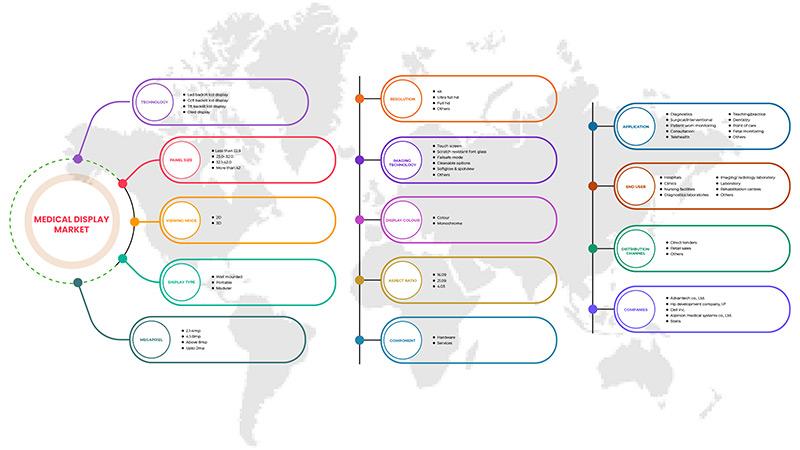

亚太医疗显示器市场,按技术(LED 背光 LCD 显示器、CCFL 背光 LCD 显示器、TFT LCD 显示器和 OLED 显示器)、面板尺寸(22.9 英寸以下面板、23.0 英寸 - 32.0 英寸面板、27.0-41.9 英寸面板和 42 英寸以上面板)、观看模式(2D 和3D)、百万像素(最高 2MP、2.1-4MP、4.1-8MP 和 8MP 以上)、分辨率(4K、超全高清、全高清和其他)、显示类型(壁挂式、便携式、模块化)、成像技术(触摸屏、防刮擦字体玻璃、故障安全模式、可清洁选项、Softglow 和 Spotview 和其他)、显示颜色(彩色、单色)、宽高比(16.09、21.09、4.03)、组件(硬件和服务)、应用(咨询、诊断、外科/介入、远程医疗、教学/实践、胎儿监护、牙科、护理点、患者佩戴监护等)最终用户(医院、诊所、护理机构、诊断实验室、影像/放射实验室、实验室、康复中心等)、分销渠道(直接招标、零售销售等)—— 行业趋势和预测到 2029 年。

亚太医疗显示器市场分析与洞察

医疗显示器市场增长的主要原因是微创治疗(MIT)的需求不断增长,因为微创治疗具有多种优势,例如术后疼痛更少、手术更少、术后并发症更少、住院时间更短、恢复时间更快、疤痕更少、对免疫系统的压力更小、切口更小,并且对于某些程序来说,它还可以缩短手术时间并降低成本。

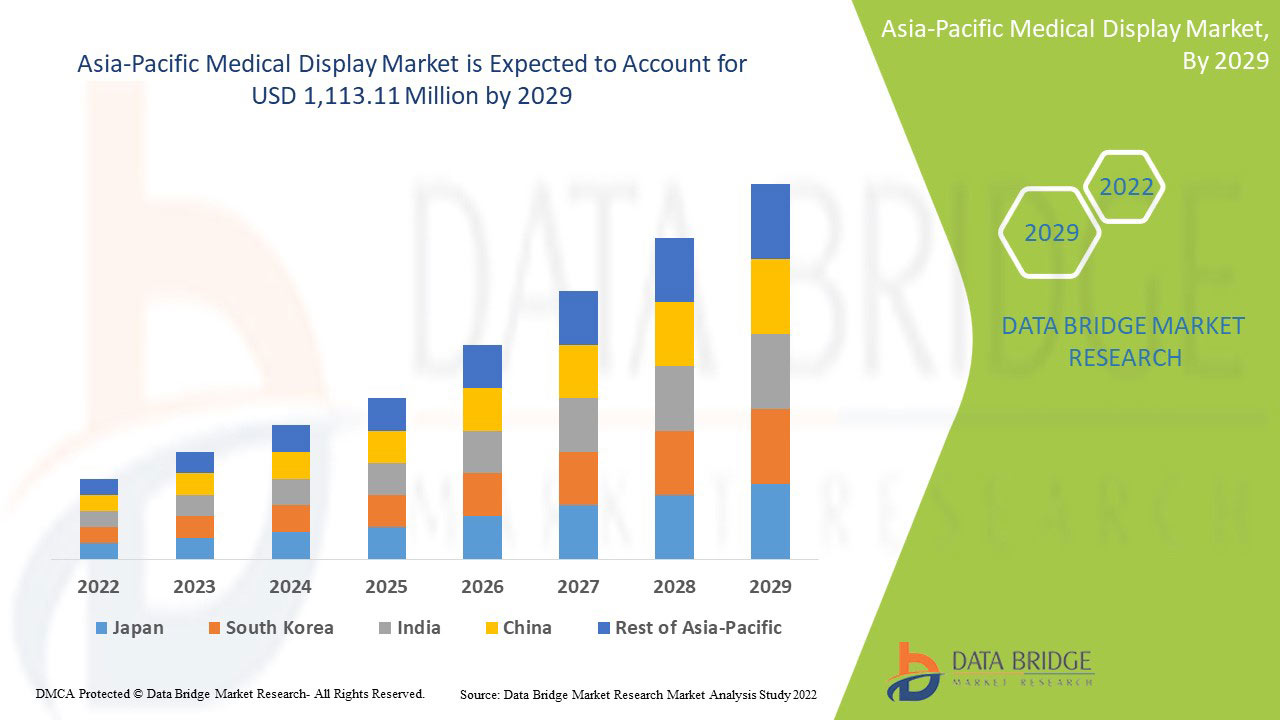

Data Bridge Market Research 分析称,预计到 2029 年,医疗显示器市场价值将达到 11.1311 亿美元,预测期内复合年增长率为 6.2%。由于全球对先进医疗显示器和成像服务的需求迅速增长,技术成为市场中最大的细分类型。本市场报告还深入介绍了定价分析、专利分析和技术进步。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020 (可定制为 2019-2014) |

|

定量单位 |

收入(百万美元),定价(美元) |

|

涵盖的领域 |

按技术(LED 背光 LCD 显示屏、CCFL 背光 LCD 显示屏、TFT LCD 显示屏和 OLED 显示屏)、面板尺寸(22.9 英寸以下面板、23.0 英寸 - 32.0 英寸面板、27.0-41.9 英寸面板和 42 英寸以上面板)、观看模式(2D 和3D)、百万像素(最高 2MP、2.1-4MP、4.1-8MP 和 8MP 以上)、分辨率(4K、超全高清、全高清和其他)、显示类型(壁挂式、便携式、模块化)、成像技术(触摸屏、防刮擦字体玻璃、故障安全模式、可清洁选项、Softglow 和 Spotview 和其他)、显示颜色(彩色、单色)、长宽比(16.09、21.09、4.03)、组件(硬件和服务)、应用程序(咨询、诊断、外科/介入、远程医疗、教学/实践、胎儿监护、牙科、护理点、患者佩戴监护等)最终用户(医院、诊所、护理机构、诊断实验室、影像/放射实验室、实验室、康复中心等)、分销渠道(直接招标、零售等) |

|

覆盖国家 |

中国、日本、印度、澳大利亚、韩国、新加坡、泰国、马来西亚、印度尼西亚、菲律宾、亚太地区其他地区 |

|

涵盖的市场参与者 |

BenQ、ALPINION MEDICAL SYSTEMS Co., Ltd、南京巨鲨商贸有限公司、COJE CO.,LTD.、Axiomtek Co., Ltd.、Dell Inc.、HP Development Company, LP、Reshin、Onyx Healthcare Inc.、Teguar Computers.、深圳市碧康显示技术有限公司、Rein Medical、STERIS.、Barco.、海信.、索尼公司、研华有限公司、LG Electronics.、夏普 NEC Display Solutions、荷兰皇家飞利浦电子公司、EIZO INC.、Novanta Inc.、FSN Medical Technologies.、Quest、Ampronix.、Siemens Healthcare GmbH、松下公司等。 |

医疗显示器市场定义

医疗显示器是一种满足医疗成像高要求的显示器。它通常配备特殊的图像增强技术,以确保显示器在整个使用寿命期间亮度一致、图像无噪声、读数符合人体工程学,并自动符合医学数字成像和通信 (DICOM) 和其他医疗标准。

医疗成像技术的发展推动了医疗保健的发展,提供了强大的诊断工具,支持对损伤和内部问题进行非侵入性评估,并使疾病比以往更早被发现。在用于医疗成像时,医疗显示器比消费类显示器更受欢迎。原因很简单:医疗显示器满足图像质量、医疗法规和质量保证的既定要求。

医疗显示设备的未来取决于人工智能 (AI) 和数据分析的发展。医疗设备让临床医生能够以前所未有的方式个性化医疗,从而推动疾病管理的发展。这些技术可以实时为个体患者提供启示性见解。

医疗显示器市场动态

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。下面将详细讨论所有这些内容:

驱动程序

- 微创治疗日益流行

亚太地区医疗显示器市场增长的主要原因是微创治疗(MIT)的需求不断增长,因为微创治疗具有多种优势,例如术后疼痛更少、手术更少、术后并发症更少、住院时间更短、恢复时间更快、疤痕更少、对免疫系统的压力更小、切口更小,并且对于某些程序来说,它还可以缩短手术时间并降低成本。

微创手术是诊断和治疗多种胸部疾病的绝佳方法,这些疾病以前需要进行胸骨切开术或开胸手术。全球范围内需要手术的慢性病患病率不断上升。由于微创治疗具有诸多优势,许多患者更喜欢它。此外,血管和血管内手术、神经和脊柱手术、骨科创伤护理和心脏手术都在混合手术室中进行。这一特点使医院能够进行先进的外科手术,从而增加了对医疗显示器的需求。此外,医疗成本的增加以及病理学和放射学实验室数量的增加推动了对医疗显示器的需求。

微创手术使外科医生能够利用现代科技和先进的手术技巧,以较少的伤害对人体进行手术。这有望增加对微创手术的需求。

- 不断增长的医疗基础设施

一些国家的政府和非营利组织主要致力于发展卫生基础设施,以尽量减少疾病负担并提供更好的卫生服务。此外,采用技术先进的医疗设备、屏幕、监视器和各种其他设备的情况也有所增加。所有这些因素都可能在预测期内为市场增长创造有利机会。此外,未来几年主要参与者对创新产品发布和更新功能的大量投资也可以促进市场发展。

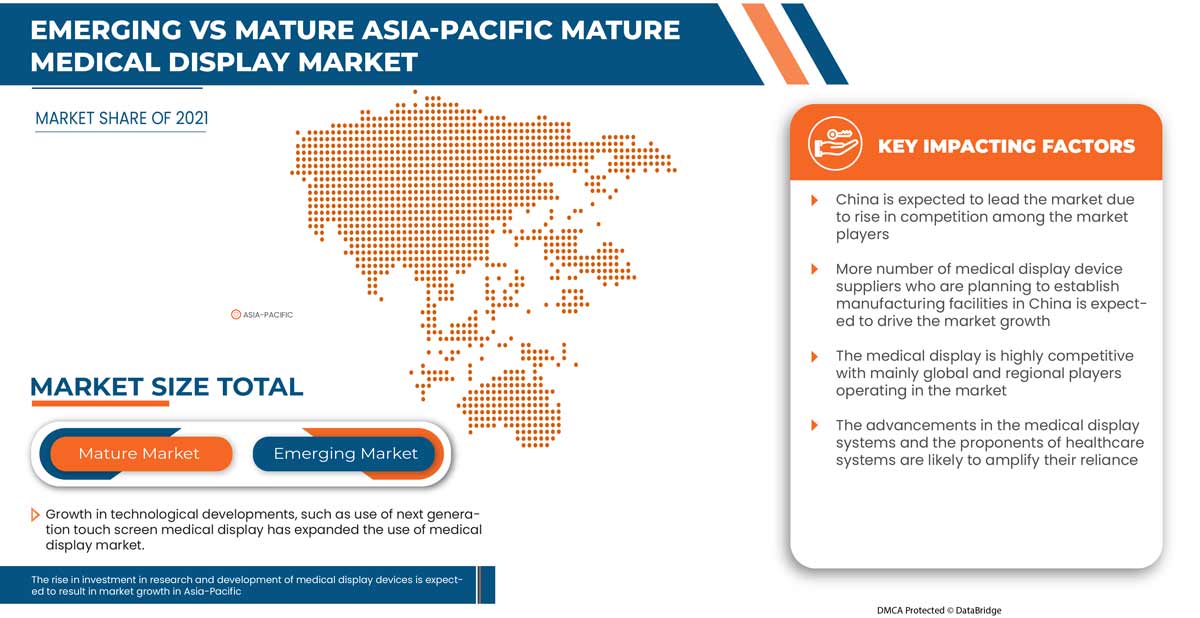

此外,对具有成本效益的医疗服务的需求不断增长、对技术解决方案的需求不断增长、信息的高度流动性不断提高、政府举措和激励措施不断增加以及医院和研究中心对高质量医疗显示器的资金不断增加,预计将推动这些医疗设施进入市场。医疗软件基础设施已成为医疗显示器、数字医疗图书馆和管理信息系统最新进展的基础。这些因素预计将推动亚太地区医疗显示器市场的增长。

机会

- 医疗显示仪器的技术进步

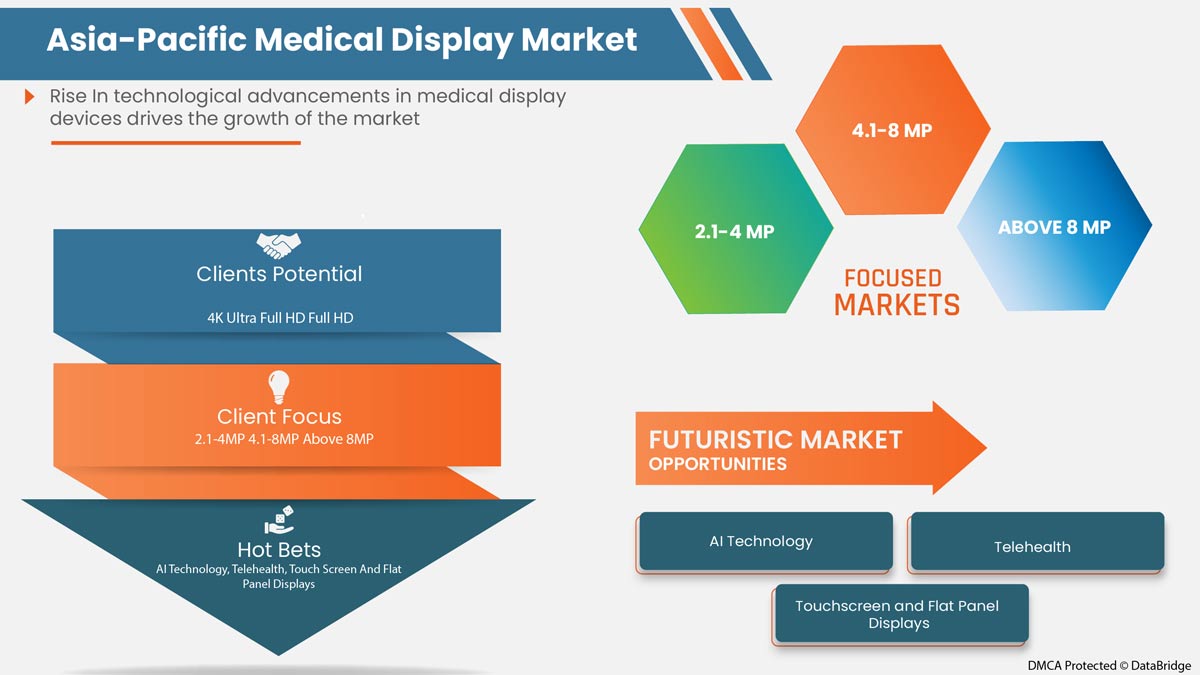

随着市场焦点转向口服剂型的生产,人们一直在努力开发适合口服的新分子配方,同时确保药物在患者体内具有最佳生物利用度。为了克服这一问题,药用辅料制造商正在开发更简单的产品,并减少开发时间和成本。医疗显示技术的发展改变了医疗保健行业,提供诊断工具、远程医疗、为非侵入性治疗提供支持、允许评估疾病并允许更早地发现疾病。

医疗显示设备技术发展的推出正在提高医疗显示器的效率,并增加医疗显示设备的易用性。医疗显示设备技术应用的激增将减少劳动力并快速诊断和恢复疾病。未来,人工智能技术将取代医疗显示器市场。预计这一因素将成为预测期内亚太地区医疗显示器市场增长的机会。

限制/挑战

- 医疗显示设备成本高昂

显示设备的高成本和高实施成本是制约市场增长的主要因素,特别是在报销情况较差的国家。发展中国家的大多数医疗机构(如医院和诊断中心)由于安装和维护成本高昂而无法负担这些设备,而由于这些医疗设备的成本高昂且财政资源不足,新兴国家的医疗机构不愿投资于新的技术先进的系统。这些因素可能会阻碍医疗机构的数字化,并影响采用先进的诊断和分析技术。

技术的进步推动了先进创新显示设备的开发,但也推高了设备成本。因此,预计显示设备的高成本将抑制市场的增长。

最新动态

- 2022 年 6 月,艺卓公司推出了 RadiForce MX243W – 一款 24.1 英寸 230 万像素(1920 x 1200 像素)显示器。这款 24.1 英寸 230 万像素(1920 x 1200 像素)显示器专为在诊所和医院中仔细监测和诊断患者系统的完整生理状况而设计。此次发布为产品组合增添了一款新的医疗设备,并提供了卓越的市场纯度

- 2021 年 5 月,巴可推出了 Nio Fusion 12MP 医疗显示器。该产品的推出增强了产品组合,并提高了北美和欧洲医疗显示器产品线的销量和扩展

亚太医疗显示器市场范围

亚太医疗显示器市场根据技术、面板尺寸、观看模式、百万像素、分辨率、显示器类型、成像技术、显示器颜色、宽高比、组件、应用、最终用户和分销渠道分为十三个重要细分市场。细分市场之间的增长有助于您分析细分市场的增长空间和进入市场的策略,并确定您的核心应用领域和目标市场的差异。

亚太医疗显示器市场(按技术分类)

- LED 背光液晶显示屏

- CCFL 背光液晶显示屏

- TFT液晶显示屏

- OLED 显示屏

根据技术,医疗显示器市场细分为LED背光液晶显示器、CCFL背光液晶显示器、TFT液晶显示器和OLED显示器。

亚太医疗显示器市场(按面板尺寸)

- 22.9 英寸以下面板

- 23.0-26.9 英寸面板

- 27.0-41.9 英寸面板

- 42 英寸以上面板

根据面板尺寸,医疗显示器市场细分为22.9英寸以下面板、23.0英寸-32.0英寸面板、27.0-41.9英寸面板和42英寸以上面板。

亚太医疗显示器市场(按观看模式)

- 2D

- 3D

根据观看模式,医疗显示器市场分为2D和3D。

亚太地区医疗显示器市场(按像素划分)

- 最高可达 2MP

- 2.1–4MP

- 4.1–8MP

- 8MP以上

根据百万像素,医疗显示器市场细分为高达 2MP、2.1-4MP、4.1-8MP 和 8MP 以上。

亚太医疗显示器市场(按分辨率)

- 全高清

- 超高清

- 4K

- 其他的

根据分辨率,医疗显示器市场分为全高清、超全高清、4K 和其他。

亚太医疗显示器市场(按显示器类型划分)

- 壁挂式

- 便携的

- 模块化的

根据显示器类型,医疗显示器市场分为壁挂式、便携式和模块化。

亚太医疗显示器市场(按成像技术划分)

- 触摸屏

- 防刮擦字体玻璃

- 故障安全模式

- 可清洁选项

- SOOTGLOW 和 SPOTVIEW

- 其他的

根据成像技术,医疗显示器市场细分为触摸屏、防刮字体玻璃、故障安全模式、可清洁选项、柔光和聚光灯等。

亚太医疗显示器市场(按显示器颜色划分)

- 颜色

- 单色

根据显示颜色,医疗显示器市场分为彩色和单色。

亚太医疗显示器市场(按宽高比划分)

- 16:09

- 21:09

- 4:03

根据长宽比,医疗显示器市场细分为 16:09、21:09 和 4:03。

亚太医疗显示器市场(按组件划分)

- 硬件

- 服务

根据组成部分,医疗显示器市场分为硬件和服务。

亚太医疗显示器市场(按应用划分)

- 诊断

- 外科/介入

- 患者佩戴监测

- 咨询

- 远程医疗

- 教学/实践

- 牙科

- 护理点

- 胎儿监护

- 其他的

On the basis of application, the medical display market is segmented into consultation, diagnostic, surgical/interventional, telehealth, teaching / practice, fetal monitoring, dentistry, point of care, patient-worn monitoring and others.

ASIA-PACIFIC MEDICAL DISPLAY MARKET, BY END USER

- HOSPITALS

- BY TECHNOLOGY

- CLINICS

- NURSING FACILITIES

- DIAGNOSTIC LABORATORIES

- IMAGING/RADIOLOGY LAB

- LABORATORY

- REHABILITATION CENTERS

- OTHERS

On the basis of end user, the medical display market is segmented into hospitals, clinics, nursing facilities, diagnostic laboratories, imaging/radiology lab, laboratory, rehabilitation centers and others.

ASIA-PACIFIC MEDICAL DISPLAY MARKET, BY DISTRIBUTION CHANNEL

- DIRECT TENDER

- RETAIL SALES

- OTHERS

On the basis of distribution channel, the medical display market is segmented into direct tender, retail sales and others.

Medical Display Market Regional Analysis/Insights

The medical display market is analyzed and market size information is provided technology, panel size, viewing mode, megapixel, resolution, display type, imaging technology, display color, aspect ratio, component, application, end user and distribution channel.

The countries covered in this market report are China, Japan, India, Australia, South Korea, Singapore, Thailand, Malaysia, Indonesia, Philippines and Rest of Asia-Pacific.

China dominates the Asia-Pacific region due to rapidly growing healthcare market coupled with rise in medical display production.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Medical Display Market Share Analysis

The medical display market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the medical display market.

市场上的一些主要参与者包括 BenQ、ALPINION MEDICAL SYSTEMS 有限公司、南京巨鲨商贸有限公司、COJE 有限公司、Axiomtek 有限公司、戴尔公司、HP Development Company、LP、Reshin、Onyx Healthcare Inc.、Teguar Computers.、深圳市碧康显示技术有限公司、Rein Medical、STERIS.、Barco.、海信、索尼公司、研华有限公司、LG 电子、夏普 NEC 显示解决方案、荷兰皇家飞利浦公司、EIZO INC.、Novanta Inc.、FSN Medical Technologies.、Quest、Ampronix.、西门子医疗有限公司、松下公司等。

研究方法:医疗显示器市场

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析以及主要(行业专家)验证。除此之外,数据模型还包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、公司市场份额分析、测量标准、亚太地区与地区以及供应商份额分析。如有进一步询问,请要求分析师致电。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC MEDICAL DISPLAY MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TECHNOLOGYLIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 PESTEL

3.2 PORTER'S FIVE FORCES MODEL

3.3 TECHNOLOGICAL LANDSCAPE IN THE ASIA PACIFIC MEDICAL DISPLAY MARKET

3.3.1 ORGANIC LIGHT EMITTING DIODE (OLED)

3.3.2 LIGHT EMITTING DIODE (LED), TECHNOLOGY

3.3.3 LIQUID CRYSTAL DISPLAY (LCD)

4 VALUE CHAIN ANALYSIS: ASIA PACIFIC MEDICAL DISPLAY MARKET

5 ASIA PACIFIC MEDICAL DISPLAY MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE GROWING TREND TOWARDS MINIMALLY INVASIVE TREATMENT

6.1.2 GROWING HEALTHCARE INFRASTRUCTURE

6.1.3 SURGE IN THE NUMBER OF DIAGNOSTIC IMAGING CENTERS

6.2 RESTRAINTS

6.2.1 INCREASE IN USE OF REFURBISHED MEDICAL DISPLAYS

6.2.2 MEDICAL COMMUNITY HAS ATTEMPTED TO TAKE ADVANTAGE

6.2.3 HIGH COSTS OF MEDICAL DISPLAY DEVICES

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN MEDICAL DISPLAY INSTRUMENTS

6.3.3 RISING DISPOSABLE INCOME

6.4 CHALLENGES

6.4.1 LACK OF SKILLED EXPERTISE

6.4.2 STRINGENT REGULATIONS

7 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 LED BACKLIT LCD DISPLAY

7.3 CCFL BACKLIT LCD DISPLAY

7.4 TFT BACKLIT LCD DISPLAY

7.5 OLED DISPLAY

7.5.1 AMOLED

7.5.2 PMOLED

8 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY PANEL SIZE

8.1 OVERVIEW

8.2 LESS THAN 22.9

8.2.1 LED BACKLIT LCD DISPLAY

8.2.2 CCFL BACKLIT LCD DISPLAY

8.2.3 TFT BACKLIT LCD DISPLAY

8.2.4 OLED DISPLAY

8.3 23.0- 32.0

8.3.1 LED BACKLIT LCD DISPLAY

8.3.2 CCFL BACKLIT LCD DISPLAY

8.3.3 TFT BACKLIT LCD DISPLAY

8.3.4 OLED DISPLAY

8.4 32.1-42.0

8.4.1 LED BACKLIT LCD DISPLAY

8.4.2 CCFL BACKLIT LCD DISPLAY

8.4.3 TFT BACKLIT LCD DISPLAY

8.4.4 OLED DISPLAY

8.5 MORE THAN 42

8.5.1 LED BACKLIT LCD DISPLAY

8.5.2 CCFL BACKLIT LCD DISPLAY

8.5.3 TFT BACKLIT LCD DISPLAY

8.5.4 OLED DISPLAY

9 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY VIEWING MODE

9.1 OVERVIEW

9.2 2D

9.3 3D

10 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY MEGAPIXEL

10.1 OVERVIEW

10.2 2.1-4MP

10.3 4.1-8MP

10.4 ABOVE 8MP

10.5 UPTO 2MP

11 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY RESOLUTION

11.1 OVERVIEW

11.2 4K

11.3 ULTRA FULL HD

11.4 FULL HD

11.5 OTHERS

12 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY DISPLAY TYPE

12.1 OVERVIEW

12.2 WALL MOUNTED

12.3 PORTABLE

12.4 MODULAR

13 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY DISPLAY COLOR

13.1 OVERVIEW

13.2 COLOR

13.2.1 LED BACKLIT LCD DISPLAY

13.2.2 CCFL BACKLIT LCD DISPLAY

13.2.3 TFT BACKLIT LCD DISPLAY

13.2.4 OLED DISPLAY

13.3 MONOCHROME

13.3.1 LED BACKLIT LCD DISPLAY

13.3.2 CCFL BACKLIT LCD DISPLAY

13.3.3 TFT BACKLIT LCD DISPLAY

13.3.4 OLED DISPLAY

14 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY COMPONENT

14.1 OVERVIEW

14.2 HARDWARE

14.2.1 ACCESSORIES

14.2.2 SENSORS

14.2.3 PANELS

14.2.4 OTHERS

14.3 SERVICES

14.3.1 CONSULTING

14.3.2 INSTALLATION

14.3.3 AFTER-SALE SERVICES

15 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY APPLICATION

15.1 OVERVIEW

15.2 DIAGNOSTICS

15.2.1 BY TYPE

15.2.1.1 GENERAL RADIOLOGY

15.2.1.2 MAMMOGRAPHY

15.2.1.3 DIGITAL PATHOLOGY

15.2.1.4 MULTI-MODALITY

15.2.2 BY PANEL SIZE

15.2.2.1 LESS THAN 22.9

15.2.2.2 23.0- 32.0

15.2.2.3 32.1-42.0

15.2.2.4 MORE THAN 42

15.3 SURGICAL/INTERVENTIONAL

15.3.1 BY TYPE

15.3.1.1 CARDIOVASCULAR

15.3.1.2 ONCOLOGY

15.3.1.3 NEUROLOGY

15.3.1.4 OPHTHALMOLOGY

15.3.1.5 OTHERS

15.3.2 BY PANEL SIZE

15.3.2.1 LESS THAN 22.9

15.3.2.2 23.0- 32.0

15.3.2.3 32.1-42.0

15.3.2.4 MORE THAN 42

15.4 PATIENT WORN MONITORING

15.5 CONSULTATION

15.6 TELEHEALTH

15.6.1 BY PANEL SIZE

15.6.1.1 LESS THAN 22.9

15.6.1.2 23.0- 32.0

15.6.1.3 32.1-42.0

15.6.1.4 MORE THAN 42

15.7 TEACHING/PRACTICE

15.7.1 BY PANEL SIZE

15.7.1.1 LESS THAN 22.9

15.7.1.2 23.0- 32.0

15.7.1.3 32.1-42.0

15.7.1.4 MORE THAN 42

15.8 DENTISTRY

15.8.1 BY PANEL SIZE

15.8.1.1 LESS THAN 22.9

15.8.1.2 23.0- 32.0

15.8.1.3 32.1-42.0

15.8.1.4 MORE THAN 42

15.9 POINT OF CARE

15.9.1 BY PANEL SIZE

15.9.1.1 LESS THAN 22.9

15.9.1.2 23.0- 32.0

15.9.1.3 32.1-42.0

15.9.1.4 MORE THAN 42

15.1 FETAL MONITORING

15.10.1 BY PANEL SIZE

15.10.1.1 LESS THAN 22.9

15.10.1.2 23.0- 32.0

15.10.1.3 32.1-42.0

15.10.1.4 MORE THAN 42

15.11 OTHERS

16 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY END USER

16.1 OVERVIEW

16.2 HOSPITALS

16.2.1 BY AREA

16.2.1.1 OPERATING ROOM

16.2.1.2 SURGERY UNIT

16.2.1.3 OTHERS

16.2.2 BY TECHNOLOGY

16.2.2.1 LED BACKLIT LCD DISPLAY

16.2.2.2 CCFL BACKLIT LCD DISPLAY

16.2.2.3 TFT BACKLIT LCD DISPLAY

16.2.2.4 OLED DISPLAY

16.2.3 CLINICS

16.2.3.1 LED BACKLIT LCD DISPLAY

16.2.3.2 CCFL BACKLIT LCD DISPLAY

16.2.3.3 TFT BACKLIT LCD DISPLAY

16.2.3.4 OLED DISPLAY

16.2.4 NURSING FACILITIES

16.2.4.1 LED BACKLIT LCD DISPLAY

16.2.4.2 CCFL BACKLIT LCD DISPLAY

16.2.4.3 TFT BACKLIT LCD DISPLAY

16.2.4.4 OLED DISPLAY

16.2.5 DIAGNOSTIC LABORATORIES

16.2.5.1 LED BACKLIT LCD DISPLAY

16.2.5.2 CCFL BACKLIT LCD DISPLAY

16.2.5.3 TFT BACKLIT LCD DISPLAY

16.2.5.4 OLED DISPLAY

16.3 IMAGING/ RADIOLOGY LABORATORY

16.3.1 LABORATORY

16.3.1.1 LED BACKLIT LCD DISPLAY

16.3.1.2 CCFL BACKLIT LCD DISPLAY

16.3.1.3 TFT BACKLIT LCD DISPLAY

16.3.1.4 OLED DISPLAY

16.3.2 REHABILITATION CENTERS

16.3.2.1 LED BACKLIT LCD DISPLAY

16.3.2.2 CCFL BACKLIT LCD DISPLAY

16.3.2.3 TFT BACKLIT LCD DISPLAY

16.3.2.4 OLED DISPLAY

16.4 OTHERS

17 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY IMAGING TECHNOLOGY

17.1 OVERVIEW

17.2 TOUCH SCREEN

17.3 SCRATCH RESISTANT FONT GLASS

17.4 FAILSAFE MODE

17.5 CLEANABLE OPTIONS

17.6 SOFTGLOW & SPOTVIEW

17.7 OTHERS

18 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY ASPECT RATIO

18.1 OVERVIEW

18.2 12/30/1899 4:09:00 PM

18.3 12/30/1899 9:09:00 PM

18.4 12/30/1899 4:03:00 AM

19 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY DISTRIBUTION CHANNEL

19.1 OVERVIEW

19.2 DIRECT TENDERS

19.3 RETAIL SALES

19.4 OTHERS

20 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY GEOGRAPHY

20.1 ASIA-PACIFIC

20.1.1 CHINA

20.1.2 JAPAN

20.1.3 SOUTH KOREA

20.1.4 INDIA

20.1.5 AUSTRALIA

20.1.6 SINGAPORE

20.1.7 THAILAND

20.1.8 MALAYSIA

20.1.9 INDONESIA

20.1.10 PHILIPPINES

20.1.11 REST OF ASIA-PACIFIC

21 ASIA PACIFIC MEDICAL DISPLAY MARKET: COMPANY LANDSCAPE

21.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

22 SWOT ANALYSIS

23 COMPANY PROFILE

23.1 ADVANTECH CO., LTD

23.1.1 COMPANY SNAPSHOT

23.1.2 REVENUE ANALYSIS

23.1.3 COMPANY SHARE ANALYSIS

23.1.4 PRODUCT PORTFOLIO

23.1.5 RECENT DEVELOPMENTS

23.2 HP DEVELOPMENT COMPANY, L.P

23.2.1 COMPANY SNAPSHOT

23.2.2 REVENUE ANALYSIS

23.2.3 COMPANY SHARE ANALYSIS

23.2.4 PRODUCT PORTFOLIO

23.2.5 RECENT DEVELOPMENT

23.3 DELL INC.

23.3.1 COMPANY SNAPSHOT

23.3.2 REVENUE ANALYSIS

23.3.3 COMPANY SHARE ANALYSIS

23.3.4 PRODUCT PORTFOLIO

23.3.5 RECENT DEVELOPMENTS

23.4 ALPINION MEDICAL SYSTEMS CO., LTD

23.4.1 COMPANY SNAPSHOT

23.4.2 COMPANY SHARE ANALYSIS

23.4.3 PRODUCT PORTFOLIO

23.4.4 RECENT DEVELOPMENTS

23.5 STERIS

23.5.1 COMPANY SNAPSHOT

23.5.2 REVENUE ANALYSIS

23.5.3 COMPANY SHARE ANALYSIS

23.5.4 PRODUCT PORTFOLIO

23.5.5 RECENT DEVELOPMENT

23.6 AMPRONIX

23.6.1 COMPANY SNAPSHOT

23.6.2 PRODUCT PORTFOLIO

23.6.3 RECENT DEVELOPMENT

23.7 AXIOMTEK CO., LTD.

23.7.1 COMPANY SNAPSHOT

23.7.2 REVENUE ANALYSIS

23.7.3 PRODUCT PORTFOLIO

23.7.4 RECENT DEVELOPMENT

23.8 BARCO

23.8.1 COMPANY SNAPSHOT

23.8.2 REVENUE ANALYSIS

23.8.3 PRODUCT PORTFOLIO

23.8.4 RECENT DEVELOPMENTS

23.9 BENQ

23.9.1 COMPANY SNAPSHOT

23.9.2 PRODUCT PORTFOLIO

23.9.3 RECENT DEVELOPMENTS

23.1 COJE CO., LTD.

23.10.1 COMPANY SNAPSHOT

23.10.2 PRODUCT PORTFOLIO

23.10.3 RECENT DEVELOPMENTS

23.11 EIZO INC (2021)

23.11.1 COMPANY SNAPSHOT

23.11.2 REVENUE ANALYSIS

23.11.3 PRODUCT PORTFOLIO

23.11.4 RECENT DEVELOPMENT

23.12 FSN MEDICAL TECHNOLOGIES.

23.12.1 COMPANY SNAPSHOT

23.12.2 PRODUCT PORTFOLIO

23.12.3 RECENT DEVELOPMENT

23.13 HISENSE MEDICAL EQUIPMENT CO, LTD (A SUBSIDIARY OF HISENSE GROUP)

23.13.1 COMPANY SNAPSHOT

23.13.2 REVENUE ANALYSIS

23.13.3 PRODUCT PORTFOLIO

23.13.4 RECENT DEVELOPMENT

23.14 KONINKLIJKE PHILIPS N.V.( 2021)

23.14.1 COMPANY SNAPSHOT

23.14.2 REVENUE ANALYSIS

23.14.3 PRODUCT PORTFOLIO

23.14.4 RECENT DEVELOPMENT

23.15 LG DISPLAY CO., LTD.

23.15.1 COMPANY SNAPSHOT

23.15.2 REVENUE ANALYSIS

23.15.3 PRODUCT PORTFOLIO

23.15.4 RECENT DEVELOPMENT

23.16 NANJING JUSHA COMMERCIAL &TRADING CO,LTD

23.16.1 COMPANY SNAPSHOT

23.16.2 PRODUCT PORTFOLIO

23.16.3 RECENT DEVELOPMENTS

23.17 NOVANTA INC. (2021)

23.17.1 COMPANY SNAPSHOT

23.17.2 REVENUE ANALYSIS

23.17.3 PRODUCT PORTFOLIO

23.17.4 RECENT DEVELOPMENTS

23.18 ONYX HEALTHCARE INC. (SUBSIDIARY OF AAEON TECHNOLOGY INC.)

23.18.1 COMPANY SNAPSHOT

23.18.2 REVENUE ANALYSIS

23.18.3 PRODUCT PORTFOLIO

23.18.4 RECENT DEVELOPMENTS

23.19 PANASONIC HOLDINGS CORPORATION

23.19.1 COMPANY SNAPSHOT

23.19.2 REVENUE ANALYSIS

23.19.3 RECENT DEVELOPMENT

23.2 QUEST MEDICAL, INC. (A SUBSIDIARY OF ATRION CORPORATION)

23.20.1 COMPANY SNAPSHOT

23.20.2 REVENUE ANALYSIS

23.20.3 PRODUCT PORTFOLIO

23.20.4 RECENT DEVELOPMENTS

23.21 REIN MEDICAL GMBH

23.21.1 COMPANY SNAPSHOT

23.21.2 PRODUCT PORTFOLIO

23.21.3 RECENT DEVELOPMENTS

23.22 SHARP NEC DISPLAY SOLUTIONS ( 2021)

23.22.1 COMPANY SNAPSHOT

23.22.2 PRODUCT PORTFOLIO

23.22.3 RECENT DEVELOPMENTS

23.23 SHENZHEN BEACON DISPLAY TECHNOLOGY CO., LTD.

23.23.1 COMPANY SNAPSHOT

23.23.2 PRODUCT PORTFOLIO

23.23.3 RECENT DEVELOPMENT

23.24 SHENZHEN JLD DISPLAY EXPERT CO., LTD

23.24.1 COMPANY SNAPSHOT

23.24.2 PRODUCT PORTFOLIO

23.24.3 RECENT DEVELOPMENTS

23.25 SIEMENS HEALTHCARE GMBH

23.25.1 COMPANY SNAPSHOT

23.25.2 REVENUE ANALYSIS

23.25.3 PRODUCT PORTFOLIO

23.25.4 RECENT DEVELOPMENT

23.26 SONY GROUP CORPORATION

23.26.1 COMPANY SNAPSHOT

23.26.2 REVENUE ANALYSIS

23.26.3 PRODUCT PORTFOLIO

23.26.4 RECENT DEVELOPMENT

23.27 TEGUAR COMPUTERS

23.27.1 COMPANY SNAPSHOT

23.27.2 PRODUCT PORTFOLIO

23.27.3 RECENT DEVELOPMENTS

24 QUESTIONNAIRE

25 RELATED REPORTS

表格列表

TABLE 1 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC LED BACKLIT LCD DISPLAY MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC CCFL BACKLIT LCD DISPLAY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC TFT BACKLIT LCD DISPLAY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC OLED DISPLAY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC OLED DISPLAY TYPE IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC LESS THAN 22.9 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC LESS THAN 22.9 IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC 23.0- 32.0 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC 23.0- 32.0 IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC 32.1-42.0 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC 32.1-40.0 IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC MORE THAN 42 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC MORE THAN 42 IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY VIEWING MODE, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC 2D IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC 3D IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY MEGAPIXEL, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC 2.1-4MP IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC 4.1-8MP IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC ABOVE 8MP IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC UPTO 2MP IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY RESOLUTION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC 4K IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC ULTRA FULL HD IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC FULL HD IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC WALL MOUNTED IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC PORTABLE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC MODULAR IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY DISPLAY COLOR, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC COLOR IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC COLOR IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC MONOCHROME IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC MONOCHROME IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC HARDWARE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC HARDWARE IN MEDICAL DISPLAY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC SERVICES IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC SERVICES IN MEDICAL DISPLAY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 43 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC DIAGNOSTICS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 ASIA PACIFIC DIAGNOSTICS IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC BY TYPE IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 ASIA PACIFIC BY PANEL SIZE IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 ASIA PACIFIC SURGICAL/INTERVENTIONAL IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 ASIA PACIFIC SURGICAL/INTERVENTIONAL IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 ASIA PACIFIC BY TYPE IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 ASIA PACIFIC BY PANEL SIZE IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 ASIA PACIFIC PATIENT WORN MONITORING IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 ASIA PACIFIC CONSULTATION IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 ASIA PACIFIC TELEHEALTH IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 ASIA PACIFIC TELEHEALTH IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 56 ASIA PACIFIC TEACHING/PRACTICE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 ASIA PACIFIC TEACHING/PRACTICE IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 58 ASIA PACIFIC DENTISTRY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 ASIA PACIFIC DENTISTRY IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 60 ASIA PACIFIC POINT OF CARE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 61 ASIA PACIFIC POINT OF CARE IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 62 ASIA PACIFIC FETAL MONITORING IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 63 ASIA PACIFIC FETAL MONITORING IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 64 ASIA PACIFIC OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 65 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 ASIA PACIFIC HOSPITALS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 ASIA PACIFIC HOSPITALS IN MEDICAL DISPLAY MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 68 ASIA PACIFIC BY AREA IN MEDICAL DISPLAY MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 69 ASIA PACIFIC BY TECHNOLOGY IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 70 ASIA PACIFIC CLINICS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 71 ASIA PACIFIC CLINICS IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 72 ASIA PACIFIC NURSING FACILITIES IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 73 ASIA PACIFIC NURSING FACILITIES IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 74 ASIA PACIFIC DIAGNOSTIC LABORATORIES IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 75 ASIA PACIFIC DIAGNOSTIC LABORATORIES IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 76 ASIA PACIFIC IMAGING/ RADIOLOGY LABORATORY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 77 ASIA PACIFIC LABORATORY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 78 ASIA PACIFIC LABORATORY IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 79 ASIA PACIFIC REHABILITATION CENTERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 80 ASIA PACIFIC REHABILITATION CENTERS IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 81 ASIA PACIFIC OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 82 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY IMAGING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 83 ASIA PACIFIC TOUCH SCREEN IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 84 ASIA PACIFIC SCRATCH RESISTANT FONT GLASS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 85 ASIA PACIFIC FAILSAFE MODE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 86 ASIA PACIFIC CLEANABLE OPTIONS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 87 ASIA PACIFIC SOFTGLOW & SPOTVIEW IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 88 ASIA PACIFIC OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 89 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY ASPECT RATIO, 2020-2029 (USD MILLION)

TABLE 90 ASIA PACIFIC 16:09 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 91 ASIA PACIFIC 21:09 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 92 ASIA PACIFIC 4:03 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 93 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 ASIA PACIFIC DIRECT TENDERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 95 ASIA PACIFIC RETAIL SALES IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 96 ASIA PACIFIC OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 ASIA PACIFIC MEDICAL DISPLAYMARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC MEDICAL DISPLAYMARKET : DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC MEDICAL DISPLAYMARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC MEDICAL DISPLAYMARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC MEDICAL DISPLAYMARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC MEDICAL DISPLAYMARKET: MULTIVARIATE MODELLING

FIGURE 7 ASIA PACIFIC MEDICAL DISPLAYMARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA PACIFIC MEDICAL DISPLAYMARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC MEDICAL DISPLAYMARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA PACIFIC MEDICAL DISPLAYMARKET: VENDOR SHARE ANALYSIS

FIGURE 11 ASIA PACIFIC MEDICAL DISPLAY MARKET: SEGMENTATION

FIGURE 12 RISE IN GENERIC DRUG PRODUCTION AND TECHNOLOGICAL FOCUS IN MEDICAL DISPLAYIS DRIVING THE ASIA PACIFIC MEDICAL DISPLAYMARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 TECHNOLOGYSEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC MEDICAL DISPLAYMARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC MEDICAL DISPLAY MARKET

FIGURE 15 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY TECHNOLOGY, 2021

FIGURE 16 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 17 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 18 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY TECHNOLOGY, LIFELINE CURVE

FIGURE 19 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY PANEL SIZE, 2021

FIGURE 20 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY PANEL SIZE, 2022-2029 (USD MILLION)

FIGURE 21 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY PANEL SIZE, CAGR (2022-2029)

FIGURE 22 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY PANEL SIZE, LIFELINE CURVE

FIGURE 23 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY VIEWING MODE, 2021

FIGURE 24 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY VIEWING MODE, 2022-2029 (USD MILLION)

FIGURE 25 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY VIEWING MODE, CAGR (2022-2029)

FIGURE 26 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY VIEWING MODE, LIFELINE CURVE

FIGURE 27 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY MEGAPIXEL, 2021

FIGURE 28 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY MEGAPIXEL, 2022-2029 (USD MILLION)

FIGURE 29 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY MEGAPIXEL, CAGR (2022-2029)

FIGURE 30 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY MEGAPIXEL, LIFELINE CURVE

FIGURE 31 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY RESOLUTION, 2021

FIGURE 32 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY RESOLUTION, 2022-2029 (USD MILLION)

FIGURE 33 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY RESOLUTION, CAGR (2022-2029)

FIGURE 34 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY RESOLUTION, LIFELINE CURVE

FIGURE 35 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY DISPLAY TYPE, 2021

FIGURE 36 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY DISPLAY TYPE, 2022-2029 (USD MILLION)

FIGURE 37 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY DISPLAY TYPE, CAGR (2022-2029)

FIGURE 38 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY DISPLAY TYPE, LIFELINE CURVE

FIGURE 39 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY DISPLAY COLOR, 2021

FIGURE 40 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY DISPLAY COLOR, 2022-2029 (USD MILLION)

FIGURE 41 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY DISPLAY COLOR, CAGR (2022-2029)

FIGURE 42 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY DISPLAY COLOR, LIFELINE CURVE

FIGURE 43 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY COMPONENT, 2021

FIGURE 44 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY COMPONENT, 2022-2029 (USD MILLION)

FIGURE 45 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY COMPONENT, CAGR (2022-2029)

FIGURE 46 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY COMPONENT, LIFELINE CURVE

FIGURE 47 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY APPLICATION, 2021

FIGURE 48 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 49 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 50 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 51 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY END USER, 2021

FIGURE 52 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 53 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY END USER, CAGR (2022-2029)

FIGURE 54 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY END USER, LIFELINE CURVE

FIGURE 55 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY IMAGING TECHNOLOGY, 2021

FIGURE 56 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY IMAGING TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 57 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY IMAGING TECHNOLOGY, CAGR (2022-2029)

FIGURE 58 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY IMAGING TECHNOLOGY, LIFELINE CURVE

FIGURE 59 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY ASPECT RATIO, 2021

FIGURE 60 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY ASPECT RATIO, 2022-2029 (USD MILLION)

FIGURE 61 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY ASPECT RATIO, CAGR (2022-2029)

FIGURE 62 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY ASPECT RATIO, LIFELINE CURVE

FIGURE 63 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 64 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 65 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 66 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 67 ASIA-PACIFIC MEDICAL DISPLAY MARKET: SNAPSHOT (2021)

FIGURE 68 ASIA-PACIFIC MEDICAL DISPLAY MARKET: BY COUNTRY (2021)

FIGURE 69 ASIA-PACIFIC MEDICAL DISPLAY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 70 ASIA-PACIFIC MEDICAL DISPLAY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 71 ASIA-PACIFIC MEDICAL DISPLAY MARKET: BY TECHNOLOGY (2022-2029)

FIGURE 72 ASIA PACIFIC MEDICAL DISPLAY MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。