Global Virtual Payment Pos Terminals Market

市场规模(十亿美元)

CAGR :

%

USD

6.10 Billion

USD

47.36 Billion

2021

2029

USD

6.10 Billion

USD

47.36 Billion

2021

2029

| 2022 –2029 | |

| USD 6.10 Billion | |

| USD 47.36 Billion | |

|

|

|

|

全球虛擬支付 (POS) 終端市場,按解決方案(專業服務、軟體平台)行業垂直領域(消費電子、零售、倉儲、酒店、食品和飲料)劃分 - 行業趨勢及 2029 年預測

市場分析與規模

消費者越來越傾向於使用虛擬支付 (POS) 終端,因為它們比傳統支付流程更數位化、更靈活、更具創新性。這些解決方案已成功覆蓋支付、轉帳等多個垂直領域。隨著近期「無現金」趨勢的興起,無現金數位化支付系統的採用率正在全球上升。 Google Pay 和亞馬遜甚至以折扣的形式向使用其應用程式付款的消費者提供忠誠度獎勵。

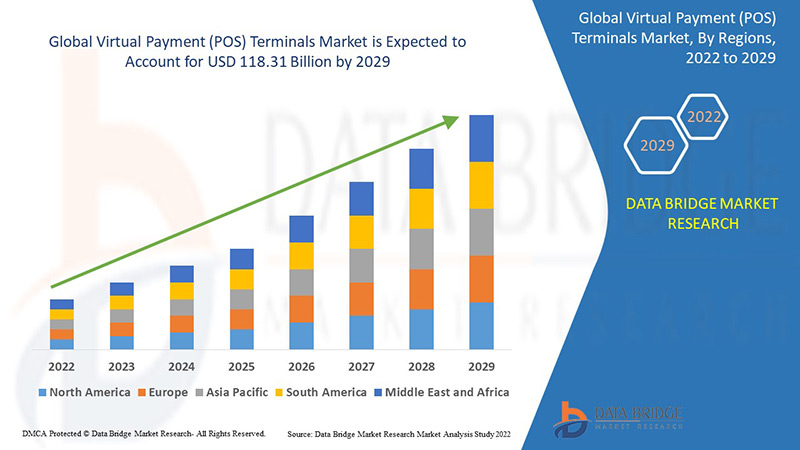

2021年,全球虛擬支付 (POS) 終端市場規模為61億美元,預計到2029年將達到1,183.1億美元,在2022-2029年的預測期內,複合年增長率為29.50%。由於電子商務行業的擴張,預計零售業在預測期內將實現高速成長。除了市場價值、成長率、細分市場、地理覆蓋範圍、市場參與者和市場情景等市場洞察外,Data Bridge 市場研究團隊整理的市場報告還包含深入的專家分析、進出口分析、定價分析、生產消費分析和研討分析。

市場定義

虛擬 POS(銷售點)是指一種 Windows 或 Web 應用程序,可供持卡商家手動授權刷卡交易。虛擬 POS 終端連接到不同的處理網絡,例如 Wi-Fi 和 LAN,以提取客戶的銀行資金進行交易。

報告範圍和市場細分

|

報告指標 |

細節 |

|

預測期 |

2022年至2029年 |

|

基準年 |

2021 |

|

歷史歲月 |

2020(可自訂為 2014 - 2019) |

|

定量單位 |

收入(十億美元)、銷售(單位)、定價(美元) |

|

涵蓋的領域 |

解決方案(專業服務、軟體平台)垂直產業(消費電子、零售、倉儲、飯店、食品和飲料) |

|

覆蓋國家 |

北美洲的美國、加拿大和墨西哥、歐洲的德國、法國、英國、荷蘭、瑞士、比利時、俄羅斯、義大利、西班牙、土耳其、歐洲其他地區、中國、日本、印度、韓國、新加坡、馬來西亞、澳洲、泰國、印尼、菲律賓、亞太地區 (APAC) 的其他地區、沙烏地阿拉伯、阿拉伯聯合大公國、以色列、埃及、南非、中東和非洲 (MEA) 的其他地區。 |

|

涵蓋的市場參與者 |

Google(美國)、亞馬遜(美國)、Paytm(印度)、Ingenico Group.(法國)、VeriFone, Inc.(美國)、First Data Corporation(美國)、NCR Corporation(美國)、Diebold Nixdorf, Incorporated(美國)、Elavon Inc.(美國)、Castles Technology(台灣)、EG Technology(印度)、Xirp Technologiesp,Eat圖片)(Egiti 你) Technology(中國)、深圳市新國都科技有限公司(中國)和松下公司(日本)等 |

|

市場機會 |

|

虛擬支付(POS)終端市場動態

本節旨在了解市場驅動因素、優勢、機會、限制因素和挑戰。下文將詳細討論這些內容:

驅動程式

- 非接觸式支付流程需求增加

無縫和非接觸式支付流程的需求增加以及全球範圍內信用卡/金融卡交易使用率的提高是推動虛擬支付(POS)終端市場的主要因素之一。

- 各行各業的卡片使用

醫療保健、飯店、零售和娛樂等各個領域的卡片使用量不斷增加,安裝這些終端並支援產業進步加速了市場成長。

- 行動錢包的使用

行動錢包使用量的激增進一步提升了消費者的關注度,進一步影響了市場。此外,消費者對行動支付的興趣日益濃厚,以及行動錢包公司提供的優惠,也對市場的成長產生了正面的影響。

此外,快速的城市化、生活方式的改變、投資的激增以及消費者支出的增加對虛擬支付(POS)終端市場產生了積極影響。

機會

此外,在 2022 年至 2029 年的預測期內,廣泛使用線上購物平台將為市場參與者帶來獲利機會。此外,數位系統的進步將進一步擴大市場。

限制/挑戰

另一方面,不可靠的網路連線和與支付交易相關的安全問題預計將阻礙市場成長。此外,嚴格的法規和安全問題預計將在2022-2029年的預測期內對虛擬支付(POS)終端市場構成挑戰。

本虛擬支付 (POS) 終端市場報告詳細介紹了近期發展動態、貿易法規、進出口分析、生產分析、價值鏈優化、市場份額、國內和本地市場參與者的影響,並分析了新興收入來源、市場法規變化、戰略市場增長分析、市場規模、品類市場增長、應用領域和主導地位、產品審批、產品、地域以及市場創新領域以及市場創新領域的市場發展以及市場創新。如需了解更多關於虛擬支付 (POS) 終端市場的信息,請聯繫 Data Bridge 市場研究部門以獲取分析師簡報,我們的團隊將協助您做出明智的市場決策,以實現市場成長。

COVID-19 對虛擬支付(POS)終端市場的影響

新冠疫情爆發期間,採用虛擬支付 (POS) 解決方案的終端用戶數量增加,這為虛擬支付 (POS) 終端市場帶來了正面影響。由於為遏制病毒傳播而實施的嚴格封鎖和保持社交距離措施,包括支付和轉帳、支票和儲蓄帳戶以及手機銀行在內的虛擬支付服務使用率有所上升。隨著人們對虛擬支付 (POS) 終端潛在優勢的認識不斷提高,以及智慧型手機普及率的不斷提升,預計虛擬支付 (POS) 終端市場在疫情後將迎來高速成長。

全球虛擬支付(POS)終端市場範圍與市場規模

虛擬支付 (POS) 終端市場根據解決方案和垂直行業進行細分。這些細分市場的成長將有助於您分析行業中成長乏力的細分市場,並為用戶提供有價值的市場概覽和市場洞察,幫助他們做出策略決策,從而確定核心市場應用。

解決方案

- 專業服務

- 軟體平台

垂直產業

- 消費性電子產品

- 零售

- 倉庫

- 飯店業

- 食品和飲料

虛擬支付(POS)終端市場區域分析/洞察

對虛擬支付(POS)終端市場進行了分析,並按上述國家、解決方案和行業垂直提供了市場規模洞察和趨勢。

虛擬支付(POS)終端市場報告涵蓋的國家包括北美洲的美國、加拿大和墨西哥,歐洲的德國、法國、英國、荷蘭、瑞士、比利時、俄羅斯、義大利、西班牙、土耳其,歐洲其他地區,中國、日本、印度、韓國、新加坡、馬來西亞、澳洲、泰國、印尼、菲律賓,亞太地區(APAC)的其他地區,沙烏地阿拉伯、阿聯酋、以色列、埃及、印尼、菲律賓和其他地區(APAC)的其他地區,沙烏地阿拉伯、阿聯酋、以色列、埃及、美國的其他

由於無現金支付技術的採用以及該地區對電子商務安全支付系統的需求增加,亞太地區 (APAC) 佔據虛擬支付 (POS) 終端市場的主導地位。

由於該地區虛擬支付 (POS) 平台的採用率上升,預計北美將在 2022 年至 2029 年的預測期內顯著增長。

報告的國家部分還提供了各個市場的影響因素以及國內市場監管變化,這些變化會影響市場的當前和未來趨勢。下游和上游價值鏈分析、技術趨勢、波特五力模型分析以及案例研究等數據點是預測各國市場狀況的一些指標。此外,在對國家/地區數據進行預測分析時,還考慮了全球品牌的存在和可用性,以及它們因本土和國內品牌的激烈競爭或稀缺而面臨的挑戰,國內關稅和貿易路線的影響。

競爭格局與虛擬支付(POS)終端市場

虛擬支付 (POS) 終端市場競爭格局提供了按競爭對手劃分的詳細資訊。詳細資訊包括公司概況、公司財務狀況、收入、市場潛力、研發投入、新市場計劃、全球佈局、生產基地和設施、生產能力、公司優勢和劣勢、產品發布、產品寬度和廣度以及應用主導地位。以上提供的數據僅與公司在虛擬支付 (POS) 終端市場的重點相關。

虛擬支付(POS)終端市場的一些主要參與者包括

- Google(美國)

- 亞馬遜(美國)

- Paytm(印度)

- Ingenico集團。 (法國)

- VeriFone公司(美國)

- 第一數據公司(美國)

- NCR公司(美國)

- 迪堡尼克斯多夫股份有限公司(美國)

- Elavon Inc.(美國)

- 城堡科技(台灣)

- EGIDE(印度)

- Squirrel Systems(加拿大)

- 新大陸支付科技(巴西)

- CitiXsys Technologies(印度)

- 百富科技(中國)

- 深圳市新果都科技有限公司 (中國)

- 松下公司(日本)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL VIRTUAL PAYMENT (POS) TERMINALS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL VIRTUAL PAYMENT (POS) TERMINALS MARKET

2.3 VENDOR POSITIONING GRID

2.4 TECHNOLOGY LIFE LINE CURVE

2.5 MARKET GUIDE

2.6 MULTIVARIATE MODELLING

2.7 TOP TO BOTTOM ANALYSIS

2.8 STANDARDS OF MEASUREMENT

2.9 VENDOR SHARE ANALYSIS

2.1 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.12 GLOBAL VIRTUAL PAYMENT (POS) TERMINALS MARKET: RESEARCH SNAPSHOT

2.13 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 BRAND ANALYSIS

5.3 ECOSYSTEM MARKET MAP

5.4 TECHNOLOGICAL TRENDS

5.5 TOP WINNING STRATEGIES

5.6 PORTER’S FIVE FORCES ANALYSIS

6 GLOBAL VIRTUAL PAYMENT (POS) TERMINALS MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOFTWARE PLATFORMS

6.2.1 DEVICE-BASED

6.2.2 WEB-BASED

6.3 SERVICES

6.3.1 PROFESSIONAL SERVICES

6.3.1.1. CONSULTING

6.3.1.2. DEPLOYMENT & INTEGRATION

6.3.1.3. SUPPORT & MAINTENANCE

6.3.2 MANAGED SERVICES

7 GLOBAL VIRTUAL PAYMENT (POS) TERMINALS MARKET, BY DEPLOYMENT MODE

7.1 OVERVIEW

7.2 CLOUD

7.3 ON-PREMISE

8 GLOBAL VIRTUAL PAYMENT (POS) TERMINALS MARKET, BY ENTERPRISE SIZE

8.1 OVERVIEW

8.2 SMALL SCALE ENTERPRISES

8.3 MEDIUM SCALE ENTERPRISES

8.4 LARGE SCALE ENTERPRISES

9 GLOBAL VIRTUAL PAYMENT (POS) TERMINALS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 HEALTHCARE

9.2.1 BY OFFERING

9.2.1.1. SOFTWARE PLATFORMS

9.2.1.1.1. DEVICE-BASED

9.2.1.1.2. WEB-BASED

9.2.1.2. SERVICES

9.2.1.2.1. PROFESSIONAL SERVICES

9.2.1.2.1.1 CONSULTING

9.2.1.2.1.2 DEPLOYMENT & INTEGRATION

9.2.1.2.1.3 SUPPORT & MAINTENANCE

9.2.1.2.2. MANAGED SERVICES

9.3 CONSUMER ELECTRONICS

9.3.1 BY OFFERING

9.3.1.1. SOFTWARE PLATFORMS

9.3.1.1.1. DEVICE-BASED

9.3.1.1.2. WEB-BASED

9.3.1.2. SERVICES

9.3.1.2.1. PROFESSIONAL SERVICES

9.3.1.2.1.1 CONSULTING

9.3.1.2.1.2 DEPLOYMENT & INTEGRATION

9.3.1.2.1.3 SUPPORT & MAINTENANCE

9.3.1.2.2. MANAGED SERVICES

9.4 FOOD & BEVERAGES

9.4.1 BY OFFERING

9.4.1.1. SOFTWARE PLATFORMS

9.4.1.1.1. DEVICE-BASED

9.4.1.1.2. WEB-BASED

9.4.1.2. SERVICES

9.4.1.2.1. PROFESSIONAL SERVICES

9.4.1.2.1.1 CONSULTING

9.4.1.2.1.2 DEPLOYMENT & INTEGRATION

9.4.1.2.1.3 SUPPORT & MAINTENANCE

9.4.1.2.2. MANAGED SERVICES

9.5 MEDIA & ENTERTAINMENT

9.5.1 BY OFFERING

9.5.1.1. SOFTWARE PLATFORMS

9.5.1.1.1. DEVICE-BASED

9.5.1.1.2. WEB-BASED

9.5.1.2. SERVICES

9.5.1.2.1. PROFESSIONAL SERVICES

9.5.1.2.1.1 CONSULTING

9.5.1.2.1.2 DEPLOYMENT & INTEGRATION

9.5.1.2.1.3 SUPPORT & MAINTENANCE

9.5.1.2.2. MANAGED SERVICES

9.6 WAREHOUSE & HOSPITALITY

9.6.1 BY OFFERING

9.6.1.1. SOFTWARE PLATFORMS

9.6.1.1.1. DEVICE-BASED

9.6.1.1.2. WEB-BASED

9.6.1.2. SERVICES

9.6.1.2.1. PROFESSIONAL SERVICES

9.6.1.2.1.1 CONSULTING

9.6.1.2.1.2 DEPLOYMENT & INTEGRATION

9.6.1.2.1.3 SUPPORT & MAINTENANCE

9.6.1.2.2. MANAGED SERVICES

9.7 RETAIL

9.7.1 BY OFFERING

9.7.1.1. SOFTWARE PLATFORMS

9.7.1.1.1. DEVICE-BASED

9.7.1.1.2. WEB-BASED

9.7.1.2. SERVICES

9.7.1.2.1. PROFESSIONAL SERVICES

9.7.1.2.1.1 CONSULTING

9.7.1.2.1.2 DEPLOYMENT & INTEGRATION

9.7.1.2.1.3 SUPPORT & MAINTENANCE

9.7.1.2.2. MANAGED SERVICES

9.8 OTHERS

9.8.1 BY OFFERING

9.8.1.1. SOFTWARE PLATFORMS

9.8.1.1.1. DEVICE-BASED

9.8.1.1.2. WEB-BASED

9.8.1.2. SERVICES

9.8.1.2.1. PROFESSIONAL SERVICES

9.8.1.2.1.1 CONSULTING

9.8.1.2.1.2 DEPLOYMENT & INTEGRATION

9.8.1.2.1.3 SUPPORT & MAINTENANCE

9.8.1.2.2. MANAGED SERVICES

10 GLOBAL VIRTUAL PAYMENT (POS) TERMINALS MARKET, BY REGION

10.1 GLOBAL VIRTUAL PAYMENT (POS) TERMINALS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

10.1.1 NORTH AMERICA

10.1.1.1. U.S.

10.1.1.2. CANADA

10.1.1.3. MEXICO

10.1.2 EUROPE

10.1.2.1. GERMANY

10.1.2.2. FRANCE

10.1.2.3. U.K.

10.1.2.4. ITALY

10.1.2.5. SPAIN

10.1.2.6. RUSSIA

10.1.2.7. TURKEY

10.1.2.8. BELGIUM

10.1.2.9. NETHERLANDS

10.1.2.10. SWITZERLAND

10.1.2.11. DENMARK

10.1.2.12. SWEDEN

10.1.2.13. POLAND

10.1.2.14. NORWAY

10.1.2.15. FINLAND

10.1.2.16. REST OF EUROPE

10.1.3 ASIA PACIFIC

10.1.3.1. JAPAN

10.1.3.2. CHINA

10.1.3.3. SOUTH KOREA

10.1.3.4. INDIA

10.1.3.5. AUSTRALIA

10.1.3.6. SINGAPORE

10.1.3.7. THAILAND

10.1.3.8. MALAYSIA

10.1.3.9. INDONESIA

10.1.3.10. PHILIPPINES

10.1.3.11. NEW ZEALAND

10.1.3.12. TAIWAN

10.1.3.13. VIETNAM

10.1.3.14. REST OF ASIA PACIFIC

10.1.4 SOUTH AMERICA

10.1.4.1. BRAZIL

10.1.4.2. ARGENTINA

10.1.4.3. REST OF SOUTH AMERICA

10.1.5 MIDDLE EAST AND AFRICA

10.1.5.1. SOUTH AFRICA

10.1.5.2. EGYPT

10.1.5.3. BAHRAIN

10.1.5.4. QATAR

10.1.5.5. KUWAIT

10.1.5.6. OMAN

10.1.5.7. SAUDI ARABIA

10.1.5.8. U.A.E

10.1.5.9. ISRAEL

10.1.5.10. REST OF MIDDLE EAST AND AFRICA

10.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

11 GLOBAL VIRTUAL PAYMENT (POS) TERMINALS MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.2 COMPANY SHARE ANALYSIS: EUROPE

11.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

11.4 MERGERS & ACQUISITIONS

11.5 NEW PRODUCT DEVELOPMENT & APPROVALS

11.6 EXPANSIONS

11.7 REGULATORY CHANGES

11.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

12 GLOBAL VIRTUAL PAYMENT (POS) TERMINALS MARKET, SWOT ANALYSIS

13 GLOBAL VIRTUAL PAYMENT (POS) TERMINALS MARKET, COMPANY PROFILE

13.1 GOOGLE

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 GEOGRAPHIC PRESENCE

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 INGENICO GROUP

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 GEOGRAPHIC PRESENCE

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 VERIFONE, INC

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 GEOGRAPHIC PRESENCE

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 FIRST DATA CORPORATION

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 GEOGRAPHIC PRESENCE

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 NCR CORPORATION

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 GEOGRAPHIC PRESENCE

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 SQUIRREL SYSTEMS

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 GEOGRAPHIC PRESENCE

13.6.4 PRODUCT PORTFOLIO

13.6.5 RECENT DEVELOPMENTS

13.7 AMAZON WEB SERVICES

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 GEOGRAPHIC PRESENCE

13.7.4 PRODUCT PORTFOLIO

13.7.5 RECENT DEVELOPMENTS

13.8 DIEBOLD NIXDORF INCORPORATED

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 GEOGRAPHIC PRESENCE

13.8.4 PRODUCT PORTFOLIO

13.8.5 RECENT DEVELOPMENTS

13.9 ELAVON, INC

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 GEOGRAPHIC PRESENCE

13.9.4 PRODUCT PORTFOLIO

13.9.5 RECENT DEVELOPMENTS

13.1 CASTLES TECHNOLOGY

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 GEOGRAPHIC PRESENCE

13.10.4 PRODUCT PORTFOLIO

13.10.5 RECENT DEVELOPMENTS

13.11 EGIDE

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 GEOGRAPHIC PRESENCE

13.11.4 PRODUCT PORTFOLIO

13.11.5 RECENT DEVELOPMENTS

13.12 EHOPPER

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 GEOGRAPHIC PRESENCE

13.12.4 PRODUCT PORTFOLIO

13.12.5 RECENT DEVELOPMENTS

13.13 CITIXSYS TECHNOLOGIES

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 GEOGRAPHIC PRESENCE

13.13.4 PRODUCT PORTFOLIO

13.13.5 RECENT DEVELOPMENTS

13.14 PAX TECHNOLOGY

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 GEOGRAPHIC PRESENCE

13.14.4 PRODUCT PORTFOLIO

13.14.5 RECENT DEVELOPMENTS

13.15 NEWLAND PAYMENT TECHNOLOGY

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 GEOGRAPHIC PRESENCE

13.15.4 PRODUCT PORTFOLIO

13.15.5 RECENT DEVELOPMENTS

13.16 PANASONIC CORPORATION

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 GEOGRAPHIC PRESENCE

13.16.4 PRODUCT PORTFOLIO

13.16.5 RECENT DEVELOPMENTS

13.17 PAYLINE DATA

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 GEOGRAPHIC PRESENCE

13.17.4 PRODUCT PORTFOLIO

13.17.5 RECENT DEVELOPMENTS

13.18 QUICKBOOKS PAYMENT

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 GEOGRAPHIC PRESENCE

13.18.4 PRODUCT PORTFOLIO

13.18.5 RECENT DEVELOPMENTS

13.19 SQUARE POS

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 GEOGRAPHIC PRESENCE

13.19.4 PRODUCT PORTFOLIO

13.19.5 RECENT DEVELOPMENTS

13.2 PAYMENT DEPOT

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 GEOGRAPHIC PRESENCE

13.20.4 PRODUCT PORTFOLIO

13.20.5 RECENT DEVELOPMENTS

13.21 CLOVER

13.21.1 COMPANY SNAPSHOT

13.21.2 REVENUE ANALYSIS

13.21.3 GEOGRAPHIC PRESENCE

13.21.4 PRODUCT PORTFOLIO

13.21.5 RECENT DEVELOPMENTS

13.22 PAYPAL ZETTLE

13.22.1 COMPANY SNAPSHOT

13.22.2 REVENUE ANALYSIS

13.22.3 GEOGRAPHIC PRESENCE

13.22.4 PRODUCT PORTFOLIO

13.22.5 RECENT DEVELOPMENTS

13.23 STAX

13.23.1 COMPANY SNAPSHOT

13.23.2 REVENUE ANALYSIS

13.23.3 GEOGRAPHIC PRESENCE

13.23.4 PRODUCT PORTFOLIO

13.23.5 RECENT DEVELOPMENTS

13.24 CHASE

13.24.1 COMPANY SNAPSHOT

13.24.2 REVENUE ANALYSIS

13.24.3 GEOGRAPHIC PRESENCE

13.24.4 PRODUCT PORTFOLIO

13.24.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

14 RELATED REPORTS

15 QUESTIONNAIRE

16 ABOUT DATA BRIDGE MARKET RESEARCH

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。