Global Anti Fog Polycarbonate Films And Sheets Market

市场规模(十亿美元)

CAGR :

%

USD

952.59 Million

USD

1,763.19 Million

2025

2033

USD

952.59 Million

USD

1,763.19 Million

2025

2033

| 2026 –2033 | |

| USD 952.59 Million | |

| USD 1,763.19 Million | |

|

|

|

|

全球防霧聚碳酸酯薄膜及板材市場細分,按厚度(0.5毫米以下、5毫米至2毫米、2毫米至5毫米、5毫米至7毫米及7毫米以上)、等級類型(光學級及透明級)、應用(透鏡、鏡子、窗戶、擋風玻璃、電顯示板、屋頂及其他)、最終用途(汽車業、食品飲料、電氣化產業

防霧聚碳酸酯薄膜和片材市場規模

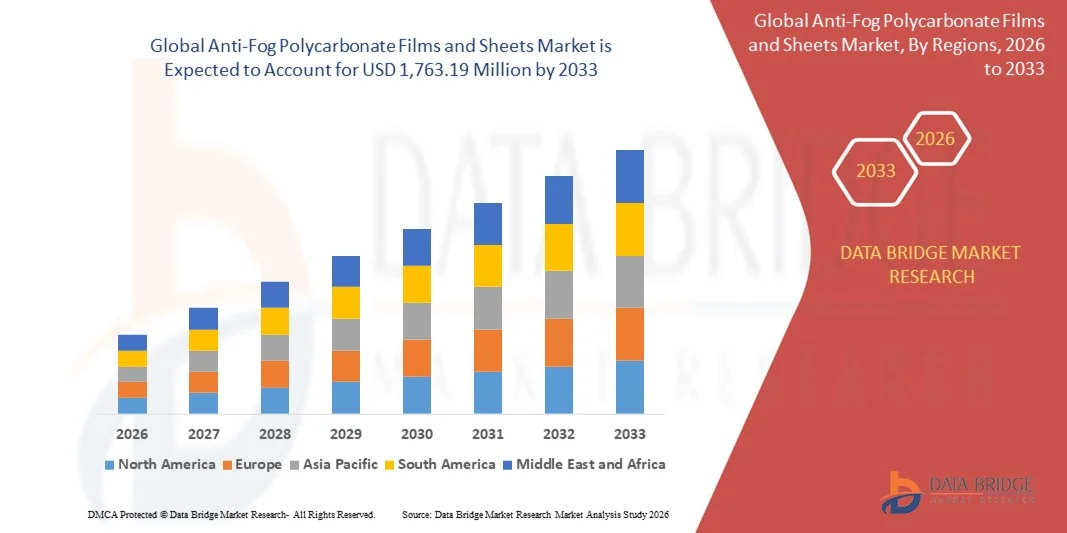

- 2025年全球防霧聚碳酸酯薄膜及片材市場規模為9.5259億美元 ,預計 2033年將達到17.6319億美元,預測期內 複合年增長率為8.00%。

- 市場成長主要得益於汽車、建築和安全設備等應用領域對透明材料需求的不斷增長,在這些領域,防霧性能對於產品性能和用戶安全至關重要。

- 防護眼鏡、面罩和醫療器材中防霧聚碳酸酯薄膜和片材的日益普及,推動了市場擴張,尤其是在人們日益重視衛生和工作場所安全標準的情況下。

防霧聚碳酸酯薄膜和片材市場分析

- 由於市場對兼具耐用性、光學清晰度和防潮性的高性能透明材料的需求不斷增長,防霧聚碳酸酯薄膜和板材市場正經歷穩步增長。

- 為了滿足不斷變化的行業需求,製造商正致力於產品創新、改進表面塗層和增強耐刮擦性,同時也在拓展其在工業、醫療和消費安全領域的應用範圍。

- 預計到2025年,北美地區將佔據防霧聚碳酸酯薄膜和板材市場的主導地位,收入份額最大。這主要得益於市場對安全導向材料、高性能透明板材的強勁需求,以及工業和消費領域對防護設備的日益重視。

- 受汽車和建築業的擴張、防護設備需求的成長以及中國、日本和印度等國家製造能力的提升等因素的推動,亞太地區預計將成為全球防霧聚碳酸酯薄膜和板材市場成長最快的地區。

- 2025年,厚度為0.5毫米至2毫米的薄片佔據了最大的市場份額,這主要得益於其在防護眼鏡、面罩和汽車零件等領域的廣泛應用,這些領域都偏愛輕質柔性材料。此厚度範圍內的薄片兼具耐用性、光學清晰度和易加工性,因此成為多個行業的熱門選擇。

報告範圍及防霧聚碳酸酯薄膜及板材市場細分

|

屬性 |

防霧聚碳酸酯薄膜和片材市場關鍵洞察 |

|

涵蓋部分 |

|

|

覆蓋國家/地區 |

北美洲

歐洲

亞太

中東和非洲

南美洲

|

|

主要市場參與者 |

|

|

市場機遇 |

|

|

加值資料資訊集 |

除了對市場狀況(如市場價值、成長率、細分、地理覆蓋範圍和主要參與者)的洞察之外,Data Bridge Market Research 精心編制的市場報告還包括進出口分析、產能概覽、生產消費分析、價格趨勢分析、氣候變遷情境、供應鏈分析、價值鏈分析、原材料/消耗標準概覽、供應商選擇、PESTLE 分析、五力分析和監管框架。 |

防霧聚碳酸酯薄膜和板材市場趨勢

對清晰可見和安全材料的需求日益增長

- The increasing emphasis on safety, visibility, and performance is significantly shaping the anti-fog polycarbonate films and sheets market, as end users seek materials that prevent moisture condensation and ensure clear vision in critical environments. Anti-fog polycarbonate solutions are gaining traction due to their durability, optical clarity, and impact resistance, supporting adoption across automotive, construction, medical, and industrial safety applications

- Growing awareness around workplace safety, hygiene, and protective equipment has accelerated the demand for anti-fog polycarbonate films and sheets in face shields, goggles, helmets, and protective barriers. Industries are prioritizing materials that maintain transparency under varying temperature and humidity conditions, encouraging manufacturers to enhance coating efficiency and long-term performance

- Safety regulations and quality standards are influencing purchasing decisions, with manufacturers focusing on advanced surface treatments, scratch resistance, and long-lasting anti-fog properties. These factors are helping companies differentiate products in a competitive market while building trust among industrial and institutional buyers

- For instance, in 2024, several automotive and safety equipment manufacturers expanded the use of anti-fog polycarbonate sheets in windshields, visors, and protective enclosures to improve visibility and user comfort. These products were introduced to meet stricter safety norms and were distributed through OEM and aftermarket channels, strengthening supplier relationships and repeat demand

- While demand for anti-fog polycarbonate materials is rising, sustained market growth depends on continuous innovation, cost-efficient coating technologies, and consistent performance under extreme conditions. Manufacturers are focusing on scalability, durability enhancement, and improving resistance to abrasion and chemicals to support wider adoption

Anti-Fog Polycarbonate Films and Sheets Market Dynamics

Driver

Growing Demand For Safety, Visibility, And High-Performance Materials

- Rising demand for clear, fog-resistant materials across automotive, industrial, and medical applications is a major driver for the anti-fog polycarbonate films and sheets market. Manufacturers are increasingly adopting these materials to enhance safety, reduce visibility-related risks, and comply with stringent safety and quality regulations

- Expanding applications in protective eyewear, face shields, automotive components, and construction glazing are supporting market growth. Anti-fog polycarbonate films and sheets help maintain optical clarity, strength, and lightweight characteristics, enabling manufacturers to meet performance and safety expectations

- Automotive, healthcare, and industrial equipment manufacturers are actively promoting anti-fog polycarbonate-based solutions through product innovation and regulatory compliance. These efforts are aligned with the growing emphasis on worker safety, hygiene standards, and long-term material reliability

- For instance, in 2023, manufacturers supplying safety equipment and automotive components in the U.S. and Europe increased the integration of anti-fog polycarbonate sheets to improve user safety and visibility. This shift was driven by stricter safety standards and higher demand for durable, transparent materials

- Despite strong demand drivers, continued growth depends on technological advancements, coating longevity, and maintaining cost competitiveness. Investment in R&D, process optimization, and advanced coating formulations will remain essential to sustain market momentum

Restraint/Challenge

High Cost And Performance Degradation Over Time

- The relatively higher cost of anti-fog polycarbonate films and sheets compared to conventional plastic materials remains a key challenge, limiting adoption among cost-sensitive applications. Advanced coating processes and specialized surface treatments contribute to higher production costs

- Performance degradation over time, such as reduced anti-fog effectiveness due to abrasion, cleaning, or chemical exposure, poses challenges for long-term use. This can increase replacement frequency and affect customer confidence in certain applications

- Manufacturing and application challenges also impact market growth, as achieving uniform, durable anti-fog coatings requires precise processing and quality control. Variations in environmental conditions can further affect coating performance and lifespan

- For instance, in 2024, industrial users in sectors such as construction and manufacturing reported concerns over coating durability and maintenance costs, leading some buyers to delay adoption or seek alternative solutions

- Addressing these challenges will require innovation in coating durability, cost reduction strategies, and improved material formulations. Collaboration between material suppliers, equipment manufacturers, and end users will be critical to unlock the long-term growth potential of the global anti-fog polycarbonate films and sheets market

Anti-Fog Polycarbonate Films and Sheets Market Scope

The market is segmented on the basis of thickness, grade type, application, and end use.

- By Thickness

On the basis of thickness, the anti-fog polycarbonate films and sheets market is segmented into Up to 0.5 mm, 0.5 mm to 2 mm, 2 mm to 5 mm, 5 mm to 7 mm, and Above 7 mm. The 0.5 mm to 2 mm segment held the largest market revenue share in 2025, driven by its widespread use in protective eyewear, face shields, and automotive components where lightweight and flexible materials are preferred. Sheets in this range offer a balance of durability, optical clarity, and ease of processing, making them a popular choice across multiple industries.

The 2 mm to 5 mm segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increased adoption in automotive windshields, windows, and industrial safety panels. The added thickness provides enhanced impact resistance and long-term durability, making it ideal for high-performance applications.

- By Grade Type

On the basis of grade type, the market is segmented into Optical Grade and Clear Grade. The Optical Grade segment accounted for the largest market share in 2025 due to its superior transparency, scratch resistance, and suitability for precision applications such as lenses, display panels, and instrumentation. Optical grade anti-fog polycarbonate ensures reliable visibility and performance under diverse environmental conditions.

The Clear Grade segment is expected to witness the fastest growth rate from 2026 to 2033, supported by its cost-effectiveness and versatility in applications such as windows, roofing, and consumer goods.

- By Application

On the basis of application, the market is segmented into Lenses, Mirrors, Windows, Windshields, Display Panels, Roofing, and Others. The Windshields segment held the largest revenue share in 2025, driven by the growing automotive industry and the demand for durable, fog-resistant materials that improve driver safety and visibility.

The Lenses segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising adoption in protective eyewear, goggles, and medical devices where precise optical clarity and fog resistance are critical.

- By End Use

On the basis of end use, the market is segmented into Automotive Industry, Food and Beverages, Electrical and Electronics, Healthcare and Pharmaceuticals, Building and Construction, Consumer Goods, and Other Industrial Manufacturing. The Automotive Industry segment accounted for the largest market share in 2025, driven by the demand for anti-fog windshields, windows, and mirrors that enhance safety and comfort for drivers and passengers.

The Healthcare and Pharmaceuticals segment is expected to witness the fastest growth rate from 2026 to 2033, supported by increasing use of anti-fog films and sheets in face shields, medical goggles, and protective barriers to maintain hygiene, safety, and visibility in clinical and laboratory environments

Anti-Fog Polycarbonate Films and Sheets Market Regional Analysis

- 預計到2025年,北美地區將佔據防霧聚碳酸酯薄膜和板材市場的主導地位,收入份額最大。這主要得益於市場對安全導向材料、高性能透明板材的強勁需求,以及工業和消費領域對防護設備的日益重視。

- 該地區的消費者和工業用戶非常重視聚碳酸酯薄膜和板材的耐用性、光學清晰度和可靠的防霧性能,這些產品廣泛應用於面罩、護目鏡、窗戶和擋風玻璃等領域。

- 高標準的行業規範、先進的製造能力以及對工人安全和衛生日益增長的投入,進一步推動了防霧聚碳酸酯解決方案的廣泛應用,使其成為多個終端應用領域的首選材料。

美國防霧聚碳酸酯薄膜和片材市場洞察

2025年,美國市場在北美市場佔據最大份額,這主要得益於日益嚴格的安全法規、防護設備的普及以及汽車、醫療保健和工業領域需求的成長。製造商正致力於研發輕巧、耐用且透明的防霧薄膜,以滿足高性能標準。先進塗層的應用、與安全標準的兼容性以及易於加工的特性,都顯著推動了市場擴張。

歐洲防霧聚碳酸酯薄膜和板材市場洞察

預計2026年至2033年間,歐洲市場將迎來最快的成長,主要驅動力來自日益嚴格的安全和建築法規,以及對高品質透明材料不斷增長的需求。工業和醫療保健應用的增加,加上城市化進程和基礎設施現代化,正在促進透明材料的應用。歐洲消費者和企業對節能、耐用且高透明度的透明板材青睞有加,推動了汽車、醫療和建築等產業的成長。

英國防霧聚碳酸酯薄膜和板材市場洞察

預計2026年至2033年間,英國市場將顯著成長,這主要得益於人們對工作場所安全、防護設備和增強可視性解決方案日益重視。工業和醫療保健領域對眼部和臉部防護意識的不斷提高,推動了防霧聚碳酸酯薄膜和片材的應用。英國強大的製造業基礎和分銷網絡也為市場擴張提供了進一步的支撐。

德國防霧聚碳酸酯薄膜和板材市場洞察

預計2026年至2033年間,德國市場將維持穩定成長,這主要得益於德國對工業安全、建築法規和汽車品質的高標準要求。防霧聚碳酸酯薄膜和板材的廣泛應用,得益於技術創新、先進的製造基礎設施,以及汽車、醫療保健和建築業對環保、耐用和高性能材料的偏好。

亞太地區防霧聚碳酸酯薄膜和片材市場洞察

預計2026年至2033年間,亞太市場將迎來最快成長,主要得益於中國、日本和印度等國的快速工業化、城市化進程以及防護和安全材料需求的不斷增長。該地區蓬勃發展的汽車和建築業,以及政府推行的工作場所安全措施,都在推動相關產品的普及。此外,聚碳酸酯板材在地化生產的增加也提高了終端用戶產業的可負擔性和可近性。

日本防霧聚碳酸酯薄膜和板材市場洞察

由於日本高度重視安全、技術進步和城市發展,預計2026年至2033年日本市場將維持穩定成長。日本製造商和消費者在汽車、醫療和工業應用領域優先考慮耐用、輕巧且透明的防霧聚碳酸酯板材。與先進塗層和物聯網安全系統的整合將進一步推動市場擴張。

中國防霧聚碳酸酯薄膜和片材市場洞察

預計到2025年,中國市場將佔據亞太地區最大的市場份額,這主要得益於快速的工業成長、汽車產量的增加以及安全標準的提高。中國正崛起為聚碳酸酯板材的重要製造中心,提供價格合理且性能卓越的解決方案。強大的國內生產能力以及醫療保健、汽車和建築等行業日益增長的應用需求,正在推動市場成長。

防霧聚碳酸酯薄膜和片材市場份額

防霧聚碳酸酯薄膜和片材產業主要由一些知名企業主導,其中包括:

• 3M(美國)

• 科思創股份公司(德國)

• 三菱化學株式會社(日本) • 沙烏地

阿拉伯

基礎工業公司(沙烏地阿拉伯

) • EIS Legacy, LLC(美國) •

WeeTect, Inc.(美國)

• Kafrit Industries Ltd(以色列) •

寧波中鼎塑膠

有限公司(中國)

• TWRA,

LLC(美國)塑膠)

. Rowland Technologies, Inc(美國)

• Gallina India(印度)

• Isik Plastik Her Hakki Saklidir(土耳其)

• Palram Industries Ltd.(以色列)

• Plazit Polygal(以色列)

• SafPlast Innovative(美國)

• Safplast Company(美國)

• Trinseo(美國)

全球防霧聚碳酸酯薄膜和片材市場最新發展動態

- 2025年8月,布雷特‧馬丁(Brett Martin)與AmeriLux International公司成立了美國聚碳酸酯公司(American Polycarbonate Company),一家合資企業,並在威斯康辛州德佩爾市(De Pere)建立了一座佔地50萬平方英尺的工廠。該工廠計劃於2026年投產,將生產用於建築、農業和建築裝飾的多層和波紋聚碳酸酯板材。此舉可望擴大國內產能,改善北美地區的供應,並增強合資企業在聚碳酸酯市場的競爭力。

- 2024年6月,帝人株式會社在其位於愛媛縣松山市的工廠投產了一條新的Panlite聚碳酸酯板材和薄膜生產線,年產能為1350噸。該工廠專注於汽車內裝和車載電子元件,目標是在2027財年實現25億日圓的銷售額。此次擴建預計將提升產能,滿足汽車產業日益增長的需求,並鞏固帝人高性能聚碳酸酯材料的市場地位。

- 2024年6月,三菱瓦斯化學公司鹿島工廠的聚碳酸酯樹脂生產獲得了ISCC PLUS認證。這項進展使得集團旗下多家公司能夠採用品質平衡法進行永續的聚碳酸酯生產,從而建構一個完全整合的生物質供應鏈。此認證可望提升公司的永續發展形象,吸引具有環保意識的客戶,並促進環保聚碳酸酯產品的更廣泛應用。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。