亚太超级高铁技术市场,按组件(管道、舱体、推进系统等)、速度(700 英里以上和 700 英里以下)、容量(座位容量和客运容量)、路线(城际和城内)、应用(客运和货运)、国家(中国、印度、日本、韩国、澳大利亚、新加坡、印度尼西亚、泰国、马来西亚、菲律宾、亚太地区其他地区)划分的行业趋势和预测(截至 2029 年)

市场分析与洞察:亚太超级高铁技术市场

市场分析与洞察:亚太超级高铁技术市场

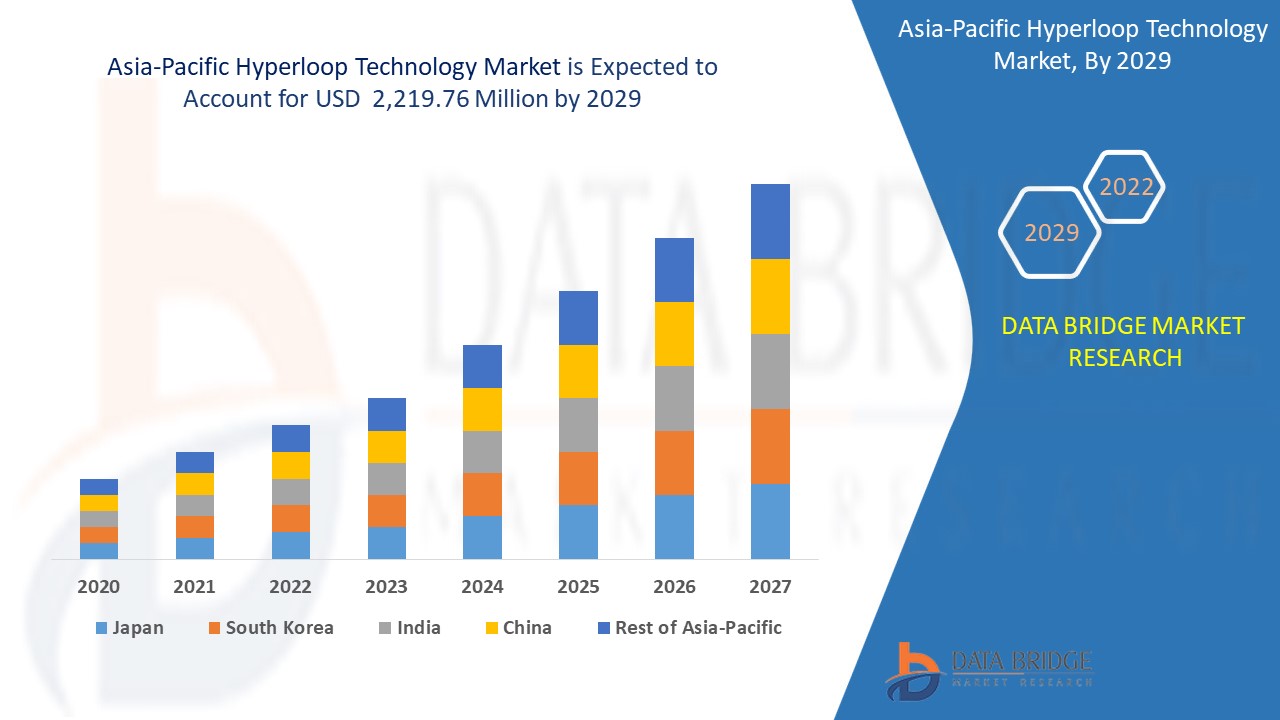

预计超级高铁技术市场将在 2022 年至 2029 年的预测期内实现市场增长。Data Bridge Market Research 分析称,在 2022 年至 2029 年的预测期内,市场复合年增长率为 34.8%,预计到 2029 年将达到 22.1976 亿美元。成本较低(需要最低限度的设施维护)是推动市场增长的一个因素。与铁路轨道不同,超级高铁轨道不需要持续供电,因为吊舱可以每 30 秒离开一次,因此持续电力成本会中断。因此,可以观察到超级高铁技术比任何其他运输系统都更便宜、更经济。

超级高铁是一种磁悬浮吊舱结构,也可以称为在真空管道中运行的列车,这意味着没有轨道摩擦,也没有空气阻力。超级高铁是市场参与者目前处于开发阶段的一种新型运输技术。超级高铁计划在地上或地下的浮动吊舱中以每小时超过 700 英里的速度行驶。超级高铁与传统铁路有两个显著的区别。首先,载客吊舱穿过管道或隧道。

超级高铁技术市场的增长主要得益于所需旅行时间的减少和运输成本的降低。超级高铁系统对地震和其他自然灾害具有一定的承受能力,这促进了超级高铁技术市场的增长,而超级高铁技术中乘客的安全问题则是超级高铁技术市场的主要制约因素。

这份超级高铁技术市场报告提供了市场份额、新发展和产品线分析、国内和本地市场参与者的影响的详细信息,分析了新兴收入领域、市场法规变化、产品审批、战略决策、产品发布、地域扩张和市场技术创新方面的机会。要了解分析和市场情况,请联系我们获取分析师简报,我们的团队将帮助您创建收入影响解决方案,以实现您的预期目标。

亚太超级高铁技术市场范围和市场规模

亚太超级高铁技术市场范围和市场规模

超级高铁技术市场根据组件、速度、容量、路线和应用进行细分。细分市场之间的增长有助于您分析利基增长领域和进入市场的策略,并确定您的核心应用领域和目标市场的差异。

- 根据组件,超级高铁技术市场已细分为管道、舱室、推进系统等。2021 年,管道占据了市场的最大份额,因为它们封闭了舱室移动的空间,有效地使超级高铁系统以更快的速度移动。

- 根据速度,超级高铁技术市场分为 700 英里以下和 700 英里以上。2021 年,700 英里以上的产品占据了更大的市场份额。这主要归因于市场参与者越来越关注实现超级高铁舱的最高速度,以减少旅行时间。

- 根据容量,超级高铁技术市场分为座位容量和车厢容量。由于对客运的偏好增加以及超级高铁项目数量的增加,座位容量在 2021 年占据了更大的市场份额。

- 根据路线,超级高铁技术市场分为城际和城内。2021 年,城际在超级高铁技术市场中占有最大份额。这主要是由于城际超级高铁项目数量的增加,例如孟买-浦那、维杰亚瓦达-阿马拉瓦蒂超级高铁等。

- 根据应用,超级高铁技术市场分为客运和货运。2021 年,客运占据了最大的市场份额。这主要归因于极度注重在较短的时间内将乘客从一个地方运送到另一个地方。

亚太超级高铁技术市场国家级分析

对亚太超级高铁技术市场进行了分析,并按国家、组件、速度、容量、路线和应用提供了市场规模信息。

亚太超级高铁技术市场报告涵盖的国家包括中国、印度、韩国、澳大利亚、日本、新加坡、马来西亚、泰国、印度尼西亚、菲律宾和亚太其他地区。

由于对高科技基础设施的投资激增、人口众多、注重改善交通方式以及强调控制污染水平,中国正在占据最大的市场份额,并有望主导市场。

报告的国家部分还提供了影响单个市场因素和国内市场法规变化,这些变化影响了市场的当前和未来趋势。新销售、替代销售、国家人口统计、监管法案和进出口分析等数据点是用于预测单个国家市场情景的一些主要指标。此外,在提供国家数据的预测分析时,还考虑了全球品牌的存在和可用性以及由于来自本地和国内品牌的激烈或稀缺竞争而面临的挑战、销售渠道的影响。

强调太阳能作为能源消耗的技术

超级高铁技术市场还为您提供了每个国家不同类型产品安装基数增长的详细市场分析、使用生命线曲线的技术影响以及监管情景的变化及其对超级高铁技术市场的影响。数据涵盖 2010 年至 2020 年的历史年份。

竞争格局和超级高铁技术市场份额分析

超级高铁技术市场竞争格局按竞争对手提供详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、全球影响力、生产基地和设施、公司优势和劣势、产品发布、临床试验渠道、品牌分析、产品批准、专利、产品宽度和广度、应用主导地位、技术生命线曲线。以上提供的数据点仅与公司对超级高铁技术市场的关注有关。

报告中涉及的主要参与者包括 Virgin Hyperloop、Hyperloop Transportation Technologies (HTT)、Hardt BV、Transpod、Zeleros、Aecom、Tesla Inc.、Waterloop、Badgerloop、SpaceX Exploration Technologies Corp.、Delft Hyperloop、NEXT Prototypes eV (TUM HYPERLOOP)、VicHyper、Dinclix GroundWorks Private Limited、Washinghton Hyperloop。DBMR 分析师了解竞争优势,并为每个竞争对手分别提供竞争分析。

全球各地的许多公司也推出了许多产品并签署了多项协议,这也加速了超级高铁技术市场的发展。

例如,

- 2018 年 7 月,超级高铁运输技术公司 (HTT) 与铜仁交通旅游投资集团签署了在中国铜仁开展超级高铁项目的协议。该项目的第一阶段包括在铜仁市修建 10 公里长的轨道。

合作、合资和其他战略通过扩大覆盖范围和影响力来提高公司的市场份额。通过扩大产品范围,它还有利于组织改善其在超级高铁技术市场上的供应。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMPONENTS TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 DECREASED TRAVEL TIME AND TRANSPORT COSTS

5.1.2 LESS EXPENSIVE (REQUIRING MINIMAL MAINTENANCE OF FACILITIES)

5.1.3 CREATION OF HYPERLOOP NETWORK REQUIRES LESS LAND AREA

5.1.4 TOLERANCE TO EARTHQUAKES AND OTHER NATURAL CALAMITIES

5.1.5 EMPHASIS ON SOLAR POWER FOR ENERGY CONSUMPTION IN THE TECHNOLOGY

5.2 RESTRAINTS

5.2.1 LACK OF AWARENESS REGARDING THE TECHNOLOGY

5.2.2 REGULATIONS NOT YET IMPLEMENTED FOR THE TECHNOLOGY BY GOVERNMENTS AND BUREAUCRATS

5.2.3 SAFETY AND SECURITY CONCERNS

5.3 OPPORTUNITIES

5.3.1 LESS EXPENSES IN TRANSPORTATION OR TRAVELLING

5.3.2 NEED FOR URBAN DECONGESTION

5.3.3 ENERGY-EFFICIENT TRANSPORTATION

5.4 CHALLENGES

5.4.1 SHORTAGES OF CAPITAL INVESTORS AND GOVERNMENT

5.4.2 POSSIBILITY OF EMERGENCY FOR PASSENGERS DUE TO POWER OUTAGE

5.4.3 CAPSULE DEPRESSURIZATION RISK

5.4.4 TECHNICALITY ISSUES OF NEW TRANSPORT SYSTEM

6 COVID-19 IMPACT ON HYPERLOOP TECHNOLOGY MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND AND SUPPLY CHAIN

6.6 CONCLUSION

7 ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET, BY COMPONENTS

7.1 OVERVIEW

7.2 TUBE

7.3 CAPSULE

7.4 PROPULSION SYSTEM

7.5 OTHERS

8 ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET, BY SPEED

8.1 OVERVIEW

8.2 MORE THAN 700 MILES

8.3 LESS THAN 700 MILES

9 ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET, BY CAPACITY

9.1 OVERVIEW

9.2 SEAT CAPACITY

9.2.1 LESS THAN 30 PERSONS

9.2.2 MORE THAN 30 PERSONS

9.3 CARRIAGE CAPACITY

10 ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET, BY ROUTE

10.1 OVERVIEW

10.2 INTERCITY

10.3 INTRACITY

11 ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 PASSENGER

11.3 CARGO/FREIGHT

12 ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET BY REGION

12.1 ASIA PACIFIC

12.1.1 CHINA

12.1.2 JAPAN

12.1.3 SOUTH KOREA

12.1.4 AUSTRALIA

12.1.5 INDIA

12.1.6 THAILAND

12.1.7 INDONESIA

12.1.8 REST OF ASIA PACIFIC

13 ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 VIRGIN HYPERLOOP

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 HYPERLOOP TRANSPORTATION TECHNOLOGIES

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PROJECT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 HARDT B.V.

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PROJECT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 TRANSPOD

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 AECOM

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PROJECT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 BADGERLOOP

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 DELFT HYPERLOOP

15.7.1 COMPANY SNAPSHOT

15.7.2 PROJECT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 DINCLIX GROUNDWORKS PRIVATE LIMITED

15.8.1 COMPANY SNAPSHOT

15.8.2 BRAND PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 NEXT PROTOTYPES E.V.

15.9.1 COMPANY SNAPSHOT

15.9.2 PROJECT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 SPACEX

15.10.1 COMPANY SNAPSHOT

15.10.2 PROJECT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 TESLA

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 VICHYPER

15.12.1 COMPANY SNAPSHOT

15.12.2 PROJECT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 WASHINGTON HYPERLOOP

15.13.1 COMPANY SNAPSHOT

15.13.2 PROJECT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 WATERLOOP

15.14.1 COMPANY SNAPSHOT

15.14.2 PROJECT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 ZELEROS

15.15.1 COMPANY SNAPSHOT

15.15.2 PROJECT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

LIST OF TABLES

TABLE 1 TRAVEL TIME SAVED USING HYPERLOOP TECHNOLOGY WHILE TRAVELLING FROM MAJOR CITIES ACROSS THE U.K. TO LONDON

TABLE 2 COMPARISON OF CAPITAL COSTS BY TRANSPORTATION MODE

TABLE 3 ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET, BY COMPONENTS, MARKET FORECAST 2022-2029 (USD MILLION)

TABLE 4 ASIA-PACIFIC TUBE IN HYPERLOOP TECHNOLOGY MARKET, BY REGION,2022-2029, (USD MILLION)

TABLE 5 ASIA-PACIFIC CAPSULE IN HYPERLOOP TECHNOLOGY MARKET, BY REGION,2022-2029, (USD MILLION)

TABLE 6 ASIA-PACIFIC PROPULSION SYSTEM IN HYPERLOOP TECHNOLOGY MARKET, BY REGION,2022-2029, (USD MILLION)

TABLE 7 ASIA-PACIFIC OTHERS IN HYPERLOOP TECHNOLOGY MARKET, BY REGION,2022-2029, (USD MILLION)

TABLE 8 ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET, BY SPEED, MARKET FORECAST 2022-2029 (USD MILLION)

TABLE 9 ASIA-PACIFIC MORE THAN 700 MILES IN HYPERLOOP TECHNOLOGY MARKET, BY REGION,2022-2029, (USD MILLION)

TABLE 10 ASIA-PACIFIC LESS THAN 700 MILES IN HYPERLOOP TECHNOLOGY MARKET, BY REGION,2022-2029, (USD MILLION)

TABLE 11 ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET, BY CAPACITY, MARKET FORECAST 2022-2029 (USD MILLION)

TABLE 12 ASIA-PACIFIC SEAT CAPACITY IN HYPERLOOP TECHNOLOGY MARKET, BY REGION,2022-2029, (USD MILLION)

TABLE 13 ASIA-PACIFIC CARRIAGE CAPACITY IN HYPERLOOP TECHNOLOGY MARKET, BY REGION,2022-2029, (USD MILLION)

TABLE 14 ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET, BY ROUTE, MARKET FORECAST 2022-2029 (USD MILLION)

TABLE 15 ASIA-PACIFIC INTERCITY IN HYPERLOOP TECHNOLOGY MARKET, BY REGION,2022-2029, (USD MILLION)

TABLE 16 ASIA-PACIFIC INTRACITY IN HYPERLOOP TECHNOLOGY MARKET, BY REGION,2022-2029, (USD MILLION)

TABLE 17 ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET, BY APPLICATION, MARKET FORECAST 2022-2029 (USD MILLION)

TABLE 18 ASIA-PACIFIC PASSENGER IN HYPERLOOP TECHNOLOGY MARKET, BY REGION,2022-2029, (USD MILLION)

TABLE 19 ASIA-PACIFIC CARGO/FREIGHT IN HYPERLOOP TECHNOLOGY MARKET, BY REGION,2022-2029, (USD MILLION)

TABLE 20 ASIA PACIFIC HYPERLOOP TECHNOLOGY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC HYPERLOOP TECHNOLOGY MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC HYPERLOOP TECHNOLOGY MARKET, BY SPEED, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC HYPERLOOP TECHNOLOGY MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC SEAT CAPACITY IN HYPERLOOP TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC HYPERLOOP TECHNOLOGY MARKET, BY ROUTE, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC HYPERLOOP TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 27 CHINA HYPERLOOP TECHNOLOGY MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 28 CHINA HYPERLOOP TECHNOLOGY MARKET, BY SPEED, 2020-2029 (USD MILLION)

TABLE 29 CHINA HYPERLOOP TECHNOLOGY MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 30 CHINA SEAT CAPACITY IN HYPERLOOP TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 CHINA HYPERLOOP TECHNOLOGY MARKET, BY ROUTE, 2020-2029 (USD MILLION)

TABLE 32 CHINA HYPERLOOP TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 33 JAPAN HYPERLOOP TECHNOLOGY MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 34 JAPAN HYPERLOOP TECHNOLOGY MARKET, BY SPEED, 2020-2029 (USD MILLION)

TABLE 35 JAPAN HYPERLOOP TECHNOLOGY MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 36 JAPAN SEAT CAPACITY IN HYPERLOOP TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 JAPAN HYPERLOOP TECHNOLOGY MARKET, BY ROUTE, 2020-2029 (USD MILLION)

TABLE 38 JAPAN HYPERLOOP TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 SOUTH KOREA HYPERLOOP TECHNOLOGY MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 40 SOUTH KOREA HYPERLOOP TECHNOLOGY MARKET, BY SPEED, 2020-2029 (USD MILLION)

TABLE 41 SOUTH KOREA HYPERLOOP TECHNOLOGY MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 42 SOUTH KOREA SEAT CAPACITY IN HYPERLOOP TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 SOUTH KOREA HYPERLOOP TECHNOLOGY MARKET, BY ROUTE, 2020-2029 (USD MILLION)

TABLE 44 SOUTH KOREA HYPERLOOP TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 AUSTRALIA HYPERLOOP TECHNOLOGY MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 46 AUSTRALIA HYPERLOOP TECHNOLOGY MARKET, BY SPEED, 2020-2029 (USD MILLION)

TABLE 47 AUSTRALIA HYPERLOOP TECHNOLOGY MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 48 AUSTRALIA SEAT CAPACITY IN HYPERLOOP TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 AUSTRALIA HYPERLOOP TECHNOLOGY MARKET, BY ROUTE, 2020-2029 (USD MILLION)

TABLE 50 AUSTRALIA HYPERLOOP TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 INDIA HYPERLOOP TECHNOLOGY MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 52 INDIA HYPERLOOP TECHNOLOGY MARKET, BY SPEED, 2020-2029 (USD MILLION)

TABLE 53 INDIA HYPERLOOP TECHNOLOGY MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 54 INDIA SEAT CAPACITY IN HYPERLOOP TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 INDIA HYPERLOOP TECHNOLOGY MARKET, BY ROUTE, 2020-2029 (USD MILLION)

TABLE 56 INDIA HYPERLOOP TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 57 THAILAND HYPERLOOP TECHNOLOGY MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 58 THAILAND HYPERLOOP TECHNOLOGY MARKET, BY SPEED, 2020-2029 (USD MILLION)

TABLE 59 THAILAND HYPERLOOP TECHNOLOGY MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 60 THAILAND SEAT CAPACITY IN HYPERLOOP TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 THAILAND HYPERLOOP TECHNOLOGY MARKET, BY ROUTE, 2020-2029 (USD MILLION)

TABLE 62 THAILAND HYPERLOOP TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 INDONESIA HYPERLOOP TECHNOLOGY MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 64 INDONESIA HYPERLOOP TECHNOLOGY MARKET, BY SPEED, 2020-2029 (USD MILLION)

TABLE 65 INDONESIA HYPERLOOP TECHNOLOGY MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 66 INDONESIA SEAT CAPACITY IN HYPERLOOP TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 INDONESIA HYPERLOOP TECHNOLOGY MARKET, BY ROUTE, 2020-2029 (USD MILLION)

TABLE 68 INDONESIA HYPERLOOP TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 REST OF ASIA PACIFIC HYPERLOOP TECHNOLOGY MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

图片列表

LIST OF FIGURES

FIGURE 1 ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET: SEGMENTATION

FIGURE 11 DECREASED TRAVEL TIME AND TRANSPORT COSTS IS EXPECTED TO DRIVE ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 COMPONENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET IN 2021 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET

FIGURE 14 ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET: BY COMPONENTS, 2021

FIGURE 15 ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET: BY SPEED, 2021

FIGURE 16 ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET: BY CAPACITY, 2021

FIGURE 17 ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET: BY ROUTE, 2021

FIGURE 18 ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET: BY APPLICATION, 2021

FIGURE 19 ASIA PACIFIC HYPERLOOP TECHNOLOGY MARKET: SNAPSHOT (2021)

FIGURE 20 ASIA PACIFIC HYPERLOOP TECHNOLOGY MARKET: BY COUNTRY (2021)

FIGURE 21 ASIA PACIFIC HYPERLOOP TECHNOLOGY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 ASIA PACIFIC HYPERLOOP TECHNOLOGY MARKET: BY COUNTRY (2020 & 2029)

FIGURE 23 ASIA PACIFIC HYPERLOOP TECHNOLOGY MARKET: BY COMPONENTS (2022-2029)

FIGURE 24 ASIA-PACIFIC HYPERLOOP TECHNOLOGY MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。