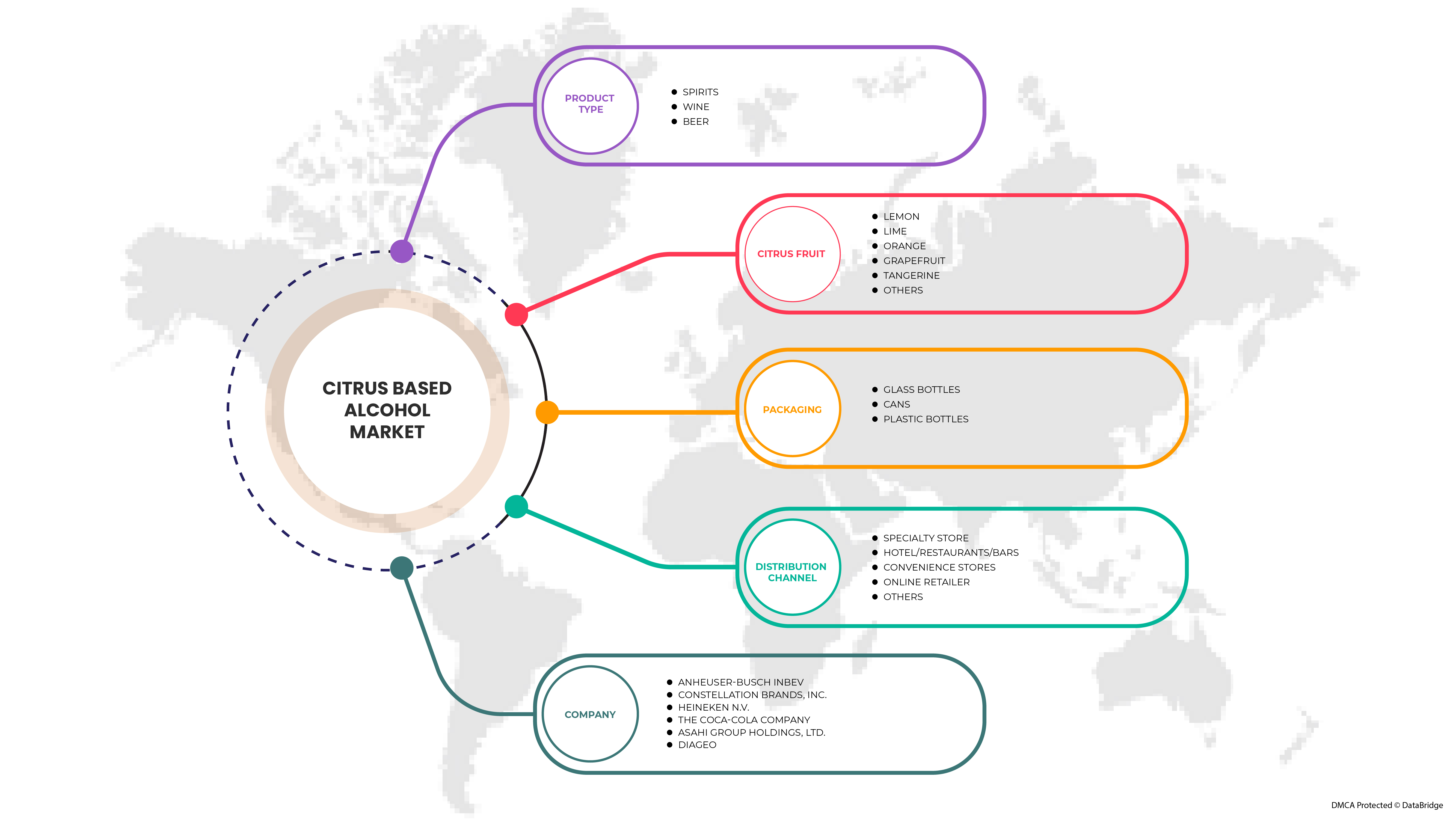

欧洲柑橘类酒精市场按产品类型(烈酒、葡萄酒和啤酒)、柑橘类水果(柠檬、酸橙、橙子、葡萄柚、橘子等)、包装(玻璃瓶、罐头和塑料瓶)、分销渠道(专卖店、酒店/餐厅/酒吧、便利店、在线零售商等)、行业趋势和预测到 2029 年。

欧洲柑橘类酒精市场分析与洞察

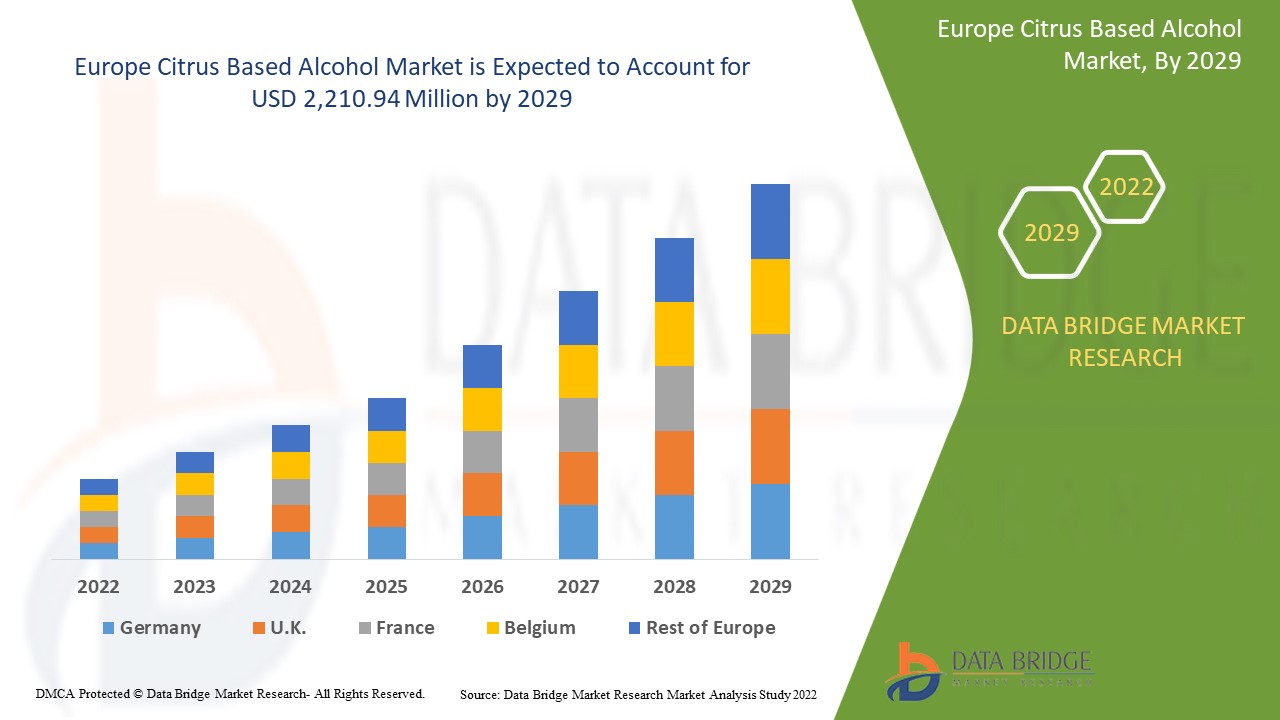

柑橘类酒精市场预计将在 2022 年至 2029 年的预测期内实现显着增长。Data Bridge Market Research 分析称,在 2022 年至 2029 年的预测期内,该市场以 3.9% 的复合年增长率增长,预计到 2029 年将达到 22.1094 亿美元。推动柑橘类酒精市场增长的主要因素是精酿烈酒的增长趋势和采用具有成本效益的原料。

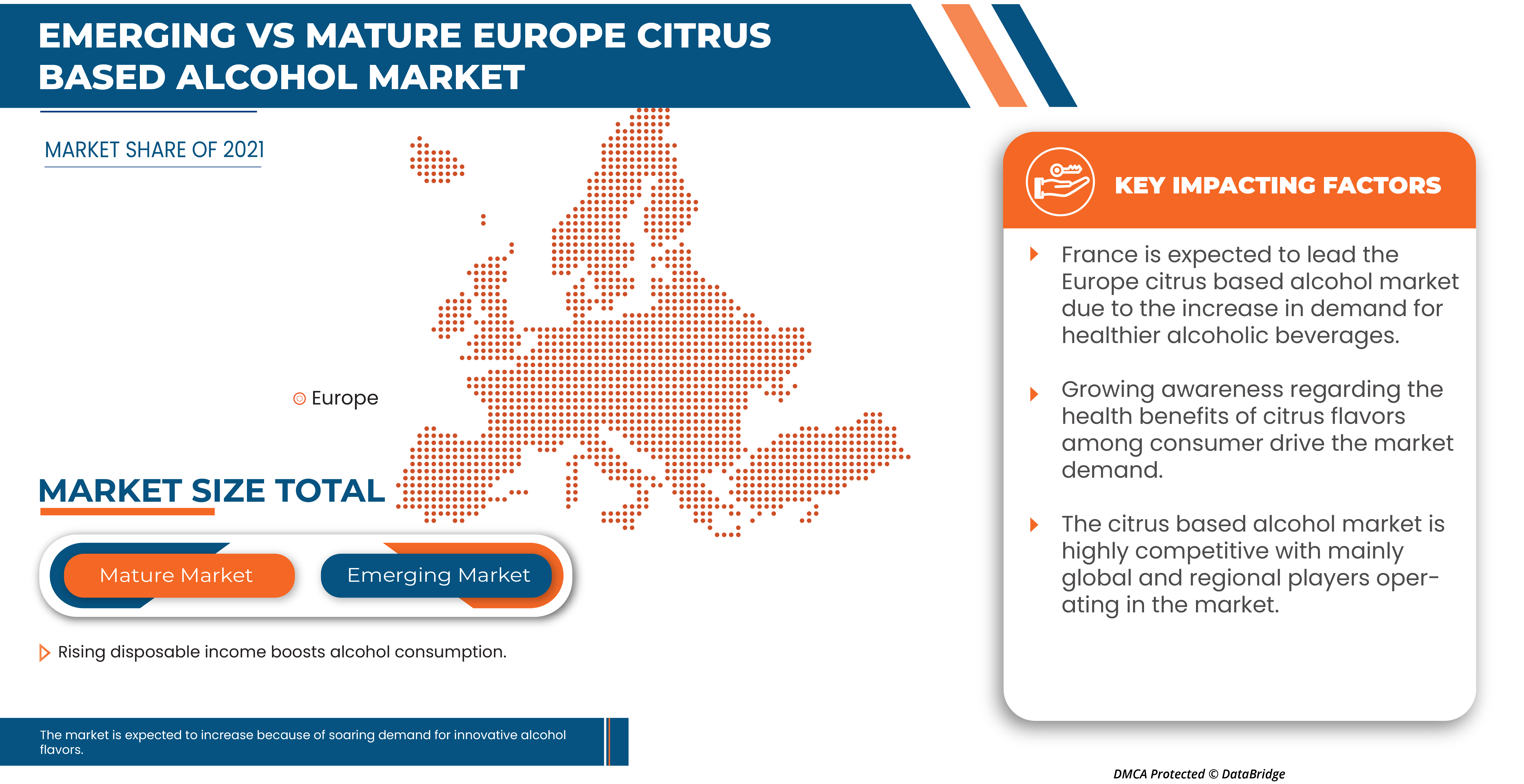

手工酿造烈酒的需求和普及度不断增长,以及成本效益高的原料的采用是欧洲柑橘类酒精市场的重要推动力。可支配收入的增加推动了酒精消费,消费者对柑橘口味健康益处的认识不断提高,预计将推动欧洲柑橘类酒精市场的增长。

柑橘类酒精市场报告提供了市场份额、新发展和国内和本地市场参与者的影响的详细信息,分析了新兴收入来源、市场法规变化、产品审批、战略决策、产品发布、地域扩张和市场技术创新方面的机会。要了解分析和市场情况,请联系我们获取分析师简报,我们的团队将帮助您创建收入影响解决方案,以实现您的预期目标。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2014) |

|

定量单位 |

收入(百万美元) |

|

涵盖的领域 |

按产品类型(烈酒、葡萄酒和啤酒)、柑橘类水果(柠檬、酸橙、橙子、葡萄柚、橘子等)、包装(玻璃瓶、罐头和塑料瓶)、分销渠道(专卖店、酒店/餐厅/酒吧、便利店、在线零售商等)。 |

|

覆盖国家 |

英国、俄罗斯、法国、西班牙、意大利、德国、土耳其、荷兰、瑞士、比利时、欧洲其他国家。 |

|

涵盖的市场参与者 |

百威英博、星座品牌公司、喜力啤酒公司、可口可乐公司、朝日集团控股有限公司、百威英博、波士顿啤酒公司、帝亚吉欧、Beam Suntory 公司、Radico Khaitan 有限公司、EDRINGTON、三得利控股有限公司、Accolade Wines Limited、WILLIAM GRANT & SONS、嘉士伯啤酒公司、Halewood Artisanal Spirits、保乐力加、联合啤酒有限公司、Brown-Forman、KALS Distilleries Private Limited、百加得有限公司 |

市场定义

柑橘类酒精饮料主要由柠檬、酸橙、葡萄柚和橙子等柑橘类水果制成。由于其风味和强酸度,柑橘已成为酒精饮料(包括啤酒和葡萄酒、朗姆酒和杜松子酒等烈酒)不可或缺的一部分,并用于平衡鸡尾酒。同样,柑橘类酒精在酒精生产中用作基础和调味添加剂。柑橘类酒精饮料继承了其生产原料柑橘类水果的营养成分,例如柠檬、酸橙、橙子、葡萄柚、橘子等。柑橘类水果富含维生素 C,这是一种强大的抗氧化剂,可保护细胞免受自由基损伤,并在预防糖尿病、癌症、神经系统疾病等疾病方面发挥重要作用。

手工烈酒主要通过注入水果风味来开发。手工烈酒带来的创新在饮料行业是无与伦比的。消费者认为手工产品更具创意、灵活和小众,具有如此多的品种和艺术性。手工烈酒的这种日益增长有助于柑橘类酒精的增长,因为它们将柑橘融入其酿酒产品中。除了柑橘类水果外,烈酒还注入了各种香料,包括肉桂、香草、生姜、胡椒等,以改善口感和香气。采用这些成分和柑橘类水果对于烈酒的生产来说既更健康,也更具成本效益。

柑橘类酒精饮料市场动态

驱动程序

- 手工酿造烈酒的趋势日益增长,且采用成本效益高的原料

随着饮料行业不断扩大和发展,精酿烈酒(包括精酿啤酒和苹果酒)的崛起不容忽视。从朗姆酒到杜松子酒,无论是在线还是实体店,都有大量的精酿烈酒可供选择——它们都体现了不同的特色。许多人更喜欢精酿烈酒而不是更传统的商业品牌,这也可能归因于消费者倾向于从小型酿酒厂和啤酒厂购买本地产品。由于年轻富裕人群的文化态度发生变化,对优质精酿烈酒的需求迅速增长,这是全球精酿烈酒市场增长的主要推动因素。精酿烈酒消费者更喜欢使用天然或有机香料制成的产品,而小型酿酒厂则通过干净的标签、正宗的手工挑选原料(如泉水和非转基因谷物)和独特的风味组合来脱颖而出。最受欢迎的精酿朗姆酒是香料朗姆酒,加入了肉桂、生姜、香草、肉豆蔻和胡椒等各种香料。采用这种原料对于手工烈酒的生产来说更加健康并且更具成本效益。

- 可支配收入增加推动酒精消费

但如今,由于人们的可支配收入不断提高,大多数国家的酒类消费都变得更加实惠。实际收入的变化大于酒类相对价格的变化。这表明实际收入的增长是推动酒类消费的主要因素。18 至 80 岁年龄段的酒类消费增长幅度很大。尤其是年轻人。就业率的提高和可支配收入的提高,再加上失业率的下降,推动了对酒类的需求。在现代社会,人们到处都需要酒类来享受假期、聚会和休闲时光。IT 行业不断发展,人们试图与同事建立更多的社交关系。这种社交活动大多需要酒类。为了缓解这种情况,酒类不仅在酒类商店或专卖店有售,高档酒店和餐馆也热衷于将精酿烈酒纳入其产品组合。

- 消费者对柑橘口味的健康益处的认识日益提高

柑橘味酒精饮料因其多种健康益处和增强口感的能力而越来越受到全世界大多数人的欢迎。柑橘类水果,如柠檬和橙子,富含维生素 C,这是一种强大的抗氧化剂,可保护细胞免受自由基的损害。骨骼生成、结缔组织愈合和牙龈健康都主要需要维生素 C,而维生素 C 可以从柑橘味饮料中获取。柑橘中的维生素 C 还有助于预防皱纹、老化引起的皮肤干燥和阳光伤害。此外,它还能催化胶原蛋白的产生,这对皮肤健康至关重要。

机会

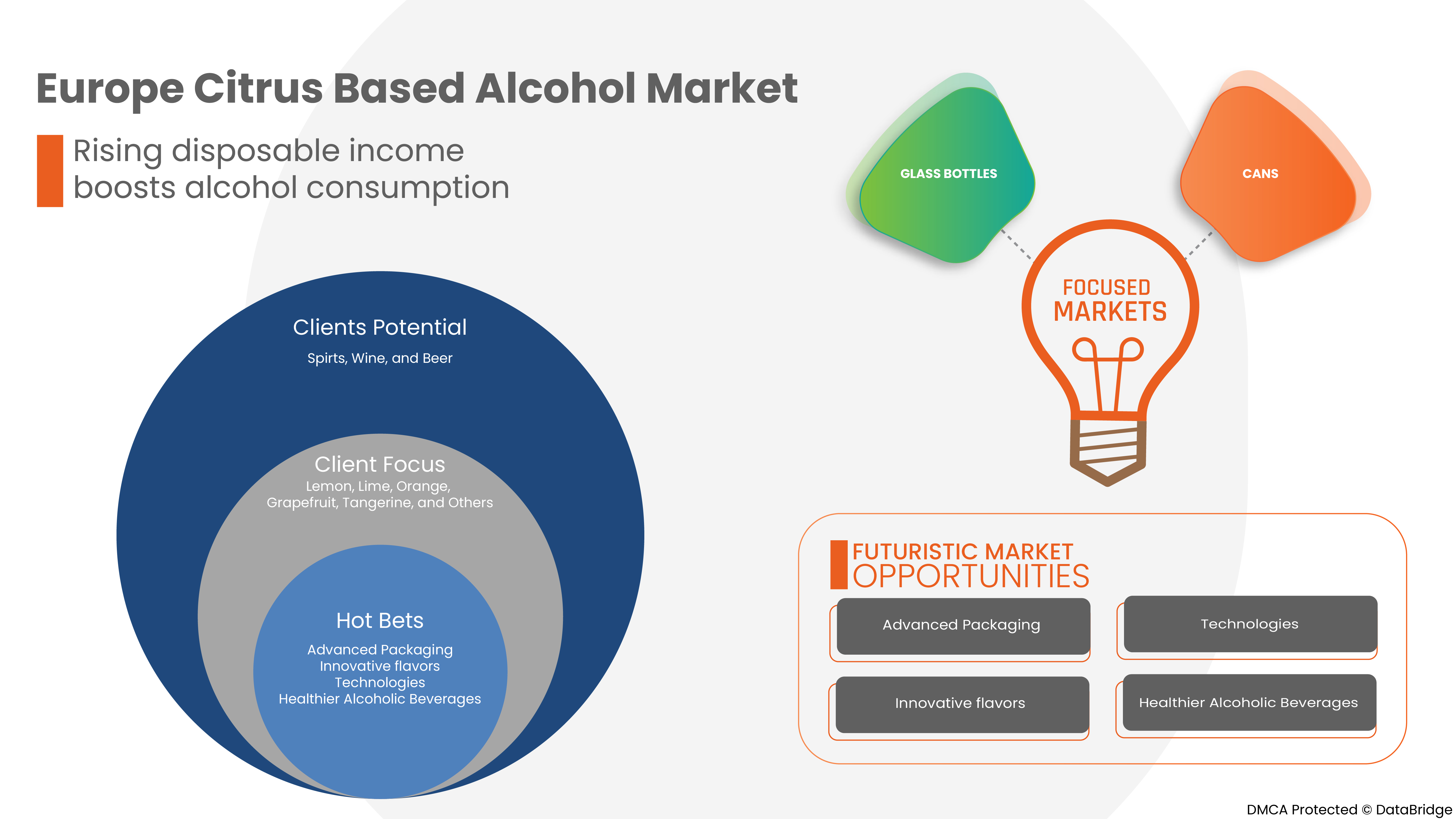

- 创新酒类口味需求飙升

有很多方法可以利用水果风味来提升纯酒精饮料的品质。柑橘油被广泛用于饮料调味。这种水果属于芸香科,由大约 140 个族和 1300 个品种组成,例如:绿柠檬、葡萄柚、橙子、黄柠檬、柑橘、柚子、佛手柑和香橼。柑橘油储存在叶子、果皮和果汁中。萜烯、倍半萜、醛、醇、酯和固醇是这些优质精油中发现的众多化学物质之一。它们也被称为碳氢化合物混合物、含氧化学物质和非挥发性残留物化合物。柑橘风味在饮料中很受欢迎,尤其是小麦啤酒。小麦啤酒发酵产物之一是酯类,它赋予啤酒本身水果的味道和香气,因此它与柑橘风味完美契合,几乎掩盖了啤酒花提供的风味和香气。最受欢迎的啤酒鸡尾酒与柠檬、橙汁或调味料等柑橘类水果混合。

- 重点制造商日益注重现有技术的升级

随着柑橘类酒类消费的扩大,酒类市场正处于快速转型之中。柑橘酒、柑橘白兰地等柑橘发酵酒类生产工艺属于柑橘深加工领域,以柑橘类果实为原料,采用压汁、离心、静置澄清、调节糖酸比、低温前发酵、后发酵、过滤陈酿、勾兑、冷冻过滤、超高温瞬时灭菌、热灌装等工序,得到柑橘发酵酒;再将干型柑橘发酵酒经蒸馏、调配、过滤、陈酿、勾兑、冷冻过滤等工序,得到本发明的柑橘白兰地。该柑橘白兰地澄清透明,具有柑橘香气和自然色泽,口感醇厚。此外,还可用其他现有技术来制造柑橘类酒类。

限制/挑战

- 柑橘类水果价格波动

柑橘类水果或原材料的价格在柑橘类酒精市场中起着重要作用,因为在酒精中使用柑橘类水果调味料,市场上生产和销售的饮料更加健康、美味。全球酒精消费量的增加也增加了柑橘类酒精饮料的消费量,因为它们含有天然的柑橘水果味混合物。生产柑橘类酒精的基本主要原料是柑橘类水果。柑橘类水果包括橙子、柠檬、酸橙和葡萄柚。尽管这些柑橘类水果在市场上随处可见,但一些国家的通货膨胀率、气候条件、进出口法律和关税、用于运输的石油产品价格波动以及其他因素都对价格波动产生重大影响并导致价格波动。

- 旨在限制酒精消费的严格规定

为减少酒精消费而采取的主要严格政策包括几个“国家”使用税收来控制酒精价格,例如单一税、特定(体积)税和其他所有酒精消费税。除了这些税收之外,一些政府对最低单位定价 (MUP) 的兴趣也越来越大。MUP 是一种政策工具,它为每单位酒精或标准饮料设定强制性最低价格,针对廉价酒精饮料。包括加拿大在内的几个国家实施了 MUP。可以限制酒精供应以影响摄入量,限制人们购买和消费酒精的机会。例如,在印度泰米尔纳德邦,酒精商店的营业时间为中午 12 点至晚上 10 点。

- 人们越来越担心人工香料对健康的有害影响

人工香料没有任何营养价值。它们不会通过必需的维生素和矿物质增加健康益处。它们对人体健康有害。大量饮用调味酒精饮料的主要影响是增加癌症风险,以及高血压、心脏病、中风、肝病、免疫系统减弱等。

- 酒精使用障碍 (AUD) 患病率高

酒精使用障碍的病因似乎是遗传、儿童早期事件和缓解情绪痛苦的尝试的综合作用。如果人们经常大量饮酒或从小就开始喝酒,遭受过创伤,例如身体虐待或性虐待,有酒精使用障碍的家族史,有精神健康问题,例如悲伤、焦虑、抑郁、饮食失调和创伤后应激障碍,那么他们更容易患上酒精使用障碍。曾因体重问题接受过胃绕道手术。

- 柑橘替代品的可用性

有许多替代新鲜柑橘汁的替代品可以平衡我们的鸡尾酒,它们以天然酸的形式出现。您可能知道的一种是柠檬酸。不过,还有其他几种:苹果酸(存在于苹果、杏子、桃子中)、酒石酸(葡萄、香蕉)和乳酸(乳制品),仅举几例。此外,醋、糖蜜和酸果汁可以提供与柑橘和粉末酸不同的酸度和酸味。使用极少量的酸可以稳定糖浆和果汁,这些糖浆和果汁的味道会自然变质,并大大延长其保质期。

近期发展

- 2021 年 10 月,据 Craft Spirits 报道,柑橘味即饮罐装鸡尾酒 SunDaze 宣布在南加州洛杉矶县的 PinkDot 和 Total Wine 门店以及全国各地(合法地区)通过在线直销的方式推出。此次推出将加强该公司在欧洲市场的运营。

- 2022 年 7 月,据《烈酒商业》报道,总部位于英国的莎士比亚酒厂推出了一款柑橘伏特加,作为其限量版酒厂特制系列的一部分。这款柑橘伏特加具有浓郁的新鲜橙子和柠檬的味道,这些橙子和柠檬是在酒厂手工剥皮的。

柑橘类酒精饮料市场范围

柑橘类酒精市场根据产品类型、柑橘类水果、包装和分销渠道进行分类。这些细分市场之间的增长将帮助您分析行业中的主要增长细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策,确定核心市场应用。

产品类型

- 烈酒

- 葡萄酒

- 啤酒

根据产品类型,柑橘类酒精市场分为三个部分,即啤酒、葡萄酒和烈酒。

柑橘类水果

- 柠檬

- 酸橙

- 橙子

- 柚子

- 柑橘

- 其他的

根据柑橘类水果,柑橘类酒精市场分为六个部分,即柠檬、酸橙、橙子、葡萄柚、橘子和其他。

包装

- 玻璃瓶

- 罐头

- 塑料瓶

根据包装,柑橘类酒精市场分为三个部分,即玻璃瓶、罐头和塑料瓶。

分销渠道

- 专卖店

- 酒店/餐厅/酒吧

- 便利店

- 网上零售商

- 其他的

根据分销渠道,柑橘类酒精市场分为五个部分,即专卖店、酒店/餐厅/酒吧、便利店、在线零售商和其他。

柑橘类酒精市场区域分析/见解

柑橘类酒精市场根据产品类型、柑橘类水果、包装和分销渠道进行细分。

柑橘类酒精市场的国家包括英国、俄罗斯、法国、西班牙、意大利、德国、土耳其、荷兰、瑞士、比利时和欧洲其他国家。

在欧洲,由于精酿烈酒的流行趋势日益增长,法国有望主导欧洲柑橘类酒精饮料市场。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。数据点下游和上游价值链分析、技术趋势、波特五力分析和案例研究是用于预测各个国家市场情景的一些指标。此外,在提供国家数据的预测分析时,还考虑了欧洲品牌的存在和可用性以及由于来自本地和国内品牌的大量或稀缺竞争而面临的挑战、国内关税的影响和贸易路线。

竞争格局和柑橘类酒精市场份额分析

柑橘类酒精市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、生产基地和设施、公司优势和劣势、产品发布、产品试验渠道、产品批准、专利、产品宽度和广度、应用优势、技术生命线曲线。以上提供的数据点仅与公司对柑橘类酒精市场的关注有关。

该市场的一些主要市场参与者包括百威英博、星座品牌公司、喜力啤酒、可口可乐公司、朝日集团控股有限公司、百威英博、波士顿啤酒公司、帝亚吉欧、Beam Suntory 公司、Radico Khaitan 有限公司、EDRINGTON、三得利控股有限公司、Accolade Wines 有限公司、WILLIAM GRANT & SONS、嘉士伯啤酒公司、Halewood Artisanal Spirits、保乐力加、联合啤酒有限公司、Brown-Forman、KALS Distilleries Private Limited、百加得有限公司等。

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析以及主要(行业专家)验证。除此之外,数据模型还包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、公司市场份额分析、测量标准、欧洲与地区以及供应商份额分析。如有进一步询问,请要求分析师致电。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE CITRUS BASED ALCOHOL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FACTORS INFLUENCING PURCHASING DECISION OF END USERS

4.2 GROWTH STRATEGIES OF THE KEY MARKET PLAYERS

4.3 IMPACT OF THE ECONOMY ON MARKET

4.3.1 IMPACT ON PRICE

4.3.2 IMPACT ON SUPPLY CHAIN

4.3.3 IMPACT ON SHIPMENT

4.3.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.4 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.5 TECHNOLOGICAL ADVANCEMENT

4.6 FOB & B2B PRICES – EUROPE CITRUS BASED ALCOHOL MARKET

4.7 B2B PRICES – EUROPE CITRUS BASED ALCOHOL MARKET

4.8 VALUE CHAIN ANALYSIS:

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 RAW MATERIAL PROCUREMENT

4.9.2 MANUFACTURING AND PACKING

4.9.3 MARKETING AND DISTRIBUTION

4.9.4 END USERS

5 REGULATORY FRAMEWORK AND GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING TREND OF CRAFT SPIRITS AND THE ADOPTION OF COST-EFFECTIVE INGREDIENTS

6.1.2 RISING DISPOSABLE INCOME BOOSTS ALCOHOL CONSUMPTION

6.1.3 GROWING AWARENESS REGARDING THE HEALTH BENEFITS OF CITRUS FLAVORS AMONG CONSUMERS

6.2 RESTRAINTS

6.2.1 PRICE VOLATILITY IN CITRUS FRUITS

6.2.2 STRICT RULES AIMED AT LIMITING ALCOHOL CONSUMPTION

6.2.3 GROWING CONCERNS ABOUT THE HARMFUL EFFECTS OF ARTIFICIAL FLAVORS ON HEALTH

6.3 OPPORTUNITIES

6.3.1 SOARING DEMAND FOR INNOVATIVE ALCOHOL FLAVORS

6.3.2 INCREASING FOCUS OF THE KEY MANUFACTURER TO UPGRADE THE EXISTING TECHNOLOGIES

6.4 CHALLENGES

6.4.1 A HIGH PREVALENCE OF ALCOHOL USE DISORDER (AUD)

6.4.2 AVAILABILITY OF SUBSTITUTES FOR CITRUS

7 EUROPE CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 SPIRITS

7.2.1 DISTILLED SPIRITS

7.2.1.1 VODKA

7.2.1.2 WHISKEY

7.2.1.3 RUM

7.2.1.3.1 LIGHT RUM

7.2.1.3.2 GOLD RUM

7.2.1.3.3 DARK RUM

7.2.1.3.4 OVER-PROOF RUM

7.2.1.3.5 SPICED RUM

7.2.1.3.6 CACHACA

7.2.1.3.7 FLAVORED RUM

7.2.1.4 TEQUILA

7.2.1.4.1 BLANCO

7.2.1.4.2 REPOSADO

7.2.1.4.3 ANEJO

7.2.1.4.4 EXTRA-ANEJO

7.2.1.5 BRANDY

7.2.1.5.1 COGNAC

7.2.1.5.2 ARMAGNAC

7.2.1.5.3 SPANISH BRANDY

7.2.1.5.4 AMERICAN BRANDY

7.2.1.5.5 GRAPPA

7.2.1.5.6 EAU-DE-VIE

7.2.1.5.7 FLAVORED BRANDY

7.2.1.6 GIN

7.2.1.6.1 LONDON DRY GIN

7.2.1.6.2 PLYMOUTH GIN

7.2.1.6.3 OLD TOM GIN

7.2.1.6.4 GENEVER

7.2.1.6.5 NEW AMERICAN

7.2.2 NON-DISTILLED SPIRITS

7.3 WINE

7.3.1 RED WINE

7.3.1.1 CABERNET SAUVIGNON

7.3.1.2 PINOT NOIR

7.3.1.3 ZINFANDEL

7.3.1.4 SYRAH

7.3.2 WHITE WINE

7.3.2.1 CHARDONNAY

7.3.2.2 RIESLING

7.3.2.3 PINOT GRIS

7.3.2.4 SAUVIGNON BLANC

7.3.3 ROSE WINE

7.3.4 SPARKLING WINE

7.3.5 DESSERT WINE

7.4 BEER

7.4.1 ALE

7.4.1.1 BROWN ALE

7.4.1.2 PALE ALE

7.4.1.3 INDIA PALE ALE

7.4.1.4 SOUR ALE

7.4.2 LAGER

7.4.3 PORTER

7.4.4 STOUT

7.4.5 WHEAT

7.4.6 PILSNER

8 EUROPE CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT

8.1 OVERVIEW

8.2 LEMON

8.3 LIME

8.4 ORANGE

8.5 GRAPEFRUIT

8.6 TANGERINE

8.7 OTHERS

9 EUROPE CITRUS BASED ALCOHOL MARKET, BY PACKAGING

9.1 OVERVIEW

9.2 GLASS BOTTLES

9.3 CANS

9.4 PLASTIC BOTTLES

10 EUROPE CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 SPECIALTY STORES

10.3 HOTEL/RESTAURANTS/BARS

10.4 CONVENIENCE STORES

10.5 ONLINE RETAILERS

10.6 OTHERS

11 EUROPE CITRUS BASED ALCOHOL MARKET, BY REGION

11.1 EUROPE

11.1.1 FRANCE

11.1.2 SPAIN

11.1.3 GERMANY

11.1.4 U.K.

11.1.5 SWITZERLAND

11.1.6 BELGIUM

11.1.7 NETHERLANDS

11.1.8 ITALY

11.1.9 RUSSIA

11.1.10 TURKEY

11.1.11 REST OF EUROPE

12 EUROPE CITRUS BASED ALCOHOL MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

12.2 MERGERS & ACQUISITIONS

12.3 EXPANSIONS

12.4 NEW PRODUCT DEVELOPMENTS

12.5 AGREEMENTS

12.6 PARTNERSHIPS

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 ANHEUSER-BUSCH INBEV

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 CONSTELLATION BRANDS, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 HEINEKEN N.V.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 THE COCA-COLA COMPANY

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 ASHAHI GROUP HOLDINGS, LTD

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ANHEUSER-BUSCH COMPANIES, LLC.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 THE BOSTON BEER COMPANY

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 DIAGEO

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 BEAM SUNTORY INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 ACCOLADE WINES LIMITED.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 BACARDI LIMITED

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 BROWN-FORMAN

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 CARLSBERG BREWERIES A/S

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 EDRINGTON

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENT

14.15 HALEWOOD ARTISANAL SPIRITS

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 KALS DISTILLERIES PRIVATE LIMITED.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 PERNOD RICARD

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 RADICO KHAITAN LTD.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENT

14.19 SUNTORY HOLDINGS LIMITED

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

14.2 UNITED BREWERIES LTD.

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT DEVELOPMENT

14.21 WILLIAM GRANT & SONS

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 EUROPE CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 EUROPE CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 3 EUROPE SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 EUROPE SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (MILLION LITRES)

TABLE 5 EUROPE SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 6 EUROPE DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 7 EUROPE RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 8 EUROPE TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 9 EUROPE BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 10 EUROPE GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 11 EUROPE WINE IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE WINE IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (MILLION LITRES)

TABLE 13 EUROPE WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 14 EUROPE RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 15 EUROPE WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 16 EUROPE BEER IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE BEER IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (MILLION LITRES)

TABLE 18 EUROPE BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 19 EUROPE ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 EUROPE CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 21 EUROPE LEMON IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE LIME IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE ORANGE IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE GRAPEFRUIT IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE TANGERINE IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE OTHERS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 28 EUROPE GLASS BOTTLES IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE CANS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE PLASTIC BOTTLES IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 32 EUROPE SPECIALTY STORES RANGE IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE HOTEL/RESTAURANTS/BARS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE CONVENIENCE STORES IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE ONLINE RETAILERS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE OTHERS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE CITRUS BASED ALCOHOL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 38 EUROPE CITRUS BASED ALCOHOL MARKET, BY COUNTRY, 2020-2029 (MILLION LITRES)

TABLE 39 EUROPE CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 40 EUROPE CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 41 EUROPE SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 42 EUROPE DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 43 EUROPE RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 44 EUROPE TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 45 EUROPE BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 46 EUROPE GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 47 EUROPE WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 48 EUROPE RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 49 EUROPE WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 50 EUROPE BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 51 EUROPE ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 EUROPE CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 53 EUROPE CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 54 EUROPE CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 55 FRANCE CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 56 FRANCE CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 57 FRANCE SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 58 FRANCE DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 59 FRANCE RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 60 FRANCE TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 61 FRANCE BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 62 FRANCE GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 63 FRANCE WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 64 FRANCE RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 65 FRANCE WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 66 FRANCE BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 67 FRANCE ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 FRANCE CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 69 FRANCE CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 70 FRANCE CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 SPAIN CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 SPAIN CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 73 SPAIN SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 74 SPAIN DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 75 SPAIN RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 76 SPAIN TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 77 SPAIN BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 78 SPAIN GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 79 SPAIN WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 80 SPAIN RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 81 SPAIN WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 82 SPAIN BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 83 SPAIN ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 SPAIN CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 85 SPAIN CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 86 SPAIN CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 87 GERMANY CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 88 GERMANY CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 89 GERMANY SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 90 GERMANY DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 91 GERMANY RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 92 GERMANY TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 93 GERMANY BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 94 GERMANY GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 95 GERMANY WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 96 GERMANY RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 97 GERMANY WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 98 GERMANY BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 99 GERMANY ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 GERMANY CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 101 GERMANY CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 102 GERMANY CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 103 U.K. CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 U.K. CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 105 U.K. SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 106 U.K. DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 107 U.K. RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 108 U.K. TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 109 U.K. BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 110 U.K. GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 111 U.K. WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 112 U.K. RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 113 U.K. WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 114 U.K. BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 115 U.K. ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 U.K. CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 117 U.K. CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 118 U.K. CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 119 SWITZERLAND CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 120 SWITZERLAND CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 121 SWITZERLAND SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 122 SWITZERLAND DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 123 SWITZERLAND RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 124 SWITZERLAND TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 125 SWITZERLAND BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 126 SWITZERLAND GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 127 SWITZERLAND WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 128 SWITZERLAND RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 129 SWITZERLAND WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 130 SWITZERLAND BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 131 SWITZERLAND ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 SWITZERLAND CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 133 SWITZERLAND CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 134 SWITZERLAND CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 135 BELGIUM CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 136 BELGIUM CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 137 BELGIUM SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 138 BELGIUM DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 139 BELGIUM RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 140 BELGIUM TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 141 BELGIUM BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 142 BELGIUM GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 143 BELGIUM WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 144 BELGIUM RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 145 BELGIUM WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 146 BELGIUM BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 147 BELGIUM ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 BELGIUM CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 149 BELGIUM CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 150 BELGIUM CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 151 NETHERLANDS CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 152 NETHERLANDS CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 153 NETHERLANDS SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 154 NETHERLANDS DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 155 NETHERLANDS RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 156 NETHERLANDS TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 157 NETHERLANDS BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 158 NETHERLANDS GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 159 NETHERLANDS WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 160 NETHERLANDS RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 161 NETHERLANDS WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 162 NETHERLANDS BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 163 NETHERLANDS ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 NETHERLANDS CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 165 NETHERLANDS CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 166 NETHERLANDS CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 167 ITALY CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 168 ITALY CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 169 ITALY SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 170 ITALY DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 171 ITALY RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 172 ITALY TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 173 ITALY BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 174 ITALY GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 175 ITALY WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 176 ITALY RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 177 ITALY WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 178 ITALY BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 179 ITALY ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 ITALY CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 181 ITALY CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 182 ITALY CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 183 RUSSIA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 184 RUSSIA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 185 RUSSIA SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 186 RUSSIA DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 187 RUSSIA RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 188 RUSSIA TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 189 RUSSIA BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 190 RUSSIA GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 191 RUSSIA WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 192 RUSSIA RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 193 RUSSIA WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 194 RUSSIA BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 195 RUSSIA ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 RUSSIA CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 197 RUSSIA CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 198 RUSSIA CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 199 TURKEY CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 200 TURKEY CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 201 TURKEY SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 202 TURKEY DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 203 TURKEY RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 204 TURKEY TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 205 TURKEY BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 206 TURKEY GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 207 TURKEY WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 208 TURKEY RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 209 TURKEY WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 210 TURKEY BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 211 TURKEY ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 TURKEY CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 213 TURKEY CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 214 TURKEY CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 215 REST OF EUROPE CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 216 REST OF EUROPE CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

图片列表

FIGURE 1 EUROPE CITRUS BASED ALCOHOL MARKET

FIGURE 2 EUROPE CITRUS BASED ALCOHOL MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE CITRUS BASED ALCOHOL MARKET: DROC ANALYSIS

FIGURE 4 EUROPE CITRUS BASED ALCOHOL MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE CITRUS BASED ALCOHOL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE CITRUS BASED ALCOHOL MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 EUROPE CITRUS BASED ALCOHOL MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE CITRUS BASED ALCOHOL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE CITRUS BASED ALCOHOL MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE CITRUS BASED ALCOHOL MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 EUROPE CITRUS BASED ALCOHOL MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 EUROPE CITRUS BASED ALCOHOL MARKET: SEGMENTATION

FIGURE 13 GROWING TREND OF CRAFT SPIRITS AND THE ADOPTION OF COST-EFFECTIVE INGREDIENTS IS EXPECTED TO DRIVE EUROPE CITRUS BASED ALCOHOL MARKET IN THE FORECAST PERIOD

FIGURE 14 SPIRITS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE CITRUS BASED ALCOHOL MARKET IN 2022 & 2029

FIGURE 15 SUPPLY CHAIN ANALYSIS – EUROPE CITRUS BASED ALCOHOL MARKET

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE CITRUS BASED ALCOHOL MARKET

FIGURE 17 EUROPE CITRUS BASED ALCOHOL MARKET: BY PRODUCT TYPE, 2021

FIGURE 18 EUROPE CITRUS BASED ALCOHOL MARKET: BY CITRUS FRUIT, 2021

FIGURE 19 EUROPE CITRUS BASED ALCOHOL MARKET: BY PACKAGING, 2021

FIGURE 20 EUROPE CITRUS BASED ALCOHOL MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 21 EUROPE CITRUS BASED ALCOHOL MARKET: SNAPSHOT (2021)

FIGURE 22 EUROPE CITRUS BASED ALCOHOL MARKET: BY COUNTRY (2021)

FIGURE 23 EUROPE CITRUS BASED ALCOHOL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 EUROPE CITRUS BASED ALCOHOL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 EUROPE CITRUS BASED ALCOHOL MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 26 EUROPE CITRUS BASED ALCOHOL MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。