Europe Leak Detection Market

市场规模(十亿美元)

CAGR :

%

USD

611.26 Million

USD

1,082.09 Million

2025

2033

USD

611.26 Million

USD

1,082.09 Million

2025

2033

| 2026 –2033 | |

| USD 611.26 Million | |

| USD 1,082.09 Million | |

|

|

|

|

Europe Leak Detection Market, By Type (Upstream, Midstream and Downstream), Product Type (Handheld Gas Detectors, UAV-Based Detectors, Manned Aircraft Detectors and Vehicle-Based Detectors), Technology (Acoustic/Ultrasound, Pressure-Flow Deviation Methods, Extended Real-Time Transient Model (E-RTTM), Thermal Imaging, Mass/Volume Balance, Vapor Sensing, Laser Absorption and Lidar, Hydraulic Leak Detection, Negative Pressure Valves and Others), End User (Oil and Gas, Chemical Plant, Water Treatment Plant, Thermal Power Plant, Mining and Slurry and Others), Country (Germany, France, U.K., Italy, Spain, Russia, Turkey, Belgium, Netherlands, Switzerland, Rest of Europe) Industry Trends and Forecast to 2028

Market Analysis and Insights: Europe Leak Detection Market

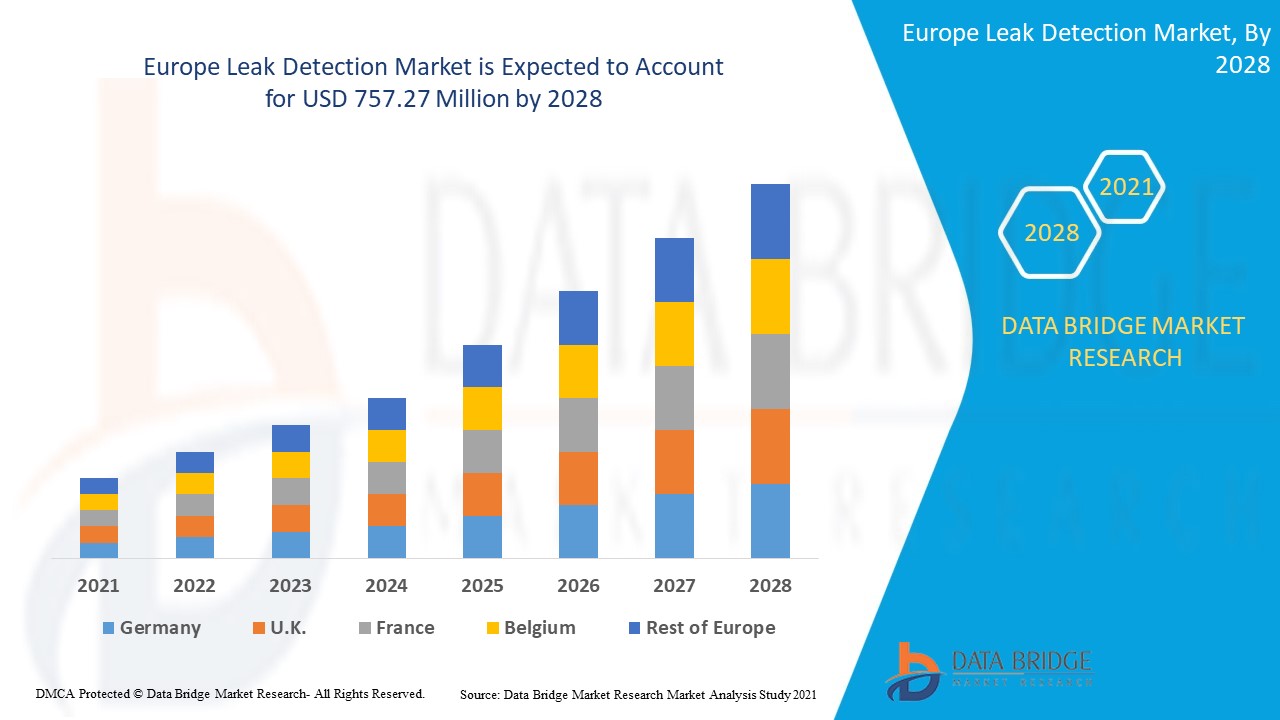

Europe leak detection market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with the CAGR of 7.4% in the forecast period of 2021 to 2028 and expected to reach USD 757.27 million by 2028. Increasing growth in oil and gas pipeline and storage plant infrastructure is the prominent factors that drive growth of the market.

The term leak or leakage means an unintended crack, hole or porosity in an enveloping wall or joint of the pipes, batteries, sealed products, chambers or storage containers which must contain/transfer different fluids and gases. These cracks or holes allow the escape of fluids and gases from closed medium. The leakages must be identified at earliest to decrease the loss and harm causing to the environment, for which various leak detection sensors and instruments are used. The main function of leak detection system is the localization and size measurement of leaks in sealed products.

High number of pipeline leakages incidents and increasing integration of advanced technology in leak detectors are augmenting the leak detection market. For instance, In January 2020, FLIR Systems Inc. has launched FLIR GF77a, its first uncooled, fixed-mount, connected thermal camera for detecting methane and other industrial gases. With this new launch of optical gas imaging (OGI) series product, company has extended their product portfolio and will increase their customer base.

This leak detection market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographical expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

Europe Leak Detection Market Scope and Market Size

Leak detection market is segmented on the basis of type, product type, technology and end user. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

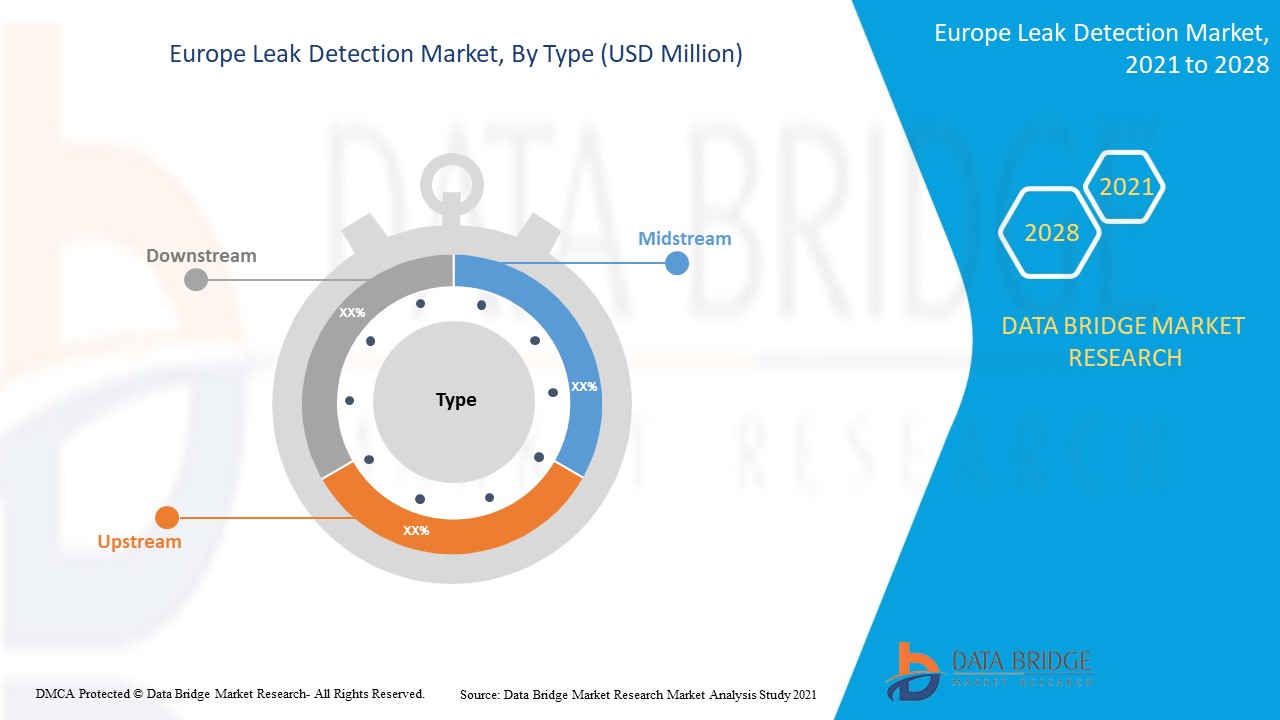

- On the basis of type, the leak detection market is segmented into upstream, midstream and downstream. In 2021, the midstream segment accounted largest market share as midstream segment basically deals with the transportation of crude oil and natural gas through various modes of transportation such as pipeline. These pipelines are needed to be protected against leakages to avoid leak incidents and cause loss of life and property. Thus, the midstream is dominating the type segment.

- On the basis of product type, the leak detection market is segmented into handheld gas detectors, UAV-based detectors, manned aircraft detectors and vehicle-based detectors. In 2021, vehicle-based detectors accounted largest market share as it can be easily mounted on a vehicle and be used for monitoring the pipelines through the moving vehicle. This is the most economical and fast way of detecting leaking and is therefore dominating the product type segment.

- On the basis of technology, the leak detection market is segmented into acoustic / ultrasound, fiber optic, pressure-flow deviation methods, extended real-time transient model (E-RTTM), thermal imaging, mass/volume balance, vapor sensing, laser absorption and LIDAR, hydraulic leak detection, negative pressure waves and others. In 2021, acoustic / ultrasound accounted largest market share as it offers faster detection of leakage and is low cost solution, moreover, it provides early detection and the loss can be prevented at an early stage, these factors lead to highest growth of acoustic/ultrasound in technology segment.

- On the basis of end user, the leak detection market is segmented into oil and gas, chemical plant, water treatment plants, thermal power plant, mining and slurry and others. In 2021, oil and gas accounted largest market share as this industry is a major user of leak detection system in order to prevent leakage of crude oil and gas and methane emission. The leakage can lead to severe loss of life and property. Moreover, several government regulations to prevent leak incidents have increased the demand of leak detection in oil and gas industry.

Europe Leak Detection Market Country Level Analysis

Leak detection market is analysed and market size information is provided by country, type, product type, technology and end user.

The countries covered in Europe leak detection market report are Germany, U.K., France, Switzerland, Italy, Spain, Netherlands, Russia, Belgium, Turkey and Rest of Europe.

Russia accounted largest market share owing to large number of oil and gas production and transferring pipeline projects in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

High Number of Pipeline Leakages Incidents

Leak detection market also provides you with detailed market analysis for every country growth in industry with sales, components sales, impact of technological development in leak detection and changes in regulatory scenarios with their support for the leak detection market. The data is available for historic period 2011 to 2019.

Competitive Landscape and Leak Detection Market Share Analysis

Leak detection market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to leak detection market.

The major players covered in the report are FLIR SYSTEMS, Inc., ABB, Honeywell International Inc., Siemens Energy, Pentair, ClampOn AS, Schneider Electric, Atmos International, Xylem, Emerson Electric Co., KROHNE Messtechnik GmbH, PERMA-PIPE International Holdings, Inc., TTK, PSI Software AG, MSA, HIMA, AVEVA Group plc, Yokogawa Electric Corporation, INFICON, Fotech Group Ltd., Asel-Tech Inc., MAGNUM Pirex AG / MAGNUM LEO-Pipe GmbH and OptaSense Ltd. among others. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many product developments are also initiated by the companies worldwide which are also accelerating the growth of leak detection market.

For instance,

- In October 2020, ABB has launched the new ABB MicroGuard, a first comprehensive gas leak detection system solution for utility industry to help safeguard city populations. The MicroGuard will work alongside ABB’s MobileGuard to pinpoint dangerous gas leaks faster and in easier way. Through this new product launch the company has expanded their product line.

- In December 2019, Honeywell International Inc. has announced that it has acquired Rebellion Photonics, a provider of innovative, intelligent, visual gas monitoring solutions which helps in maximizing safety, operational performance and emissions mitigation in oil & gas, petrochemicals and power industries. This acquisition will help company to expand their product portfolio.

Production expansion, new product development and other strategies enhances the company market share with increased coverage and presence. It also provides the benefit for organisation to improve their offering for leak detection.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。