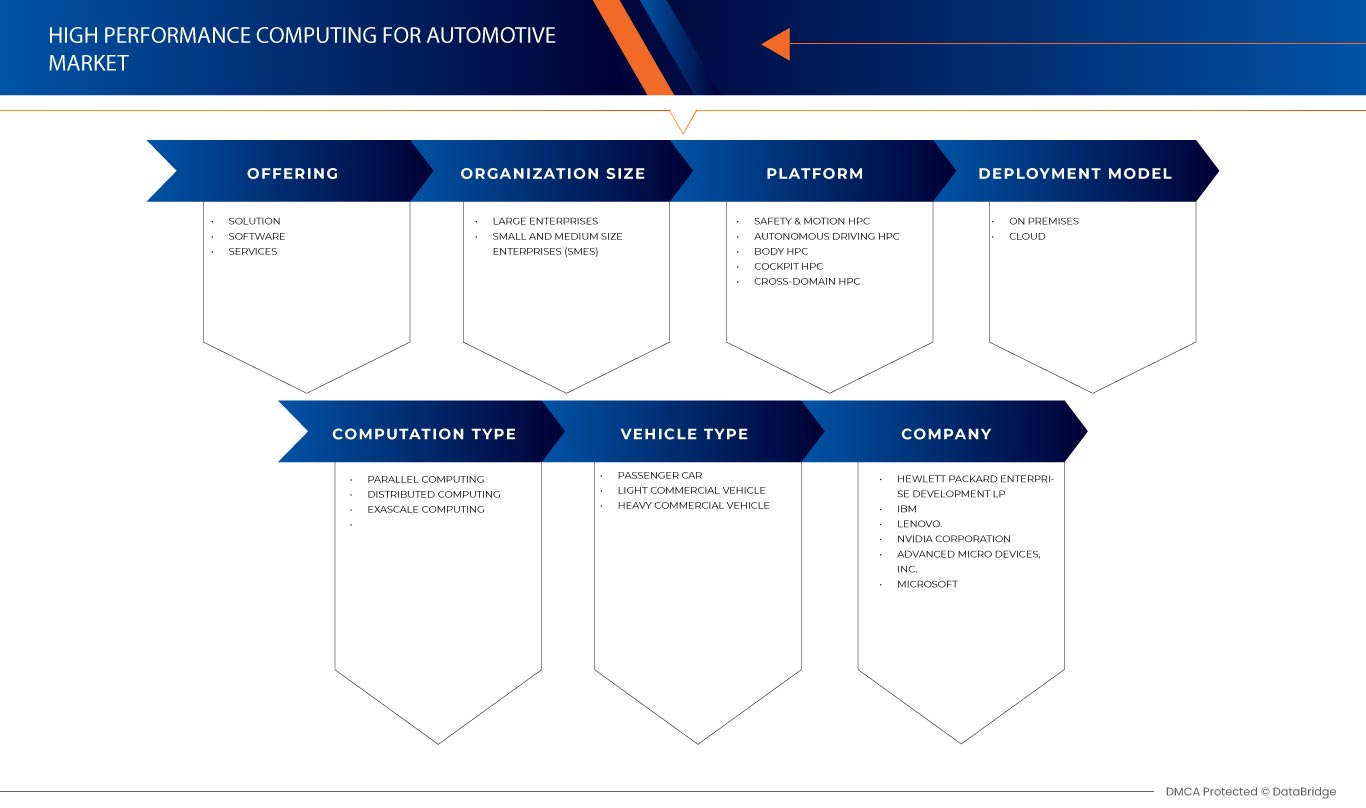

全球汽车高性能计算市场,按产品(解决方案、软件和服务)、部署模型(本地和云)、组织规模(大型企业、中小型企业 (SMES))、计算类型(并行计算、分布式计算和百亿亿次计算)、平台(安全与运动 HPC、自动驾驶 HPC、车身 HPC、驾驶舱 HPC 和跨域 HPC)、车辆类型(乘用车、轻型商用车和重型商用车)划分 - 行业趋势和预测到 2030 年。

汽车高性能计算市场分析及规模

全球对 HPC 研究的需求增长是推动高性能计算市场增长的主要因素之一。对高效计算、增强可扩展性和可靠存储的需求增加,以及对持续多样化、IT 行业扩张、高效计算和虚拟化进步的需求不断增长,加速了市场的增长。由于 HPC 系统能够以更高的速度处理大量数据并在各个领域具有高使用率,高性能计算的采用率不断上升,进一步影响了市场。

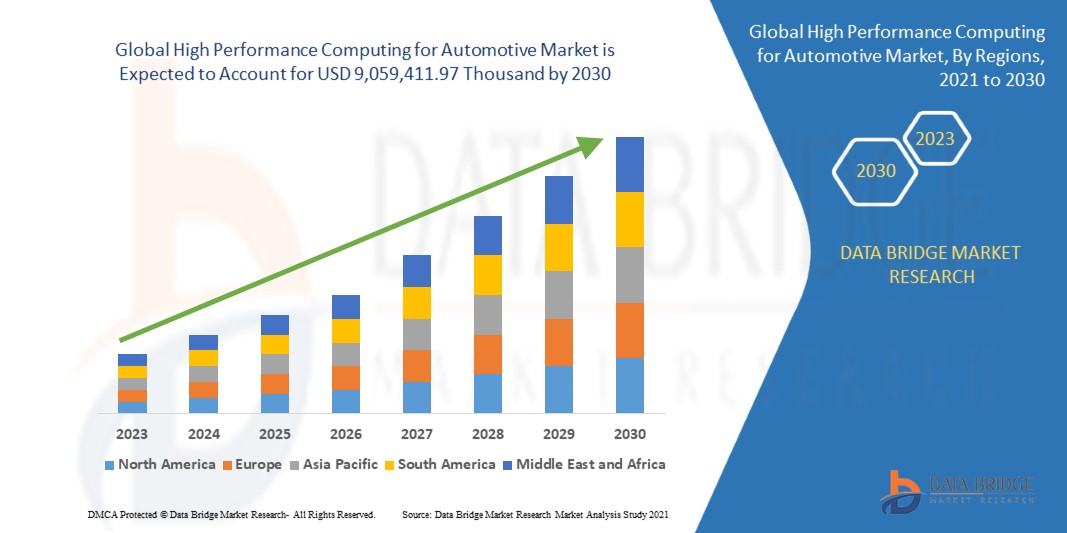

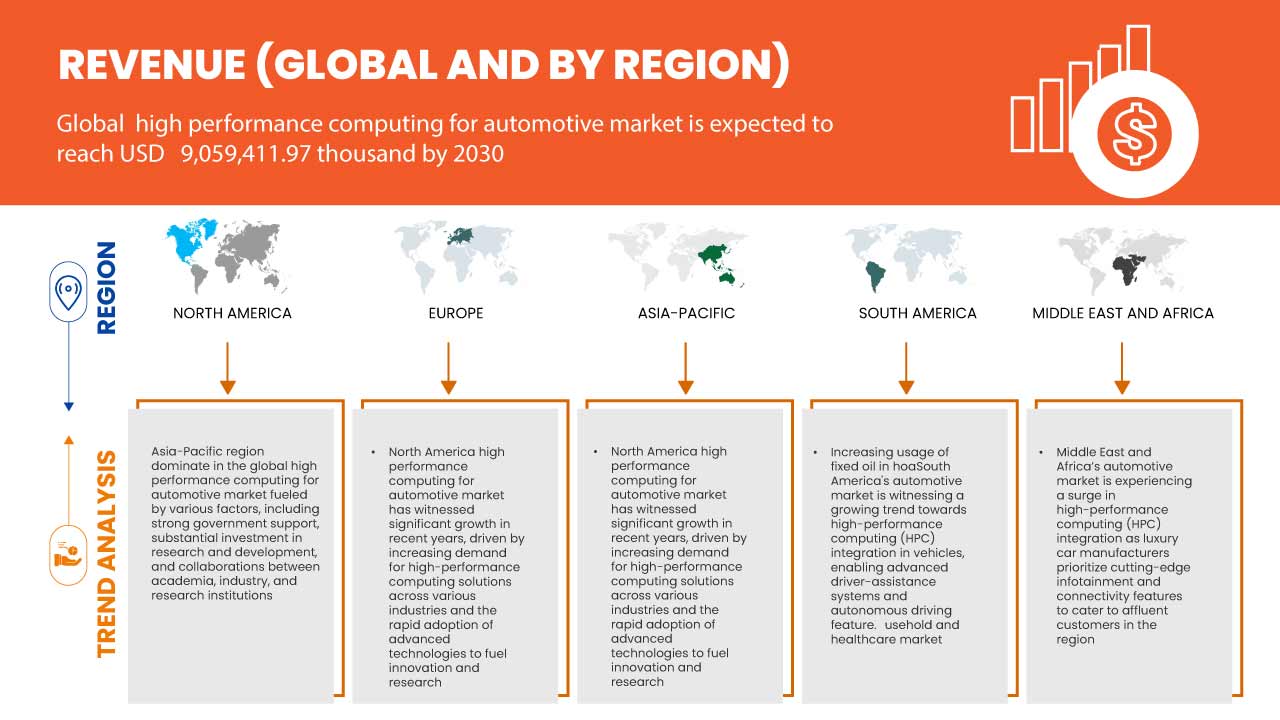

Data Bridge Market Research 分析称,预计到 2030 年,全球汽车高性能计算市场价值将达到 9,059,411.97 千美元,预测期内复合年增长率为 12.1%。全球汽车高性能计算市场报告还全面涵盖了定价分析、专利分析和技术进步。

|

报告指标 |

细节 |

|

预测期 |

2023 至 2030 年 |

|

基准年 |

2022 |

|

历史岁月 |

2021 (可定制为 2015-2020) |

|

定量单位 |

收入(千美元),定价(美元) |

|

涵盖的领域 |

产品(解决方案、软件和服务)、部署模式(本地和云)、组织规模(大型企业、中小型企业 (SMES))、计算类型(并行计算、分布式计算和百亿亿次计算)、平台(安全与运动 HPC、自动驾驶 HPC、车身 HPC、驾驶舱 HPC 和跨域 HPC)、车辆类型(乘用车、轻型商用车和重型商用车) |

|

覆盖区域 |

美国、加拿大、墨西哥、巴西、阿根廷、南美洲其他地区、德国、法国、英国、俄罗斯、意大利、西班牙、荷兰、波兰、瑞士、比利时、瑞典、土耳其、丹麦、欧洲其他地区、日本、中国、印度、韩国、越南、台湾、澳大利亚和新西兰、新加坡、马来西亚、泰国、印度尼西亚、菲律宾、亚太其他地区、沙特阿拉伯、阿联酋、南非、埃及、以色列、科威特、卡塔尔、中东和非洲其他地区 |

|

涵盖的市场参与者 |

Hewlett Packard Enterprise Development LP、IBM、联想、NVIDIA Corporation、Advanced Micro Devices、Microsoft、台湾半导体制造有限公司、戴尔公司、富士通、Elektrobit、NEC Corporation、北京经纬恒润科技有限公司、恩智浦半导体、ANSYS、ESI Group、Super Micro Computer、Inc.、Altair Engineering Inc.、TotalCAE、Vector Informatik GmbH、神通电脑科技股份有限公司、Rescale、Inc. |

市场定义

高性能计算 (HPC) 是指使用功能强大且专业的计算机系统,能够以极高的速度处理和分析大量数据。这些系统采用先进的并行处理技术,通常利用多个处理器或节点协同工作来解决科学研究、工程模拟、财务建模、天气预报和其他计算密集型任务中的复杂问题。HPC 使研究人员和专业人员能够应对使用传统计算机无法或不切实际的挑战,从而加速发现、获得更好的见解并更有效地解决各个领域的问题。

全球汽车高性能计算市场动态

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。以下内容将详细讨论所有这些内容:

驱动程序

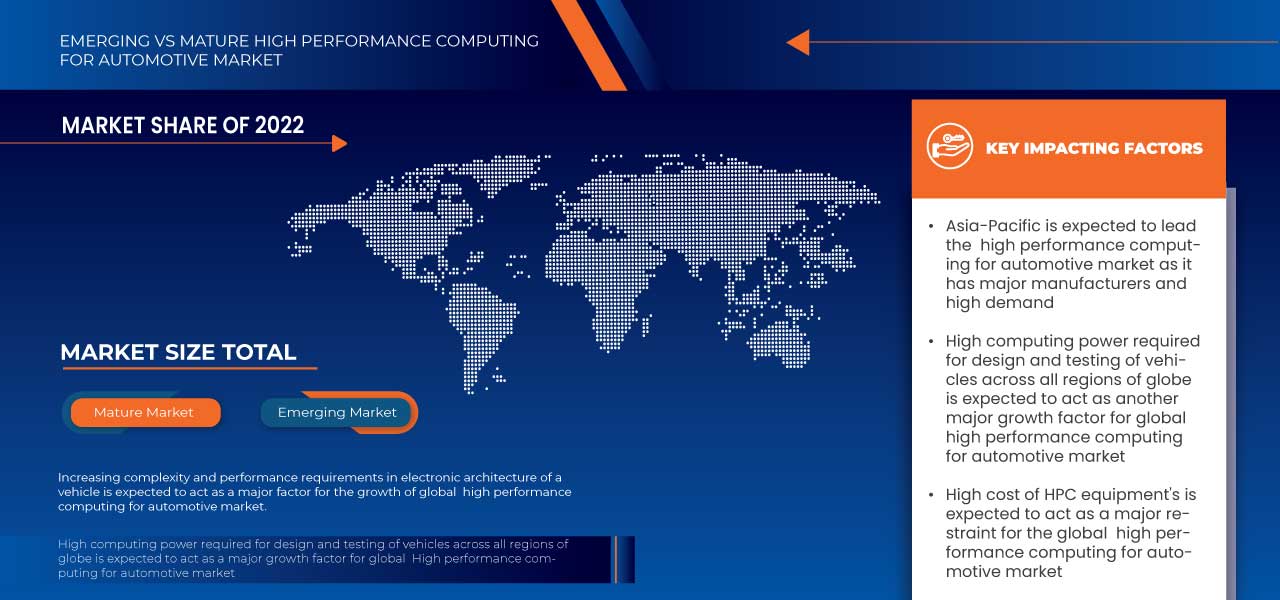

- 车辆电子架构的复杂性和性能要求不断提高

数字化将使未来的出行体验更加丰富多彩,提供更多新功能和服务。然而,这也导致需要处理的数据和信息量呈指数级增长。当前的电气/电子 (E/E) 架构已经超出了极限。自动驾驶、软件定义汽车和互联出行等汽车行业的大趋势要求提高智能化和计算机容量。当今汽车电气/电子架构的复杂性和性能已达到极限。它需要大量处理能力来支持连接、无线更新、自动驾驶和高级驾驶辅助系统 (ADAS)。

- 车辆设计和测试需要高计算能力

汽车高性能计算 (HPC) 是一种改进的 HPC,旨在满足汽车制造业对计算能力和软件兼容性的需求。现代汽车采用软件支持的精密工程生产,这需要相当高的计算性能。HPC 可以在设计过程的任何阶段提供必要的处理能力,包括功能测试和安全模拟。汽车本身的软件交付功能也受到更多关注。在 CASE(联网、自动驾驶、共享、电动)愿景下,汽车正在发展成为软件定义汽车 (SDV),其中通过代码实现的特性将机械功能联系在一起。

机会

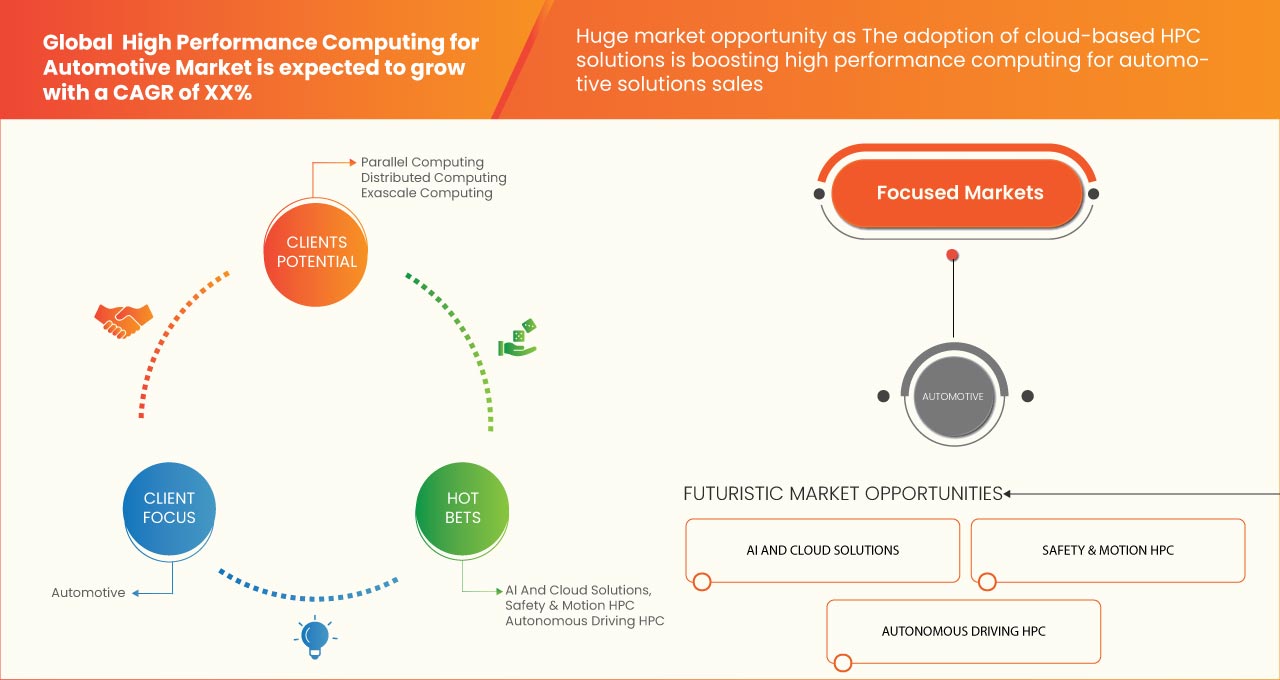

- 采用基于云的 HPC 解决方案

随着技术发展推动电动汽车、无人驾驶汽车和联网汽车的创新,汽车行业正在经历一场巨大的变革。汽车公司正在寻找加快产品开发、提高车辆性能和优化生产流程的方法,以在这个快速变化的环境中保持竞争力。采用基于云的高性能计算 (HPC) 技术是最近受到关注的一项战略。汽车企业正在利用云计算和尖端计算机功能的强大功能,为更快、更高效、更便宜的研究、设计和测试流程打开新的大门。

克制/挑战

- HPC 设备成本高

HPC 技术在汽车领域被接受的主要障碍之一是其成本。购买和维护 HPC 系统的高成本对汽车公司(尤其是中小型汽车公司)来说是一个重大障碍。HPC 系统通常拥有大量处理器,这可能会推高成本。HPC 系统通常使用高速处理器,这也会增加成本。HPC 系统通常需要大量内存,这也会增加成本。HPC 系统会产生大量热量,需要专门的冷却系统。这也会推高成本。

- 处理敏感的汽车数据

汽车制造商和移动服务提供商现在高度重视联网汽车的安全和数据隐私。个人身份信息 (PII)、客户位置、行为和财务数据以及与汽车和所提供服务相关的知识产权都可能包含在通过联网汽车收集的敏感数据中。世界各地的员工和承包商都可以访问这些敏感数据,因为这些数据在许多设置和平台(包括本地和云端)中移动。由于这些信息的“蜜罐”,制造商极易受到网络攻击。

最新动态

- 2023 年 1 月,NVIDIA Corporation 与鸿海科技集团 (Foxconn) 今天宣布建立战略合作伙伴关系,共同开发自动驾驶汽车平台。作为交易的一部分,富士康将作为一级制造商为全球汽车市场生产基于 NVIDIA DRIVE Orin 的电子控制单元 (ECU)

- 2022 年 11 月,戴尔公司宣布扩展其高性能计算 (HPC) 产品组合,包括新硬件、服务和混合量子计算解决方案。戴尔量子计算解决方案使企业能够从量子技术的增强计算中受益。客户可以利用它来加速机器学习、自然语言处理以及化学和材料模拟

全球汽车高性能计算市场范围

全球汽车高性能计算市场根据产品、部署模式、组织规模、计算类型、平台和车辆类型进行细分。这些细分市场之间的增长将帮助您分析行业中微弱的增长细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

奉献

- 解决方案

- 软件

- 服务

根据产品供应情况,全球汽车高性能计算市场细分为解决方案、软件和服务。

部署模型

- 本地

- 云

根据部署模型,全球汽车高性能计算市场细分为内部部署和云端。

组织规模

- 大型企业

- 中小企业

根据组织规模,全球汽车高性能计算市场细分为大型企业和中小型企业 (SMES)。

计算类型

- 并行计算

- 分布式计算

- 百亿亿次计算

根据计算类型,全球汽车高性能计算市场分为并行计算、分布式计算和百亿亿次计算。

平台

- 安全与运动 HPC

- 自动驾驶 HPC

- 身体 HPC

- 驾驶舱 HPC

- 跨域 HPC

根据平台类型,全球汽车高性能计算市场细分为安全与运动高性能计算、自动驾驶高性能计算、车身高性能计算、驾驶舱高性能计算和跨域高性能计算。

车辆类型

- 乘用车

- 轻型商用车

- 重型商用车

根据车辆类型,全球汽车高性能计算市场分为乘用车、轻型商用车和重型商用车。

全球汽车高性能计算市场区域分析/见解

对全球汽车高性能计算市场进行了分析,并按地区、类型、部署模式、应用和最终用户提供了市场规模洞察和趋势。

The regions covered in the global high performance computing for automotive market report are North America, South America, Europe, Asia-Pacific, Middle East and Africa. Asia-Pacific region is expected to dominate in the global high performance computing for automotive market fuelled by various factors, including strong government support, substantial investment in research and development, and collaborations between academia, industry, and research institutions. China dominates in the Asia-Pacific region as China has been investing heavily in HPC infrastructure and research to enhance its technological capabilities and scientific advancements. Moreover, U.S. dominates the North America region owing to factors such as high adoption of HPC technologies in automotive sectors which rely on HPC to accelerate product development, enhance scientific discoveries, and optimize operations.

Europe high performance computing for automotive market has witnessed the highest growth rate among all regions in high performance computing for the automotive market. Owing to factors such as the growing adoption of electric vehicle (EVs) and autonomous driving technology. Germany is dominating the region due to collaborative efforts between automotive manufacturers and HPC providers to develop eco-friendly, lightweight materials and streamline manufacturing processes, promoting sustainability and reducing environmental impact.

The region section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the region data.

Competitive Landscape and Global High Performance Computing For Automotive Market Share Analysis

Global high performance computing for automotive market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to global high performance computing for automotive market.

全球汽车高性能计算市场的一些主要参与者包括惠普企业发展有限公司、IBM、联想、NVIDIA 公司、超微半导体公司、微软、台湾半导体制造有限公司、戴尔公司、富士通、Elektrobit、NEC 公司、北京经纬恒润科技有限公司、恩智浦半导体、ANSYS 公司、ESI 集团、超微电脑股份有限公司、Altair Engineering Inc.、TotalCAE.、Vector Informatik GmbH、神通电脑科技股份有限公司、Rescale 公司等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPANY SHARE ANALYSIS AT COUNTRY LEVEL

4.2 COMPANY COMPARATIVE ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING COMPLEXITY AND PERFORMANCE REQUIREMENTS IN THE ELECTRONIC ARCHITECTURE OF A VEHICLE

5.1.2 HIGH COMPUTING POWER REQUIRED FOR DESIGN AND TESTING OF VEHICLES

5.1.3 RISING INTEGRATION OF AI AND ML TECHNOLOGIES IN AUTOMOBILES

5.2 RESTRAINTS

5.2.1 HIGH COST OF HPC EQUIPMENTS

5.3 OPPORTUNITIES

5.3.1 HIGH-PERFORMANCE COMPUTING CAN OPTIMIZE AUTOMOTIVE MANUFACTURING PROCESSES

5.3.2 THE ADOPTION OF CLOUD-BASED HPC SOLUTIONS

5.4 CHALLENGES

5.4.1 HANDLING SENSITIVE AUTOMOTIVE DATA

6 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTION

6.2.1 SERVER

6.2.2 STORAGE

6.2.3 NETWORKING DEVICE

6.3 SOFTWARE

6.4 SERVICES

6.4.1 INTEGRATION AND IMPLEMENTATION

6.4.2 SUPPORT AND MAINTENANCE

6.4.3 DESIGNING AND CONSULTING

7 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY DEPLOYMENT MODEL

7.1 OVERVIEW

7.2 ON PREMISES

7.3 CLOUD

8 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY ORGANIZATION SIZE

8.1 OVERVIEW

8.2 LARGE ENTERPRISES

8.2.1 ON PREMISES

8.2.2 CLOUD

8.3 SMALL AND MEDIUM SIZE ENTERPRISES (SMES)

8.3.1 ON PREMISES

8.3.2 CLOUD

9 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY COMPUTATION TYPE

9.1 OVERVIEW

9.2 PARALLEL COMPUTING

9.3 DISTRIBUTED COMPUTING

9.4 EXASCALE COMPUTING

10 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY PLATFORM

10.1 OVERVIEW

10.2 SAFETY & MOTION HPC

10.3 AUTONOMOUS DRIVING HPC

10.4 BODY HPC

10.5 COCKPIT HPC

10.6 CROSS-DOMAIN HPC

11 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 PASSENGER CAR

11.2.1 BY TYPE

11.2.1.1 SUV

11.2.1.2 HATCHBACK

11.2.1.3 SEDAN

11.2.1.4 COUPE

11.2.1.5 SPORT CAR

11.2.1.6 CONVERTIBLE

11.2.1.7 OTHERS

11.2.2 BY OFFERING

11.2.2.1 SOLUTION

11.2.2.1.1 SERVER

11.2.2.1.2 STORAGE

11.2.2.1.3 NETWORKING DEVICE

11.2.2.2 SOFTWARE

11.2.2.3 SERVICES

11.3 LIGHT COMMERCIAL VEHICLE

11.3.1 BY TYPE

11.3.1.1 VANS

11.3.1.2 PICK UP TRUCKS

11.3.1.3 MINI BUS

11.3.1.4 TOW TRUCK

11.3.1.5 OTHER

11.3.2 BY OFFERING

11.3.2.1 SOLUTION

11.3.2.1.1 SERVER

11.3.2.1.2 STORAGE

11.3.2.1.3 NETWORKING DEVICE

11.3.2.2 SOFTWARE

11.3.2.3 SERVICES

11.4 HEAVY COMMERCIAL VEHICLE

11.4.1 BY TYPE

11.4.1.1 HEAVY TRUCK

11.4.1.1.1 SEMI-TRAILER TRUCK

11.4.1.1.2 BOX TRUCK

11.4.1.2 OTHERS

11.4.2 BY OFFERING

11.4.2.1 SOLUTION

11.4.2.1.1 SERVER

11.4.2.1.2 STORAGE

11.4.2.1.3 NETWORKING DEVICE

11.4.2.2 SOFTWARE

11.4.2.3 SERVICES

12 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION

12.1 OVERVIEW

12.2 ASIA-PACIFIC

12.2.1 CHINA

12.2.2 JAPAN

12.2.3 SOUTH KOREA

12.2.4 INDIA

12.2.5 AUSTRALIA & NEW ZEALAND

12.2.6 SINGAPORE

12.2.7 TAIWAN

12.2.8 THAILAND

12.2.9 INDONESIA

12.2.10 MALAYSIA

12.2.11 PHILIPPINES

12.2.12 VIETNAM

12.2.13 REST OF ASIA-PACIFIC

12.3 NORTH AMERICA

12.3.1 U.S.

12.3.2 CANADA

12.3.3 MEXICO

12.4 EUROPE

12.4.1 GERMANY

12.4.2 FRANCE

12.4.3 U.K.

12.4.4 RUSSIA

12.4.5 ITALY

12.4.6 SPAIN

12.4.7 NETHERLANDS

12.4.8 POLAND

12.4.9 SWITZERLAND

12.4.10 BELGIUM

12.4.11 SWEDEN

12.4.12 TURKEY

12.4.13 DENMARK

12.4.14 REST OF EUROPE

12.5 SOUTH AMERICA

12.5.1 BRAZIL

12.5.2 ARGENTINA

12.5.3 REST OF SOUTH AMERICA

12.6 MIDDLE EAST AND AFRICA

12.6.1 SAUDI ARABIA

12.6.2 U.A.E.

12.6.3 ISRAEL

12.6.4 SOUTH AFRICA

12.6.5 EGYPT

12.6.6 KUWAIT

12.6.7 QATAR

12.6.8 REST OF MIDDLE EAST AND AFRICA

13 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13.3 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.4 COMPANY SHARE ANALYSIS: EUROPE

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 IBM

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 LENOVO

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 NVIDIA CORPORATION

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PROTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 ADVANCED MICRO DEVICES, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ALTAIR ENGINEERING INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 ANSYS, INC

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 BEIJING JINGWEI HIRAIN TECHNOLOGIES CO., INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 DELL INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 ELEKTROBIT

15.10.1 COMPANY SNAPSHOT

15.10.2 SOLUTION PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 ESI GROUP

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 FUJITSU

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 MICROSOFT

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 NEC CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 NXP SEMICONDUCTORS

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 RESCALE, INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 SUPER MICRO COMPUTER, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 TAIWAN SEMICONDUCTOR

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 TOTALCAE

15.19.1 COMPANY SNAPSHOT

15.19.2 SOLUTION PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 TYAN

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 VECTOR INFORMATIK GMBH

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 2 GLOBAL SOLUTION IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 3 GLOBAL SOLUTION IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 GLOBAL SOFTWARE IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 GLOBAL SERVICES IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 GLOBAL SERVICES IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 8 GLOBAL ON PREMISES IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 GLOBAL CLOUD IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD THOUSAND)

TABLE 11 GLOBAL LARGE ENTERPRISES IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 GLOBAL LARGE ENTERPRISES IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 13 GLOBAL SMALL AND MEDIUM SIZE ENTERPRISES (SMES) IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 GLOBAL SMALL AND MEDIUM SIZE ENTERPRISES (SMES) IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 15 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY COMPUTATION TYPE, 2021-2030 (USD THOUSAND)

TABLE 16 GLOBAL PARALLEL COMPUTING IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 GLOBAL DISTRIBUTED COMPUTING IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 GLOBAL EXASCALE COMPUTING IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY PLATFORM, 2021-2030 (USD THOUSAND)

TABLE 20 GLOBAL SAFETY & MOTION HPC IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 GLOBAL AUTONOMOUS DRIVING HPC IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 GLOBAL BODY HPC IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 GLOBAL COCKPIT HPC IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 GLOBAL CROSS-DOMAIN HPC IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2021-2030 (USD THOUSAND)

TABLE 26 GLOBAL PASSENGER CAR IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 GLOBAL PASSENGER CAR IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 GLOBAL PASSENGER CAR IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 29 GLOBAL SOLUTION IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 GLOBAL LIGHT COMMERCIAL VEHICLE IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 31 GLOBAL LIGHT COMMERCIAL VEHICLE IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 GLOBAL LIGHT COMMERCIAL VEHICLE IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 33 GLOBAL SOLUTION IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 GLOBAL HEAVY COMMERCIAL VEHICLE IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 35 GLOBAL HEAVY COMMERCIAL VEHICLE IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 GLOBAL HEAVY TRUCK IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 GLOBAL HEAVY COMMERCIAL VEHICLE IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 38 GLOBAL SOLUTION IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

图片列表

FIGURE 1 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: SEGMENTATION

FIGURE 2 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: MULTIVARIATE MODELING

FIGURE 10 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: OFFERING TIMELINE CURVE

FIGURE 11 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: SEGMENTATION

FIGURE 12 INCREASING COMPLEXITY AND PERFORMANCE REQUIREMENT IN ELECTRONICS ARCHITECTURE OF A VEHICLE IS EXPECTED TO DRIVE THE GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 SOLUTIONS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET IN 2023 & 2030

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE IN THE GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 EUROPE IS THE FASTEST GROWING MARKET FOR HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 16 COMPANY SHARE ANALYSIS AT COUNTRY LEVEL

FIGURE 17 COMPANY COMPARISON

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET

FIGURE 19 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY OFFERING, 2022

FIGURE 20 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY DEPLOYMENT MODEL, 2022

FIGURE 21 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY ORGANIZATION SIZE, 2022

FIGURE 22 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY COMPUTATION TYPE, 2022

FIGURE 23 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY PLATFORM, 2022

FIGURE 24 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY VEHICLE TYPE, 2022

FIGURE 25 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: SNAPSHOT (2022)

FIGURE 26 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY COUNTRY (2022)

FIGURE 27 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 28 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 29 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY REGION (2023-2030)

FIGURE 30 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: COMPANY SHARE 2022 (%)

FIGURE 31 ASIA-PACIFIC HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: COMPANY SHARE 2022 (%)

FIGURE 32 NORTH AMERICA HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: COMPANY SHARE 2022 (%)

FIGURE 33 EUROPE HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: COMPANY SHARE 2022 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。