Global Diabetic Assays Market

市场规模(十亿美元)

CAGR :

%

USD

3.53 Billion

USD

5.02 Billion

2024

2032

USD

3.53 Billion

USD

5.02 Billion

2024

2032

| 2025 –2032 | |

| USD 3.53 Billion | |

| USD 5.02 Billion | |

|

|

|

|

全球糖尿病檢測市場細分,按方法(ELISA、即時檢驗、酶促分析、比色分析等)、產品類型(儀器、檢測試劑盒和試劑)、疾病類型(1 型糖尿病、2 型糖尿病和妊娠期糖尿病)、最終用戶(醫院、家庭護理、專科診所等)、分銷渠道(醫院藥房、在線藥房和零售藥房)進行細分 - 20 年至 203 年)

糖尿病檢測市場規模

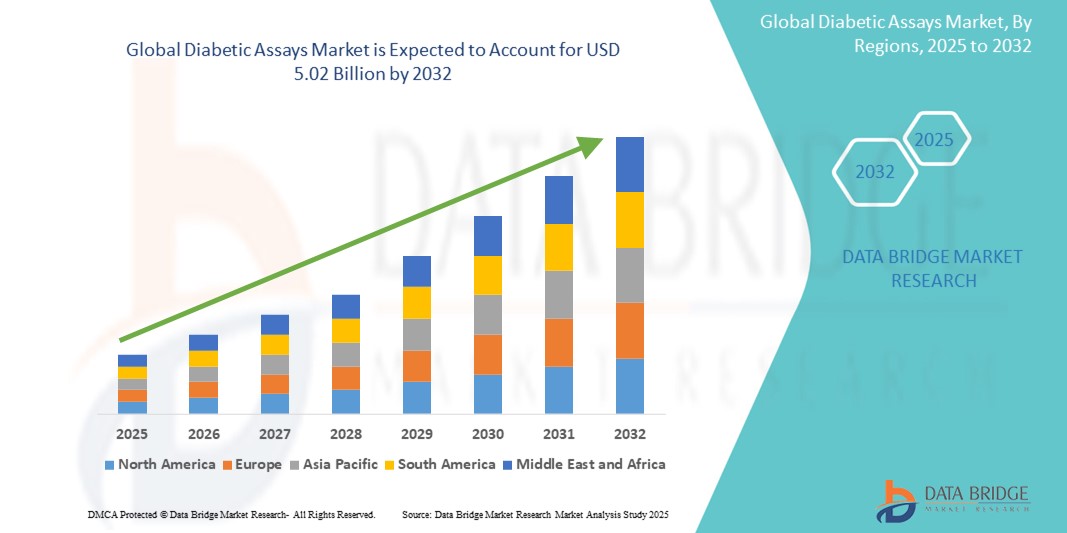

- 2024 年全球糖尿病檢測市場規模為35.3 億美元 ,預計 到 2032 年將達到 50.2 億美元,預測期內 複合年增長率為 4.50%。

- 市場成長主要源自於全球糖尿病盛行率的上升,以及檢測技術的進步,這些技術使得診斷解決方案更快、更準確、更具成本效益。即時檢測和持續血糖監測系統的普及也進一步促進了市場擴張。

- 此外,醫療保健提供者和患者對糖尿病早期診斷和持續監測意識的不斷增強,以及政府大力推廣糖尿病篩檢計劃,正在推動全球對糖尿病檢測產品的需求。這些因素共同推動了糖尿病檢測市場的快速成長。

糖尿病檢測市場分析

- 糖尿病檢測涵蓋一系列用於檢測和監測葡萄糖、胰島素和糖化血紅蛋白 (HbA1c ) 等生物標記的診斷工具,由於其準確性高、結果快速、與自動化和即時診斷系統兼容,已成為臨床和家庭護理環境中現代糖尿病管理中越來越重要的組成部分。

- 糖尿病檢測需求的不斷增長,主要源於全球糖尿病負擔的不斷加重、早期診斷檢測意識的不斷提高,以及促進高效、頻繁監測的技術先進的診斷平台的普及。

- 北美在糖尿病檢測市場佔據主導地位,2024 年的收入份額最大,為 38.5%,其特點是糖尿病患病率高、醫療基礎設施先進,並得到政府和私人組織的大力支持,促進早期發現和疾病管理

- 由於糖尿病人口不斷增加、醫療診斷管道不斷改善以及對常規血糖和糖化血紅蛋白檢測重要性的認識不斷提高,預計亞太地區將成為預測期內糖尿病檢測市場增長最快的地區

- 酶法測定領域在糖尿病測定市場佔據主導地位,2024 年的市場份額為 45.5%,這得益於其高靈敏度、準確性以及在葡萄糖和糖化血紅蛋白 (HbA1c) 檢測臨床診斷中的廣泛應用

報告範圍和糖尿病檢測市場細分

|

屬性 |

糖尿病檢測關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

歐洲

亞太

中東和非洲

南美洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深入的專家分析、定價分析、品牌份額分析、消費者調查、人口統計分析、供應鏈分析、價值鏈分析、原材料/消耗品概述、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

糖尿病檢測市場趨勢

“即時護理和自動化檢測的技術進步”

- 全球糖尿病檢測市場的一個重要且加速發展的趨勢是即時診斷 (POC) 和自動化檢測解決方案技術的快速進步,使得臨床和家庭護理環境中的診斷體驗更加快捷、準確且用戶友好。這些創新正在重塑糖尿病監測,提高可及性,縮短週轉時間,並增強檢測結果的可靠性。

- For instance, Abbott’s FreeStyle Libre system exemplifies how continuous glucose monitoring (CGM) technologies are integrating with mobile applications to provide real-time glucose readings without the need for traditional finger-prick testing. Roche’s Cobas systems are another instance, automating HbA1c and glucose testing for centralized laboratories with high throughput and precision

- The evolution of diabetic assays is also marked by the use of miniaturized biosensors and microfluidic platforms that support compact and portable diagnostic devices. These advancements facilitate convenient self-monitoring and frequent testing, particularly beneficial for managing Type 2 diabetes, which often requires continuous lifestyle and treatment adjustments

- The integration of diabetic testing devices with smartphone apps and cloud-based platforms is enabling remote monitoring and data sharing with healthcare providers, supporting telemedicine and personalized treatment plans. For instance, Bio-Rad’s D-10 system and PTS Diagnostics’ CardioChek analyzers enable consistent tracking of HbA1c and lipid levels, with digital connectivity enhancing patient engagement and clinical decision-making

- This trend toward faster, more connected, and user-centric diagnostic technologies is fundamentally transforming how patients and clinicians manage diabetes. As a result, companies such as Siemens Healthineers and Dexcom are focusing on AI-supported diagnostics, compact multi-analyte devices, and POC solutions that combine clinical-grade accuracy with real-time data integration

- The growing demand for diabetic assays that offer speed, precision, and digital connectivity is accelerating across both high-income and emerging economies, driven by the increasing burden of diabetes, healthcare digitalization, and the shift toward value-based care

Diabetic Assays Market Dynamics

Driver

“Increasing Diabetes Prevalence and Demand for Early, Accurate Diagnosis”

- The global rise in diabetes prevalence, driven by sedentary lifestyles, unhealthy diets, and aging populations, is a major driver of demand for diabetic assays, which are essential for timely diagnosis and effective disease management across all age groups

- For instance, in 2024, the International Diabetes Federation (IDF) estimated that over 537 million adults globally are living with diabetes, with projections reaching 643 million by 2030. This alarming increase is pushing healthcare systems and diagnostic companies to prioritize early and accessible testing solutions, boosting the adoption of diabetic assay technologies

- Accurate and early detection of blood glucose levels, HbA1c, insulin, and other biomarkers is critical for initiating treatment plans and preventing long-term complications such as neuropathy, retinopathy, and cardiovascular diseases. Diabetic assays offer this clinical value, positioning them as indispensable tools in chronic disease monitoring

- In addition, growing public and private healthcare investments in diabetes screening and awareness programs are supporting the increased deployment of diagnostic kits and point-of-care testing devices in both urban and rural areas, particularly in developing regions.

- Technological advancements such as lab-on-a-chip platforms, biosensors, and integration with mobile health apps are making diabetic assays more accessible, faster, and easier to use. These innovations enhance patient compliance and enable decentralized testing outside of traditional clinical settings

- The demand for precise, reliable, and patient-friendly diagnostic tools continues to grow as healthcare providers and governments focus on reducing the global burden of diabetes. As a result, diabetic assays are becoming central to routine screenings, personalized therapy plans, and value-based healthcare strategies

Restraint/Challenge

“Regulatory Complexities and High Cost of Advanced Diagnostic Solutions”

- Regulatory hurdles and the high cost associated with advanced diagnostic technologies present significant challenges to the widespread adoption of diabetic assays, especially in low- and middle-income countries. Stringent regulatory approval processes for new diagnostic assays often delay product launches and market availability, thereby slowing innovation diffusion and limiting access in key regions

- For instance, companies developing novel HbA1c or biosensor-based glucose assays must undergo rigorous clinical validation and approval from authorities such as the FDA, EMA, or regional equivalents, which can be time-consuming and resource-intensive

- In addition, the cost of high-performance diabetic diagnostic systems—particularly automated platforms and continuous glucose monitoring (CGM) devices—can be prohibitive for smaller clinics and patients without sufficient insurance coverage. This is particularly evident in developing countries, where healthcare budgets are constrained and access to reliable diagnostic tools remains inconsistent

- Despite the introduction of lower-cost point-of-care kits and test strips, advanced diagnostics such as integrated analyzers or mobile-connected devices remain out of reach for many healthcare providers and individuals. Moreover, recurrent expenses related to consumables, calibration, and maintenance can further increase the economic burden

- The complexity of diagnostic reimbursement policies across regions, coupled with the lack of standardized diagnostic practices, also contributes to uneven adoption. This variability makes it difficult for global manufacturers to scale efficiently and ensure affordability

- 克服這些挑戰需要對成本效益高的創新、監管協調以及旨在提高可及性和可負擔性的國際合作進行策略性投資。增強對預防性糖尿病篩檢計畫的認識和支持,也能在緩解這些障礙和促進長期市場成長方面發揮關鍵作用。

糖尿病檢測市場範圍

市場根據方法、產品類型、疾病類型、最終用戶和分銷管道進行細分。

- 依方法

根據方法,糖尿病檢測市場可細分為酵素連結免疫吸附試驗 (ELISA)、即時檢測、酵素分析、比色分析等。酵素分析領域在2024年佔據最大的市場收入份額,達到45.5%,這得益於其高特異性、高靈敏度以及對葡萄糖和糖化血紅蛋白 (HbA1c) 定量分析的適用性。由於這些檢測方法在檢測與糖尿病相關的代謝變化方面具有可靠性,因此在臨床實驗室和自動化平台中被廣泛採用。

預計2025年至2032年間,即時診斷(POCT)市場將迎來最快成長,這得益於家庭和門診對快速、現場糖尿病診斷和監測的需求不斷增長。 POCT能夠提供即時結果,有助於早期介入和改善疾病管理,尤其是在資源有限的環境中。

- 依產品類型

根據產品類型,糖尿病檢測市場可細分為儀器、檢測試劑盒和試劑。由於檢測試劑盒在專業醫療機構和個人監測領域的廣泛應用,其在2024年佔據了最大的市場收入份額。這些試劑盒兼具經濟實惠、便攜性和易用性,使其成為常規血糖和糖化血紅蛋白(HbA1c)檢測的必備工具。

預計試劑市場將在2025年至2032年期間實現最高的複合年增長率,這得益於檢測化學領域的持續創新,以及對兼容先進分析儀和自動化平台的高通量試劑日益增長的需求。試劑是診斷性能的核心,對於準確的生化測量至關重要。

- 依疾病類型

依疾病類型,糖尿病檢測市場可分為第1型糖尿病、第2型糖尿病和妊娠糖尿病。 2型糖尿病將在2024年佔據市場主導地位,佔據糖尿病檢測應用的絕大部分,因為2型糖尿病在全球的患病率很高,且在老齡化和肥胖人群中的發病率不斷上升。對常規監測和早期檢測的日益重視,進一步加速了該領域檢測的應用。

預計妊娠糖尿病領域將以最快的速度成長,這得益於人們對產婦和新生兒併發症的認識不斷提高,以及整個醫療保健系統越來越多地實施產前篩檢方案。

- 按最終用戶

根據最終用戶,糖尿病檢測市場可細分為醫院、家庭護理、專科診所和其他。醫院在2024年佔據了最大的市場份額,這得益於其集中式診斷基礎設施、更高的患者流量以及用於糖尿病篩檢和管理的先進實驗室儀器。

預計在預測期內,家庭護理領域將以最快的速度增長,這得益於糖尿病患病率的上升、老齡人口的增長以及個性化家庭診斷解決方案的趨勢。便攜式血糖儀和數位血糖儀的日益普及,顯著提高了家庭血糖檢測的可行性。

- 按分銷管道

根據分銷管道,糖尿病檢測市場可細分為醫院藥房、線上藥房和零售藥房。 2024年,醫院藥局將引領糖尿病檢測市場,這得益於與醫療保健提供者的緊密整合,以及住院和門診患者均可立即獲得診斷耗材和試劑盒。

預計線上藥局市場將在2025年至2032年期間實現最高的複合年增長率,這得益於電子商務滲透率的提高、便利性的提升以及遠距醫療平台的興起。越來越多的消費者,尤其是在城市和精通科技的人群中,轉向線上平台來滿足經常性的診斷需求。

糖尿病檢測市場區域分析

- 北美在糖尿病檢測市場佔據主導地位,2024 年的收入份額最大,為 38.5%,這得益於糖尿病的高盛行率、先進的醫療基礎設施以及政府和私人組織大力支持早期發現和疾病管理

- 該地區廣泛實施常規糖尿病篩檢計劃,加上優惠的報銷政策和完善的臨床實驗室,大大促進了醫院和診斷中心對糖尿病檢測產品的需求

- 此外,關鍵參與者的存在、正在進行的研發活動以及對早期疾病檢測和個人化治療的日益重視,正在促進北美糖尿病檢測市場的持續擴張

美國糖尿病檢測市場洞察

2024年,美國糖尿病檢測市場佔據北美地區最大的收入份額,達83.5%,這得益於該國的高糖尿病盛行率、積極的醫療政策以及先進的診斷能力。對早期疾病檢測和個人化糖尿病管理的日益重視,使得酵素法和ELISA檢測技術得到廣泛應用。此外,雄厚的科學研究資金、領先的診斷公司以及民眾的高篩檢意識,有力地支持了公立和私立醫療機構的市場成長。

歐洲糖尿病檢測市場洞察

預計歐洲糖尿病檢測市場在整個預測期內將以顯著的複合年增長率擴張,這主要得益於各主要經濟體醫療保健支出的不斷增長以及糖尿病負擔的日益加重。隨著各國政府大力重視預防性醫療措施,糖尿病篩檢計畫正在蓬勃發展,尤其是在德國、法國和義大利等國家。此外,該地區向分散式診斷和即時檢測的轉變,也推動了初級保健機構和家庭護理機構對快速可靠的糖尿病檢測試劑盒的需求。

英國糖尿病檢測市場洞察

英國糖尿病檢測市場預計在預測期內將實現顯著的複合年增長率,這得益於國家透過早期檢測和公眾意識提升舉措應對糖尿病發病率上升的努力。英國國家醫療服務體系 (NHS) 及其附屬機構持續投資診斷技術,以降低長期醫療保健成本,從而為糖尿病檢測製造商創造了有利條件。此外,技術創新以及醫療保健提供者和診斷公司之間的合作正在加速自動化和家用檢測解決方案的普及。

德國糖尿病檢測市場洞察

受強大的診斷基礎設施和日益重視預防保健的推動,德國糖尿病檢測市場預計將以可觀的複合年增長率擴張。德國的全民健保覆蓋,加上對慢性病管理資金的增加,支持了醫院、診所和專業診斷實驗室的常規糖尿病檢測。由於高度重視準確性和效率,德國門診和機構對高靈敏度檢測試劑盒(尤其是酵素法和 ELISA 試劑盒)的需求日益增長。

亞太糖尿病檢測市場洞察

在2025年至2032年的預測期內,亞太地區糖尿病檢測市場預計將以25.3%的複合年增長率保持高速增長,這得益於該地區日益加重的糖尿病負擔、醫療保健覆蓋面的擴大以及人們對定期血糖監測的認識不斷提高。中國、印度和日本等國家正透過大規模公共衛生運動和政府支持的慢性病篩檢計畫推動區域成長。此外,本土診斷設備製造商的不斷壯大以及即時檢測技術的創新,使得糖尿病檢測在各個人群中都更容易獲得且價格更實惠。

日本糖尿病檢測市場洞察

由於日本人口老化、糖尿病高發生率以及對預防性診斷的重視,日本糖尿病檢測市場正在蓬勃發展。日本先進的醫療基礎設施以及人工智慧在診斷領域的應用,正在提升基於檢測的糖尿病檢測的可靠性和速度。此外,政府機構與私人企業之間的合作,使得即時診斷試劑盒在社區診所、養老院和家庭環境中得到廣泛應用,從而促進了早期幹預和持續的疾病管理。

印度糖尿病檢測市場洞察

2024年,印度糖尿病檢測市場佔據亞太地區最大市場份額,這得益於該國不斷擴展的醫療基礎設施、不斷增長的糖尿病患者群體以及政府主導的篩檢計畫。快速的城市化和久坐生活方式的轉變導致糖尿病患者數量激增,從而刺激了對診斷檢測的需求。國內製造商和新創公司也發揮關鍵作用,他們為農村和服務欠缺地區提供經濟高效且便捷的檢測解決方案,從而顯著拓展了市場覆蓋範圍。

糖尿病檢測市場佔有率

糖尿病檢測產業主要由知名公司主導,包括:

- Abbvie, Inc(美國)

- 諾華公司(瑞士)

- 梯瓦製藥工業股份有限公司(以色列)

- 輝瑞公司(美國)

- 默克公司(美國)

- 雅培(美國)

- 西門子(德國)

- Dynatronics公司(美國)

- 生物梅里埃(法國)

- Bio-Rad Laboratories, Inc.(美國)

- BAG Diagnostics GmbH(德國)

- DiaSorin SpA(義大利)

- DRG INSTRUMENTS GMBH(德國)

- PTS Diagnostics(美國)

- QuidelOrtho Corporation(美國)

- Diazyme Laboratories(美國)

- ETHOS BIOSCIENCES(美國)

- 上元科技股份有限公司 (台灣)

- Monobind Inc.(美國)

全球糖尿病檢測市場的最新發展

- 2024年3月,雅培實驗室推出了新一代FreeStyle Libre 3連續血糖監測系統,該系統具有更高的準確性和即時血糖數據傳輸功能。此次升級為糖尿病患者提供了更強大的監測功能,支援更精準的血糖控制和主動管理。雅培的這項進步彰顯了其致力於將創新感測器技術與用戶友好的行動應用程式相結合的承諾。

- 2024年2月,羅氏診斷推出了一款專為即時診斷設計的新型酵素法快速糖化血紅素(HbA1c)檢測試劑盒。此檢測試劑盒可在幾分鐘內提供準確結果,有助於在臨床環境中及時診斷和監測糖尿病。羅氏的研發滿足了初級保健和專科診所對便利、可靠、快速的糖尿病檢測日益增長的需求。

- 2024年1月,西門子醫療擴展了其產品組合,推出了一款針對2型糖尿病生物標記優化的先進試劑盒。新試劑盒提高了靈敏度和特異性,從而改善了早期檢測和個人化治療策略。西門子的創新凸顯了糖尿病照護中精準診斷日益增長的趨勢。

- 2023年12月,Bio-Rad實驗室宣布推出一款針對懷孕期間糖尿病的比色檢測試劑盒。該試劑盒可在妊娠期間進行非侵入性快速篩檢,從而實現早期幹預以減少併發症。 Bio-Rad的產品擴展有助於應對全球妊娠期糖尿病盛行率的上升。

- 2023年11月,Dexcom, Inc. 推出了其連續血糖監測 (CGM) 設備的增強型軟體整合功能,可與醫療保健提供者無縫共享數據,並與電子健康記錄 (EHR) 整合。這項改進有助於改善遠端患者監測和個人化糖尿病管理。 Dexcom 致力於數位健康創新,使其在糖尿病檢測市場中佔據強勢地位。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。