中国汽车测试、检验和认证 (TIC) 市场,按应用(底盘和车身控制器、驾驶舱控制器和功能安全)、供应链(设计、生产、分销、销售和运营)、采购类型(内部和外包)、类型(电气系统和组件、电动汽车、混合动力电动汽车和电池系统、远程信息处理、燃料、流体和润滑剂、内部和外部材料和组件、车辆检测服务、认证测试等)划分 - 行业趋势和预测到 2030 年。

中国汽车测试、检验和认证 (TIC) 市场分析及规模

中国汽车市场发展迅速,尤其是乘用车市场。中国汽车市场似乎是世界上最大的汽车市场,拥有互联网连接和自动驾驶等智能功能。预计到2025年,这将推动销量增长30%。虽然随着中国汽车销量的增长,交通事故也随之增加。中国交通事故的主要原因是违反交通规则的行为,包括超载超速、疲劳驾驶、车辆故障等。近年来,政府在长途客运高峰期加强了对安全措施的大规模检查,从而遏制了重特大交通事故的频发,有效控制了交通事故死亡人数的上升。然而,另一方面,随着汽车保有量的增加,事故或车辆碰撞造成的死亡人数也在增加。

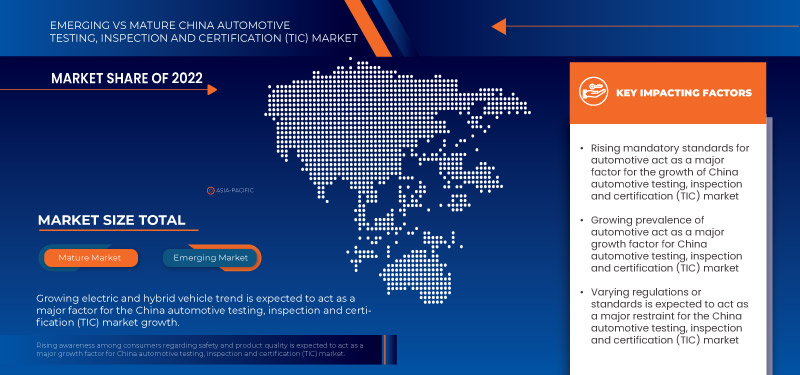

Data Bridge Market Research分析,中国汽车测试、检验和认证(TIC)市场预计在2023年至2030年间的复合年增长率为4.8%。政府对汽车制造商实施严格强制性的安全标准,这一要求多年来一直在加强。

|

报告指标 |

细节 |

|

预测期 |

2023 至 2030 年 |

|

基准年 |

2022 |

|

历史岁月 |

2021(可定制 2015-2020) |

|

定量单位 |

收入(百万美元),定价(美元) |

|

涵盖的领域 |

按应用(底盘和车身控制器、驾驶舱控制器和功能安全)、供应链(设计、生产、分销、销售和运营)、采购类型(内部和外包)、类型(电气系统和组件、电动汽车、混合动力电动汽车和电池系统、远程信息处理、燃料、流体和润滑剂、内部和外部材料和组件、车辆检测服务、认证测试、其他) |

|

覆盖国家 |

中国 |

|

涵盖的市场参与者 |

Nemko、DEKRA、RINA SpA、NSF、Applus+、Asia Quality Focus、DNV GL、TÜV SÜD、TÜV NORD GROUP、Intertek Group Plc、MISTRAS Group、SGS Société Générale de Surveillance SA、TÜV Rheinland、Element Materials Technology、英国标准协会、Veritell Inspection Certification Co., Ltd、中国检验认证(集团)有限公司、Eurofins Scientific 和 HQTS Group Ltd. 等 |

市场定义

汽车测试、检验和认证 (TIC) 市场是汽车行业的一个专业领域,提供基本服务以确保车辆和汽车零部件的安全、质量和合规性。该市场涵盖一系列活动,包括测试、检验和认证服务,这些服务在提高产品可靠性、降低风险和满足监管要求方面发挥着至关重要的作用。

在 TIC 市场中,测试服务涉及对汽车产品、系统和材料的全面评估,以评估其性能、耐用性和是否符合行业标准。这包括制造厂检查、供应链审计、质量控制检查和装运前检查。此外,认证服务涉及颁发官方认证和批准,以验证汽车产品和流程是否符合相关法规和标准。

中国汽车测试、检验和认证 (TIC) 市场动态

本节旨在了解驱动因素、限制因素、挑战和弱点。下文将详细讨论所有这些内容:

驱动程序

- 政府越来越重视对汽车实施强制性安全标准

中国汽车市场正在快速增长,尤其是乘用车市场。中国汽车市场似乎是世界上最大的汽车市场,拥有互联网连接和自动驾驶等智能功能。预计到 2025 年,这将推动销量增长 30%。

虽然随着国内汽车销量的不断增长,交通事故也随之增多。我国交通事故的主要原因是超载超速、疲劳驾驶、车辆故障等违反交通法规的行为。近年来,政府加大对长途客运高峰期安全措施的大检查力度,遏制了重大交通事故的频发,有效控制了交通事故造成的死亡人数上升。但另一方面,随着汽车保有量的增加,事故或车辆碰撞造成的死亡人数也随之增加。

- 汽车日益普及

我国汽车生产和消费主要以乘用车为主,这是21世纪以来汽车产业增长的主要驱动因素,随着我国经济的增长,汽车保有量特别是以私家车为主体的乘用车数量快速增加。

按年销量和制造产量计算,中国继续是全球最大的汽车市场,预计到 2025 年国内产量将达到 3500 万辆。根据工信部的数据,2021 年汽车销量超过 2600 万辆,其中乘用车 2148 万辆,比 2020 年增长 7.1%。商用车销量达 479 万辆,比 2020 年下降 6.6%。

此外,电动汽车在全球范围内的重要性日益增加。电动汽车 (EV) 旨在成为实现零碳排放、低噪音和高效率的可持续交通的有前途的技术。电动汽车高度嵌入汽车软件,具有各国集中的各种优势。这导致制定法规、政策、测试、检查和认证流程,以提高电动汽车质量,因为它有助于控制碳排放并避免中国变暖。

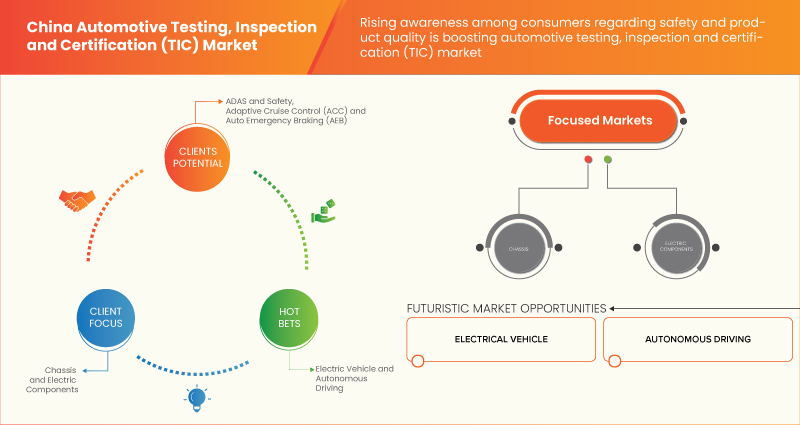

机会

- 电动和 ADAS 汽车日益流行

电动汽车 (EV) 旨在成为一种有前途的可持续交通技术,具有零碳排放、低噪音和高效率的特点。此外,电动汽车在 19 世纪发展起来,但由于缺乏技术进步,内燃机的需求量比电动汽车大得多。在 20 世纪,技术进步逐年提升,从而带来了有助于重塑电动汽车的发展和创新。

此外,电动汽车是实现道路运输脱碳的关键技术。近年来,电动汽车的销量呈指数级增长,续航里程不断提高,车型种类不断增多,性能不断提高。乘用电动汽车越来越受欢迎。此外,中国政府正在支持电动汽车的使用。各国政府正在制定各种政策和规则来促进电动汽车的使用。

克制/挑战

- 不同地区/国家的标准不同

汽车尾气排放是空气污染的主要因素之一。汽车尾气排放的各种废气,如氮氧化物、二氧化碳和一氧化碳,是污染大气和环境的主要原因,进而导致人类呼吸系统和皮肤疾病。这使得许多国家制定了严格的规则和法规来减少排放。

此外,不同国家和地区实施了不同的规范并制定了不同的标准。北京汽车工业公司、华晨汽车控股等多家大型国有汽车企业都试图与外国汽车制造商合作。这些合资企业的成立是为了提高产能和增强技术能力。

然而,其他国家的汽车标准和规范与中国不同。这将导致汽车的功能和价格有所不同。此外,中国政府正在频繁更改规范和标准。

最新动态

- 2022 年 11 月,Nemko 收购了 Nemko Norlab 的剩余股份,使其成为该公司的唯一所有者。此次收购旨在加强合作并更有效地满足客户需求,利用自 6 月首次收购股份以来观察到的市场协同效应和机遇。

- 2023 年 10 月,Nemko 德国获得了 DAkkS 的功能安全认证。这一发展使他们能够根据国际标准和法规测试和评估设备/系统的功能安全,确保控制危险并最大限度地降低个人、设施和环境安全的风险。这种认可有助于公司在中国获得客户的关注。

中国汽车测试、检验和认证 (TIC) 市场范围

中国汽车测试、检验和认证 (TIC) 市场根据应用、供应链、采购类型和类型分为四个显著的细分市场。这些细分市场之间的增长将帮助您分析行业中增长微弱的细分市场,并为用户提供有价值的市场概览和见解,帮助他们做出战略决策,以确定核心市场应用。

应用

- 底盘及车身控制器

- 驾驶舱控制器

- 功能安全

根据应用,中国汽车测试、检验和认证 (TIC) 市场细分为底盘和车身控制器、驾驶舱控制器和功能安全。

供应链

- 设计

- 生产

- 分配

- 销售

- 手术

根据供应链,中国汽车测试、检验和认证(TIC)市场分为设计、生产、分销、销售和运营。

采购类型

- 内部

- 外包

根据采购类型,中国汽车测试、检验和认证 (TIC) 市场分为内部采购和外包采购。

类型

- 电气系统和组件

- 电动汽车、混合动力汽车和电池系统

- 远程信息处理

- 燃料、液体和润滑剂

- 内饰和外饰材料及部件

- 车辆检验服务

- 认证测试

- 其他的

根据类型,中国汽车测试、检验和认证 (TIC) 市场细分为电气系统和组件、电动汽车、混合动力电动汽车和电池系统、远程信息处理、燃料、液体和润滑剂、内部和外部材料和组件、车辆检验服务、认证测试等。

竞争格局和中国汽车检测、检验和认证 (TIC) 市场份额分析

中国汽车测试、检验和认证 (TIC) 市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、区域业务、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度以及应用主导地位。以上数据点仅与专注于市场的公司有关。

中国汽车测试、检验和认证 (TIC) 市场的一些主要参与者包括 Nemko、DEKRA、RINA SpA、NSF、Applus+、Asia Quality Focus、DNV GL、TÜV SÜD、TÜV NORD GROUP、Intertek Group Plc、MISTRAS Group、SGS Société Générale de Surveillance SA、TÜV Rheinland、Element Materials Technology、英国标准协会、Veritell Inspection Certification Co., Ltd、中国检验认证(集团)有限公司、Eurofins Scientific 和 HQTS Group Ltd. 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 APPLICATION CURVE

2.8 MARKET END-USER COVERAGE GRID

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING FOCUS OF THE GOVERNMENT ON IMPOSING MANDATORY SAFETY STANDARDS FOR AUTOMOTIVE

5.1.2 GROWING PREVALENCE OF AUTOMOTIVE

5.2 RESTRAINTS

5.2.1 VARYING STANDARDS ACROSS DIFFERENT REGIONS/COUNTRIES

5.2.2 LENGTHY PROCESS AND LEAD TIME FOR QUALIFICATION TESTS

5.3 OPPORTUNITIES

5.3.1 GROWING TREND OF ELECTRIC AND ADAS VEHICLES

5.3.2 INCREASE IN THE USAGE OF ELECTRONIC SYSTEMS IN VEHICLES

5.3.3 RISING AWARENESS REGARDING SAFETY AND PRODUCT QUALITY AMONG CONSUMERS

5.4 CHALLENGES

5.4.1 RISK AVERSION AND NEW TECHNOLOGY RELUCTANCE

5.4.2 LACK OF SKILLED PROFESSIONALS

6 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY APPLICATION

6.1 OVERVIEW

6.2 CHASSIS AND BODY CONTROLLER

6.3 FUNCTIONAL SAFETY

6.3.1 ADAS AND SAFETY

6.3.2 ADAPTIVE CRUISE CONTROL (ACC)

6.3.3 AUTO EMERGENCY BRAKING (AEB)

6.3.4 LANE DEPARTURE WARNING SYSTEM (LDWS)

6.3.5 TIRE PRESSURE MONITORING SYSTEM (TPMS)

6.3.6 AUTOMATIC PARKING

6.3.7 PEDESTRIAN WARNING/PROTECTION SYSTEM

6.3.8 AUTOMOTIVE NIGHT VISION

6.3.9 TRAFFIC SIGN RECOGNITION

6.3.10 DRIVER DROWSINESS DETECTION

6.3.11 BLIND SPOT DETECTION

6.3.12 OTHER ADAS AND SAFETY CONTROLLERS

6.4 COCKPIT CONTROLLER

6.4.1 HUMAN-MACHINE INTERFACE (HMI)

6.4.2 HEADS-UP DISPLAY (HUD)

6.4.3 OTHER

7 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SUPPLY CHAIN

7.1 OVERVIEW

7.2 DESIGN

7.3 PRODUCTION

7.4 DISTRIBUTION

7.5 OPERATION

7.6 SELLING

8 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE

8.1 OVERVIEW

8.2 IN-HOUSE

8.3 OUTSOURCED

9 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY TYPE

9.1 OVERVIEW

9.2 ELECTRICAL SYSTEMS AND COMPONENTS

9.2.1 IN-HOUSE

9.2.2 OUTSOURCED

9.3 ELECTRIC VEHICLES, HYBRID ELECTRIC VEHICLES, AND BATTERY SYSTEMS

9.3.1 IN-HOUSE

9.3.2 OUTSOURCED

9.4 TELEMATICS

9.4.1 IN-HOUSE

9.4.2 OUTSOURCED

9.5 FUELS, FLUIDS AND LUBRICANT

9.5.1 IN-HOUSE

9.5.2 OUTSOURCED

9.6 INTERIOR AND EXTERIOR MATERIALS AND COMPONENTS

9.6.1 IN-HOUSE

9.6.2 OUTSOURCED

9.7 VEHICLE INSPECTION SERVICES

9.7.1 IN-HOUSE

9.7.2 OUTSOURCED

9.8 HOMOLOGATION TESTING

9.8.1 IN-HOUSE

9.8.2 OUTSOURCED

9.9 OTHERS

10 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 DEKRA

12.1.1 COMPANY SNAPSHOT

12.1.2 SERVICE PORTFOLIO

12.1.3 RECENT DEVELOPMENTS

12.2 TÜV SÜD

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 SERVICE PORTFOLIO

12.2.4 RECENT DEVELOPMENTS

12.3 DNV GL

12.3.1 COMPANY SNAPSHOT

12.3.2 SERVICE PORTFOLIO

12.3.3 RECENT DEVELOPMENTS

12.4 APPLUS+

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 SERVICE PORTFOLIO

12.4.4 RECENT DEVELOPMENTS

12.5 TÜV RHEINLAND

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 SERVICE PORTFOLIO

12.5.4 RECENT DEVELOPMENTS

12.6 ASIA QUALITY FOCUS

12.6.1 COMPANY SNAPSHOT

12.6.2 SERVICE PORTFOLIO

12.6.3 RECENT DEVELOPMENTS

12.7 CHINA CERTIFICATION AND INSPECTION (GROUP) CO., LTD.

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENTS

12.8 ELEMENT MATERIALS TECHNOLOGY

12.8.1 COMPANY SNAPSHOT

12.8.2 SERVICE PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 EUROFINS SCIENTIFIC

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 SERVICE PORTFOLIO

12.9.4 RECENT DEVELOPMENTS

12.1 HQTS GROUP LTD

12.10.1 COMPANY SNAPSHOT

12.10.2 SERVICE PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

12.11 INTERTEK GROUP PLC

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 SERVICE PORTFOLIO

12.11.4 RECENT DEVELOPMENTS

12.12 MISTRAS GROUP

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 SERVICE PORTFOLIO

12.12.4 RECENT DEVELOPMENT

12.13 NEMKO

12.13.1 COMPANY SNAPSHOT

12.13.2 SERVICE PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

12.14 NSF

12.14.1 COMPANY SNAPSHOT

12.14.2 SERVICE PORTFOLIO

12.14.3 RECENT DEVELOPMENTS

12.15 RINA S.P.A.

12.15.1 COMPANY SNAPSHOT

12.15.2 SERVICE PORTFOLIO

12.15.3 RECENT DEVELOPMENTS

12.16 SGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA

12.16.1 COMPANY SNAPSHOT

12.16.2 REVENUE ANALYSIS

12.16.3 SERVICE PORTFOLIO

12.16.4 RECENT DEVELOPMENTS

12.17 THE BRITISH STANDARDS INSTITUTION

12.17.1 COMPANY SNAPSHOT

12.17.2 SERVICE PORTFOLIO

12.17.3 RECENT DEVELOPMENTS

12.18 TÜV NORD GROUP

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 SERVICE PORTFOLIO

12.18.4 RECENT DEVELOPMENTS

12.19 VERITELL INSPECTION CERTIFICATION CO., LTD

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

表格列表

TABLE 1 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 2 CHINA FUNCTIONAL SAFETY IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 3 CHINA COCKPIT CONTROLLER IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SUPPLY CHAIN, 2021-2030 (USD MILLION)

TABLE 5 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

TABLE 6 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 CHINA ELECTRICAL SYSTEMS AND COMPONENTS IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

TABLE 8 CHINA ELECTRIC VEHICLES, HYBRID ELECTRIC VEHICLES, AND BATTERY SYSTEMS IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

TABLE 9 CHINA TELEMATICS IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

TABLE 10 CHINA FUELS, FLUIDS AND LUBRICANT IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

TABLE 11 CHINA INTERIOR AND EXTERIOR MATERIALS AND COMPONENTS IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

TABLE 12 CHINA VEHICLE INSPECTION SERVICES IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

TABLE 13 CHINA HOMOLOGATION TESTING IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

图片列表

FIGURE 1 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: SEGMENTATION

FIGURE 2 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: DATA TRIANGULATION

FIGURE 3 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: DROC ANALYSIS

FIGURE 4 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: MULTIVARIATE MODELLING

FIGURE 7 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: MARKET: APPLICATION CURVE

FIGURE 8 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: MARKET END-USER COVERAGE GRID

FIGURE 9 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: DBMR MARKET POSITION GRID

FIGURE 11 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: SEGMENTATION

FIGURE 12 UPSURGE OF ADOPTION OF ADVANCED FEATURES FOR VEHICLES IS EXPECTED TO DRIVE CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET IN THE FORECAST PERIOD

FIGURE 13 CHASSIS AND BODY CONTROLLER IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET FROM 2023 & 2030

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF GLOBAL SYNCHRONOUS CONDENSER MARKET

FIGURE 15 GROWTH RATE OF ADOPTION OF ELECTRONIC SYSTEMS IN VARIOUS APPLICATIONS (CAGR)

FIGURE 16 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: BY APPLICATION, 2022

FIGURE 17 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: BY SUPPLY CHAIN, 2022

FIGURE 18 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: BY SOURCING TYPE, 2022

FIGURE 19 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: BY TYPE, 2022

FIGURE 20 THE CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: COMPANY SHARE 2022(%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。