亚太地区γ-丁内酯市场,按等级(工业级(5 重量%)、电容级(9 重量%)和普通级(8 重量%)、纯度(最低 99.9% 和最低 99.7%)、应用(溶剂、铸造粘合剂、除草剂和杀虫剂、电池和电容器、脱漆剂、抛光剂、麻醉剂、镇静剂和其他)、最终用途(制药工业、电气工业、农用化学品工业、石油工业、食品工业和其他)划分 - 行业趋势和预测到 2030 年。

亚太地区γ-丁内酯市场分析与洞察

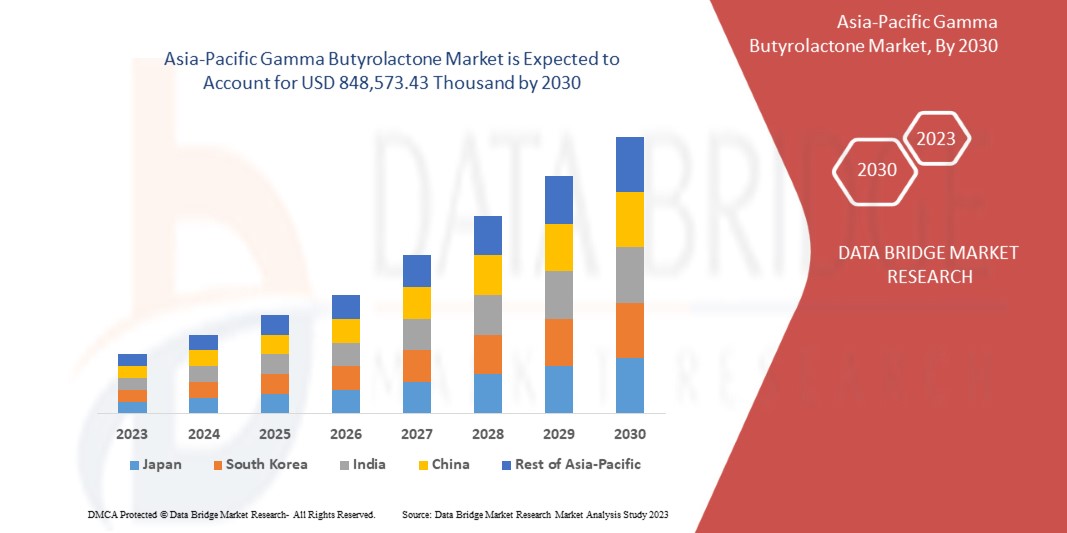

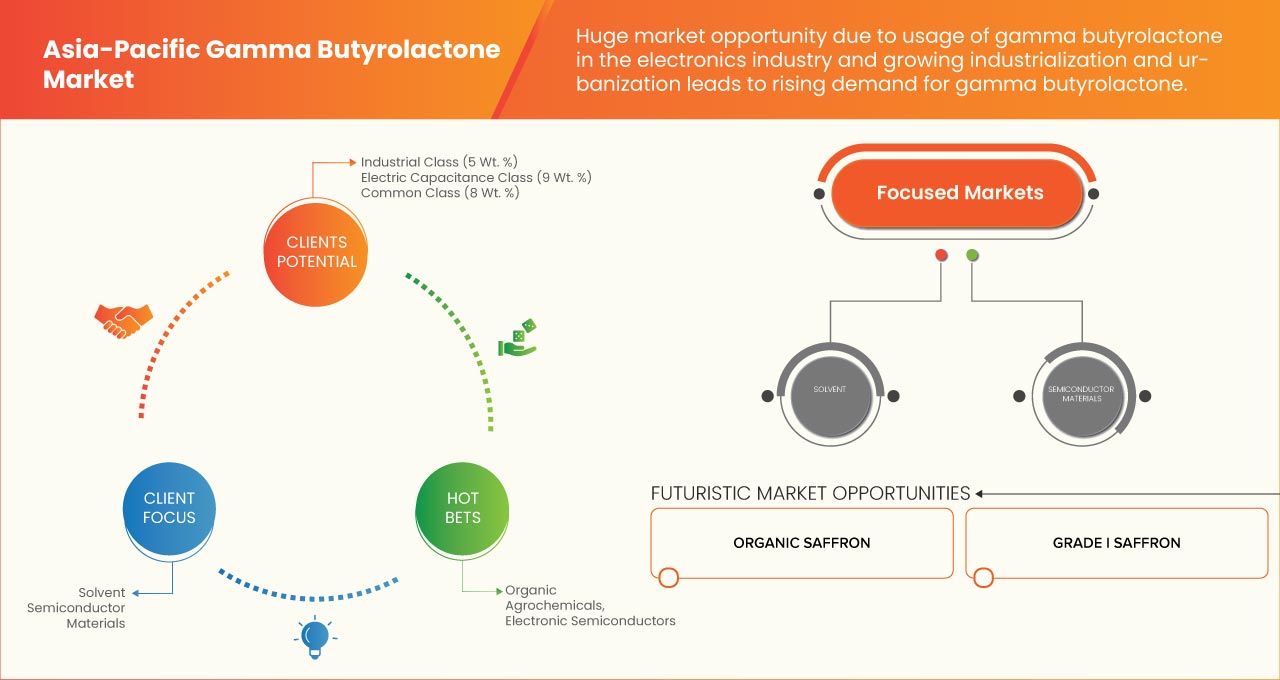

预计亚太地区γ-丁内酯市场将在 2023 年至 2030 年的预测期内实现显着增长。Data Bridge Market Research 分析称,在 2023 年至 2030 年的预测期内,该市场的复合年增长率为 3.2%,预计到 2030 年将达到 848,573.43 万美元。

推动γ-丁内酯增长的主要因素是衍生化学产品的应用不断增长,预计这将推动市场增长。

亚太地区 γ-丁内酯市场报告提供了市场份额、新发展和产品线分析、国内和本地市场参与者的影响的详细信息,分析了新兴收入领域、市场法规变化、产品审批、战略决策、产品发布、地域扩张和市场技术创新方面的机会。要了解分析和市场情况,请联系我们获取分析师简报。我们的团队将帮助您创建收入影响解决方案,以实现您的预期目标。

|

预测期 |

2023 至 2030 年 |

|

基准年 |

2022 |

|

历史岁月 |

2021 (可定制至 2020-2015) |

|

定量单位 |

收入(千美元) |

|

涵盖的领域 |

按等级(工业级(5 重量%)、电容级(9 重量%)和普通级(8 重量%)、纯度(最低 99.9% 和最低 99.7%)、用途(溶剂、铸造粘合剂、除草剂和杀虫剂、电池和电容器、脱漆剂、抛光剂、麻醉剂、镇静剂等)、最终用途(制药工业、电气工业、农用化学品工业、石油工业、食品工业等) |

|

覆盖国家 |

日本、中国、韩国、印度、新加坡、泰国、印度尼西亚、马来西亚、菲律宾、澳大利亚和新西兰、亚太地区其他地区 |

|

涵盖的市场参与者 |

浙江瑞盛化工有限公司、Biosynth、浙江百恩化工有限公司、DCC、BASF SE、Ashland、博爱新开源制药有限公司、三菱化学株式会社、Sipchem Company、BALAJI AMINES 等 |

市场定义

γ-丁内酯是一种吸湿性液体,具有酮类气味,外观无色、油腻且透明。它还用作制造多种化合物的前体。GBL 在制药行业用作美容剂和安抚剂,并用于生产干扰素和环丙沙星。

亚太地区γ-丁内酯市场动态

驱动程序

- 衍生化学产品的应用日益广泛

化学品在日常生活的各个方面都发挥着重要作用。世界上的一切都是由化学品组成的。要制造这些有用的化学品,需要原材料。每种化学品都有不同的原材料和化学中间体。药品、食品、化妆品、个人护理产品、油漆、燃料、电子产品等日常用品都是由化合物制成的,这些化合物来自一种或多种化学原料。有利的框架、发展中经济体外国直接投资的增加、消费者需求的增加以及化学品制造商之间的激烈竞争是化学品市场增长的驱动力。

- 广泛应用于各行各业

经济的增长、交通运输业的崛起和基础设施的增长是导致石油工业增长的一些关键变量。γ-丁内酯是一种有用的化学品,在丁二烯、芳烃和高级油脂石油加工中用作萃取剂。除了石油工业外,γ-丁内酯还用于农用化学品工业。农用化学品在提高农业产量方面发挥着重要作用。使用农用化学品可以提高作物产量、植物健康并控制植物疾病。这些农用化学品分为除草剂、杀线虫剂、杀菌剂、杀虫剂和土壤改良剂。该化学品用于生产有机农用化学品,如除草剂、杀线虫剂和杀虫剂。除此之外,γ-丁内酯还用作含磷和氯代烃农药的植物生长调节剂和稳定剂。因此,人口数量众多、粮食需求不断增加以及农民对农用化学品益处的认识是推动农用化学品行业增长的因素,从而推动亚太地区γ-丁内酯市场的发展。

机会

- 电动汽车需求上升

由于全球对电动汽车的需求不断增加,如今道路上的电动汽车数量也越来越多,而且这一趋势只会持续下去。由于公众对减少温室气体排放、燃料成本高昂以及技术进步的认识不断提高,过去几年对电动汽车的需求不断增加。市场上的电动汽车包括电动汽车、公共汽车、拖拉机、踏板车、自行车、个人交通工具等等。这些不同类型的电动汽车吸引了来自不同工作领域的消费者,从而增加了电动汽车的需求和销量。

- 有机农用化学品的使用增加

工厂或汽车行业中安装的机器或发动机使用寿命较长,但使用频率较高,因此发动机内部零件的磨损更大。与机器一起安装的密封件必须在不同的压力和温度下工作,这会增加密封件的磨损。机器中使用多种类型的润滑剂,这些润滑剂涉及不同的化学成分,有时也会影响密封产品的成分。

限制/挑战

- 严重的健康影响和安全问题

γ-丁内酯是一种应用范围广泛的著名化学品。该化学品应用于制药、石油、农用化学品、化妆品和个人护理产品等各个行业。它还用作生产各种化学品的中间体,例如聚乙烯吡咯烷酮、苯基丁酸和 DL-蛋氨酸。此外,该化学品还用作醋酸纤维素、甲基丙烯酸甲酯和其他聚合物的溶剂。

最新动态

- 据 My Chemical Monitoring 报道,澳大利亚卫生部代表宣布计划限制在化妆品和其他物品中使用γ-丁内酯

亚太地区γ-丁内酯市场范围和市场规模

亚太地区 γ-丁内酯市场按等级、应用、纯度和最终用途进行分类。各细分市场之间的增长有助于您分析利基市场的增长和进入市场的策略,并确定您的核心应用领域和目标市场的差异。

年级

- 工业级(5重量%)

- 普通类 (8 重量%)

- 电容等级 (9 Wt.%)

根据等级,市场分为工业级(5重量%)、普通级(8重量%)和电容级(9重量%)

纯度

- 最低 99.9%

- 最低 99.7%

根据纯度,市场分为最低 99.7% 和最低 99.9%。

应用

- 溶剂

- 铸造粘合剂

- 除草剂和杀虫剂

- 电池和电容器

- 油漆剥离剂

- 抛光剂

- 麻药

- 镇静剂

- 其他的

根据应用,市场分为溶剂、铸造粘合剂、除草剂和杀虫剂、电池和电容器、脱漆剂、抛光剂、麻醉剂、镇静剂和其他。

最终用途

- 制药行业

- 电气行业

- 农化行业

- 石油工业

- 食品工业

- 其他的

根据最终用途,市场分为制药行业、电气行业、农用化学品行业、石油行业、食品行业和其他行业。

亚太地区伽马丁内酯市场区域/国家层面分析

如上所述,我们对亚太地区的γ-丁内酯市场进行了分析,并提供了按国家、等级、纯度、应用和最终用途划分的市场规模信息。

亚太地区γ-丁内酯市场涵盖的国家包括日本、中国、韩国、印度、新加坡、泰国、印度尼西亚、马来西亚、菲律宾、澳大利亚和新西兰以及亚太地区其他地区。

由于γ-丁内酯在化妆品行业中的应用日益广泛,例如用于指甲油去除剂等,预计中国将引领亚太地区γ-丁内酯市场。

报告的国家部分还提供了影响单个市场因素和国内市场监管变化,这些因素和变化会影响市场的当前和未来趋势。新销售、替代销售、国家人口统计、监管法案和进出口关税等数据点是用于预测单个国家市场情景的一些主要指标。此外,在对国家数据进行预测分析时,还考虑了品牌的存在和可用性以及由于来自本地和国内品牌的激烈或稀缺竞争而面临的挑战,以及销售渠道的影响。

竞争格局和亚太地区γ-丁内酯市场份额分析

亚太地区伽马丁内酯市场竞争格局按竞争对手提供详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、亚太地区业务、生产基地和设施、公司优势和劣势、产品发布、临床试验渠道、品牌分析、产品批准、专利、产品宽度和广度、应用优势、技术生命线曲线。以上提供的数据点仅与公司对亚太地区伽马丁内酯市场的关注有关。

报告中涉及的一些主要参与者包括浙江瑞盛化工有限公司、Biosynth、BYN化学有限公司、DCC、BASF SE、Ashland、博爱新开源制药有限公司、三菱化学株式会社、Sipchem Company、BALAJI AMINES等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC GAMMA BUTYROLACTONE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 GRADE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USE COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT'S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 LIST OF KEY PATENTS LAUNCHED

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 OVERVIEW

4.5.2 LOGISTIC COST SCENARIO

4.5.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.6 VENDOR SELECTION CRITERIA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING APPLICATION OF DERIVED CHEMICAL PRODUCTS

5.1.2 APPLICATION IN A WIDE RANGE OF INDUSTRIES

5.1.3 INCREASED DEMAND FOR ELECTRONIC ITEMS

5.2 RESTRAINTS

5.2.1 SERIOUS HEALTH EFFECTS AND SAFETY CONCERNS

5.2.2 STRINGENT RULES AND REGULATIONS

5.3 OPPORTUNITIES

5.3.1 RISE IN DEMAND FOR ELECTRIC VEHICLES

5.3.2 INCREASE IN USAGE OF ORGANIC AGROCHEMICALS

5.4 CHALLENGES

5.4.1 GOVERNMENT RESTRICTIONS FOR ILLEGAL USAGE

6 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET, BY GRADE

6.1 OVERVIEW

6.2 INDUSTRIAL CLASS (5 WT.%)

6.3 ELECTRIC CAPACITANCE CLASS (9 WT.%)

6.4 COMMON CLASS (8 WT.%)

7 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET, BY PURITY

7.1 OVERVIEW

7.2 MIN. 99.9%

7.3 MIN. 99.7%

8 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 SOLVENT

8.3 CASTING BINDER

8.4 HERBICIDES AND INSECTICIDES

8.5 BATTERIES AND CAPACITORS

8.6 PAINT STRIPPERS

8.7 POLISH REMOVERS

8.8 ANESTHETIC

8.9 SEDATIVE

8.1 OTHERS

9 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET, BY END-USE

9.1 OVERVIEW

9.2 PHARMACEUTICAL INDUSTRY

9.3 ELECTRICAL INDUSTRY

9.4 AGROCHEMICAL INDUSTRY

9.5 PETROLEUM INDUSTRY

9.6 FOOD INDUSTRY

9.7 OTHERS

10 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET, BY REGION

10.1 ASIA-PACIFIC

10.1.1 CHINA

10.1.2 INDIA

10.1.3 JAPAN

10.1.4 SOUTH KOREA

10.1.5 SINGAPORE

10.1.6 THAILAND

10.1.7 AUSTRALIA & NEW ZEALAND

10.1.8 INDONESIA

10.1.9 MALAYSIA

10.1.10 PHILIPPINES

10.1.11 REST OF ASIA-PACIFIC

11 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

11.2 RECOGNITION

11.3 AWARD

11.4 EVENT

11.5 EXPANSION

11.6 AGREEMENT

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 MITSUBISHI CHEMICAL CORPORATION.

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 BASF SE

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENT

13.3 SIPCHEM COMPANY

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 BALAJI AMINES

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 ASHLAND

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENT

13.6 BIOSYNTH

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 BOAI NKY PHARMACEUTICALS LTD.

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 BYN CHEMICALS CO., LTD

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 DCC

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 ZHEJIANG REALSUN CHEMICAL CO.,LTD.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

表格列表

TABLE 1 IMPORT DATA OF LACTONES; HS CODE – 293220 (USD THOUSAND)

TABLE 2 EXPORT DATA OF LACTONES; HS CODE – 293220 (USD THOUSAND)

TABLE 3 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 4 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 5 ASIA PACIFIC INDUSTRIAL CLASS (5 WT.%) IN GAMMA BUTYROLACTONE MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 6 ASIA PACIFIC INDUSTRIAL CLASS (5 WT.%) IN GAMMA BUTYROLACTONE MARKET, BY REGION, 2017-2030 (TONS)

TABLE 7 ASIA PACIFIC ELECTRIC CAPACITANCE CLASS (9 WT.%) IN GAMMA BUTYROLACTONE MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 8 ASIA PACIFIC ELECTRIC CAPACITANCE CLASS (9 WT.%) IN GAMMA BUTYROLACTONE MARKET, BY REGION, 2017-2030 (TONS)

TABLE 9 ASIA PACIFIC COMMON CLASS (8 WT.%) IN GAMMA BUTYROLACTONE MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 10 ASIA PACIFIC COMMON CLASS (8 WT.%) IN GAMMA BUTYROLACTONE MARKET, BY REGION, 2017-2030 (TONS)

TABLE 11 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET, BY PURITY, 2017-2030 (USD THOUSAND)

TABLE 12 ASIA PACIFIC MIN. 99.9% IN GAMMA BUTYROLACTONE MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 13 ASIA PACIFIC MIN. 99.7% IN GAMMA BUTYROLACTONE MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 14 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 15 ASIA PACIFIC SOLVENT IN GAMMA BUTYROLACTONE MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 16 ASIA PACIFIC CASTING BINDER IN ASIA PACIFIC GAMMA BUTYROLACTONE MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 17 ASIA PACIFIC HERBICIDES AND INSECTICIDES IN GAMMA BUTYROLACTONE MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 18 ASIA PACIFIC BATTERIES AND CAPACITORS IN GAMMA BUTYROLACTONE MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 19 ASIA PACIFIC PAINT STRIPPERS IN GAMMA BUTYROLACTONE MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 20 ASIA PACIFIC POLISH REMOVERS IN GAMMA BUTYROLACTONE MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 21 ASIA PACIFIC ANESTHETIC IN GAMMA BUTYROLACTONE MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 22 ASIA PACIFIC SEDATIVE IN GAMMA BUTYROLACTONE MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 23 ASIA PACIFIC OTHERS IN GAMMA BUTYROLACTONE MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 24 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET, BY END-USE, 2017-2030 (USD THOUSAND)

TABLE 25 ASIA PACIFIC PHARMACEUTICAL INDUSTRY IN ASIA PACIFIC GAMMA BUTYROLACTONE MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 26 ASIA PACIFIC ELECTRICAL INDUSTRY IN GAMMA BUTYROLACTONE MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 27 ASIA PACIFIC AGROCHEMICAL INDUSTRY IN GAMMA BUTYROLACTONE MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 28 ASIA PACIFIC PETROLEUM INDUSTRY IN GAMMA BUTYROLACTONE MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 29 ASIA PACIFIC FOOD INDUSTRY IN GAMMA BUTYROLACTONE MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 30 ASIA PACIFIC OTHERS IN GAMMA BUTYROLACTONE MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC GAMMA BUTYROLACTONE MARKET, BY COUNTRY, 2017-2030 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC GAMMA BUTYROLACTONE MARKET, BY COUNTRY, 2017-2030 (TONS)

TABLE 33 ASIA-PACIFIC GAMMA BUTYROLACTONE MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC GAMMA BUTYROLACTONE MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 35 ASIA-PACIFIC GAMMA BUTYROLACTONE MARKET, BY PURITY, 2017-2030 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC GAMMA BUTYROLACTONE MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC GAMMA BUTYROLACTONE MARKET, BY END-USE, 2017-2030 (USD THOUSAND)

TABLE 38 CHINA GAMMA BUTYROLACTONE MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 39 CHINA GAMMA BUTYROLACTONE MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 40 CHINA GAMMA BUTYROLACTONE MARKET, BY PURITY, 2017-2030 (USD THOUSAND)

TABLE 41 CHINA GAMMA BUTYROLACTONE MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 42 CHINA GAMMA BUTYROLACTONE MARKET, BY END-USE, 2017-2030 (USD THOUSAND)

TABLE 43 INDIA GAMMA BUTYROLACTONE MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 44 INDIA GAMMA BUTYROLACTONE MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 45 INDIA GAMMA BUTYROLACTONE MARKET, BY PURITY, 2017-2030 (USD THOUSAND)

TABLE 46 INDIA GAMMA BUTYROLACTONE MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 47 INDIA GAMMA BUTYROLACTONE MARKET, BY END-USE, 2017-2030 (USD THOUSAND)

TABLE 48 JAPAN GAMMA BUTYROLACTONE MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 49 JAPAN GAMMA BUTYROLACTONE MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 50 JAPAN GAMMA BUTYROLACTONE MARKET, BY PURITY, 2017-2030 (USD THOUSAND)

TABLE 51 JAPAN GAMMA BUTYROLACTONE MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 52 JAPAN GAMMA BUTYROLACTONE MARKET, BY END-USE, 2017-2030 (USD THOUSAND)

TABLE 53 SOUTH KOREA GAMMA BUTYROLACTONE MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 54 SOUTH KOREA GAMMA BUTYROLACTONE MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 55 SOUTH KOREA GAMMA BUTYROLACTONE MARKET, BY PURITY, 2017-2030 (USD THOUSAND)

TABLE 56 SOUTH KOREA GAMMA BUTYROLACTONE MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 57 SOUTH KOREA GAMMA BUTYROLACTONE MARKET, BY END-USE, 2017-2030 (USD THOUSAND)

TABLE 58 SINGAPORE GAMMA BUTYROLACTONE MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 59 SINGAPORE GAMMA BUTYROLACTONE MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 60 SINGAPORE GAMMA BUTYROLACTONE MARKET, BY PURITY, 2017-2030 (USD THOUSAND)

TABLE 61 SINGAPORE GAMMA BUTYROLACTONE MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 62 SINGAPORE GAMMA BUTYROLACTONE MARKET, BY END-USE, 2017-2030 (USD THOUSAND)

TABLE 63 THAILAND GAMMA BUTYROLACTONE MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 64 THAILAND GAMMA BUTYROLACTONE MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 65 THAILAND GAMMA BUTYROLACTONE MARKET, BY PURITY, 2017-2030 (USD THOUSAND)

TABLE 66 THAILAND GAMMA BUTYROLACTONE MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 67 THAILAND GAMMA BUTYROLACTONE MARKET, BY END-USE, 2017-2030 (USD THOUSAND)

TABLE 68 AUSTRALIA & NEW ZEALAND GAMMA BUTYROLACTONE MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 69 AUSTRALIA & NEW ZEALAND GAMMA BUTYROLACTONE MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 70 AUSTRALIA & NEW ZEALAND GAMMA BUTYROLACTONE MARKET, BY PURITY, 2017-2030 (USD THOUSAND)

TABLE 71 AUSTRALIA & NEW ZEALAND GAMMA BUTYROLACTONE MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 72 AUSTRALIA & NEW ZEALAND GAMMA BUTYROLACTONE MARKET, BY END-USE, 2017-2030 (USD THOUSAND)

TABLE 73 INDONESIA GAMMA BUTYROLACTONE MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 74 INDONESIA GAMMA BUTYROLACTONE MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 75 INDONESIA GAMMA BUTYROLACTONE MARKET, BY PURITY, 2017-2030 (USD THOUSAND)

TABLE 76 INDONESIA GAMMA BUTYROLACTONE MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 77 INDONESIA GAMMA BUTYROLACTONE MARKET, BY END-USE, 2017-2030 (USD THOUSAND)

TABLE 78 MALAYSIA GAMMA BUTYROLACTONE MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 79 MALAYSIA GAMMA BUTYROLACTONE MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 80 MALAYSIA GAMMA BUTYROLACTONE MARKET, BY PURITY, 2017-2030 (USD THOUSAND)

TABLE 81 MALAYSIA GAMMA BUTYROLACTONE MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 82 MALAYSIA GAMMA BUTYROLACTONE MARKET, BY END-USE, 2017-2030 (USD THOUSAND)

TABLE 83 PHILIPPINES GAMMA BUTYROLACTONE MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 84 PHILIPPINES GAMMA BUTYROLACTONE MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 85 PHILIPPINES GAMMA BUTYROLACTONE MARKET, BY PURITY, 2017-2030 (USD THOUSAND)

TABLE 86 PHILIPPINES GAMMA BUTYROLACTONE MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 87 PHILIPPINES GAMMA BUTYROLACTONE MARKET, BY END-USE, 2017-2030 (USD THOUSAND)

TABLE 88 REST OF ASIA-PACIFIC GAMMA BUTYROLACTONE MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 89 REST OF ASIA-PACIFIC GAMMA BUTYROLACTONE MARKET, BY GRADE, 2017-2030 (TONS)

图片列表

FIGURE 1 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET

FIGURE 2 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET: THE GRADE LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET: MARKET END-USE COVERAGE GRID

FIGURE 11 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET: SEGMENTATION

FIGURE 14 GROWING APPLICATION OF DERIVED CHEMICAL PRODUCTS IS EXPECTED TO DRIVE THE ASIA PACIFIC GAMMA BUTYROLACTONE MARKET GROWTH IN THE FORECAST PERIOD

FIGURE 15 INDUSTRIAL CLASS (5 WT. %) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC GAMMA BUTYROLACTONE MARKET IN 2022 & 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF THE ASIA PACIFIC GAMMA BUTYROLACTONE MARKET

FIGURE 17 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET: BY GRADE, 2022

FIGURE 18 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET: BY PURITY, 2022

FIGURE 19 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET: BY APPLICATION, 2022

FIGURE 20 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET: BY END-USE, 2022

FIGURE 21 ASIA-PACIFIC GAMMA BUTYROLACTONE MARKET: SNAPSHOT (2022)

FIGURE 22 ASIA-PACIFIC GAMMA BUTYROLACTONE MARKET: BY COUNTRY (2022)

FIGURE 23 ASIA-PACIFIC GAMMA BUTYROLACTONE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 24 ASIA-PACIFIC GAMMA BUTYROLACTONE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 25 ASIA-PACIFIC GAMMA BUTYROLACTONE MARKET: BY GRADE (2022 - 2030)

FIGURE 26 ASIA PACIFIC GAMMA BUTYROLACTONE MARKET: COMPANY SHARE 2022 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。