中东和北非特种油田化学品市场,按类型(表面活性剂、破乳剂、抑制剂、杀菌剂降滤失剂、流变改性剂、发泡剂、聚合物、润滑剂/减摩剂、降凝剂、铁控制剂、清除剂、胶凝剂和增粘剂、缓凝剂等)、按用途(钻井、油井刺激、生产和提高采收率 (EOR)、水泥、修井和完井等)、特种油田位置(陆上和海上)划分 - 行业趋势和预测到 2030 年。

中东和北非特种油田化学品市场分析与洞察

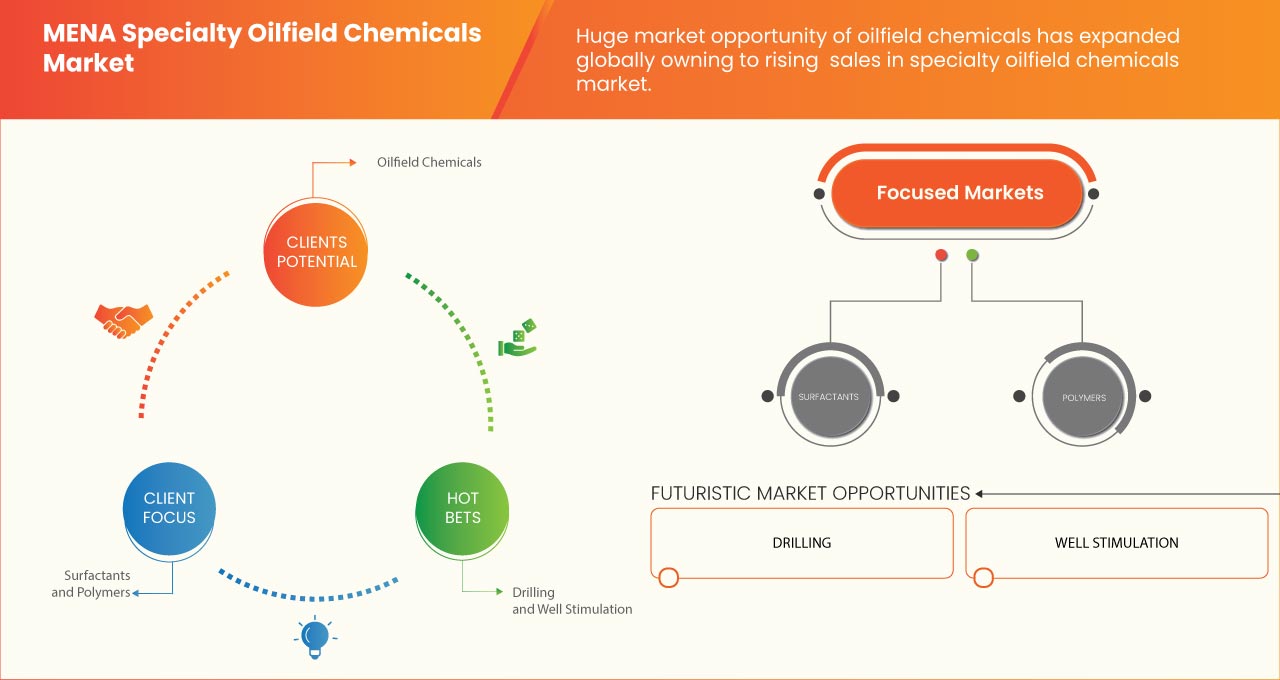

现代化学工业高度依赖原油和天然气原料。化学工程与石油工程一起在石油和天然气产品的生产中发挥着重要作用。使用油田专用化学品可以更有效地钻探和操作油气井,提高油田储层的生产力,并且随着石油工业越来越依赖于增加现有油田的原油或石油产品产量,油田专用化学品的使用将会增加。

油田特种化学品由具有不同化学成分的化学品制成,有助于分离、粘合和强化。油田特种化学品是天然和合成化合物的混合物,用于冷却和润滑钻头、清洁钻井设备的孔底、将岩屑输送到地面、控制地层压力和控制井下地层压力。油田特种化学品产品具有独特的性能,使其成为许多不同应用的理想解决方案。特种化学品用于减少地下地层在有水的情况下的膨胀。

然而,原油价格影响到用于原油开采的油田特种化学品产品的使用,而日益严格的环境法规和地缘政治问题可能会在预测期内抑制市场的增长。

市场参与者不断推出的战略举措为市场增长提供了机会。然而,石油行业的激烈竞争和海外资格认证的漫长准备时间是市场增长面临的主要挑战。Data Bridge Market Research 分析称,预计到 2030 年,中东和北非地区特种油田化学品市场价值将达到 2.418 亿美元,预测期内的复合年增长率为 4.1%。由于油田公司对特种化学品的需求不断增加,以便更好地处理石油和水,因此该类型占据了市场上最大的服务类型细分市场。本市场报告还深入介绍了定价分析、专利分析和技术进步。

|

报告指标 |

细节 |

|

预测期 |

2023 至 2030 年 |

|

基准年 |

2022 |

|

历史岁月 |

2021(可定制为 2015 – 2020) |

|

定量单位 |

收入(百万美元)、销量(单位)、定价(美元) |

|

涵盖的领域 |

类型(表面活性剂、破乳剂、抑制剂、杀菌剂、降滤失剂、流变改性剂、发泡剂、聚合物、润滑剂/减摩剂、降凝剂、铁控制剂、清除剂、胶凝剂、增粘剂、缓凝剂等)、应用(钻井、油井刺激、生产和提高采收率 (EOR)、水泥、修井和完井等)、专业油田位置(陆上和海上) |

|

覆盖国家 |

沙特阿拉伯、伊拉克、阿拉伯联合酋长国、伊朗、卡塔尔、科威特、阿尔及利亚、利比亚、埃及和中东及北非其他地区 |

|

涵盖的市场参与者 |

涉足特种油田化学品市场的主要公司包括 BASF SE、Solvay、Dow、Baker Hughes Company、Clariant、Evonik Industries AG、Kemira、Thermax Limited、Huntsman International LLC、Innospec、Stepan Company、EMEC、Chevron Phillips Chemical Company LLC、Versalis SpA、Halliburton、Albemarle Inc. 和 ChampionX 等。 |

中东和北非特种油田化学品市场定义

油田专用化学品是那些通常用于从资源中有效回收石油而不会影响环境和设备的化学品。油田专用化学品具有多种积极作用,例如提高采收率、优化钻井、防腐、防止不同地质构造中的泥浆流失、在高压和高温环境中稳定钻井液等。这些化学品的使用有助于提高运营效率、保护设备并提高原油和天然气勘探、生产、运输和炼制各个阶段油田运营的整体绩效。

中东和北非地区特种油田化学品市场动态

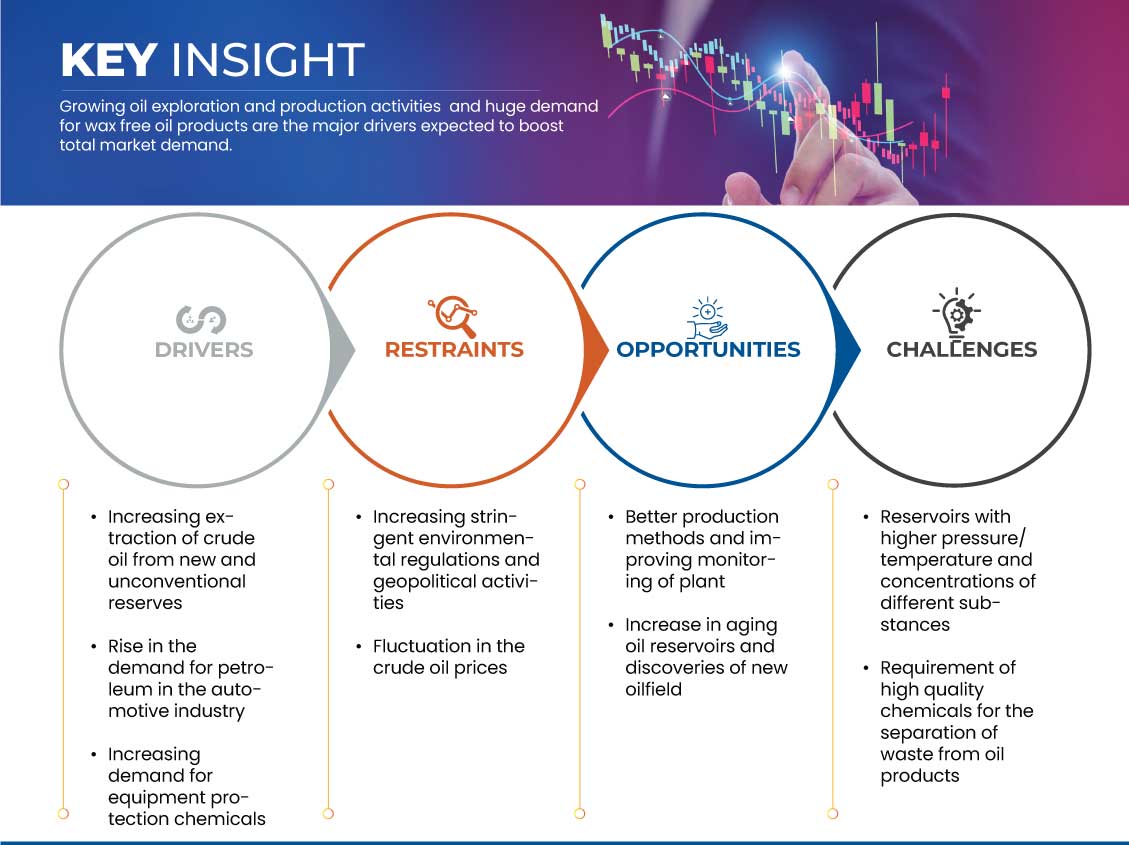

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。下面将详细讨论所有这些内容:

驱动程序

- 增加新的和非常规储量的原油开采量

原油是通过多种工艺和巨型钻井机从陆地深处开采出来的。原油存在于古代海洋所在的巨大地下油藏中。原油油藏可以位于陆地或海底之下。常规石油是使用传统钻井和泵送方法从地下油藏中提取的。常规石油在常温常压下是液体。使用传统钻井和泵送方法无法从非常规储量中提取原油。

先进的开采技术,如油砂开采和钻井,正被用于开采不能独立流动的较重石油。轻质油 (LTO) 非常规储量位于地表深处,主要位于低渗透性岩层中,包括页岩、砂岩和泥岩储层。从非常规储量中提取原油采用水平钻井和水力压裂。

油田专用化学品用于开采原油储备的机械和设备。目前,人们还在进行多种类型的研究,以寻找新的原油资源。从原油中可以生产出各种各样的产品:天然气、汽油、煤油、柴油,最后制成沥青。油田专用化学品有助于有效开采原油,并降低过程中材料的浪费。

因此,非常规储量中原油开采量的不断增加将在更大程度上增加油田对特种化学品的需求,预计这将推动市场增长。

- 汽车行业对石油的需求上升

汽车工业在各个地区都处于上升趋势。轿车、重型车辆和两轮车的需求不断增加,推动了汽车工业的增长。车辆的发动机依靠燃烧石油产品来运行。发展中国家对汽车的需求不断增加,这又推动了对石油产品的需求。

石油产品是通过多种工艺从原油中提取出来的。在原油副产品的分离过程中,需要使用多种类型的油田专用化学品。油田专用化学品可提高作业效率,从而生产出质量理想的石油产品。

总之,不同行业对石油产品的需求不断增长,将增加炼油行业对石油生产用的油田特种化学品的需求,预计这将推动市场增长。

克制

- 日益严格的环境法规和地缘政治问题

石油和天然气钻探对我们的荒地和社区产生了严重影响。钻探项目昼夜不停地进行,产生污染,加剧气候变化,扰乱野生动物,破坏公共土地。一些地区有关钻探的规定越来越严格。钻探对环境的影响更大。在没有足够深海生态系统基线数据的情况下增加石油和天然气勘探活动给环境管理带来了挑战。

为开采石油和天然气而建造的基础设施可能会对荒地产生巨大影响。修建道路、设施和钻井场地需要重型设备,可能会摧毁大片原始荒野。大规模石油泄漏是野生动物的致命杀手,可能会对海洋生态系统造成长期破坏。

注入油井用于润滑的钻井液本应被收集到衬砌的坑中进行处理。然而,油田专用化学品经常泄漏并溅到钻井现场周围,影响环境。油藏和化学品对生态系统的影响越来越大,导致油田对专用化学品产品的需求下降。

总之,原油价格波动加剧将导致制造商亏损,无法在市场上投入更多资金。石油产品需求的不稳定预计将抑制市场增长。

机会

- 更好的生产方法和改进工厂监控

在石油和天然气行业,制造商正在转向更好的生产方法和技术,以提高产品质量。用于开采原油和加工各种产品的原油的设备正在实现自动化。原油开采使用高质量的设备。采油厂采用新的生产技术将增加对油田专用化学品的需求。

定期监测工厂将有助于降低设备的更换成本和损失。在生产石油产品的过程中,还会排出几种有毒化学物质,影响工厂的寿命。定期监测工厂不会影响产品质量,设备的生产能力也会提高。油田专用化学品是根据监测建议在地面上施用的。

因此,采用新的生产技术和对工厂的定期监控将增加对油田特种化学品的需求,预计这将为市场增长创造机会。

挑战

- 压力/温度较高且不同物质浓度较高的储层

油藏位于海洋或陆地深处,原油就是从那里开采出来的。油藏位于不同的区域,这些区域在地下承受着额外的压力。地表内部还存在其他类型的气体,这会增加油藏的温度。油藏中还存在不同物质的混合,这对油田专用化学品来说是一个挑战。

储层压力和温度的波动会影响管道设计和运行。储层压力与井口压力直接相关,井口压力会影响管道运行压力。极高的储层压力可能需要特殊的管道冶金术和油田专用化学品,这会大大提高材料成本。极高或极低的温度也会消除设计的灵活性。

油田专用化学品面临的挑战是产品必须能够承受恶劣的环境。钻井液在高压和高温条件下必须化学稳定且无腐蚀性。水泥的物理和化学行为在高温和高压下会发生显著变化。

总之,高压和高温条件以及油藏中不同物质的协同作用预计将对市场增长提出挑战。

最新动态

- 2021 年 8 月,巴斯夫 SE 和中石化进一步扩建其位于中国南京的一体化基地,从而增加了几家下游化工厂的产量。这一进展帮助该公司在短时间内增加了收入

- 2019 年 11 月,贝克休斯公司决定在沙特阿拉伯设立新工厂,扩大其化学品制造能力。这一举措帮助该公司满足了不同应用领域对化学品日益增长的需求

- 2019年9月,赢创工业集团决定增加其在德国的特种化学品生产能力,并决定在该项目上投资4.41亿美元。这一发展有助于该公司增加场地和生产能力

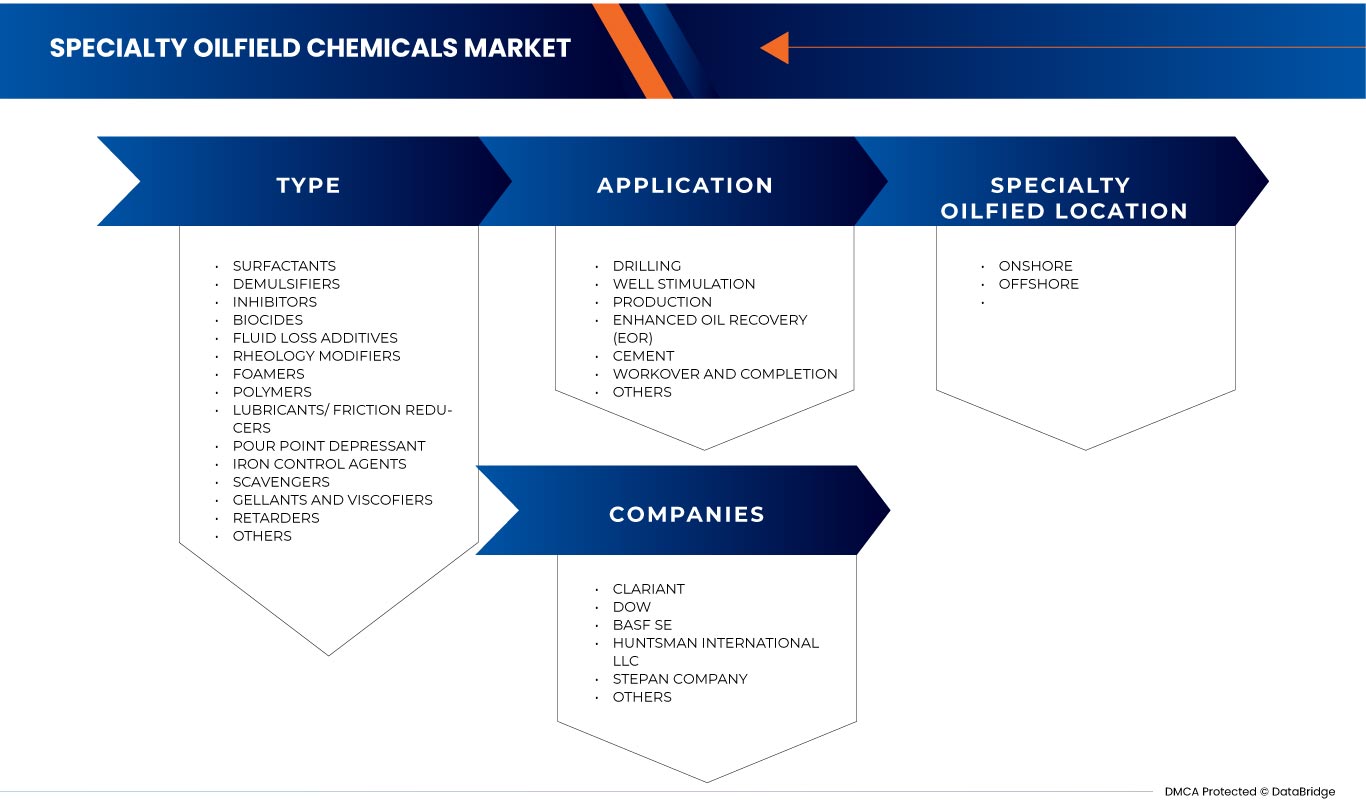

中东和北非特种油田化学品市场范围

中东和北非特种油田化学品市场按类型、位置和应用进行细分。细分市场之间的增长有助于您分析利基增长领域和进入市场的策略,并确定您的核心应用领域和目标市场的差异。

按类型

根据类型,中东和北非特种油田化学品市场分为表面活性剂、破乳剂、抑制剂、杀菌剂、降滤失剂、流变改性剂、发泡剂、聚合物、润滑剂/减摩剂、倾点抑制剂、铁控制剂、清除剂、胶凝剂和增粘剂、缓凝剂等。

按位置

- 陆上

- 海上

根据特种油田的位置,中东和北非特种油田化学品市场分为陆上和海上

按应用

- 钻孔

- 油井增产

- 生产

- 提高采收率 (Eor)

- 水泥

- 修井完井

- 其他的

根据应用,中东和北非特种油田化学品市场细分为钻井、油井刺激、生产、提高采收率 (EOR)、水泥、修井和完井等。

中东和北非特种油田化学品市场区域分析/见解

分析了 MENA 特种油田化学品市场,并提供了类型、位置和应用的市场规模信息。本市场报告涵盖的国家包括沙特阿拉伯、伊拉克、阿拉伯联合酋长国、伊朗、卡塔尔、科威特、阿尔及利亚、利比亚、埃及和 MENA 的其他地区。

由于各公司正在扩大生产能力并跨不同地区达成协议以满足石油和天然气行业对油田特种化学品日益增长的需求,预计沙特阿拉伯地区将主导中东和北非特种油田化学品市场。

报告的国家部分还提供了影响单个市场因素和国内市场监管变化,这些因素和变化会影响市场的当前和未来趋势。新销售、替代销售、国家人口统计、监管法案和进出口关税等数据点是用于预测单个国家市场情景的一些主要指标。此外,在对国家数据进行预测分析时,还考虑了欧洲品牌的存在和可用性以及它们因来自本地和国内品牌的激烈或稀少竞争而面临的挑战,以及销售渠道的影响。

竞争格局和中东和北非特种油田化学品市场份额分析

MENA 特种油田化学品市场竞争格局按竞争对手提供详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、生产基地和设施、公司优势和劣势、产品发布、产品试验渠道、产品批准、专利、产品宽度和广度、应用优势、技术生命线曲线。以上提供的数据点仅与公司对 MENA 特种油田化学品市场的关注有关。

中东和北非特种油田化学品市场的一些主要参与者包括巴斯夫 SE、索尔维、陶氏、贝克休斯公司、科莱恩、赢创工业股份公司、凯米拉、Thermax Limited、亨斯迈国际有限责任公司、Innospec、Stepan Company、EMEC、雪佛龙菲利普斯化学公司、Versalis SpA、哈里伯顿、Albemarle Inc.、ChampionX 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MENA SPECIALTY OILFIELD CHEMICALS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER FIVE FORCES ANALYSIS

4.3 RAW MATERIAL COVERAGE

4.3.1 PRODUCTION CONSUMPTION ANALYSIS

4.3.2 IMPORT-EXPORT SCENARIO

4.3.3 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.3.4 VENDOR SELECTION CRITERIA

4.4 REGULATORY COVERAGE

4.4.1 PRODUCT CODES

4.4.2 CERTIFIED STANDARDS

4.4.3 SAFETY STANDARDS

4.4.3.1 MATERIAL AND HANDLING

4.4.3.2 TRANSPORTATION AND PRECAUTION

4.4.3.3 TRANSPORTATION AND PRECAUTION

4.5 PRODUCTION INSIGHTS

5 CLIMATE CHANGE SCENARIO

5.1 ENVIRONMENTAL CONCERNS

5.2 INDUSTRY RESPONSE

5.3 GOVERNMENT’S ROLE

5.4 ANALYST RECOMMENDATIONS

6 PRICING ANALYSIS

7 SUPPLY CHAIN ANALYSIS

7.1 LOGISTIC COST SCENARIO

7.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 INCREASING EXTRACTION OF CRUDE OIL FROM NEW AND UNCONVENTIONAL RESERVES

8.1.2 RISE IN THE DEMAND FOR PETROLEUM IN THE AUTOMOTIVE INDUSTRY

8.1.3 INCREASING DEMAND FOR EQUIPMENT PROTECTION CHEMICALS

8.1.4 HUGE DEMAND FOR WAX-FREE OIL PRODUCTS

8.1.5 GROWING OIL EXPLORATION & PRODUCTION ACTIVITIES

8.2 RESTRAINTS

8.2.1 INCREASING STRINGENT ENVIRONMENTAL REGULATIONS AND GEOPOLITICAL ISSUES

8.2.2 FLUCTUATION IN THE CRUDE OIL PRICES

8.3 OPPORTUNITIES

8.3.1 BETTER PRODUCTION METHODS AND IMPROVING MONITORING OF PLANT

8.3.2 INCREASE IN AGING OIL RESERVOIRS AND DISCOVERIES OF NEW OIL FIELDS

8.3.3 GROWING DEEP-WATER & ULTRA-DEEP-WATER DRILLING PROJECTS

8.4 CHALLENGES

8.4.1 RESERVOIRS HIGHER PRESSURES/TEMPERATURE AND CONCENTRATIONS OF DIFFERENT SUBSTANCES

8.4.2 REQUIREMENT OF HIGH-QUALITY CHEMICALS FOR THE SEPARATION OF WASTE FROM OIL PRODUCTS

9 MENA SPECIALTY OIL FIELD CHEMICALS MARKET, BY TYPE

9.1 OVERVIEW

9.2 SURFACTANTS

9.3 DEMULSIFIERS

9.4 INHIBITORS

9.4.1 SCALE INHIBITORS

9.4.2 ACID COROSSION INHIBITORS

9.5 BIOCIDES

9.6 FLUID LOSS ADDITIVES

9.7 RHEOLOGY MODIFIERS

9.8 FOAMERS

9.9 POLYMERS

9.1 LUBRICANTS/ FRICTION REDUCERS

9.11 POUR POINT DEPRESSANT

9.12 IRON CONTROL AGENTS

9.13 SCAVENGER

9.14 GELLANTS AND VISCOSIFIERS

9.15 RETARDERS

9.16 OTHERS

10 MENA SPECIALTY OIL FIELD CHEMICALS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 DRILLING

10.3 WELL STIMULATION

10.4 PRODUCTION

10.5 ENHANCED OIL RECOVERY (EOR)

10.6 CEMENT

10.7 WORKOVER & COMPLETION

10.8 OTHERS

11 MENA SPECIALTY OIL FIELD CHEMICALS MARKET, BY SPECIALTY OILFIELD LOCATION

11.1 OVERVIEW

11.2 ONSHORE

11.3 OFFSHORE

12 MENA SPECIALTY OILFIELD CHEMICALS MARKET BY COUNTRIES

12.1 SAUDI ARABIA

12.2 IRAQ

12.3 UNITED ARAB EMIRATES

12.4 IRAN

12.5 KUWAIT

12.6 QATAR

12.7 ALGERIA

12.8 LIBYA

12.9 EGYPT

12.1 REST OF MENA

13 MENA SPECIALTY OILFIELD CHEMICALS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MENA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 CLARIANT

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 DOW

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 BASF SE

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 HUNTSMAN INTERNATIONAL LLC

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 STEPAN COMPANY

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 ALBEMARLE INC

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 BAKER HUGHES COMPANY

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 COMPANY SHARE ANALYSIS

15.7.4 PRODUCT PORTFOLIO

15.7.5 RECENT DEVELOPMENT

15.8 CHAMPIONX

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 CHEVRON PHILLIPS CHEMICAL COMPANY LLC

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 EMEC

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 EVONIK INDUSTRIES AG

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.12 HALLIBURTON

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 COMPANY SHARE ANALYSIS

15.12.4 PRODUCT PORTFOLIO

15.12.5 RECENT DEVELOPMENT

15.13 INNOSPEC

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 KEMIRA

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 MULTICHEM INDUSTRIES LTD.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 SOLVAY

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 COMPANY SHARE ANALYSIS

15.16.4 PRODUCT PORTFOLIO

15.16.5 RECENT DEVELOPMENT

15.17 THERMAX LIMITED

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 VERSALIS S.P.A.

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

16 QUESTIONNAIRES

17 RELATED REPORTS

表格列表

TABLE 1 U.A.E PRODUCT CODE-

TABLE 2 MENA SPECIALTY OIL FIELD CHEMICALS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 3 MENA SPECIALTY OIL FIELD CHEMICALS MARKET, BY TYPE, 2021-2030 (KILO TONNES)

TABLE 4 MENA INHIBITORS IN SPECIALTY OIL FIELD CHEMICALS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 5 MENA SPECIALTY OIL FIELD CHEMICALS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 6 MENA SPECIALTY OIL FIELD CHEMICALS MARKET, BY SPECILATY OILFILED LOCATION, 2021-2030 (USD MILLION)

图片列表

FIGURE 1 MENA SPECIALTY OILFIELD CHEMICALS MARKET: SEGMENTATION

FIGURE 2 MENA SPECIALTY OILFIELD CHEMICALS MARKET: DATA TRIANGULATION

FIGURE 3 MENA SPECIALTY OILFIELD CHEMICALS MARKET: DROC ANALYSIS

FIGURE 4 MENA SPECIALTY OILFIELD CHEMICALS MARKET: REGIONAL VS. COUNTRY MARKET ANALYSIS

FIGURE 5 MENA SPECIALTY OILFIELD CHEMICALS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MENA SPECIALTY OILFIELD CHEMICALS MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 MENA SPECIALTY OILFIELD CHEMICALS MARKET: MULTIVARIATE MODELLING

FIGURE 8 MENA SPECIALTY OILFIELD CHEMICALS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MENA SPECIALTY OILFIELD CHEMICALS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MENA SPECIALTY OILFIELD CHEMICALS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MENA SPECIALTY OILFIELD CHEMICALS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MENA SPECIALTY OILFIELD CHEMICALS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MENA SPECIALTY OILFIELD CHEMICALS MARKET: SEGMENTATION

FIGURE 14 INCREASING EXTRACTION OF CRUDE OIL FROM NEW AND UNCONVENTIONAL RESERVES IS EXPECTED TO DRIVE THE MENA SPECIALTY OILFIELD CHEMICALS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 SURFACTANTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MENA SPECIALTY OILFIELD CHEMICALS MARKET IN 2022 & 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF MENA SPECIALTY OILFIELD CHEMICALS MARKET

FIGURE 17 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY TYPE, 2022

FIGURE 18 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY TYPE, 2023-2030 (USD MILLION)

FIGURE 19 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 20 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 21 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY APPLICATION, 2022

FIGURE 22 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 23 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 24 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 25 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY SPECILATY OILFILED LOCATION, 2022

FIGURE 26 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY SPECILATY OILFILED LOCATION, 2023-2030 (USD MILLION)

FIGURE 27 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY SPECILATY OILFILED LOCATION, CAGR (2023-2030)

FIGURE 28 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY SPECILATY OILFILED LOCATION, LIFELINE CURVE

FIGURE 29 MENA SPECIALTY OILFIELD CHEMICALS MARKET: SNAPSHOT (2022)

FIGURE 30 MENA SPECIALTY OILFIELD CHEMICALS MARKET: BY COUNTRY (2022)

FIGURE 31 MENA SPECIALTY OILFIELD CHEMICALS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 32 MENA SPECIALTY OILFIELD CHEMICALS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 33 MENA SPECIALTY OILFIELD CHEMICALS MARKET: BY TYPE (2023-2030)

FIGURE 34 MENA SPECIALTY OILFIELD CHEMICALS MARKET: COMPANY SHARE 2022 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。