欧洲和南美二手车市场,按供应商类型(有组织的、无组织的)、推进类型(汽油、柴油、电动、液化石油气和压缩天然气)、发动机容量(小型(1499 CC 以下)、中型(1500-2499 CC)和全尺寸(2500 CC 以上))、经销商(特许经营、独立)、变速箱(手动、自动)、车辆类型(SUV、轿车、跨界车、轿跑车、掀背车、MPV、敞篷车、跑车等)、价格类别(高(20,000 美元以上)、中(5501 美元 - 20000 美元)和低(低于 5500 美元)、销售渠道(线下、线上) - 行业趋势和预测到 2030 年。

欧洲和南美二手车市场分析及规模

该行业涵盖这些地区各个国家/地区的二手车买卖。该市场包括通过经销商、在线平台、拍卖和私人销售进行的二手车交易,涉及以前拥有和驾驶过的车辆。它涉及各种细分市场,包括乘用车、SUV、卡车和商用车,包括参与买卖过程的个人消费者和企业。影响该市场的因素包括供需动态、经济状况、监管政策、技术进步和消费者偏好。

Data Bridge Market Research 分析称,预计到 2030 年,欧洲二手车市场价值将达到 6390.1139 亿美元,预测期内复合年增长率为 6.4%。预计到 2030 年,南美二手车市场价值将达到 991.4678 亿美元,预测期内复合年增长率为 4.1%。欧洲和南美二手车市场报告还全面涵盖了定价分析、专利分析和技术进步。

|

报告指标 |

细节 |

|

预测期 |

2023 至 2030 年 |

|

基准年 |

2022 |

|

历史岁月 |

2021(可定制为2015-2020) |

|

定量单位 |

收入(百万美元) |

|

涵盖的领域 |

供应商类型(有组织、无组织)、推进类型(汽油、柴油、电动、液化石油气和压缩天然气)、发动机容量(小型(1499 CC 以下)、中型(1500-2499 CC)和全尺寸(2500 CC 以上))、经销商(特许经营、独立)、变速箱(手动、自动)、车辆类型(SUV、轿车、跨界车、轿跑车、掀背车、MPV、敞篷车、跑车和其他)、定价类别(高(超过 20,000 美元)、中(5501 美元 - 20000 美元)和低(低于 5500 美元)、销售渠道(线下、线上) |

|

覆盖国家 |

德国、英国、法国、意大利、西班牙、俄罗斯、波兰、荷兰、比利时、瑞士、丹麦、芬兰、瑞典、挪威、土耳其、欧洲其他地区、巴西、阿根廷和南美洲其他地区 |

|

涵盖的市场参与者 |

AUTO1 Group、Penske Automotive Group, Inc.、Lookers PLC、PENDRAGON、Emil Frey AG、Group1 Automotive, Inc.、Arnold Clark Automobiles Limited、Gottfried Schultz Automobile Trading SE、Alibaba Group Holding Limited、OLX GROUP、Auto Trader Group plc.、KAVAK、HELLMAN & FRIEDMAN LLC、leboncoin、mobile.de GmbH、Gumtree.com Limited、Webmotors SA、AUTONIZA、Seminuevos.com、SALFA、Unidas、Grupo Sinal 等 |

市场定义

二手车市场是一个充满活力的行业,涉及这些地区内多个国家/地区的二手车交易。它涵盖各种类型的车辆,例如个人或公司以前拥有的乘用车、SUV、卡车和商用车。该市场通过各种渠道运作,包括经销商网络、在线平台、拍卖和直接人对人交易。

该市场的关键要素包括二手车的评估和定价、车辆历史检查、融资选择、维护和翻新服务以及整体客户体验。经济状况、消费者购买力、文化偏好、环境法规和技术进步在塑造市场动态方面发挥着重要作用。在线平台的增长也改变了二手车的买卖方式,为消费者提供了更便捷的信息获取渠道和更广泛的选择。

欧洲和南美二手车市场动态

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。下面将详细讨论所有这些内容:

驱动程序

- 欧洲和南美地区出现不同的电子商务平台

电子商务平台从根本上改变了汽车零售市场。互联网的日益普及也促进了全球在线市场的形成。这样一来,消费者就可以在在线门户网站上拥有多种选择,包括无限的品种、款式、价格和车型比较功能。大多数经销商都会在网上列出新车和二手车的详细信息,以便客户可以找到几乎所有感兴趣的车辆的信息和图片。此外,如果没有定价和激励信息,用户只需致电并联系许多在线经销商,即可获得有关车型的所需信息。此外,各种在线二手车销售网站都提供免费或折扣售后服务套餐,涵盖购买后与车辆相关的各种维护费用。

- 提高经销商与客户之间的信息透明度和对称性

网上购物正在影响消费者购买二手车的想法。消费者希望根据自己的需求选择配置车辆,而不是接受停车场上唯一的选择。因此,消费者和经销商之间的信任对于他们的决策过程至关重要,以避免任何冲突或分歧。与新车销售一样,经销商和客户之间的关系需要建立在尊重和购买便利的基础上。这种不对称的关系将假定买家和卖家拥有相同的信息来确定产品质量。此外,互联网正日益成为二手车买家的首选信息来源。因此,如今客户对汽车、其质量、剩余价值、适用价格、财务费用、可用性以及经销商在达成交易时获得的确切利润率的了解越来越多。技术还使经销商能够找到新的方式来采购库存并更快地卸载批发单位。二手车行业的此类改进进一步帮助经销商更有效地运行其销售流程,同时还改善了库存流控制。

机会

- 两家公司之间的战略合作和收购增多

协调和整合各种技术对于实现汽车行业的持续改进至关重要。为此,政府也在努力通过合作和收购来加速现有技术在二手车市场的适当使用。这不仅有助于提高组织的知名度和利润,而且还为新发明创造了空间。此外,通过合作,公司可以提供所有设施,包括在线促销和优惠,以吸引市场上的买家。此外,这还有助于两家公司在高端市场获得认可。因此,汽车行业并购的增加为二手车市场广泛发展创造了很多机会。

克制/挑战

- 二手车售后服务缺失

毫无疑问,客户满意度是任何企业的基本目标之一,不仅是为了企业的生存,也是为了企业的持续发展。不幸的是,由于激烈的竞争和客户的复杂性,这在现实中并不容易实现。如果没有客户重视的质量增强功能,就无法实现客户满意度。如果客户通过服务体验和售后评价对质量不满意,二手车的需求最终会下降。尽管如此,服务质量已成为市场上每个服务提供商产品的关键方面,汽车行业也不例外,客户寻求更好的售后服务以获得更高的性价比。毫无疑问,售后服务已成为汽车公司营销战略的一个重要方面,因为它们在短期和长期内都能带来好处和回报。

最新动态

- 2023 年 4 月,AUTO1 集团推出了 Auto1 集团价格指数,这是欧洲首个基于批发交易数据的二手车价格指数,该指数显示,2022 年 7 月二手车价格同比飙升 25.7%,创历史新高,原因是疫情干扰、半导体短缺和地缘政治紧张局势。在波动趋势中,该指数在 2023 年 3 月反弹 1.2%,但同比下降 5.9%。这一综合指数为了解欧洲二手车批发市场的价格动态提供了宝贵的见解。

- 2023 年 3 月,Emil Frey AG 与瑞士再保险的数字保险子公司 iptiQ 合作,推出了一项名为“Emil Frey Protect”的突破性数字保险解决方案。这一战略合作伙伴关系利用了 Emil Frey 在汽车领域的客户至上方法以及 iptiQ 在将数字保险无缝集成到消费品牌价值链方面的专业知识。Emil Frey Protect 可在瑞士客户购买和维修汽车时使用,完全集成到 Emil Frey 的数字销售和移动平台中,提供 100% 无纸化体验。这一创新的保险解决方案增强了 Emil Frey 的服务产品,为客户提供轻松全面的个性化汽车保险,巩固了公司在欧洲和南美二手车市场的地位。

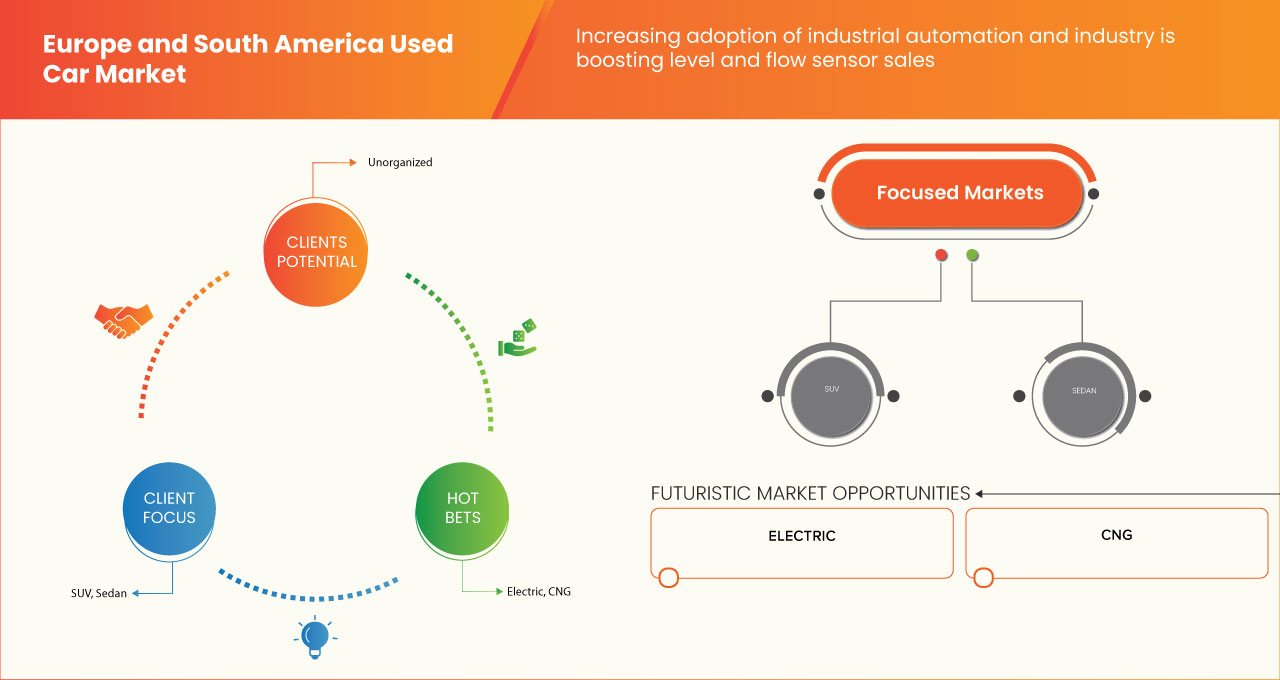

欧洲和南美二手车市场范围

欧洲和南美二手车市场根据供应商类型、推进类型、发动机容量、车辆类型、经销商、变速箱、定价类别和销售渠道进行细分。这些细分市场之间的增长将帮助您分析行业中增长微弱的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

供应商类型

- 有组织

- 无组织

根据供应商类型,欧洲和南美二手车市场分为有组织的和无组织的。

推进类型

- 汽油

- 柴油机

- 天然气

- 液化石油气

- 电的

根据推进类型,欧洲和南美二手车市场分为汽油、柴油、压缩天然气、液化石油气和电动。

发动机容量

- 全尺寸(2500 Cc 以上)

- 中型 (1500-2499 Cc 之间)

- 小型 (1499 Cc 以下)

根据发动机容量,欧洲和南美二手车市场分为全尺寸(2500 Cc 以上)、中型(1500-2499 Cc 之间)和小型(1499 Cc 以下)。

经销店

- 专营

- 独立的

根据经销商类型,欧洲和南美二手车市场分为特许经营和独立经销商。

传播

- 自动的

- 手动的

根据变速器,欧洲和南美二手车市场分为自动变速器和手动变速器。

定价类别

- 高(超过 20,000 美元)

- 中等(5,501 美元 - 20,000 美元)

- 低(低于 5,500 美元)

根据价格类别,欧洲和南美二手车市场分为高档(20,000 美元以上)、中档(5,501 美元 - 20,000 美元)和低价(低于 5,500 美元)。

销售渠道

- 在线的

- 离线

根据销售渠道,欧洲和南美二手车市场分为线上和线下。

车辆类型

- 越野车

- 轿车

- 掀背车

- 敞篷车

- 交叉

- 多功能车

- 轿跑车

- 跑车

- 其他的

根据车辆类型,欧洲和南美二手车市场分为 SUV、轿车、掀背车、敞篷车、跨界车、MPV、轿跑车、跑车等。

欧洲和南美二手车市场国家分析/见解

欧洲和南美二手车市场根据供应商类型、推进类型、发动机容量、车辆类型、经销商、变速器、定价类别和销售渠道进行细分。

欧洲和南美二手车市场报告涵盖的国家包括德国、英国、法国、意大利、西班牙、俄罗斯、波兰、荷兰、比利时、瑞士、丹麦、芬兰、瑞典、挪威、土耳其和欧洲其他地区、巴西、阿根廷和南美其他地区。

英国在欧洲地区占据主导地位,因为英国是欧洲最大的经济体和人口大国之一,这自然意味着其汽车市场(包括二手车市场)规模更大。巴西在南美地区占据主导地位,因为与购买新车相比,许多人更喜欢购买二手车,因为二手车更省钱。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。下游和上游价值链分析、技术趋势和波特五力分析、案例研究等数据点是用于预测各个国家市场情景的一些指标。此外,在提供国家数据的预测分析时,还考虑了欧洲和南美品牌的存在和可用性以及它们因来自本地和国内品牌的大量或稀缺竞争而面临的挑战、国内关税的影响和贸易路线。

竞争格局及欧洲及南美二手车市场份额分析

欧洲和南美二手车市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、欧洲和南美业务、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度、应用主导地位。以上提供的数据点仅与公司对欧洲和南美二手车市场的关注有关。

欧洲和南美二手车市场的一些主要参与者包括:AUTO1 Group、Penske Automotive Group, Inc.、Lookers PLC、PENDRAGON、Emil Frey AG、Group1 Automotive, Inc.、Arnold Clark Automobiles Limited、Gottfried Schultz Automobile Trading SE、Alibaba Group Holding Limited、OLX GROUP、Auto Trader Group plc.、KAVAK、HELLMAN & FRIEDMAN LLC、leboncoin、mobile.de GmbH、Gumtree.com Limited、Webmotors SA、AUTONIZA、Seminuevos.com、SALFA、Unidas、Grupo Sinal 等等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE AND SOUTH AMERICA USED CAR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 VENDOR TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 EMERGENCE OF DIFFERENT E-COMMERCE PLATFORM IN EUROPE AND SOUTH AMERICA REGIONS

5.1.1.1 GERMANY

5.1.1.1.1 AUTOSCOUT24

5.1.1.1.2 MOBILE.DE

5.1.1.2 U.K.

5.1.1.2.1 MOTORS. CO.UK.

5.1.1.2.2 AUTOTRADER

5.1.1.3 FRANCE

5.1.1.3.1 LEBONCOIN

5.1.1.4 BRAZIL

5.1.1.4.1 VOLANTY

5.1.2 INCREASE IN TRANSPARENCY AND SYMMETRY OF INFORMATION BETWEEN DEALERS AND CUSTOMERS

5.1.3 RISE IN DEMAND FOR OFF-LEASE CARS & SUBSCRIPTION SERVICE BY THE FRANCHISE

5.1.4 RISE IN DEMAND FOR THE PERSONAL TRANSPORT MOBILITY

5.1.5 UPSURGE DEMAND FOR THE VEHICLE WITH GREATER VALUE AT LOWER COST

5.2 RESTRAINTS

5.2.1 EVER INCREASE IN COST OF OWNERSHIP

5.2.2 STRINGENT GOVERNMENT REGULATIONS FOR CAR DEALERS

5.2.3 HIGHER MAINTENANCE AND SERVICE COST

5.3 OPPORTUNITIES

5.3.1 RISE IN STRATEGIC PARTNERSHIP AND ACQUISITIONS BETWEEN TWO COMPANIES

5.3.2 ORIGINAL EQUIPMENT MANUFACTURERS (OEMS) INVOLVEMENT IN CERTIFICATION AND MARKETING PROGRAMS

5.3.3 RISE IN THE INVESTMENT BY THE GOVERNMENT IN THE AUTOMOBILE SECTOR

5.3.4 AVAILABILITY OF THE REIMBURSED POLICY FOR THE USED CAR

5.4 CHALLENGES

5.4.1 LACK OF POST-SALE SERVICES FOR USED CAR

5.4.2 INCLINATION OF OEMS (ORIGINAL EQUIPMENT MANUFACTURERS) IN SALE OF ONLY NEW CAR

6 EUROPE & SOUTH AMERICA USED CAR MARKET, BY VENDOR TYPE

6.1 OVERVIEW

6.2 ORGANIZED

6.3 UNORGANIZED

7 EUROPE & SOUTH AMERICA USED CAR MARKET, BY PROPULSION TYPE

7.1 OVERVIEW

7.2 PETROL

7.3 DIESEL

7.4 ELECTRIC

7.4.1 BATTERY OPERATED VEHICLES (BEV)

7.4.2 PLUGIN VEHICLES (PEV)

7.4.3 HYBRID VEHICLES (HEVS)

7.5 LPG

7.6 CNG

8 EUROPE & SOUTH AMERICA USED CAR MARKET, BY ENGINE CAPACITY

8.1 OVERVIEW

8.2 SMALL (BELOW 1499 CC)

8.3 MID-SIZE (BETWEEN 1500-2499 CC)

8.4 FULL SIZE (ABOVE 2500 CC)

9 EUROPE & SOUTH AMERICA USED CAR MARKET, BY DEALERSHIP

9.1 OVERVIEW

9.2 FRANCHIASED

9.3 INDEPENDENT

10 EUROPE & SOUTH AMERICA USED CAR MARKET, BY TRANSMISSION

10.1 OVERVIEW

10.2 MANUAL

10.3 AUTOMATIC

11 EUROPE & SOUTH AMERICA USED CAR MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 SUV

11.3 SEDAN

11.4 CROSSOVER

11.5 COUPE

11.6 HATCHBACK

11.7 MPV

11.8 CONVERTIBLE

11.9 SPORTS CARS

11.1 OTHERS

12 EUROPE & SOUTH AMERICA USED CAR MARKET, BY PRICING CATEGORY

12.1 OVERVIEW

12.2 HIGH (MORE THAN USD 20,000)

12.3 MEDIUM (USD 5501-USD 20000)

12.4 LOW (LESS THAN USD 5500)

13 EUROPE & SOUTH AMERICA USED CAR MARKET, BY SALES CHANNEL

13.1 OVERVIEW

13.2 OFFLINE

13.3 ONLINE

14 EUROPE AND SOUTH AMERICA USED CAR MARKET BY REGION

14.1 EUROPE

14.1.1 U.K.

14.1.2 GERMANY

14.1.3 FRANCE

14.1.4 ITALY

14.1.5 RUSSIA

14.1.6 SPAIN

14.1.7 TURKEY

14.1.8 NETHERLANDS

14.1.9 BELGIUM

14.1.10 SWITZERLAND

14.1.11 DENMARK

14.1.12 SWEDEN

14.1.13 POLAND

14.1.14 NORWAY

14.1.15 FINLAND

14.1.16 REST OF EUROPE

14.2 SOUTH AMERICA

14.2.1 BRAZIL

14.2.2 ARGENTINA

14.2.3 REST OF SOUTH AMERICA

15 EUROPE AND SOUTH AMERICA USED CAR MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

15.2 COMPANY SHARE ANALYSIS: SOUTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 AUTO1 GROUP

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 BRAND PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 PENSKE AUTOMOTIVE GROUP, INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENTS

17.3 LOOKERS PLC

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 PENDRAGON

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 EMIL FREY AG

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENTS

17.6 ALIBABA GROUP HOLDING LIMITED

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 ARNOLD CLARK AUTOMOBILES LIMITED

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 AUTO TRADER GROUP PLC

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 AUTONIZA

17.9.1 COMPANY SNAPSHOT

17.9.2 BRAND PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 GOTTFRIED SCHULTZ AUTOMOBILE TRADING SE

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 GROUP1 AUTOMOTIVE, INC.

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 GRUPO SINAL

17.12.1 COMPANY SNAPSHOT

17.12.2 SOLUTION PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 GUMTREE.COM LIMITED

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 HELLMAN & FRIEDMAN LLC

17.14.1 COMPANY SNAPSHOT

17.14.2 BRAND PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 KAVAK

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 LEBONCOIN

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 MOBILE.DE GMBH

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 OLX GROUP

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 SALFA

17.19.1 COMPANY SNAPSHOT

17.19.2 BRAND PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 SEMINUEVOS.COM

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 UNIDAS

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 WEBMOTORS SA

17.22.1 COMPANY SNAPSHOT

17.22.2 SOLUTION PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

表格列表

TABLE 1 SCALE OF USED VEHICLE EXPORTS IN THE YEAR 2017 (USD MILLION)

TABLE 2 COMPARISON OF THE BRAND AND ESTIMATED MAINTENANCE COST OVER 10 YEARS (APPROX.)

TABLE 3 ROUTINE AND BASIC MAINTENANCE COST OF USED CARS (APPROX. IN USD)

TABLE 4 EUROPE USED CAR MARKET, BY VENDOR TYPE, 2021-2030 (UD MILLION)

TABLE 5 SOUTH AMERICA USED CAR MARKET, BY VENDOR TYPE, 2021-2030 (UD MILLION)

TABLE 6 EUROPE USED CAR MARKET, BY PROPULSION TYPE, 2021-2030 (UD MILLION)

TABLE 7 SOUTH AMERICA USED CAR MARKET, BY PROPULSION TYPE, 2021-2030 (UD MILLION)

TABLE 8 EUROPE ELECTRIC IN USED CAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 SOUTH AMERICA ELECTRIC IN USED CAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 EUROPE USED CAR MARKET, BY ENGINE CAPACITY, 2021-2030 (USD MILLION)

TABLE 11 SOUTH AMERICA USED CAR MARKET, BY ENGINE CAPACITY, 2021-2030 (USD MILLION)

TABLE 12 EUROPE USED CAR MARKET, BY DEALERSHIP, 2021-2030 (USD MILLION)

TABLE 13 SOUTH AMERICA USED CAR MARKET, BY DEALERSHIP, 2021-2030 (USD MILLION)

TABLE 14 EUROPE USED CAR MARKET, BY TRANSMISSION, 2021-2030 (USD MILLION)

TABLE 15 SOUTH AMERICA USED CAR MARKET, BY TRANSMISSION, 2021-2030 (USD MILLION)

TABLE 16 EUROPE USED CAR MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 17 SOUTH AMERICA USED CAR MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 18 EUROPE USED CAR MARKET, BY PRICING CATEGORY, 2021-2030 (USD MILLION)

TABLE 19 SOUTH AMERICA USED CAR MARKET, BY PRICING CATEGORY, 2021-2030 (USD MILLION)

TABLE 20 EUROPE USED CAR MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 21 SOUTH AMERICA USED CAR MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

图片列表

FIGURE 1 EUROPE AND SOUTH AMERICA USED CAR MARKET SEGMENTATION

FIGURE 2 EUROPE AND SOUTH AMERICA USED CAR MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE AND SOUTH AMERICA USED CAR MARKET: DROC ANALYSIS

FIGURE 4 EUROPE USED CAR MARKET: REGION VS COUNTRY MARKET ANALYSIS

FIGURE 5 SOUTH AMERICA USED CAR MARKET: REGION VS COUNTRY MARKET ANALYSIS

FIGURE 6 EUROPE AND SOUTH AMERICA USED CAR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 7 EUROPE AND SOUTH AMERICA USED CAR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE USED CAR MARKET: DBMR MARKET POSITION GRID

FIGURE 9 SOUTH AMERICA USED CAR MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE AND SOUTH AMERICA USED CAR MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 EUROPE AND SOUTH AMERICA USED CAR MARKET: MULTIVARIATE MODELING

FIGURE 12 EUROPE USED CAR MARKET: VENDOR TYPE TIMELINE CURVE

FIGURE 13 SOUTH AMERICA USED CAR MARKET: VENDOR TYPE TIMELINE CURVE

FIGURE 14 EUROPE AND SOUTH AMERICA USED CAR MARKET SEGMENTATION

FIGURE 15 EMERGENCE OF DIFFERENT ECOMMERCE PLATFORMS IS EXPECTED TO DRIVE THE EUROPE USED CAR MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 16 RISE IN DEMAND FOR OFF-LEASE CARS & AND SUBSCRIPTION SERVICE BY THE FRANCHISE IS EXPECTED TO DRIVE THE SOUTH AMERICA USED CAR MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 17 ORGANIZED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE USED CAR MARKET IN 2023 & 2030

FIGURE 18 ORGANIZED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF SOUTH AMERICA USED CAR MARKET IN 2023 & 2030

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR EUROPE AND SOUTH AMERICA USED CAR MARKET

FIGURE 20 MONTHLY PASSENGER CAR SALES IN EUROPE BETWEEN AUGUST 2020 AND JUNE 2021 (1,000 UNITS)

FIGURE 21 CAR RENTAL PRICES FOR POPULAR CITIES IN SOUTH AMERICA

FIGURE 22 VARIOUS GOVERNMENT INITIATIVES

FIGURE 23 EUROPE USED CAR MARKET: BY VENDOR TYPE, 2022

FIGURE 24 SOUTH AMERICA USED CAR MARKET: BY VENDOR TYPE, 2022

FIGURE 25 EUROPE USED CAR MARKET: BY PROPULSION TYPE, 2022

FIGURE 26 SOUTH AMERICA USED CAR MARKET: BY PROPULSION TYPE, 2022

FIGURE 27 EUROPE USED CAR MARKET: BY ENGINE CAPACITY, 2022

FIGURE 28 SOUTH AMERICA USED CAR MARKET: BY ENGINE CAPACITY, 2022

FIGURE 29 EUROPE USED CAR MARKET: BY DEALERSHIP, 2022

FIGURE 30 SOUTH AMERICA USED CAR MARKET: BY DEALERSHIP, 2022

FIGURE 31 EUROPE USED CAR MARKET: BY TRANSMISSION, 2022

FIGURE 32 SOUTH AMERICA USED CAR MARKET: BY TRANSMISSION, 2022

FIGURE 33 EUROPE USED CAR MARKET: BY VEHCLE TYPE, 2022

FIGURE 34 SOUTH AMERICA USED CAR MARKET: BY VEHCLE TYPE, 2022

FIGURE 35 EUROPE USED CAR MARKET: BY PRICING CATEGORY, 2022

FIGURE 36 SOUTH AMERICA USED CAR MARKET: BY PRICING CATEGORY, 2022

FIGURE 37 EUROPE USED CAR MARKET: BY SALES CHANNEL, 2022

FIGURE 38 SOUTH AMERICA USED CAR MARKET: BY SALES CHANNEL, 2022

FIGURE 39 EUROPE USED CAR MARKET: SNAPSHOT (2022)

FIGURE 40 SOUTH AMERICA USED CAR MARKET: SNAPSHOT (2022)

FIGURE 41 EUROPE USED CAR MARKET: COMPANY SHARE 2022 (%)

FIGURE 42 SOUTH AMERICA USED CAR MARKET: COMPANY SHARE 2022 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。