Asia Pacific Medical Device Testing Market

市场规模(十亿美元)

CAGR :

%

USD

527.22 Million

USD

1,237.03 Million

2021

2029

USD

527.22 Million

USD

1,237.03 Million

2021

2029

| 2022 –2029 | |

| USD 527.22 Million | |

| USD 1,237.03 Million | |

|

|

|

亚太医疗器械测试市场,按服务类型(测试服务、检验服务和认证服务)、测试类型(物理测试、化学/生物测试、网络安全测试、微生物学和无菌测试等)、阶段(临床前和临床)、采购类型(内部和外包)、设备类别(I 类、II 类和 III 类)、产品(有源植入医疗器械、有源医疗器械、无源医疗器械、体外诊断医疗器械、眼科医疗器械、骨科和牙科医疗器械、血管医疗器械等)划分,行业趋势和预测至 2029 年

亚太医疗器械测试市场分析与洞察

医疗器械测试是证明设备在使用过程中可靠且安全的过程。在新产品开发中,会应用广泛的设计验证测试。这包括性能测试、毒性、化学分析,有时还包括人为因素或临床测试。持续的质量保证测试通常更为有限。这通常包括尺寸检查、一些功能测试和包装验证。市场上有各种类型的医疗测试服务,例如检验服务、认证服务等。

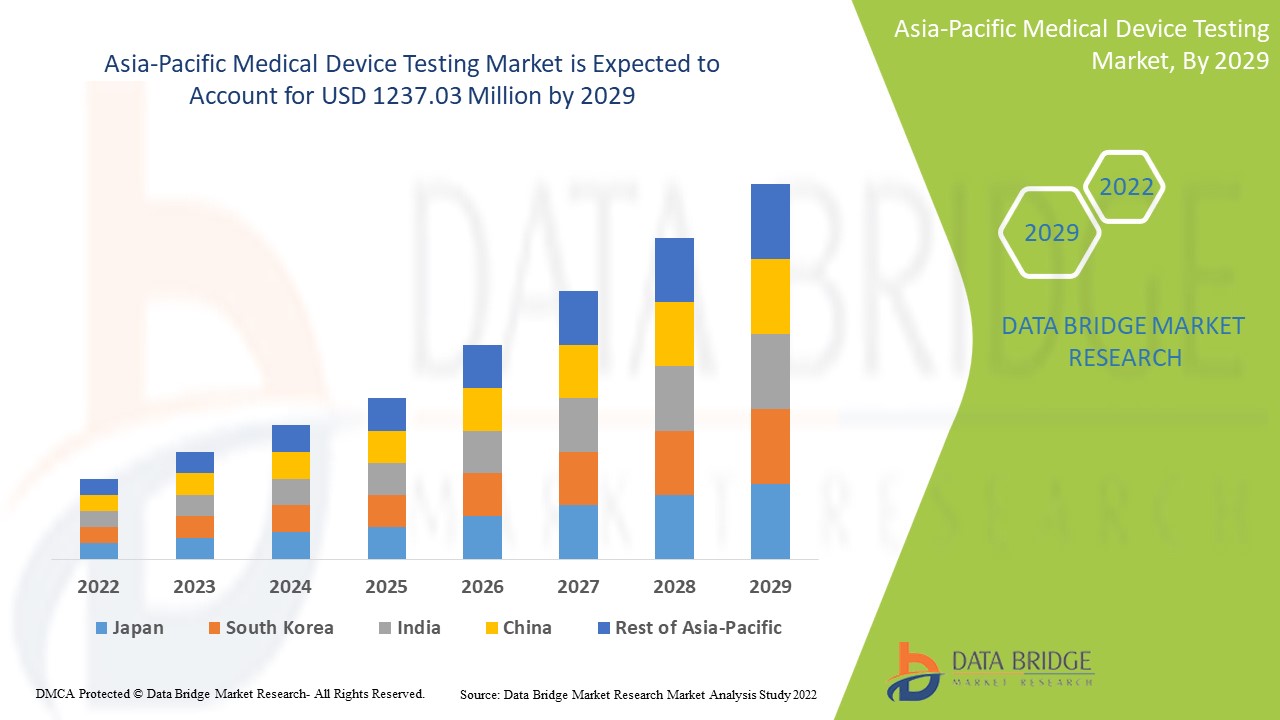

亚太医疗器械测试市场预计将在 2022 年至 2029 年的预测期内增长。Data Bridge Market Research 分析称,在 2022 年至 2029 年的预测期内,该市场以 11.7% 的复合年增长率增长,预计将从 2021 年的 5.2722 亿美元达到 2029 年的 12.3703 亿美元。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020 (可定制为 2019-2014) |

|

定量单位 |

收入(百万美元),定价(美元) |

|

涵盖的领域 |

按服务类型(测试服务、检验服务和认证服务)、测试类型(物理测试、化学/生物测试、网络安全测试、微生物学和无菌测试等)、阶段(临床前和临床)、采购类型(内部和外包)、设备类别(I 类、II 类和 III 类)、产品(有源植入医疗器械、有源医疗器械、无源医疗器械、体外诊断医疗器械、眼科医疗器械、骨科和牙科医疗器械、血管医疗器械等) |

|

覆盖国家 |

中国、日本、印度、韩国、澳大利亚、新加坡、泰国、马来西亚、印度尼西亚、菲律宾、亚太地区其他地区 |

|

涵盖的市场参与者 |

Intertek Group plc、SGS SA、Bureau Veritas、TUV SUD、TUV Rheinland、Biomedical Device Labs、UL LLC、North American Science Associates, LLC、WuXi AppTec、NSF、Eurofins Scientific、Nelson Laboratories, LLC- A Sotera Health company、Element Materials Technology、Medical Engineering Technologies Ltd.、Bioneeds、Cigniti、Arbro Pharmaceuticals Private Limited & Auriga Research Private Limited、IMR Test Labs 等 |

市场定义

医疗器械测试是证明设备在使用中可靠且安全的过程。在新产品开发中,会应用广泛的设计验证测试。这包括性能测试、毒性和化学分析,有时还包括人为因素甚至临床测试。持续的质量保证测试通常更为有限。这通常包括尺寸检查、一些功能测试和包装验证。市场上有各种类型的医疗测试服务,例如检验服务、认证服务等。

医疗器械测试市场动态

驱动程序

- 医疗器械验证和确认需求上升

验证和确认方法在医疗保健行业中广泛使用。一般来说,验证是产品是否符合指定要求的开发阶段,而确认则检查产品是否符合预期用途,从而满足可用性要求。医疗器械最常见的验证和确认类型是设计、流程和软件验证和确认。医疗器械也变得越来越小,设计越来越复杂,有时使用先进的工程塑料。这使得确认和确认 (V&V) 变得更加重要。结果是更好的可重复性、更少的错误、更少的返工和重新设计、更快的上市时间、更高的竞争力和更低的生产成本。

- 体外测试需求增加

体外诊断 (IVD) 是对从人体采集的血液或组织等样本进行的测试。体外诊断可以检测疾病或其他状况,并可用于监测一个人的整体健康状况,以帮助治愈、治疗或预防疾病。体外测试用于各种疾病检测,例如艾滋病毒感染、疟疾、肝炎等。此类疾病的流行率在全球范围内迅速上升,导致对体外测试和各种医疗设备的需求不断增加。

机会

-

医疗支出上涨

随着各国人民的可支配收入不断增加,全球医疗保健支出也随之增加。此外,为了满足人口需求,政府机构和医疗保健组织正在采取主动行动,加快医疗保健支出。医疗保健支出的增加同时帮助医疗保健机构近年来改善其医疗器械测试服务

此外,主要市场参与者采取的战略举措将为 2022-2029 年预测期内的医疗器械测试市场提供结构完整性和未来机遇。

克制/挑战

- 医疗器械本土发展的障碍

然而,医疗器械本地化发展的障碍和某些地区医疗器械的高成本可能会阻碍医疗器械的生产,从而阻碍市场的增长。此外,医疗技术行业的激烈竞争和海外认证的漫长准备时间可能是市场发展的挑战因素

本医疗器械测试市场报告详细介绍了最新发展、贸易法规、进出口分析、生产分析、价值链优化、市场份额、国内和本地市场参与者的影响,分析了新兴收入来源、市场法规变化、战略市场增长分析、市场规模、类别市场增长、应用领域和主导地位、产品批准、产品发布、地域扩展、市场技术创新等方面的机会。如需了解有关共济失调市场的更多信息,请联系 Data Bridge Market Research 获取分析师简报,我们的团队将帮助您做出明智的市场决策,实现市场增长。

COVID-19 对医疗器械测试市场的影响

COVID-19 对市场产生了积极影响。这些年来,MRI 扫描仪、呼吸机等医疗设备的使用有所增加。因此,各种设备的使用在世界范围内广泛增长。因此,疫情对这个测试市场产生了积极影响

近期发展

- 2021 年 4 月,TÜV SÜD 宣布已在 Medtec LIVE 上亮相,展示其作为医疗器械测试一站式服务商的能力。服务涵盖电气和功能安全、网络安全和软件、EMC 和生物相容性测试。TÜV SÜD 的专家参加了在线贸易展和会议计划,进行了各种演讲、现场直播和电梯演讲。

亚太医疗器械测试市场范围

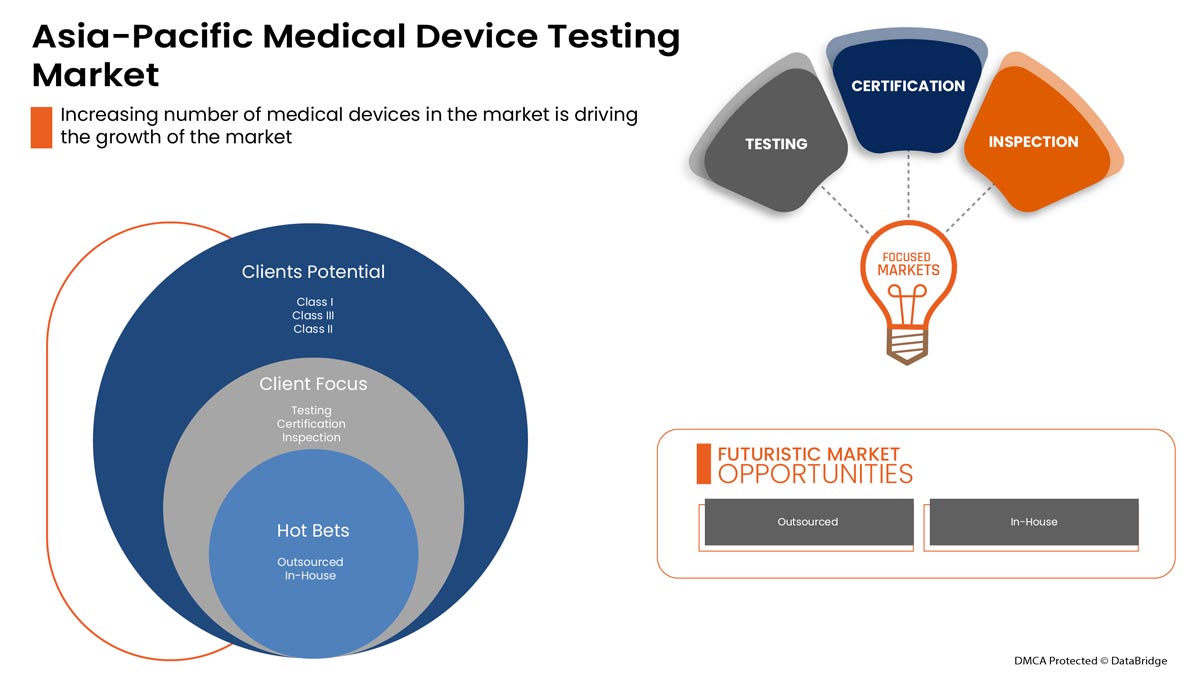

亚太医疗器械测试市场分为服务类型、测试类型、阶段、采购类型、设备类别和产品。这些细分市场之间的增长将帮助您分析行业中增长微弱的细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策,确定核心市场应用。

服务类型

- 测试服务

- 检验服务

- 认证服务

根据服务类型,亚太医疗器械测试市场分为测试服务、检验服务和认证服务。

测试类型

- 物理测试

- 化学/生物测试

- 网络安全测试

- 微生物学和无菌测试

- 其他的

根据测试类型,亚太医疗器械测试市场分为物理测试、化学/生物测试、网络安全测试、微生物学和无菌测试等。

阶段

- 临床前

- 临床

根据阶段,亚太医疗器械测试市场分为临床前和临床。

采购类型

- 外包

- 内部

根据采购类型,亚太医疗器械测试市场分为内部采购和外包采购。

设备类别

- 一级

- II 类

- III 级

根据设备类别,亚太医疗器械测试市场分为 I 类、II 类和 III 类。

产品

- 有源植入医疗器械

- 有源医疗器械

- 无源医疗器械

- 体外诊断医疗器械

- 眼科医疗器械

- 骨科及牙科医疗设备

- 血管医疗器械

- 其他的

根据产品,亚太医疗器械测试市场细分为有源植入医疗器械、有源医疗器械、无源医疗器械、体外诊断医疗器械、眼科医疗器械、骨科及牙科医疗器械、血管医疗器械等。

医疗器械测试市场区域分析/见解

对医疗器械测试市场进行了分析,并按国家、服务类型、测试类型、阶段、采购类型、设备类别和产品提供了市场规模见解和趋势。

该地区涵盖的国家包括中国、印度、日本、澳大利亚、韩国、新加坡、印度尼西亚、泰国、马来西亚、菲律宾和亚太其他地区。

中国在市场份额和市场收入方面占据医疗器械检测市场的主导地位,并将在预测期内继续保持主导地位。这是由于该国医疗器械创新和技术的不断升级。

报告的国家部分还提供了影响单个市场因素和市场法规变化的信息,这些因素和变化会影响市场的当前和未来趋势。新旧销售、国家人口统计、疾病流行病学和进出口关税等数据点是预测单个国家市场情况的一些主要指标。此外,在对国家数据进行预测分析时,还考虑了全球品牌的存在和可用性以及它们因本土和国内品牌的激烈竞争而面临的挑战以及销售渠道的影响。

竞争格局和医疗器械测试市场份额分析

医疗器械测试市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、全球影响力、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度以及应用主导地位。以上数据点仅与公司对医疗器械测试的关注有关。

医疗器械测试市场的一些主要参与者包括 Intertek Group plc、SGS SA、Bureau Veritas、TUV SUD、TUV Rheinland、Biomedical Device Labs、UL LLC、North American Science Associates, LLC、WuXi AppTec、NSF、Eurofins Scientific、Nelson Laboratories, LLC- A Sotera Health company、Element Materials Technology、Medical Engineering Technologies Ltd.、Bioneeds、Cigniti、Arbro Pharmaceuticals Private Limited & Auriga Research Private Limited、IMR Test Labs 等。

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析以及主要(行业专家)验证。除此之外,数据模型还包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、公司市场份额分析、测量标准、亚太地区与地区和供应商份额分析。如有进一步询问,请要求分析师致电。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC MEDICAL DEVICE TESTING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 SERVICE TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET TESTING TYPE COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES

5 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING NEED FOR VERIFICATION VALIDATION OF MEDICAL DEVICES

6.1.2 INCREASING DEMAND FOR IN-VITRO TESTS

6.1.3 ESCALATION IN INNOVATION AND TECHNOLOGIES

6.2 RESTRAINTS

6.2.1 BARRIERS TO THE LOCAL DEVELOPMENT OF MEDICAL DEVICES

6.2.2 HIGH COST OF MEDICAL DEVICES

6.3 OPPORTUNITIES

6.3.1 RISE IN HEALTHCARE EXPENDITURE

6.3.2 DEVELOPMENT IN AI AND IOT IN VARIOUS MEDICAL DEVICES

6.3.3 STRATEGIC INITIATIVES OF KEY PLAYERS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION IN MEDICAL TECHNOLOGY INDUSTRY

6.4.2 LONG LEAD TIME FOR OVERSEAS QUALIFICATION

7 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE

7.1 OVERVIEW

7.2 TESTING SERVICES

7.3 INSPECTION SERVICES

7.4 CERTIFICATION SERVICES

8 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE

8.1 OVERVIEW

8.2 CHEMICAL/BIOLOGICAL TESTING

8.3 MICROBIOLOGY AND STERILITY TESTING

8.3.1 STERILITY TEST & VALIDATION

8.3.2 BIO BURDEN DETERMINATION

8.3.3 ANTIMICROBIAL ACTIVITY TESTING

8.3.4 PYROGEN & ENDOTOXIN TESTING

8.3.5 OTHERS

8.4 PHYSICAL TESTING

8.4.1 ELECTRICAL SAFETY TESTING

8.4.2 FUNCTIONAL SAFETY TESTING

8.4.3 EMC TESTING

8.4.4 ENVIRONMENTAL TESTING

8.4.5 OTHERS

8.5 CYBERSECURITY TESTING

8.6 OTHERS

9 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET, BY PHASE

9.1 OVERVIEW

9.2 PRECLINICAL

9.3 CLINICAL

10 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE

10.1 OVERVIEW

10.2 OUTSOURCED

10.3 IN-HOUSE

11 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS

11.1 OVERVIEW

11.2 CLASS I

11.3 CLASS III

11.4 CLASS II

12 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET, BY PRODUCT

12.1 OVERVIEW

12.2 NON-ACTIVE MEDICAL DEVICE

12.3 ORTHOPEDIC AND DENTAL MEDICAL DEVICE

12.4 ACTIVE IMPLANT MEDICAL DEVICE

12.5 VASCULAR MEDICAL DEVICE

12.6 ACTIVE MEDICAL DEVICE

12.7 IN-VITRO DIAGNOSTICS MEDICAL DEVICE

12.8 OPTHALMIC MEDICAL DEVICE

12.9 OTHERS

13 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET, BY GEOGRAPHY

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 JAPAN

13.1.3 INDIA

13.1.4 SOUTH KOREA

13.1.5 AUSTRALIA

13.1.6 INDONESIA

13.1.7 THAILAND

13.1.8 PHILIPPINES

13.1.9 MALAYSIA

13.1.10 SINGAPORE

13.1.11 REST OF ASIA-PACIFIC

14 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 LABCORP

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 CHARLES RIVER LABORATORIES.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 TUV SUD

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 WUXI APPTEC

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 SGS SA

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 NORTH AMERICAN SCIENCE ASSOCIATES, LLC

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 HOHENSTEIN

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 ARBRO PHARMACEUTICALS PRIVATE LIMITED & AURIGA RESEARCH PRIVATE LIMITED

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 BIOMEDICAL DEVICE LABS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 BIONEEDS

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 BUREAU VERITAS

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 CIGNITI

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 ELEMENT MATERIALS TECHNOLOGY

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 ENDOLAB MECHANICAL ENGINEERING GMBH

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 EUROFINS SCIENTIFIC

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 GATEWAY ANALYTICAL.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 IMR TEST LABS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 INTERTEK GROUP PLC

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 ITC ZLIN

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 MEDICAL ENGINEERING TECHNOLOGIES LTD.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 MEDISTRI SA

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 NELSON LABORATORIES, LLC- A SOTERA HEALTH COMPANY

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENTS

16.23 NSF.

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 PACE

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 Q LABORATORIES

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 TUV RHEINLAND

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT DEVELOPMENTS

16.27 UL LLC

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

表格列表

TABLE 1 FDA REGULATIONS BASED ON DEVICES TYPE

TABLE 2 PRICES OF ESSENTIAL MEDICAL DEVICES

TABLE 3 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC TESTING SERVICES IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC INSPECTION SERVICES IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC CERTIFICATION SERVICES IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC CHEMICAL/BIOLOGICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC CYBERSECURITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC OTHERS IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC PRECLINICAL IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC CLINICAL IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC OUTSOURCED IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC IN-HOUSE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC CLASS I IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC CLASS III IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC CLASS II IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC NON-ACTIVE MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC ORTHOPEDIC AND DENTAL MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC ACTIVE IMPLANT MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC VASCULAR MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC ACTIVE MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC IN-VITRO MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC OPTHALMIC MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC OTHERS IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC MEDICAL DEVICE TESTING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 37 ASIA-PACIFIC MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 43 CHINA MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 44 CHINA MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 45 CHINA MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 46 CHINA PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 47 CHINA MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 48 CHINA MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 49 CHINA MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 50 CHINA MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 51 JAPAN MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 52 JAPAN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 53 JAPAN MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 54 JAPAN PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 55 JAPAN MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 56 JAPAN MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 57 JAPAN MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 58 JAPAN MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 59 INDIA MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 60 INDIA MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 61 INDIA MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 62 INDIA PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 63 INDIA MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 64 INDIA MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 65 INDIA MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 66 INDIA MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 67 SOUTH KOREA MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 68 SOUTH KOREA MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 69 SOUTH KOREA MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 70 SOUTH KOREA PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 71 SOUTH KOREA MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 72 SOUTH KOREA MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 73 SOUTH KOREA MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 74 SOUTH KOREA MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 75 AUSTRALIA MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 76 AUSTRALIA MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 77 AUSTRALIA MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 78 AUSTRALIA PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 79 AUSTRALIA MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 80 AUSTRALIA MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 81 AUSTRALIA MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 82 AUSTRALIA MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 83 INDONESIA MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 84 INDONESIA MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 85 INDONESIA MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 86 INDONESIA PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 87 INDONESIA MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 88 INDONESIA MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 89 INDONESIA MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 90 INDONESIA MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 91 THAILAND MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 92 THAILAND MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 93 THAILAND MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 94 THAILAND PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 95 THAILAND MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 96 THAILAND MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 97 THAILAND MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 98 THAILAND MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 99 PHILIPPINES MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 100 PHILIPPINES MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 101 PHILIPPINES MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 102 PHILIPPINES PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 103 PHILIPPINES MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 104 PHILIPPINES MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 105 PHILIPPINES MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 106 PHILIPPINES MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 107 MALAYSIA MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 108 MALAYSIA MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 109 MALAYSIA MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 110 MALAYSIA PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 111 MALAYSIA MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 112 MALAYSIA MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 113 MALAYSIA MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 114 MALAYSIA MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 115 SINGAPORE MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 116 SINGAPORE MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 117 SINGAPORE MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 118 SINGAPORE PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 119 SINGAPORE MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 120 SINGAPORE MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 121 SINGAPORE MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 122 SINGAPORE MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 123 REST OF ASIA-PACIFIC MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: MARKET TESTING TYPE COVERAGE GRID

FIGURE 9 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: SEGMENTATION

FIGURE 11 INCREASING DEMAND FOR IN-VITRO TESTS AND DEVELOPMENT IN AI AND IOT IN VARIOUS MEDICAL DEVICES ARE EXPECTED TO DRIVE THE ASIA PACIFIC MEDICAL DEVICE TESTING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 TESTING SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC MEDICAL DEVICE TESTING MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE ASIA PACIFIC MEDICAL DEVICE TESTINGMARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC MEDICAL DEVICE TESTING MARKET

FIGURE 15 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY SERVICE TYPE, 2021

FIGURE 16 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY SERVICE TYPE, 2022-2029 (USD MILLION)

FIGURE 17 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY SERVICE TYPE, CAGR (2022-2029)

FIGURE 18 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY SERVICE TYPE, LIFELINE CURVE

FIGURE 19 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY TESTING TYPE, 2021

FIGURE 20 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY TESTING TYPE, 2022-2029 (USD MILLION)

FIGURE 21 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY TESTING TYPE, CAGR (2022-2029)

FIGURE 22 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY TESTING TYPE, LIFELINE CURVE

FIGURE 23 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY PHASE, 2021

FIGURE 24 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY PHASE, 2022-2029 (USD MILLION)

FIGURE 25 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY PHASE, CAGR (2022-2029)

FIGURE 26 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY PHASE, LIFELINE CURVE

FIGURE 27 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY SOURCING TYPE, 2021

FIGURE 28 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY SOURCING TYPE, 2022-2029 (USD MILLION)

FIGURE 29 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY SOURCING TYPE, CAGR (2022-2029)

FIGURE 30 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY SOURCING TYPE, LIFELINE CURVE

FIGURE 31 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY DEVICE CLASS, 2021

FIGURE 32 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY DEVICE CLASS, 2022-2029 (USD MILLION)

FIGURE 33 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY DEVICE CLASS, CAGR (2022-2029)

FIGURE 34 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY DEVICE CLASS, LIFELINE CURVE

FIGURE 35 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY PRODUCT, 2021

FIGURE 36 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY PRODUCT, 2022-2029 (USD MILLION)

FIGURE 37 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 38 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 39 ASIA-PACIFIC MEDICAL DEVICE TESTING MARKET: SNAPSHOT (2021)

FIGURE 40 ASIA-PACIFIC MEDICAL DEVICE TESTING MARKET: BY COUNTRY (2021)

FIGURE 41 ASIA-PACIFIC MEDICAL DEVICE TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 42 ASIA-PACIFIC MEDICAL DEVICE TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 43 ASIA-PACIFIC MEDICAL DEVICE TESTING MARKET: BY SERVICE TYPE (2022-2029)

FIGURE 44 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。