亚太香草 (B2B) 市场,按香草类型(马达加斯加、墨西哥、合成原产地、印度、印度尼西亚、大溪地、汤加、巴布亚新几内亚、乌干达等)、香草原产地(天然和合成)、等级(A 级(30% 水分)、B 级(20% 水分)等)、形式(液体、粉末和糊状)、最终用途(食品、饮料、个人护理和化妆品、制药、家庭/零售等)分销渠道(批发和线上)、行业趋势和预测到 2029 年

市场分析和见解

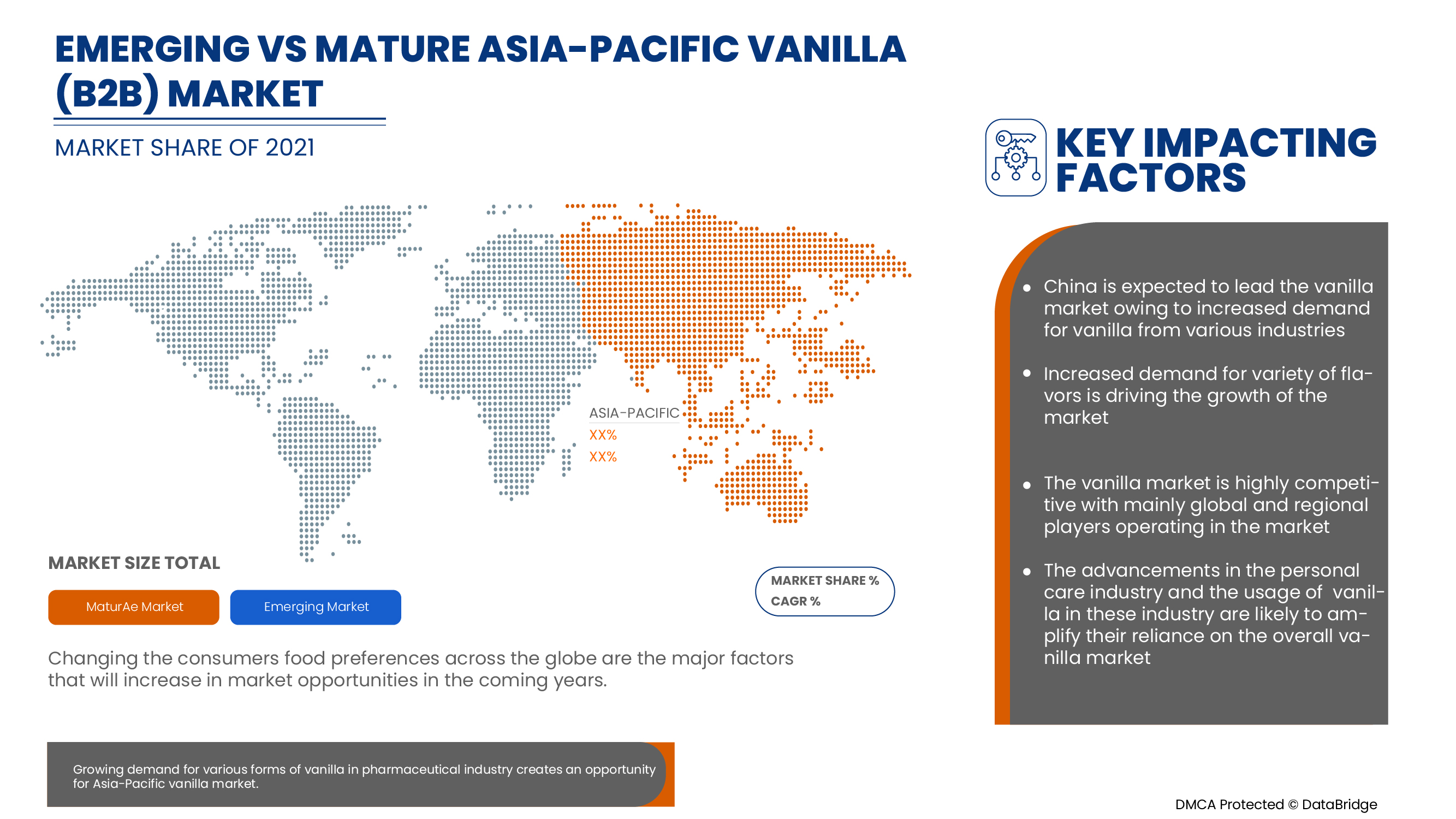

由于食品饮料行业的发展和烘焙产品需求的增加,亚太香草(B2B)市场正在获得显著增长。对不同类型糖果产品的需求增加也推动了亚太香草(B2B)市场的增长。然而,预计在预测期内,与合成香草相关的严格政府法规将抑制香草市场的增长。

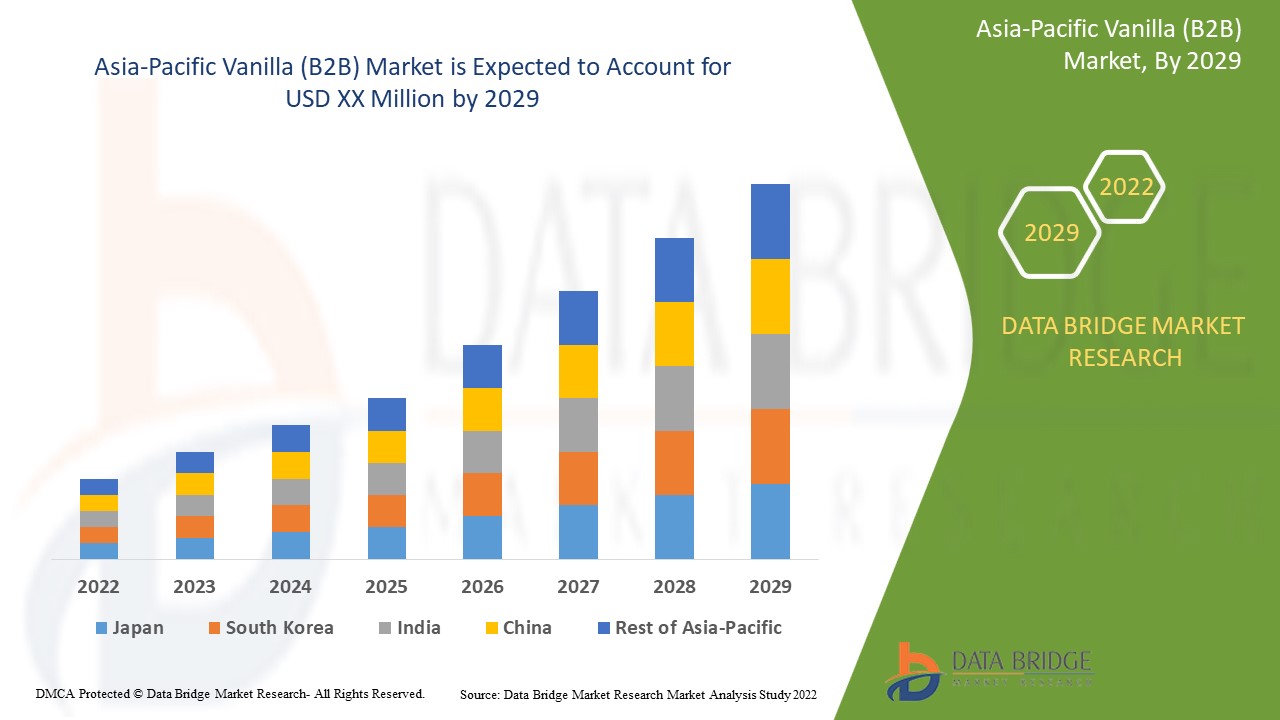

Data Bridge Market Research 分析称,2022 年至 2029 年的预测期内,亚太香草(B2B)市场将以 5.6% 的复合年增长率增长。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020 (可定制至 2019 - 2015) |

|

定量单位 |

收入(百万美元)、销量(吨)、定价(美元) |

|

覆盖国家 |

按香草类型(马达加斯加、墨西哥、合成原产地、印度、印度尼西亚、大溪地、汤加、巴布亚新几内亚、乌干达等)、香草原产地(天然和合成)、等级(A 级(30% 水分)、B 级(20% 水分)等)、形态(液体、粉末和糊状)、最终用途(食品、饮料、个人护理和化妆品、药品、家庭/零售等)分销渠道(批发和线上)划分 |

|

覆盖区域 |

中国、印度、日本、韩国、新西兰、澳大利亚、印度尼西亚、新加坡、泰国、菲律宾、马来西亚和亚太地区其他地区 |

|

涵盖的市场参与者 |

Nielsen-Massey Vanillas, Inc.、McCormick & Company, Inc.、Prova、SYNERGY、IFFinc、Kerry、Takasago International Corporation、ADM、Madagascar Vanilla Company LLC 和 Firmenich SA 等 |

市场定义

香草是一种香料,来源于香草属的兰花。它在世界各地广泛种植。此外,马达加斯加、墨西哥和印度尼西亚在香草豆的生产方面处于领先地位。香草味是从香草豆中提取的,市场上称之为天然香草精。然而,消费者对香草味的需求正在迅速增加,导致香草加工商从可再生资源中生产合成香草精。香草豆根据质量分为 A 级、B 级和其他级。

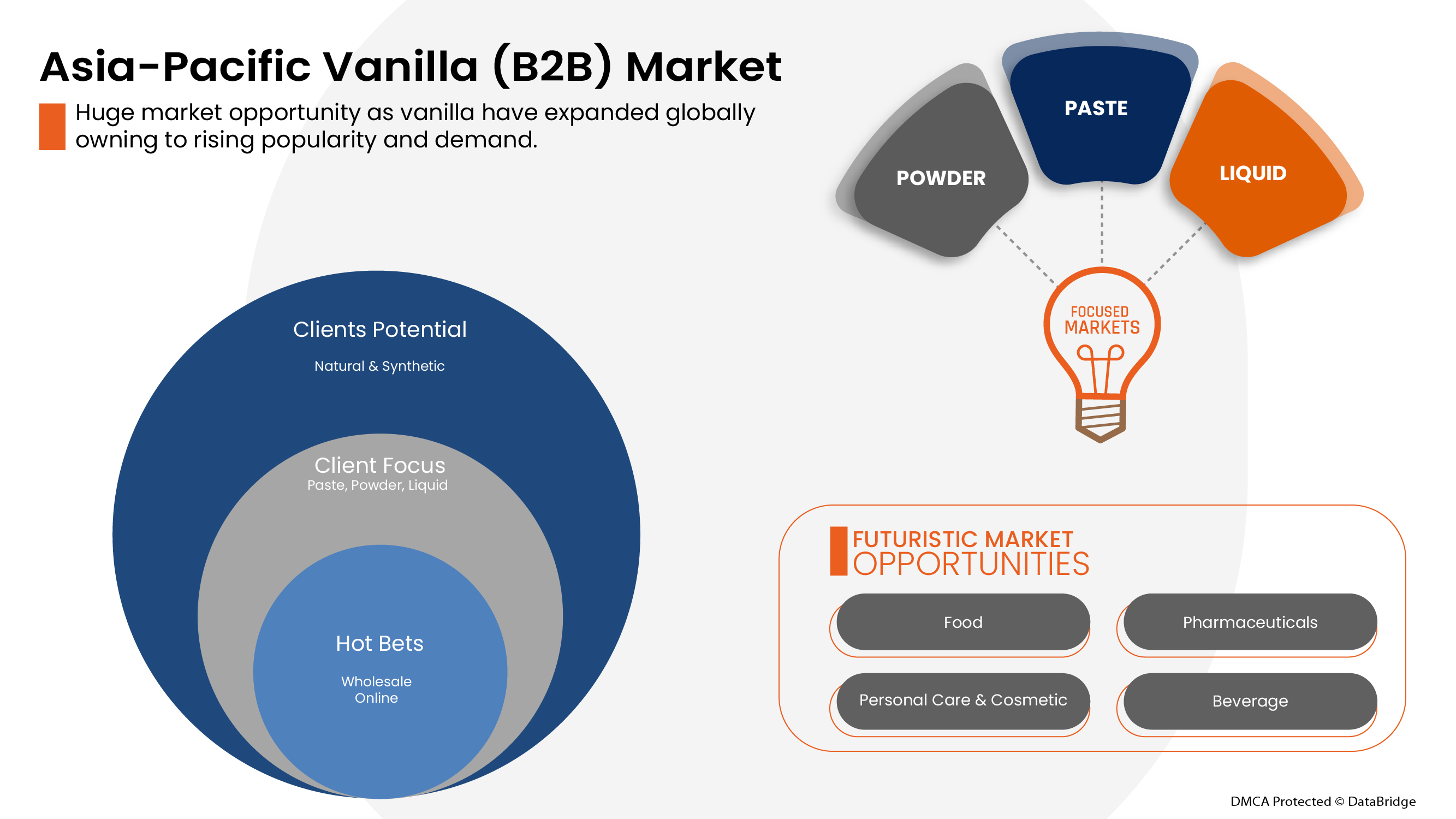

同样,香草也分为液体、粉末和糊状等各种形式。香草豆和香草提取物广泛用于烘焙、糖果和乳制品。此外,香草还广泛用于制药和个人护理产品。

亚太地区香草(B2B)市场动态

驱动程序

-

食品和饮料行业对香草的需求不断增长

食品和饮料行业对香草的需求正在迅速增长。香草精是食品和饮料加工行业的重要调味剂。在食品工业中,香草被添加到各种食品中,包括乳制品、烘焙产品、加工食品、巧克力和糖果等,以增强其风味和口感。因此,食品行业对香草粉、香草酱和香草液的需求增加预计将推动市场增长。

同时,香草精在巧克力行业中对减少苦味和增强产品风味起着重要作用。此外,香草会掩盖可可麸皮对巧克力造成的口味变化。因此,巧克力行业对香草的需求增加推动了香草在市场上的增长。

-

制药和个人护理行业对香草的需求不断增长

近年来,全球消费者对含香料的化妆品和个人护理产品的需求不断增加。因此,对添加香草的化妆品的需求增加推动了香草在市场上的增长。除了香味之外,香草还具有修复皮肤损伤的特殊功能特性。

例如,香草富含天然抗氧化剂,有助于中和自由基并减少皮肤损伤。由于其功能特性,香草液体、粉末和糊状物广泛用于化妆品中。因此,香草在化妆品行业的使用量增加将推动市场增长。此外,马达加斯加香草在个人护理产品中也有广泛应用,如乳液、抗衰老面霜和富含维生素 B 的润唇膏,维生素 B 有助于皮肤健康。因此,化妆品制造商正在将香草添加到他们的产品中。

因此,个人护理产品对马达加斯加香草的需求不断增长将推动市场增长。

机会

-

合成香草精的需求不断增长

尽管香草豆产量低,导致市场上天然香草精的产量减少。为了满足需求,香草精制造商专注于生产合成香草精。这进一步为香草精生产商创造了在全球市场上扩大其价值的机会。由于消费者对香草味食品的偏好不断增加,食品行业对市场上合成香草精的需求也随之增加。

近年来,由于有可能用可再生资源替代合成香草产品,化学工业对此产生了浓厚的兴趣。根据美国法规,从可再生资源中提取的香草精可以标记为天然。因此,制造商强调使用生物技术方法生产香草精。

限制/挑战

- 原材料价格波动

全球各行业和消费者对香草香精的需求不断增长。然而,市场上香草的需求量超过了供应量。

例如,

- 根据 NPR 的报告,2017 年马达加斯加香草豆的需求不断增长,导致产品价格比前几年上涨了十倍。因此,马达加斯加豆价格上涨将降低市场增长,因为客户对价格很敏感

同样,客户也在寻找清洁标签产品,并要求天然和有机产品。因此,公司从天然来源生产香草精以满足客户。尽管如此,原材料供应不足导致制造商以更高的成本出售其产品。由于价格上涨,对香草的需求将下降并阻碍全球市场的增长。

- 替代产品的可用性

香草是消费者中最常见的口味,尽管市场上替代口味的供应是香草在市场上增长的主要挑战。枫糖浆、杏仁提取物、柑橘皮等是市场上可用的替代口味。枫糖浆是香草提取物的替代品,它具有令人愉悦的香气和香草的醇厚口味。

枫糖浆是制作煎饼、饼干、烤蔬菜和其他食品的理想选择。

由于成本效益高,消费者选择枫糖浆作为香草味的替代品。因此,对枫糖浆的需求不断增加将降低香草在市场上的增长。因此,杏仁提取物也被用作香草提取物的替代来源。此外,杏仁提取物比香草味更有效。这种提取物被广泛添加到烘焙食品和其他甜点中,以增强其风味和口感。因此,烘焙行业对杏仁提取物的需求不断增加将阻碍香草在市场上的增长。

新冠肺炎疫情后对亚太香草(B2B)市场的影响

新冠疫情过后,由于消费者购买模式的改变,以及食品饮料等各类终端用户对各种口味产品的需求逐渐增加,亚太地区对香草的需求有所增加。由于许多严格的规定和限制被取消,制造商和生产商能够满足亚太地区对香草的需求。

对不同口味食品的需求增加使得制造商推出各种有机和合成香草,从而促进了市场的增长。

最新动态

- 2020 年 10 月,领先的私营香水和调味品公司 Firmenich SA 与马达加斯加领先的生产商和 Group's Naturals Together 的创始成员 authentic products 签署了合作协议。此次合作加强了市场上香草的负责任来源。此外,两家公司还为马达加斯加的青少年提供农业培训设施,并为种植香草的家庭创造改善生计的独特机会

- 2020 年 1 月,ADM 收购了领先的植物提取物和成分制造商 Yerbalatina Phytoactives。此次收购有助于扩大 ADM 在巴西的业务并加强其在健康与保健市场的地位

例如,

- 2019 年 6 月,索尔维推出了以 vanifolia 和 vanifolia bean 为品牌的全新香草解决方案。这些新产品为香草精提供了一种具有成本效益的天然替代品。因此,vanifolia 和 vanifolia bean 满足了客户对正宗口味和稳定品质的期望

亚太香草(B2B)市场范围

亚太香草 (B2B) 市场根据香草类型、等级、香草产地、形式、最终用途和分销渠道分为六个显著的细分市场。这些细分市场之间的增长将帮助您分析行业中的主要增长细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策,确定核心市场应用。

香草味

- 马达加斯加

- 印度尼西亚

- 墨西哥美食

- 合成起源

- 巴布亚新几内亚

- 乌干达

- 大溪地

- 印度

- 汤加

- 其他的

根据香草类型,亚太香草(B2B)市场分为马达加斯加、墨西哥、合成原产地、印度、印度尼西亚、大溪地、汤加、巴布亚新几内亚、乌干达等。

形式

- 液体

- 粉末

- 粘贴

根据形态,亚太香草(B2B)市场分为液体、粉末和膏状。

香草起源

- 自然的

- 合成的

根据香草的产地,亚太香草(B2B)市场分为天然香草和合成香草。

年级

- A 级(含水量 30%)

- B 级(含水量 20%)

- 其他的

根据等级,亚太香草(B2B)市场分为 A 级(水分含量 30%)、B 级(水分含量 20%)和其他级。

最终用途

- 食物

- 制药

- 饮料

- 个人护理及化妆品

- 家庭/零售

- 其他的

根据最终用途,亚太香草(B2B)市场分为食品、饮料、个人护理和化妆品、医药、家庭/零售和其他。

分销渠道

- 批发的

- 在线的

根据分销渠道,亚太香草(B2B)市场分为批发和在线。

Asia-Pacific Vanilla (B2B) Markets Regional Analysis/Insights

The Asia-Pacific vanilla (B2B) markets analyzed and market size insights and trends are provided based on as referenced above.

The countries covered in the Asia-Pacific vanilla (B2B) market report are China, India, Japan, South Korea, New Zealand, Australia, Indonesia, Singapore, Thailand, Philippines, Malaysia and Rest of Asia-Pacific

China dominates the Asia-Pacific vanilla (B2B) market terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to growing demand for vanilla in various industries in North America such as food, beverages, personal care, and others.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Europe brands and their challenges faced due to high competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Vanilla Market Share Analysis

The Asia-Pacific vanilla (B2B) market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on market.

Some of the key market players are Nielsen-Massey Vanillas, Inc., McCormick & Company, Inc., Prova, SYNERGY, IFFinc, Kerry, Takasago International Corporation, ADM, Madagascar Vanilla Company LLC, and Firmenich SA among others.

Research Methodology

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析以及主要(行业专家)验证。除此之外,数据模型还包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、公司市场份额分析、测量标准、亚太地区与地区以及供应商份额分析。如有进一步询问,请要求分析师致电。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。