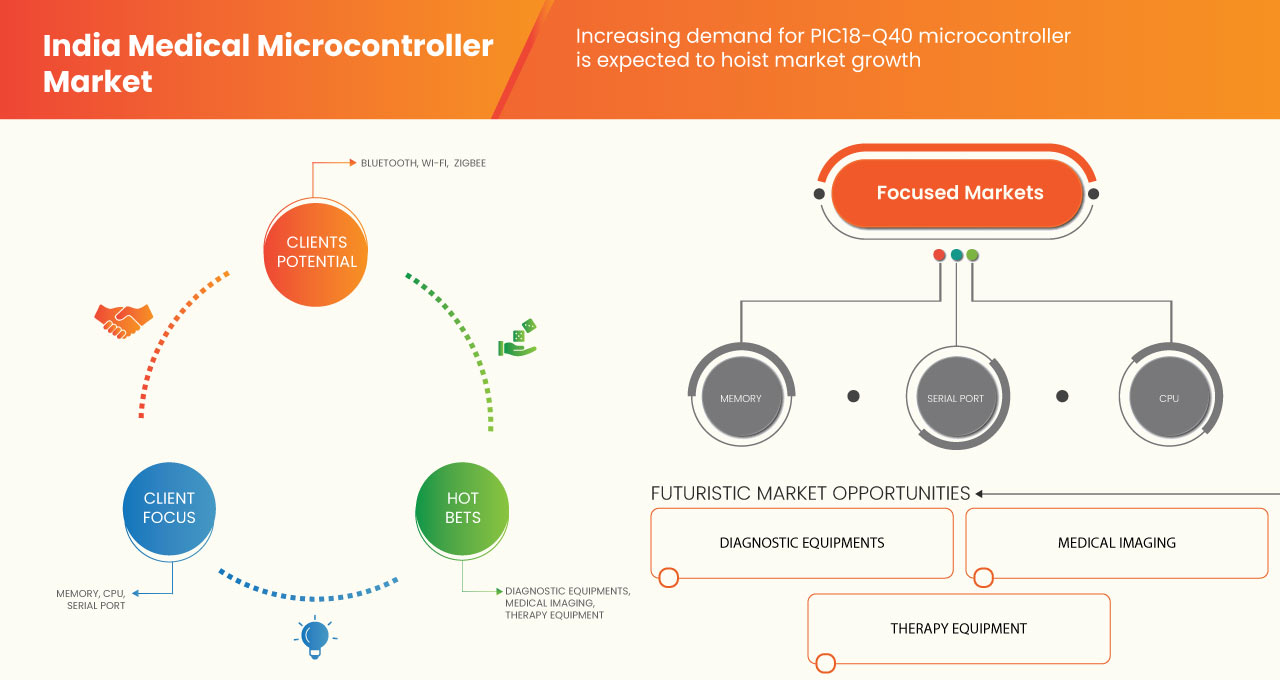

印度医疗微控制器市场,按类型(8 位微控制器、16 位微控制器、32 位微控制器和 64 位微控制器)、存储器(嵌入式存储器微控制器和外部存储器微控制器)、引脚数(少于 20 针、20 针至 40 针和超过 40 针)、连接性(蓝牙、Wi-Fi、Zigbee 等)、组件(内存、CPU、串行端口等)、应用(诊断设备、医学成像、治疗设备等)划分的行业趋势和预测到 2029 年

印度医疗微控制器市场分析与见解

与电子设备中通常使用的微控制器相比,医疗微控制器具有许多优势。医疗微控制器的特点是操作所需的时间投入少、使用简单、故障排除和保持最新状态。许多家务可以在与人类相同的时间内完成,从而减少了对环境的整体影响。处理器芯片非常小,可以定制。该系统价格较低,体积较小,微控制器一旦设置就无法重新编程。这些主要因素在最近增加了医疗行业对微控制器的采用。因此,这些好处预计将在预测期内推动印度医疗微控制器市场的增长。此功能允许微控制器独立工作并提高医疗设备的效率,这取决于医疗使用服务技术和该地区新市场参与者的进入。预计印度医疗微控制器市场将在未来蓬勃发展。

当前,医疗微控制器建设的重要性急剧上升,印度各地的微控制器连接性也不断增长。此外,市场对先进医疗设备的需求也在不断增长。Data Bridge Market Research 分析称,预计到 2029 年,印度医疗微控制器市场价值将达到 8.3339 亿美元,在 2022 年至 2029 年的预测期内,复合年增长率将达到 8.0%。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2014) |

|

定量单位 |

收入(百万美元)、销量(百万单位)、定价(美元) |

|

涵盖的领域 |

按类型(8 位微控制器、16 位微控制器、32 位微控制器和 64 位微控制器)、存储器(嵌入式存储器微控制器和外部存储器微控制器)、引脚数(少于 20 针、20 针至 40 针和超过 40 针)、连接性(蓝牙、Wi-Fi、Zigbee 等)、组件(内存、CPU、串行端口等)、应用(诊断设备、医学成像、治疗设备等) |

|

覆盖国家 |

印度 |

|

涵盖的市场参与者 |

瑞萨电子株式会社(日本)、通用电气公司(美国)、新唐科技股份有限公司(中国)、意法半导体公司(美国)、贸泽电子公司(美国)、Microchip Technology Inc.(美国)、TMI Systems.(印度)、罗姆株式会社(日本)、恩智浦半导体公司(美国)、东芝公司(中国)、Analog Devices, Inc.(美国)、Integral Medical Instrumentation.(印度)、英飞凌科技股份公司(德国)、Semiconductor Components Industries, LLC(美国)、Zilog. Inc(美国)、松下北美公司(美国)、Integrated Silicon Solution Inc.(美国)、德州仪器公司(美国)、Digi-Key Electronics.(美国)、富士通半导体有限公司(日本)、Bhairav Electronics(印度)、Cosmic Devices(印度)、Skrip Electronics(印度) |

市场定义

微控制器可以定义为包含可编程输入/输出外设、处理器和内存的微芯片、微型计算机或集成电路。微控制器种类繁多,其中最常用的是 8051 微控制器。与 PC 或其他通用设备中使用的微处理器相比,微控制器适用于嵌入式设备。微控制器用于自动管理的发明和设备,如电动工具、植入式医疗设备、汽车发动机控制系统和办公室。8051 微控制器在医疗应用中的应用使医疗领域发生了革命性的变化。通过 GSM 的 GPS 提供位置详情的患者健康监测系统是一个基于微控制器应用的电子项目。该项目旨在跟踪患者的位置,使设施能够在紧急情况下快速到达患者位置。通过此项目,可以使用GPS无线监测患者的体温,并使用 GSM 向相关/授权人员发送消息。

印度医疗微控制器市场动态

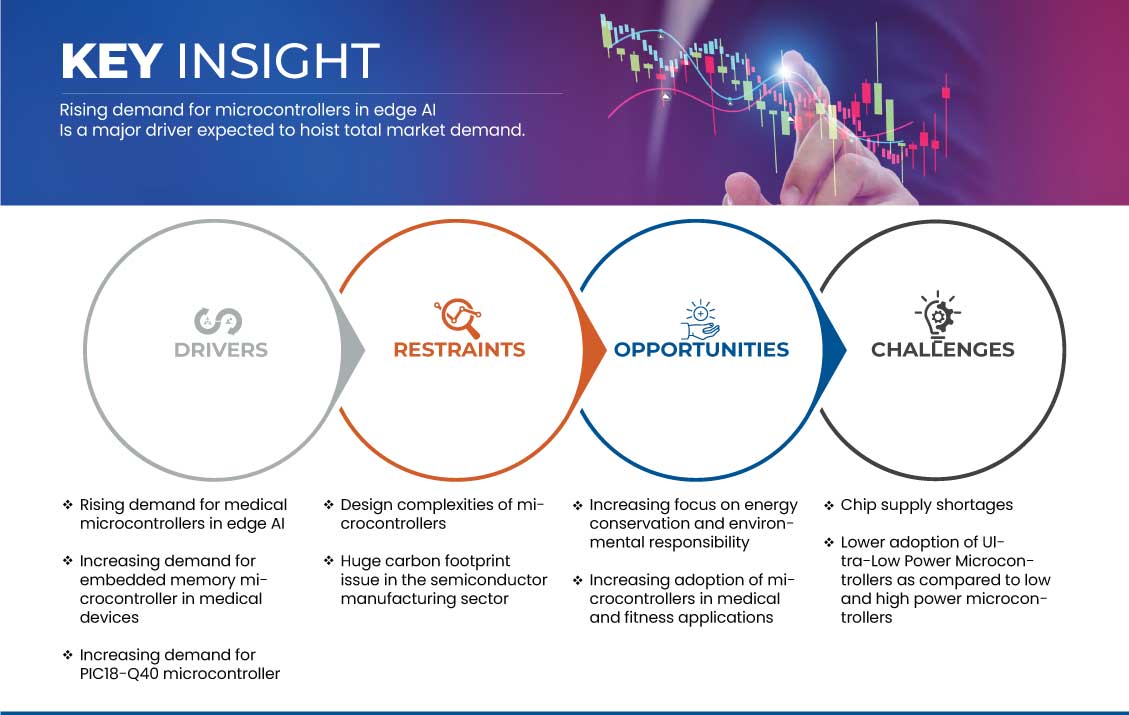

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。下面将详细讨论所有这些内容:

驱动程序

- 边缘 AI 对微控制器的需求上升

电力电子技术的进步让人们忘记了执行机器学习和深度学习任务需要高端硬件的理念。网关、边缘服务器或数据中心在边缘执行训练和推理。在越来越多的情况下,最新的微控制器(其中一些带有嵌入式 ML 加速器)能够将 ML 引入边缘设备。

物联网产品设计师看到了人工智能和机器学习的巨大潜力,它们可以为家庭安全系统、可穿戴医疗监视器、监控商业设施和工业设备的传感器等边缘应用带来更高的智能。那些考虑在边缘部署人工智能或机器学习的人面临着巨大的性能和能源消耗损失,这可能会抵消其带来的好处。

- 医疗设备对嵌入式存储器微控制器的需求增加

个人健康和医疗可穿戴应用市场正在快速增长。新技术的进步和生活方式的改变导致全球范围内智能设备的采用率不断提高。全球可穿戴设备用户的数量正在增加,这直接影响了用于开发这些技术的复杂电子产品的需求。

嵌入式系统用于MRI和 CT 扫描仪,它们使用射频脉冲和 X 射线生成人体部位和人体结构的图片。设备还必须具有高精度、低噪音和各种操作模式下极低功耗,以确保单次充电后具有足够的使用寿命。这导致对设备内部电子元件提出了新的复杂要求。超声波机器也内置了嵌入式系统,称为超声波成像,它使用高频声波。

- PIC18-q40 微控制器需求增加

世界正变得比以往任何时候都更加互联,随着物联网 (IoT) 的快速崛起,家用电器已成为智能家居自动化网络的一部分。它们通过基于传感器的直观操作,实现了更安静、更节能的医疗器械设计。产品现在可以无缝连接在一起,形成内置智能和通信功能的广泛数字网络。这一趋势带来了更高级别的功能,让精通技术的消费者的生活更加便捷。

PIC18-Q40 微控制器允许针对印度的下一代空间约束设计进行定制,从而使系统工作更加轻松。这些微控制器采用高水平的精密设计,封装在 14 到 20 个引脚的小型封装中。该微控制器包含高度可配置的独立于内核的外设,具有先进的互连功能。这些微控制器非常适合远程医疗设备、可穿戴设备、消费电子、汽车、工业和物联网。

机会

- 医疗和健身应用中微控制器的采用率不断提高

随着连通性的不断提高,健身和医疗设备使用技术也在不断进步。世界各地越来越重视增加健身设备的生产和采用,以减轻医生定期检查的负担。

这一进步可归功于医疗设备的技术发展,这些设备功耗低,需要高电压和电流,具有最新的设计和紧凑的尺寸。这为超低功耗微控制器等电力电子元件创造了巨大的机会。

- 更加注重节能减排和环保责任

电力是现代社会持续运转的基础。尽管人们呼吁节约能源,但近年来电力消耗却不断增加。IT设备的迅速普及大大促进了这一趋势。在此背景下,电力电子作为缓解环境和能源问题的关键技术之一,如今再次受到关注。

- 克制/挑战

宏观经济状况改善

宏观经济状况的改善将对微控制器市场的增长构成重大挑战。16 位、32 位和其他微控制器系统之间的激烈竞争将进一步抑制微控制器市场的增长率。缺乏标准化以及安全和隐私问题也将阻碍微控制器市场的增长率。

Covid-19 对印度医疗微控制器市场的影响

COVID-19 对印度医疗微控制器市场产生了积极影响。由于数据生产不受封锁的影响,企业和机构不断利用这些数据来增强其产品。在这一阶段,人们对更多电动汽车的需求也出现了,但电动汽车充电站的建设受到了影响,这赶上了疫情后所需的阶段。不可否认的是,数据中心建设市场在 COVID-19 期间和之后都取得了积极进展。

最新动态

- 2020 年 12 月,恩智浦半导体宣布与富士康集团子公司富士康工业互联网有限公司合作,将汽车转变为终极边缘设备。恩智浦为富士康工业互联网提供了其全面的汽车技术组合。联合项目的初始阶段专注于开发完整的数字驾驶舱解决方案,其中包括数字仪表盘和平视显示 (HUD) 系统,这将使全球领先的汽车 OEM 和一级供应商能够为其客户提供生动的车内体验

- 2020 年 7 月,全球领先的电子元件分销商 Future Electronics 在最新一期的 The Edge 上重点介绍了 STMicroelectronics STM32L5 系列微控制器 (MCU)。该系列是嵌入式和物联网应用开发人员日益关注安全性的解决方案。这些微控制器主要用于医疗设备,因为它成本低且功能更多

印度医疗微控制器市场范围

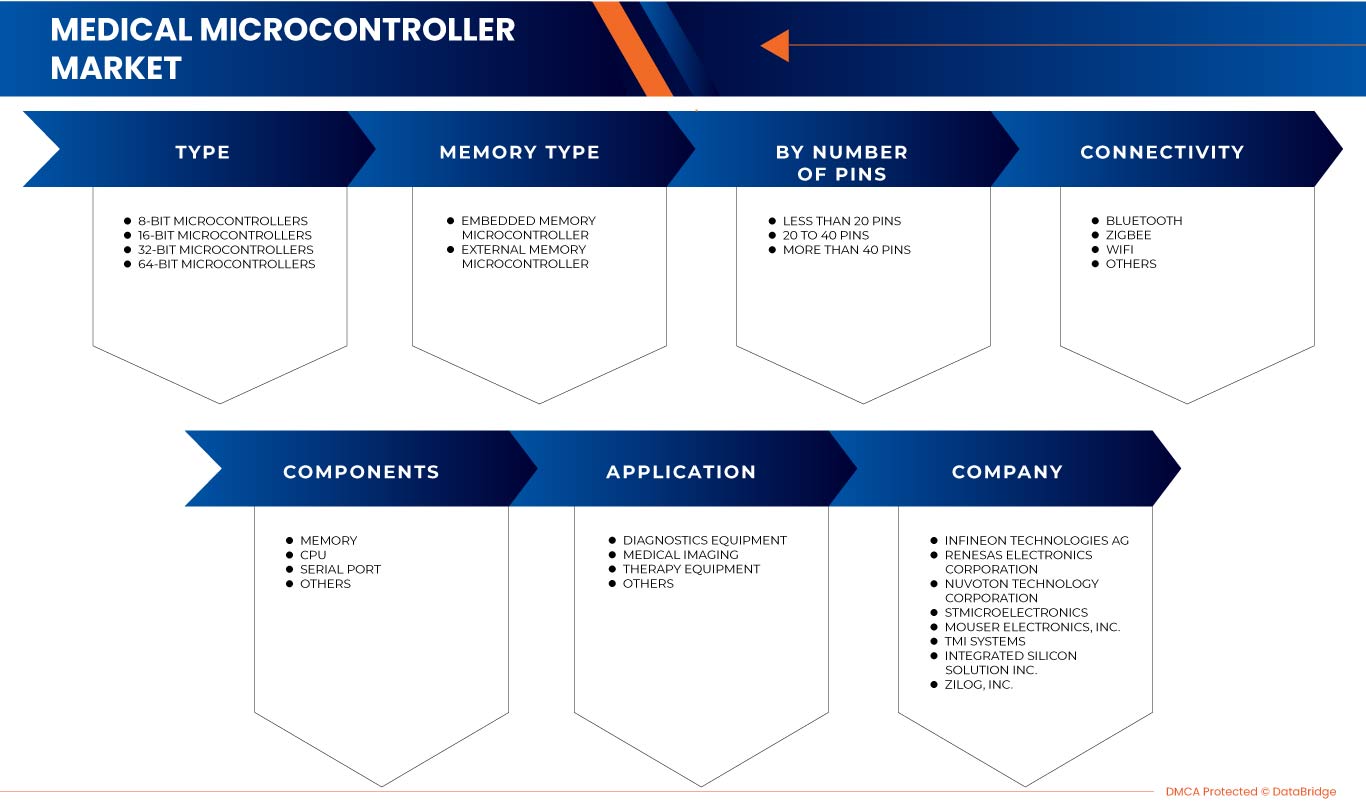

印度医疗微控制器市场根据类型、内存、引脚数、连接性、组件和应用进行细分。这些细分市场之间的增长情况将帮助您分析行业中增长缓慢的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

按类型

- 8 位微控制器

- 16 位微控制器

- 32 位微控制器

- 64 位微控制器

根据类型,印度医疗微控制器市场分为 8 位微控制器、16 位微控制器、32 位微控制器和 64 位微控制器。

记忆

- 嵌入式存储器微控制器

- 外部存储器微控制器

根据内存,印度医疗微控制器市场分为嵌入式存储器微控制器和外部存储器微控制器。

引脚数

- 少于 20 针

- 20 针至 40 针

- 超过 40 个 Pin

根据引脚数量,印度医疗微控制器市场分为少于 20 引脚、20 至 40 引脚和超过 40 引脚。

连接

- 蓝牙

- 无线上网

- 无线网

- 其他的

根据连接性,印度医疗微控制器市场分为蓝牙、Wi-Fi、Zigbee 和其他。

成分

- 记忆

- 中央处理器

- 串行端口

- 其他的

根据组件,印度医疗微控制器市场细分为内存、CPU、串行端口等

应用

- 诊断设备,

- 医学成像

- 治疗设备

- 其他的

根据应用,印度医疗微控制器市场分为诊断设备、医学成像、治疗设备等。

印度医疗微控制器市场区域分析/见解

对印度医疗微控制器市场进行了分析,并提供了上述类型、内存、引脚数、连接性、组件和应用的市场规模见解和趋势。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和国内市场法规变化。新销售、替代销售、国家人口统计、疾病流行病学和进出口关税等数据点是用于预测各个国家市场情景的一些主要指标。此外,在对国家数据进行预测分析时,还考虑了全球品牌的存在和可用性以及它们因来自本地和国内品牌的激烈或稀缺竞争而面临的挑战以及销售渠道的影响。

竞争格局和印度医疗微控制器市场份额分析

医疗微控制器市场竞争格局数据提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、全球影响力、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度以及应用主导地位。以上提供的数据点仅与公司对印度医疗微控制器市场的关注有关。

印度医疗微控制器市场的一些主要参与者包括英飞凌科技股份公司、瑞萨电子株式会社、新唐科技株式会社、意法半导体、贸泽电子公司、TMI 系统、Integrated Silicon Solution Inc.、Zilog 公司、ADI 公司、Microchip Technology Inc.、罗姆株式会社、得捷电子、德州仪器公司、富士通半导体存储器解决方案、通用电气公司、Integral Medical Instrumentation、Semiconductor Components Industries, LLC、恩智浦半导体、东芝公司、松下北美公司、Bhairav Electronics、Cosmic Devices、Skrip Electronics 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF INDIA MEDICAL MICROCONTROLLER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 TYPE TIMELINE CURVE

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 REGULATORY FRAMEWORK

4.2 PRICING ANALYSIS

4.3 PRICING ANALYSIS REPORT FOR INDIA MEDICAL MICROCONTROLLER MARKET BASED ON APPLICATION SEGMENT (PRICE PER MICRONTROLLER IN USD)

4.4 CASE STUDIES

4.5 TECHNOLOGICAL TRENDS

4.5.1 INTERNET OF THINGS (IOT) TARGETED MICROCONTROLLERS

4.5.2 USE OF TYPE-C CONNECTORS

4.6 VALUE CHAIN FOR INDIA MEDICAL MICROCONTROLLER MARKET

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR MEDICAL MICROCONTROLLERS IN EDGE AI

5.1.2 INCREASING DEMAND FOR EMBEDDED MEMORY MICROCONTROLLERS IN MEDICAL DEVICES

5.1.3 INCREASING DEMAND FOR PIC18-Q40 MICROCONTROLLER

5.2 RESTRAINTS

5.2.1 DESIGN COMPLEXITIES OF MICROCONTROLLERS

5.2.2 HUGE CARBON FOOTPRINT ISSUE IN THE SEMICONDUCTOR MANUFACTURING SECTOR

5.3 OPPORTUNITIES

5.3.1 INCREASING ADOPTION OF MICROCONTROLLERS IN MEDICAL AND FITNESS APPLICATIONS

5.3.2 INCREASING FOCUS ON ENERGY CONSERVATION AND ENVIRONMENTAL RESPONSIBILITY

5.4 CHALLENGES

5.4.1 CHIP SUPPLY SHORTAGES

5.4.2 LESS ADOPTION OF ULTRA-LOW-POWER MICROCONTROLLERS THAN LOW AND HIGH-POWER MICROCONTROLLERS

6 INDIA MEDICAL MICROCONTROLLER MARKET, BY TYPE

6.1 OVERVIEW

6.2 8-BIT MICROCONTROLLERS

6.3 16-BIT MICROCONTROLLERS

6.4 32-BIT MICROCONTROLLERS

6.5 64-BIT MICROCONTROLLERS

7 INDIA MEDICAL MICROCONTROLLER MARKET, BY MEMORY TYPE

7.1 OVERVIEW

7.2 EMBEDDED MEMORY MICROCONTROLLER

7.3 EXTERNAL MEMORY MICROCONTROLLER

8 INDIA MEDICAL MICROCONTROLLER MARKET, BY NUMBER OF PINS

8.1 OVERVIEW

8.2 MORE THAN 40 PINS

8.3 20 PINS TO 40 PINS

8.4 LESS THAN 20 PINS

9 INDIA MEDICAL MICROCONTROLLER MARKET, BY CONNECTIVITY

9.1 OVERVIEW

9.2 BLUETOOTH

9.3 WI-FI

9.4 ZIGBEE

9.5 OTHERS

10 INDIA MEDICAL MICROCONTROLLER MARKET, BY COMPONENTS

10.1 OVERVIEW

10.2 MEMORY

10.3 CPU

10.4 SERIAL PORT

10.5 OTHERS

11 INDIA MEDICAL MICROCONTROLLER MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 DIAGNOSTIC EQUIPMENT

11.2.1 PULSE OXIMETER

11.2.2 BLOOD GLUCOSE METER

11.2.3 IR CONTACTLESS THERMOMETER

11.2.4 ELECTROCARDIOLOGY

11.2.5 MEDICAL PATCH

11.2.6 HANDHELD ULTRASOUND SCANNER

11.2.7 BLOOD GLUCOSE MONITOR

11.2.8 ELECTRONIC THERMOMETER

11.2.9 SMART CONNECTED PULSE OXIMETER

11.2.10 OTHERS

11.3 MEDICAL IMAGING

11.3.1 BLOOD GLUCOSE MONITOR MAGNETIC RESONANCE IMAGING

11.3.2 ULTRASOUND IMAGING

11.3.3 X-RAY & COMPUTER TOMOGRAPHY

11.3.4 OTHERS

11.4 THERAPY EQUIPMENT

11.4.1 CPAP & RESPIRATORS

11.4.2 DIALYSIS MACHINES

11.4.3 POWERED PATIENT BEDS

11.4.4 OTHERS

11.5 OTHERS

12 INDIA MEDICAL MICROCONTROLLER MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: INDIA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 NXP SEMICONDUCTORS

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 ROHM CO., LTD.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 FUJITSU SEMICONDUCTOR MEMORY SOLUTION

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 NUVOTON TECHNOLOGY CORPORATION

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 STMICROELECTRONICS

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.6 ANALOG DEVICES, INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 DIGI-KEY ELECTRONICS

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 GENERAL ELECTRIC COMPANY

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 INFINEON TECHNOLOGIES AG

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 INTEGRAL MEDICAL INSTRUMENTATION

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 INTEGRATED SILICON SOLUTION INC.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 MICROCHIP TECHNOLOGY INC.

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 MOUSER ELECTRONICS, INC.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 PANASONIC CORPORATION OF NORTH AMERICA

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENT

14.15 RENESAS ELECTRONICS CORPORATION

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENTS

14.16 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENT

14.17 TEXAS INSTRUMENTS INCORPORATED

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENT

14.18 TMI SYSTEMS

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 TOSHIBA CORPORATION

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

14.2 ZILOG, INC.

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 BHAIRAV ELECTRONICS

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENTS

14.22 COSMIC DEVICES

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT DEVELOPMENTS

14.23 SKRIP ELECTRONICS

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 PRICING OF INDIA MEDICAL MICROCONTROLLER MARKET, BY TYPE

TABLE 2 PRICING OF INDIA MEDICAL MICROCONTROLLER MARKET, BY MEMORY TYPE

TABLE 3 PRICING OF INDIA MEDICAL MICROCONTROLLER MARKET, BY APPLICATION

TABLE 4 PRICING OF INDIA MEDICAL MICROCONTROLLER MARKET, BY APPLICATION

TABLE 5 PRICING OF INDIA DIAGNOSTIC EQUIPMENT IN MEDICAL MICROCONTROLLER MARKET, BY TYPE

TABLE 6 PRICING OF INDIA MEDICAL IMAGING IN MEDICAL MICROCONTROLLER MARKET, BY TYPE

TABLE 7 PRICING OF INDIA THERAPY EQUIPMENT IN MEDICAL MICROCONTROLLER MARKET, BY TYPE

TABLE 8 INDIA MEDICAL MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 INDIA MEDICAL MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 10 INDIA MEDICAL MICROCONTROLLER MARKET, BY MEMORY TYPE, 2020-2029 (USD MILLION)

TABLE 11 INDIA MEDICAL MICROCONTROLLER MARKET, BY MEMORY TYPE, 2020-2029 (MILLION UNITS)

TABLE 12 INDIA MEDICAL MICROCONTROLLER MARKET, BY NUMBER OF PINS, 2020-2029 (USD MILLION)

TABLE 13 INDIA MEDICAL MICROCONTROLLER MARKET, BY NUMBER OF PINS, 2020-2029 (MILLION UNITS)

TABLE 14 INDIA MEDICAL MICROCONTROLLER MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 15 INDIA MEDICAL MICROCONTROLLER MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 16 INDIA MEDICAL MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 INDIA MEDICAL MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (MILLION UNITS)

TABLE 18 INDIA DIAGNOSTIC EQUIPMENT IN MEDICAL MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 INDIA DIAGNOSTIC EQUIPMENT IN MEDICAL MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 20 INDIA MEDICAL IMAGING IN MEDICAL MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 INDIA MEDICAL IMAGING IN MEDICAL MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 22 INDIA THERAPY EQUIPMENT IN MEDICAL MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 INDIA THERAPY EQUIPMENT IN MEDICAL MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

图片列表

FIGURE 1 INDIA MEDICAL MICROCONTROLLER MARKET: SEGMENTATION

FIGURE 2 INDIA MEDICAL MICROCONTROLLER MARKET: DATA TRIANGULATION

FIGURE 3 INDIA MEDICAL MICROCONTROLLER MARKET: DROC ANALYSIS

FIGURE 4 INDIA MEDICAL MICROCONTROLLER MARKET: COUNTRY MARKET ANALYSIS

FIGURE 5 INDIA MEDICAL MICROCONTROLLER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDIA MEDICAL MICROCONTROLLER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 INDIA MEDICAL MICROCONTROLLER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 INDIA MEDICAL MICROCONTROLLER MARKET: MULTIVARIATE MODELING

FIGURE 9 INDIA MEDICAL MICROCONTROLLER MARKET: MARKET TYPE TIMELINE CURVE

FIGURE 10 INDIA MEDICAL MICROCONTROLLER MARKET:MARKET APPLICATION COVERAGE GRID

FIGURE 11 INDIA MEDICAL MICROCONTROLLER MARKET: SEGMENTATION

FIGURE 12 INCREASE IN DEMAND BY MEDICAL INDUSTRY IS EXPECTED TO DRIVE THE INDIA MEDICAL MICROCONTROLLER MARKET IN THE FORECAST PERIOD

FIGURE 13 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF INDIA MEDICAL MICROCONTROLLER MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF INDIA MEDICAL MICROCONTROLLER MARKET

FIGURE 15 INDIA MEDICAL MICROCONTROLLER MARKET: BY TYPE, 2021

FIGURE 16 INDIA MEDICAL MICROCONTROLLER MARKET: BY MEMORY TYPE, 2021

FIGURE 17 INDIA MEDICAL MICROCONTROLLER MARKET: BY NUMBER OF PINS, 2021

FIGURE 18 INDIA MEDICAL MICROCONTROLLER MARKET: BY CONNECTIVITY, 2021

FIGURE 19 INDIA MEDICAL MICROCONTROLLER MARKET: BY COMPONENTS, 2021

FIGURE 20 INDIA MEDICAL MICROCONTROLLER MARKET: BY APPLICATION, 2021

FIGURE 21 INDIA MEDICAL MICROCONTROLLER MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。