Ksa Trucking Road Freight Market

市场规模(十亿美元)

CAGR :

%

USD

8.61 Billion

USD

13.77 Billion

2024

2031

USD

8.61 Billion

USD

13.77 Billion

2024

2031

| 2025 –2031 | |

| USD 8.61 Billion | |

| USD 13.77 Billion | |

|

|

|

|

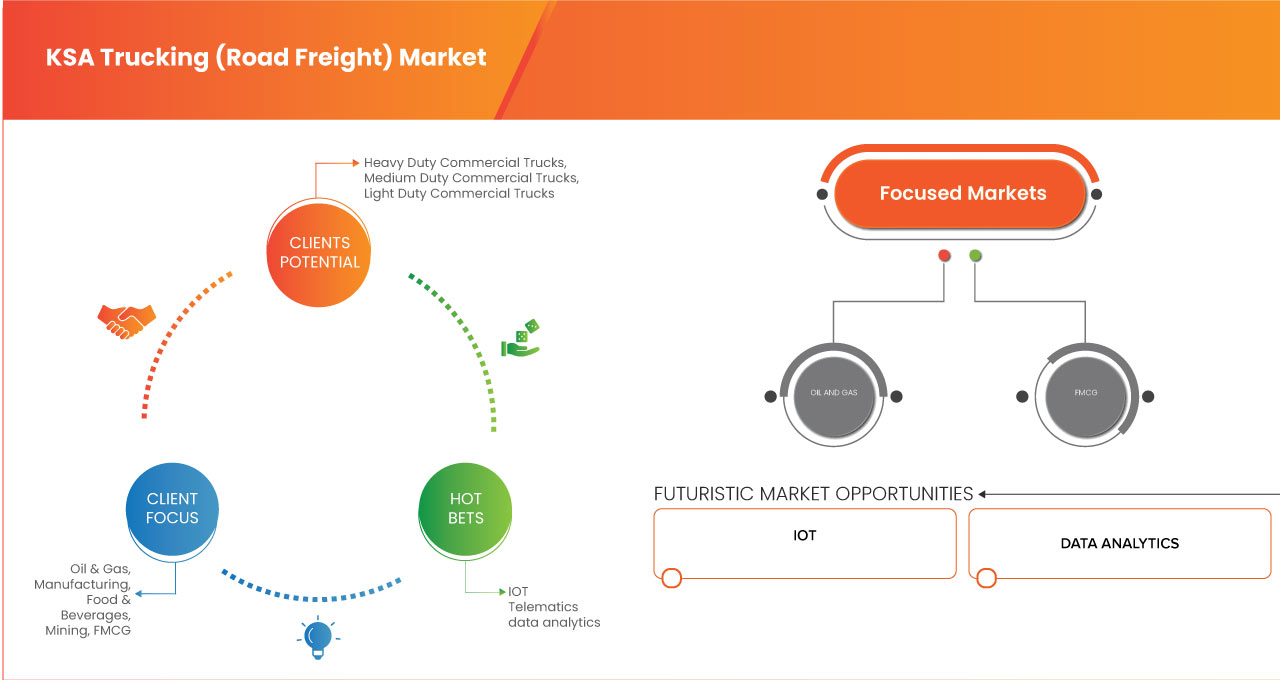

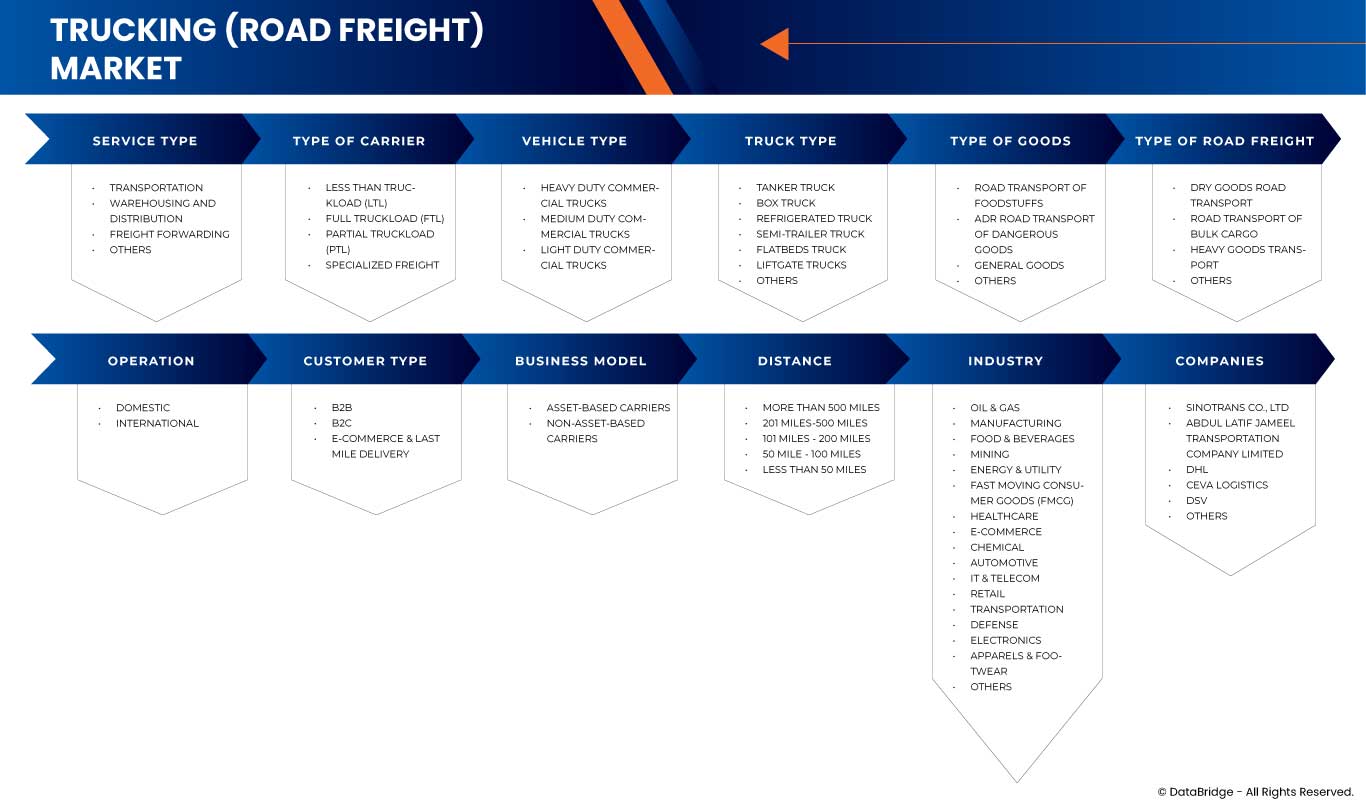

KSA 卡車運輸 (公路貨運) 市場細分,按服務類型 (運輸、倉儲和配送以及貨運代理)、承運人類型 (零擔 (LTL)、整車 (FTL)、部分卡車 (PTL) 和專用貨運)、車輛類型 (重型商用卡車、中型貨車和輕型商用卡車)、卡車類型 (油罐公路運輸和普通貨物)、公路貨運類型 (乾貨公路運輸、散貨公路運輸和重型貨物運輸)、運營 (國內和國際)、客戶類型 (B2B、B2C 和電子商務和最後一英里交付)、商業模式 (基於資產的承運人和非基於資產的承運人) 距離 (更多超過 500 英里、201 英里 - 500 英里 - 100 英里和 100 英里和 10 英里 - 50 英里)、行業(石油和天然氣、製造業、食品和飲料、採礦業、能源和公用事業、快速消費品 (FMCG)、醫療保健、電子商務、化工、汽車、IT 和電信、零售、運輸、國防、電子、服裝和鞋類)- 行業趨勢和預測至 2032 年

沙烏地阿拉伯卡車運輸(公路貨運)市場分析

受技術進步和各行各業對精準水文數據需求日益增長的推動,沙烏地阿拉伯的卡車運輸(公路貨運)市場實現了顯著增長。該市場涵蓋聲納系統、多波束和單波束迴聲測深儀、水下無人機、GPS 系統和資料管理軟體等各類產品。其主要應用領域涵蓋海洋導航、環境監測、海岸工程、石油與天然氣勘探以及國防領域。水下地形精確測繪的需求日益增長,加上海上貿易、近海作業和環境保護措施的蓬勃發展,持續推動市場擴張。此外,自動化、人工智慧整合和感測器技術改進等創新技術正在塑造水文測量的未來,使其更有效率、更具成本效益。

沙烏地阿拉伯卡車運輸(公路貨運)市場規模

預計到 2032 年,沙烏地阿拉伯卡車運輸(公路貨運)市場規模將從 2024 年的 86.1 億美元增至 137.7 億美元,在 2025 年至 2032 年的預測期內,複合年增長率為 6.2%。除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察外,Data Bridge Market Research 策劃的市場報告還包括深度專家分析、患者流行病學、管道分析、定價分析和監管框架。

沙烏地阿拉伯卡車運輸(公路貨運)市場趨勢

“擴大海上貿易和商業”

海上貿易和商業的擴張是沙烏地阿拉伯公路貨運市場的主要驅動力。隨著國際航運活動的成長,對準確、最新的海洋數據的需求對於安全航行和高效的港口運作至關重要。水文測量有助於繪製航道圖、識別水下危險源並確保船舶安全通行,從而支持貨物在國際水域的順暢流通。此外,全球貿易路線的日益複雜性以及港口可持續發展的需求也要求先進的測量技術。對精確數據日益增長的需求確保了沙烏地阿拉伯公路貨運市場的持續成長。隨著貿易量的不斷增長,市場將見證對先進測量技術的投資增加。因此,水文測量在維持全球海洋經濟方面發揮著至關重要的作用。

報告範圍和 KSA 卡車運輸(公路貨運)市場細分

|

屬性 |

沙烏地阿拉伯卡車運輸(公路貨運)市場關鍵市場洞察 |

|

涵蓋的領域 |

|

|

主要市場參與者 |

Kuehne+Nagel(瑞士)、CEVA Logistics(法國)、DHL(德國)、DSV(丹麥)、Abdul Latif Jameel Transportation Company Limited(沙烏地阿拉伯)、中國外運股份有限公司(中國)、GAC(阿聯酋)、FedEx(美國)、SEKO Logistics(美國)、聯合包裹服務公司(美國)、Jellmann(德國)、Jellmann(德國)、 SCHENKER(歐洲)、fourwinds(沙烏地阿拉伯)、Ardian Global Express LLC.(阿聯酋)、NTF GROUP(沙烏地阿拉伯)、Defaf Logistics(沙烏地阿拉伯)、WeFreight(阿聯酋)和 Freights Solutions Co.(沙烏地阿拉伯) |

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深度專家分析、患者流行病學、管道分析、定價分析和監管框架。 |

沙烏地阿拉伯卡車運輸(公路貨運)市場定義

沙烏地阿拉伯公路貨運市場(KSA)是指透過公路運輸貨物的行業,是整個物流行業中一個充滿活力且至關重要的組成部分。該市場主要透過卡車車隊在廣泛的公路網路上運輸從原材料到成品等各種貨物。公路貨運產業在連接供應鏈各個環節、確保貨物及時有效交付方面發揮著至關重要的作用。這個市場參與者種類繁多,包括承運人、托運人和第三方物流供應商,在促進和支持貿易和商業發展方面發揮關鍵作用。市場動態受技術進步、監管架構、燃油價格和經濟趨勢等因素的影響。這些因素塑造了公路貨運業企業所採用的策略。公路貨運市場是貨物順暢流通的重要管道,為全球商品流通和當代經濟運作做出了重大貢獻。

沙烏地阿拉伯卡車運輸(公路貨運)市場動態

驅動程式

- 電子商務行業的成長推動了公路貨運/卡車運輸服務

海上油氣勘探需求的不斷增長,加速了沙烏地阿拉伯對先進卡車運輸(公路貨運)市場的需求,以支援精確的水下測繪和資料收集。隨著企業探索更深、更複雜的水下環境,準確的水深圖和海床資料對於識別資源豐富的區域、確保鑽井作業安全以及最大限度地降低環境風險至關重要。海上能源生產活動的日益活躍預計將推動全球市場採用最先進的水文技術,包括多波束迴聲測深儀、側掃聲納和ROV系統。

例如:

2024年2月,一艘噴灑燃油的船隻在海岸線附近擱淺,21天后,在多巴哥灣附近的一處沉船地點啟動了一項水文調查。調查旨在測量水深並定位航行危險,以便於清除傾覆的駁船,同時評估燃油和碳氫化合物的分佈。調查人員部署了專業人員和先進設備,用於燃油圍堵和船隻打撈。這次事件凸顯了沙烏地阿拉伯卡車運輸(公路貨運)市場在海上油氣作業中的關鍵作用,因為它能夠實現精確測繪、降低風險和高效應對災害,從而進一步推動全球市場的需求。

2024年10月,土耳其先進的石油研究船「奧魯克·雷斯」號啟動了索馬利亞首個綜合海上石油勘探項目,覆蓋三個區塊,總面積達1.5萬平方公裡。該船配備了最先進的水文勘測和地震勘探能力,將在5至7個月內進行地質、地球物理和海洋學研究。隨著各國尋求先進的工具來開發能源資源並推動未開發地區的經濟成長,這項土耳其-索馬利亞合作的舉措凸顯了沙烏地阿拉伯對海上油氣勘探卡車運輸(公路貨運)市場日益增長的需求。

- 沙烏地阿拉伯基礎建設快速發展

沿海基礎設施建設的興起推動了沙烏地阿拉伯卡車運輸(公路貨運)市場的發展,因為對沿海地區進行準確細緻的勘測對於港口、港灣和海防系統等基礎設施的規劃和建設至關重要。隨著這些計畫在全球的擴張,對水文勘測設備(包括先進的聲納系統、測繪技術和環境監測工具)的需求也不斷增長。這些技術有助於評估水深、海床狀況和潛在的環境影響,確保沿海基礎設施專案安全、高效、永續地實施。

例如,

- 2024年10月,印度海軍接收了四艘大型測量船中的第二艘-「Nirdeshak」(船廠編號3026),該船由加爾各答的Garden Reach造船與工程公司(GRSE)建造。 「Nirdeshak」號專為進行全面的沿海和深水水文測量而設計,這對於評估港口、港灣進港和航道以及收集海洋學和地球物理數據至關重要。該船配備了先進的水文技術,包括側掃聲納、DGPS定位系統和自主水下航行器。隨著全球沿海基礎設施建設的持續增長,對「Nirdeshak」號等先進測量船的需求日益增長,凸顯了對精確數據收集和監測日益增長的需求,以實現安全高效的基礎設施規劃和發展。

- 2021年4月,尼日利亞海軍最新的海上測量船NNS LANA在返回尼日利亞途中停靠西班牙拉斯帕爾馬斯港。該船將取代已退役的NNS LANA,配備了最先進的水文、海洋和地球物理測量設備,包括用於最大限度減少數據失真的電力推進系統。 NNS LANA專為水文測量和海上安全任務而設計,是尼日利亞海上能力的關鍵資產。該船的先進性能將增強尼日利亞進行詳細測量的能力,並支援沿海基礎設施建設。對先進測量船日益增長的需求,也推動了全球沙烏地阿拉伯卡車運輸(公路貨運)市場的需求成長,尤其是在沿海和近海基礎設施項目中。

機會

- 政府支持運輸和物流業的舉措

勘測設備的技術進步正顯著改變沙烏地阿拉伯的卡車運輸(公路貨運)市場,使其能夠更精準、更有效率、更具成本效益地收集資料。自主水下航行器 (AUV)、遙控潛水器 (ROV)、多波束聲納系統以及先進的定位技術等創新增強了勘測能力,能夠對複雜的水下環境進行精細測繪。這些發展推動了更先進設備的採用,這對於監測和管理沿海基礎設施、海洋環境和航行路線至關重要。隨著技術的不斷發展,沙烏地阿拉伯的卡車運輸(公路貨運)市場預計將持續擴張,為從海事安全到環境監測等各種應用提供更可靠、更永續的解決方案。

例如,

2020年11月,印度理工學院馬德拉斯分校研發了一艘太陽能無人自主測量船,用於在印度港口和內陸水道進行水文和海洋測量。這艘創新測量船既能手動操作,也能自主操作,為昂貴的外國測量船提供了本土替代方案。該測量船配備迴聲測深儀、GPS和寬頻通訊系統,可測量水深和水下地形,並進行遠距離即時資料傳輸。它還可以安裝雷射雷達(LiDAR)等附加感測器,以實現無縫地形和水深測量。這項技術進步與沙烏地阿拉伯卡車運輸(公路貨運)市場對經濟高效的測量設備日益增長的需求相契合,凸顯了向更自主、更永續的解決方案轉變的趨勢,這些解決方案旨在提高測量精度、降低營運成本,並更好地管理沿海基礎設施。

- 冷鏈物流需求不斷成長

隨著企業紛紛採用預測性維護來提高營運效率並減少停機時間,將水文測量設備納入這些框架將帶來巨大的機會。預測性維護利用即時感測器資料來預測設備故障,並在這些系統中引入感測器清潔方法可以提高感測器的性能和耐用性。這種整合不僅可以使感測器保持最佳狀態,還可以提升預測性維護計畫的整體價值主張,尤其是在依賴複雜機械和自動化系統的企業中。例如,

根據MDPI的文章,透過利用清潔機器人的振動訊號,預測性維護框架可以及早發現性能下降和潛在的安全問題。這可以實現主動幹預,防止自主移動清潔系統出現運作故障。將預測性維護整合到感測器清潔技術中,可提高系統可靠性並減少停機時間,從而帶來巨大的成長機會。隨著自動駕駛需求的不斷增長,具有先進監控功能的感測器清潔解決方案對於保持最佳感測器性能至關重要。這為感測器清潔市場的創新和成長開闢了新的途徑。

- 市場參與者之間的策略夥伴關係與合作

沙烏地阿拉伯的卡車運輸(公路貨運)市場是該國蓬勃發展的物流和運輸產業的重要組成部分。受快速發展的經濟和不斷升級的貿易活動的推動,對高效的公路貨運服務的需求日益增長。市場格局多元化,涵蓋物流公司、卡車運輸公司和技術供應商。策略合作機會眾多,尤其是在技術整合領域,合作可以增強路線優化、即時追蹤和整體車隊管理,從而提高效率並降低營運成本。透過與政府機構、報關行和技術供應商合作來簡化通關流程,為提升跨境運輸和改善卡車運輸體驗提供了另一種途徑。

針對最後一哩配送解決方案的合作,能夠滿足日益增長的精準及時配送需求,優化路線,並充分利用共享倉儲設施。秉持環境永續理念,合作可以專注於採用環保實踐、替代燃料解決方案和綠色技術,以符合國家永續發展目標。數據共享,以洞察市場動態、跨境合作、運力共享和網路擴展,以及應對監管挑戰和確保合規的努力,進一步凸顯了眾多機會。然而,企業必須應對監管差異、資料安全問題和文化差異等挑戰,才能確保合作成功。沙烏地阿拉伯卡車運輸(公路貨運)市場蘊藏著巨大的轉型合作夥伴關係潛力,為沙烏地阿拉伯建立更有效率、更永續、反應更快的公路貨運生態系統鋪平了道路。

例如,

- 2023 年 10 月,根據《印度運輸與物流新聞》發表的一篇文章報道,瑞士物流巨頭 Kuehne+Nagel 已與沙烏地阿拉伯的 Tamer Logistics 達成獨家合作夥伴關係,以增強其服務範圍並滿足該地區日益增長的物流解決方案需求。此次合作擴展了 Kuehne+Nagel 在合約物流方面的能力,補充了其在該國現有的貨運代理活動。 Tamer Logistics 隸屬於 Tamer 集團,擁有龐大的本地現代倉儲設施網路和強大的車隊,以增強 Kuehne+Nagel 全球公認的合約物流專業知識。 Kuehne+Nagel 旨在為全球和國內客戶提供端到端供應鏈解決方案。 Kuehne+Nagel 合約物流執行副總裁 Gianfranco Sgro 表示,他相信 Tamer Logistics 能夠提供優質服務,這與沙烏地王國 2030 年願景一致,即將其打造為該地區的中央物流樞紐。此次合作標誌著沙烏地阿拉伯物流業發展的關鍵里程碑,強調了效率、數位轉型和永續性。 Tamer Logistics 執行長 Ayman Albarqawi 強調,公司致力於滿足客戶需求,並致力於與國際頂級服務標準接軌。

- 根據Locate2u報道,2023年10月,沙烏地阿拉伯富有遠見的超級城市計畫Neom與DSV攜手,成立了價值100億美元的獨家物流合資企業。此次合作旨在改變Neom的物流格局。 Neom是位於沙烏地阿拉伯西北部塔布克省規劃的未來城市區域。 Neom持有51%的多數股權,DSV持有剩餘的49%,專注於滿足Neom複雜的物流需求,促進其快速發展,並提振沙烏地阿拉伯經濟。該合資企業涵蓋陸運、海運和空運,預計將創造超過2萬個就業機會。除了傳統物流之外,雙方還致力於創新,將部分收入用於開發可持續的下一代物流解決方案。此次合作標誌著Neom實現其宏偉願景的關鍵時刻,並彰顯了其致力於革新沙烏地阿拉伯物流行業的決心。

限制/挑戰

- 嚴格的政府法規

資料隱私和安全問題對沙烏地阿拉伯(KSA)的卡車運輸(公路貨運)市場構成了重大挑戰。隨著水文測量越來越依賴數位系統、無人駕駛車輛和雲端資料存儲,網路攻擊和資料外洩的風險也隨之上升。敏感資訊(例如詳細的海底測繪和戰略海事數據)容易受到未經授權的存取或操縱。確保這些資料的安全,尤其是在國防和安全應用中,需要採取強有力的網路安全措施並遵守不斷發展的資料保護法規。保護這些先進技術的複雜性也增加了額外的難度,尤其是在資料收集量持續成長的情況下。

例如: -

根據Balbix Inc.於2024年10月發布的博客,資料隱私和安全問題已成為物聯網系統面臨的主要挑戰,這與沙烏地阿拉伯的卡車運輸(公路貨運)市場息息相關。隨著沙烏地阿拉伯的卡車運輸(公路貨運)市場日益整合物聯網設備,安全協議薄弱、漏洞測試不力以及軟體未打補丁等問題也逐漸顯現。許多設備缺乏強大的安全措施,容易受到網路攻擊。這些系統產生的大量資料(例如詳細的海底測繪資料)如果沒有妥善保護,也可能帶來巨大的隱私風險。這些問題使確保資料安全管理和保護的工作變得更加複雜,凸顯了在水文測量技術中加強安全措施的必要性。

- 燃油價格波動

發展中地區資金有限,對沙烏地阿拉伯的卡車運輸(公路貨運)市場構成重大挑戰。這些地區的許多國家難以為水文測量設備等先進技術配置充足的資源,而這些技術對於有效的海岸管理、基礎設施建設和環境監測至關重要。這種資金限制阻礙了現代設備的採用,限制了收集準確數據、做出明智決策和支持永續發展的能力。因此,這些地區可能無法實現可靠的測量能力,進而影響其整體成長和發展。

例如: -

2023年10月,根據聯合國貿易和發展會議(UNCTAD)發布的博客,由於多重全球危機、不斷增長的債務以及對波動性大宗商品的依賴,46個最不發達國家(LDC)面臨嚴峻的財政挑戰。這些財政限制大大壓縮了這些國家的財政空間,使其難以投資於關鍵基礎設施,包括水文測量設備。這些地區資金有限,阻礙了它們採用現代技術進行有效的環境監測和基礎設施建設。氣候緊急和全球經濟動盪加劇了財政緊縮,對這些發展中國家沙烏地阿拉伯卡車運輸(公路貨運)市場的成長構成了重大障礙。

本市場報告詳細介紹了最新發展動態、貿易法規、進出口分析、生產分析、價值鏈優化、市場份額、國內和本地市場參與者的影響,並分析了新興收入來源、市場法規變化、戰略市場增長分析、市場規模、品類市場增長、應用領域和主導地位、產品審批、產品發布、地域擴張以及市場技術創新等方面的機遇。如需了解更多市場信息,請聯繫 Data Bridge 市場研究部門獲取分析師簡報,我們的團隊將協助您做出明智的市場決策,實現市場成長。

沙烏地阿拉伯卡車運輸(公路貨運)市場範圍

沙烏地阿拉伯卡車運輸(公路貨運)市場根據服務類型、承運商類型、車輛類型、卡車類型、貨物類型、公路貨運類型、營運方式、客戶類型、商業模式、運輸距離和產業,細分為11個重要的細分市場。這些細分市場的成長將有助於您分析行業中成長乏力的細分市場,並為用戶提供有價值的市場概覽和市場洞察,幫助他們做出策略決策,確定核心市場應用。

服務類型

- 運輸

- 倉儲和配送

- 貨運代理

- 其他的

承運商類型

- 零擔(Ltl)

- 整車裝載量 (Ftl)

- 部分貨車裝載 (Ptl)

- 專用貨運

車輛類型

- 重型商用卡車

- 中型商用卡車

- 輕型商用卡車

卡車類型

- 油罐車

- 類型

- 液體油輪

- 乾散貨油輪

- 運輸產品

- 燃料

- 類型

- 柴油引擎

- 汽油

- 類型

- 氣體

- 類型

- 液化石油氣

- 丙烷

- 液化丁烷氣

- 氮

- 氧

- 氦

- 其他的

- 類型

- 化學品

- 牛奶

- 果汁

- 其他的

- 燃料

- 加壓

- 非加壓

- 加壓

- 冷藏

- 非冷藏

- 冷藏

- 絕緣

- 非絕緣

- 絕緣

- 類型

- 箱式貨車

- 運輸產品

- 送餐

- 家電和家具

- 最後一哩配送

- 其他的

- 運輸產品

- 冷藏車

- 運輸產品

- 食物

- 醫療用品

- 類型

- 製藥

- 疫苗

- 血庫

- 其他的

- 類型

- 易腐爛貨物

- 類型

- 肉

- 水果

- 蔬菜

- 海鮮

- 其他的

- 類型

- 飲料

- 類型

- 碳酸飲料

- 果汁飲料

- 運動與能量飲料

- 茶

- 咖啡

- 其他的

- 類型

- 其他的

- 運輸產品

- 半掛卡車

- 平闆卡車

- 運輸產品

- 汽車

- 建築材料

- 機械

- 廢金屬

- 其他可回收物

- 運輸產品

- 後尾門卡車

- 其他的

商品類型

- 食品公路運輸

- 類型

- 冷藏運送與冷藏

- 冷凍冷藏運輸

- 類型

- 危險貨物公路運輸

- 日用百貨

- 其他的

公路貨運類型

- 乾貨公路運輸

- 散貨公路運輸

- 重型貨物運輸

- 其他的

手術

- 國內的

- 國際的

客戶類型

- B2B

- B2C

- 電子商務和最後一英里配送

商業模式

- 資產型承運商

- 非資產型承運人

距離

- 超過 500 英里

- 201英里-500英里

- 101英里 – 200英里

- 50英里 – 100英里

- 少於50英里

產業

- 石油和天然氣

- 運輸

- 倉儲和配送

- 貨運代理

- 其他的

- 製造業

- 運輸

- 倉儲和配送

- 貨運代理

- 其他的

- 食品和飲料

- 運輸

- 倉儲和配送

- 貨運代理

- 其他的

- 礦業

- 運輸

- 倉儲和配送

- 貨運代理

- 其他的

- 能源與公用事業

- 運輸

- 倉儲和配送

- 貨運代理

- 其他的

- 快速消費品(FMCG)

- 運輸

- 倉儲和配送

- 貨運代理

- 其他的

- 衛生保健

- 運輸

- 倉儲和配送

- 貨運代理

- 其他的

- 電子商務

- 運輸

- 倉儲和配送

- 貨運代理

- 其他的

- 化學

- 運輸

- 倉儲和配送

- 貨運代理

- 其他的

- 汽車

- 運輸

- 倉儲和配送

- 貨運代理

- 其他的

- 資訊科技和電信

- 運輸

- 倉儲和配送

- 貨運代理

- 其他的

- 零售

- 運輸

- 倉儲和配送

- 貨運代理

- 其他的

- 運輸

- 運輸

- 倉儲和配送

- 貨運代理

- 其他的

- 防禦

- 運輸

- 倉儲和配送

- 貨運代理

- 其他的

- 電子產品

- 運輸

- 倉儲和配送

- 貨運代理

- 其他的

- 服裝和鞋類

- 運輸

- 倉儲和配送

- 貨運代理

- 其他的

- 其他的

- 運輸

- 倉儲和配送

- 貨運代理

- 其他的

沙烏地阿拉伯卡車運輸(公路貨運)市場份額

市場競爭格局按競爭對手提供詳細資料。詳細資訊包括公司概況、公司財務狀況、收入、市場潛力、研發投入、新市場計劃、全球影響力、生產基地和設施、生產能力、公司優勢和劣勢、產品發布、產品寬度和廣度以及應用主導地位。以上提供的數據點僅與公司在市場中的重點相關。

在市場上運營的KSA卡車運輸(公路貨運)市場領導者有:

- Kuehne+Nagel(瑞士)

- CEVA物流(法國)

- DHL(德國)

- DSV(丹麥)

- 安利捷運輸 (KSA)

- 中國外運股份有限公司 (中國)

- 廣汽集團(阿聯酋)

- 聯邦快遞(美國)

- SEKO物流(美國)

- 美國聯合包裹服務公司(美國)

- Hellmann(德國)

- JAS(美國)

- 德鐵信可 (歐洲)

- 四風(阿聯酋)

- 阿迪安全球快遞有限責任公司。 (阿聯酋)

- NTF集團(沙烏地阿拉伯)

- Defaf物流(沙烏地阿拉伯)

- WEFEX(阿聯酋)

- 貨運解決方案公司(KSA)

沙烏地阿拉伯卡車運輸(公路貨運)市場的最新發展

- 2024年2月,Applanix推出了POS MV系列——Surfmaster、Wavemaster和Oceanmaster——一套完整的慣性導航系統,為船舶和感測器提供精確的姿態、航向、升沈、位置和速度數據。這項進展鞏固了Applanix作為水文測量設備領導者的聲譽,提供高度可靠、精確的解決方案,在充滿挑戰的海洋環境中也能出色運行,使其成為該領域專業人士的首選。

- 2024年9月,Teledyne Marine指定iOne Resources Inc.為其在菲律賓的官方經銷商,進一步拓展其在東南亞的業務版圖。此次合作使當地客戶能夠使用Teledyne Marine先進的水文測量設備,包括高解析度多波束聲納系統、單波束迴聲測深儀和強大的數據採集軟體,以及更完善的支援和服務。

- 2023年10月,ATLAS ELEKTRONIK公司與以色列航空航太工業公司聯合推出了先進反潛作戰的「藍鯨」反潛戰平台。該平台是一款先進的自主水下航行器,整合了ELTA先進的感測器系統和ATLAS ELEKTRONIK的拖曳式被動聲納陣列,旨在高效探測潛艇。此次合作將增強兩家公司在海軍防禦方面的能力,充分利用IAI在無人系統方面的專業知識和ELTA先進的傳感器技術,打造出適用於各種海軍作戰的先進長航時反潛戰解決方案。

- 2022年1月,Esri印度公司與AGNIi合作啟動了「地理創新2022」(GeoInnovation 2022),旨在利用位置智慧技術,支持農業、醫療保健和智慧城市等領域的新創公司。該計畫將Esri的GIS解決方案整合到新創企業生態系統中,促進創新,尤其是在水文測量領域。透過將地理空間資料融入海上能源和海事防禦等產業,Esri增強了在塑造水文測量解決方案未來方面的作用,促進了這個新興市場的成長。

- 2022年3月,賽萊默與聯合國兒童基金會深化合作,共同因應非洲之角地區緊迫的水資源和衛生挑戰,並聚焦在衣索比亞、索馬利亞、蘇丹和烏幹達。此次合作旨在應對乾旱和洪水等氣候危機,並透過太陽能鑽孔和當地公用事業能力建設等創新措施,增強永續水資源和衛生設施的可及性。該倡議強化了賽萊默對水資源安全的承諾,展現了其專業知識和社會責任,同時提升了品牌信譽,並在全球範圍內推動永續解決方案。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF KSA TRUCKING (ROAD FREIGHT) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 SERVICE TYPE TIMELINE CURVE

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 ROUTE ANALYSIS FOR COMMODITIES TYPE IN KSA TRUCKING (ROAD FREIGHT) MARKET

4.2 QUICK OUTLOOK FOR COMMODITIES TYPE IN KSA TRUCKING (ROAD FREIGHT) MARKET

4.2.1 BULK

4.2.2 BREAKBULK

4.2.3 PALLETS

4.2.4 LIQUID BULK

4.2.5 CONTAINERS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWTH IN E-COMMERCE SECTOR BOOSTING THE ROAD FREIGHT/TRUCKING SERVICES

5.1.2 RAPID INFRASTRUCTURE DEVELOPMENT IN KSA

5.1.3 RISING INVESTMENT IN SMART FREIGHT MANAGEMENT

5.1.4 INCREASING CROSS-BORDER TRADES IN KSA

5.2 RESTRAINTS

5.2.1 STRINGENT GOVERNMENT REGULATIONS

5.2.2 FLUCTUATIONS IN FUEL PRICES

5.3 OPPORTUNITIES

5.3.1 GOVERNMENT INITIATIVES TO SUPPORT TRANSPORTATION AND LOGISTICS SECTOR

5.3.2 INCREASING DEMAND FOR COLD CHAIN LOGISTICS

5.3.3 STRATEGIC PARTNERSHIPS AND COLLABORATIONS AMONG MARKET PLAYERS

5.4 CHALLENGES

5.4.1 AVAILABILITY OF ALTERNATIVE MODES OF TRANSPORTATION

5.4.2 SECURITY CONCERNS RELATED TO CARGO THEFT

6 KSA TRUCKING (ROAD FREIGHT) MARKET, SERVICE TYPE

6.1 OVERVIEW

6.2 TRANSPORTATION

6.3 WAREHOUSING AND DISTRIBUTION

6.4 FREIGHT FORWARDING

6.5 OTHERS

7 KSA TRUCKING (ROAD FREIGHT) MARKET, TYPE OF CARRIER

7.1 OVERVIEW

7.2 LESS THAN TRUCKLOAD (LTL)

7.3 FULL TRUCKLOAD (FTL)

7.4 PARTIAL TRUCKLOAD (PTL)

7.5 SPECIALIZED FREIGHT

8 KSA TRUCKING (ROAD FREIGHT) MARKET, TYPE OF GOODS

8.1 OVERVIEW

8.2 ROAD TRANSPORT OF FOODSTUFFS

8.2.1 REFRIGERATED TRANSPORT WITH REFRIGERATION

8.2.2 REFRIGERATED TRANSPORT WITH FREEZING

8.3 ADR ROAD TRANSPORT OF DANGEROUS GOODS

8.4 GENERAL GOODS

8.5 OTHERS

9 KSA TRUCKING (ROAD FREIGHT) MARKET, BY BUSINESS MODEL

9.1 OVERVIEW

9.2 ASSET-BASED CARRIERS

9.3 NON-ASSET-BASED CARRIERS

10 KSA TRUCKING (ROAD FREIGHT) MARKET, BY DISTANCE

10.1 OVERVIEW

10.2 MORE THAN 500 MILES

10.3 201 MILES-500 MILES

10.4 101 MILES – 200 MILES

10.5 50 MILE – 100 MILES

10.6 LESS THAN 50 MILES

11 KSA TRUCKING (ROAD FREIGHT) MARKET, BY INDUSTRY

11.1 OVERVIEW

11.2 OIL & GAS

11.2.1 BY SERVICE TYPE

11.2.1.1 TRANSPORTATION

11.2.1.2 WAREHOUSING AND DISTRIBUTION

11.2.1.3 FREIGHT FORWARDING

11.2.1.4 OTHERS

11.3 MANUFACTURING

11.3.1 BY SERVICE TYPE

11.3.1.1 TRANSPORTATION

11.3.1.2 WAREHOUSING AND DISTRIBUTION

11.3.1.3 FREIGHT FORWARDING

11.3.1.4 OTHERS

11.4 FOOD & BEVERAGES

11.4.1 BY SERVICE TYPE

11.4.1.1 TRANSPORTATION

11.4.1.2 WAREHOUSING AND DISTRIBUTION

11.4.1.3 FREIGHT FORWARDING

11.4.1.4 OTHERS

11.5 MINING

11.5.1 BY SERVICE TYPE

11.5.1.1 TRANSPORTATION

11.5.1.2 WAREHOUSING AND DISTRIBUTION

11.5.1.3 FREIGHT FORWARDING

11.5.1.4 OTHERS

11.6 ENERGY & UTILITY

11.6.1 BY SERVICE TYPE

11.6.1.1 TRANSPORTATION

11.6.1.2 WAREHOUSING AND DISTRIBUTION

11.6.1.3 FREIGHT FORWARDING

11.6.1.4 OTHERS

11.7 FAST MOVING CONSUMER GOODS (FMCG)

11.7.1 BY SERVICE TYPE

11.7.1.1 TRANSPORTATION

11.7.1.2 WAREHOUSING AND DISTRIBUTION

11.7.1.3 FREIGHT FORWARDING

11.7.1.4 OTHERS

11.8 HEALTHCARE

11.8.1 BY SERVICE TYPE

11.8.1.1 TRANSPORTATION

11.8.1.2 WAREHOUSING AND DISTRIBUTION

11.8.1.3 FREIGHT FORWARDING

11.8.1.4 OTHERS

11.9 E-COMMERCE

11.9.1 BY SERVICE TYPE

11.9.1.1 TRANSPORTATION

11.9.1.2 WAREHOUSING AND DISTRIBUTION

11.9.1.3 FREIGHT FORWARDING

11.9.1.4 OTHERS

11.1 CHEMICAL

11.10.1 BY SERVICE TYPE

11.10.1.1 TRANSPORTATION

11.10.1.2 WAREHOUSING AND DISTRIBUTION

11.10.1.3 FREIGHT FORWARDING

11.10.1.4 OTHERS

11.11 AUTOMOTIVE

11.11.1 BY SERVICE TYPE

11.11.1.1 TRANSPORTATION

11.11.1.2 WAREHOUSING AND DISTRIBUTION

11.11.1.3 FREIGHT FORWARDING

11.11.1.4 OTHERS

11.12 IT & TELECOM

11.12.1 BY SERVICE TYPE

11.12.1.1 TRANSPORTATION

11.12.1.2 WAREHOUSING AND DISTRIBUTION

11.12.1.3 FREIGHT FORWARDING

11.12.1.4 OTHERS

11.13 RETAIL

11.13.1 BY SERVICE TYPE

11.13.1.1 TRANSPORTATION

11.13.1.2 WAREHOUSING AND DISTRIBUTION

11.13.1.3 FREIGHT FORWARDING

11.13.1.4 OTHERS

11.14 TRANSPORTATION

11.14.1 BY SERVICE TYPE

11.14.1.1 TRANSPORTATION

11.14.1.2 WAREHOUSING AND DISTRIBUTION

11.14.1.3 FREIGHT FORWARDING

11.14.1.4 OTHERS

11.15 DEFENSE

11.15.1 BY SERVICE TYPE

11.15.1.1 TRANSPORTATION

11.15.1.2 WAREHOUSING AND DISTRIBUTION

11.15.1.3 FREIGHT FORWARDING

11.15.1.4 OTHERS

11.16 ELECTRONICS

11.16.1 BY SERVICE TYPE

11.16.1.1 TRANSPORTATION

11.16.1.2 WAREHOUSING AND DISTRIBUTION

11.16.1.3 FREIGHT FORWARDING

11.16.1.4 OTHERS

11.17 APPARELS & FOOTWEAR

11.17.1 BY SERVICE TYPE

11.17.1.1 TRANSPORTATION

11.17.1.2 WAREHOUSING AND DISTRIBUTION

11.17.1.3 FREIGHT FORWARDING

11.17.1.4 OTHERS

11.18 OTHERS

11.18.1 BY SERVICE TYPE

11.18.1.1 TRANSPORTATION

11.18.1.2 WAREHOUSING AND DISTRIBUTION

11.18.1.3 FREIGHT FORWARDING

11.18.1.4 OTHERS

12 KSA TRUCKING (ROAD FREIGHT) MARKET, VEHICLE TYPE

12.1 OVERVIEW

12.2 HEAVY DUTY COMMERCIAL TRUCKS

12.3 MEDIUM DUTY COMMERCIAL TRUCKS

12.4 LIGHT DUTY COMMERCIAL TRUCKS

13 KSA TRUCKING (ROAD FREIGHT) MARKET, BY TYPE OF ROAD FREIGHT

13.1 OVERVIEW

13.2 DRY GOODS ROAD TRANSPORT

13.3 ROAD TRANSPORT OF BULK CARGO

13.4 HEAVY GOODS TRANSPORT

13.5 OTHERS

14 KSA TRUCKING (ROAD FREIGHT) MARKET, BY OPERATION

14.1 OVERVIEW

14.2 DOMESTIC

14.3 NON-ASSET-BASED CARRIERS

15 KSA TRUCKING (ROAD FREIGHT) MARKET, BY CUSTOMER TYPE

15.1 OVERVIEW

15.2 B2B

15.3 B2C

15.4 E-COMMERCE & LAST MILE DELIVERY

16 KSA TRUCKING (ROAD FREIGHT) MARKET, BY TRUCK TYPE

16.1 OVERVIEW

16.2 TANKER TRUCK

16.2.1 TANKER TRUCK, BY TYPE

16.2.1.1 LIQUID TANKERS

16.2.1.2 DRY BULK TANKERS

16.2.2 TANKER TRUCK, BY TRANSPORT PRODUCT

16.2.2.1 FUEL

16.2.2.1.1 FUEL, BY TYPE

16.2.2.1.1.1 DIESEL

16.2.2.1.1.2 PETROL

16.2.2.2 GASES

16.2.2.2.1 GASES, BY TYPE

16.2.2.2.1.1 LPG

16.2.2.2.1.2 PROPANE

16.2.2.2.1.3 LIQUEFIED BUTANE GAS

16.2.2.2.1.4 NITROGEN

16.2.2.2.1.5 OXYGEN

16.2.2.2.1.6 HELIUM

16.2.2.3 CHEMICALS

16.2.2.4 MILK

16.2.2.5 JUICES

16.2.2.6 OTHERS

16.2.3 TANKER TRUCK, BY PRESSURIZATION

16.2.3.1 NON-PRESSURIZED

16.2.3.2 PRESSURIZED

16.2.4 TANKER TRUCK, BY REFRIGERATION

16.2.4.1 NON-REFRIGERATED

16.2.4.2 REFRIGERATED

16.2.5 TANKER TRUCK, BY INSULATION

16.2.5.1 NON-INSULATED

16.2.5.2 INSULATED

16.3 BOX TRUCK

16.3.1 BOX TRUCK, BY TRANSPORT PRODUCTS

16.3.1.1 FOOD DELIVERY

16.3.1.2 HOME APPLIANCES AND FURNITURE

16.3.1.3 LAST-MILE DELIVERIES

16.3.1.4 OTHERS

16.4 REFRIGERATED TRUCK

16.4.1 REFRIGERATED TRUCK, BY TRANSPORT PRODUCTS

16.4.1.1 FOOD

16.4.1.2 MEDICAL SUPPLIES

16.4.1.2.1 MEDICAL SUPPLIES, BY TYPE

16.4.1.2.1.1 PHARMACEUTICALS

16.4.1.2.1.2 VACCINES

16.4.1.2.1.3 BLOOD BANKS

16.4.1.2.1.4 OTHERS

16.4.1.3 PERISHABLE GOODS

16.4.1.3.1 PERISHABLE GOODS, BY TYPE

16.4.1.3.1.1 MEAT

16.4.1.3.1.2 FRUITS

16.4.1.3.1.3 VEGETABLES

16.4.1.3.1.4 SEAFOOD

16.4.1.3.1.5 OTHERS

16.4.1.4 BEVERAGES

16.4.1.4.1 BEVERAGES, BY TYPE

16.4.1.4.1.1 CARBONATED BEVERAGES

16.4.1.4.1.2 JUICE BASED BEVERAGES

16.4.1.4.1.3 SPORTS & ENERGY BEVERAGES

16.4.1.4.1.4 TEA

16.4.1.4.1.5 COFFEE

16.4.1.4.1.6 OTHERS

16.4.1.5 OTHERS

16.5 SEMI-TRAILER TRUCK

16.6 FLATBEDS TRUCK

16.6.1 FLATBEDS TRUCK, BY TRANSPORT PRODUCTS

16.6.1.1 CARS

16.6.1.2 CONSTRUCTION MATERIAL

16.6.1.3 MACHINERY

16.6.1.4 SCRAP METAL

16.6.1.5 OTHERS RECYCLABLES

16.7 LIFTGATE TRUCK

16.8 OTHERS

17 KSA TRUCKING (ROAD FREIGHT) MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: KSA

18 SWOT ANALYSIS

19 COMPANY PROFILES

19.1 SINOTRANS LIMITED

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 SERVICE PORTFOLIO

19.1.4 RECENT DEVELOPMENTS

19.2 ABDUL LATIF JAMEEL

19.2.1 COMPANY SNAPSHOT

19.2.2 SERVICE PORTFOLIO

19.2.3 RECENT DEVELOPMENTS

19.3 DEUTSCHE POST AG

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 SOLUTION PORTFOLIO

19.3.4 RECENT DEVELOPMENT

19.4 CEVA LOGISTICS

19.4.1 COMPANY SNAPSHOT

19.4.2 SERVICES PORTFOLIO

19.4.3 RECENT DEVELOPMENTS

19.5 DSV

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 SOLUTION PORTFOLIO

19.5.4 RECENT DEVELOPMENTS

19.6 ARDIAN GLOBAL EXPRESS LLC.

19.6.1 COMPANY SNAPSHOT

19.6.2 SERVICE PORTFOLIO

19.6.3 RECENT DEVELOPMENTS

19.7 DB SCHENKER

19.7.1 COMPANY SNAPSHOT

19.7.2 SERVICES PORTFOLIO

19.7.3 RECENT DEVELOPMENTS

19.8 DEFAF LOGISTICS

19.8.1 COMPANY SNAPSHOT

19.8.2 SERVICE PORTFOLIO

19.8.3 RECENT DEVELOPMENT

19.9 FEDEX

19.9.1 COMPANY SNAPSHOT

19.9.2 REVENUE ANALYSIS

19.9.3 SERVICES PORTFOLIO

19.9.4 RECENT DEVELOPMENTS

19.1 FOURWINDS-KSA.COM

19.10.1 COMPANY SNAPSHOT

19.10.2 SERVICE PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 FREIGHTS SOLUTIONS CO.

19.11.1 COMPANY SNAPSHOT

19.11.2 SERVICE PORTFOLIO

19.11.3 RECENT DEVELOPMENT

19.12 GAC

19.12.1 COMPANY SNAPSHOT

19.12.2 SERVICE PORTFOLIO

19.12.3 RECENT DEVELOPMENTS

19.13 HELLMANN WORLDWIDE LOGISTICS SE & CO. KG

19.13.1 COMPANY SNAPSHOT

19.13.2 SERVICE PORTFOLIO

19.13.3 RECENT DEVELOPMENT

19.14 JAS WORLDWIDE, INC.

19.14.1 COMPANY SNAPSHOT

19.14.2 SERVICE PORTFOLIO

19.14.3 RECENT DEVELOPMENTS

19.15 KUEHNE+NAGEL

19.15.1 COMPANY SNAPSHOT

19.15.2 REVENUE ANALYSIS

19.15.3 SERVICE PORTFOLIO

19.15.4 RECENT DEVELOPMENTS

19.16 NTF GROUP

19.16.1 COMPANY SNAPSHOT

19.16.2 SERVICE PORTFOLIO

19.16.3 RECENT DEVELOPMENT

19.17 SEKO LOGISTICS

19.17.1 COMPANY SNAPSHOT

19.17.2 SERVICE PORTFOLIO

19.17.3 RECENT DEVELOPMENTS

19.18 UNITED PARCEL SERVICE OF AMERICA, INC.

19.18.1 COMPANY SNAPSHOT

19.18.2 REVENUE ANALYSIS

19.18.3 SERVICE PORTFOLIO

19.18.4 RECENT DEVELOPMENTS

19.19 WEFREIGHT

19.19.1 COMPANY SNAPSHOT

19.19.2 SERVICES PORTFOLIO

19.19.3 RECENT DEVELOPMENTS

20 QUESTIONNAIRE

21 RELATED REPORTS

表格列表

TABLE 1 KSA TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 2 KSA TRUCKING (ROAD FREIGHT) MARKET, BY TYPE OF CARRIER, 2018-2032 (USD MILLION)

TABLE 3 KSA TRUCKING (ROAD FREIGHT) MARKET, BY TYPE OF GOODS, 2018-2032 (USD MILLION)

TABLE 4 KSA ROAD TRANSPORT OF FOODSTUFFS IN TRUCKING (ROAD FREIGHT) MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 5 KSA TRUCKING (ROAD FREIGHT) MARKET, BY BUSINESS MODEL, 2018-2032 (USD MILLION)

TABLE 6 KSA TRUCKING (ROAD FREIGHT) MARKET, BY DISTANCE, 2018-2032 (USD MILLION)

TABLE 7 KSA TRUCKING (ROAD FREIGHT) MARKET, BY INDUSTRY, 2018-2032 (USD MILLION)

TABLE 8 KSA OIL & GAS IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 9 KSA OIL & GAS IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 10 KSA MANUFACTURING IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 11 KSA MANUFACTURING IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 12 KSA FOOD & BEVERAGES IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 13 KSA FOOD & BEVERAGES IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 14 KSA MINING IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 15 KSA MINING IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 16 KSA ENERGY & UTILITY IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 17 KSA ENERGY & UTILITY IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 18 KSA FAST MOVING CONSUMER GOODS (FMCG) IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 19 KSA FAST MOVING CONSUMER GOODS (FMCG) IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 20 KSA HEALTHCARE IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 21 KSA HEALTHCARE IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 22 KSA E-COMMERCE IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 23 KSA E-COMMERCE IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 24 KSA CHEMICAL IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 25 KSA CHEMICAL IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 26 KSA AUTOMOTIVE IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 27 KSA AUTOMOTIVE IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 28 KSA IT & TELECOM IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 29 KSA IT & TELECOM IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 30 KSA RETAIL IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 31 KSA RETAIL IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 32 KSA TRANSPORTATION IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 33 KSA TRANSPORTATION IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 34 KSA DEFENSE IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 35 KSA DEFENSE IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 36 KSA ELECTRONICS IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 37 KSA ELECTRONICS IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 38 KSA APPARELS & FOOTWEAR IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 39 KSA APPARELS & FOOTWEAR IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 40 KSA OTHERS IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 41 KSA OTHERS IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 42 KSA TRUCKING (ROAD FREIGHT) MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 43 KSA TRUCKING (ROAD FREIGHT) MARKET, BY TYPE OF ROAD FREIGHT, 2018-2032 (USD MILLION)

TABLE 44 KSA TRUCKING (ROAD FREIGHT) MARKET, BY OPERATION, 2018-2032 (USD MILLION)

TABLE 45 KSA TRUCKING (ROAD FREIGHT) MARKET, BY CUSTOMER TYPE, 2018-2032 (USD MILLION)

TABLE 46 KSA TRUCKING (ROAD FREIGHT) MARKET, BY TRUCK TYPE, 2018-2032 (USD MILLION)

TABLE 47 KSA TANKER TRUCK IN TRUCKING (ROAD FREIGHT) MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 48 KSA TANKER TRUCK IN TRUCKING (ROAD FREIGHT) MARKET, BY TRANSPORT PRODUCT, 2018-2032 (USD MILLION)

TABLE 49 KSA FUEL IN TRUCKING (ROAD FREIGHT) MARKET, BY TYPE 2018-2032 (USD MILLION)

TABLE 50 KSA GASES IN TRUCKING (ROAD FREIGHT) MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 51 KSA TANKER TRUCK IN TRUCKING (ROAD FREIGHT) MARKET, BY PRESSURIZATION, 2018-2032 (USD MILLION)

TABLE 52 KSA TANKER TRUCK IN TRUCKING (ROAD FREIGHT) MARKET, BY REFRIGERATION, 2018-2032 (USD MILLION)

TABLE 53 KSA TANKER TRUCK IN TRUCKING (ROAD FREIGHT) MARKET, BY INSULATION, 2018-2032 (USD MILLION)

TABLE 54 KSA BOX TRUCK IN TRUCKING (ROAD FREIGHT) MARKET, BY TRANSPORT PRODUCTS, 2018-2032 (USD MILLION)

TABLE 55 KSA REFRIGERATED TRUCK IN TRUCKING (ROAD FREIGHT) MARKET, BY TRANSPORT PRODUCTS, 2018-2032 (USD MILLION)

TABLE 56 KSA MEDICAL SUPPLIES IN TRUCKING (ROAD FREIGHT) MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 57 KSA PERISHABLE GOODS IN TRUCKING (ROAD FREIGHT) MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 58 KSA BEVERAGES IN TRUCKING (ROAD FREIGHT) MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 59 KSA FLATBEDS TRUCK IN TRUCKING (ROAD FREIGHT) MARKET, BY TRANSPORT PRODUCTS, 2018-2032 (USD MILLION)

图片列表

FIGURE 1 KSA TRUCKING (ROAD FREIGHT) MARKET: SEGMENTATION

FIGURE 2 KSA TRUCKING (ROAD FREIGHT) MARKET: DATA TRIANGULATION

FIGURE 3 KSA TRUCKING (ROAD FREIGHT) MARKET: DROC ANALYSIS

FIGURE 4 KSA TRUCKING (ROAD FREIGHT) MARKET: COUNTRY-WISE ANALYSIS

FIGURE 5 KSA TRUCKING (ROAD FREIGHT) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 KSA TRUCKING (ROAD FREIGHT) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 KSA TRUCKING (ROAD FREIGHT) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 KSA TRUCKING (ROAD FREIGHT) MARKET: SEGMENTATION

FIGURE 9 FOUR SEGMENTS COMPRISE THE KSA TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE (2024)

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 STRATEGIC DECISIONS

FIGURE 12 GROWTH IN E-COMMERCE SECTOR BOOSTING THE ROAD FREIGHT/TRUCKING SERVICES IS EXPECTED TO DRIVE THE KSA TRUCKING (ROAD FREIGHT) MARKET GROWTH IN THE FORECAST PERIOD 2025-2032

FIGURE 13 TRANSPORTATION IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE KSA TRUCKING (ROAD FREIGHT) MARKET IN 2025 & 2032

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE KSA TRUCKING (ROAD FREIGHT) MARKET

FIGURE 15 KSA TRUCKING (ROAD FREIGHT) MARKET: BY SERVICE TYPE, 2024

FIGURE 16 KSA TRUCKING (ROAD FREIGHT) MARKET: BY TYPE OF CARRIER, 2024

FIGURE 17 KSA TRUCKING (ROAD FREIGHT) MARKET: BY TYPE OF GOODS, 2024

FIGURE 18 KSA TRUCKING (ROAD FREIGHT) MARKET: BY BUSINESS MODEL, 2024

FIGURE 19 KSA TRUCKING (ROAD FREIGHT) MARKET: BY DISTANCE, 2024

FIGURE 20 KSA TRUCKING (ROAD FREIGHT) MARKET: BY INDUSTRY, 2024

FIGURE 21 KSA TRUCKING (ROAD FREIGHT) MARKET: BY VEHICLE TYPE, 2024

FIGURE 22 KSA TRUCKING (ROAD FREIGHT) MARKET: BY TYPE OF ROAD FREIGHT, 2024

FIGURE 23 KSA TRUCKING (ROAD FREIGHT) MARKET: BY OPERATION, 2024

FIGURE 24 KSA TRUCKING (ROAD FREIGHT) MARKET: BY CUSTOMER TYPE, 2024

FIGURE 25 KSA TRUCKING (ROAD FREIGHT) MARKET: BY TRUCK TYPE, 2024

FIGURE 26 KSA TRUCKING (ROAD FREIGHT) MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。