全球食品过敏原和不耐受测试市场,按测试类型(过敏原测试、不耐受测试)、方法(体外、体内)、最终用户(过敏原测试最终用户、不耐受测试最终用户)划分 - 行业趋势和预测到 2029 年。

市场定义和见解

食品安全和质量是食品制造业、零售业和酒店业的主要关注点。它对生产力有影响。全球范围内的食物过敏正在增加,包括过敏原的数量、致敏率和患病率。为了保护社区中的食物过敏人群,需要对食物过敏进行适当的管理、在加工食品中进行检测并在其上贴上适当的标签。过敏原检测的存在最近有所增加,检测实验室可以帮助检测这些过敏原。食物过敏原实验室最重要的功能是检测食物中是否存在过敏原,例如大豆、乳制品、花生和树坚果等。

食品检测需求不断增长,制造商参与新产品发布、促销、奖项、认证和市场活动。这些决策最终促进了市场的增长。

全球食品过敏原和不耐受性测试市场报告提供了市场份额、新发展、国内和本地市场参与者的影响的详细信息,分析了新兴收入来源、市场法规变化、产品批准、战略决策、产品发布、地域扩张和市场技术创新方面的机会。要了解分析和市场情景,请联系我们获取分析师简报,我们的团队将帮助您创建收入影响解决方案以实现您的预期目标。合作、协议和签署销售协议等战略举措以发明和创新药物治疗是推动预测期内市场需求的主要驱动力。

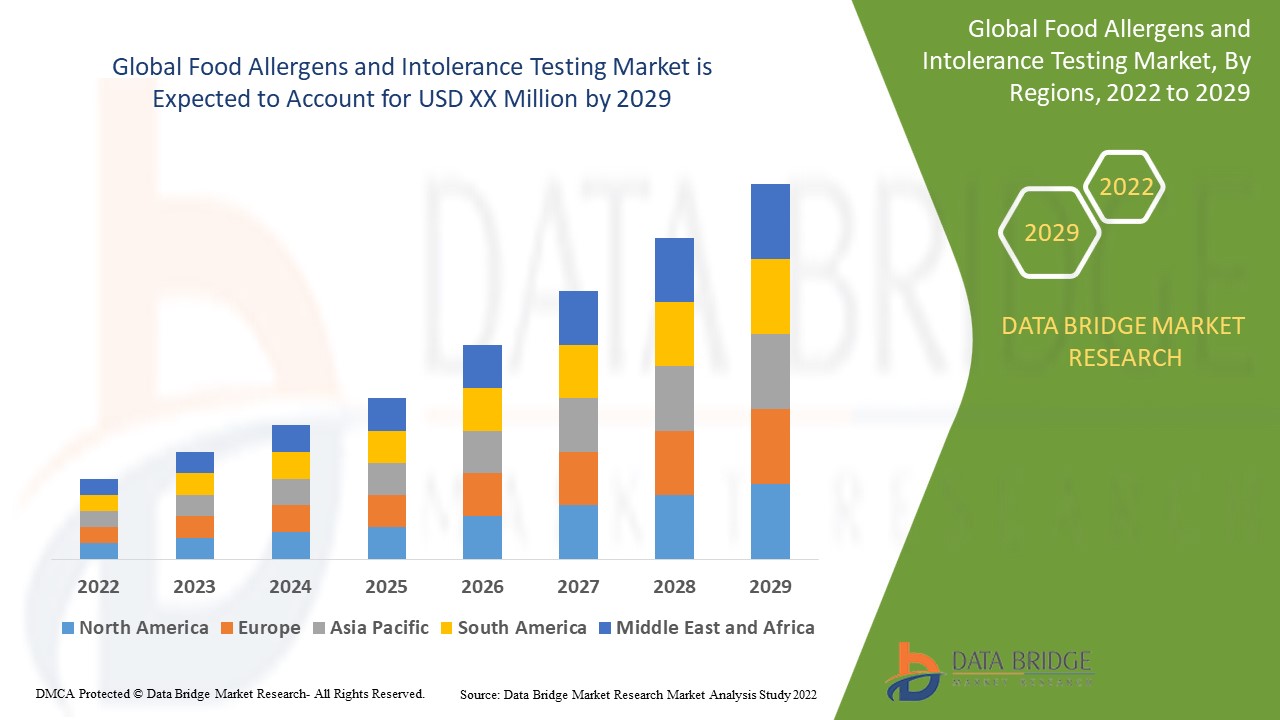

全球食品过敏原和不耐受检测市场具有支持性,旨在减少疾病的进展。Data Bridge Market Research 分析称,在 2022 年至 2029 年的预测期内,全球食品过敏原和不耐受检测市场将以 8.1% 的复合年增长率增长。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2014) |

|

定量单位 |

收入(百万美元),定价(美元) |

|

涵盖的领域 |

按测试类型(过敏原测试、不耐受测试)、方法(体外、体内)、最终用户(过敏原测试最终用户、不耐受测试最终用户) |

|

覆盖国家 |

美国、加拿大、墨西哥、德国、法国、意大利、英国、法国、德国、意大利、西班牙、俄罗斯、比利时、丹麦、土耳其、荷兰、瑞士、波兰、瑞典、欧洲其他地区、日本、中国、印度、韩国、澳大利亚、新加坡、马来西亚、泰国、印度尼西亚、菲律宾、越南、新西兰、亚太其他地区、巴西、阿根廷、南美洲其他地区、沙特阿拉伯、南非、阿联酋、阿曼、卡塔尔、科威特、中东和非洲其他地区 |

|

涵盖的市场参与者 |

SGS SA、安捷伦科技公司、NEOGEN Corporation、ALS Limited、Mérieux NutriSciences、Eurofins Scientific、Intertek Group plc、TÜV SÜD、Bureau Veritas、Symbio Laboratories、RJ Hill Laboratories Limited、NSF International、Healthy Stuff Online Limited、QIMA、IFP INSTITUT FÜR PRODUKTQUALITÄT GMBH、ADPEN LABORATORIES, INC.、AsureQuality、Microbac Laboratories, Inc、Romer Labs Division Holding GmbH、FOOD SAFETY NET SERVICES、PCAS Labs、Element Materials Technology、OMIC USA Inc. 等。 |

市场定义

食物过敏是食用某种食物后不久发生的免疫系统反应。即使是少量的过敏食物也会引发消化问题、荨麻疹或呼吸道肿胀等症状。对某些人来说,食物过敏会导致严重症状,甚至危及生命的过敏反应。另一方面,食物不耐受是指一个人难以消化某种食物。这可能导致肠胃胀气、腹痛或腹泻等症状。食物过敏原和不耐受测试是对食物和食物成分进行科学分析以检测过敏原。这样做是为了提供有关食物各种过敏成分的信息,包括食物的结构、成分和物理化学性质。食品产品测试可以使用几种非常先进的方法进行,以提供有关食品营养价值和安全性的准确信息。

食品检测和分析对于确保食品安全至关重要,可以确保食品安全食用。这包括发展食品检测实验室网络、确保食品检测质量、投资人力资源和开展监测活动以及教育消费者。

全球食品过敏原和不耐受测试市场动态

驱动程序

- 食物过敏和不耐症的患病率不断上升

据世界卫生组织统计,全球有多达 40% 的人口受过敏症影响,大城市和工业化国家的患者比例正在上升。过敏症可导致慢性疾病,某些食物过敏甚至可能致命。食物过敏已成为一个严重的公共卫生问题。据估计,成人食物过敏的患病率约为 2-4%,儿童为 6-8%。据报道,西方国家经诱发诊断的食物过敏率高达 10%,且幼儿的患病率最高。越来越多的证据表明,发展中国家的食物过敏患病率也在上升,据报道,中国和非洲经诱发诊断的食物过敏率与西方国家相似。一个有趣的观察是,与白人儿童相比,出生在西方环境中的东亚或非洲裔儿童患食物过敏的风险更高;这一有趣的发现强调了基因组与环境相互作用的重要性,并预测随着亚洲和非洲经济的持续增长,这些地区的食物过敏未来将会增加。虽然牛奶和鸡蛋过敏是大多数国家最常见的两种食物过敏,但根据每个国家的饮食模式,在各个地理区域可以观察到不同的食物过敏模式。此外,由于不良的非毒性反应(超敏反应),食物过敏的患病率呈指数级增长。食物过敏病例的增加促使世界各地的公共卫生当局采取重大措施来遏制过敏反应及其后果。

- 多种食物易受过敏原影响,需要进行检测

从婴儿食品到烘焙和糖果、乳制品、饮料、方便食品和肉制品,所有这些都容易引起过敏,这创造了一个巨大的食品过敏原检测市场。此外,由于动物饲料质量差,肉类总是有可能引起人类过敏。尽管食品和饮料行业对能够改善饲料质量的动物饲料添加剂的需求正在增加,但食物不耐受检测市场在改善肉类引起的过敏方面仍然具有重要意义。

尽管已确定有 170 多种食物会导致敏感消费者产生食物过敏,但美国农业部和美国食品药品监督管理局根据 2004 年 FALCPA(食品过敏原标签和消费者保护法),确定了八种主要的过敏性食物。

机会

- 新兴市场的食品过敏原检测

根据世界过敏组织 (WAO) 的数据,匈牙利、日本和中国急诊室每年发生的过敏反应分别为 222 起、300-350 起和 3,000 起。此外,该组织估计,美国、韩国和澳大利亚的过敏反应患病率分别为 2%、0.1% 和 0.6-1%。食品药品管理局 (FDA) 已将食品安全作为食品行业的一项重要内容,这是市场发展的驱动因素。此外,自 1990 年代以来,患有食物过敏的人数明显增加,这进一步使食物过敏原检测市场成为欧洲、美国等国家的一个重要领域。

限制/挑战

许多障碍阻碍了发展中国家对食物过敏 (FA) 的正确诊断,因为有证据表明父母和医护人员对食物过敏的知识不足,而且体外诊断测试不易获得。早期诊断 FA 对于预后和适当的营养管理非常重要。然而,即使在发达国家,也有报道称诊断滞后 4 个月,尤其是非 IgE 介导的牛奶过敏症状较轻的婴儿。144 这种情况在发展中国家可能更糟;Aguilar-Jasso 等人发现墨西哥西北部 FA 的诊断延迟了 38 个月。

发展中国家缺乏食品控制基础设施和资源,以及取样、检测和蛋白质鉴定过程中的技术困难,预计将阻碍市场增长。中东和非洲国家以及其他低收入国家目前仍受到限制,因为人们对食物过敏原和不耐受测试的认识不足。缺乏政府主动性、经济不景气,最重要的是个人对食物过敏缺乏认识,这些都将阻碍市场

然而,每个国家都受到不同当局制定的指导方针的约束,这预计会对全球食品过敏原和不耐受测试市场的增长构成挑战。

最新动态

- 2020 年 12 月,Eurofins Scientific 推出了 SENSI Strip Allergen 产品系列,用于检测包装食品中的过敏原。此次新产品的推出有助于该公司增强其产品组合。

- 2020 年 10 月,NEOGEN 公司推出了一种新的食品提取方法,以扩展 Reveal 3-D 食品过敏原测试直接检测食品的能力。新的 Reveal 3-D 产品可以快速筛选食品和成分样品。该缓冲液可用于鸡蛋、椰子、榛子、大豆、花生和杏仁测试。此次新产品的推出帮助该公司扩大了其食品安全产品组合。

全球食品过敏原和不耐受测试市场细分

全球食品过敏原和不耐受性检测市场根据检测类型、方法和最终用户分为三个显著的细分市场。细分市场之间的增长有助于您分析利基增长领域和进入市场的策略,并确定您的核心应用领域和目标市场的差异。

过敏原类型

- 过敏原检测

- 不耐受测试

根据测试类型,全球食品过敏原和不耐受测试市场分为过敏原测试和不耐受测试。

方法

- 体外

- 体内

根据方法,全球食品过敏原和不耐受检测市场分为体外和体内

最终用户

- 过敏原测试最终用户

- 不耐受测试最终用户

根据最终用户,全球食品过敏原和不耐受测试市场分为过敏原测试最终用户和不耐受测试最终用户。

全球食品过敏原和不耐受测试市场区域分析/见解

对全球食品过敏原和不耐受测试市场进行了分析,并根据上述测试类型、方法和最终用户提供了市场规模洞察和趋势。

食品过敏原和不耐受测试市场报告涵盖的地区包括美国、加拿大、墨西哥、德国、法国、意大利、英国、法国、德国、意大利、西班牙、俄罗斯、比利时、丹麦、土耳其、荷兰、瑞士、波兰、瑞典、欧洲其他地区、日本、中国、印度、韩国、澳大利亚、新加坡、马来西亚、泰国、印度尼西亚、菲律宾、越南、新西兰、亚太其他地区、巴西、阿根廷、南美洲其他地区、沙特阿拉伯、南非、阿联酋、阿曼、卡塔尔、科威特、中东和非洲其他地区。

在欧洲,英国预计将主导市场,因为英国对过敏原检测和标签的监管机构非常严格。美国预计将主导北美市场,因为美国拥有众多主要市场参与者。中国预计将主导亚太市场,因为加工食品消费呈增长趋势。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。下游和上游价值链分析、技术趋势和波特五力分析、案例研究等数据点是用于预测各个国家市场情景的一些指标。此外,在提供国家数据的预测分析时,还考虑了全球品牌的存在和可用性以及它们因来自本地和国内品牌的大量或稀缺竞争而面临的挑战、国内关税和贸易路线的影响。

竞争格局和全球食品过敏原和不耐受测试市场份额分析

食品过敏原和不耐受测试市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、全球影响力、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度以及应用主导地位。以上提供的数据点仅与公司对食品过敏原和不耐受测试市场的关注有关。

全球食品过敏原和不耐受测试市场的一些主要参与者包括 SGS SA、安捷伦科技公司、NEOGEN Corporation、ALS Limited、Mérieux NutriSciences、Eurofins Scientific、Intertek Group plc、TÜV SÜD、Bureau Veritas、Symbio Laboratories、RJ Hill Laboratories Limited、NSF International、Healthy Stuff Online Limited、QIMA、IFP INSTITUT FÜR PRODUKTQUALITÄT GMBH、ADPEN LABORATORIES, INC.、AsureQuality、Microbac Laboratories, Inc、Romer Labs Division Holding GmbH、FOOD SAFETY NET SERVICES、PCAS Labs、Element Materials Technology、OMIC USA Inc. 等。

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析以及主要(行业专家)验证。除此之外,数据模型还包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、公司市场份额分析、测量标准、全球与区域和供应商份额分析。如有进一步询问,请要求分析师致电。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL FOOD ALLERGENS AND INTOLERANCE TESTING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TESTING TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS-

4.1.1 BARGAINING POWER OF CUSTOMERS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 THE THREAT OF NEW ENTRANTS

4.1.4 THREAT OF SUBSTITUTES

4.1.5 RIVALRY AMONG EXISTING COMPETITORS

4.2 VALUE CHAIN ANALYSIS

4.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.4 TECHNOLOGY INNOVATIONS

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.6 FACTOR INFLUENCING PURCHASING DECISION OF END-USERS

4.6.1 QUALITY OF THE PRODUCTS:

4.6.2 AVAILABILITY OF A VARIETY OF TESTING TYPES:

4.6.3 WIDE USE IN VARIOUS INDUSTRIES:

4.7 UPCOMING TESTING TECHNOLOGIES

5 REGULATORY FRAMEWORK

5.1 GLOBAL FOOD SAFETY INITIATIVE

5.2 INTERNATIONAL BODY FOR FOOD SAFETY STANDARDS AND REGULATIONS

5.3 FEDERAL LEGISLATION

5.3.1 EUROPEAN UNION

5.3.2 THE U.S.

5.3.3 CANADA

5.3.4 AUSTRALIA

5.4 FDA FOOD SAFETY MODERNIZATION ACT

5.5 FOOD SAFETY ON TRACEABILITY SYSTEMS AND FOOD DIAGNOSTICS

5.6 THE TOXIC SUBSTANCES CONTROL ACT OF 1976

5.7 REGULATORY IMPOSITIONS ON GM LABELING

5.8 RAPID ALERT SYSTEM FOR FOOD AND FEED (RASFF) TO REPORT FOOD SAFETY ISSUES

5.9 OTHERS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING PREVALENCE OF FOOD ALLERGIES AND INTOLERANCE

6.1.2 INCREASED HEALTH CARE EXPENDITURE WORLDWIDE

6.1.3 A VARIETY OF FOODS SUSCEPTIBLE TO ALLERGENS CREATES A NEED FOR TESTING

6.1.4 GROWING AWARENESS OF FOOD ALLERGENS

6.1.5 LABELING COMPLIANCE IN SEVERAL FOOD INDUSTRIES

6.2 RESTRAINTS

6.2.1 UNAVAILABILITY OF FOOD CONTROL INFRASTRUCTURE & RESOURCES

6.2.2 LACK OF AWARENESS ABOUT LABELLING REGULATION

6.2.3 HIGH COST OF TREATMENT

6.3 OPPORTUNITIES

6.3.1 FOOD ALLERGEN TESTING IN EMERGING MARKETS

6.3.2 USE OF HEALTH IN ALLERGY DIAGNOSIS

6.4 CHALLENGES

6.4.1 DIAGNOSTIC CHALLENGES IN DEVELOPING WORLD

6.4.2 LACK OF STANDARDIZATION IN ALLERGEN TESTING PRACTICES

7 POST COVID-19 IMPACT ON FOOD ALLERGENS AND INTOLERANCE TESTING MARKET

8 GLOBAL FOOD ALLERGEN AND INTOLERANCE TESTING MARKET, BY TESTING TYPE

8.1 OVERVIEW

8.2 ALLERGEN TESTING

8.3 INTOLERANCE TESTING

9 GLOBAL FOOD ALLERGEN AND INTOLERANCE TESTING MARKET, BY METHOD

9.1 OVERVIEW

9.2 IN-VITRO

9.3 IN-VIVO

10 GLOBAL FOOD ALLERGEN AND INTOLERANCE TESTING MARKET, BY END USER

10.1 OVERVIEW

10.2 ALLERGEN TESTING END USER

10.3 INTOLERANCE TESTING END USER

11 GLOBAL FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY REGION

11.1 OVERVIEW

11.2 EUROPE

11.2.1 U.K.

11.2.2 FRANCE

11.2.3 GERMANY

11.2.4 ITALY

11.2.5 SPAIN

11.2.6 RUSSIA

11.2.7 NETHERLANDS

11.2.8 BELGIUM

11.2.9 DENMARK

11.2.10 TURKEY

11.2.11 SWITZERLAND

11.2.12 POLAND

11.2.13 SWEDEN

11.2.14 REST OF EUROPE

11.3 NORTH AMERICA

11.3.1 U.S.

11.3.2 CANADA

11.3.3 MEXICO

11.4 ASIA-PACIFIC

11.4.1 CHINA

11.4.2 JAPAN

11.4.3 AUSTRALIA

11.4.4 INDIA

11.4.5 SOUTH KOREA

11.4.6 MALAYSIA

11.4.7 SINGAPORE

11.4.8 INDONESIA

11.4.9 THAILAND

11.4.10 NEW ZEALAND

11.4.11 PHILIPPINES

11.4.12 VIETNAM

11.4.13 REST OF ASIA-PACIFIC

11.5 SOUTH AMERICA

11.5.1 BRAZIL

11.5.2 ARGENTINA

11.5.3 REST OF SOUTH AMERICA

11.6 MIDDLE EAST AND AFRICA

11.6.1 SOUTH AFRICA

11.6.2 SAUDI ARABIA

11.6.3 U.A.E

11.6.4 OMAN

11.6.5 QATAR

11.6.6 KUWAIT

11.6.7 REST OF MIDDLE EAST AND AFRICA

12 GLOBAL INHERITED RETINAL DISEASES MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: EUROPE

12.3 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13 SWOT

14 COMPANY PROFILE

14.1 EUROFINS SCIENTIFIC

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 SERVICE PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.1.5.1 ACQUISITION

14.1.5.2 LAUNCH

14.2 SGS SA

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 SERVICES PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.2.5.1 BUISNESS EXPANSION

14.2.5.2 ACQUISITION

14.3 BUREAU VERITAS

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 SERVICE PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.3.5.1 AGREEMENTS

14.3.5.2 AWARD

14.4 TÜV SÜD

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 SERVICE PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.4.4.1 EVENT

14.4.4.2 PATNERSHIP

14.5 ALS LIMITED

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 SERVICE PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.5.5.1 ACQUISITION

14.5.5.2 AWARDS

14.6 NEOGEN CORPORATION

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 SERVICE PORTFOLIO

14.6.4 RECENT DEVELOPMENS

14.6.4.1 PRODUCT DEVELOPMENTS

14.6.4.2 AGREEMENT

14.7 INTERTEK GROUP PLC

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 SERVICE PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.7.4.1 AWARD

14.7.5 ACQUISITION

14.8 ROMER LABS DIVISION HOLDING GMBH

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 QIMA

14.9.1 COMPANY SNAPSHOT

14.9.2 SERVICES PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 MÉRIEUX NUTRISCIENCES

14.10.1 COMPANY SNAPSHOT

14.10.2 SERVICES PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 MICROBAC LABORATORIES, INC.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 FOOD SAFETY NET SERVICES

14.12.1 COMPANY SNAPSHOT

14.12.2 SERVICES PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 ADPEN LABORATORIES, INC.

14.13.1 COMPANY SNAPSHOT

14.13.2 SERVICES PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 ASUREQUALITY

14.14.1 COMPANY SNAPSHOT

14.14.2 SERVICES PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 ELEMENT MATERIALS TECHNOLOGY

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 HEALTHY STUFF ONLINE LIMITED

14.16.1 COMPANY SNAPSHOT

14.16.2 SERVICE PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 IFP INSTITUT FÜR PRODUKTQUALITÄT GMBH

14.17.1 COMPANY SNAPSHOT

14.17.2 SERVICES PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 NSF INTERNATIONAL

14.18.1 COMPANY SNAPSHOT

14.18.2 SERVICE PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.18.3.1 RELOCATION

14.19 OMIC USA INC.

14.19.1 COMPANY SNAPSHOT

14.19.2 SERVICE PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 PCAS LABS

14.20.1 COMPANY SNAPSHOT

14.20.2 SERVICES PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 R J HILL LABORATORIES LIMITED

14.21.1 COMPANY SNAPSHOT

14.21.2 SERVICE PORTFOLIO

14.21.3 RECENT DEVELOPMENTS

14.21.3.1 LAUNCH

14.22 SYMBIO LABORATORIES

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT DEVELOPMENTS

14.22.3.1 EXPANSION

14.22.3.2 ACQUISITION

15 QUESTIONNAIRE

16 RELATED REPORTS

图片列表

FIGURE 1 GLOBAL FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: SEGMENTATION

FIGURE 2 GLOBAL FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 GLOBAL FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 GLOBAL FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 GLOBAL FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: SEGMENTATION

FIGURE 11 EUROPE IS EXPECTED TO DOMINATE THE GLOBAL FOOD ALLERGENS AND INTOLERANCE TESTING MARKET AND IS GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 12 INCREASING CASES OF FOOD ALLERGIES ARE EXPECTED TO DRIVE THE GLOBAL FOOD ALLERGENS AND INTOLERANCE TESTING MARKET IN THE FORECAST PERIOD

FIGURE 13 ALLERGEN TESTING IN TESTING TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL FOOD ALLERGENS AND INTOLERANCE TESTING MARKET IN 2022 & 2029

FIGURE 14 EUROPE IS THE FASTEST-GROWING MARKET FOR FOOD ALLERGENS AND INTOLERANCE TESTING MARKET IN THE FORECAST PERIOD

FIGURE 15 VALUE CHAIN OF GLOBAL FOOD ALLERGENS AND INTOLERANCE TESTING MARKET

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF GLOBAL FOOD ALLERGENS AND INTOLERANCE TESTING MARKET

FIGURE 17 SELF-REPORTED PREVALENCE OF FOOD ALLERGY IN THE UNITED STATES

FIGURE 18 GLOBAL FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY TESTING TYPE, 2021

FIGURE 19 GLOBAL FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY TESTING TYPE, 2022-2029 (USD MILLION)

FIGURE 20 GLOBAL FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY TESTING TYPE, CAGR (2022-2029)

FIGURE 21 GLOBAL FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY TESTING TYPE, LIFELINE CURVE

FIGURE 22 GLOBAL FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY METHOD, 2021

FIGURE 23 GLOBAL FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY METHOD, 2022-2029 (USD MILLION)

FIGURE 24 GLOBAL FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY METHOD, CAGR (2022-2029)

FIGURE 25 GLOBAL FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY METHOD, LIFELINE CURVE

FIGURE 26 GLOBAL FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY END USER, 2021

FIGURE 27 GLOBAL FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 28 GLOBAL FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY END USER, CAGR (2022-2029)

FIGURE 29 GLOBAL FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 GLOBAL FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: SNAPSHOT (2021)

FIGURE 31 GLOBAL FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY REGION (2021)

FIGURE 32 GLOBAL FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY REGION (2022 & 2029)

FIGURE 33 GLOBAL FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY REGION (2021 & 2029)

FIGURE 34 GLOBAL FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY TESTING TYPE (2022-2029)

FIGURE 35 EUROPE FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: SNAPSHOT (2021)

FIGURE 36 EUROPE FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY COUNTRY (2021)

FIGURE 37 EUROPE FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 EUROPE FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 EUROPE FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY TESTING TYPE (2022-2029)

FIGURE 40 NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: SNAPSHOT (2021)

FIGURE 41 NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY COUNTRY (2021)

FIGURE 42 NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 43 NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 44 NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY TESTING TYPE (2022-2029)

FIGURE 45 ASIA-PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: SNAPSHOT (2021)

FIGURE 46 ASIA-PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY COUNTRY (2021)

FIGURE 47 ASIA-PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 48 ASIA-PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 49 ASIA-PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY TESTING TYPE (2022-2029)

FIGURE 50 SOUTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: SNAPSHOT (2021)

FIGURE 51 SOUTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY COUNTRY (2021)

FIGURE 52 SOUTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 53 SOUTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 54 SOUTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY TESTING TYPE (2022-2029)

FIGURE 55 MIDDLE EAST AND AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: SNAPSHOT (2021)

FIGURE 56 MIDDLE EAST AND AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY COUNTRY (2021)

FIGURE 57 MIDDLE EAST AND AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 58 MIDDLE EAST AND AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 59 MIDDLE EAST AND AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY TESTING TYPE (2022-2029)

FIGURE 60 GLOBAL FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: COMPANY SHARE 2021 (%)

FIGURE 61 EUROPE FOOD ALLERGENS AND INTOLERANCE TESTING MARKET MARKET: COMPANY SHARE 2021 (%)

FIGURE 62 NORTH AMERICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: COMPANY SHARE 2021 (%)

FIGURE 63 ASIA-PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。