Global Healthcare Analytical Testing Services Market

市场规模(十亿美元)

CAGR :

%

USD

12.10 Billion

USD

22.45 Billion

2021

2029

USD

12.10 Billion

USD

22.45 Billion

2021

2029

| 2022 –2029 | |

| USD 12.10 Billion | |

| USD 22.45 Billion | |

|

|

|

|

Global Healthcare Analytical Testing Services Market, By Type (Bioanalytical Testing Services, Physical Characterization Services, Method Development and Validation Services, Raw Material Testing Services, Batch-Release Testing Services, Stability Testing, Microbial Testing Services, Environmental Monitoring Services), End User (Pharmaceutical and Biopharmaceutical Companies, Medical Device Companies, Contract Research Organizations) – Industry Trends and Forecast to 2029.

Healthcare Analytical Testing Services Market Analysis and Size

Healthcare analytical testing services is referred to as material testing. Healthcare analytical services are used to confirm product quality and purity. Examine impurities that could infect the products during manufacturing or the early stages of product development. Bioanalytical testing devices are used to determine metabolites and drugs in biological matrices. These services are broadly used in drug development, pharmaceuticals, biotechnology and medical devices manufacturing which will further propel the market growth of healthcare analytical testing services.

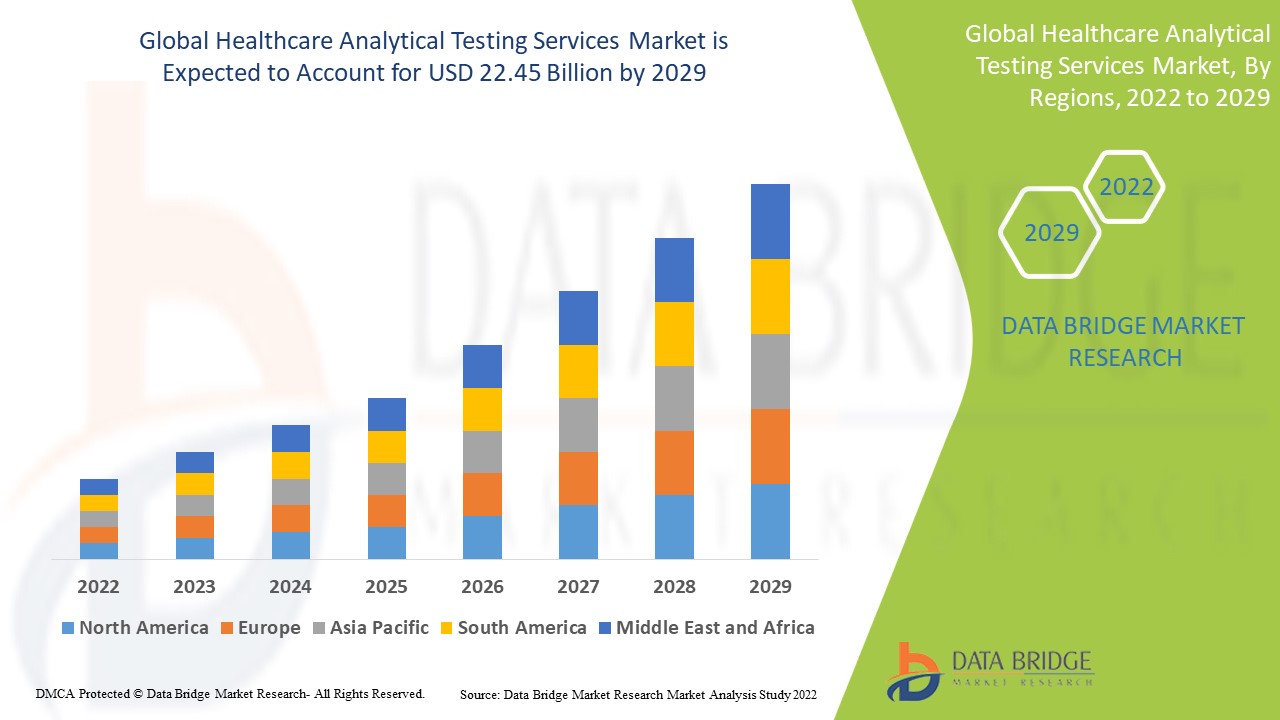

Data Bridge Market Research analyses that the healthcare analytical testing services market which was USD 12.1 billion in 2021, is expected to reach USD 22.45 billion by 2029, at a CAGR of 8.03% during the forecast period 2022 to 2029. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Healthcare Analytical Testing Services Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Bioanalytical Testing Services, Physical Characterization Services, Method Development and Validation Services, Raw Material Testing Services, Batch-Release Testing Services, Stability Testing, Microbial Testing Services, Environmental Monitoring Services), End User (Pharmaceutical and Biopharmaceutical Companies, Medical Device Companies, Contract Research Organizations) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Almac Group (U.S.), Element Materials Technology (U.K.), Eurofins Scientific (Luxembourg), PPD Inc. (U.S.), Source BioScience (U.K.), Intertek Group plc (U.K.), Laboratory Corporation of America Holdings (U.S.), Charles River Laboratories (U.S.), Medpace (U.S.), WuXi AppTec (China), IQVIA (U.S.), SGS Société Générale de Surveillance SA (Switzerland), Intertek Group plc (U.K.), Syneos Health. (U.K.), ICON plc (Ireland), PPD Inc. (U.S.), Parexel International Corporation. (U.S.), Altasciences. (Canada), BioAgilytix Labs. (U.S.), LGC Limited (U.K.) |

|

Market Opportunities |

|

Market Definition

Biopharmaceutical, pharmaceutical, and medical device manufacturers widely use healthcare analytical testing services to assist them throughout drug development. This service assists in drug development, from discovery to clinical development or clinical trials to commercialization.

Global Healthcare Analytical Testing Services Market Dynamics

Drivers

- Increased number of laboratory outsourcing service

Outsourcing bioanalytical services are becoming increasingly popular to maximize resource utilization. While dedicated in-house laboratories are equipped with cutting-edge technology, they may be unable to handle complex bioanalytical testing. Furthermore, running in-house laboratories can be costly from a strategic standpoint. Outsourcing the lab role lowers overhead and operational costs, allowing businesses to continue to reap the benefits of such lab services. Lab outsourcing assists businesses and other institutions make money by allowing them to trade higher fixed costs for lower variable costs, reducing the need for capital investment in the company, and providing quick access to world-class analytical expertise and capabilities. The above-mentioned factors are significantly driving market growth.

- Rise in the R&D expenditure in the pharmaceutical and biopharmaceutical industry

In 2012, the pharmaceutical industry spent a total of 136 billion dollars. It spent 186 billion dollars on research and development in 2019. According to PhRMA, member companies' R&D investment totaled 83 billion U.S. dollars in 2019, making the biopharmaceutical industry the most R&D-intensive industry in the U.S. economy. The biopharmaceutical industry invests six times more in R&D than all other manufacturing sectors combined. PhRMA member companies have invested nearly USD 1 trillion in discovering and developing new and improved drugs and cures over the last few decades. Usually, during the pre-clinical phase, the regulatory authority oversees, controls, and eventually authorizes the drugs. Major pharmaceutical research and development advances have begun to alter the R&D landscape in recent years.

- Rising demand for bioanalytical testing services

Rising demand for bioanalytical testing services is one of the major factors driving market growth due to its benefits, such as utility in controlling drug development costs and effectively evaluating the therapeutic entity, resulting in a cost-effective drug development cycle. The healthcare analytical testing services market is expected to grow significantly during the forecast period, owing to the increasing utility of these services in ensuring the quality of pharmaceuticals and biopharmaceuticals before release for sale, supply, or export. These are the factors which helps to grow the market.

Opportunities

- Rise in biosimilar

Analytical testing establishes the physicochemical characterization to prove the "sameness" of the biosimilar to the reference molecule throughout the biosimilar development process. As a result, demand for healthcare analytical testing services is expected to increase in the coming years. For instance, in July 2021, Pfizer was working on 96 biosimilars in a different phase. The company is an industry leader in biosimilars and based in the United States, contributing to the region's growth.

Restraints/Challenges

- High cost of healthcare analytical testing services

High cost of healthcare analytical testing services and the low adoption rate in emerging and underdeveloped countries will obstruct the market's growth rate. Assays due to high maintenance and instrument costs, stringent regulations on reagent usage and lack of skilled professionals are some key factors expected to hamper growth of the healthcare analytical testing services.

This healthcare analytical testing services market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the healthcare analytical testing services market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on the Healthcare Analytical Testing Services Market

The COVID-19 pandemic had a major impact on the global economy and business operations. The COVID-19 pandemic has presented new challenges to the bioanalytical community. The pandemic's impact on business practices, supply chains, timelines, and project prioritization is still being felt across the industry one year later. Because of travel and personnel constraints, laboratories have modified their day-to-day lab operations and clinical trial procedures. Because supply chains have been disrupted, the availability of lab consumables, reagents, personal protective equipment (PPE), and biological matrices has decreased. COVID-19 clinical trials have a broader range of analytical requirements than traditional therapeutic candidates, as each therapeutic may necessitate pharmacokinetic, immunogenicity, biomarker, SARS-CoV-2 antigen, and serological testing.

Recent developments

• In April 2021, SGS SA completed the acquisition of SYNLAB Analytics, a pharmaceutical, food, and environmental testing service provider. As a result of this acquisition, SGS gained over 37 laboratories, with the primary goal of expanding its analytical testing capabilities in pharmaceutical, environmental, and food testing.

• In April 2021, Charles River Laboratories announced the acquisition of Retrogenix Ltd., which provides cell microarray services, air sampling, and quality, to expand its early-stage contract research organization offerings.

Global Healthcare Analytical Testing Services Market Scope

The healthcare analytical testing services market is segmented on the basis of type, usage, end-user and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Bioanalytical testing services

- Cell-based assays

- Virology testing

- Immunogenicity and neutralizing antibody testing

- Biomarker testing

- Pharmacokinetic testing

- Other

- Physical characterization services

- Laser particle size analysis

- Thermal analysis

- Image analysis

- Surface area analysis

- Other

- Method development and validation services

- Extractable and leachable method development and validation

- Process impurity method development and validation

- Stability-indicating method validation

- Cleaning validation

- Analytical standard characterization

- Technical consulting

- Other

- Batch-release testing services

- Dissolution testing

- Elemental impurity testing

- Disintegration testing, hardness testing

- Friability testing

- Other

- Raw Material Testing Services

- Stability testing

- Drug substance stability testing

- Formulation evaluation stability testing

- Accelerated stability testing

- Photostability testing

- Comparative stability testing

- Other

- Microbial testing services

- Microbial limit testing

- Sterility testing

- Endotoxin testing

- Preservative efficacy testing

- Water testing

- Other

- Environmental monitoring services

- Air testing

- Wastewater/ETP testing

- Other

End User

- Pharmaceutical and Biopharmaceutical Companies

- Medical Device Companies

- Contract Research Organizations

Healthcare Analytical Testing Services Market Regional Analysis/Insights

The healthcare analytical testing services market is analyzed and market size insights and trends are provided by country, type, usage, end-user and application as referenced above.

The countries covered in the healthcare analytical testing services market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the healthcare analytical testing services market because of technological advances and increased demand for healthcare testing services. Furthermore, biopharmaceutical companies are focusing their investments on the U.S. market due to the rapidly growing healthcare sector and favourable regulatory reforms.

Asia-Pacific is expected to grow at the highest growth rate in the forecast period of 2022 to 2029 because of increased investments by companies from developed economies in improving regional analytical services, regulatory body amendments to change evaluation standards to align with global standards, and the establishment of new facilities and alliances to expand the reach of their offerings to various locations in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The healthcare analytical testing services market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for healthcare analytical testing services market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the healthcare analytical testing services market. The data is available for historic period 2010-2020.

Competitive Landscape and Healthcare Analytical Testing Services Market Share Analysis

The healthcare analytical testing services market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to healthcare analytical testing services market.

Some of the major players operating in the healthcare analytical testing services market are:

- Almac Group (U.S.)

- Element Materials Technology (U.K.)

- Eurofins Scientific (Luxembourg)

- PPD Inc. (U.S.)

- Source BioScience (U.K.)

- Intertek Group plc (U.K.)

- Laboratory Corporation of America Holdings (U.S.)

- Charles River Laboratories (U.S.)

- Medpace (U.S.)

- WuXi AppTec (China)

- IQVIA (U.S.)

- SGS Société Générale de Surveillance SA (Switzerland)

- Intertek Group plc (U.K.)

- Syneos Health. (U.K.)

- ICON plc (Ireland)

- PPD Inc. (U.S.)

- Parexel International Corporation. (U.S.)

- Altasciences. (Canada)

- BioAgilytix Labs. (U.S.)

- LGC Limited (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。