Global Clinical Laboratory Tests Market

市场规模(十亿美元)

CAGR :

%

USD

206,645.00 Billion

USD

399,819.07 Billion

2021

2029

USD

206,645.00 Billion

USD

399,819.07 Billion

2021

2029

| 2022 –2029 | |

| USD 206,645.00 Billion | |

| USD 399,819.07 Billion | |

|

|

|

|

全球臨床實驗室測試市場,按測試類型、臨床(全面測試或全身測試)、完整身體計數、基本代謝組 (BMP)、HGB/HCT)、測試、糖化血紅蛋白 (HbA1c) 測試、尿素氮 (BUN)肌酸酐測試、電解質測試、腎臟組測試、脂質組測試、常規、專業)、應用(寄生蟲學、血液學、病毒學、毒理學、免疫學/血清學、組織病理學和尿液分析)、最終用戶(醫院實驗室、診所實驗室、中央/獨立實驗室、醫生辦公室實驗室和其他 - 零售診所)– 行業趨勢和預測到 2029 年。

臨床實驗室測試市場分析和規模

根據世界衛生組織的數據,每年有超過1700萬人死於由各種不健康行為、高血壓和高膽固醇引起的心血管疾病。肝硬化、肝炎、肝癌、骨骼疾病、膽管阻塞和自體免疫疾病都屬於肝病專科。肝炎在2019年佔比最高,而由於生活方式紊亂以及菸酒消費的增加,預計肝硬化將成為預測期內增長最快的專科。

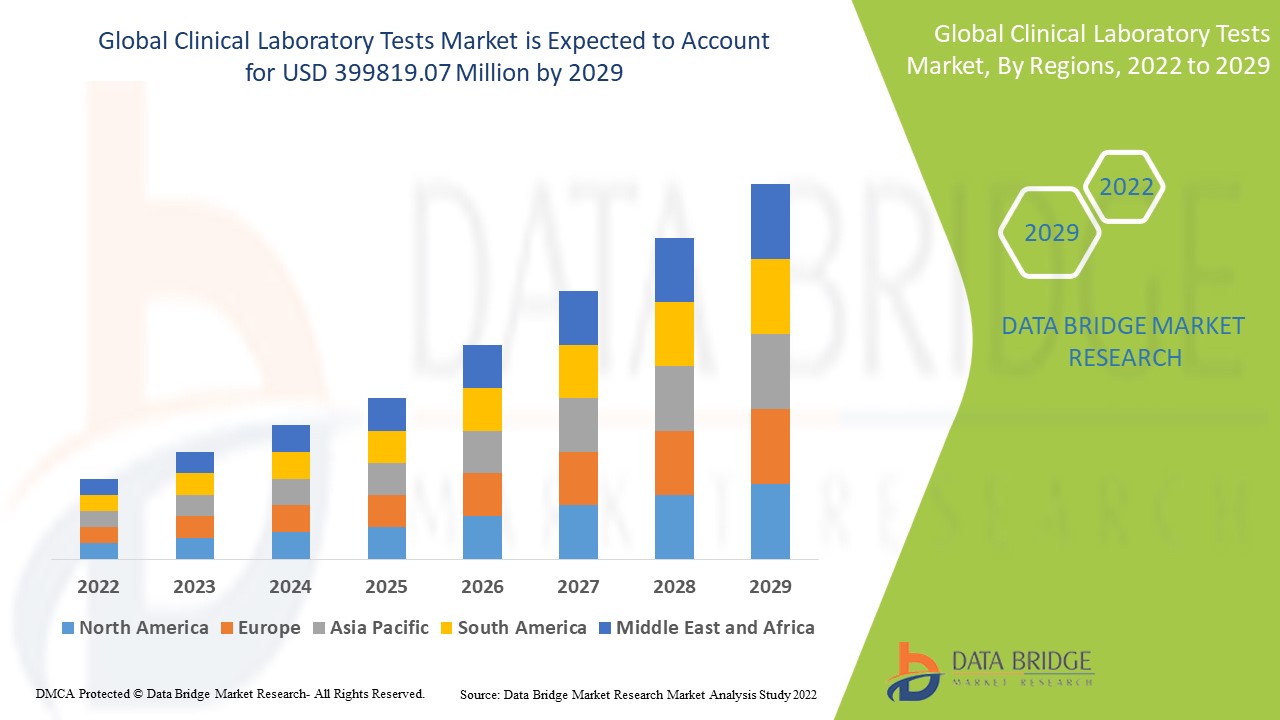

Data Bridge Market Research 分析稱,2021 年臨床實驗室測試市場規模為 2066.45 億美元,預計到 2029 年將達到 3998.1907 億美元,在 2022 年至 2029 年的預測期內複合年增長率為 8.6%。除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察外,Data Bridge Market Research 策劃的市場報告還包括深度專家分析、患者流行病學、管道分析、定價分析和監管框架。

臨床實驗室測試市場範圍和細分

|

報告指標 |

細節 |

|

預測期 |

2022年至2029年 |

|

基準年 |

2021 |

|

歷史歲月 |

2020(可自訂為 2014 - 2019) |

|

定量單位 |

收入(百萬美元)、銷售(單位)、定價(美元) |

|

涵蓋的領域 |

測試類型、臨床(全面綜合測試或全身測試)、CBC(全身計數)、基本代謝組 (BMP)、HGB/HCT)、測試、HbA1c 測試、BUN 肌酸酐測試、電解質測試、腎臟組學測試、脂質組測試、常規、專業)、應用(寄生蟲學、血液學、病毒學、毒理學、免疫組學、研究實驗室、其他診所零售診所) |

|

覆蓋國家 |

北美洲的美國、加拿大和墨西哥、德國、法國、英國、荷蘭、瑞士、比利時、俄羅斯、義大利、西班牙、土耳其、歐洲的其他地區、中國、日本、印度、韓國、新加坡、馬來西亞、澳洲、泰國、印尼、菲律賓、亞太地區(APAC)的其他地區、沙烏地阿拉伯、阿拉伯聯合大公國、南非、埃及、以色列、中東和非洲(MEA)的其他地區(MEA)的其他地區。 |

|

涵蓋的市場參與者 |

雅培(美國)、ARUP Laboratories(美國)、OPKO Health, Inc.(美國)、ioscientia Healthcare GmbH(德國)、Charles River Laboratories(美國)、NeoGenomics Laboratories(美國)、Genoptix, Inc.(美國)、Healthscope(澳洲)、The Laboratory(美國)、Genoplos, Inc.(美國)、Healthscope(澳洲)、The Laboratory(美國)(美國)、標準) KGaA(德國)、QIAGEN(德國)、Quest Diagnostics Incorporated(美國)、Siemens Healthcare Private Limited(德國)、Tulip Diagnostics (P) Ltd.(印度)、Sonic Healthcare Limited(澳洲)、Merck KGaA(德國) |

|

市場機會 |

|

市場定義

臨床實驗室檢測結果用於臨床醫學的診斷決策。臨床實驗室檢測分為三類。美國食品藥物管理局 (FDA) 使用評分系統來確定已獲準臨床使用的檢測類別,該系統綜合考慮檢測的複雜性、校準品和品控品的穩定性、所需的分析前步驟以及結果解讀的必要性。檢測樣本由技術人員或醫生進行分析,以確定結果是否在正常範圍內。臨床實驗室是一種醫療服務機構,提供廣泛的研究技術,幫助醫生進行診斷、治療介入和患者監督。這些實驗室由醫學技術人員(臨床實驗室物理學家)運營,他們有資格對從患者身上採集的生物樣本進行實驗。絕大多數臨床實驗室位於醫療機構內或附近,方便醫師和病患使用。臨床實驗室的分類表明,這些機構可以進行滿足臨床和公共衛生需求的高品質實驗室實驗。

全球臨床實驗室測試市場動態

驅動程式

- 老年人口的成長將推動成長率

預計老年人口的成長將推動整個臨床實驗室檢測市場的發展。根據《世界人口展望:2019年修訂版》的數據,2019年全球約每11人中就有1人年齡超過65歲,預計到2050年,全球約每6人中就有1人年齡超過65歲。臨床實驗室檢測越來越多地被用於診斷與年齡相關的疾病。

此外,運動不足、不健康飲食以及由此導致的肥胖病例增加,預計將增加各種慢性疾病的盛行率。世界各地的醫療保健專業人員和患者越來越意識到定期進行體檢的重要性,這推動了對臨床實驗室檢測的需求。

- 目標疾病盛行率上升

預計預測期內,心血管疾病和糖尿病等目標疾病盛行率的上升將推動市場成長。心血管疾病是全球主要死亡原因。心血管疾病相關未滿足的醫療需求以及患者意識的提高預計將推動即時血脂檢測的需求。世界衛生組織預測,心血管疾病將在2021年成為死亡和發病的主要原因。在過去的三十年中,已有1,770萬人死於心血管疾病,佔全球死亡人數的31%。

肥胖等生活方式相關疾病的盛行率不斷上升、全球吸煙趨勢以及不健康飲食是導致全球腎臟和脂質相關疾病發病率上升的因素之一。此外,隨著全球糖尿病盛行率的上升,需要進行臨床實驗室檢查的患者數量也在增加。

機會

- 臨床實驗室測試的創新解決方案

旨在提高效率和消除錯誤的創新解決方案預計將成為該行業的主要驅動力。整合工作流程管理系統、資料庫管理工具和病患檢測記錄在醫療保健產業中正變得越來越重要,各機構每年要處理1,000億至1,500億個樣本。為保障平穩營運而實施和開發資料管理和資訊學解決方案預計將推動市場成長。

限制/挑戰

- 嚴格的政府指導方針將限製成長率

嚴格的政府實驗室研究指導方針和法規是限制市場成長的主要因素。臨床實驗室產品的品質維護由各國特定的監管機構管理。這些機構確保免受設備或週邊設備在設計、技術、包裝和製造方面缺陷所造成的風險。

- 監理框架不明確

醫療保健產業嚴重依賴美國FDA和EMA等機構制定的監管架構。而中國和印度等新興市場對診斷業務並沒有具體的監管要求。實驗室設計檢測(LDT)是由內部臨床實驗室開發的檢測,能夠提供準確及時的結果。 LDT風險可能會降低利潤率,並導致新設計檢測的上市延遲。這一因素阻礙了全球臨床實驗室檢測市場的成長。

本臨床實驗室檢測市場報告詳細介紹了最新發展動態、貿易法規、進出口分析、生產分析、價值鏈優化、市場份額、國內和本地市場參與者的影響,並分析了新興收入來源、市場法規變化、戰略市場增長分析、市場規模、品類市場增長、應用領域和市場主導地位、產品審批、產品發布、地域擴張以及市場技術創新等方面的機遇。如需了解更多關於臨床實驗室檢測市場的信息,請聯繫 Data Bridge 市場研究部門獲取分析師簡報,我們的團隊將幫助您做出明智的市場決策,實現市場成長。

近期動態

- 2022 年 4 月,總部位於新澤西州錫考卡斯的 Quest Diagnostics 宣布了一系列組織變革和高階領導任命,以更好地支持公司加速成長和推動卓越營運的兩點業務策略。

- 2022年4月,雅培更新了其數位健康應用程序,新增了慢性疼痛神經刺激設備,方便臨床醫生監測患者治療反應。在使用雅培Proclaim系列設備進行脊髓刺激(SCS)或背根神經節(DRG)治療時,Neurosphere myPath應用程式可以測量並報告患者感知的疼痛緩解情況和整體健康狀況。

全球臨床實驗室測試市場範圍

臨床實驗室檢測市場根據檢測類型、應用和最終用戶進行細分。這些細分市場的成長將有助於您分析行業中成長乏力的細分市場,並為用戶提供有價值的市場概覽和市場洞察,幫助他們做出策略決策,確定核心市場應用。

測試類型

- 臨床

- 完成綜合測試或全身測試

- 完整體檢計數(CBC)

- 基礎代謝組(BMP)

- 血紅素/血球比容

- 糖化血紅素 (HbA1c) 測試

- 尿素氮肌酸酐檢測

- 電解質測試

- 腎臟檢查

- 血脂檢查

- 肝炎

- 膽管阻塞

- 肝硬化

- 肝癌

- 骨病

- 自體免疫疾病

- 其他的

- 常規

- 專業

應用

- 寄生蟲學

- 血液學

- 病毒學

- 毒理學

- 免疫學/血清學

- 組織病理學

- 尿液分析

最終用戶

- 醫院實驗室

- 診所實驗室

- 中央/獨立實驗室

- 醫生辦公室實驗室

- 零售診所

- 其他

臨床實驗室測試市場區域分析/洞察

對臨床實驗室測試市場進行了分析,並按國家、測試類型、應用和最終用戶提供了市場規模洞察和趨勢,如上所述。

臨床實驗室測試市場報告涵蓋的國家有:北美的美國、加拿大和墨西哥、歐洲的德國、法國、英國、荷蘭、瑞士、比利時、俄羅斯、義大利、西班牙、土耳其、歐洲其他地區、中國、日本、印度、韓國、新加坡、馬來西亞、澳洲、泰國、印尼、菲律賓、亞太地區(APAC)的其他地區、沙烏地阿拉伯、阿聯酋、南非、澳洲、泰國、其他國家(歐洲)的其他地區(非洲歐洲地區)。

北美在臨床實驗室檢測市場佔據主導地位,這得益於該地區眾多製藥公司以及生物技術公司的廣泛存在。此外,技術的不斷進步也推動著該地區市場的發展,而老年人口的不斷增長也增加了對診斷技術的需求。

由於研發部門的不斷發展以及對醫療保健部門的投資不斷增加,預計亞太地區將在 2022 年至 2029 年的預測期內實現最高成長率。

報告的國家部分還提供了各個市場的影響因素以及國內市場監管變化,這些變化會影響市場的當前和未來趨勢。下游和上游價值鏈分析、技術趨勢、波特五力模型分析以及案例研究等數據點是預測各國市場狀況的一些指標。此外,在對國家/地區數據進行預測分析時,還考慮了全球品牌的存在和可用性,以及它們因本土和國內品牌的激烈競爭或稀缺而面臨的挑戰,國內關稅和貿易路線的影響。

醫療保健基礎設施成長安裝基礎和新技術滲透

臨床實驗室檢測市場還為您提供詳細的市場分析,涵蓋各國資本設備醫療支出的增長情況、臨床實驗室檢測市場中各類產品的安裝基數、生命線曲線技術的影響以及醫療監管環境的變化及其對臨床實驗室檢測市場的影響。數據涵蓋2010年至2020年的歷史時期。

競爭格局和臨床實驗室測試市場份額分析

臨床實驗室檢測市場競爭格局提供了按競爭對手劃分的詳細資訊。詳細資訊包括公司概況、公司財務狀況、收入、市場潛力、研發投入、新市場計劃、全球佈局、生產基地和設施、生產能力、公司優勢和劣勢、產品發布、產品寬度和廣度以及應用主導地位。以上提供的數據僅與公司在臨床實驗室檢測市場的重點相關。

臨床實驗室測試市場的一些主要參與者包括:

- 雅培(美國)

- ARUP實驗室(美國)

- OPKO Health, Inc.(美國)

- Bioscientia Healthcare GmbH(德國)

- Charles River Laboratories(美國)

- NeoGenomics Laboratories(美國)

- Genoptix, Inc.(美國)

- Healthscope(澳洲)

- 實驗室玻璃器皿公司(美國)

- 美國實驗室控股公司(美國)

- 費森尤斯醫療保健股份公司(德國)

- QIAGEN(德國)

- Quest Diagnostics Incorporated(美國)

- 西門子醫療私人有限公司(德國)

- Tulip Diagnostics (P) Ltd.(印度)

- Sonic Healthcare Limited(澳洲)

- 默克集團(德國)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CLINICAL LABORATORY TESTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL CLINICAL LABORATORY TESTS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VOLUME

2.2.11 VENDOR SHARE ANALYSIS

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL CLINICAL LABORATORY TESTS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTLE ANALYSIS

5.2 PORTER’S FIVE FORCES

6 REGULATORY SCENARIO

7 INDUSTRY INSIGHTS

8 IMPACT OF COVID-19 PANDEMIC ON THE MARKET

8.1 PRICE IMPACT

8.2 IMPACT ON DEMAND

8.3 IMPACT ON SUPPLY CHAIN

8.4 STRATEGIC DECISION FOR MANUFACTURERS

8.5 CONCLUSION

9 GLOBAL CLINICAL LABORATORY TESTS MARKET, BY TEST

9.1 OVERVIEW

9.2 CLINICAL

9.3 COMPLETE COMPREHENSIVE TEST OR COMPLETE BODY TEST

9.4 COMPLETE BODY COUNT (CBC)

9.5 BASIC METABOLIC PANEL (BMP)

9.6 HGB/HCT

9.7 HBA1C TESTS

9.8 BUN CREATININE TESTS

9.9 ELECTROLYTES TESTS

9.1 RENAL PANEL TESTS

9.11 LIPID PANEL TESTS

9.12 HEPATITIS

9.13 BILE DUCT OBSTRUCTION

9.14 LIVER PANNEL TESTS

9.14.1 HEPATITIS

9.14.2 BILE DUCT OBSTRUCTION

9.14.3 LIVER CIRRHOSIS

9.14.4 LIVER CANCER

9.14.5 BONE DISEASE

9.14.6 AUTOIMMUNE DISORDERS

9.14.7 OTHERS

9.15 BONE DISEASE TEST

9.16 AUTOIMMUNE DISORDERS TEST

9.17 OTHERS

10 GLOBAL CLINICAL LABORATORY TESTS MARKET, BY TYPE

10.1 OVERVIEW

10.2 ROUTINE

10.3 SPECIALTY

11 GLOBAL CLINICAL LABORATORY TESTS MARKET, BY APPLICATIONS

11.1 OVERVIEW

11.2 PARASITOLOGY

11.3 HEMATOLOGY

11.4 VIROLOGY

11.5 TOXICOLOGY

11.6 IMMUNOLOGY/SEROLOGY

11.7 URINALYSIS

11.8 OTHERS

12 GLOBAL CLINICAL LABORATORY TESTS MARKET, BY SPECIALTY

12.1 ORGAN FUNCTION TESTS

12.1.1 KIDNEY

12.1.1.1. CREATININE

12.1.1.2. UREA

12.1.1.3. URIC ACID

12.1.1.4. OTHERS

12.1.2 LIVER

12.1.2.1. AST

12.1.2.2. ALT

12.1.2.3. AST & ALT

12.1.2.4. LDH

12.1.2.5. BILIRUBIN

12.1.2.6. OTHERS

12.1.3 PANCREAS

12.1.3.1. AMYLASE

12.1.3.2. LIPASE

12.1.4 CARDIOVASCULAR

12.1.4.1. TOTAL CHOLESTEROL

12.1.4.2. TRIGLYCERIDES

12.1.4.3. HDL-CHOLESTEROL

12.1.4.4. LDL-CHOLESTEROL

12.1.5 OTHERS

12.2 HORMONE LEVEL TESTS

12.2.1 CORTISOL

12.2.2 TESTOSTERONE

12.2.3 FOLLICLE-STIMULATING HORMONE

12.2.4 LUTEINIZING HORMONE (LH)

12.2.5 ESTRADIOL

12.2.6 PROGESTERONE

12.2.7 PROLACTIN

12.2.8 OTHERS

12.3 SCREENING TESTS

12.3.1 COMPLETE BLOOD COUNT

12.3.1.1. HAEMOGLOBIN

12.3.1.2. RBC & HEMATOCRIT (HCT)

12.3.1.3. WBC (WHITE BLOOD CELLS, LEUKOCYTES)

12.3.1.4. PLATELET

12.3.1.5. OTHERS

12.3.2 PAP SMEAR

12.3.3 URINALYSIS

12.3.4 HGB/HCT TESTING

12.3.5 OTHERS

12.4 INFECTIOUS DISEASE TESTS

12.4.1 FLU PANEL TEST

12.4.2 MONONUCLEOSIS

12.4.3 OTHERS

12.5 SEXUALLY TRANSMITTED INFECTION TESTS

12.5.1 CHLAMYDIA

12.5.2 GONORRHEA

12.5.3 HIV

12.5.4 OTHERS

12.6 CANCER TESTS

12.6.1 LIVER CANCER

12.6.1.1. CA 125

12.6.1.2. PSA,

12.6.1.3. AFP

12.6.1.4. CEA

12.6.1.5. OTHERS

12.6.2 PROSTATE CANCER

12.6.3 OVARIAN CANCER

12.6.4 OTHERS

12.7 AUTOIMMUNE TESTS

12.8 OTHERS

13 GLOBAL CLINICAL LABORATORY TESTS MARKET, BY END USERS

13.1 OVERVIEW

13.2 INDEPENDENT & REFERENCE LABORATORIES

13.3 HOSPITAL-BASED LABORATORIES

13.4 CLINIC-BASED LABORATORIES

13.5 CENTRAL/INDEPENDENT LABORATORIES

13.6 PHYSICIAN OFFICE-BASED LABORATORIES

13.7 OTHERS

14 GLOBAL CLINICAL LABORATORY TESTS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.5 MERGERS & ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT & APPROVALS

14.7 EXPANSIONS

14.8 REGULATORY CHANGES

14.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 GLOBAL CLINICAL LABORATORY TESTS MARKET, BY GEOGRAPHY

GLOBAL CLINICAL LABORATORY TESTS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

15.2 EUROPE

15.2.1 GERMANY

15.2.2 FRANCE

15.2.3 U.K.

15.2.4 HUNGARY

15.2.5 LITHUANIA

15.2.6 AUSTRIA

15.2.7 IRELAND

15.2.8 NORWAY

15.2.9 POLAND

15.2.10 ITALY

15.2.11 SPAIN

15.2.12 RUSSIA

15.2.13 TURKEY

15.2.14 NETHERLANDS

15.2.15 SWITZERLAND

15.2.16 REST OF EUROPE

15.3 ASIA-PACIFIC

15.3.1 JAPAN

15.3.2 CHINA

15.3.3 SOUTH KOREA

15.3.4 INDIA

15.3.5 SINGAPORE

15.3.6 THAILAND

15.3.7 INDONESIA

15.3.8 MALAYSIA

15.3.9 PHILIPPINES

15.3.10 AUSTRALIA

15.3.11 NEW ZEALAND

15.3.12 VIETNAM

15.3.13 TAIWAN

15.3.14 REST OF ASIA-PACIFIC

15.4 SOUTH AMERICA

15.4.1 BRAZIL

15.4.2 ARGENTINA

15.4.3 PERU

15.4.4 REST OF SOUTH AMERICA

15.5 MIDDLE EAST AND AFRICA

15.5.1 SOUTH AFRICA

15.5.2 SAUDI ARABIA

15.5.3 UAE

15.5.4 EGYPT

15.5.5 KUWAIT

15.5.6 ISRAEL

15.5.7 REST OF MIDDLE EAST AND AFRICA

15.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

16 GLOBAL CLINICAL LABORATORY TESTS MARKET, SWOT AND DBMR ANALYSIS

17 GLOBAL CLINICAL LABORATORY TESTS MARKET, COMPANY PROFILE

17.1 ABBOTT

17.1.1 COMPANY OVERVIEW

17.1.2 GEOGRAPHIC PRESENCE

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 ARUP LABORATORIES

17.2.1 COMPANY OVERVIEW

17.2.2 GEOGRAPHIC PRESENCE

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENTS

17.3 OPKO HEALTH, INC.

17.3.1 COMPANY OVERVIEW

17.3.2 GEOGRAPHIC PRESENCE

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 BIOSCIENTIA HEALTHCARE GMBH

17.4.1 COMPANY OVERVIEW

17.4.2 GEOGRAPHIC PRESENCE

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 CHARLES RIVER LABORATORIES

17.5.1 COMPANY OVERVIEW

17.5.2 GEOGRAPHIC PRESENCE

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 NEOGENOMICS LABORATORIES

17.6.1 COMPANY OVERVIEW

17.6.2 GEOGRAPHIC PRESENCE

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 GENOPTIX, INC.

17.7.1 COMPANY OVERVIEW

17.7.2 GEOGRAPHIC PRESENCE

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 HEALTHSCOPE

17.8.1 COMPANY OVERVIEW

17.8.2 GEOGRAPHIC PRESENCE

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 THE LABORATORY GLASSWARE CO.

17.9.1 COMPANY OVERVIEW

17.9.2 GEOGRAPHIC PRESENCE

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.1 LABORATORY CORPORATION OF AMERICA® HOLDINGS

17.10.1 COMPANY OVERVIEW

17.10.2 GEOGRAPHIC PRESENCE

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENTS

17.11 FRESENIUS MEDICAL CARE AG & CO. KGAA

17.11.1 COMPANY OVERVIEW

17.11.2 GEOGRAPHIC PRESENCE

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 QIAGEN

17.12.1 COMPANY OVERVIEW

17.12.2 GEOGRAPHIC PRESENCE

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 QUEST DIAGNOSTICS INCORPORATED

17.13.1 COMPANY OVERVIEW

17.13.2 GEOGRAPHIC PRESENCE

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENTS

17.14 SIEMENS HEALTHCARE PRIVATE LIMITED

17.14.1 COMPANY OVERVIEW

17.14.2 GEOGRAPHIC PRESENCE

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 TULIP DIAGNOSTICS (P) LTD.

17.15.1 COMPANY OVERVIEW

17.15.2 GEOGRAPHIC PRESENCE

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENTS

17.16 SONIC HEALTHCARE LIMITED

17.16.1 COMPANY OVERVIEW

17.16.2 GEOGRAPHIC PRESENCE

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT DEVELOPMENTS

17.17 MERCK KGAA

17.17.1 COMPANY OVERVIEW

17.17.2 GEOGRAPHIC PRESENCE

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENTS

17.18 LABCORP

17.18.1 COMPANY OVERVIEW

17.18.2 GEOGRAPHIC PRESENCE

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENTS

17.19 SPECTRA LABORATORIES

17.19.1 COMPANY OVERVIEW

17.19.2 GEOGRAPHIC PRESENCE

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENTS

17.2 DAVITA HEALTHCARE PARTNERS

17.20.1 COMPANY OVERVIEW

17.20.2 GEOGRAPHIC PRESENCE

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENTS

17.21 ACM MEDICAL LABORATORY

17.21.1 COMPANY OVERVIEW

17.21.2 GEOGRAPHIC PRESENCE

17.21.3 PRODUCT PORTFOLIO

17.21.4 RECENT DEVELOPMENTS

17.22 CEREBA HEALTHCARE

17.22.1 COMPANY OVERVIEW

17.22.2 GEOGRAPHIC PRESENCE

17.22.3 PRODUCT PORTFOLIO

17.22.4 RECENT DEVELOPMENTS

18 RELATED REPORTS

19 CONCLUSION

20 QUESTIONNAIRE

21 ABOUT DATA BRIDGE MARKET RESEARCH

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。