Asia Pacific Exosome Therapeutic Market

市场规模(十亿美元)

CAGR :

%

USD

122.59 Thousand

USD

404.38 Thousand

2021

2029

USD

122.59 Thousand

USD

404.38 Thousand

2021

2029

| 2022 –2029 | |

| USD 122.59 Thousand | |

| USD 404.38 Thousand | |

|

|

|

亚太外泌体治疗市场,按类型(天然外泌体、混合外泌体)、来源(间充质干细胞、血液、体液、尿液、树突状细胞、唾液、牛奶等)、疗法(免疫疗法、化疗和基因疗法)、运输能力(生物大分子和小分子)、应用(代谢紊乱、肿瘤学、心脏病、神经病学、炎症性疾病、器官移植、妇科疾病、血液病等)、给药途径(肠外和口服)、最终用户(研究和学术机构、医院和诊断中心)、国家(韩国、澳大利亚、香港、亚太其他地区)行业趋势和预测到 2029 年

市场分析与洞察:亚太地区外泌体治疗市场

市场分析与洞察:亚太地区外泌体治疗市场

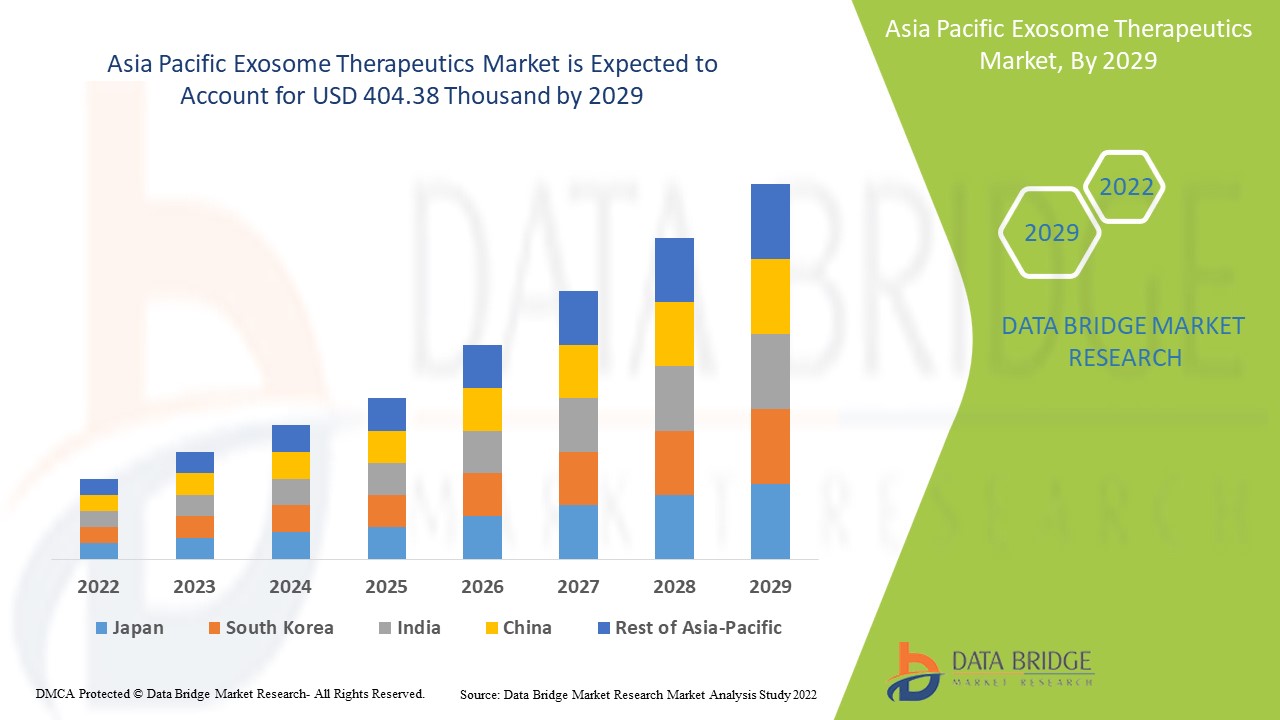

预计亚太地区外泌体治疗市场将在 2022 年至 2029 年的预测期内实现市场增长。Data Bridge Market Research 分析称,在 2022 年至 2029 年的预测期内,该市场将以 16.4% 的复合年增长率增长,预计将从 2021 年的 12.259 万美元达到 2029 年的 40.438 万美元。慢性炎症性自身免疫性疾病患病率的上升和外泌体治疗技术的发展很可能成为预测期内市场需求的主要驱动力。

外泌体是一类特殊的由内体组成的细胞衍生的细胞外囊泡,直径通常为 30-150 纳米——是最小的细胞外囊泡类型。在脂质双层的保护下,外泌体被推入细胞外环境,该环境包含来自原始细胞的复杂内容物。内容物中存在的内容物是蛋白质、脂质、信使核糖核酸 (mRNA)、微粒体核糖核酸 (miRNA) 和脱氧核糖核酸 (DNA)。外泌体的形成方式不同——通过多囊泡体融合和外排到细胞外空间。外泌体可用于治疗各种慢性病,如自身免疫性疾病。纳米技术为基于外泌体等纳米载体的癌症早期检测带来了新见解。由于外泌体在治疗干预中具有巨大的应用潜力,外泌体被视为潜在的药物载体。

外泌体分为两种类型:天然外泌体和混合外泌体。天然外泌体进一步细分为外源性外泌体和自源性外泌体。自源性外泌体是安全有效的靶向递送药物的载体,可用于治疗癌症、自身免疫性疾病和慢性炎症疾病。外源性外泌体是从各种细胞的内体释放的微小细胞外膜囊泡,可在大多数体液中找到,例如滑液、羊水和精液。在癌症中,外泌体在转移扩散、耐药性和新血管形成中起着至关重要的作用。

推动亚太地区外泌体治疗市场增长的因素包括慢性炎症疾病发病率的增加、外泌体治疗研究和开发活动的增加以及政府对外泌体治疗开发和生产的资助。此外,新兴经济体外泌体治疗的增长潜力和抗衰老疗法的使用增加促进了外泌体治疗市场的增长。然而,成本的上升、严格的规定以及使用外泌体治疗时观察到的风险是可能阻碍市场增长的制约因素。医疗保健支出的增加预计将为市场增长提供丰厚的机会。另一方面,投资增加,加上缺乏分离外泌体的标准化程序以及缺乏所需的专业知识,是预计会影响市场增长的一些重大挑战。

亚太外泌体治疗市场报告提供了市场份额、新发展和国内和本地市场参与者的影响的详细信息,分析了新兴收入来源、市场法规变化、产品审批、战略决策、产品发布、地域扩张和市场技术创新方面的机会。要了解分析和市场情况,请联系我们获取分析师简报。我们的团队将帮助您创建收入影响解决方案,以实现您的预期目标。

亚太外泌体治疗市场范围和市场规模

亚太外泌体治疗市场范围和市场规模

亚太外泌体治疗市场根据类型、来源、治疗方法、运输能力、应用、给药途径和最终用户分为七个显著的细分市场。

- 根据类型,亚太外泌体治疗市场分为天然外泌体和混合外泌体。2022 年,由于外泌体含有天然物质且在药物输送方面具有优势,天然外泌体预计将在亚太外泌体治疗市场占据主导地位。

- 根据来源,亚太外泌体治疗市场细分为间充质干细胞、血液、体液、尿液、树突状细胞、唾液、牛奶等。由于间充质干细胞的新兴应用以及管道、可用性和易于收集的扩展,预计 2022 年间充质干细胞领域将主导亚太外泌体治疗市场。

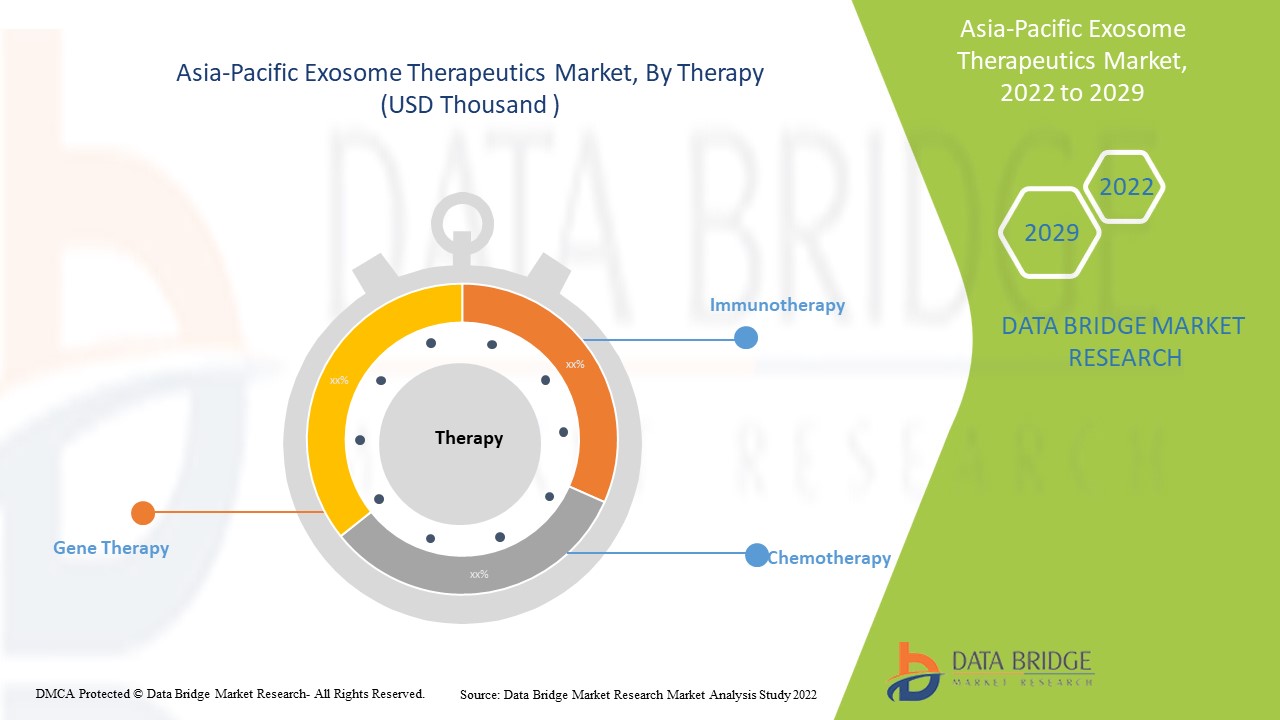

- 根据治疗方法,亚太外泌体治疗市场细分为免疫治疗、基因治疗和化疗。2022 年,免疫治疗领域预计将主导亚太外泌体治疗市场,因为它方便、准确度高,并且能提高长期生存率。

- 根据运输能力,亚太外泌体治疗市场分为生物大分子和小分子。2022 年,生物大分子领域预计将在亚太外泌体治疗市场占据主导地位,因为生物大分子具有高敏感性、蛋白质疗法在治疗炎症性疾病方面的应用增加以及增强人体的天然防御能力以对抗炎症疾病。

- 根据应用,亚太地区外泌体治疗市场细分为代谢紊乱、肿瘤学、心脏病、神经病学、炎症性疾病、器官移植、妇科疾病、血液病等。由于中国和印度代谢紊乱病例增加,以及诊断实验室提供外泌体治疗,预计到 2022 年,代谢紊乱领域将主导亚太地区外泌体治疗市场。

- 根据给药途径,亚太外泌体治疗市场分为肠外给药和口服给药。2022 年,肠外给药预计将占据亚太外泌体治疗市场的主导地位,因为肠外给药具有更高的生物利用度和即时起效的特点。

- 根据最终用户,亚太外泌体治疗市场分为研究和学术机构、医院和诊断中心。由于日本外泌体研究和开发的增加以及政府的资金支持,预计 2022 年研究和学术机构将主导亚太外泌体治疗市场。

亚太外泌体治疗市场国家级分析

对亚太外泌体治疗市场进行了分析,并按类型、来源、治疗方法、运输能力、应用、给药途径和最终用户提供了市场规模信息。

外泌体治疗市场报告涵盖的国家包括日本、中国、印度、韩国、澳大利亚、新加坡、印度尼西亚、菲律宾和亚太地区其他地区。

预计亚太地区在预测期内将以最高的复合年增长率增长,因为随着城市化和实验室自动化的发展,亚太地区国家对外泌体治疗产品的需求正在迅速增长。中国是外泌体治疗市场的主要国家之一,因此预计中国将在亚太市场占据主导地位。

报告的国家部分还提供了影响单个市场因素和国内市场监管变化,这些因素和变化会影响市场的当前和未来趋势。新销售、替代销售、国家人口统计、监管法案和进出口关税等数据点是用于预测单个国家市场情景的一些主要指标。此外,在对国家数据进行预测分析时,还考虑了亚太地区品牌的存在和可用性以及它们因来自本地和国内品牌的激烈或稀少竞争而面临的挑战、销售渠道的影响。

外泌体治疗在新兴经济体的增长潜力和市场参与者的战略举措正在为亚太外泌体治疗市场创造新的机遇

亚太外泌体治疗市场还为您提供有关每个国家/地区特定行业增长的详细市场分析,包括外泌体治疗销售、外泌体治疗进步的影响以及监管环境的变化及其对外泌体治疗市场的支持。数据涵盖 2011 年至 2020 年的历史时期。

竞争格局和亚太地区外泌体治疗市场份额分析

亚太地区外泌体治疗市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、生产基地和设施、公司优势和劣势、产品发布、产品试验渠道、产品批准、专利、产品宽度和广度、应用优势、技术生命线曲线。以上提供的数据点仅与公司对外泌体治疗市场的关注有关。

亚太地区外泌体疗法的主要提供公司是Exopharm。

DBMR 分析师了解竞争优势并为每个竞争对手分别提供竞争分析。

市场参与者的战略举措以及外泌体治疗的新技术进步正在弥补慢性自身免疫性疾病治疗的空白。

例如,

- 2021 年 9 月,Exopharm 与日本昭和电工材料公司合作,将 LEAP 技术用于外泌体治疗。LEAP 技术减少了生产外泌体过程中面临的主要问题,外泌体可用作癌症等疾病的再生医学。此次合作将在其横滨再生医学业务部门内评估 Exopharm 的 LEAP(基于配体的外泌体亲和纯化)技术平台。这将使昭和电工材料公司利用 Exopharm 的外泌体技术

市场参与者的合作、合资和其他策略正在增强公司在外泌体治疗市场中的市场,这也为组织改善其在外泌体治疗市场中的产品提供了好处。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC EXOSOME THERAPEUTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 TYPE SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 PIPELINE ANALYSIS

6 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING PREVALENCE OF CHRONIC INFLAMMATION, AUTOIMMUNE DISEASE, LYME DISEASE, AND OTHER CHRONIC DEGENERATIVE DISEASES

7.1.2 RISE IN INCIDENCE OF ONCOLOGY DISEASES

7.1.3 TECHNOLOGICAL ADVANCEMENTS IN EXOSOME THERAPEUTICS

7.1.4 RISE IN RESEARCH AND DEVELOPMENT ACTIVITIES, INVOLVED IN EXOSOME THERAPEUTICS

7.1.5 GOVERNMENT FUNDING FOR THE DEVELOPMENT AND PRODUCTION OF EXOSOME THERAPEUTICS

7.2 RESTRAINTS

7.2.1 HIGH COST ASSOCIATED WITH THE EXOSOME THERAPEUTICS

7.2.2 LACK OF AUTHENTICATION REQUIREMENTS FOR ISOLATION OF EXOSOMES

7.2.3 RISKS OBSERVED WHILE USING EXOSOME THERAPEUTICS

7.2.4 UNMET MEDICAL NEEDS

7.3 OPPORTUNITIES

7.3.1 INCREASE USE OF ANTI-AGING THERAPY

7.3.2 STRATEGIC INITIATIVES BY MARKET PLAYERS

7.3.3 RISE IN HEALTHCARE EXPENDITURE

7.3.4 AVAILABILITY OF VARIOUS EXOSOME ISOLATION AND PURIFICATION TECHNIQUES

7.3.5 PROGRESSING THERAPEUTIC VALUE OF EXOSOME

7.4 CHALLENGES

7.4.1 THE SHORTAGE OF SKILLED PROFESSIONALS REQUIRED FOR THE ISOLATION OF EXOSOME

7.4.2 LATE APPROVAL ASSOCIATED WITH PRODUCT LAUNCHES

8 IMPACT OF COVID-19 ON ASIA PACIFIC EXOSOME THERAPEUTICS MARKET

8.1 IMPACT ON PRICE

8.2 IMPACT ON DEMAND

8.3 IMPACT ON SUPPLY CHAIN

8.4 STRATEGIC DECISIONS BY MANUFACTURERS

8.5 CONCLUSION

9 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY TYPE

9.1 OVERVIEW

9.2 NATURAL EXOSOMES

9.2.1 AUTOLOGOUS EXOSOMES

9.2.2 EXOGENOUS EXOSOMES

9.3 HYBRID EXOSOMES

10 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY SOURCE

10.1 OVERVIEW

10.2 MESENCHYMAL STEM CELLS

10.3 BLOOD

10.3.1 T-LYMPHOCYTES

10.3.2 OTHERS

10.4 BODY FLUIDS

10.4.1 AMNIOTIC FLUID

10.4.2 SEMEN

10.4.3 SYNOVIAL FLUID

10.4.4 OTHERS

10.5 URINE

10.6 DENDRITIC CELLS

10.7 SALIVA

10.8 MILK

10.9 OTHERS

11 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY THERAPY

11.1 OVERVIEW

11.2 IMMUNOTHERAPY

11.3 GENE THERAPY

11.4 CHEMOTHERAPY

12 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY TRANSPORTING CAPACITY

12.1 OVERVIEW

12.2 BIO MACROMOLECULES

12.2.1 NUCLEIC ACIDS

12.2.2 PROTEINS

12.2.3 PEPTIDES

12.3 SMALL MOLECULES

13 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 METABOLIC DISORDERS

13.3 ONCOLOGY

13.3.1 NON-SMALL CELL LUNG CANCER

13.3.2 BREAST CANCER

13.3.3 GASTRIC CANCER

13.3.4 HEAD AND NECK CANCER

13.3.5 OTHERS

13.4 CARDIAC DISORDERS

13.5 NEUROLOGY

13.5.1 ALZHEIMER'S DISEASE

13.5.2 PARKINSON'S DISEASE

13.5.3 OTHERS

13.6 INFLAMMATORY DISORDERS

13.7 ORGAN TRANSPLANTATION

13.8 GYNECOLOGY DISORDERS

13.9 BLOOD DISORDERS

13.1 OTHERS

14 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY ROUTE OF ADMINISTRATION

14.1 OVERVIEW

14.2 PARENTERAL

14.3 ORAL

15 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY END USER

15.1 OVERVIEW

15.2 RESEARCH AND ACADEMIC INSTITUTES

15.3 HOSPITALS

15.4 DIAGNOSTIC CENTERS

16 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY REGION

16.1 ASIA-PACIFIC

16.1.1 SOUTH KOREA

16.1.2 AUSTRALIA

16.1.3 HONG-KONG

16.1.4 REST OF ASIA-PACIFIC

17 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

18 COMPANY PROFILE

18.1 KIMERA LABS

18.1.1 COMPANY SNAPSHOT

18.1.2 COMPANY SHARE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT DEVELOPMENTS

18.2 STEM CELLS GROUP

18.2.1 COMPANY SNAPSHOT

18.2.2 COMPANY SHARE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENTS

18.3 AEGLE THERAPEUTICS

18.3.1 COMPANY SNAPSHOT

18.3.2 PRODUCT PORTFOLIO

18.3.3 RECENT DEVELOPMENTS

18.4 AVALON GLOBOCARE CORP.(2021)

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENTS

18.5 CAPRICOR THERAPEUTICS (2021)

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENTS

18.6 CODIAK (2021)

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

18.7 EXOSOME SCIENCES (A SUBSIDIARY OF AETHLON MEDICAL) (2021)

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENTS NO RECENT DEVELOPMENTS

18.8 EXOPHARM

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 EVOX THERAPEUTICS

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENTS

18.1 EV THERAPEUTICS

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.11 JAZZ PHARMACEUTICALS, INC

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENTS

18.12 RENEURON GROUP PLC

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT DEVELOPMENTS

18.13 STEM CELL MEDICINE

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

表格列表

TABLE 1 ASIA PACIFIC EXOSOME THERAPEUTICSMARKET, PIPELINE ANALYSIS

TABLE 2 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 3 ASIA PACIFIC NATURAL EXOSOMES IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 4 ASIA PACIFIC NATURAL EXOSOMES IN EXOSOME THERAPEUTICS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 ASIA PACIFIC HYBRID EXOSOMES IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 7 ASIA PACIFIC MESENCHYMAL STEM CELLS IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 ASIA PACIFIC BLOOD IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 ASIA PACIFIC BLOOD IN EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 10 ASIA PACIFIC BODY FLUIDS IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 ASIA PACIFIC BLOOD IN EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 12 ASIA PACIFIC URINE IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 ASIA PACIFIC DENDRITIC CELLS IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 ASIA PACIFIC SALIVA IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 ASIA PACIFIC MILK IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 ASIA PACIFIC OTHERS IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY THERAPY, 2020-2029 (USD THOUSAND)

TABLE 18 ASIA PACIFIC IMMUNOTHERAPY IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 ASIA PACIFIC GENE THERAPY IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 ASIA PACIFIC CHEMOTHERAPY IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY TRANSPORTING CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 22 ASIA PACIFIC BIO MACROMOLECULES IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 ASIA PACIFIC BIO MACROMOLECULES IN EXOSOME THERAPEUTICS MARKET, BY TRANSPORTING CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 24 ASIA PACIFIC SMALL MOLECULES IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 26 ASIA PACIFIC METABOLIC DISORDERS IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 ASIA PACIFIC ONCOLOGY IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 ASIA PACIFIC ONCOLOGY IN ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 29 ASIA PACIFIC CARDIAC DISORDERS IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 ASIA PACIFIC NEUROLOGY IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 ASIA PACIFIC NEUROLOGY IN EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 32 ASIA PACIFIC INFLAMMATORY DISORDERS IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 ASIA PACIFIC ORGAN TRANSPLANTATION IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 ASIA PACIFIC GYNECOLOGY DISORDERS IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 ASIA PACIFIC BLOOD DISORDERS IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 ASIA PACIFIC OTHERS IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD THOUSAND)

TABLE 38 ASIA PACIFIC PARENTERAL IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 ASIA PACIFIC ORAL IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 40 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 41 ASIA PACIFIC RESEARCH AND ACADEMIC INSTITUTES IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 42 ASIA PACIFIC HOSPITALS IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 43 ASIA PACIFIC DIAGNOSTIC CENTERS IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC EXOSOME THERAPEUTICS MARKET, BY COUNTRY, 2019-2029 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC EXOSOME THERAPEUTICS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC NATURAL EXOSOME IN EXOSOME THERAPEUTICS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC BLOOD IN EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC BODY FLUIDS IN EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC EXOSOME THERAPEUTICS MARKET, BY THERAPY, 2020-2029 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC EXOSOME THERAPEUTICS MARKET, BY TRANSPORTING CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC BIO MACROMOLECULES IN EXOSOME THERAPEUTICS MARKET, BY TRANSPORTING CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC ONCOLOGY IN EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC NEUROLOGY IN EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC EXOSOME THERAPEUTICS MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD THOUSAND)

TABLE 57 ASIA-PACIFIC EXOSOME THERAPEUTICS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 58 SOUTH KOREA EXOSOME THERAPEUTICS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 SOUTH KOREA NATURAL EXOSOME IN EXOSOME THERAPEUTICS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 SOUTH KOREA EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 61 SOUTH KOREA BLOOD IN EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 62 SOUTH KOREA BODY FLUIDS IN EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 63 SOUTH KOREA EXOSOME THERAPEUTICS MARKET, BY THERAPY, 2020-2029 (USD THOUSAND)

TABLE 64 SOUTH KOREA EXOSOME THERAPEUTICS MARKET, BY TRANSPORTING CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 65 SOUTH KOREA BIO MACROMOLECULES IN EXOSOME THERAPEUTICS MARKET, BY TRANSPORTING CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 66 SOUTH KOREA EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 67 SOUTH KOREA ONCOLOGY IN EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 68 SOUTH KOREA NEUROLOGY IN EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 69 SOUTH KOREA EXOSOME THERAPEUTICS MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD THOUSAND)

TABLE 70 SOUTH KOREA EXOSOME THERAPEUTICS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 71 AUSTRALIA EXOSOME THERAPEUTICS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 72 AUSTRALIA NATURAL EXOSOME IN EXOSOME THERAPEUTICS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 73 AUSTRALIA EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 74 AUSTRALIA BLOOD IN EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 75 AUSTRALIA BODY FLUIDS IN EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 76 AUSTRALIA EXOSOME THERAPEUTICS MARKET, BY THERAPY, 2020-2029 (USD THOUSAND)

TABLE 77 AUSTRALIA EXOSOME THERAPEUTICS MARKET, BY TRANSPORTING CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 78 AUSTRALIA BIO MACROMOLECULES IN EXOSOME THERAPEUTICS MARKET, BY TRANSPORTING CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 79 AUSTRALIA EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 80 AUSTRALIA ONCOLOGY IN EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 81 AUSTRALIA NEUROLOGY IN EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 82 AUSTRALIA EXOSOME THERAPEUTICS MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD THOUSAND)

TABLE 83 AUSTRALIA EXOSOME THERAPEUTICS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 84 HONG-KONG EXOSOME THERAPEUTICS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 HONG-KONG NATURAL EXOSOME IN EXOSOME THERAPEUTICS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 86 HONG-KONG EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 87 HONG-KONG BLOOD IN EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 88 HONG-KONG BODY FLUIDS IN EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 89 HONG-KONG EXOSOME THERAPEUTICS MARKET, BY THERAPY, 2020-2029 (USD THOUSAND)

TABLE 90 HONG-KONG EXOSOME THERAPEUTICS MARKET, BY TRANSPORTING CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 91 HONG-KONG BIO MACROMOLECULES IN EXOSOME THERAPEUTICS MARKET, BY TRANSPORTING CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 92 HONG-KONG EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 93 HONG-KONG ONCOLOGY IN EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 94 HONG-KONG NEUROLOGY IN EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 95 HONG-KONG EXOSOME THERAPEUTICS MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD THOUSAND)

TABLE 96 HONG-KONG EXOSOME THERAPEUTICS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 97 REST OF ASIA-PACIFIC EXOSOME THERAPEUTICS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

图片列表

FIGURE 1 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: DBMR POSITION GRID

FIGURE 8 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: END USER COVERAGE GRID

FIGURE 10 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: SEGMENTATION

FIGURE 11 THE INCREASED PREVALENCE OF AUTOIMMUNE DISORDERS, LYME DISEASES, INCIDENCE OF CANCER AND RISE IN TECHNOLOGICAL ADVANCEMENTS IS EXPECTED TO DRIVE THE ASIA PACIFIC EXOSOME THERAPEUTICS MARKET FROM 2022 TO 2029

FIGURE 12 TYPE SEGMENT IS EXPECTED TO HAVE THE LARGEST SHARE OF THE ASIA PACIFIC EXOSOME THERAPEUTICS MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC EXOSOME THERAPEUTICS MARKET

FIGURE 14 THE PREVALENCE OF MULTIPLE SCLEROSIS IN WORLD HEALTH ORGANISATION (WHO) REGIONS IN 2020.

FIGURE 15 INCIDENCE RATE OF CANCER IN AUSTRALIA AND OTHER COUNTRIES (2020)

FIGURE 16 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY TYPE, 2021

FIGURE 17 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY TYPE, 2020-2029 (USD THOUSAND)

FIGURE 18 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 19 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 20 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY SOURCE, 2021

FIGURE 21 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY SOURCE, 2020-2029 (USD THOUSAND)

FIGURE 22 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY SOURCE, CAGR (2022-2029)

FIGURE 23 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY SOURCE, LIFELINE CURVE

FIGURE 24 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY THERAPY, 2021

FIGURE 25 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY THERAPY, 2020-2029 (USD THOUSAND)

FIGURE 26 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY THERAPY, CAGR (2022-2029)

FIGURE 27 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY THERAPY, LIFELINE CURVE

FIGURE 28 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY TRANSPORTING CAPACITY, 2021

FIGURE 29 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY TRANSPORTING CAPACITY, 2020-2029 (USD THOUSAND)

FIGURE 30 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY TRANSPORTING CAPACITY, CAGR (2022-2029)

FIGURE 31 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY TRANSPORTING CAPACITY, LIFELINE CURVE

FIGURE 32 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY APPLICATION, 2021

FIGURE 33 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY APPLICATION, 2020-2029 (USD THOUSAND)

FIGURE 34 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 35 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 36 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY ROUTE OF ADMINISTRATION, 2021

FIGURE 37 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY ROUTE OF ADMINISTRATION, 2020-2029 (USD THOUSAND)

FIGURE 38 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2022-2029)

FIGURE 39 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 40 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY END USER, 2021

FIGURE 41 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY END USER, 2020-2029 (USD THOUSAND)

FIGURE 42 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 43 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY END USER, LIFELINE CURVE

FIGURE 44 ASIA-PACIFIC EXOSOME THERAPEUTICS MARKET: SNAPSHOT (2021)

FIGURE 45 ASIA-PACIFIC EXOSOME THERAPEUTICS MARKET: BY COUNTRY (2021)

FIGURE 46 ASIA-PACIFIC EXOSOME THERAPEUTICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 47 ASIA-PACIFIC EXOSOME THERAPEUTICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 48 ASIA-PACIFIC EXOSOME THERAPEUTICS MARKET: BY TYPE (2022-2029)

FIGURE 49 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。