Ksa Aftermarket Spare Parts Market

市场规模(十亿美元)

CAGR :

%

USD

4.79 Thousand

USD

6.61 Thousand

2023

2029

USD

4.79 Thousand

USD

6.61 Thousand

2023

2029

| 2024 –2029 | |

| USD 4.79 Thousand | |

| USD 6.61 Thousand | |

|

|

|

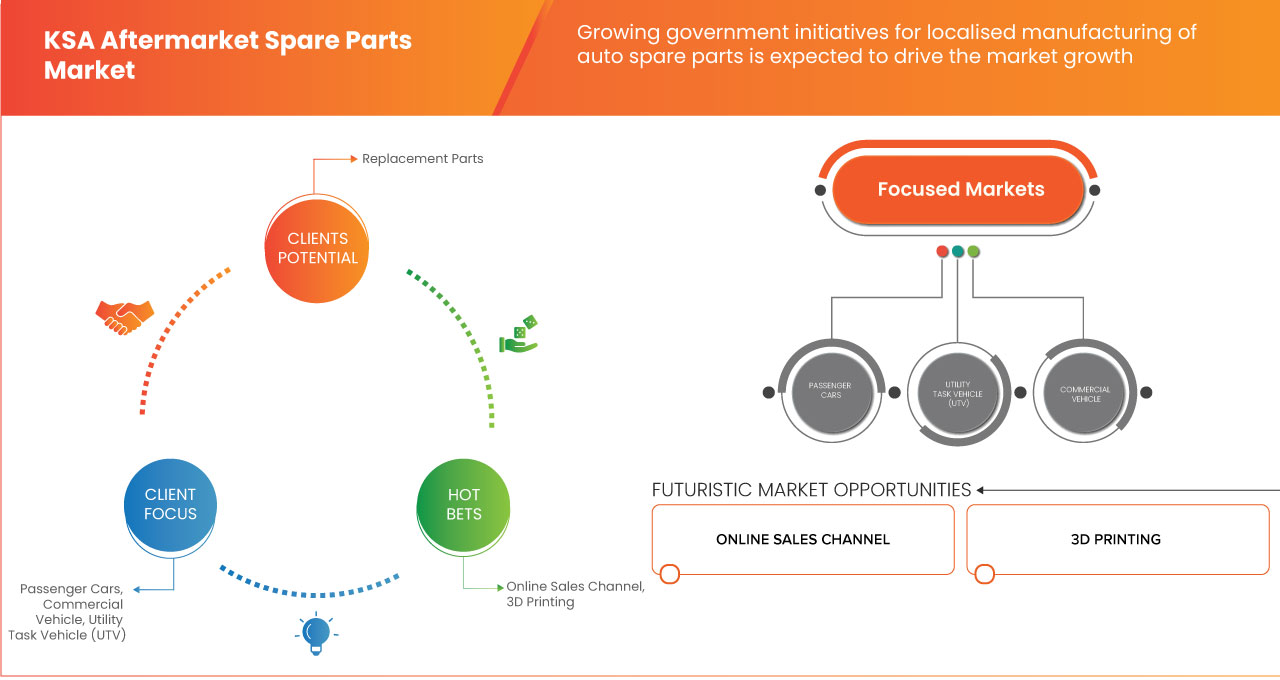

沙特阿拉伯售后零配件市场,按类型(更换零件及配件)、分销渠道(批发商及分销商及零售商)、认证展望(原厂零件、认证零件及未认证零件)、服务渠道(DIFM(为我做)、DIY(自己做)及 OE(委托给 OEM))、车龄(4 至 8 年、0 至 4 年及 8 年以上)、车辆类型(乘用车、商用车、多用途任务车 (UTV)、休闲车)、销售渠道(线下和线上)、推进类型(柴油/汽油、压缩天然气及电动)划分 - 行业趋势及预测至 2029 年。

沙特阿拉伯售后配件市场分析及规模

售后备件是指由第三方公司制造并与原始设备制造商 (OEM) 分开销售的组件或部件。这些零件旨在在车辆、机械或其他设备中的原始零件磨损或发生故障后更换或维修其原始零件。售后备件通常按照达到或超过 OEM 零件的规格生产,并且通常以具有竞争力的价格提供。它们为消费者提供 OEM 零件的替代品,提供更广泛的选择,并且与直接从原始制造商处购买相比,通常可以节省成本。

Data Bridge Market Research 分析,KSA 售后零配件市场价值预计将从 2023 年的 4.79 万美元达到 2029 年的 6.61 万美元,在 2024 年至 2029 年的预测期内以 5.7% 的复合年增长率增长。

|

报告指标 |

细节 |

|

预测期 |

2024 至 2029 年 |

|

基准年 |

2023 |

|

历史岁月 |

2022 (可定制为 2016-2021) |

|

定量单位 |

收入(千美元) |

|

涵盖的领域 |

类型(更换零件和配件)、分销渠道(批发商和分销商和零售商)、认证前景(原厂零件、认证零件和未认证零件)、服务渠道(DIFM(为我做)、DIY(自己做)和 OE(委托给 OEM))、车辆年龄(4 至 8 年、0 至 4 年和 8 年以上)、车辆类型(乘用车、商用车、多用途车辆 (UTV)、休闲车)、销售渠道(线下和线上)、推进类型(柴油/汽油、CNG和电动) |

|

覆盖国家 |

沙特阿拉伯 |

|

涵盖的市场参与者 |

米其林、固特异轮胎橡胶公司、大陆汽车集团、安波福、采埃孚股份公司、罗伯特·博世有限公司、克诺尔制动系统股份公司、横滨轮胎株式会社、天纳克公司、电装株式会社等 |

市场定义

售后备件是指由第三方公司制造并与原始设备制造商 (OEM) 分开销售的组件或部件。这些零件旨在在车辆、机械或其他设备中的原始零件磨损或发生故障后更换或维修其原始零件。售后备件通常按照达到或超过 OEM 零件的规格生产,并且通常以具有竞争力的价格提供。它们为消费者提供 OEM 零件的替代品,提供更广泛的选择,并且与直接从原始制造商处购买相比,通常可以节省成本。

沙特阿拉伯售后配件市场动态

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。下面将详细讨论所有这些内容:

驱动程序

- 汽车需求不断增长

沙特阿拉伯对汽车的需求不断增长,成为推动售后零配件市场向前发展的关键驱动力。该国人口稳步增长,城市化趋势不断上升,个人交通需求也随之激增,无论是通勤还是休闲。这种需求的增加导致乘用车、商用车和越野车等各个领域的汽车销量增加,从而增强了该国汽车车队的整体规模。

- 汽车配件线上购买偏好激增

人们对在线购买汽车零配件的偏好日益高涨,这是沙特阿拉伯售后零配件市场发展的重要推动力。数字化和电子商务继续受到关注,消费者越来越看重在线平台提供的便利性、可访问性和广泛的产品选择。随着电子商务渠道和专用汽车零配件网站的激增,车主可以轻松地在家中或工作场所浏览、比较价格和购买零配件。

机会

- 市场参与者之间的合作与伙伴关系

市场参与者之间的协作和伙伴关系为 KSA 售后备件市场提升竞争力和效率提供了重要机会。通过建立战略联盟,备件行业的公司可以利用彼此的优势、资源和专业知识来推动创新、扩大市场范围并提高供应链效率。例如,备件制造商、分销商和零售商之间的合作可以简化分销渠道、缩短交货时间并优化库存管理,最终使最终客户能够更快地获得优质备件。

- 创新分销模式

创新的分销模式为沙特阿拉伯王国 (KSA) 售后零配件市场带来了重大机遇。KSA 的汽车行业正在经历快速增长和技术进步,传统分销渠道面临着适应不断变化的消费者偏好和市场动态的挑战。电子商务平台、直接面向消费者的销售和基于订阅的服务等创新模式有可能通过为消费者提供更大的便利性、可访问性和效率来彻底改变 KSA 的售后零配件市场。

限制/挑战

- 汽车零部件相关法规合规性

法规合规性对沙特阿拉伯的售后零配件市场构成了重大制约。沙特标准、计量和质量组织 (SASO) 制定的严格标准和法规要求供应商和分销商遵守汽车零配件的特定质量和安全标准。确保符合 SASO 标准通常需要严格的认证流程,这对于在售后市场运营的企业来说可能既耗时又昂贵。此外,进口法规和关税进一步增加了在沙特市场采购和分销零配件的复杂性和成本。因此,这些监管负担可能会阻碍新参与者进入售后市场,并限制具有竞争力的零配件的供应,从而阻碍市场增长和创新。

- 原材料价格波动较大

沙特阿拉伯的售后备件市场因原材料价格的持续波动而面临巨大制约。这些波动波及整个供应链,影响制造商、分销商,最终影响最终消费者。制造商,尤其是中小型企业 (SME),承受着这些价格波动的最大影响,在充满不确定性的情况下努力应对管理运营成本的艰巨任务。与原材料供应商建立合作伙伴关系变得越来越复杂,因为在动荡的市场中,谈判稳定的价格合同变得难以实现。

最新动态

- 2023 年 6 月,据 Cotecna Inspection SA 发表的一篇文章称,Cotecna Worldwide 宣布了沙特阿拉伯监管合规方面的重大进展。沙特标准、计量和质量组织 (SASO) 已批准对汽车零部件技术法规和标准规范的修订,反映了其对维护沙特产品质量和安全标准的承诺

- 2023 年 6 月,根据 BRIDGESTONE MIDDLE EAST AND AFRICA 发表的一篇文章,海湾合作委员会地区炎热的夏季气温经常超过 50°C,对汽车轮胎构成重大挑战,因此车主必须采取预防措施。随着气温升高,轮胎内空气分子膨胀导致轮胎压力增加,导致轮胎充气过大并可能爆胎。驾驶时产生的摩擦会进一步升高轮胎温度

- 2022 年 6 月,据沙特阿拉伯工业中心发表的一篇文章称,汽车集群致力于按照国家工业战略推动沙特阿拉伯的汽车工业发展。他们的目标是到 2030 年,国内有 3-4 家 OEM 生产超过 40 万辆乘用车,目标是实现 40% 的本地总增加值 (LGVA)。他们的目标是将沙特阿拉伯定位为全球高附加值汽车产品的出口中心

- 2024 年 2 月,New East General Trading 与五十铃汽车建立合作伙伴关系,最终在沙特阿拉伯建立了经销店,标志着汽车卓越发展的重要里程碑。该经销店位于沙特阿拉伯中心地带,占地 8,060 平方米,体现了合作伙伴对创新和卓越服务的承诺,树立了新的行业标准

KSA 售后配件市场范围

KSA 售后备件市场根据类型、分销渠道、认证前景、推进类型、服务渠道、车辆年龄、车辆类型和销售渠道分为八个显著的细分市场。细分市场之间的增长有助于您分析利基增长领域和进入市场的策略,并确定您的核心应用领域和目标市场的差异。

类型

- 更换零件

- 配件

根据类型,市场分为替换零件和配件。

分销 渠道

- 批发商和分销商

- 零售

根据分销渠道,市场分为批发商和分销商以及零售商。

认证 展望

- 原厂配件

- 认证部件

- 未经认证的零件

根据认证前景,市场分为原装零件、认证零件和未认证零件。

服务 渠道

- DIFM(帮我做)

- DIY(自己动手)

- OE(委托给 OEM)

根据服务渠道,市场细分为 DIFM(为我服务)、DIY(自己动手)和 OE(委托给 OEM)。

车辆 年龄

- 4至8岁

- 0 至 4 岁

- 8 岁以上

根据车龄,市场分为4至8年、0至4年和8年以上。

车辆 类型

- 乘用车

- 商用车

- 多功能任务车 (UTV)

- 休闲车

根据车辆类型,市场分为乘用车、商用车、多用途车 (UTV) 和休闲车。

销售 渠道

- 离线

- 在线的

根据销售渠道,市场分为线上和线下。

推进 类型

- 柴油/汽油

- 天然气

- 电的

根据推进类型,市场分为柴油/汽油、压缩天然气和电动。

竞争格局和 KSA 售后配件市场份额分析

KSA 售后备件市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度、应用主导地位。以上提供的数据点仅与公司对全球工业自动化市场的关注有关。

沙特阿拉伯售后零配件市场的一些主要参与者包括米其林、固特异轮胎橡胶公司、大陆汽车集团、安波福、采埃孚股份公司、罗伯特·博世有限公司、克诺尔股份公司、横滨轮胎株式会社、天纳克公司和电装株式会社等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF KSA AFTERMARKET SPARE PARTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 TYPE TIMELINE CURVE

2.9 VEHICLE TYPE COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER FIVE FORCES ANALYSIS

4.2 REGULATORY STANDARDS

4.3 TECHNOLOGICAL TRENDS

4.4 TOP 50 SPARE PARTS PRICES

4.5 MOST SELLING SPARE PARTS FOR TOP 15 BRANDS IN KSA

4.6 MARKET SIZE TOP 5 BRANDS IN KSA

4.7 TOP EXPORTING COUNTRIES TO KSA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR AUTOMOBILE

5.1.2 SURGING PREFERENCE FOR ONLINE PURCHASES OF AUTO SPARE PARTS

5.1.3 EXTREME WEATHER CONDITIONS IN SAUDI ARABIA

5.1.4 GROWING GOVERNMENT INITIATIVES FOR LOCALISED MANUFACTURING OF AUTO SPARE PARTS

5.2 RESTRAINTS

5.2.1 REGULATORY COMPLIANCES RELATED TO AUTO SPARE PARTS

5.2.2 HIGH RAW MATERIAL PRICE FLUCTUATIONS

5.3 OPPORTUNITIES

5.3.1 COLLABORATION AND PARTNERSHIPS AMONG MARKET PLAYERS

5.3.2 INNOVATIVE DISTRIBUTION MODELS

5.3.3 TECHNOLOGICAL ADVANCEMENTS RELATED TO AUTO SPARE PARTS

5.4 CHALLENGES

5.4.1 HIGH PRODUCT VARIABILITY

5.5 PREVALENCE OF COUNTERFEIT SPARE PARTS

6 KSA AFTERMARKET SPARE PARTS MARKET, BY TYPE

6.1 OVERVIEW

6.2 REPLACEMENT PART

6.2.1 TIRE AND WHEELS

6.2.2 BATTERY

6.2.3 ENGINE AND TRANSMISSION PART

6.2.4 BRAKES AND BRAKE PARTS

6.2.5 BODY PARTS

6.2.6 ELECTRONIC COMPONENTS

6.2.6.1 LIGHTS

6.2.6.2 ALTERNATORS

6.2.6.3 STARTERS

6.2.6.4 SENSOR

6.2.7 COOLING SYSTEMS

6.2.7.1 WATER PUMPS

6.2.7.2 RADIATORS

6.2.7.3 INTERCOOLER

6.2.7.4 OTHERS

6.2.8 BELTS AND HOSES

6.2.9 FUEL INTAKE AND IGNITION PARTS

6.2.9.1 FUEL PUMP

6.2.9.2 FUEL INJECTOR

6.2.9.3 SPARK PLUG

6.2.9.4 FUEL FILTER

6.2.9.5 OTHERS

6.2.10 EXHAUST COMPONENTS

6.2.10.1 MUFFLERS

6.2.10.2 PIPES

6.2.11 IGNITION COILS AND DISTRIBUTORS

6.2.12 A/C PARTS

6.2.13 OTHERS

6.3 ACCESSORIES

6.3.1 CAR EXTERIORS

6.3.2 CAR INTERIORS

7 KSA AFTERMARKET SPARE PARTS MARKET, BY PROPULSION TYPE

7.1 OVERVIEW

7.2 DIESEL/PETROL

7.3 CNG

7.4 ELECTRIC

8 KSA AFTERMARKET SPARE PARTS MARKET, BY SERVICE CHANNEL

8.1 OVERVIEW

8.2 DIFM (DO IT FOR ME)

8.2.1 AUTO PARTS STORES

8.2.2 DISCOUNT DEPARTMENT STORES

8.3 DIY (DO IT YOURSELF)

8.4 OE (DELEGATING TO OEM’S)

9 KSA AFTERMARKET SPARE PARTS MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 WHOLESALERS & DISTRIBUTORS

9.3 RETAILS

9.3.1 OEM

9.3.2 REPAIR SHOPS

10 KSA AFTERMARKET SPARE PARTS MARKET, BY CERTIFICATION OUTLOOK

10.1 OVERVIEW

10.2 GENUINE PARTS

10.3 CERTIFIED PARTS

10.4 UNCERTIFIED PARTS

11 KSA AFTERMARKET SPARE PARTS MARKET, BY VEHICLE AGE

11.1 OVERVIEW

11.2 4 TO 8 YEARS

11.3 0 TO 4 YEARS

11.4 ABOVE 8 YEARS

12 KSA AFTERMARKET SPARE PARTS MARKET, BY SALES CHANNEL

12.1 OVERVIEW

12.2 OFFLINE

12.3 ONLINE

12.4 E-COMMERCE

12.5 COMPANY WEBSITE

13 KSA AFTERMARKET SPARE PARTS MARKET, BY VEHICLE TYPE

13.1 OVERVIEW

13.2 PASSENGER CARS

13.2.1 SUV

13.2.2 SEDAN

13.2.3 HATCHBACK

13.2.4 CROSSOVER

13.2.5 COUPE

13.2.6 CONVERTIBLE

13.2.7 OTHERS

13.3 COMMERCIAL VEHICLE

13.3.1 LIGHT COMMERCIAL VEHICLE

13.3.1.1 PICK UP TRUCKS

13.3.1.2 VANS

13.3.1.3 MINI BUS

13.3.1.4 OTHERS

13.3.2 MEDIUM COMMERCIAL VEHICLE

13.3.3 HEAVY COMMERCIAL VEHICLE

13.3.3.1 TRUCK

13.3.3.1.1 TANKER TRUCKS

13.3.3.1.2 DUMP TRUCK

13.3.3.1.3 CEMENT TRUCK

13.3.3.1.4 REFRIGERATED TRUCKS

13.3.3.1.5 TOW TRUCK

13.3.3.1.6 FIRE TRUCK

13.3.3.2 BUSES

13.3.3.3 OTHERS

13.4 UTILITY TASK VEHICLE (UTV)

13.4.1 SPORTS UTVS

13.4.2 LOAD CARRIER UTVS

13.4.3 MULTIPURPOSE UTVS

13.5 RECREATIONAL VEHICLE

14 KSA FREIGHT FORWARDING MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: KSA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 MICHELIN

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 THE GOODYEAR TIRE & RUBBER COMPANY

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 CONTINENTAL AG

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 APTIV PLC

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 ZF FRIEDRICHSHAFEN AG

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENTS

16.6 DENSO CORPORATION

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 KNORR-BREMSE AG

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 ROBERT BOSCH GMBH

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 TENNECO INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 YOKOHAMA TIRE CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

表格列表

TABLE 1 REGULATORY STANDARDS FOR KSA AFTERMARKET SPARE PARTS MARKET

TABLE 2 TOP 50 SPARE PARTS PRICES

TABLE 3 MOST SELLING SPARE PARTS FOR TOP 15 BRANDS IN KSA

TABLE 4 KSA AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 5 KSA AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (THOUSAND UNITS)

TABLE 6 KSA REPLACEMENT PARTS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 7 KSA REPLACEMENT PARTS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (THOUSAND UNITS)

TABLE 8 KSA ELECTRONIC COMPONENTS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 9 KSA ELECTRONIC COMPONENTS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (THOUSAND UNITS)

TABLE 10 KSA COOLING SYSTEMS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 11 KSA COOLING SYSTEMS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (THOUSAND UNITS)

TABLE 12 KSA FUEL INTAKE AND IGNITION PARTS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 13 KSA FUEL INTAKE AND IGNITION PARTS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (THOUSAND UNITS)

TABLE 14 KSA EXHAUST COMPONENTS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 15 KSA EXHAUST COMPONENTS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (THOUSAND UNITS)

TABLE 16 KSA ACCESSORIES IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 17 KSA ACCESSORIES IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (THOUSAND UNITS)

TABLE 18 KSA AFTERMARKET SPARE PARTS MARKET, BY PROPULSION TYPE, 2018-2029 (USD MILLION)

TABLE 19 KSA AFTERMARKET SPARE PARTS MARKET, BY SERVICE CHANNEL, 2018-2029 (USD MILLION)

TABLE 20 KSA DIFM (DO IT FOR ME) IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 21 KSA AFTERMARKET SPARE PARTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2029 (USD MILLION)

TABLE 22 KSA RETAILS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 23 KSA AFTERMARKET SPARE PARTS MARKET, BY CERTIFICATION OUTLOOK, 2018-2029 (USD MILLION)

TABLE 24 KSA AFTERMARKET SPARE PARTS MARKET, BY VEHICLE AGE, 2018-2029 (USD MILLION)

TABLE 25 KSA AFTERMARKET SPARE PARTS MARKET, BY SALES CHANNEL, 2018-2029 (USD MILLION)

TABLE 26 KSA ONLINE IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 27 KSA AFTERMARKET SPARE PARTS MARKET, BY VEHICLE TYPE, 2018-2029 (USD MILLION)

TABLE 28 KSA PASSENGER CARS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 29 KSA COMMERCIAL VEHICLE IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 30 KSA LIGHT COMMERCIAL VEHICLE IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 31 KSA HEAVY COMMERCIAL VEHICLE IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 32 KSA TRUCK IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 33 KSA UTILITY TASK VEHICLE (UTV) IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

图片列表

FIGURE 1 KSA AFTERMARKET SPARE PARTS MARKET: SEGMENTATION

FIGURE 2 KSA AFTERMARKET SPARE PARTS MARKET: DATA TRIANGULATION

FIGURE 3 KSA AFTERMARKET SPARE PARTS MARKET : DROC ANALYSIS

FIGURE 4 KSA AFTERMARKET SPARE PARTS MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 KSA AFTERMARKET SPARE PARTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 KSA AFTERMARKET SPARE PARTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 KSA AFTERMARKET SPARE PARTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 KSA AFTERMARKET SPARE PARTS MARKET: MULTIVARIATE MODELING

FIGURE 9 KSA AFTERMARKET SPARE PARTS MARKET: TYPE TIMELINE CURVE

FIGURE 10 KSA AFTERMARKET SPARE PARTS MARKET: VEHICLE TYPE COVERAGE GRID

FIGURE 11 KSA AFTERMARKET SPARE PARTS MARKET: SEGMENTATION

FIGURE 12 INCREASING DEMAND FOR AUTOMOBILE IS EXPECTED TO DRIVE THE MARKET GROWTH IN THE FORECAST PERIOD 2024-2029

FIGURE 13 REPLACEMENT PARTS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE KSA AFTERMARKET SPARE PARTS MARKET IN 2024 & 2029

FIGURE 14 PORTER FIVE FORCES ANALYSIS

FIGURE 15 MARKET SIZE TOP 5 BRANDS IN KSA

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE KSA AFTERMARKET SPARE PART MARKET

FIGURE 17 VEHICLE SOLD IN 2022, 2023, AND 2032 (FORECASTED) IN THOUSAND UNITS

FIGURE 18 FACTORS INFLUENCING THE AUTOMOBILE DEMAND IN KSA

FIGURE 19 HIGH TEMPERATURE AFFECTS AUTO SPARE PARTS

FIGURE 20 VARIOUS GOVERNMENT INITIATIVES FOR AUTO SPARE PARTS

FIGURE 21 REGULATORY COMPLIANCES RELATED TO AUTO SPARE PARTS

FIGURE 22 STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

FIGURE 23 INNOVATIONS IN WHOLESALE AUTO PARTS DISTROBUTION

FIGURE 24 TECHNOLOGICAL ADVANCEMENT IN AUTO SPARE PARTS

FIGURE 25 KSA AFTERMARKET SPARE PARTS MARKET: BY TYPE, 2023

FIGURE 26 KSA AFTERMARKET SPARE PARTS MARKET: BY PROPULSION TYPE, 2023

FIGURE 27 KSA AFTERMARKET SPARE PARTS MARKET: BY SERVICE CHANNEL, 2023

FIGURE 28 KSA AFTERMARKET SPARE PARTS MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 29 KSA AFTERMARKET SPARE PARTS MARKET: BY CERTIFICATION OUTLOOK, 2023

FIGURE 30 KSA AFTERMARKET SPARE PARTS MARKET: BY VEHICLE AGE, 2023

FIGURE 31 KSA AFTERMARKET SPARE PARTS MARKET: BY SALES CHANNEL, 2023

FIGURE 32 KSA AFTERMARKET SPARE PARTS MARKET: BY VEHICLE TYPE, 2023

FIGURE 33 KSA FREIGHT FORWARDING MARKET: COMPANY SHARE 2023 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。