Asia Pacific Departmental Pacs Market

市场规模(十亿美元)

CAGR :

%

USD

3.39 Billion

USD

5.52 Billion

2024

2032

USD

3.39 Billion

USD

5.52 Billion

2024

2032

| 2025 –2032 | |

| USD 3.39 Billion | |

| USD 5.52 Billion | |

|

|

|

|

亚太地区部门级 PACS 市场细分,按产品类型(传统 PACS 和专业 PACS)、组件(软件、服务和硬件)、应用(MRI、计算机断层扫描、数字放射摄影、超声波、核成像、C 臂等)、集成级别(集成 PACS 和独立 PACS)、最终用户(医院、放射科连锁店/中心、门诊手术中心等)、分销渠道(直接投标、第三方管理员等) - 行业趋势和预测(至 2032 年)

亚太地区部门级 PACS 市场规模

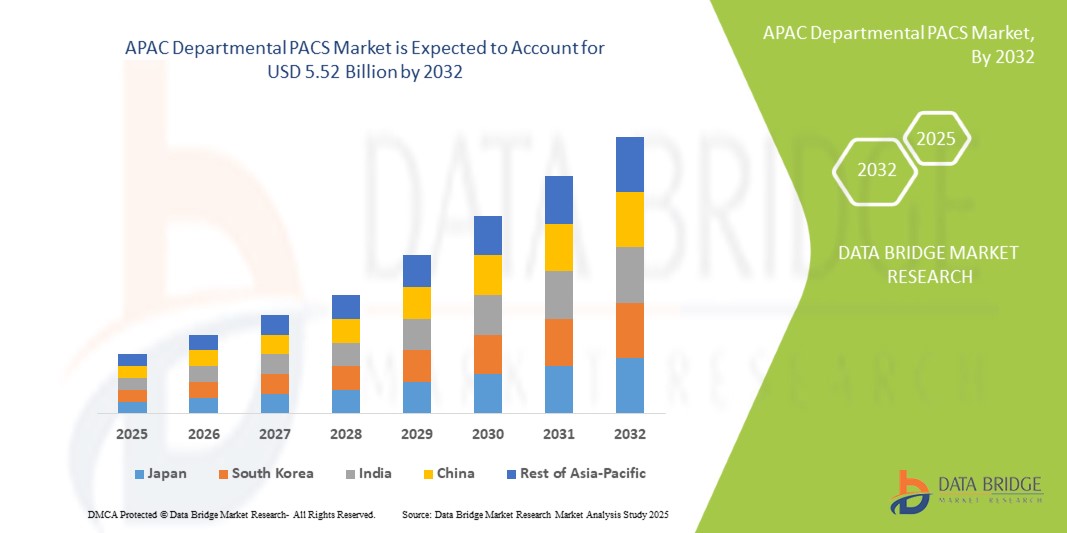

- 亚太地区部门级 PACS 市场规模估值为2024年为33.9亿美元预计将达到到2032年将达到55.2亿美元, 在复合年增长率为6.30%在预测期内

- 这一增长受到医疗数字化程度不断提高、慢性病患病率不断上升、技术进步、政府举措、基础设施改善以及新兴经济体的采用等因素的推动

亚太地区部门级 PACS 市场分析

- 受医疗机构日益普及先进医疗技术的推动,部门级 PACS 市场正在稳步扩张。医院和诊断中心越来越多地整合这些系统,以优化工作流程并改善患者护理。

- 医疗影像领域对高效数据存储和检索系统日益增长的需求也推动了部门级 PACS 解决方案的需求。这些系统可以集中访问患者图像,从而提高诊断准确性并降低运营成本。

- 中国凭借其先进的医疗保健基础设施、数字成像技术的广泛采用以及领先的 PACS 供应商的强大影响力,预计将在亚太地区部门级 PACS 市场占据主导地位

- 由于医疗保健数字化的快速发展、医学成像投资的不断增加以及对高效诊断解决方案的需求不断增长,印度预计将在预测期内成为亚太地区部门 PACS 市场增长最快的地区

- 预计专业 PACS 领域将在 2025 年占据市场主导地位,市场份额达到 28%,因为它具有针对特定医学专业的定制功能,可提高诊断准确性和工作流程效率

报告范围和亚太地区部门 PACS 市场细分

|

属性 |

亚太地区部门级 PACS 关键市场洞察 |

|

涵盖的领域 |

|

|

覆盖国家 |

亚太

|

|

主要市场参与者 |

|

|

市场机会 |

|

|

增值数据信息集 |

除了对市场价值、增长率、细分、地理覆盖范围和主要参与者等市场情景的洞察之外,Data Bridge Market Research 策划的市场报告还包括深度专家分析、患者流行病学、管道分析、定价分析和监管框架。 |

亚太地区部门级 PACS 市场趋势

“日益融合人工智能进入成像系统”

- 人工智能正在彻底改变行业,提高成像系统的效率、准确性和功能性

- 例如,谷歌的 DeepMind 开发了一种人工智能系统,在通过视网膜扫描诊断眼部疾病方面比人类专家表现更好

- 在医疗保健领域,人工智能算法可以高精度分析医学图像(X 射线、MRI、CT 扫描、超声波)

- 例如,Aidoc 的 AI 软件可协助放射科医生快速识别 CT 扫描中的危重病例,从而减少紧急护理的响应时间

- 人工智能有助于更早、更准确地检测癌症、心血管疾病和神经系统疾病等病症

- 例如,PathAI 的深度学习模型可以帮助病理学家更精确地诊断癌变组织,减少诊断错误

- 人工智能可以识别人类专家可能忽略的图像模式,从而实现更快、更可靠的诊断

- 例如,Enlitic 开发的 AI 系统已证明它可以发现放射科医生经常忽略的 X 射线中的细微骨折

- 在安全领域,人工智能驱动的成像系统用于面部识别和监视,以监视活动并识别个人。

亚太地区部门级 PACS 市场动态

司机

“早期疾病检测需求不断增长”

- 早期疾病检测需求的不断增长推动了亚太地区部门级 PACS 市场的发展

- 医疗保健提供者专注于预防性护理,这需要先进的成像技术来早期识别疾病

- PACS 系统能够高效存储、检索和共享医学图像从而实现及时准确的诊断

- 早期发现癌症、心血管疾病和神经系统疾病等疾病可以带来更好的患者治疗效果

- 人工智能和机器学习与 PACS 的结合提高了诊断精度和工作流程效率,促进了市场增长

例如,

- Aidoc 的 AI 驱动 PACS 解决方案可帮助放射科医生更快地识别 CT 扫描中的危重病例,从而提高紧急情况下的诊断速度

- 谷歌的 DeepMind AI 已证明其通过视网膜扫描诊断眼部疾病的能力超越了人类专家,彰显了 AI 集成到 PACS 中用于早期疾病检测的强大功能

机会

“对基于云的 PACS 解决方案的需求不断增长”

- 对基于云的 PACS 解决方案的需求不断增长,为亚太地区部门级 PACS 市场带来了重大机遇

- 医疗保健组织越来越希望降低基础设施成本并提高可扩展性

- 与传统的本地系统相比,基于云的 PACS 具有灵活性、较低的初始资本投资和简化的维护

- 这些系统允许医疗保健提供者远程存储和访问医学成像数据,这在物理基础设施有限的地区或跨多个地点运营的医疗保健机构中尤其有益。

- 云的可扩展性有助于管理不断增长的医学成像数据量,而无需不断升级硬件

例如,

- Ambra Health 提供基于云的 PACS 解决方案,使医疗保健提供商能够远程访问和共享影像数据,从而降低基础设施成本并提高运营灵活性

- Everlight Radiology 使用基于云的 PACS 提供实时放射学报告,使医疗资源匮乏的地区能够获取专家意见,从而改善患者护理和诊断效率

克制/挑战

“实施成本高昂”

- 实施医疗影像管理系统(如 PACS)的高成本是亚太地区部门级 PACS 市场发展的重大制约因素

- 这些成本不仅包括硬件和软件的初始投资,还包括与系统维护、升级和员工培训相关的持续费用

- 规模较小的医疗机构和发展中地区的医疗机构经常面临预算限制,难以为先进的成像解决方案分配资金

- 将 PACS 与现有医院信息系统集成、确保数据安全以及遵守医疗保健法规的财务负担进一步增加了成本

- 尽管 PACS 技术在提高诊断准确性和运营效率方面具有优势,但这些经济挑战可能会阻碍医疗保健提供商采用该技术

例如,

- 在印度的许多农村医院,实施 PACS 系统的高成本推迟了这些技术的采用,限制了人们获得先进诊断工具的机会

- 世界卫生组织 (WHO) 的一项研究强调,东南亚的小型诊所难以承担 PACS 系统建立和维护的成本,这阻碍了他们提供高质量影像服务的能力

亚太地区部门级 PACS 市场范围

市场根据产品类型、组件、应用、集成度、最终用户和分销渠道进行细分。

|

分割 |

细分 |

|

按产品类型 |

|

|

按组件 |

|

|

按应用 |

|

|

按集成级别 |

|

|

按最终用户 |

|

|

按分销渠道 |

|

预计到 2025 年,专业 PACS 解决方案将占据市场主导地位,在产品类型细分市场中占有最大份额

预计到 2025 年,专业 PACS 领域将占据亚太地区部门 PACS 市场的主导地位,占据 28% 的最大份额 得益于其针对肿瘤科、心脏病科、骨科和眼科等特定医学专业的定制解决方案。这些系统旨在处理复杂的成像数据,从而提高诊断准确性和工作流程效率。

预计 MRI 将在预测期内占据技术市场的最大份额

预计到2025年,MRI领域将占据市场主导地位,市场份额最高可达30%至35%,这得益于其在非侵入性诊断中的关键作用以及提供软组织高分辨率成像的能力。MRI广泛用于诊断神经系统疾病、肌肉骨骼问题、癌症和其他复杂疾病。

亚太地区部门级 PACS 市场区域分析

“中国占据亚太地区部门级 PACS 市场最大份额”

- 由于中国拥有强大的医疗基础设施和先进成像技术的广泛应用,预计它将占据最大的市场份额

- 中国在医疗数字化和医院网络扩展方面的大量投资,使其在 PACS 市场占据领先地位

- 随着医疗器械行业的发展,中国有能力保持其在 PACS 领域的主导地位

- 政府支持数字医疗工具的举措进一步加强了中国医疗机构之间 PACS 系统的整合

“预计印度将在亚太地区部门级 PACS 市场中实现最高复合年增长率”

- 受医疗保健行业不断扩张的推动,印度有望成为亚太地区 PACS 市场中复合年增长率 (CAGR) 最高的国家

- 印度快速发展的医疗设备和医院行业对先进成像解决方案的需求不断增长,推动了市场的快速增长

- 印度的医疗保健行业是关键驱动力,占整个医疗行业的很大份额,推动了 PACS 的采用

- 印度医院和诊断中心数量的不断增加凸显了对高效成像系统的需求,加速了该地区 PACS 的增长

亚太地区部门级 PACS 市场份额

市场竞争格局按竞争对手提供详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投入、新市场计划、全球影响力、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度以及应用主导地位。以上提供的数据点仅与公司在市场中的重点相关。

市场中的主要市场领导者有:

- 富士胶片株式会社(日本)

- Mach 7 Technologies Limited(澳大利亚)

- Reyence(日本)

- 中华网视(中国)

- TeleRAD Reporting Services Private Limited(印度)

- 佳能医疗系统株式会社(日本)

- 柯尼卡美能达公司(日本)

- 英菲尼迪医疗保健(韩国)

- 三星麦迪逊(韩国)

亚太地区部门级 PACS 市场最新发展

- 2024年1月,富士胶片Diosynth Biotechnologies(美国)与SHL Medical(瑞士)达成战略合作伙伴关系,以满足日益增长的自动注射器药物市场需求。此次合作将提升富士胶片在丹麦的产能,到2025年初,年产量将达到3000万支。通过整合SHL的Molly自动注射器平台,此次合作旨在简化生产流程并降低供应链风险。这一进展将使制药和生物技术公司受益,因为它可以缩短产品上市时间,并改善患者获得自动注射药物的渠道。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。