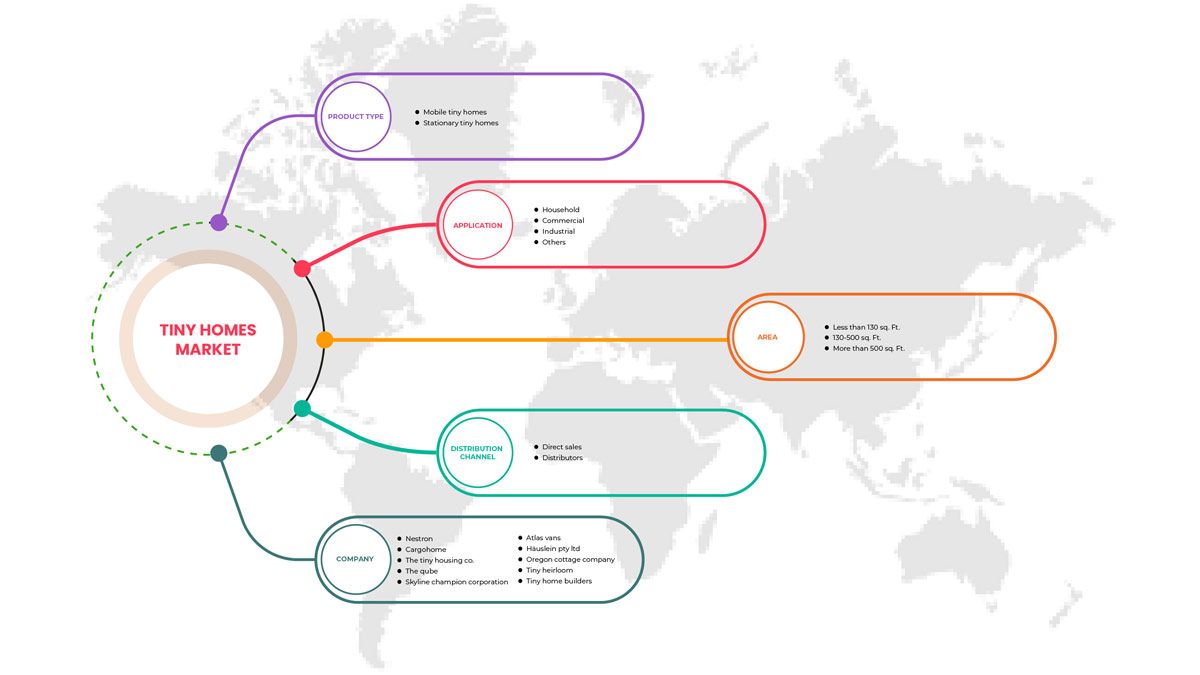

亚太小型住宅市场,按产品类型(移动小型住宅和固定小型住宅)、面积(小于 130 平方英尺、130-500 平方英尺和大于 500 平方英尺)、应用(家庭、商业、工业和其他)、分销渠道(直销和分销商)行业趋势和预测到 2029 年。

亚太地区小型住宅市场分析及规模

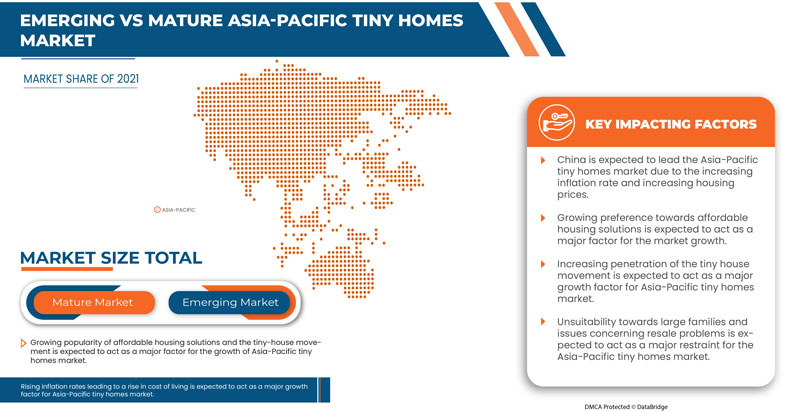

微型住宅在旅游活动中的日益普及是亚太微型住宅市场的重要推动力。通货膨胀率上升导致生活成本上升,经济适用房解决方案越来越受欢迎,微型住宅运动预计将推动亚太微型住宅市场的增长。

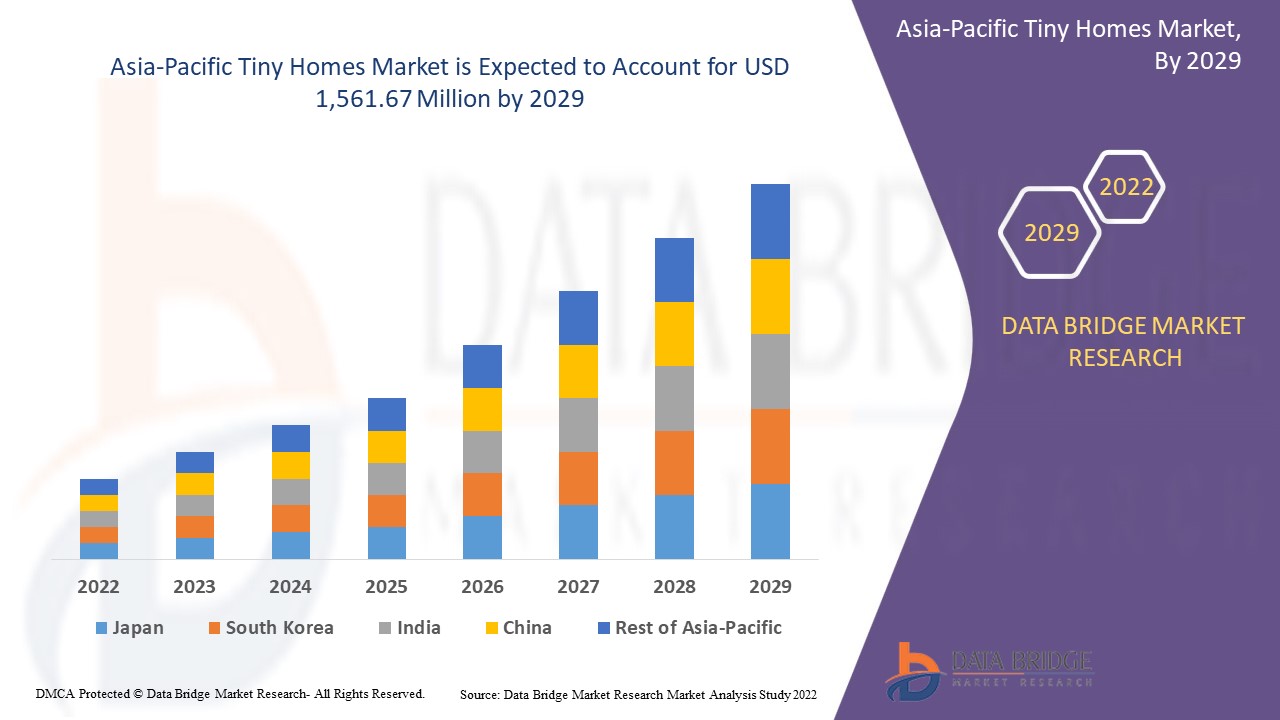

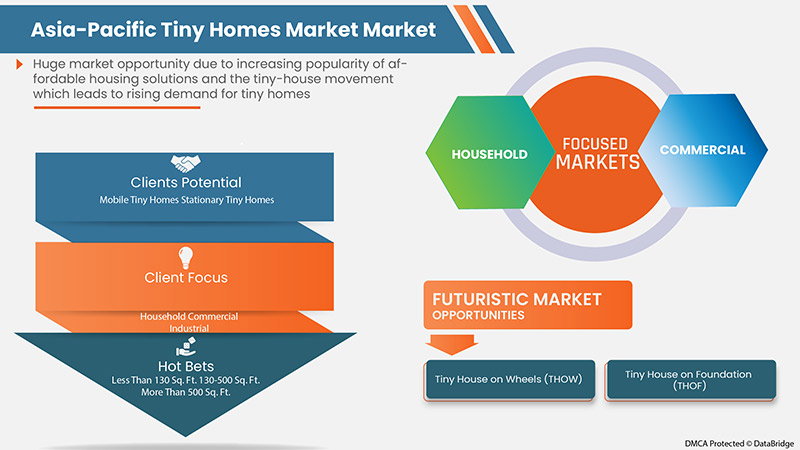

Data Bridge Market Research 分析称,预计到 2029 年,亚太地区小型住宅市场价值将达到 15.6167 亿美元,预测期内复合年增长率为 3.9%。由于小型住宅的兴起,“家庭”成为各自市场中最突出的应用领域。Data Bridge Market Research 团队策划的市场报告包括深入的专家分析、进出口分析、定价分析、生产消费分析和气候链情景。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2014) |

|

定量单位 |

收入(百万美元) |

|

涵盖的领域 |

按产品类型(移动式小房子和固定式小房子)、面积(小于 130 平方英尺、130-500 平方英尺和大于 500 平方英尺)、用途(家庭、商业、工业和其他)、分销渠道(直销和分销商)。 |

|

覆盖国家 |

日本、中国、韩国、印度、新加坡、泰国、印度尼西亚、马来西亚、菲律宾、澳大利亚和新西兰、亚太地区其他地区。 |

|

涵盖的市场参与者 |

Nestron、CargoHome、Häuslein Pty Ltd. |

市场定义

微型住宅通常指建在永久或可移动地基上的面积小于 400 平方英尺的单一住宅单元。微型住宅为消费者及其当地社区提供了多项显著优势,例如购买价格更低、建筑材料浪费更少、碳足迹更少、能源消耗显著减少。

微型住宅在近几十年中不断发展,风格和设计多种多样,吸引了各行各业的人士,包括退休人员、首次购房的夫妇和崇尚简约主义的年轻人等。微型住宅提供各种优质、实惠且环保的住房,可用于满足个人梦想、财务和生活方式目标以及社区需求。

亚太地区小型住宅市场的市场动态

本节旨在了解市场驱动因素、机遇、限制因素和挑战。下文将详细讨论所有这些内容:

驱动因素/机遇

- 微型房屋在旅游活动中的使用越来越多

在世界许多地方,微型住宅不需要许可证,因为它们被视为交通工具。许多家庭投资建造微型住宅,然后将其出租给人们。一些服务提供商甚至以各种建筑和装饰风格出租微型住宅。这些风格从现代或简约到乡村或传统,是酒店住宿的独特替代品。他们为微型住宅配备了厨房、起居空间、浴室和睡眠区。全球化、互联网普及和社交媒体影响力的不断增强等各种因素推动了对微型住宅的需求。此外,新的生活方式、更高的可支配收入和消费者环保意识的增强也创造了对微型住宅的需求。反过来,这有望成为亚太地区微型住宅市场增长的驱动力。

- 通货膨胀上升导致生活成本上升

住房贷款利率促使消费者寻求更实惠的住房选择。消费者对低维护、节能、环保的房屋也越来越感兴趣。人们对这种低成本、环保的微型房屋的兴趣和支出不断增长,预计将在未来几年推动对微型房屋的需求。因此,亚太地区微型房屋市场可能会受到生活成本上升和高住房贷款利率的推动。

- 经济适用房解决方案和小房子运动日益流行

微型住宅正在兴起,因为它是一种创新且经济实惠的住房解决方案。它需要更少的空间、土地和建造成本,并且可以提供基本的设施。可以节省供暖、制冷、房产税或房屋维护方面的费用。与需要更多维护成本的大型房屋相比,微型住宅可以大大节省电力、水和能源。

微型房屋运动,也被称为小房子运动,旨在缩小居住空间,简化生活,本质上是“用更少的钱生活”。根据国际规范委员会的规定,微型房屋是指“建筑面积最大为 37 平方米(400 平方英尺)的住宅单元,不包括阁楼”。人们为推动微型房屋运动做出了许多努力。

- 维护负担小,环保

微型住宅越来越多地使用透明金属氧化物涂层来控制窗户的温度,因此所需的电子元件和装置数量比传统住宅少得多。由于面积和空间较小,与传统住宅相比,维护成本较低。因此,微型住宅的维护负担较小,而且对环境友好,这有望推动亚太地区微型住宅市场的发展。

- 消费者偏好转向环保住宅

越来越多的消费者也更加积极地追求更可持续的生活方式,无论是选择符合道德或环境可持续做法和价值观的产品,还是因为担心可持续性做法或价值观而不再购买某些产品。对于大多数消费者来说,采用更可持续的生活方式始于家庭、回收、堆肥或减少食物浪费。人们也越来越多地选择小房子生活方式,通过简化和减少生活来缩小生活空间,从而接受这种哲学和自由。

此外,生活成本上升、环保意识增强和政府举措不断增加等因素正在推动亚太地区小型住宅市场的需求。此外,消费者对环保住宅的偏好转变可能为亚太地区小型住宅市场的增长提供机会。

- 可持续的 3D 打印微型房屋介绍

使用结合数字技术和材料技术应用的混凝土 3D 打印技术有助于创造各种形状和设计。它允许建筑师在更少的时间和成本下建造各种形状,例如曲线、球体等。3D 打印技术是建筑行业即将出现的技术。然而,需要借助技术进步来升级传统或标准的施工方法。这反过来又为亚太小型住宅市场的增长提供了新的机会。

限制/挑战

- 与传统住宅相比,人们对小型住宅的偏好较低

与传统住宅相比,建造微型住宅不需要太多土地。但许多城镇都很难建造微型住宅。分区法通常包括住宅的最小面积。例如,在北卡罗来纳州,微型住宅必须至少有 150 平方英尺才能获得建筑许可,每增加一名居住者就必须增加 100 平方英尺。这些分区规定可以禁止人们购买土地并在其上建造自己的微型住宅。有时,获得建造微型住宅的贷款是另一个挑战。有时,由于银行不认为微型住宅具有足够的价值来作为良好的抵押品,因此不可能获得标准抵押贷款。

- 住宅建筑数量不断增加

搬入新居和翻新旧居的消费者住在住宅楼里。生活方式的改变和可支配收入的增加促使消费者住在建筑物和大空间中以保持他们的标准和地位。出于这个原因,人们更喜欢住在住宅楼里。因此,预计越来越多的住宅建设将抑制亚太小型住宅市场。

- 不适合大家庭,且存在转售问题

微型房屋的业主经常难以调节房屋内的温度。结果,窗户、墙壁和家具上积聚了水。微型房屋缺乏适当的通风和冷却系统。许多怀着旅行梦想搬进微型房屋的人后来意识到,从一个地方搬到另一个地方很困难。在大多数情况下,需要连接一辆更大的卡车,这大大增加了成本。此外,物品需要绑紧,以免在搬运过程中掉落和损坏。

此外,人们更容易受到自然灾害的影响,而且意识有限。此外,小型住宅不适合大家庭居住,以及小型住宅转售的问题可能会对亚太地区小型住宅市场的增长构成挑战。

后疫情时代对亚太地区小型住宅市场的影响

2020-2021 年,COVID-19 影响了各个制造业,导致工作场所关闭、供应链中断和交通限制。由于封锁,过去几年零售店关闭和客户访问限制导致市场销售额下降。

然而,后疫情时期市场的增长归因于更多人在家工作和可支配收入增加。这导致对可持续、环保和负担得起的住房解决方案的需求增加。主要的市场参与者正在做出各种战略决策,以在 COVID-19 后反弹。参与者正在进行多项研发活动以改进他们的产品。他们正在通过探索不同的零售渠道和扩展到新的地区来提高其市场份额。

这份亚太小型住宅市场报告详细介绍了最新发展、贸易法规、进出口分析、生产分析、价值链优化、市场份额、国内和本地市场参与者的影响,分析了新兴收入来源、市场法规变化、战略市场增长分析、市场规模、类别市场增长、应用领域和主导地位、产品审批、产品发布、地域扩展、市场技术创新等方面的机会。如需了解有关小型住宅市场的更多信息,请联系 Data Bridge Market Research 获取分析师简报。我们的团队将帮助您做出明智的市场决策,以实现市场增长。

最新动态

- 2019 年 10 月,Häuslein Pty Ltd 推出了两款新型小房子——Little Sojourner 和 Grand Sojourner。这两款产品分别是高端小房子系列中最小和最大的新成员。新推出的产品将帮助该公司凭借高品质的小房子提升其市场占有率。

亚太地区小型住宅市场范围

亚太小型住宅市场根据产品类型、区域、应用和分销渠道进行细分。这些细分市场之间的增长情况将帮助您分析行业中增长缓慢的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

产品类型

- 移动小房子

- 固定式微型房屋

根据产品类型,亚太小型住宅市场分为移动小型住宅和固定小型住宅。

区域

- 小于 130 平方英尺

- 130-500 平方英尺

- 超过 500 平方英尺。

根据面积,亚太小型住宅市场分为小于130平方英尺、130-500平方英尺和大于500平方英尺。

应用

- 家庭

- 商业的

- 工业的

- 其他的

根据应用,亚太小型住宅市场分为家庭、商业、工业和其他。

分销渠道

- 直销

- 分销商

根据分销渠道,亚太小型住宅市场分为直销和分销商。

亚太地区小型住宅市场区域分析/见解

对亚太小型住宅市场进行了分析,并按国家、产品类型、地区、应用和分销渠道提供了市场规模洞察和趋势,如上所述。

亚太小型住宅市场报告涵盖的国家包括日本、中国、韩国、印度、新加坡、泰国、印度尼西亚、马来西亚、菲律宾、澳大利亚和新西兰以及亚太地区其他国家。

2022 年,中国预计将在亚太地区微型住宅市场占据主导地位,因为该地区的微型住宅运动将推动消费者在微型住宅上的支出增加。商业和住宅微型住宅建设的投资和举措的增加推动了该地区对微型住宅的需求。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。下游和上游价值链分析、技术趋势、波特五力分析和案例研究等数据点是用于预测各个国家市场情景的一些指标。此外,在对国家数据进行预测分析时,还考虑了亚太品牌的存在和可用性以及它们因来自本地和国内品牌的激烈或稀缺竞争而面临的挑战、国内关税的影响和贸易路线。

竞争格局和亚太地区小型住宅市场份额分析

亚太小型住宅市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、亚太地区业务、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度以及应用主导地位。以上提供的数据点仅与公司对亚太小型住宅市场的关注有关。

小型住宅市场的一些主要参与者包括 Nestron、CargoHome 和 Häuslein Pty Ltd 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC TINY HOMES MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 3D PRINTING IN TINY HOMES

4.2 CONSUMERS BUYING BEHAVIOUR

4.2.1 OVERVIEW

4.2.2 COMPLEX BUYING BEHAVIOR

4.2.3 DISSONANCE-REDUCING BUYING BEHAVIOR

4.2.4 HABITUAL BUYING BEHAVIOR

4.2.5 VARIETY SEEKING BEHAVIOR

4.2.6 CONCLUSION

4.3 LIST OF SUPPLIERS & DISTRIBUTORS

4.3.1 ASIA PACIFIC

4.4 CONSUMERS ANALYSIS

4.5 REGULATION COVERAGE

4.5.1 INTERNATIONAL RESIDENTIAL CODE (IRC)

4.5.1.1 GENERAL

4.5.1.2 DEFINITIONS

4.5.1.3 CEILING HEIGHT

4.5.1.4 LOFTS

4.5.1.5 EMERGENCY ESCAPE AND RESCUE OPENINGS

4.5.1.6 ENERGY CONSERVATION

4.5.2 NATIONAL FIRE PROTECTION ASSOCIATION (NFPA)

4.5.3 RV INDUSTRY ASSOCIATION

4.5.4 U.S. DEPARTMENT OF HOUSING AND URBAN DEVELOPMENT (HUD)

4.5.5 NATIONAL ORGANIZATION OF ALTERNATIVE HOUSING (NOAH)

5 REGIONAL SUMMARY

5.1 ASIA PACIFIC

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING USAGE OF TINY HOMES IN TOURISM ACTIVITIES

6.1.2 RISING INFLATION LEADS TO A RISE IN LIVING COSTS

6.1.3 INCREASING POPULARITY OF AFFORDABLE HOUSING SOLUTIONS AND THE TINY-HOUSE MOVEMENT

6.1.4 LESS BURDEN OF MAINTENANCE AS WELL AS ENVIRONMENT FRIENDLY

6.2 RESTRAINTS

6.2.1 LOW PREFERENCE TOWARDS THE TINY HOMES OVER CONVENTIONAL HOMES

6.2.2 LACK OF WELL-ESTABLISHED INFRASTRUCTURE AND LIMITED AWARENESS

6.2.3 GROWING NUMBER OF RESIDENTIAL BUILDINGS

6.3 OPPORTUNITIES

6.3.1 SHIFTING CONSUMER PREFERENCE TOWARD THE ENVIRONMENTALLY FRIENDLY HOMES

6.3.2 HIGH INTEREST RATES ON HOME LOANS

6.3.3 INTRODUCTION OF SUSTAINABLE 3D PRINTED TINY HOMES

6.4 CHALLENGES

6.4.1 LIMITED DEMAND FROM DEVELOPING ECONOMIES

6.4.2 UNSUITABLE FOR LARGE FAMILIES AND ISSUES CONCERNING RESALE PROBLEMS

7 ASIA PACIFIC TINY HOMES MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 STATIONARY TINY HOMES

7.3 MOBILE TINY HOMES

8 ASIA PACIFIC TINY HOMES MARKET, BY AREA

8.1 OVERVIEW

8.2 130-500 SQ.FT

8.3 LESS THAN 130 SQ.FT

8.4 MORE THAN 500 SQ.FT

9 ASIA PACIFIC TINY HOMES MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 HOUSEHOLD

9.3 COMMERCIAL

9.4 INDUSTRIAL

9.5 OTHERS

10 ASIA PACIFIC TINY HOMES MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT SALES

10.3 DISTRIBUTORS

11 ASIA PACIFIC TINY HOMES MARKET, BY REGION

11.1 ASIA-PACIFIC

11.1.1 CHINA

11.1.2 JAPAN

11.1.3 INDIA

11.1.4 AUSTRALIA & NEW ZEALAND

11.1.5 SOUTH KOREA

11.1.6 THAILAND

11.1.7 INDONESIA

11.1.8 MALAYSIA

11.1.9 SINGAPORE

11.1.10 PHILIPPINES

11.1.11 REST OF ASIA-PACIFIC

12 ASIA PACIFIC TINY HOMES MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

12.2 PRODUCT LAUNCHES

12.3 PARTNERSHIP

12.4 PARTICIPATION

12.5 AWARDS

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 NESTRON

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 CARGOHOME

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 THE TINY HOUSING CO.

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 THE QUBE

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 SKYLINE CHAMPION CORPORATION

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ATLAS VANS

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 HÄUSLEIN PTY LTD

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 OREGON COTTAGE COMPANY

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 TINY HEIRLOOM

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 TINY HOME BUILDERS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 TINY SMART HOUSE, INC.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 TUMBLEWEED TINY HOUSE COMPANY

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 NEW FRONTIER TINY HOMES

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 TIMBERCARAFT TINY HOMES

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 MUSTARD SEED TINY HOMES LLC

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 AMERICAN TINY HOUSE

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 B&B MICRO MANUFACTURING, INC.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 CALIFORNIA TINY HOUSE

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 MAVERICK TINY HOMES, LLC

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

14.2 TINY IDAHOMES

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 ASIA PACIFIC TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC STATIONARY TINY HOMES IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC MOBILE TINY HOMES IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC 130-500 SQ.FT IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC LESS THAN 130 SQ.FT IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC MORE THAN 500 SQ.FT IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC HOUSEHOLD IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC COMMERCIAL IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC INDUSTRIAL IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC OTHERS IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC DIRECT SALES IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC DISTRIBUTORS IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA-PACIFIC TINY HOMES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 17 ASIA-PACIFIC TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 18 ASIA-PACIFIC TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 19 ASIA-PACIFIC TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 ASIA-PACIFIC TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 21 CHINA TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 22 CHINA TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 23 CHINA TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 24 CHINA TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 25 JAPAN TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 26 JAPAN TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 27 JAPAN TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 JAPAN TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 INDIA TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 30 INDIA TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 31 INDIA TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 INDIA TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 33 AUSTRALIA & NEW ZEALAND TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 34 AUSTRALIA & NEW ZEALAND TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 35 AUSTRALIA & NEW ZEALAND TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 36 AUSTRALIA & NEW ZEALAND TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 37 SOUTH KOREA TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 38 SOUTH KOREA TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 39 SOUTH KOREA TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 SOUTH KOREA TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 41 THAILAND TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 THAILAND TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 43 THAILAND TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 THAILAND TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 INDONESIA TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 46 INDONESIA TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 47 INDONESIA TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 INDONESIA TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 49 MALAYSIA TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 MALAYSIA TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 51 MALAYSIA TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 MALAYSIA TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 53 SINGAPORE TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 SINGAPORE TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 55 SINGAPORE TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 SINGAPORE TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 57 PHILIPPINES TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 58 PHILIPPINES TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 59 PHILIPPINES TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 60 PHILIPPINES TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 61 REST OF ASIA-PACIFIC TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 ASIA PACIFIC TINY HOMES MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC TINY HOMES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC TINY HOMES MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC TINY HOMES MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC TINY HOMES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC TINY HOMES MARKET: THE PRODUCT TYPE LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC TINY HOMES MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC TINY HOMES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC TINY HOMES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC TINY HOMES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 ASIA PACIFIC TINY HOMES MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC TINY HOMES MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC TINY HOMES MARKET: SEGMENTATION

FIGURE 14 INCREASING POPULARITY OF AFFORDABLE HOUSING SOLUTIONS IS EXPECTED TO DRIVE THE ASIA PACIFIC TINY HOMES MARKET IN THE FORECAST PERIOD

FIGURE 15 THE STATIONARY TINY HOMES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC TINY HOMES MARKET IN 2022 & 2029

FIGURE 16 ASIA PACIFIC TINY HOMES MARKET: TYPES OF CONSUMER'S BUYING BEHAVIOUR

FIGURE 17 ASIA PACIFIC TINY HOMES MARKET: SHARE OF CONSUMER TYPE

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC TINY HOMES MARKET

FIGURE 19 ASIA PACIFIC TINY HOMES MARKET, BY PRODUCT TYPE, 2021

FIGURE 20 ASIA PACIFIC TINY HOMES MARKET, BY AREA, 2021

FIGURE 21 ASIA PACIFIC TINY HOMES MARKET, BY APPLICATION, 2021

FIGURE 22 ASIA PACIFIC TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 23 ASIA-PACIFIC TINY HOMES MARKET: SNAPSHOT (2021)

FIGURE 24 ASIA-PACIFIC TINY HOMES MARKET: BY COUNTRY (2021)

FIGURE 25 ASIA-PACIFIC TINY HOMES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 ASIA-PACIFIC TINY HOMES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 ASIA-PACIFIC TINY HOMES MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 28 ASIA PACIFIC TINY HOMES MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。