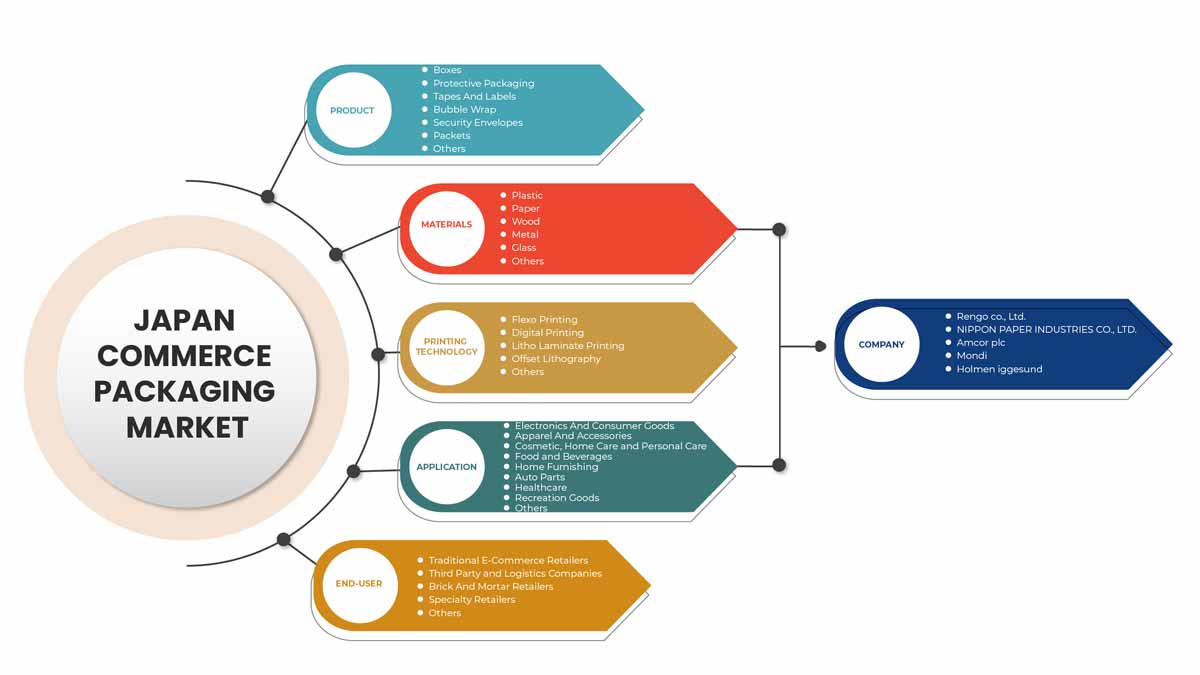

日本电子商务包装市场,按产品(盒子、保护性包装、安全信封、胶带和标签、小包、气泡包装等)、材料(玻璃、纸张、木材、塑料、金属等)、印刷技术(柔版印刷、数码印刷、平版印刷、胶印、数码印刷等)、应用(电子和消费品、服装和配饰、化妆品、家庭护理和个人护理、食品和饮料、家居装饰、汽车零部件、医疗保健、娱乐用品等)、最终用户(传统电子商务零售商、第三方和物流公司、实体零售商、专业零售商等)行业趋势和预测到 2029 年

市场分析和规模

Packaging 开发了一个平台,使公司能够充分利用其电子商务产品。该公司还建立了一种在大型或小型瓦楞板上直接印刷的方法。这样就无需印刷平版印刷标签,节省了时间和成本。它是环保的,据该服务称,直接在纸板上印刷是可回收的。有了这个订购和分销系统,越来越多的用户可以轻松更改模板,并且在电子商务包装上第三方广告的潜力巨大。运送的物品越奢华,外观就越令人惊叹。这样做是为了不透露包装的价值,以确保保护和防止盗窃。在这种情况下,包装内仍然有精美的图形。只有打开包装后才会显示出来。

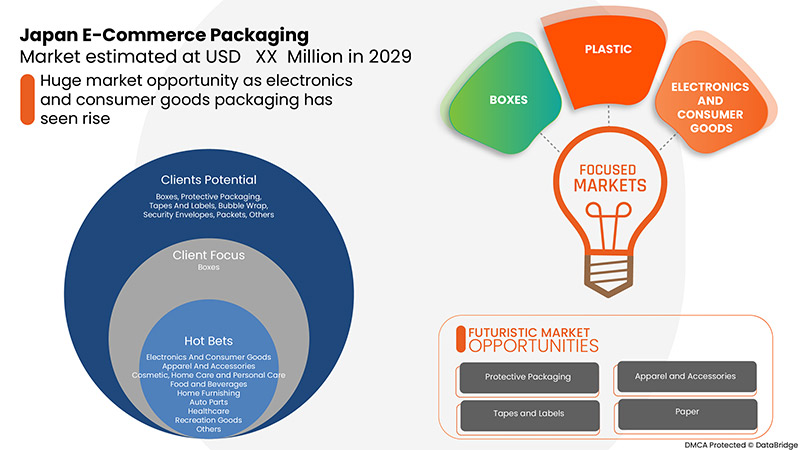

由于便利性和智能包装的日益普及,人们的购物偏好转向线上,这些是预计推动市场对电子商务包装需求的一些驱动因素。Data Bridge Market Research 分析称,电子商务包装市场预计到 2029 年将达到 133.9698 亿美元的价值,预测期内的复合年增长率为 16.0%。由于电子商务包装需求的增加,“盒子”在相应市场中占据最突出的产品细分市场。Data Bridge Market Research 团队策划的市场报告包括深入的专家分析、进出口分析、定价分析、生产消费分析和气候链情景。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2014) |

|

定量单位 |

收入(百万美元),销量(百万台) |

|

涵盖的领域 |

按产品(盒子、保护性包装、安全信封、胶带和标签、小包、气泡膜、其他)、材料(玻璃、纸张、木材、塑料、金属、其他)、印刷技术(柔版印刷、数码印刷、平版印刷、胶版印刷、数码印刷、其他)、应用(电子和消费品、服装和配饰、化妆品、家庭护理和个人护理、食品和饮料、家居装饰、汽车零部件、医疗保健、娱乐用品、其他)、最终用户(传统电子商务零售商、第三方和物流公司、实体零售商、专业零售商、其他) |

|

覆盖国家 |

日本 |

|

涵盖的市场参与者 |

国际纸业(美国田纳西州)、日本制纸株式会社(日本东京)、Mondi(英国阿德尔斯通)、Amcor Plc(瑞士苏黎世)、希悦尔(美国北卡罗来纳州)、Rengo Co., Ltd.(日本大阪)、AptarGroup, Inc.(美国伊利诺伊州)、WestRock Company(美国佐治亚州)、Yamakoh, Co., Ltd.(日本京都)、CHUOH PACK INDUSTRY CO., LTD.(日本本州)、Holmen Iggesund(瑞典伊格松德)等。 |

市场定义

电子商务包装是品牌推广的重要组成部分。与特定品牌首次自然接触的顾客通常会在网上购物时处理送到他手中的包裹。这是企业创造良好影响并加强或破坏其品牌形象的难得机会。由于包装破损或质量差,优质包装可以提高顾客的忠诚度。最近第三方在线零售商在其产品上做广告的力度甚至更大。行业专业人士预计其他零售商店和分销公司也会采用这种模式。包装将增加收入并融入创新形式的交叉品牌和营销。

监管框架

日本的包装和标签规定 - 海关对包装和标签的质量非常严格。正确的包装、标记和标签对于顺利通关至关重要。通常,大多数进口产品的标签不是在通关阶段要求的,而是在销售点要求的。因此,日本进口商通常会在进口产品通关后贴上标签。日本禁止使用吸管包装。

COVID-19 对电子商务包装市场的影响微乎其微

COVID-19 疫情导致世界许多地方突然封锁,以防止病毒传播,导致工厂、商店等迅速关闭。需求和供应的快速下降以及旅行禁令导致全球非必需品市场崩溃。由于需求减少、工厂员工短缺以及旅行禁令导致原材料短缺,疫情对经济产生了重大负面影响,从而停止了电子商务包装产品的生产。然而,随着封锁的放松和日本疫苗接种运动的开展,工作流程开始增加,从而帮助市场参与者卷土重来。政府对经济增长的监管和支持以及初创企业的崛起预计将在预测期内推动日本电子商务包装市场的估值飙升。由于网上购物的增加,疫情期间对电子商务包装的需求不断上升,但供应链中断在一定程度上阻碍了增长。

电子商务包装市场的市场动态包括:

电子商务包装市场的驱动因素/机遇

- 由于方便,购物偏好转向网上

便捷是电子商务的基石,也是过去几年网上购物兴起的主要原因。网上购物提供了一种选择购买方式的付款方式,您可以在合适的地点付款,甚至可以使用便捷的流程领取商品。

- 电子产品二次包装和保护性包装的需求不断增长

随着电子商务从现有的分销网络转向分散的客户网络,一个现代化的计划体系正在被创建,以提供直接履行以满足不同的标准。随着对这些转变的更好理解,它将改善响应策略的制定。确保避免意外影响仍然至关重要。为此,围绕供应链的沟通和协调很重要。通过合作,行业可以利用这一机会在供应链发展的早期就将可持续性融入其中。

- 智能包装日益普及

消费者希望包装能够智能开启,无需使用工具即可轻松打开。最好是撕条,然后打开包装。货物应妥善送达,最好带有个人风格,给人一种有人专门为他们打包的印象。物品应完好无损地送达,没有过多的填充材料或空间,因为它们得到了很好的保护。这一点尤为重要,因为消费者在产品和包装方面正在寻找可持续的解决方案。

- 新冠疫情增加了食品杂货购物对电子商务的依赖

与世界在 COVID-19 危机中看到的任何情况相反,各国、各机构和企业领导人面临着艰难的选择,不确定性程度空前。短期内,方向至关重要,危机将变得更加清晰,社会和经济秩序将不断形成,就像最近发生的许多灾难一样,未来已经成为现实。随着我们工作、学习、购物和使用技术,社会趋势正在迅速变化。虽然这些发展在危机之前就已经形成,但我们看到危机的升级正在助长新常态。虽然短期反应对于生存很重要,但从长远来看,赢家将会出现。

电子商务包装市场面临的限制/挑战

- 电子商务公司的包装成本增加降低了他们的利润

消费者对其影响有了更好的认识,他们希望购买有关公司如何抵消其运营影响的决策。然而,在这样做时,您必须考虑平均包装价格上涨的触发因素以及可以抵消这些影响的不同方面。重要的是利用可用的增值服务,使包装功能更强大,确保最佳质量,并利用可接受的增值服务。

- 成本效益比是制造商关心的问题

企业利用互联网电子服务(e-services)来吸引客户、共享商业信息、维持业务联系并开展业务交易。在使用电子服务的早期阶段,组织对其企业和社会影响没有事实和认识。企业也通过多年的电子服务经验获得了类似的专业知识。迫切需要评估将服务转移到网上的成本与采用电子服务的优势,并通过创新利用电子服务来确定电子服务对企业与客户关系的影响。

最新动态

- 2022年3月,联合株式会社在日本印刷工业联合会主办的第61届日本包装大赛(2022JPC)中荣获两个类别的三个奖项。这一成就将有助于该公司获得全球认可。

- 2022 年 4 月,Amcor Rigid Packaging (ARP) 和达能为 Villavicencio 水品牌推出了 100% 可回收瓶。它由 100% 再生材料制成,与旧瓶相比,碳足迹减少了 21%。这一发展将吸引寻求创新产品的新客户。

日本电子商务包装市场范围

电子商务包装市场根据产品、材料、印刷技术、应用和最终用户进行细分。这些细分市场之间的增长将帮助您分析行业中增长微弱的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

产品

- 盒子

- 保护性包装

- 胶带和标签

- 气泡膜

- 安全信封

- 数据包

- 其他的

根据产品,日本电子商务包装市场分为盒子、保护包装、安全信封、胶带和标签、小包、气泡膜等。

材料

- 塑料

- 纸

- 木头

- 金属

- 玻璃

根据材料,日本电子商务包装市场分为玻璃、纸张、木材、塑料、金属和其他。

印刷技术

- 柔版印刷

- 数码印刷

- 平版印刷

- 胶版印刷

- 其他的

根据印刷技术,日本电子商务包装市场分为柔版印刷、数码印刷、平版印刷、胶印、数字印刷等。

应用

- 电子产品和消费品

- 服饰与配饰

- 化妆品、家庭护理和个人护理

- 食品和饮料

- 家居装饰

- 汽车零部件

- 卫生保健

- 休闲用品

- 其他的

根据应用,日本电子商务包装市场细分为电子和消费品、服装和配饰、化妆品、家庭护理和个人护理、食品和饮料、家居装饰、汽车零部件、医疗保健、娱乐用品等。

终端用户

- 传统电子商务零售商

- 第三方及物流公司

- 实体零售商

- 专业零售商

- 其他的

根据最终用户,日本电子商务包装市场分为传统电子商务零售商、第三方和物流公司、实体零售商、专业零售商和其他。

竞争格局和电子商务包装市场份额分析

电子商务包装市场竞争格局按竞争对手提供详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、全球影响力、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度、应用主导地位。以上提供的数据点仅与公司对电子商务包装市场的关注有关。

参与日本电子商务包装市场的一些主要市场参与者包括国际纸业、日本制纸工业株式会社、Mondi、Amcor Plc、Sealed Air、Rengo Co., Ltd.、AptarGroup, Inc.、WestRock Company、Yamakoh, Co., Ltd.、CHUOH PACK INDUSTRY CO., LTD. 和 Holmen Iggesund 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF JAPAN E-COMMERCE PACKAGING MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 DBMR MARKET CHALLENGE MATRIX

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SHIFTING SHOPPING PREFERENCE TOWARDS ONLINE DUE TO CONVENIENCE

5.1.2 RISING DEMAND FOR SECONDARY PACKAGING AND PROTECTIVE PACKAGING FOR ELECTRONIC GOODS

5.1.3 GROWING POPULARITY OF SMART PACKAGING

5.1.4 COVID-19 PANDEMIC INCREASED DEPENDENCY OF GROCERY SHOPPING TO E-COMMERCE

5.2 RESTRAINTS

5.2.1 GOVERNMENT RULES AND REGULATIONS REGARDING PACKAGING

5.2.2 INCREASING PACKAGING COST FOR E-COMMERCE COMPANIES REDUCED THEIR BOTTOM LINE

5.2.3 COST-TO-BENEFIT RATIO IS A CONCERN FOR MANUFACTURERS

5.3 OPPORTUNITY

5.3.1 GROWING DEMAND FOR SUSTAINABLE PACKAGING SOLUTIONS

5.4 CHALLENGES

5.4.1 GREATER TECHNOLOGICAL UNDERSTANDING THAN REQUIRED FOR OTHER PACKAGING FORMS

5.4.2 FLUCTUATIONS IN THE RAW MATERIAL PRICES

6 JAPAN E-COMMERCE PACKAGING MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 BOXES

6.2.1 CORRUGATED BOXES

6.2.1.1 REGULAR SLOTTED CONTAINERS

6.2.1.2 ROLL END CORRUGATED BOXES

6.2.1.3 OTHERS CORRUGATED BOXES

6.2.2 SET-UP BOXES

6.3 PROTECTIVE PACKAGING

6.4 TAPES AND LABELS

6.5 BUBBLE WRAP

6.6 SECURITY ENVELOPES

6.7 PACKETS

6.8 OTHERS

7 JAPAN E-COMMERCE PACKAGING MARKET, BY PRINTING TECHNOLOGY

7.1 OVERVIEW

7.2 FLEXO PRINTING

7.3 DIGITAL PRINTING

7.4 LITHO LAMINATE PRINTING

7.5 OFFSET LITHOGRAPHY

7.6 OTHERS

8 JAPAN E-COMMERCE PACKAGING MARKET, BY MATERIALS

8.1 OVERVIEW

8.2 PLASTIC

8.2.1 POLYETHYLENE (PE)

8.2.1.1 LOW DENSITY POLYETHYLENE (LDPE)

8.2.1.2 HIGH DENSITY POLYETHYLENE (HDPE)

8.2.1.3 LINEAR LOW DENSITY POLYETHYLENE (LLDPE)

8.2.1.4 OTHERS

8.2.2 POLYPROPYLENE (PP)

8.2.3 POLYETHYLENE TEREPHTHALATE (PET)

8.2.4 POLYVINYL CHLORIDE (PVC)

8.2.5 POLYCARBONATE (PC)

8.2.6 POLYSTYRENE (PS)

8.2.7 OTHERS

8.3 PAPER

8.3.1 PAPER BAGS

8.3.2 CORRUGATED BOARD

8.3.3 PAPER CARTONS

8.3.4 KRAFT PAPER

8.3.5 GREASEPROOF PAPER

8.3.6 OTHERS

8.4 WOOD

8.5 METAL

8.5.1 ALUMINUM

8.5.2 STEEL

8.5.3 OTHERS

8.6 GLASS

8.7 OTHERS

9 JAPAN E-COMMERCE PACKAGING MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 ELECTRONICS AND CONSUMER GOODS

9.2.1 WEARABLE TECHNOLOGY

9.2.2 COMPUTER AND ACCESSORIES

9.2.3 MEDIA PLAYERS

9.2.4 MOBILE PHONES

9.2.5 CAMERAS AND PHOTOGRAPHY

9.2.6 CAR AND VEHICLE ELECTRONICS

9.2.7 HOME AUDIO

9.2.8 OTHERS

9.3 APPAREL AND ACCESSORIES

9.3.1 APPAREL AND ACCESSORIES, BY APPLICATION

9.3.1.1 CLOTHING

9.3.1.2 SHOES

9.3.1.3 HANDBAG AND CLUTCHES

9.3.1.4 WATCHES

9.3.1.5 JEWELLERY

9.3.1.6 OTHERS

9.3.2 APPAREL AND ACCESSORIES, BY GENDER

9.3.2.1 MEN

9.3.2.2 WOMEN

9.3.2.3 KIDS

9.4 COSMETIC, HOME CARE AND PERSONAL CARE

9.4.1 SKIN CARE

9.4.2 BATH AND SHOWER

9.4.3 HAIR CARE AND STYLING

9.4.4 TOILET CLEANERS

9.4.5 DISHWASHING

9.4.6 FOOT CARE

9.4.7 HAND CARE

9.4.8 OTHERS

9.5 FOOD AND BEVERAGES

9.5.1 EXTRUDED SNACKS

9.5.2 FRUITS AND VEGETABLES

9.5.3 FROZEN FOOD

9.5.4 PROCESSED FOODS

9.5.5 BAKERY PRODUCTS

9.5.6 BABY FOODS

9.5.7 DAIRY PRODUCTS

9.5.8 JUICES

9.5.9 BOTTLED WATER

9.5.10 OTHERS

9.6 HOME FURNISHING

9.6.1 BED SHEETS

9.6.2 BEDDING SETS

9.6.3 KITCHEN APRONS

9.6.4 BLANKETS

9.6.5 FABRIC

9.6.6 CARPETS

9.6.7 OTHERS

9.7 AUTO PARTS

9.7.1 INTERIOR MIRRORS

9.7.2 DOOR PROTECTION

9.7.3 VEHICLE TOOLS

9.7.4 MOTORBIKE FILTERS

9.7.5 CAR STYLING BODY FITTINGS

9.7.6 SIDE MIRROR AND ACCESSORIES

9.7.7 OTHERS

9.8 HEALTHCARE

9.9 RECREATION GOODS

9.1 OTHERS

10 JAPAN E-COMMERCE PACKAGING MARKET, BY END USER

10.1 OVERVIEW

10.2 TRADITIONAL E-COMMERCE RETAILERS

10.2.1 BOXES

10.2.2 PROTECTIVE PACKAGING

10.2.3 TAPES AND LABELS

10.2.4 BUBBLE WRAP

10.2.5 SECURITY ENVELOPES

10.2.6 PACKETS

10.2.7 OTHERS

10.3 THIRD PARTY AND LOGISTICS COMPANIES

10.3.1 BOXES

10.3.2 PROTECTIVE PACKAGING

10.3.3 TAPES AND LABELS

10.3.4 BUBBLE WRAP

10.3.5 SECURITY ENVELOPES

10.3.6 PACKETS

10.3.7 OTHERS

10.4 BRICK AND MORTAR RETAILERS

10.4.1 BOXES

10.4.2 PROTECTIVE PACKAGING

10.4.3 TAPES AND LABELS

10.4.4 BUBBLE WRAP

10.4.5 SECURITY ENVELOPES

10.4.6 PACKETS

10.4.7 OTHERS

10.5 SPECIALTY RETAILERS

10.5.1 BOXES

10.5.2 PROTECTIVE PACKAGING

10.5.3 TAPES AND LABELS

10.5.4 BUBBLE WRAP

10.5.5 SECURITY ENVELOPES

10.5.6 PACKETS

10.5.7 OTHERS

10.6 OTHERS

10.6.1 BOXES

10.6.2 PROTECTIVE PACKAGING

10.6.3 TAPES AND LABELS

10.6.4 BUBBLE WRAP

10.6.5 SECURITY ENVELOPES

10.6.6 PACKETS

10.6.7 OTHERS

11 JAPAN E-COMMERCE PACKAGING MARKET, BY COUNTRY

11.1 JAPAN

12 JAPAN E-COMMERCE PACKAGING MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: JAPAN

12.1.1 AGREEMENTS

12.1.2 PRODUCT LAUNCHES

12.1.3 PARTNERSHIP

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 RENGO CO., LTD.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT UPDATE

14.2 NIPPON PAPER INDUSTRIES CO., LTD.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT UPDATE

14.3 AMCOR PLC

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT UPDATES

14.4 MONDI

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT UPDATES

14.5 HOLMEN IGGESUND

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT UPDATES

14.6 CHUOH PACK INDUSTRY CO., LTD.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATE

14.7 APTARGROUP, INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT UPDATE

14.8 INTERNATIONAL PAPER

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT UPDATE

14.9 SEALED AIR

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT UPDATE

14.1 WESTROCK COMPANY

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT UPDATES

14.11 YAMAKOH, CO., LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATE

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 IMPORT DATA OF BOXES, CASES, CRATES AND SIMILAR ARTICLES FOR THE CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS; HS CODE - 392310 (USD THOUSAND)

TABLE 2 EXPORT DATA OF BOXES, CASES, CRATES AND SIMILAR ARTICLES FOR THE CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS; HS CODE - 392310 (USD THOUSAND)

TABLE 3 JAPAN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 4 JAPAN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (MILLION UNITS)

TABLE 5 JAPAN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (MILLION METER SQUARE)

TABLE 6 JAPAN BOXES IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 7 JAPAN CORRUGATED BOXES IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 8 JAPAN E-COMMERCE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 9 JAPAN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 10 JAPAN PLASTIC IN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 11 JAPAN POLYETHYLENE (PE) IN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 12 JAPAN PAPER IN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 13 JAPAN METAL IN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 14 JAPAN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 15 JAPAN ELECTRONICS AND CONSUMER GOODS IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 16 JAPAN APPAREL AND ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 JAPAN APPAREL AND ACCESSORIES COMPANIES IN E-COMMERCE PACKAGING MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 18 JAPAN COSMETIC, HOME CARE AND PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 19 JAPAN FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 JAPAN HOME FURNISHING IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 JAPAN AUTO PARTS IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 22 JAPAN E-COMMERCE PACKAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 23 JAPAN TRADITIONAL E-COMMERCE RETAILERS IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 24 JAPAN THIRD PARTY AND LOGISTICS COMPANIES IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 25 JAPAN BRICK AND MORTAR RETAILERS IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 26 JAPAN SPECIALTY RETAILERS IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 27 JAPAN OTHERS IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 28 JAPAN E-COMMERCE PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 29 JAPAN E-COMMERCE PACKAGING MARKET, BY COUNTRY, 2020-2029 (MILLION UNITS)

TABLE 30 JAPAN E-COMMERCE PACKAGING MARKET, BY COUNTRY, 2020-2029 (MILLION METER SQUARE)

TABLE 31 JAPAN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 32 JAPAN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (MILLION UNITS)

TABLE 33 JAPAN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (MILLION METER SQUARE)

TABLE 34 JAPAN BOXES IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 35 JAPAN CORRUGATED BOXES IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 36 JAPAN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 37 JAPAN PAPER IN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 38 JAPAN PLASTIC IN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 39 JAPAN POLYETHYLENE (PE) IN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 40 JAPAN METAL IN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 41 JAPAN E-COMMERCE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 42 JAPAN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 43 JAPAN ELECTRONICS AND CONSUMER GOODS IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 JAPAN APPAREL AND ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 JAPAN APPAREL AND ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 46 JAPAN HOME FURNISHING IN IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 JAPAN AUTO PARTS IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 JAPAN FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 JAPAN COSMETIC, HOME CARE AND PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 JAPAN E-COMMERCE PACKAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 51 JAPAN TRADITIONAL E-COMMERCE RETAILERS IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 52 JAPAN THIRD PARTY AND LOGISTICS COMPANIES IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 53 JAPAN BRICK AND MOTOR RETAILERS IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 54 JAPAN SPECIALTY RETAILERS IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 55 JAPAN OTHERS IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 JAPAN E-COMMERCE PACKAGING MARKET: SEGMENTATION

FIGURE 2 JAPAN E-COMMERCE PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 JAPAN E-COMMERCE PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 JAPAN E-COMMERCE PACKAGING MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 JAPAN E-COMMERCE PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 JAPAN E-COMMERCE PACKAGING MARKET: PRODUCT LIFE LINE CURVE

FIGURE 7 JAPAN E-COMMERCE PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 JAPAN E-COMMERCE PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 JAPAN E-COMMERCE PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 JAPAN E-COMMERCE PACKAGING MARKET: APPLICATION COVERAGE GRID

FIGURE 11 JAPAN E-COMMERCE PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 JAPAN E-COMMERCE PACKAGING MARKET: CHALLENGE MATRIX

FIGURE 13 JAPAN E-COMMERCE PACKAGING MARKET: SEGMENTATION

FIGURE 14 SHIFTING SHOPPING PREFERENCE TOWARDS ONLINE DUE TO CONVENIENCE IS EXPECTED TO DRIVE THE JAPAN E-COMMERCE PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 BOXES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE JAPAN E-COMMERCE PACKAGING MARKET IN 2022 & 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITY, AND CHALLENGES OF JAPANE-COMMERCE PACKAGING MARKET

FIGURE 17 JAPAN E-COMMERCE PACKAGING MARKET: BY PRODUCT, 2021

FIGURE 18 JAPAN E-COMMERCE PACKAGING MARKET: BY PRINTING TECHNOLOGY, 2021

FIGURE 19 JAPAN E-COMMERCE PACKAGING MARKET: BY MATERIALS, 2021

FIGURE 20 JAPAN E-COMMERCE PACKAGING MARKET: BY APPLICATION, 2021

FIGURE 21 JAPAN E-COMMERCE PACKAGING MARKET: BY END USER, 2021

FIGURE 22 JAPAN E-COMMERCE PACKAGING MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。