 SAUDI ARABIA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 99 SAUDI ARABIA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 SAUDI ARABIA AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 101 SAUDI ARABIA MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 102 SOUTH AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 103 SOUTH AFRICA SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 SOUTH AFRICA GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 SOUTH AFRICA PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 SOUTH AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 SOUTH AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 108 SOUTH AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 SOUTH AFRICA PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 SOUTH AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 111 SOUTH AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 SOUTH AFRICA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 SOUTH AFRICA IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 114 SOUTH AFRICA MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 SOUTH AFRICA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 116 SOUTH AFRICA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 117 SOUTH AFRICA AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 SOUTH AFRICA MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 119 EGYPT APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 120 EGYPT SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 EGYPT GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 EGYPT PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 EGYPT FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 EGYPT FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 125 EGYPT FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 126 EGYPT PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 EGYPT APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 128 EGYPT APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 129 EGYPT CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 EGYPT IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 EGYPT MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 132 EGYPT INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 133 EGYPT INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 EGYPT AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 EGYPT MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 REST OF MIDDLE EAST AND AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: MIDDLE EAST & AFRICA VS REGIONAL ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: DBMRMARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET:MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: SEGMENTATION

FIGURE 11 GROWING DEMAND FOR SMARTPHONES AND TABLETS IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SEMI-CUSTOM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET

FIGURE 15 TOP 10 COUNTRIES WITH SMARTPHONES (IN MILLIONS)

FIGURE 16 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY DESIGN TYPE, 2021

FIGURE 17 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY PROGRAMMING TECHNOLOGY, 2021

FIGURE 18 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY APPLICATION, 2021

FIGURE 19 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: SNAPSHOT (2021)

FIGURE 20 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY COUNTRY (2021)

FIGURE 21 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 23 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY DESIGN TYPE (2022-2029)

FIGURE 24 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。