Japan Tax It Software Market

市场规模(十亿美元)

CAGR :

%

USD

2.58 Billion

USD

4.66 Billion

2024

2032

USD

2.58 Billion

USD

4.66 Billion

2024

2032

| 2025 –2032 | |

| USD 2.58 Billion | |

| USD 4.66 Billion | |

|

|

|

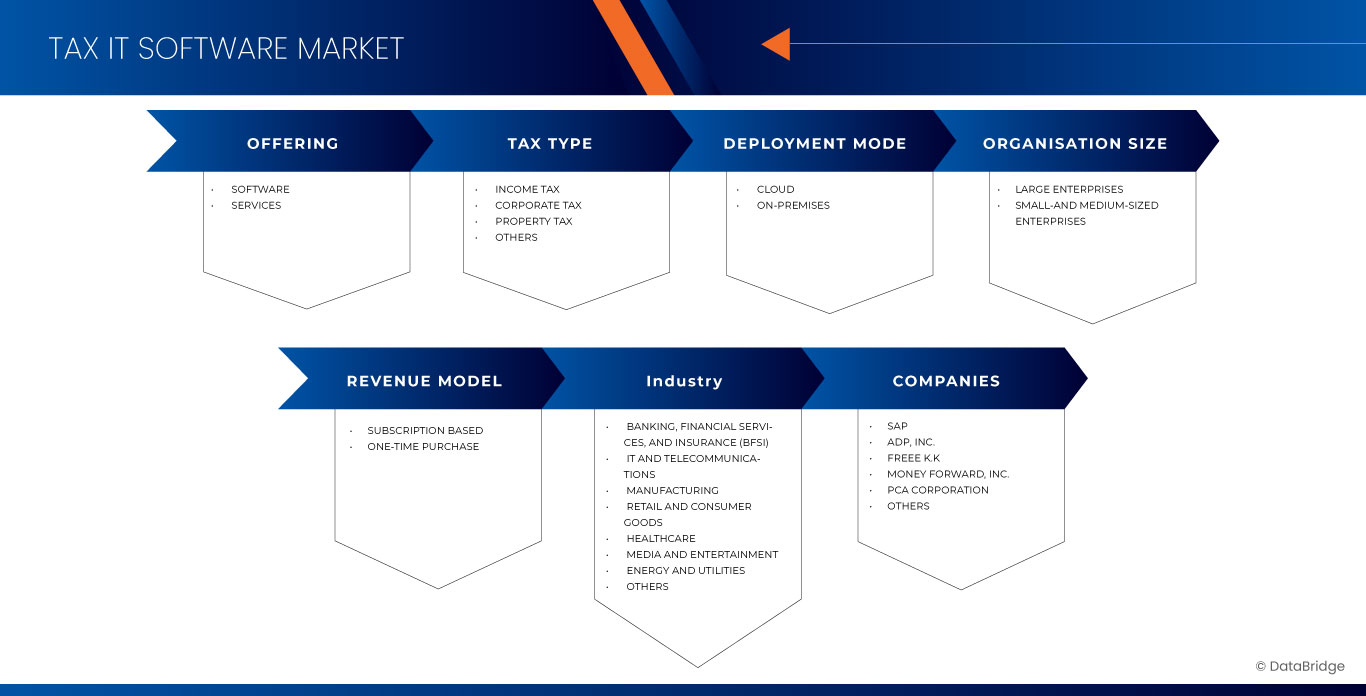

日本稅務 IT 軟體市場細分,按產品(軟體和服務)、稅種(所得稅、公司稅、財產稅等)、部署模式(新雲和本地)、組織規模(中小型企業和大型企業)、收入模式(一次性購買和基於訂閱)行業(銀行、金融服務和保險 (BFSI)、IT 和電信、製造、零售和消費品、醫療保健娛樂和消費品、金融服務和保險

日本稅務IT軟體市場分析及規模

日本 IT 稅務軟體市場正在經歷成長,這得益於對不斷演變的稅收法規和電子稅務等政府數位化措施的遵守需求不斷增長。企業正在採用自動化解決方案來減少錯誤並提高報稅的營運效率。人工智慧與即時分析的融合是一個重要趨勢,可實現動態更新和個人化洞察。主要參與者專注於使用者友善的介面和強大的網路安全,以滿足多樣化的業務需求。挑戰包括小型企業實施成本高以及數位轉型的阻力。機會在於擴大基於雲端的解決方案並滿足不斷增長的中小企業部門的需求。隨著國內和國際供應商紛紛瞄準該市場,競爭愈演愈烈。

Data Bridge Market Research 分析稱,日本稅務 IT 軟體市場規模預計將從 2024 年的 25.8 億美元增至 2032 年的 46.6 億美元,在 2025 年至 2032 年的預測期內,複合年增長率為 7.7%。

報告範圍和稅務IT軟體市場細分

|

屬性 |

感測器清潔系統關鍵市場洞察 |

|

涵蓋的領域 |

|

|

主要市場參與者 |

SAP(德國)、ADP, Inc.(美國)、freee KK(日本)、Money Forward, Inc.(日本)、PCA Corporation(美國)、QUICKBOOKS (INTUIT INC.)(美國)、SAGE GROUP PLC(英國)、TKC Corporation(日本)和 Wolters Kluwer NV(荷蘭) |

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深度專家分析、患者流行病學、管道分析、定價分析和監管框架。 |

市場定義

日本稅務 IT 軟體市場涵蓋一系列軟體解決方案,旨在簡化和自動化個人、企業和稅務專業人士的稅務相關流程。該市場包括支援根據日本具體稅收法規進行稅務準備、申報、合規和報告的軟體應用程式。主要功能通常涉及即時數據分析、電子申報功能、稅務規劃和監管更新,以幫助用戶遵守當地和國際稅務要求。隨著數位轉型需求的不斷增長,這些解決方案越來越多地融合雲端運算、人工智慧和資料安全等技術,從而提高稅務管理的效率和準確性。

日本稅務IT軟體市場動態

驅動程式

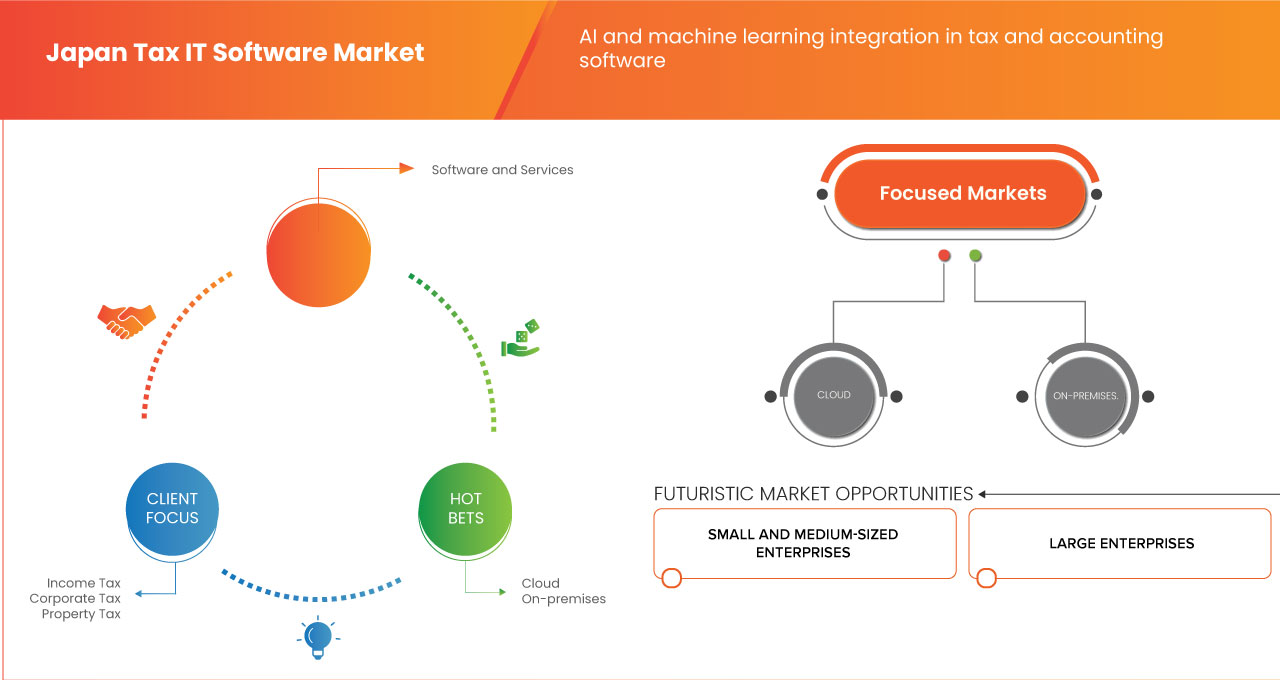

- 日本中小企業需求不斷成長

日本的中小企業 (SMB) 部門正在快速擴張,對高效且經濟的解決方案的需求不斷增加,尤其是在稅務和會計方面。隨著公司的發展,簡化財務運作和保證遵守不斷變化的法律法規的需求變得更加重要。在此背景下,基於雲端的稅務和會計軟體為希望改善財務管理同時控製成本的中小企業提供了完美的選擇。

- 稅務和會計軟體中的人工智慧和機器學習集成

人工智慧 (AI) 和機器學習 (ML) 技術與稅務和會計軟體的整合正在改變企業的財務管理格局。隨著企業面臨日益複雜的財務狀況,使用人工智慧進行預測分析、稅收優化和詐欺偵測可提供顯著的競爭優勢。這些技術使公司能夠實現耗時操作的自動化並提高準確性,從而提高營運效率。

機會

- 擴展企業雲端服務

雲端服務的快速擴張為日本的中小企業(SMB)創造了新的機會。隨著國家邁向數位轉型,基於雲端的稅務和會計軟體越來越受歡迎。這些解決方案為組織提供了一種經濟高效、可擴展且用戶友好的方式來管理其財務運營,而無需大量的基礎設施投資。

- 政府推動數位合規軟體發展的舉措

包括日本在內的世界各國政府都在積極支持企業使用數位合規軟體,以提高生產力、消除錯誤並確保遵守法規。隨著數位轉型活動的出現,政府正在製定計劃和法律,鼓勵企業使用現代技術(例如稅務和會計軟體)來簡化營運並滿足日益增長的監管合規需求。

限制/挑戰

- 高成本和初始投資限制

儘管現代稅務和會計軟體具有許多優勢,但獲取、部署和維護這些系統的高成本可能是一個巨大的障礙,尤其是對於中小型企業(SME)而言。隨著組織尋求簡化其財務運作並保持競爭力,此類軟體所需的初始投資可能會讓許多人望而卻步,尤其是在包含額外的客製化和整合費用的情況下。

- 網路安全和資料隱私問題

隨著企業將財務營運數位化,網路安全問題已成為使用現代稅務和會計軟體的主要障礙。企業越來越依賴數位平台來管理敏感的財務數據,因此面臨資料外洩、網路攻擊和隱私侵犯的風險。這些問題常常阻礙企業完全採用數位財務管理系統。

最新動態

- 2024 年 10 月,ADP 收購了全球企業領先的勞動力管理解決方案供應商 Workforce Software。此次收購擴展了 ADP 的產品線,增強了全球勞動力管理能力,並推動了未來創新以滿足不斷變化的業務需求

- 2024年10月,TKC株式會社推出了專為稅務會計師辦公室設計的安全智慧型手機TKC-Phone SE3。該設備可協助公司遵守稅務會計師法的保密和監督要求。它具有應用程式限制、資料保護和設備管理功能,確保員工的隱私和安全的通訊。全國推廣計畫於 2024 年 12 月進行

日本稅務IT軟體市場範圍

日本稅務 IT 軟體市場根據產品、稅務類型、部署模式、組織規模、收入模式和產業分為六個顯著的部分。這些細分市場之間的成長將幫助您分析行業中微弱的成長細分市場,並為用戶提供有價值的市場概覽和市場洞察,幫助他們做出策略決策,確定核心市場應用。

奉獻

- 軟體

- 服務

稅種

- 所得稅

- 公司稅

- 財產稅

- 其他的

部署模式

- 新雲

- 本地

組織規模

- 中小企業

- 大型企業

獲利模式

- 一次性購買

- 基於訂閱

產業

- 銀行業

- 金融服務和保險 BFSI

- 資訊科技和電信

- 製造業

- 零售和消費品

- 衛生保健

- 能源與公用事業

- 媒體和娛樂

- 其他的

日本稅務IT軟體市場競爭格局及份額分析

日本稅務 IT 軟體市場競爭格局提供了競爭對手的詳細資訊。詳細資訊包括公司概況、公司財務狀況、收入、市場潛力、研發投資、新市場計劃、生產基地和設施、生產能力、公司優勢和劣勢、產品發布、產品寬度和廣度、應用優勢。以上提供的數據點僅與公司對日本稅務IT軟體市場的關注有關。

- SAP(德國)

- ADP公司(美國)

- freee KK(日本)

- Money Forward, Inc.(日本)

- PCA公司(美國)

- QUICKBOOKS(INTUIT INC.)(美國)

- SAGE GROUP PLC(英國)

- TKC株式會社(日本)

- Wolters Kluwer NV(荷蘭)

- 彌生株式會社(日本)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF JAPAN TAX IT SOFTWARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 OFFERING TIMELINE CURVE

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.1.1 INDUSTRY ANALYSIS

4.1.2 CURRENT MARKET LANDSCAPE

4.1.3 FUTURISTIC SCENARIO

4.1.3.1 TECHNOLOGY TRENDS

4.1.4 COMPETITIVE LANDSCAPE

4.1.5 FUTURE OUTLOOK

4.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.3 MARKET OPPORTUNITIES

4.4 TECHNOLOGY ANALYSIS

4.5 COMPANY COMPARATIVE ANALYSIS

5 REGULATORY STANDARDS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND AMONG JAPAN’S SMALL AND MEDIUM-SIZED BUSINESSES

6.1.2 AI AND MACHINE LEARNING INTEGRATION IN TAX AND ACCOUNTING SOFTWARE

6.1.3 BUSINESSES AIM TO SIMPLIFY FREQUENT ACCOUNTING OPERATIONS TO REDUCE MANUAL ERRORS

6.1.4 RISING DEMAND FOR REAL-TIME FINANCIAL INSIGHTS

6.2 RESTRAINTS

6.2.1 HIGH COSTS AND INITIAL INVESTMENT RESTRICTIONS FOR THE USE OF ADVANCED TAX AND ACCOUNTING SOFTWARE

6.2.2 CYBERSECURITY AND DATA PRIVACY CONCERNS HINDER ADOPTION OF TAX AND ACCOUNTING SOFTWARE

6.3 OPPORTUNITIES

6.3.1 EXPANSION OF CLOUD SERVICES FOR BUSINESS

6.3.2 GOVERNMENT INITIATIVES TO PROMOTE DIGITAL COMPLIANCE SOFTWARE ADOPTION ACROSS BUSINESSES

6.4 CHALLENGES

6.4.1 FREQUENT TAX UPDATES CREATE CHALLENGES FOR SOFTWARE

6.4.2 CHALLENGES OF INTEGRATING LEGACY SYSTEMS FOR BUSINESSES IN JAPAN

7 JAPAN TAX IT SOFTWARE MARKET, BY OFFERING

7.1 OVERVIEW

7.2 SOFTWARE

7.3 SERVICES

7.3.1 SERVICES, BY TYPE

7.4 TRAINING AND CONSULTING

7.5 SUPPORT

8 JAPAN TAX IT SOFTWARE MARKET, BY TAX TYPE

8.1 OVERVIEW

8.2 INCOME TAX

8.3 CORPORATE TAX

8.4 PROPERTY TAX

8.5 OTHERS

9 JAPAN TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE

9.1 OVERVIEW

9.2 CLOUD

9.3 ON-PREMISES

10 JAPAN TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE

10.1 OVERVIEW

10.2 LARGE ENTERPRISES

10.3 SMALL AND MEDIUM-SIZED ENTERPRISES

11 JAPAN TAX IT SOFTWARE MARKET, BY REVENUE MODEL

11.1 OVERVIEW

11.2 SUBSCRIPTION BASED

11.3 ONE-TIME PURCHASE

12 JAPAN TAX IT SOFTWARE MARKET, BY INDUSTRY

12.1 OVERVIEW

12.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

12.3 IT AND TELECOMMUNICATIONS

12.4 MANUFACTURING

12.5 RETAIL AND CONSUMER GOODS

12.6 HEALTHCARE

12.7 MEDIA AND ENTERTAINMENT

12.8 ENERGY AND UTILITIES

12.9 OTHERS

13 JAPAN TAX IT SOFTWARE MARKET

13.1 COMPANY SHARE ANALYSIS: JAPAN

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 ADP,INC

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 YAYOI CO., LTD.

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENT

15.3 TKC CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 SAGE GROUP PLC

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 MONEY FORWARD, INC

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 FREEE KK

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 INTUIT INC

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 PCA CORPORATION

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 SAP SE

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 WOLTERS KLUWER N.V.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 AWI TAX CONSULTING TAX SOFTWARE PRICE (IN USD)

TABLE 2 TECHNOLOGY MATRIX

TABLE 3 COMPARATIVE ANALYSIS

TABLE 4 REGULATIONS AND STANDARDS FOR JAPAN TAX AND ACCOUNTING SOFTWARE MARKET

TABLE 5 JAPAN TAX IT SOFTWARE MARKET, BY OFFERING 2018-2032 (USD THOUSAND)

TABLE 6 JAPAN SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE 2018-2032 (USD THOUSAND)

TABLE 7 JAPAN TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 JAPAN TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 9 JAPAN TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2022-2032 (USD THOUSAND)

TABLE 10 JAPAN TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 11 JAPAN TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

图片列表

FIGURE 1 JAPAN TAX IT SOFTWARE MARKET: SEGMENTATION

FIGURE 2 JAPAN TAX IT SOFTWARE MARKET: DATA TRIANGULATION

FIGURE 3 JAPAN TAX IT SOFTWARE MARKET: DROC ANALYSIS

FIGURE 4 JAPAN TAX IT SOFTWARE MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 JAPAN TAX IT SOFTWARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 JAPAN TAX IT SOFTWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 JAPAN TAX IT SOFTWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 JAPAN TAX IT SOFTWARE MARKET: MULTIVARIATE MODELING

FIGURE 9 JAPAN TAX IT SOFTWARE MARKET: PRODUCT TIMELINE CURVE

FIGURE 10 JAPAN TAX IT SOFTWARE MARKET: SEGMENTATION

FIGURE 11 TWO SEGMENTS COMPRISE THE JAPAN TAX IT SOFTWARE MARKET, BY PRODUCT (2024)

FIGURE 12 JAPAN TAX IT SOFTWARE MARKET, BY MARKET REVENUE, PRODUCT & VENDOR PENETRATION MATRIX

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 GROWING DEMAND AMONG JAPAN’S SMALL AND MEDIUM-SIZED BUSINESS IS EXPECTED TO DRIVE THE JAPAN TAX IT SOFTWARE MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 15 SOFTWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE JAPAN TAX IT SOFTWARE MARKET IN 2025 & 2032

FIGURE 16 JAPAN’S METHODS OF PREPARING TAXES

FIGURE 17 TRENDS IN THE TOTAL SALES OF THE MANUFACTURING INDUSTRY (IN USD BILLION)

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE JAPAN TAX IT SOFTWARE MARKET

FIGURE 19 JAPAN TAX IT SOFTWARE MARKET: BY OFFERING, 2024

FIGURE 20 JAPAN TAX IT SOFTWARE MARKET: BY TAX TYPE, 2024

FIGURE 21 JAPAN TAX IT SOFTWARE MARKET: BY DEPLOYMENT MODE, 2024

FIGURE 22 JAPAN TAX IT SOFTWARE MARKET: BY ORGANIZATION SIZE, 2024

FIGURE 23 JAPAN TAX IT SOFTWARE MARKET: BY ORGANIZATION SIZE, 2024

FIGURE 24 JAPAN TAX IT SOFTWARE MARKET: BY INDUSTRY, 2024

FIGURE 25 JAPAN TAX IT SOFTWARE MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。