Europe Next Generation Packaging Market

市场规模(十亿美元)

CAGR :

%

USD

1,766.07 Million

USD

2,800.02 Million

2021

2029

USD

1,766.07 Million

USD

2,800.02 Million

2021

2029

| 2022 –2029 | |

| USD 1,766.07 Million | |

| USD 2,800.02 Million | |

|

|

|

Europe Next Generation Packaging Market, By Type (Active Packaging, Intelligent Packaging, and Modified Atmosphere Packaging), Function (Moisture Control, Temperature Indicators, Shelf Life Sensing, Product Tracking, and Others), Technology (Scavengers and Susceptors, RFID Tags, QR Codes, NFC Tags, Coding & Markings, Sensors & Output Devices, and Others), Material (Plastic, Paper, Glass, Corrugated Board, Metal, and Others), and Application (Food, Beverages, Personal Care, Healthcare, Logistics And Supply Chain, Consumer Electronics, and Others), Country (Germany, UK, Italy, France, Spain, Russia, Switzerland, Turkey, Belgium, Netherlands, Luxemburg and rest of Europe) Industry Trends And Forecast To 2029

Market Analysis and Insights: Europe Next Generation Packaging Market

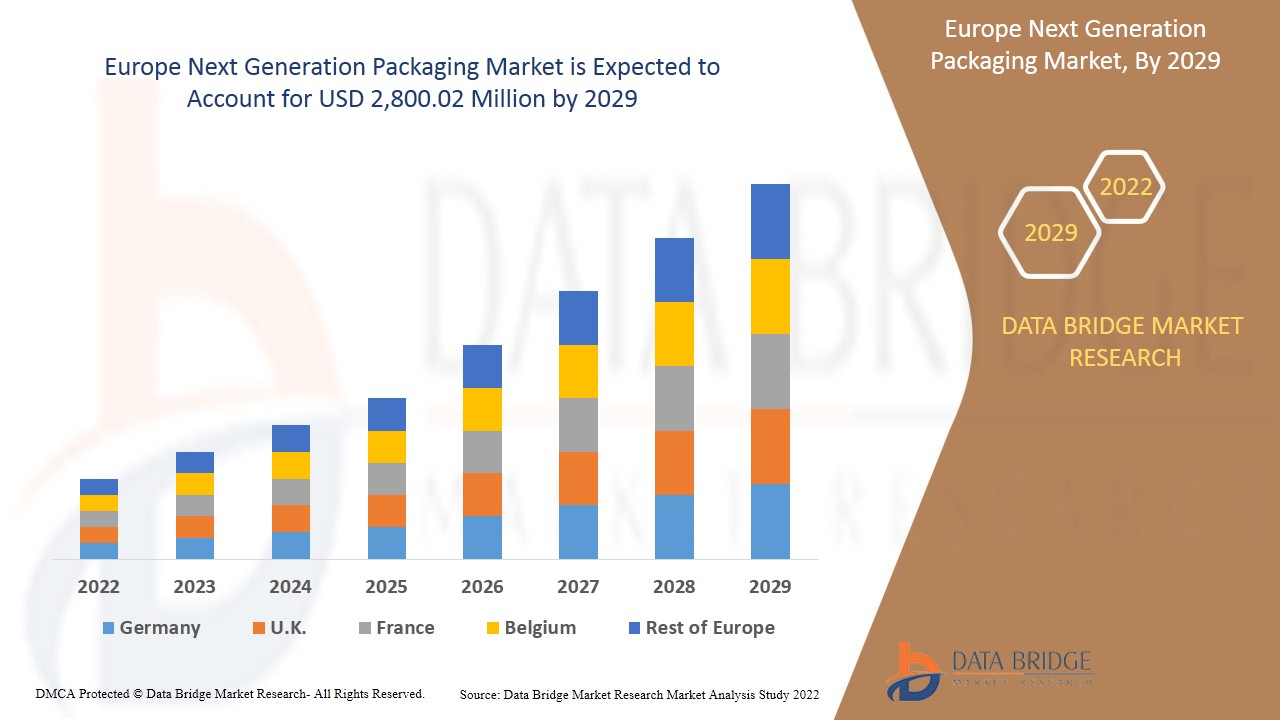

Europe next generation packaging market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyzes that the market is growing with a CAGR of 5.9% in the forecast period of 2022 to 2029 and is expected to reach USD 2,800.02 million by 2029 from USD 1,766.07 million in 2021.

Next generation packaging includes active, intelligent and modified atmosphere packaging. It is basically a packaging technology, which possesses different advanced features, such as traceability, offers various benefits such as product shelf life extension and provides product quality information. The term active packaging, intelligent packaging, smart packaging refer to packaging systems used for foods, pharmaceuticals, and several other types of products. They help extend shelf life, monitor freshness, display information on quality, improve safety, and improve convenience. These terms are closely related. For instance- active packaging usually means having active functions beyond the inert passive containment and protection of the product, Intelligent and active packaging usually involves the ability to sense or measure an attribute of the product, the inner atmosphere of the package, or the shipping environment. This information can be communicated to users or can trigger active packaging functions, programmable matter, and smart materials among others.

The recent trend indicates increasing demand for next generation packaging as investments in public and private healthcare industries increase. The factors driving the growth of the market are raising health awareness among the general population, and continuous technological advancements in packaging. With the rapid growth of globalization and increase in mandates for food and beverages by various countries and regions, the global next generation packaging market will witness an increased trajectory in the coming years. However, the high cost of packaging will restrict the market growth.

Various companies are making strategic decisions, such as forming agreements with research facilities to launch new products, to improve their market share. As a result, the next generation packaging market is growing at a rapid rate.

To understand the analysis and the next generation packaging market scenario, contact Data Bridge Market Research for an Analyst Brief. Our team will help you create a revenue impact solution to achieve your desired goal.

Europe Next Generation Packaging Market Scope and Market Size

Europe next generation packaging market is segmented into five segments based on type, function, technology, material, and application.

The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

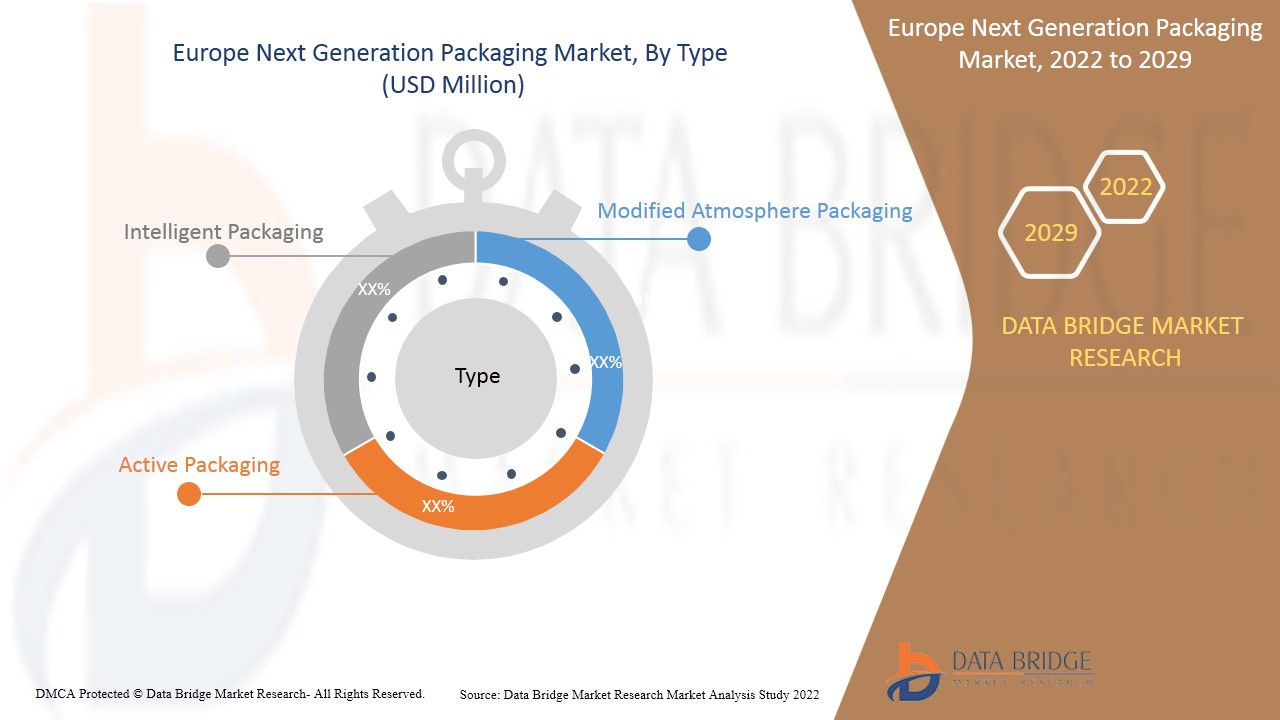

- On the basis of type, the Europe next generation packaging market is segmented into active packaging, intelligent packaging and modified atmosphere packaging. In 2022, active packaging segment is expected to dominate the market due to high production quantity and ease to use active packaging.

- On the basis of function, the Europe next generation packaging market is segmented into moisture control, temperature indicators, shelf life sensing, product tracking, and others. In 2022, the moisture control segment is expected to dominate the market as it is the most demanded packaging function to extend the shelf life of the product.

- On the basis of technology, the Europe next generation packaging market is segmented into scavengers and susceptors, RFID tags, QR codes, NFC tags, coding & markings, sensors & output devices, and others. In 2022, the scavengers and susceptors segment is expected to dominate the market as it gives easy access of the product to consumers.

- On the basis of material, the Europe next generation packaging market is segmented into plastic, paper, glass, corrugated board, metal, and others. In 2022, the plastic segment is expected to dominate the market as consumers are interested in product’s packaging due to its affordability.

- On the basis of application, the Europe next generation packaging market is segmented into food, beverages, personal care, healthcare, logistics and supply chain, consumer electronics, and others. In 2022, the food segment is expected to dominate the market as the demand for packed food is increasing globally owing to the busy lifestyle of consumers.

Europe next generation packaging market is fragmented and the major players have used various strategies such as new product launches, expansions, agreements, joint ventures, partnerships, acquisitions, and others to increase their footprints in the next generation packaging market.

Europe by country is segmented into Germany, U.K., Italy, France, Spain, Russia, Switzerland, Turkey, Belgium, Netherlands, Luxemburg and Rest of Europe. In 2022, Germany is expected to dominate the Europe next generation packaging market, due to growing application of this market in food and beverage industry.

Growing Strategic Activities by Major Market Players to Enhance the Awareness for Next Generation Packaging is Boosting the Market Growth

The Europe next generation packaging market also provides you with a detailed market analysis for every country's growth in a particular market. Additionally, it provides detailed information regarding the market players’ strategy and their geographical presence. The data is available for the historical period 2010 to 2020.

Competitive Landscape and Europe Next Generation Packaging Market Share Analysis

Europe next generation packaging market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product approvals, patents, product width, and breadth, application dominance, and technology lifeline curve. The above data points provided are only related to the companies’ focus related to the Europe next generation packaging market.

Some of the major players operating in the Europe next generation packaging market are LCR Hallcrest Ltd, Ampacet Corporation, WestRock Company, Tetra Pak, Scan and win, R.R. Donnelley & Sons Company, Sonoco Products Company, Smart Packaging, Amcor Plc, CONSTANTIA FLEXIBLES, Klöckner Pentaplast, Graham Packaging Company, Avery Dennison Corporation, DS Smith, and Cryolog among others. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many developments are also initiated by the companies worldwide, which are accelerating the Europe next generation packaging market.

For instance,

- In October 2021, R.R. Donnelley & Sons Company launched new Scannable Smart Tags for retail signage, commercial print, packaging, forms, and direct mail. This will increase the customer base of the company.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE NEXT GENERATION PACKAGING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 SOURCE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 EUROPE NEXT GENERATION PACKAGING MARKET: APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 INDUSTRIAL INSIGHTS: EUROPE NEXT GENERATION PACKAGING MARKET

5.1 DEVELOPMENT OF ADVANCED SMART PACKAGING PRODUCT

5.2 TEMPERATURE BALANCING SMART PACKAGING:

5.3 SMART PACKAGING TO IMPROVE CONSUMER SAFETY:

5.4 CONCLUSION:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR INTELLIGENT PACKAGING TO AVOID FOOD WASTAGE

6.1.2 INCREASING DISPOSABLE INCOME OF CONSUMERS

6.1.3 INCREASING CASES OF FOOD CONTAMINATION

6.1.4 INCREASE IN THE CONSUMPTION OF PACKAGED PRODUCTS

6.1.5 INCREASING HEALTH AWARENESS AMONG CONSUMERS

6.2 RESTRAINTS

6.2.1 COSTS ASSOCIATED WITH RESEARCH AND DEVELOPMENT ACTIVITIES

6.2.2 HIGH COMPETITION AMONG MARKET PLAYERS

6.3 OPPORTUNITIES

6.3.1 RECENT INNOVATIONS AND NEW PRODUCT LAUNCHES

6.3.2 GROWING ALCOHOLIC AND NON-ALCOHOLIC INDUSTRY WITH ACTIVE AND INTELLIGENT PACKAGING

6.4 CHALLENGES

6.4.1 AVAILABILITY OF ALTERNATIVES IN THE MARKET

6.4.2 SUPPLY CHAIN DISRUPTION DUE TO COVID-19

7 IMPACT OF COVID-19 ON THE EUROPE NEXT GENERATION PACKAGING MARKET

7.1 AWARENESS ABOUT FOOD SAFETY AND QUALITY INCREASED DUE TO THE COVID-19 PANDEMIC

7.2 COVID-19 IMPACT ON DEMAND & SUPPLY CHAIN OF NEXT GENERATION PACKAGING

7.3 IMPACT ON PRICE

7.4 INITIATIVES TAKEN BY MANUFACTURERS

7.5 CONCLUSION

8 EUROPE NEXT GENERATION PACKAGING MARKET, BY TYPE

8.1 OVERVIEW

8.2 ACTIVE PACKAGING

8.2.1 GAS SCAVENGERS/EMITTERS

8.2.2 MICROWAVE SUSCEPTORS

8.2.3 OTHERS

8.3 INTELLIGENT PACKAGING

8.4 MODIFIED ATMOSPHERE PACKAGING

9 EUROPE NEXT GENERATION PACKAGING MARKET, BY FUNCTION

9.1 OVERVIEW

9.2 MOISTURE CONTROL

9.3 TEMPERATURE INDICATORS

9.4 PRODUCT TRACKING

9.5 SHELF LIFE SENSING

9.6 OTHERS

10 EUROPE NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 SCAVENGERS AND SUSCEPTORS

10.3 RFID TAGS

10.4 NFC TAGS

10.5 QR CODES

10.6 SENSORS & OUTPUT DEVICES

10.7 CODING & MARKINGS

10.8 OTHERS

11 EUROPE NEXT GENERATION PACKAGING MARKET, BY MATERIAL

11.1 OVERVIEW

11.2 PLASTIC

11.3 PAPER

11.4 CORRUGATED BOARD

11.5 OTHERS

12 EUROPE NEXT GENERATION PACKAGING MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD

12.2.1 PACKAGED FOOD

12.2.2 PROCESSED FOOD

12.2.2.1 CHILLED

12.2.2.2 DRIED

12.2.3 MEAT & POULTRY

12.2.4 DAIRY

12.2.5 BAKERY & CONFECTIONERY

12.2.6 FRUITS & VEGETABLES

12.2.7 FROZEN FOOD

12.2.8 OTHERS

12.3 BEVERAGES

12.3.1 NON- ALCOHOLIC

12.3.2 ALCOHOLIC

12.4 PERSONAL CARE

12.5 HEALTH CARE

12.6 LOGISTICS & SUPPLY CHAIN

12.7 CONSUMER ELECTRONICS

12.8 OTHERS

13 EUROPE NEXT GENERATION PACKAGING MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 FRANCE

13.1.3 U.K.

13.1.4 ITALY

13.1.5 SPAIN

13.1.6 RUSSIA

13.1.7 BELGIUM

13.1.8 NETHERLANDS

13.1.9 SWITZERLAND

13.1.10 TURKEY

13.1.11 LUXEMBURG

13.1.12 REST OF EUROPE

14 COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 AVERY DENNISON CORPORATION

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 DUPONT

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 BALL CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 GRAHAM PACKAGING COMPANY

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 R.R. DONNELLEY & SONS COMPANY

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ACTIVE PACKAGING

16.6.1 COMPANY SANPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 AMCOR PLC

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 AMERPLAST

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 AMERICAN THERMAL INSTRUMENTS

16.9.1 COMPANY SANPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 CORTEC PACKAGING

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 KLÖCKNER PENTAPLAST

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 MICROBEGUARD CORPORATION

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 MITSUBISHI GAS CHEMICAL COMPANY, INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 SAES GETTERS S.P.A.

16.14.1 COMPANY SANPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 SEALED AIR

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 TEMPTIME CORPORATION.

16.16.1 COMPANY SANPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 TOPPAN INC.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 VESTA

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

表格列表

TABLE 1 EUROPE NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 EUROPE ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 EUROPE ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE INTELLIGENT PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE MODIFIED ATMOSPHERE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE MOISTURE CONTROL IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE TEMPERATURE INDICATORS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE PRODUCT TRACKING IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE SHELF LIFE SENSING IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE OTHERS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 13 EUROPE SCAVENGERS AND SUSCEPTORS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE RFID TAGS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE NFC TAGS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE QR CODES IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE SENSORS & OUTPUT DEVICES IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE CODING & MARKINGS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE OTHERS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 21 EUROPE PLASTIC IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE PAPER IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE CORRUGATED BOARD IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE OTHERS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE FOOD IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICTION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE PERSONAL CARE IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE HEALTHCARE IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE LOGISTICS & SUPPLY CHAIN IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE CONSUMER ELECTRONICS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE OTHERS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE NEXT GENERATION PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 37 EUROPE NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 EUROPE ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 EUROPE NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 41 EUROPE NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 42 EUROPE NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 43 EUROPE FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 EUROPE PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 EUROPE BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 GERMANY NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 GERMANY ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 GERMANY NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 49 GERMANY NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 50 GERMANY NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 51 GERMANY NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 GERMANY FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 GERMANY PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 GERMANY BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 FRANCE NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 FRANCE ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 FRANCE NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 58 FRANCE NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 59 FRANCE NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 60 FRANCE NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 FRANCE FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 FRANCE PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 FRANCE BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 U.K. NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 U.K. ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.K. NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 67 U.K. NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 68 U.K. NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 69 U.K. NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 U.K. FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 U.K. PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 72 U.K. BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 ITALY NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 ITALY ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 ITALY NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 76 ITALY NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 77 ITALY NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 78 ITALY NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 ITALY FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 ITALY PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 ITALY BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 SPAIN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 SPAIN ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 SPAIN NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 85 SPAIN NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 86 SPAIN NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 87 SPAIN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 SPAIN FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 SPAIN PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 SPAIN BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 91 RUSSIA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 RUSSIA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 RUSSIA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 94 RUSSIA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 95 RUSSIA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 96 RUSSIA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 RUSSIA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 RUSSIA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 RUSSIA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 BELGIUM NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 BELGIUM ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 BELGIUM NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 103 BELGIUM NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 104 BELGIUM NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 105 BELGIUM NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 BELGIUM FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 107 BELGIUM PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 108 BELGIUM BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 NETHERLANDS NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 NETHERLANDS ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 NETHERLANDS NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 112 NETHERLANDS NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 113 NETHERLANDS NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 114 NETHERLANDS NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 NETHERLANDS FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 116 NETHERLANDS PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 117 NETHERLANDS BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 SWITZERLAND NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 SWITZERLAND ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 SWITZERLAND NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 121 SWITZERLAND NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 122 SWITZERLAND NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 123 SWITZERLAND NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 124 SWITZERLAND FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 125 SWITZERLAND PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 126 SWITZERLAND BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 127 TURKEY NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 TURKEY ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 TURKEY NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 130 TURKEY NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 131 TURKEY NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 132 TURKEY NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 133 TURKEY FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 TURKEY PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 TURKEY BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 LUXEMBURG NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 LUXEMBURG ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 LUXEMBURG NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 139 LUXEMBURG NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 140 LUXEMBURG NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 141 LUXEMBURG NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 142 LUXEMBURG FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 143 LUXEMBURG PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 144 LUXEMBURG BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 145 REST OF EUROPE NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 EUROPE NEXT GENERATION PACKAGING MARKET: SEGMENTATION

FIGURE 2 EUROPE NEXT GENERATION PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE NEXT GENERATION PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE NEXT GENERATION PACKAGING MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE NEXT GENERATION PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE NEXT GENERATION PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE NEXT GENERATION PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE NEXT GENERATION PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE NEXT GENERATION PACKAGING MARKET: SEGMENTATION

FIGURE 10 ASIA-PACIFIC IS EXPECTED TO DOMINATE EUROPE NEXT GENERATION PACKAGING MARKET AND IS EXPECTED TO GROW WITH HIGHEST CAGR IN FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 AN INCREASE IN CONSUMPTION OF BEVERAGES AND HEALTH AWARENESS AMONG CONSUMERS IS EXPECTED TO DRIVE EUROPE NEXT GENERATION PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PACKAGING TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR LARGEST SHARE OF EUROPE NEXT GENERATION PACKAGING MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE NEXT GENERATION PACKAGING MARKET

FIGURE 14 EUROPE NEXT GENERATION PACKAGING MARKET, BY TYPE, 2021

FIGURE 15 EUROPE NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2021

FIGURE 16 EUROPE NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2021

FIGURE 17 EUROPE NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2021

FIGURE 18 EUROPE NEXT GENERATION MARKET, BY APPLICATION, 2021

FIGURE 19 EUROPE NEXT GENERATION PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 20 EUROPE NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 21 EUROPE NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 EUROPE NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 23 EUROPE NEXT GENERATION PACKAGING MARKET: BY TYPE (2022 & 2029)

FIGURE 24 EUROPE NEXT GENERATION PACKAGING MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。