Europe Health Insurance Market

市场规模(十亿美元)

CAGR :

%

EURO

481,427.01 million

EURO

706,497.32 million

2022

2030

EURO

481,427.01 million

EURO

706,497.32 million

2022

2030

| 2023 –2030 | |

| EURO 481,427.01 million | |

| EURO 706,497.32 million | |

|

|

|

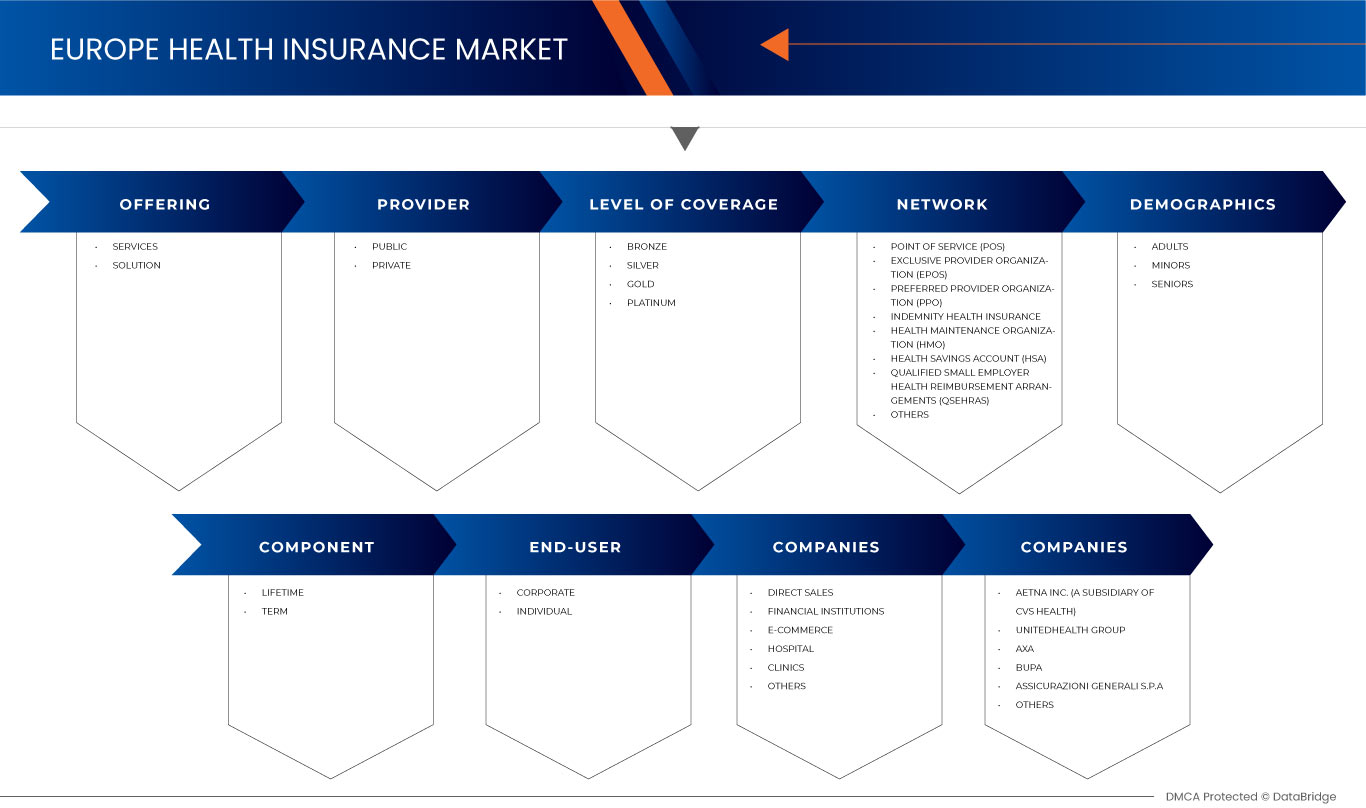

Europe Health Insurance Market, By Offering (Services and Solution), Provider (Public and Private), Level of Coverage (Bronze, Silver, Gold and Platinum), Network (Point Of Service (POS), Exclusive Provider Organization (EPOS), Indemnity Health Insurance, Health Savings Account (HSA), Qualified Small Employer Health Reimbursement Arrangements (QSEHRAS), Preferred Provider Organization (PPO), Health Maintenance Organization (HMO) and Others), Demographics (Adults, Minors, and Seniors), Coverage Type (Lifetime and Term), End User (Corporate and Individual), Distribution Channel (Direct Sales, Financial Institutions, E-Commerce, Hospitals, Clinics and Others) - Industry Trends and Forecast to 2030.

Europe Health Insurance Market Analysis and Insights

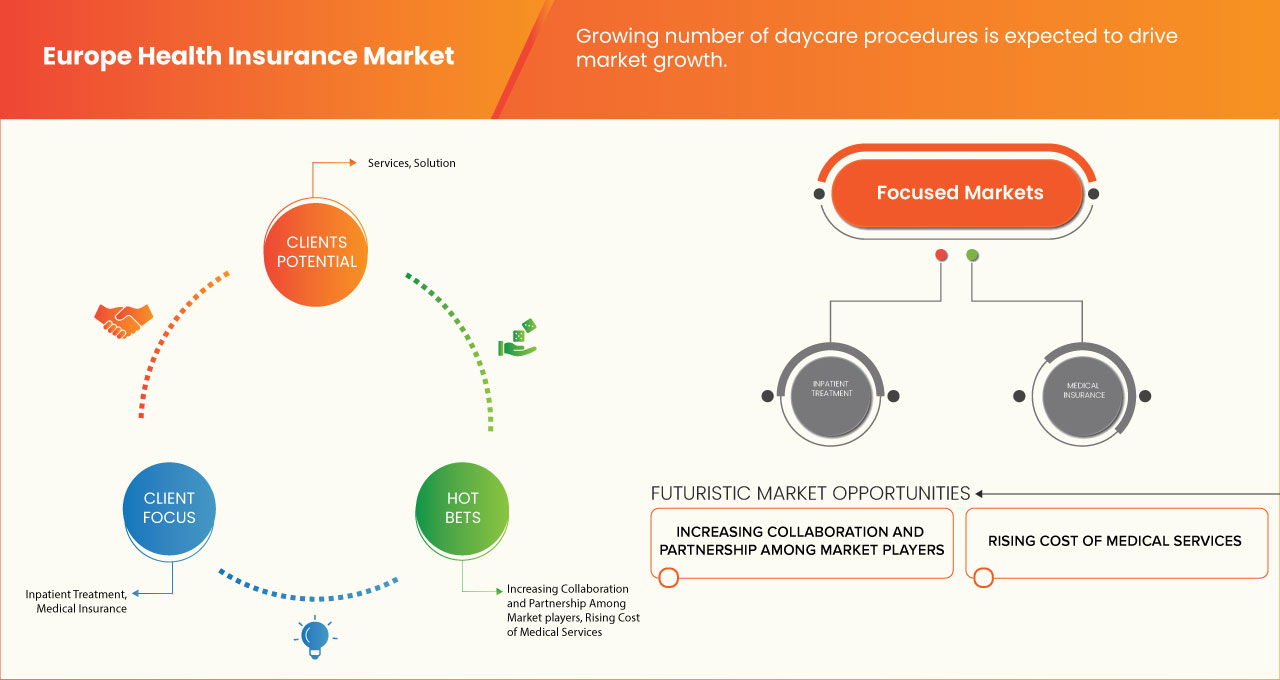

Growing number of daycare procedures is expected to drive market growth. However, the high cost of insurance premiums is expected to restrain market growth. The advantages of health insurance policies are expected to act as opportunities for market growth. However, Lack of awareness regarding the benefits of health insurance is expected to pose a challenge to market growth.

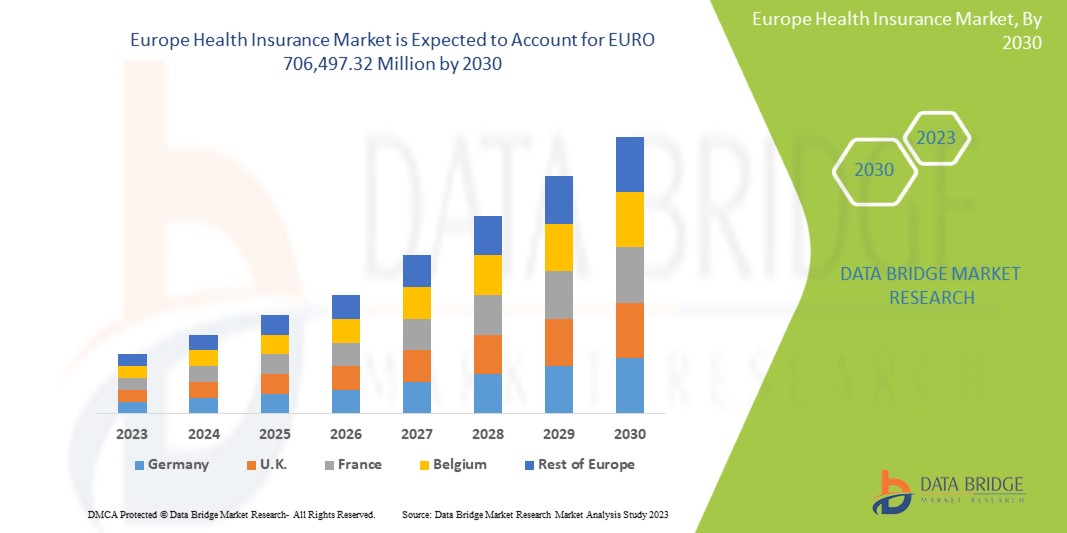

Data Bridge Market Research analyzes that the Europe health insurance market is expected to reach EURO 706,497.32 million by 2030 from EURO 481,427.01 million in 2022, growing with a substantial CAGR of 5.1% in the forecast period of 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in EURO Million |

|

Segments Covered |

Offering (Services and Solution), Provider (Public and Private), Level of Coverage (Bronze, Silver, Gold and Platinum), Network (Point Of Service (POS), Exclusive Provider Organization (EPOS), Indemnity Health Insurance, Health Savings Account (HSA), Qualified Small Employer Health Reimbursement Arrangements (QSEHRAS), Preferred Provider Organization (PPO), Health Maintenance Organization (HMO) and Others), Demographics (Adults, Minors, and Seniors), Coverage Type (Lifetime and Term), End User (Corporate and Individual), Distribution Channel (Direct Sales, Financial Institutions, E-Commerce, Hospitals, Clinics and Others) |

|

Countries Covered |

U.K., Germany, France, Russia, Italy, Spain, Netherlands, Poland, Switzerland, Belgium, Sweden, Turkey, Denmark, Norway, Finland and Rest of Europe |

|

Market Players Covered |

Aetna Inc . (A Subsidiary of CVS Health) (U.S.), UNITEDHEALTH GROUP (U.S.), AXA (France), Bupa (U.K.), ASSICURAZIONI GENERALI S.P.A. (Italy), Allianz Care (A subsidiary of Allianz) (France), Cigna (U.S.), Aviva (U.K.), VHI Group (Ireland), Vitality (U.K.), Oracle (U.S.), MAPFRE (Spain), Saga (U.K.), International Medical Group Inc. (U.S.), Broadstone Corporate Benefits Limited (U.K.), General and Medical Finance Ltd (U.K.), Healthcare International Global Network Ltd. (U.K.), Now Health International (Hong Kong), Freedom Health Insurance (U.K.) and among others |

Market Definition

Health insurance is a type of insurance that provides coverage of all types of surgical expenses as well as medical treatment incurred from an illness or injury. It applies to a comprehensive or limited range of medical services providing the coverage of full or partial costs of specific services. It provides financial support to the policyholder as it covers all the medical expenses when the policyholder is hospitalized for treatment. It also covers pre as well and post-hospitalization expenses.

In the health insurance plan several types of coverage are available which is cashless or reimbursement claim. A cashless benefit is available when the policyholder takes treatment from the network hospitals of the insurance company. If the policyholder takes treatment from hospitals that are not in the list network, in that case, the policyholder meets all the medical expenses and then claims for reimbursement in the insurance company by submitting all the medical bills.

Europe Health Insurance Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Rising Cost of Medical Services

The rising expenses associated with surgeries, hospital stays, and medical services have resulted in a global financial crisis. In cases of severe illness or accidents, health insurance offers crucial financial assistance. The cost of medical services encompasses various elements, such as surgical expenses, doctor fees, hospitalization costs, emergency room charges, and diagnostic testing fees. This upward trend in medical service costs has consequently fueled the expansion of the health insurance market.

- Increasing Number of Daycare Procedures

Daycare procedures refer to medical procedures or surgeries that involve a shorter hospital stay. Patients undergoing daycare procedures only need to stay in the hospital for a brief period. In recent times, many health insurance companies have started including daycare procedures in their insurance plans. Unlike traditional insurance claims that require a minimum 24-hour hospital stay, policyholders can now claim insurance for daycare procedures without meeting this requirement. This inclusion of daycare procedures in health insurance policies has increased the demand for such coverage and contributed to the growth of the market.

Opportunities

- Advantages of Health Insurance Policies

Health insurance plans provide policyholders with reimbursement for various medical expenses, including hospitalization, surgeries, and treatments related to injuries or illnesses. A health insurance policy represents an agreement between the policyholder and the insurance company. Under this agreement, the insurance company commits to covering the costs of future medical issues, while the policyholder agrees to pay regular premiums according to the chosen insurance plan. The advantages offered by health insurance policies create favorable conditions for the expansion of the global health insurance market, as individuals recognize the value and benefits of securing such coverage.

- Increasing Healthcare Expenditure

Healthcare expenditure worldwide is experiencing rapid growth. According to a report by the World Health Organization (WHO), global spending on health has shown a consistent upward trend. Over the past two decades, health spending has more than doubled, reaching USD 8.5 trillion in 2019, equivalent to 9.8% of global GDP. However, the distribution of health spending is unequal, with high-income countries accounting for approximately 80% of the total expenditure. In low-income countries, healthcare is primarily financed through out-of-pocket spending (44%) and external aid (29%), whereas government spending takes precedence in high-income countries (70%). This increasing healthcare expenditure presents opportunities for the Europe health insurance market to expand and cater to the growing demand for comprehensive coverage.

- Restraints/ Challenges

Lack of Awareness Regarding the Benefits of Health Insurance

A significant portion of the global population lacks awareness about the advantages of health insurance policies in the healthcare sector. As medical expenses rise due to advancements in the field, the healthcare industry is experiencing substantial growth. However, the adoption of health insurance policies remains limited due to a lack of awareness about their benefits. Despite the growth and advancements in healthcare technology, there is a need to increase awareness and understanding among individuals regarding the value and advantages of health insurance coverage.

- High Cost of Insurance Premiums

Health insurance is designed to cover a wide range of medical treatment costs, providing crucial financial support to policyholders when they require hospitalization. It extends coverage to both pre-hospitalization and post-hospitalization expenses, ensuring comprehensive support throughout the treatment journey. To maintain an active health insurance policy, policyholders are required to pay regular insurance premiums. However, in many cases, the cost of insurance premiums can be high, posing a challenge to the market's growth. The affordability and pricing of insurance plans are important factors to consider in order to address this barrier and foster market expansion.

Recent Developments

- In August 2020, International Medical Group, Inc. (IMG) introduced expanded product offerings to assist organizations in planning and researching safe international travel. The company introduced unique assistance services aimed at supporting clients in their travel plans for both the present and future. This strategic development enabled IMG to navigate the challenges posed by the pandemic successfully and maintain its growth and success.

- In June 2021, Vitality revealed a collaboration with Samsung UK, whereby Samsung Health will be integrated into the Vitality Programme. This integration aims to offer members additional options for tracking their activity and enhancing their overall health. By linking their Samsung Health profile to their Vitality Member Zone account, Android users can now enjoy the complete advantages of the Vitality Programme. The partnership allows for the automatic recording of daily steps and heart rate activity through Samsung Health, enabling members to earn Vitality activity points seamlessly.

Europe Health Insurance Market Scope

The Europe health insurance is segmented into eight notable segments based on offering, provider, level of coverage, network, demographics, coverage type, end use, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the differences in your target markets.

Offering

- services

- solution

On the basis of offering, Europe health insurance market is segmented into services and solution.

Provider

- Public

- Private

On the basis of provider, Europe health insurance market is segmented into public and private.

Level Of Coverage

- Bronze

- Silver

- Gold

- Platinum

On the basis of level of coverage, Europe health insurance market is segmented into bronze, silver, gold and platinum.

Network

- Point Of Service (POS)

- Exclusive Provider Organization (EPOS)

- Indemnity Health Insurance

- Health Savings Account (HSA)

- Qualified Small Employer Health Reimbursement Arrangements (QSEHRAS)

- Preferred Provider Organization (PPO)

- Health Maintenance Organization (HMO)

- Others

On the basis of network, Europe health insurance market is segmented into point of service (POS), exclusive provider organization (EPOS), indemnity health insurance, health savings account (HSA), qualified small employer health reimbursement arrangements (QSEHRAS), preferred provider organization (PPO), health maintenance organization (HMO) and others.

Demographics

- Adults

- Minors

- Seniors

On the basis of demographics, Europe health insurance market is segmented into adults, minors and seniors.

Coverage Type

- Lifetime

- Term

On the basis of coverage type, Europe health insurance market is segmented into lifetime and term.

End Use

- Corporates

- Individual

On the basis of end use, Europe health insurance market is segmented into corporates and individual.

Distribution Channel

- Direct Sales

- Financial Institutions

- E-Commerce

- Hospitals

- Clinics

- Others

On the basis of distribution channel, Europe health Insurance market is segmented into direct sales, financial institutions, e-commerce, hospitals, clinics, others.

Europe Health Insurance Market Regional Analysis/Insights

Europe health insurance is segmented into eight notable segments based on offering, provider, level of coverage, network, demographics, coverage type, end use, and distribution channel.

The countries covered in the Europe health insurance market report are U.K., Germany, France, Russia, Italy, Spain, Netherlands, Poland, Switzerland, Belgium, Sweden, Turkey, Denmark, Norway, Finland and Rest of Europe.

U.K. is expected to dominate the market due to growing demand for health insurance from corporates sector in the region.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Health Insurance Market Share Analysis

The Europe health insurance market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product approvals, product width and breadth, application dominance, and product type lifeline curve. The above data points provided are only related to the company’s focus on the market.

Some of the major market players operating in the Europe health insurance market are Aetna Inc . (A Subsidiary of CVS Health) (U.S.), UNITEDHEALTH GROUP (U.S.), AXA (France), Bupa (U.K.), ASSICURAZIONI GENERALI S.P.A. (Italy), Allianz Care (A subsidiary of Allianz) (France), Cigna (U.S.), Aviva (U.K.), VHI Group (Ireland), Vitality (U.K.), Oracle (U.S.), MAPFRE (Spain), Saga (U.K.), International Medical Group Inc. (U.S.), Broadstone Corporate Benefits Limited (U.K.), General and Medical Finance Ltd (U.K.), Healthcare International Global Network Ltd. (U.K.), Now Health International (Hong Kong), Freedom Health Insurance (U.K.) and among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE HEALTH INSURANCE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END-USER COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PREMIUM INSIGHT- GLOBAL OVERVIEW

4.2 MIGRATION TRENDS IN EUROPE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING COST OF MEDICAL SERVICES

5.1.2 GROWING NUMBER OF DAYCARE PROCEDURES

5.1.3 MANDATORY PROVISION OF HEALTHCARE INSURANCE IN PUBLIC AND PRIVATE SECTORS

5.2 RESTRAINTS

5.2.1 HIGH COST OF INSURANCE PREMIUMS

5.2.2 STRICT DOCUMENTATION PROCESS FOR REIMBURSEMENT CLAIM

5.3 OPPORTUNITIES

5.3.1 ADVANTAGES OF HEALTH INSURANCE POLICIES

5.3.2 INCREASING HEALTHCARE EXPENDITURE

5.4 CHALLENGE

5.4.1 LACK OF AWARENESS REGARDING THE BENEFITS OF HEALTH INSURANCE

6 EUROPE HEALTH INSURANCE MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SERVICES

6.2.1 INPATIENT TREATMENT

6.2.2 OUTPATIENT TREATMENT

6.2.3 MEDICAL ASSURANCE

6.2.4 OTHERS

6.3 SOLUTION

6.3.1 MEDICAL ASSURANCE

6.3.2 DISEASES INSURANCE

6.3.3 INCOME PROTECTION INSURANCE

7 EUROPE HEALTH INSURANCE MARKET, BY PROVIDER

7.1 OVERVIEW

7.2 PUBLIC

7.3 PRIVATE

8 EUROPE HEALTH INSURANCE MARKET, BY COVERAGE TYPE

8.1 OVERVIEW

8.2 LIFETIME

8.3 TERM

9 EUROPE HEALTH INSURANCE MARKET, BY END USE

9.1 OVERVIEW

9.2 CORPORATE

9.2.1 SERVICES

9.2.1 SOLUTION

9.3 INDIVIDUAL

9.3.1 SERVICES

9.3.2 SOLUTION

10 EUROPE HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT SALES

10.3 FINANCIAL INSTITUTIONS

10.4 E-COMMERCE

10.5 HOSPITALS

10.6 CLINICS

10.7 OTHERS

11 EUROPE HEALTH INSURANCE MARKET, BY LEVEL OF COVERAGE

11.1 OVERVIEW

11.2 BRONZE

11.3 SILVER

11.4 GOLD

11.5 PLATINUM

12 EUROPE HEALTH INSURANCE MARKET, BY NETWORK

12.1 OVERVIEW

12.2 POINT OF SERVICE (POS)

12.3 EXCLUSIVE PROVIDER ORGANIZATION (EPOS)

12.4 PREFERRED PROVIDER ORGANIZATION (PPO)

12.5 INDEMNITY HEALTH INSURANCE

12.6 HEALTH MAINTENANCE ORGANIZATION (HMO)

12.7 HEALTH SAVINGS ACCOUNT (HSA)

12.8 QUALIFIED SMALL EMPLOYER HEALTH REIMBURSEMENT ARRANGEMENTS (QSEHRAS)

12.9 OTHERS

13 EUROPE HEALTH INSURANCE MARKET, BY DEMOGRAPHICS

13.1 OVERVIEW

13.2 ADULTS

13.3 MINORS

13.4 SENIORS

14 EUROPE

14.1 U.K.

14.2 GERMANY

14.3 FRANCE

14.4 RUSSIA

14.5 ITALY

14.6 SPAIN

14.7 NETHERLANDS

14.8 POLAND

14.9 SWITZERLAND

14.1 BELGIUM

14.11 SWEDEN

14.12 TURKEY

14.13 DENMARK

14.14 NORWAY

14.15 FINLAND

14.16 REST OF EUROPE

15 EUROPE HEALTH INSURANCE MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 AETNA INC. (A SUBSIDIARY OF CVS HEALTH)

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 UNITEDHEALTH GROUP

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENTS

17.3 AXA

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 BUPA

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 ASSICURANZIONI GENERALI S.P.A.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 ALLIANZ CARE (A SUBSIDIARY OF ALLIANZ)

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 AVIVA

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 BROADSTONE CORPORATE BENEFITS LIMITED

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 CIGNA

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.1 FREEDOM HEALTH INSURANCE

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 GENERAL AND MEDICAL FINANCE LTD

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 HEALTHCARE INTERNATIONAL GLOBAL NETWORK LTD.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 INTERNATIONAL MEDICAL GROUP, INC.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 MAPFRE

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 NOW HEALTH INTERNATIONAL

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEEVLOPMENTS

17.16 ORACLE

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT DEVELOPMENTS

17.17 SAGA

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENTS

17.18 VHI GROUP

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 VITALITY (A SUBSIDIARY OF DISCOVERY LTD)

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

表格列表

TABLE 1 AVERAGE COSTS FOR COMMON SURGERIES

TABLE 2 LIST OF DAY CARE PROCEDURES

TABLE 3 EUROPE HEALTH INSURANCE MARKET, BY OFFERING, 2021-2030 (EURO MILLION)

TABLE 4 EUROPE SERVICES IN HEALTH INSURANCE MARKET, BY TYPE, 2021-2030 (EURO MILLION)

TABLE 5 EUROPE SOLUTION IN HEALTH INSURANCE MARKET, BY TYPE, 2021-2030 (EURO MILLION)

TABLE 6 EUROPE HEALTH INSURANCE MARKET, BY PROVIDER, 2021-2030 (EURO MILLION)

TABLE 7 EUROPE HEALTH INSURANCE MARKET, BY COVERAGE TYPE, 2021-2030 (EURO MILLION)

TABLE 8 EUROPE HEALTH INSURANCE MARKET, BY END USE, 2021-2030 (EURO MILLION)

TABLE 9 EUROPE CORPORATE IN HEALTH INSURANCE MARKET, BY OFFERING, 2021-2030 (EURO MILLION)

TABLE 10 EUROPE INDIVIDUAL IN HEALTH INSURANCE MARKET, BY OFFERING, 2021-2030 (EURO MILLION)

TABLE 11 EUROPE HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (EURO MILLION)

TABLE 12 EUROPE HEALTH INSURANCE MARKET, BY LEVEL OF COVERAGE, 2021-2030 (EURO MILLION)

TABLE 13 EUROPE HEALTH INSURANCE MARKET, BY NETWORK, 2021-2030 (EURO MILLION)

TABLE 14 EUROPE HEALTH INSURANCE MARKET, BY DEMOGRAPHICS, 2021-2030 (EURO MILLION)

图片列表

FIGURE 1 EUROPE HEALTH INSURANCE MARKET: SEGMENTATION

FIGURE 2 EUROPE HEALTH INSURANCE MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE HEALTH INSURANCE MARKET: DROC ANALYSIS

FIGURE 4 EUROPE HEALTH INSURANCE MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE HEALTH INSURANCE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE HEALTH INSURANCE MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE HEALTH INSURANCE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE HEALTH INSURANCE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE HEALTH INSURANCE MARKET: END-USER COVERAGE GRID

FIGURE 10 EUROPE HEALTH INSURANCE MARKET: SEGMENTATION

FIGURE 11 INCREASING COST FOR MEDICAL SERVICES IS EXPECTED TO DRIVE THE GROWTH OF THE EUROPE HEALTH INSURANCE MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE HEALTH INSURANCE MARKET IN 2023 AND 2030

FIGURE 13 MIGRANT POPULATION STATISTICS IN EUROPEAN COUNTRIES (2021)

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF EUROPE HEALTH INSURANCE MARKET

FIGURE 15 INCREASE IN HEALTH CARE EXPENDITURE BY ALL FINANCING SCHEMES (2019-2020)

FIGURE 16 EUROPE PRIVATE HEALTH INSURANCE COVERAGE, 2020

FIGURE 17 PERCENTAGE OF OUT-OF-POCKET EXPENDITURE ON HEALTH (2019)

FIGURE 18 HEALTH INSURANCE COVERAGE

FIGURE 19 EUROPE HEALTH INSURANCE MARKET: BY OFFERING, 2022

FIGURE 20 EUROPE HEALTH INSURANCE MARKET: BY PROVIDER, 2022

FIGURE 21 EUROPE HEALTH INSURANCE MARKET: BY COVERAGE TYPE, 2022

FIGURE 22 EUROPE HEALTH INSURANCE MARKET: BY END USE, 2022

FIGURE 23 EUROPE HEALTH INSURANCE MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 24 EUROPE HEALTH INSURANCE MARKET: BY LEVEL OF COVERAGE, 2022

FIGURE 25 EUROPE HEALTH INSURANCE MARKET: BY NETWORK, 2022

FIGURE 26 EUROPE HEALTH INSURANCE MARKET: BY DEMOGRAPHICS, 2022

FIGURE 27 EUROPE HEALTH INSURANCE MARKET: SNAPSHOT (2022)

FIGURE 28 EUROPE HEALTH INSURANCE MARKET: COMPANY SHARE 2022 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。